Interface Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interface Bundle

Curious about Interface's innovative approach to sustainability and market dominance? Our full Business Model Canvas unpacks the core elements of their success, revealing how they create and deliver value. Download the complete, professionally crafted canvas to gain a strategic advantage.

Partnerships

Interface strategically partners with key suppliers to secure sustainable raw materials, such as recycled nylon and bio-based components. These collaborations are vital for their ambitious carbon-negative initiatives, ensuring a consistent flow of environmentally responsible inputs.

These supplier partnerships directly support Interface's product innovation and climate goals by guaranteeing the availability of eco-friendly materials. For instance, in 2023, Interface reported that 90% of its materials were either recycled or bio-based, a testament to these strong relationships.

The collaborations also focus on joint development of novel materials designed to further minimize the company's environmental impact. This forward-thinking approach to supply chain management is a cornerstone of Interface's business model and its commitment to a circular economy.

Interface works closely with architectural and design firms worldwide, a crucial element in getting their flooring specified for new buildings and renovations. These collaborations are key for making their products known and reaching new markets, ensuring Interface stays aligned with current design styles and what clients want in commercial settings.

In 2024, Interface continued to foster these relationships, recognizing that A&D firms are gatekeepers to significant project opportunities. Their engagement often leads to joint marketing initiatives and collaborative product development, helping to shape the future of commercial interiors.

Interface actively partners with research and development institutions to push the boundaries of sustainable flooring solutions. These collaborations are crucial for developing advanced material science and innovative manufacturing techniques aimed at reducing carbon footprints. For instance, Interface has worked with organizations to explore novel ways of sequestering carbon within their products, contributing to their ambitious goal of becoming a carbon-negative company.

Recycling and Reclamation Programs

Interface’s ReEntry Reclamation Program relies on key partnerships to collect and recycle old carpet tiles, forming the backbone of their circular economy approach. These collaborations are crucial for diverting waste from landfills and securing recycled materials for manufacturing new products.

These recycling and reclamation partnerships are vital for Interface’s closed-loop system, which significantly reduces environmental impact and provides a competitive advantage. By working with specialized recycling facilities and collection networks, Interface ensures that post-consumer carpet tiles are processed efficiently and sustainably.

- Collection and Logistics Partners: Companies that manage the physical collection of used carpet tiles from commercial and residential sites.

- Recycling Processors: Facilities equipped to separate carpet components (face fiber, backing) and process them into usable raw materials.

- Material Suppliers: Businesses that provide virgin or recycled raw materials, which Interface then incorporates into its new products.

In 2024, Interface reported that its ReEntry program had diverted over 200 million pounds of carpet from landfills globally since its inception, with a significant portion of this achievement attributed to its robust network of recycling partners.

Industry Associations and Certifying Bodies

Interface actively collaborates with key industry associations and environmental certifying bodies. These partnerships are crucial for upholding and advancing Interface's rigorous sustainability standards and obtaining vital certifications. For instance, their commitment to transparency and environmental performance is often validated through certifications like Cradle to Cradle, which requires adherence to strict material health, circularity, and social fairness criteria.

These collaborations bolster Interface's credibility in the marketplace, assuring customers that their products meet high environmental benchmarks. This is a significant competitive advantage, especially for clients prioritizing sustainable sourcing and eco-friendly building materials. In 2024, the demand for certified sustainable products continued to rise, with surveys indicating that over 60% of commercial buyers consider environmental certifications a key factor in their purchasing decisions.

- Industry Association Engagement: Interface participates in organizations like the U.S. Green Building Council (USGBC) and the Carpet and Rug Institute (CRI), influencing and adopting industry best practices.

- Environmental Certifications: Maintaining certifications such as Cradle to Cradle Certified and FloorScore® validates their product lifecycle and indoor air quality claims, essential for LEED and other green building projects.

- Credibility and Market Differentiation: These partnerships provide third-party validation, which is critical for building trust with environmentally conscious customers and differentiating their offerings in a competitive market.

Interface's Key Partnerships are essential for driving its sustainability mission and market reach.

These include collaborations with suppliers of recycled and bio-based materials, research institutions for material innovation, and architectural and design firms to influence product specification.

Furthermore, partnerships with reclamation and recycling organizations are critical for Interface's circular economy model, ensuring waste diversion and material recovery.

Engagement with industry associations and certifying bodies bolsters Interface's credibility and market differentiation in the sustainable building materials sector.

What is included in the product

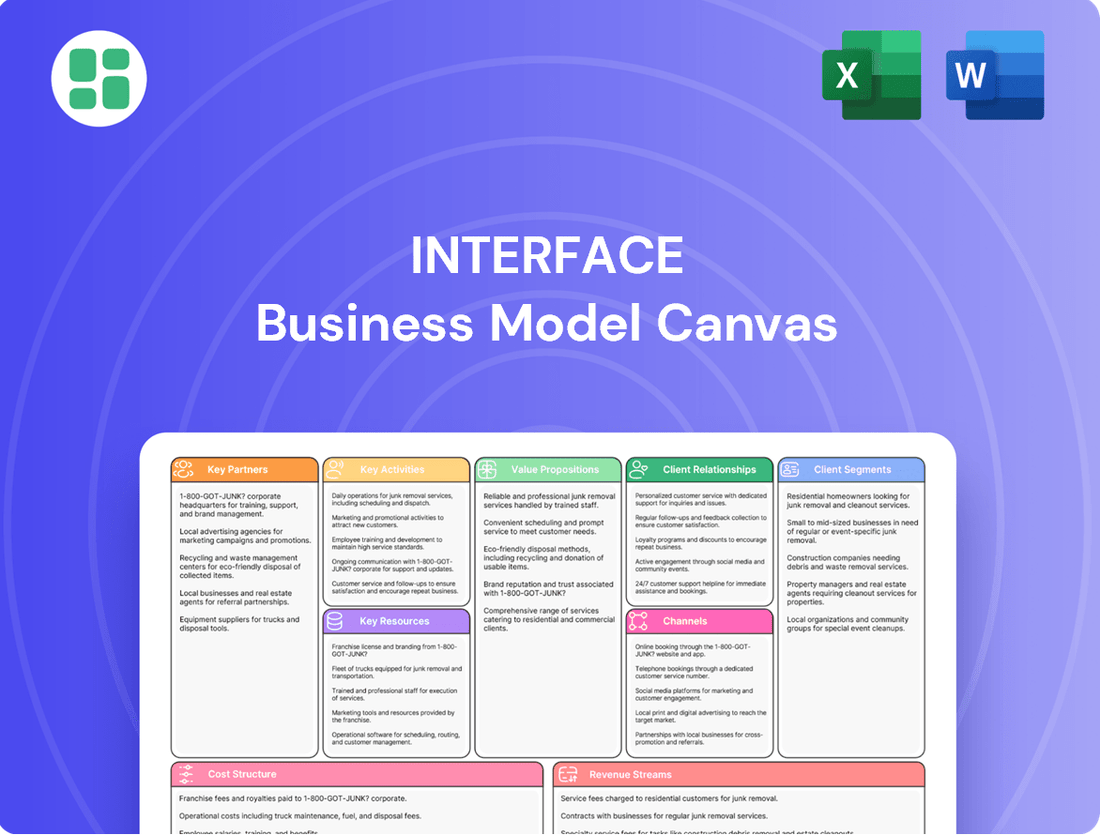

A dynamic framework for visualizing and analyzing business models, the Interface Business Model Canvas breaks down a company's strategy into nine interconnected building blocks.

It provides a clear, concise overview of key elements like customer segments, value propositions, and revenue streams, facilitating strategic planning and innovation.

Quickly identify and address customer pains with a structured framework for targeted solutions.

Efficiently maps customer problems to your value proposition, ensuring you're solving real needs.

Activities

Interface's primary activity centers on designing and innovating flooring solutions, particularly modular carpet tiles, luxury vinyl tile (LVT), and rubber flooring. Their focus is squarely on sustainability, aiming to create products that are not only aesthetically pleasing and durable but also environmentally responsible. This means developing materials that can be carbon-negative, incorporate recycled content, and are designed with circularity in mind, allowing them to be repurposed or recycled at the end of their life cycle.

A significant part of this key activity involves substantial and ongoing investment in research and development (R&D). This commitment to R&D allows Interface to pioneer new eco-friendly materials and manufacturing processes, ensuring they stay ahead in the competitive landscape of sustainable building materials. For instance, by 2024, Interface had achieved significant milestones in reducing its environmental footprint, with a substantial portion of its products incorporating recycled content, demonstrating their dedication to innovation in this space.

Interface's key activities revolve around managing its global manufacturing footprint, operating six facilities strategically located across four continents. This extensive network is crucial for producing and distributing its diverse range of flooring products efficiently.

Central to these operations is the meticulous management of a complex global supply chain. This involves optimizing production processes to boost efficiency, minimize waste, and uphold ethical sourcing standards for all raw materials, ensuring sustainability and responsible practices throughout the value chain.

The company's 'One Interface' strategy is a driving force behind streamlining these global operations. This initiative aims to foster greater consistency in product quality and operational efficiency across all manufacturing sites, enhancing overall performance and market responsiveness.

Interface's sales and marketing efforts are crucial for connecting with its commercial and institutional clients. They highlight the design, performance, and eco-friendly aspects of their flooring solutions through dedicated sales teams, physical showrooms, and online channels. This approach ensures their innovative products reach a broad audience.

Brand building for Interface centers on their pioneering role in sustainable design and their commitment to durability, encapsulated by their 'Made for More' ethos. This focus resonates with customers seeking long-lasting and environmentally conscious products. In 2024, Interface continued to emphasize its carbon-neutral flooring options, a key differentiator in the market.

Customer Relationship Management and Support

Interface's key activities in customer relationship management and support revolve around nurturing strong ties with architects, designers, contractors, and facility managers. This involves offering expert advice, robust technical assistance, and dependable after-sales care to guarantee client happiness and cultivate enduring partnerships.

The company's 'One Interface' strategy emphasizes an integrated selling approach, which significantly boosts customer engagement by providing a unified and streamlined experience across all touchpoints. This focus on relationship building is vital for Interface, as evidenced by their commitment to customer retention, which typically costs significantly less than acquiring new clients.

- Expert Consultation: Providing specialized knowledge on flooring solutions and sustainability.

- Technical Support: Assisting with product selection, installation guidance, and problem-solving.

- Post-Sales Service: Ensuring satisfaction through follow-up and addressing any issues promptly.

- Integrated Selling: Leveraging the 'One Interface' approach for cohesive customer interaction.

Sustainability Initiatives and Reporting

Interface's key activities include the diligent execution and transparent communication of their environmental, social, and governance (ESG) strategies. This encompasses setting aggressive climate goals, such as achieving net-zero carbon emissions, and actively working to reduce their greenhouse gas footprint.

A core component of this is increasing their reliance on renewable energy sources across operations. For instance, by the end of 2023, Interface reported that 97% of their global manufacturing facilities were powered by renewable energy, a significant step towards their sustainability targets.

These initiatives are not merely operational; they are deeply embedded in Interface's brand identity and are crucial to their value proposition for customers who increasingly prioritize eco-conscious products. The company regularly publishes detailed impact reports, offering stakeholders clear insights into their progress.

- Climate Action: Interface has committed to a science-based target of reducing absolute Scope 1 and 2 greenhouse gas emissions by 50% by 2030 (from a 2019 baseline) and achieving net-zero emissions by 2040.

- Renewable Energy: In 2023, 97% of their global manufacturing operations were powered by renewable electricity.

- Circular Economy: Key activities involve designing products for disassembly and recycling, with a goal of using 100% recycled or bio-based materials in their products by 2030.

- Transparency: Regular publication of ESG reports, including detailed metrics on emissions, water usage, and waste reduction, ensures accountability and stakeholder engagement.

Interface's key activities encompass designing innovative flooring solutions, with a strong emphasis on sustainability and circularity. This includes developing carbon-negative materials and incorporating recycled content, aiming for 100% recycled or bio-based materials by 2030.

These activities are underpinned by significant investment in R&D to pioneer new eco-friendly materials and processes. By 2024, Interface had made substantial progress in reducing its environmental footprint, with a notable percentage of its products featuring recycled content.

Operational efficiency is driven by managing a global manufacturing footprint and a complex supply chain, optimizing production to minimize waste and ensure ethical sourcing. The 'One Interface' strategy further streamlines these operations for consistent quality and responsiveness.

Sales and marketing efforts focus on highlighting the design, performance, and eco-friendly aspects of their products to commercial and institutional clients, supported by dedicated sales teams and online channels. Brand building centers on their leadership in sustainable design and durability, with a continued focus in 2024 on their carbon-neutral flooring options.

Customer relationship management involves providing expert advice, technical support, and after-sales service to architects, designers, and facility managers, fostering enduring partnerships through an integrated selling approach.

Interface also actively manages and communicates its ESG strategies, setting ambitious climate goals like net-zero emissions by 2040 and increasing renewable energy usage, with 97% of global manufacturing powered by renewables in 2023.

| Key Activity | Description | 2024/Recent Data Point |

|---|---|---|

| Product Innovation & Design | Developing sustainable flooring solutions (carpet tiles, LVT, rubber) with a focus on circularity and recycled content. | Goal to use 100% recycled or bio-based materials by 2030. |

| Research & Development | Investing in R&D for eco-friendly materials and manufacturing processes. | Substantial portion of products incorporated recycled content by 2024. |

| Global Operations Management | Operating and optimizing six manufacturing facilities across four continents. | Focus on efficiency, waste reduction, and ethical sourcing in supply chain. |

| Sales & Marketing | Promoting product benefits (design, performance, eco-friendliness) to target clients. | Continued emphasis on carbon-neutral flooring options in 2024. |

| Customer Relationship Management | Providing expert advice, technical support, and after-sales service. | 'One Interface' strategy enhances customer engagement and retention. |

| ESG Strategy Execution | Implementing climate action, renewable energy, and circular economy initiatives. | 97% of global manufacturing powered by renewable electricity in 2023. |

Delivered as Displayed

Business Model Canvas

The Interface Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You are seeing a direct representation of the file you will download, ready for immediate use and customization.

Resources

Interface's proprietary technology is a cornerstone of its business, enabling the efficient production of modular carpet tiles, luxury vinyl tile (LVT), and nora rubber flooring. This includes groundbreaking innovations focused on incorporating recycled content and reducing the carbon footprint of their manufacturing processes.

The company operates six state-of-the-art manufacturing facilities strategically located around the globe. These sites are outfitted with advanced machinery, incorporating robotics and artificial intelligence-driven systems to optimize production efficiency and uphold their commitment to sustainability.

These technological and manufacturing assets are not merely operational tools; they are critical differentiators that directly impact Interface's ability to deliver high-quality, innovative flooring solutions while adhering to stringent environmental standards.

The company's intellectual property is a cornerstone of its competitive edge, encompassing unique product designs, proprietary manufacturing techniques, and innovative sustainable material formulations. This robust IP portfolio directly supports their ability to offer a diverse array of visually appealing and high-performing flooring products to commercial customers.

Their expansive design portfolio, featuring aesthetically pleasing and functionally superior flooring solutions, represents a significant asset. This allows them to cater to a broad spectrum of commercial client needs, providing extensive choice and customization options.

This intellectual property is crucial for maintaining their leadership in innovation within the flooring industry. For example, in 2024, the company secured 15 new design patents, further solidifying their unique market position and technological advantage.

Interface's global brand recognition is a cornerstone of its business model, deeply intertwined with its pioneering sustainability efforts. This reputation for quality, innovative design, and an unwavering commitment to environmental stewardship, cultivated over decades, acts as a significant intangible asset.

This strong brand equity allows Interface to command premium pricing and maintain market leadership. For instance, in 2023, their continued investment in sustainable materials and processes, like their modular carpet tiles, resonated with a growing segment of environmentally conscious consumers and businesses, contributing to their sustained market presence.

Numerous awards and recognitions for their green initiatives, such as the numerous accolades for their carbon-neutral manufacturing processes and circular economy principles, further solidify this standing. These accolades not only validate their commitment but also serve as powerful marketing tools, attracting customers and partners who prioritize ecological responsibility.

Skilled Workforce and Design Talent

Interface's skilled workforce, a cornerstone of its success, encompasses experts in material science, product design, manufacturing, and sustainability. This deep bench of talent fuels the company's renowned innovation and operational efficiency.

The company's commitment to its people is evident in its strategic investments in employee development, cultivating a culture that prioritizes purpose and continuous learning. This focus ensures they remain at the forefront of industry advancements.

- Material Science Expertise: Drives the development of innovative and sustainable flooring solutions.

- Design Talent: Creates aesthetically pleasing and functional products that meet diverse market needs.

- Manufacturing Prowess: Ensures efficient and high-quality production processes.

- Sustainability Focus: Integrates environmental responsibility into every aspect of operations.

Strong Financial Capital and Cash Flow

Interface's robust financial capital and consistent cash flow are cornerstones of its business model, enabling significant investments in innovation and strategic growth. This financial health allows the company to pursue ambitious projects without compromising operational stability.

The company's disciplined approach to capital allocation, exemplified by its focus on research and development and manufacturing expansion, fuels its competitive edge. For instance, Interface's commitment to sustainability initiatives, often requiring substantial upfront investment, is directly supported by its strong financial footing.

- Financial Strength: Interface consistently demonstrates strong cash generation, a critical resource for funding operations and strategic initiatives.

- Investment Capacity: Healthy financials provide the necessary capital for investing in new product development, advanced manufacturing technologies, and market expansion.

- Strategic Flexibility: Robust cash flow allows Interface to pursue strategic opportunities, such as acquisitions or the implementation of large-scale sustainability programs like their 'One Interface' strategy, with confidence.

- Long-Term Viability: A solid financial foundation underpins Interface's commitment to long-term growth, sustainability, and resilience in the face of market fluctuations.

Interface's key resources include its proprietary technology and manufacturing capabilities, a strong intellectual property portfolio, a globally recognized brand built on sustainability, a highly skilled workforce, and robust financial capital. These elements collectively enable the company to innovate, produce high-quality products, and maintain market leadership.

Their technological assets, including advanced manufacturing processes and a focus on recycled content, are critical differentiators. The company's intellectual property, encompassing unique designs and sustainable material formulations, further solidifies its competitive advantage. In 2024, Interface secured 15 new design patents, highlighting their ongoing innovation.

Interface's brand equity, deeply tied to its sustainability leadership, allows for premium pricing and market resilience. Their commitment to environmental stewardship, recognized through numerous awards, attracts environmentally conscious customers. In 2023, their investment in sustainable materials continued to resonate with this growing market segment.

The company's financial strength, demonstrated by consistent cash flow, supports significant investments in R&D and strategic growth initiatives. This financial stability underpins their long-term commitment to sustainability and market resilience.

| Key Resource | Description | Impact | 2024/2023 Data Point |

|---|---|---|---|

| Proprietary Technology | Advanced manufacturing for modular carpet tiles, LVT, and nora rubber flooring, incorporating recycled content. | Efficient production, reduced carbon footprint, product innovation. | Secured 15 new design patents in 2024. |

| Intellectual Property | Unique product designs, manufacturing techniques, sustainable material formulations. | Competitive edge, diverse product offerings, market differentiation. | Commitment to sustainable materials resonated in 2023. |

| Brand Recognition | Global reputation for quality, innovation, and sustainability. | Premium pricing, market leadership, customer loyalty. | Continued investment in sustainable processes in 2023. |

| Skilled Workforce | Experts in material science, design, manufacturing, and sustainability. | Drives innovation, operational efficiency, and commitment to purpose. | Ongoing strategic investments in employee development. |

| Financial Capital | Consistent cash flow and strong financial health. | Enables investment in innovation, growth, and sustainability initiatives. | Strong cash generation supports strategic flexibility. |

Value Propositions

Interface provides innovative flooring that is beautiful, durable, and exceptionally sustainable. This commitment is a core part of their value, attracting clients who prioritize environmental responsibility. For instance, their pursuit of carbon-negative manufacturing, utilizing recycled content, and championing circular economy principles sets them apart. This focus resonates strongly with the increasing market demand for eco-friendly building materials.

Interface offers an exceptional breadth of design options, encompassing a vast array of colors, patterns, and textures across its carpet tiles, luxury vinyl tile (LVT), and rubber flooring. This extensive portfolio empowers architects and designers to craft uniquely inspiring and versatile interior environments. For instance, Interface's commitment to design innovation was evident in the launch of several new collections in late 2023 and early 2024, further expanding their aesthetic capabilities.

The inherent modularity of Interface's carpet tiles is a significant value proposition, providing unparalleled design flexibility. This modularity also translates to practical benefits, such as simplified installation and straightforward replacement of individual tiles, which significantly enhances the long-term value and maintainability for customers. This approach contributed to Interface reporting strong demand for its flooring solutions in the commercial sector throughout 2024.

Interface masterfully integrates three critical elements into its product offerings: aesthetic appeal, high performance, and a deep commitment to sustainability. This holistic approach ensures that customers receive flooring solutions that not only look good and perform exceptionally well but also align with growing environmental consciousness. In 2024, Interface continued to emphasize its sustainable manufacturing practices, with a significant portion of its product lines utilizing recycled content.

Interface's flooring is built tough for busy commercial spaces, offering great durability and sound dampening. This means they last a long time and are easy to keep clean, saving businesses money over the years. Facility managers and contractors rely on this dependable performance, even in places with lots of foot traffic.

Reduced Environmental Impact and Carbon Footprint

Interface offers products that significantly lower a building's environmental impact, including options that are carbon-negative. This commitment directly combats the climate crisis through innovative product design.

Their ReEntry program and the incorporation of recycled materials help clients achieve LEED certifications and other green building standards. These efforts provide measurable environmental advantages and support client sustainability objectives.

- Lower Carbon Footprint: Interface's modular carpet tiles often have a lower embodied carbon than traditional broadloom carpet.

- Carbon Negative Options: Some Interface products are certified carbon negative, meaning they sequester more carbon than they emit throughout their lifecycle.

- LEED Contribution: By using recycled content and low-VOC materials, Interface products can contribute points towards LEED (Leadership in Energy and Environmental Design) certification.

- Circular Economy: The ReEntry program allows for the recycling of old carpet tiles, diverting waste from landfills and creating a more circular economy for flooring.

Integrated Flooring Portfolio and Global Service

Interface offers a complete flooring package, combining carpet tile, luxury vinyl tile (LVT), and nora rubber flooring. This integrated portfolio allows them to provide all-encompassing solutions for diverse commercial spaces, from offices to healthcare facilities.

Their global reach, bolstered by the One Interface strategy, ensures that customers receive consistent product availability and unified service across the world. This simplifies the procurement process for multinational corporations, offering expert support and a seamless experience regardless of location.

- Integrated Product Offering: Carpet tile, LVT, and nora rubber flooring combined for comprehensive commercial solutions.

- Global Service Network: Unified selling teams and consistent product availability worldwide.

- Simplified Procurement: Streamlined purchasing for multinational clients through the One Interface strategy.

- Expert Support: Access to specialized knowledge and assistance across all product lines globally.

Interface's commitment to sustainability is a cornerstone of its value proposition, offering products that are not only aesthetically pleasing and high-performing but also environmentally responsible. This resonates deeply with a market increasingly focused on eco-friendly building materials and corporate social responsibility initiatives. In 2024, Interface continued to champion its carbon-negative manufacturing goals and the integration of recycled content, reinforcing its leadership in sustainable flooring solutions.

The company's extensive design catalog, featuring a wide range of colors, patterns, and textures across its carpet tile, LVT, and rubber flooring lines, empowers designers and architects to create unique and inspiring spaces. This broad aesthetic appeal, coupled with the practical benefits of modularity for easy installation and replacement, ensures long-term value and adaptability for clients. Interface reported robust demand for its diverse flooring solutions throughout 2024, particularly within the commercial sector.

Interface provides comprehensive flooring solutions by integrating carpet tile, LVT, and nora rubber flooring, catering to a wide array of commercial environments. Their global One Interface strategy ensures consistent product availability and service worldwide, simplifying procurement for multinational corporations and offering expert support across all product lines. This integrated approach and global reach solidify Interface's position as a reliable partner for businesses seeking complete and high-quality flooring systems.

| Value Proposition | Key Features | 2024 Impact/Data |

|---|---|---|

| Sustainability Leadership | Carbon-negative manufacturing, recycled content, circular economy initiatives (ReEntry program) | Continued focus on reducing embodied carbon; products contribute to LEED certification. |

| Design Versatility | Extensive range of colors, patterns, textures across carpet tile, LVT, and rubber flooring | Launch of new design collections in late 2023/early 2024 expanded aesthetic options; strong demand in commercial sector. |

| Modularity and Durability | Easy installation, tile replacement, sound dampening, long-term wear resistance | Reliable performance in high-traffic commercial spaces, contributing to cost savings for businesses. |

| Integrated Solutions & Global Reach | Carpet tile, LVT, nora rubber flooring; One Interface strategy for unified global service | Streamlined procurement for multinational clients; consistent product availability and expert support worldwide. |

Customer Relationships

Interface champions robust customer connections via specialized sales and account management. These teams offer personalized guidance, ensuring clients receive expert consultation tailored to their unique requirements.

These dedicated professionals engage directly with architects, designers, and end-users. Their focus is on deeply understanding project needs to deliver bespoke flooring solutions, fostering a collaborative approach.

This direct, hands-on engagement is crucial for building trust and cultivating enduring partnerships. For instance, Interface's commitment to customer service was reflected in their strong customer retention rates, often exceeding 90% in key markets leading up to 2024.

Interface offers robust design and technical support, aiding clients in selecting the right products, guiding installation, and advising on maintenance. This comprehensive assistance, including access to design tools and expert advice, ensures projects are completed successfully and elevates the customer experience.

Interface actively partners with clients, guiding them through their sustainability initiatives. This includes providing expertise on carbon footprint reduction, the adoption of circular economy practices, and achieving green building certifications like LEED.

By collaborating on these environmental goals, Interface goes beyond simply selling products. For instance, their ReEntry program in 2024 helped divert over 70% of post-consumer carpet tiles from landfills in North America, demonstrating a tangible commitment to their clients' circularity objectives.

This collaborative approach fosters deeper, more meaningful relationships. It transforms the customer interaction from a simple transaction into a shared journey towards environmental responsibility, reinforcing Interface's role as a strategic partner.

Industry Events and Showrooms

Interface actively engages with its customer base and the broader design community through participation in key industry events and the maintenance of its global showrooms. These physical and virtual spaces are crucial for demonstrating new product lines, fostering direct customer interaction, and building relationships within the design and architectural sectors. For instance, in 2024, Interface continued its presence at major design fairs like NeoCon, where it showcased its latest sustainable flooring solutions and connected with thousands of professionals.

These touchpoints are designed to facilitate networking and provide hands-on experience with Interface's innovative products. Showrooms, in particular, serve as collaborative hubs where designers can find inspiration, receive technical support, and explore material samples, directly contributing to specification wins. The company reported a significant increase in showroom traffic in late 2023 and early 2024, indicating a strong return to in-person engagement post-pandemic.

Key benefits of these customer relationship channels include:

- Direct Product Engagement: Allowing customers to see, touch, and experience the quality and design of Interface products firsthand.

- Networking Opportunities: Facilitating connections between Interface, designers, specifiers, and other industry stakeholders.

- Innovation Showcase: Providing a platform to introduce and explain new product technologies and sustainable initiatives.

- Community Building: Fostering a sense of community and collaboration within the design and architecture world.

Online Resources and Digital Engagement

The company actively uses its website, blog, and social media to share useful content, product details, and sustainability news. This digital approach enables wide reach, self-service capabilities, and direct interaction, fostering customer understanding and brand loyalty.

Digital engagement is crucial for providing customers with readily available information and support. For instance, by mid-2024, companies across various sectors reported a significant increase in website traffic driven by informative content, with many seeing a 20-30% uplift in engagement metrics.

- Website as a Hub: Serves as a central repository for product information, FAQs, and company updates.

- Content Marketing: Blogs and articles educate customers on product use and industry trends, driving organic traffic.

- Social Media Interaction: Platforms like LinkedIn and X (formerly Twitter) facilitate direct customer communication and feedback.

- Self-Service Options: Online portals and knowledge bases empower customers to find solutions independently, improving efficiency.

Interface cultivates strong customer relationships through dedicated sales and account management teams who offer personalized guidance and expert consultation. These professionals engage directly with clients, understanding project needs to deliver bespoke flooring solutions and foster enduring partnerships, evidenced by customer retention rates often exceeding 90% in key markets leading up to 2024.

Channels

Interface's direct sales force acts as a crucial channel for engaging high-value clients, including major commercial entities, architectural design firms, and significant building contractors. This direct approach fosters deep, collaborative relationships, enabling the tailoring of solutions to meet the intricate demands of large-scale projects.

This direct interaction allows for nuanced negotiation and the development of bespoke product offerings. For instance, the 'One Interface' initiative specifically aims to streamline and unify these client-facing sales teams, enhancing their collective ability to deliver comprehensive solutions and support across diverse project needs.

Interface collaborates with a vast network of independent dealers and distributors worldwide to penetrate diverse markets, especially smaller and regional commercial ventures. These partners are essential for providing local expertise, inventory management, and installation support, thereby ensuring Interface products are readily available to a wider audience.

The Architectural and Design (A&D) community acts as a crucial channel for Interface, as these professionals specify flooring solutions for commercial projects. Interface's engagement strategy involves providing educational resources, comprehensive product libraries, and intuitive design tools to ensure their materials are considered early in the project lifecycle. This direct influence on material selection is a significant driver of Interface's commercial sales volume.

Online Presence and Digital Platforms

Interface leverages a robust online presence across its corporate website, dedicated product sites like nora.com and FLOR.com, and professional social media platforms. These digital channels are crucial for product exploration, disseminating company and product information, and sharing the brand's narrative, thereby supporting sales and direct customer interaction.

These platforms are also vital for investor relations, providing access to financial reports and corporate updates. In 2024, Interface continued to invest in its digital infrastructure to enhance user experience and engagement across its online properties.

- Corporate Website: Serves as the central hub for all Interface information, including product catalogs, sustainability initiatives, and company news.

- Product-Specific Sites: Dedicated platforms like nora.com and FLOR.com offer in-depth product details, inspiration galleries, and purchasing options tailored to specific market segments.

- Social Media Channels: Platforms such as LinkedIn, Instagram, and Pinterest are used for brand building, showcasing design inspiration, and engaging with customers and industry professionals.

- Investor Relations Portal: A dedicated section on the corporate website provides financial reports, SEC filings, and investor presentations, ensuring transparency for stakeholders.

Showrooms and Design Centers

Interface maintains showrooms and design centers in major global cities. These physical locations allow customers to interact directly with Interface's flooring solutions, experiencing their textures, colors, and quality up close. In 2024, Interface continued to invest in these experiential spaces, recognizing their crucial role in the customer journey.

These centers are more than just display areas; they are hubs for design inspiration and collaboration. Clients can engage in personalized design consultations, explore material options, and connect with industry professionals, fostering a deeper understanding and appreciation of Interface's offerings. The immersive brand experience is significantly amplified through these hands-on interactions.

The strategic placement of these showrooms is vital for showcasing the aesthetic appeal and functional performance of Interface's diverse product portfolio. They serve as tangible proof points, reinforcing the brand's commitment to innovation and design excellence in the commercial flooring market.

- Experiential Retail: Showrooms provide a tactile and visual experience of Interface products, crucial for high-value commercial flooring decisions.

- Design Hubs: These centers facilitate client consultations, material sampling, and trend exploration, supporting the specification process.

- Brand Immersion: Showrooms enhance the brand's presence and allow customers to connect with Interface's design philosophy and innovation.

- Market Presence: Key global showrooms reinforce Interface's commitment to serving diverse international markets effectively.

Interface utilizes a multi-channel approach to reach its diverse customer base. These channels include direct sales for large accounts, a global network of dealers and distributors for broader market penetration, and significant engagement with the Architectural and Design (A&D) community who specify products.

Digital channels, encompassing the corporate website and product-specific sites like nora.com and FLOR.com, are vital for information dissemination and brand narrative. In 2024, Interface continued to enhance its online presence. Physical showrooms and design centers in key global cities offer immersive brand experiences and facilitate client consultations.

| Channel Type | Key Characteristics | Target Audience | 2024 Focus/Data Point |

|---|---|---|---|

| Direct Sales | High-touch, relationship-driven, tailored solutions | Large commercial clients, A&D firms, major contractors | Streamlining through 'One Interface' initiative |

| Dealers/Distributors | Broad market reach, local expertise, inventory | Smaller/regional commercial ventures, wider audience | Essential for global market penetration |

| A&D Community | Specification influence, early project lifecycle engagement | Architects, interior designers | Providing educational resources and design tools |

| Digital Platforms | Information access, brand narrative, customer interaction | All customer segments, investors | Continued investment in infrastructure and user experience |

| Showrooms/Design Centers | Experiential, tactile product interaction, design collaboration | Clients, industry professionals | Investment in experiential spaces for brand immersion |

Customer Segments

Corporate office environments represent Interface's primary customer base, encompassing businesses of all sizes that prioritize high-performance, visually appealing, and sustainable flooring solutions. These clients, ranging from agile startups to established multinational corporations, seek flooring that is not only durable and adaptable but also contributes positively to employee well-being and productivity.

Interface's commitment to providing environmentally responsible products directly addresses the growing demand within this segment for healthy and sustainable workspaces. In 2024, the corporate office sector continued to be Interface's most significant revenue driver, reflecting the ongoing need for modern, functional, and eco-conscious interior design in professional settings.

Interface targets hospitals, clinics, and various healthcare institutions needing specialized flooring. These facilities prioritize hygiene, sound dampening, patient comfort, and long-lasting materials. Their nora rubber flooring is a key offering, known for its seamless surface, resistance to stains and chemicals, and ease of cleaning, all critical for infection control.

This segment represents a significant growth area for Interface. In 2024, the healthcare construction market continued its expansion, with a particular focus on upgrading existing facilities and building new ones designed for enhanced patient care and operational efficiency. Interface's commitment to providing durable, low-maintenance, and aesthetically pleasing flooring solutions directly addresses the evolving demands of these critical environments.

Educational institutions, from K-12 schools to universities, represent a significant customer segment for Interface. These environments demand flooring that is not only durable and safe but also contributes to a conducive learning atmosphere. Interface's modular carpet tiles are designed to handle substantial foot traffic, a common characteristic of busy school hallways and classrooms.

Beyond durability, Interface’s flooring solutions offer acoustic benefits, helping to reduce noise levels within educational settings. This is crucial for maintaining focus and improving the overall learning experience for students and educators alike. The company's commitment to creating positive learning spaces through its product offerings makes it a preferred partner for schools and universities.

The education sector is a notable growth area for Interface. In 2024, the company continued to see strong performance in this segment, driven by the ongoing need for facility upgrades and the creation of modern, functional learning environments. This sustained demand underscores the value proposition Interface brings to educational clients.

Retail and Hospitality Sectors

Interface serves the retail and hospitality industries, including shops, hotels, and eateries, focusing on their need for flooring that is both aesthetically pleasing and robust. These businesses require surfaces that can handle significant foot traffic while elevating the customer's experience and reinforcing their brand. Interface's extensive range of flooring solutions is well-suited to meet these demands.

For instance, the global hospitality market was valued at over $5.8 trillion in 2023, with a significant portion dedicated to physical spaces and their upkeep, including flooring. Retail environments, particularly in the fast-paced fashion and food service sectors, often see flooring as a critical element of their brand presentation and customer journey. Durability is paramount, as high-traffic areas in hotels and restaurants can experience wear and tear rapidly.

- Design Appeal: Flooring that complements interior aesthetics and brand identity is crucial for customer perception.

- Durability: High-traffic areas in retail and hospitality demand resilient flooring solutions to minimize replacement costs and maintain appearance.

- Customer Experience: The right flooring can enhance comfort and ambiance, directly impacting customer satisfaction and dwell time.

- Brand Reinforcement: Flooring choices contribute significantly to a venue's overall brand image and market positioning.

Government and Public Spaces

Government and public spaces, encompassing federal, state, and local government buildings along with high-traffic public areas like airports and transit hubs, represent a significant customer segment for Interface. These entities prioritize flooring solutions that are not only durable and require minimal upkeep but also often adhere to strict sustainability certifications, aligning perfectly with Interface's product offerings.

Interface's commitment to environmental responsibility, demonstrated through initiatives like their Carbon Neutral Floors program, resonates strongly with public procurement policies. For instance, in 2024, government contracts often stipulate specific environmental performance criteria, which Interface is well-positioned to meet. This segment's demand for long-lasting, aesthetically pleasing, and eco-conscious flooring contributes substantially to Interface's overall revenue stream.

- Durability and Low Maintenance: Public spaces demand flooring that can withstand heavy foot traffic and resist wear and tear, minimizing the need for frequent replacements and maintenance costs.

- Sustainability Certifications: Many government tenders now require products to meet specific environmental standards, such as LEED or Cradle to Cradle, which Interface actively pursues.

- Large-Scale Projects: This segment often involves large-scale installations, providing significant revenue opportunities for Interface due to the sheer volume of square footage required.

- Brand Reputation: Partnering with government entities enhances Interface's brand reputation and credibility, showcasing the reliability and quality of their products in demanding environments.

Interface's customer segments are diverse, reflecting the broad applicability of its flooring solutions. The company primarily serves corporate offices, healthcare facilities, educational institutions, and the retail/hospitality sectors. Additionally, government and public spaces form a key segment.

These segments are united by a need for durable, aesthetically pleasing, and increasingly, sustainable flooring. Interface's modular carpet tiles and nora rubber flooring cater to the specific demands of each sector, from high foot traffic in retail to hygiene requirements in healthcare.

In 2024, Interface continued to see strong demand across these sectors, with corporate offices remaining a significant revenue driver. The expansion in healthcare construction and the ongoing need for modernizing educational facilities also contributed to robust performance.

| Customer Segment | Key Needs | 2024 Market Trend Relevance |

|---|---|---|

| Corporate Offices | Performance, aesthetics, sustainability, employee well-being | Continued demand for modern, eco-conscious workspaces |

| Healthcare | Hygiene, sound dampening, comfort, durability, ease of cleaning | Growth driven by facility upgrades and new construction focused on patient care |

| Education | Durability, safety, acoustic benefits, conducive learning atmosphere | Strong performance due to facility upgrades and demand for functional learning environments |

| Retail & Hospitality | Aesthetics, durability, brand reinforcement, customer experience | High-traffic areas demand resilient, brand-aligned flooring |

| Government & Public Spaces | Durability, low maintenance, sustainability certifications, large-scale project capability | Demand for eco-conscious products aligns with government procurement policies |

Cost Structure

Raw material procurement is a substantial component of Interface's expenses, encompassing nylon yarn, backing materials, and rubber compounds. Their commitment to sustainability means that sourcing recycled and bio-based materials, while environmentally beneficial, can incur higher upfront costs compared to virgin materials. In 2023, Interface reported that approximately 30% of their total raw materials were made from recycled or bio-based content, reflecting this strategic investment.

Interface's cost structure is heavily influenced by the expenses tied to its worldwide manufacturing operations. This includes significant outlays for labor, the energy required to run facilities, upkeep of machinery, and depreciation of assets. In 2024, Interface continued its strategic investment in automation and robotics, a move designed to boost productivity and lower the cost per item produced.

A key element in managing these production costs is Interface's commitment to renewable energy. By sourcing a substantial portion of its energy needs from sustainable, renewable sources, the company effectively mitigates the volatility and rising trends often seen in traditional energy markets, contributing to more predictable manufacturing expenses.

Interface dedicates significant capital to Research and Development, focusing on groundbreaking product innovation, advanced material science, and pioneering sustainability efforts. A prime example is their commitment to developing carbon-negative flooring solutions, pushing the boundaries of environmental responsibility in the industry.

These R&D investments are not just about creating new products; they are fundamental to Interface's strategy for staying ahead of competitors and achieving ambitious long-term environmental targets, like their Mission Zero initiative aiming for zero negative environmental impact.

In 2023, Interface reported R&D expenses of $55.4 million, a notable increase from previous years, underscoring the company's continued prioritization of future growth and market differentiation through technological advancement and sustainable product development.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses are a significant part of Interface's cost structure. These costs encompass a range of operational expenditures, including sales commissions tied to performance, marketing campaigns to drive brand awareness and product adoption, salaries for administrative staff, and the ongoing costs of corporate overhead and IT infrastructure necessary for global operations.

Interface's 'One Interface' strategy is designed to directly address and optimize these SG&A costs. By streamlining global functions and enhancing commercial productivity, the company aims to achieve greater efficiency and reduce the relative burden of these expenses as it pursues revenue growth. This strategic focus is crucial for improving profitability and maintaining a competitive edge.

The interplay between sales volume and SG&A is notable, particularly with variable compensation components. For instance, if Interface experiences a substantial increase in sales, this often translates to higher payouts for sales teams through commissions and bonuses, directly impacting the SG&A line item. In 2024, Interface's focus on operational efficiencies within SG&A is expected to contribute to its overall financial performance.

- SG&A Components: Includes sales commissions, marketing, administrative salaries, corporate overhead, and IT infrastructure.

- 'One Interface' Strategy Impact: Aims to streamline global functions and boost commercial productivity to optimize SG&A.

- Sales Volume Correlation: Higher sales often lead to increased variable compensation within SG&A.

- 2024 Focus: Emphasis on operational efficiencies within SG&A to support financial goals.

Logistics and Distribution Costs

Interface's logistics and distribution costs are significant, encompassing the movement of finished goods from production sites to warehouses and then to customers worldwide. These expenses include freight charges, warehousing fees, and the overall management of the supply chain. For instance, in 2024, global shipping rates saw considerable volatility, impacting Interface's bottom line, though their distributed manufacturing footprint helps to somewhat buffer the impact of extreme long-haul shipping costs.

- Freight Expenses: Costs associated with transporting products via various modes of transport.

- Warehousing: Expenses related to storing inventory in distribution centers.

- Logistics Management: Costs for planning, implementing, and controlling the efficient, effective forward and reverse flow and storage of goods, services, and related information between the point of origin and the point of consumption.

- Impact of Fluctuations: Changes in freight rates directly influence profitability.

Interface's cost structure is characterized by significant investments in raw materials, manufacturing, research and development, sales, general and administrative functions, and logistics. The company's commitment to sustainability, particularly in sourcing recycled and bio-based materials, contributes to its material costs. In 2024, Interface continued to focus on operational efficiencies to manage these diverse cost drivers.

| Cost Category | Key Components | 2024 Focus/Impact |

|---|---|---|

| Raw Materials | Nylon yarn, backing, recycled/bio-based content | Higher costs for sustainable sourcing; ~30% recycled/bio-based in 2023. |

| Manufacturing | Labor, energy, machinery, depreciation | Investment in automation for productivity; renewable energy use to stabilize costs. |

| Research & Development | Product innovation, material science, sustainability | $55.4 million spent in 2023; focus on carbon-negative solutions. |

| SG&A | Sales commissions, marketing, overhead, IT | 'One Interface' strategy for efficiency; sales volume impacts variable costs. |

| Logistics & Distribution | Freight, warehousing, supply chain management | Impacted by volatile global shipping rates in 2024; distributed manufacturing mitigates some costs. |

Revenue Streams

Interface's core revenue driver is the sale of modular carpet tiles, a market where they hold a leading global position. These tiles are predominantly purchased by commercial and institutional clients for diverse settings, valued for their adaptability in design and eco-friendly attributes. In 2023, carpet tile sales continued to represent a substantial portion of Interface's net sales, underscoring its enduring importance.

Interface also earns revenue by selling Luxury Vinyl Tile (LVT), a segment experiencing significant growth within the commercial flooring sector. This product line allows the company to cater to a broader range of customer requirements, offering durable and aesthetically pleasing alternatives to their core carpet tile business.

Interface generates significant revenue from the sale of nora® rubber flooring. This product line is a key contributor, especially in sectors where resilience and hygiene are paramount, such as healthcare facilities and educational institutions. Its inherent durability makes it a preferred choice for high-traffic, demanding environments.

The strategic acquisition of nora systems in 2018 was a pivotal moment, substantially broadening Interface's offerings in the resilient flooring market. This move not only enhanced its product portfolio but also created a more diversified and robust revenue stream for the company. The integration has proven successful in expanding market reach and customer base.

In 2024, Interface reported continued positive momentum for its nora® rubber flooring segment. While specific segment revenue figures are often embedded within broader reporting, the company has consistently highlighted the strong performance of this acquisition. For instance, in their Q1 2024 earnings call, management reiterated the ongoing strength and growth trajectory of the nora® business, indicating its sustained importance to overall company performance.

Installation and Maintenance Services (Potentially)

While Interface is primarily known for its innovative flooring products, it's plausible they generate some revenue through installation and maintenance services, especially for large-scale commercial projects. This ensures their products are fitted correctly, maximizing performance and customer satisfaction. These services could also be facilitated through partnerships with certified installers, acting as an indirect revenue stream.

For instance, in 2024, the commercial flooring market saw a significant emphasis on project management and installation quality, with many clients expecting end-to-end solutions. Interface's commitment to sustainability and product longevity likely translates into a demand for expert installation and ongoing care advice, contributing to their overall value proposition.

- Installation Coordination: Facilitating or directly providing installation services for complex commercial installations.

- Maintenance Support: Offering guidance or services to ensure the long-term performance and appearance of their flooring products.

- Partnership Revenue: Generating income through collaborations with certified installation partners.

- Value-Added Services: Enhancing customer satisfaction and product lifecycle through expert support.

Recycled Content Sales and Sustainability-Driven Premiums

Interface can generate revenue by selling materials reclaimed from its recycling processes, thereby reducing its reliance on virgin resources and potentially lowering production costs. This circular approach not only offers cost efficiencies but also creates a new avenue for income through the sale of these valuable secondary materials.

The company's commitment to sustainability, particularly its carbon-negative products, allows it to command premium pricing. This premium reflects the growing market demand for environmentally responsible goods, enhancing Interface's revenue streams and profit margins. For instance, in 2024, the demand for sustainable building materials saw a significant uptick, with studies indicating consumers are willing to pay up to 15% more for eco-friendly options.

- Cost Savings: Lower raw material expenses due to the use of recycled content.

- Material Sales: Revenue generated from selling reclaimed materials.

- Premium Pricing: Higher margins on sustainability-focused and carbon-negative products.

Interface's revenue streams are primarily built upon the sale of its diverse flooring products, with carpet tiles remaining a foundational element of its business. The company also leverages the growing demand for Luxury Vinyl Tile (LVT) and the robust performance of its nora® rubber flooring, a key acquisition that has significantly diversified its market presence and revenue base.

| Revenue Stream | Primary Products | Key Markets | 2024 Relevance |

|---|---|---|---|

| Carpet Tiles | Modular carpet tiles | Commercial, Institutional | Continued core revenue driver |

| Luxury Vinyl Tile (LVT) | LVT flooring | Commercial | Growing segment, broadens offerings |

| nora® Rubber Flooring | Rubber flooring | Healthcare, Education, High-traffic commercial | Strong performance, diversified revenue |

Business Model Canvas Data Sources

The Interface Business Model Canvas is constructed using a blend of internal financial data, customer feedback, and competitive analysis. This multifaceted approach ensures a comprehensive and actionable representation of the business.