Interface Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interface Bundle

Interface's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the ever-present threat of new entrants. Understanding these dynamics is crucial for any business operating in or looking to invest in the flooring industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Interface’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Interface's bargaining power with suppliers can be moderate to high, especially for specialized or sustainably sourced raw materials. While common materials like nylon might have many providers, Interface's focus on recycled and bio-based content narrows down supplier choices, potentially increasing their leverage.

By 2025, Interface aims to source 82% of its yarn from recycled nylon, a significant move that could influence supplier relationships. Their collaboration with companies like Aquafil, which provides 100% recycled nylon, is a strategic effort to manage supplier power and ensure a stable supply chain for their sustainability goals.

Interface's commitment to sustainability, including its ambitious carbon-negative goals and circular economy principles, often necessitates unique inputs such as recycled materials and bio-based polymers. When a limited number of suppliers can provide these specialized, eco-friendly components, their leverage grows. This reliance on a narrow supplier base for differentiated inputs can potentially drive up costs or reduce Interface's operational agility if alternative sustainable sources are scarce.

Switching suppliers for Interface's core raw materials, such as specialized polymers and rubber compounds, presents considerable financial and operational hurdles. These switching costs can include the expense of retooling manufacturing lines, the time and resources needed to re-qualify new materials against stringent performance and sustainability benchmarks, and the risk of supply chain disruptions during the transition. These factors empower current suppliers with increased bargaining leverage.

Threat of Forward Integration by Suppliers

The threat of raw material suppliers moving into flooring manufacturing, known as forward integration, is a potential, though less common, factor that could bolster their bargaining power against Interface. Should a crucial supplier of a specialized material decide to produce their own modular carpet tiles or resilient flooring, they would directly enter into competition with Interface.

This strategic shift would grant the supplier considerable leverage over both pricing and the availability of essential inputs for Interface. For instance, if a primary producer of a proprietary recycled yarn used in Interface's high-performance carpet tiles were to start manufacturing finished tiles, they could dictate terms or even withhold supply to their former client.

- Potential for Increased Supplier Power: Forward integration by suppliers into flooring manufacturing directly increases their bargaining power.

- Direct Competition: A supplier producing Interface's finished goods would become a direct competitor.

- Control over Pricing and Supply: This scenario grants suppliers significant control over pricing and the continuity of supply.

Impact of Input Costs on Interface's Margins

Fluctuations in the cost of raw materials, particularly petroleum-based products essential for vinyl and synthetic fibers, directly affect Interface's gross profit margins. These price swings represent a significant lever suppliers can pull.

Interface's Q2 2025 financial results highlighted this dynamic. The company reported that while pricing and product mix improvements boosted performance, these gains were partially eroded by increased raw material expenses, underscoring the impact of supplier pricing power.

To mitigate this, Interface actively pursues strategies like incorporating recycled content into its products. This approach not only aids environmental goals but also serves to stabilize energy and raw material costs, thereby improving the company's resilience against the volatility inherent in supplier pricing.

- Impact on Margins: Higher raw material costs, especially for petroleum derivatives, directly squeeze Interface's profit margins.

- Q2 2025 Evidence: Interface's Q2 2025 performance showed that rising raw material prices partially negated positive pricing and product mix contributions.

- Mitigation Strategy: The use of recycled content is a key tactic to stabilize energy and raw material expenses, reducing vulnerability to supplier price hikes.

Interface's bargaining power with suppliers is influenced by its commitment to sustainability, particularly its reliance on specialized recycled and bio-based materials. This can concentrate purchasing power with a limited number of specialized suppliers, potentially increasing their leverage.

For example, Interface's goal to source 82% of its yarn from recycled nylon by 2025, working with partners like Aquafil, highlights this dynamic. While this strengthens specific supplier relationships, it also means a smaller pool of providers for these niche materials, giving them more sway.

Switching costs for these specialized inputs are high, involving retooling and material re-qualification, which further empowers existing suppliers. This situation can lead to increased costs or reduced flexibility for Interface if these sustainable material sources are scarce.

| Factor | Impact on Interface | Supplier Leverage |

| Specialized Sustainable Materials | Reliance on niche inputs | Moderate to High |

| High Switching Costs | Operational and financial barriers to change | Moderate to High |

| Supplier Forward Integration | Potential direct competition | High |

What is included in the product

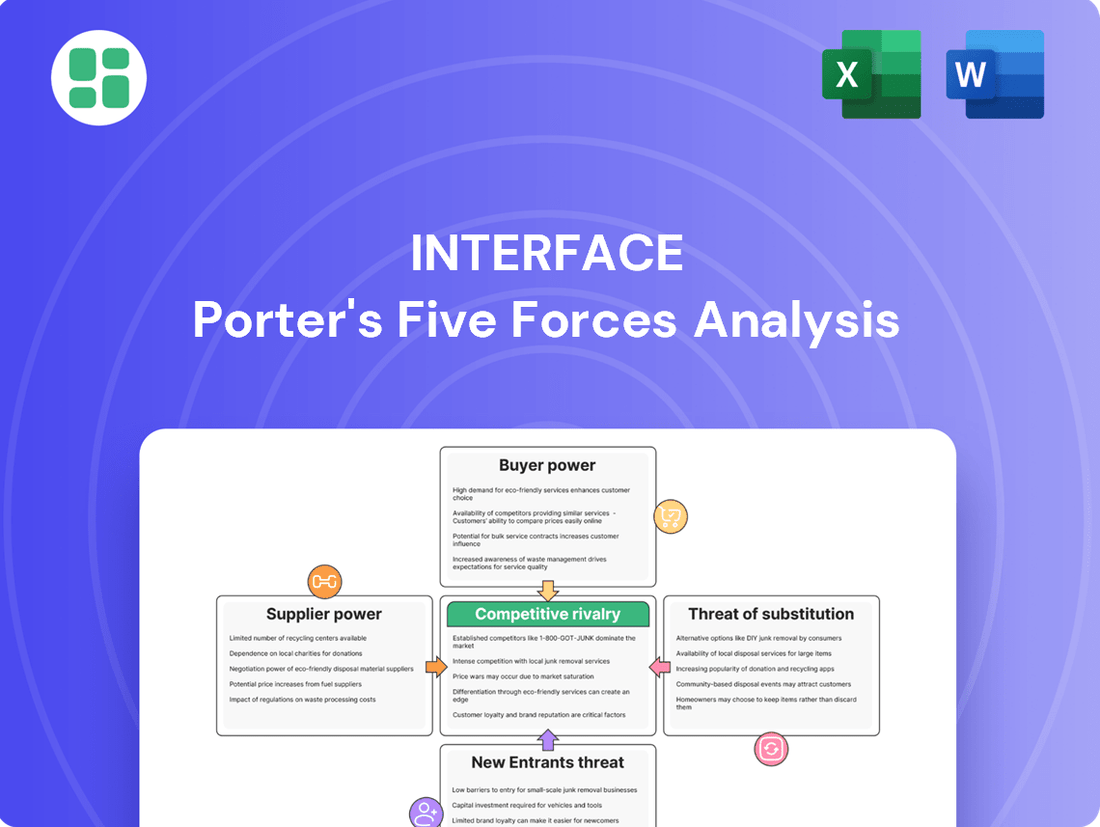

This analysis dissects the competitive forces impacting Interface, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Instantly identify and address competitive threats with a visual breakdown of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Interface's customer base is largely comprised of significant commercial and institutional clients, spanning sectors like corporate, healthcare, education, and retail. These clients frequently engage in large, project-based purchases, which inherently grants them considerable influence due to the sheer volume of their orders.

The substantial nature of these projects allows customers to negotiate for competitive pricing, advantageous payment terms, and bespoke product configurations. For instance, a major corporate headquarters renovation could involve hundreds of thousands of square feet of flooring, giving the client considerable bargaining power.

Customers possess significant bargaining power due to the wide variety of flooring solutions available beyond Interface's core offerings. The market is flooded with alternatives, from the increasing popularity of Luxury Vinyl Tile (LVT) produced by numerous competitors to established options like hardwood, ceramic, and polished concrete.

This abundance of choice means customers can easily source comparable products from different suppliers. For instance, the global LVT market was valued at approximately $13.7 billion in 2023 and is projected to grow, indicating a robust competitive landscape where consumers have many choices. This readily available substitution directly empowers customers to negotiate better prices or demand specific product features, as they can readily switch if Interface's offerings don't meet their expectations.

Customer switching costs for commercial clients in the flooring industry are generally not prohibitive. For instance, during new construction or large-scale renovations, companies often solicit bids from multiple suppliers, making it straightforward to compare pricing and product offerings from competitors such as Mohawk Industries and Shaw Industries. This ease of comparison inherently caps the switching costs Interface can impose.

Price Sensitivity of Commercial Clients

Commercial and institutional clients, particularly those undertaking large-scale projects, often exhibit significant price sensitivity. For these customers, flooring represents a substantial capital investment, making cost a critical factor in their purchasing decisions. Interface's commitment to sustainability, while a valuable differentiator, must still be weighed against the overall cost-benefit analysis by these buyers.

This inherent price sensitivity compels Interface to carefully calibrate its pricing strategy. The company needs to strike a balance between its premium, environmentally conscious product lines and the need to remain competitive to secure significant contracts in the commercial sector. For instance, in the 2024 fiscal year, Interface reported net sales of $1.2 billion, indicating the scale of business where price negotiations are paramount.

- Price Sensitivity: Commercial clients often view flooring as a major capital expenditure, increasing their focus on price.

- Value Proposition: While Interface's sustainability offers value, it doesn't entirely negate price considerations for large buyers.

- Competitive Landscape: Interface must price its eco-friendly products competitively to win bids in the commercial market.

- Market Share: In 2024, the commercial flooring market saw intense competition, with pricing being a key battleground.

Customer Knowledge and Specification Power

Architects, designers, and large facility managers are critical to Interface's sales, and their deep understanding of flooring requirements significantly influences purchasing decisions. These professionals actively seek out specific performance metrics, environmental credentials such as LEED points, and precise delivery schedules for their projects.

This elevated level of customer knowledge directly translates into substantial bargaining power. For instance, in 2024, the demand for sustainable building materials, including flooring with high recycled content or low VOC emissions, continued to rise, empowering specifiers to negotiate terms more favorably with manufacturers like Interface.

- Informed Buyers: Key Interface customers possess expertise in flooring specifications, performance, and sustainability.

- Demand for Customization: They leverage this knowledge to request specific product features and environmental certifications.

- Negotiating Leverage: This informed stance grants them considerable power in price and contract negotiations.

- Market Trends: The growing emphasis on green building in 2024 amplified their ability to demand eco-friendly options.

Interface's customers, particularly large commercial and institutional clients, wield significant bargaining power. This stems from their substantial order volumes, the availability of numerous alternative flooring solutions, and generally low switching costs. These buyers are often highly price-sensitive, especially for large projects, and their informed decision-making, influenced by architects and designers, further amplifies their ability to negotiate favorable terms and pricing.

| Customer Characteristic | Impact on Bargaining Power | Supporting Data/Example (2023-2024) |

|---|---|---|

| Large Order Volumes | High | Major corporate renovations can involve hundreds of thousands of square feet, enabling significant price negotiation. |

| Availability of Substitutes | High | The global LVT market, valued at $13.7 billion in 2023, offers numerous competitors and alternative materials like hardwood and concrete. |

| Low Switching Costs | Moderate | Commercial clients solicit multiple bids, making it easy to compare and switch between suppliers like Mohawk and Shaw. |

| Price Sensitivity | High | Flooring is a major capital expenditure for commercial clients, making cost a critical factor in purchasing decisions. Interface's 2024 net sales of $1.2 billion highlight the scale where price is paramount. |

| Informed Buyers (Specifiers) | High | Demand for sustainable materials (e.g., LEED points) in 2024 empowered specifiers to negotiate for specific environmental credentials and features. |

What You See Is What You Get

Interface Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis, offering a thorough examination of competitive forces within an industry. The document you see here is the exact, professionally formatted analysis you will receive instantly upon purchase. It's ready for immediate application to your strategic planning needs, providing actionable insights without any hidden elements or placeholders.

Rivalry Among Competitors

The commercial flooring sector is a crowded arena, brimming with both global giants and nimble regional specialists. This intense competition means Interface faces a constant battle for visibility and customer loyalty.

Key rivals like Mohawk Industries and Shaw Industries, with their vast product portfolios and extensive distribution networks, represent significant challenges. Additionally, companies such as Milliken & Company and Tarkett, along with numerous niche players focusing on specific materials like luxury vinyl tile (LVT) or rubber flooring, further fragment the market and amplify competitive pressures.

The commercial flooring market is showing healthy growth, with Luxury Vinyl Tile (LVT) projected to expand at a 13.0% CAGR and the broader commercial flooring sector expected to see a 5.0-6.6% CAGR between 2024 and 2029. However, this growth occurs within a generally mature market that is sensitive to economic fluctuations. Periods of slower expansion or localized economic downturns can heighten competition among players vying for market share.

The global carpet tile market, a key segment for Interface, is anticipated to grow at a steady 4.5% CAGR from 2024 to 2031. While this represents consistent progress, it's not a high-growth scenario, which means companies must remain competitive to capture their portion of the market.

Interface distinguishes itself through a robust dedication to environmental sustainability, featuring carbon-negative carpet tiles and products with substantial recycled content. This emphasis on eco-friendly and forward-thinking solutions, including the anti-slip attributes of nora rubber flooring and Interface's broader climate advancements, effectively lessens direct price-based competition.

While Interface leads in sustainability, rivals are also channeling resources into eco-conscious and technologically sophisticated flooring options. This industry-wide push for continuous innovation means competitors are increasingly matching or developing similar advanced features, intensifying the rivalry.

In 2023, Interface reported a significant portion of its sales from products with a lower environmental footprint, underscoring the market's demand for sustainable options and the effectiveness of its differentiation strategy. This trend is expected to continue, with industry analysts projecting further growth in the green building materials sector.

Exit Barriers for Competitors

Interface, like many in the flooring industry, faces substantial exit barriers. The significant capital investment in manufacturing facilities, specialized machinery, and complex distribution networks means that exiting the market is not a simple decision. These high fixed costs can trap even struggling companies, forcing them to continue operating and competing, often aggressively on price.

This situation directly impacts competitive rivalry. When it's costly to leave, underperforming competitors tend to stay, contributing to sustained pressure on pricing and market share. For instance, in 2024, the global flooring market, valued at approximately $360 billion, still sees numerous players with substantial fixed assets, making a swift exit difficult.

- High Capital Intensity: The flooring sector demands considerable investment in plant, property, and equipment, creating a significant financial hurdle for any company considering departure.

- Specialized Assets: Machinery and production lines are often highly specialized for flooring manufacturing, limiting their resale value or alternative use.

- Established Distribution: Building and maintaining extensive distribution channels requires long-term commitment, making it hard to simply walk away from these networks.

Strategic Objectives of Competitors

Competitors in the flooring market exhibit a wide array of strategic aims. For instance, some prioritize gaining significant market share, even at the expense of short-term profitability, while others focus intently on maximizing margins within niche segments. This divergence means Interface must constantly monitor and react to varied competitive pressures.

The pursuit of aggressive pricing is a common tactic, particularly among larger, established players seeking to deter new entrants or capture volume. Conversely, many competitors are investing heavily in design and material innovation, aiming to differentiate their offerings and command premium pricing. Interface's strategy must account for both these approaches.

- Market Share Focus: Competitors like Mohawk Industries and Shaw Industries often aim for broad market penetration, leveraging scale to compete on price and distribution reach.

- Profitability Focus: Smaller, specialized manufacturers might concentrate on high-margin, premium product lines, such as luxury vinyl tile or custom-designed carpet tiles, prioritizing profitability over sheer volume.

- Geographic Expansion: Some rivals are actively expanding their presence in emerging markets, seeking new growth avenues beyond mature economies, which could impact Interface's global strategy.

- Product Specialization: Companies focusing on specific product categories, like sustainable or resilient flooring, present a focused challenge that Interface must address through its own product development and marketing efforts.

Competitive rivalry within the commercial flooring sector is intense, driven by numerous global and regional players. Interface faces strong competition from established giants like Mohawk Industries and Shaw Industries, as well as specialized firms such as Milliken & Company and Tarkett. This crowded market, even with growth in segments like LVT, necessitates continuous innovation and strategic maneuvering to maintain market position.

SSubstitutes Threaten

The threat of substitutes for Interface's carpet tiles is significant, primarily stemming from alternative flooring materials that can serve similar purposes in commercial settings. These include hardwood, ceramic tile, polished concrete, and epoxy coatings, each offering distinct performance attributes and visual appeal.

The commercial flooring sector is indeed seeing a notable trend where materials like Luxury Vinyl Tile (LVT) are gaining traction, potentially at the expense of traditional broadloom carpet. In 2024, the global commercial flooring market was valued at approximately $45 billion, with LVT capturing a substantial and growing share.

The threat of substitutes is significant for Interface, primarily driven by the compelling price-performance trade-off offered by alternatives like Luxury Vinyl Tile (LVT). LVT effectively replicates the aesthetic of natural materials such as wood and stone, but at a considerably lower price point. This makes it a very attractive option for many customers.

LVT's growing popularity is a direct challenge. Market projections indicate a substantial Compound Annual Growth Rate (CAGR) for LVT through 2029, meaning its market share is expected to expand considerably. This growth directly siphons demand from traditional flooring options, including carpet tiles, which Interface specializes in.

Customers are increasingly comparing the value they receive from Interface's carpet tiles against these more affordable LVT solutions. The ability of LVT to offer durability and water resistance, alongside its lower cost and aesthetic appeal, forces a critical evaluation of Interface's product proposition in the market.

Customer preferences are shifting rapidly, with a growing appetite for flooring that offers both low maintenance and aesthetic flexibility. This evolution directly impacts the threat of substitutes, as clients increasingly seek solutions that are waterproof and adaptable to diverse design needs.

Emerging trends favor hard surfaces, integrated smart flooring technologies, and materials that improve acoustics and overall comfort. These developments present viable alternatives to traditional carpet, pushing customers to explore options beyond Interface's core offerings, even as the company expands into LVT and nora rubber.

Ease and Cost of Switching to Substitutes

The threat of substitutes for Interface, a major carpet tile manufacturer, is significantly influenced by the ease and cost associated with switching to alternative flooring solutions. For many commercial projects, particularly during new construction or major renovations, the transition to a different flooring material can be surprisingly straightforward and inexpensive.

Consider a scenario where a client opts for polished concrete instead of Interface's carpet tiles. The direct financial outlay for this switch is often minimal, primarily encompassing adjustments in design specifications and installation procedures. This low barrier to entry for substitutes directly amplifies the competitive pressure Interface faces.

In 2024, the flooring market continues to see robust demand for diverse materials, with vinyl plank flooring (LVP) and polished concrete gaining significant traction in commercial spaces. For instance, the global LVP market was projected to reach approximately $25 billion in 2024, indicating a substantial and accessible alternative for consumers.

- Low Switching Costs: For many commercial projects, changing from carpet tiles to alternatives like polished concrete or luxury vinyl plank (LVP) involves minimal direct costs, primarily related to design and installation adjustments.

- Material Versatility: Alternatives such as LVP offer a wide range of aesthetic options, mimicking wood, stone, or tile, making them a versatile substitute for carpet tiles in various commercial settings.

- Growing Market Share of Substitutes: In 2024, the global LVP market is a significant competitor, with projections indicating continued growth, underscoring the increasing accessibility and appeal of substitute flooring solutions.

Emerging Technologies and Solutions

The threat of substitutes for Interface is amplified by emerging technologies and innovative solutions that offer alternative ways to achieve similar functional or aesthetic outcomes. For instance, the rise of smart flooring systems, which integrate sensors for heating, lighting, or safety, presents a forward-looking challenge. These systems move beyond traditional carpeting to offer enhanced functionality, potentially drawing customers who prioritize integrated building technology.

Furthermore, the growing availability of rental flooring solutions for temporary commercial needs is a tangible substitute. Businesses requiring flexible, short-term installations, such as for events or pop-up retail, can opt for these rental services instead of purchasing and installing permanent flooring. This segment is expected to see continued growth, particularly in dynamic urban markets.

Interface must therefore maintain its focus on innovation to counter these evolving substitutes. The company's commitment to sustainability, including its modular carpet tile designs and recycled content, positions it well, but the pace of technological advancement in building materials and services demands continuous adaptation. Staying ahead requires not only product development but also understanding shifts in customer preferences towards integrated, flexible, and technologically advanced building solutions.

- Smart Flooring Systems: Offer integrated heating, lighting, and safety features, representing a technological leap beyond traditional flooring.

- Rental Flooring Solutions: Provide cost-effective and flexible alternatives for temporary commercial spaces, catering to event and short-term retail needs.

- Interface's Innovation Imperative: Continuous development is crucial to remain competitive against these technologically advanced and service-based substitutes.

The threat of substitutes for Interface's carpet tiles is substantial, driven by the increasing availability and appeal of alternative flooring materials like Luxury Vinyl Tile (LVT) and polished concrete. These substitutes often provide a compelling price-performance ratio, mimicking high-end aesthetics while demanding less maintenance and offering greater durability in certain commercial applications.

In 2024, the global commercial flooring market, valued around $45 billion, saw significant growth in LVT, which now competes directly with carpet tiles. The ease and low cost of switching to these alternatives, often involving minimal design or installation adjustments, further amplify the competitive pressure on Interface.

Emerging trends favoring hard surfaces, integrated smart flooring technologies, and rental flooring solutions for temporary needs also present viable alternatives, forcing Interface to continuously innovate and adapt its product offerings to maintain market relevance.

| Substitute Material | Key Advantages | 2024 Market Context |

|---|---|---|

| Luxury Vinyl Tile (LVT) | Aesthetic versatility, durability, lower cost than natural materials, water resistance | Global LVP market projected to reach ~$25 billion in 2024, significant growth |

| Polished Concrete | Low maintenance, durability, modern aesthetic, minimal installation cost adjustment | Gaining traction in commercial spaces for its industrial appeal and longevity |

| Smart Flooring Systems | Integrated technology (heating, lighting, safety), enhanced functionality | Represents a technological leap, appealing to clients prioritizing integrated building solutions |

| Rental Flooring | Flexibility, cost-effectiveness for temporary installations (events, pop-ups) | Growing segment, particularly in dynamic urban markets needing short-term solutions |

Entrants Threaten

Entering the commercial flooring manufacturing sector, particularly for products like carpet tile, luxury vinyl tile (LVT), and rubber flooring, demands significant upfront capital. Companies need to invest in state-of-the-art production facilities, specialized machinery, and robust research and development to compete effectively. For instance, establishing a new carpet tile manufacturing plant alone could easily run into tens of millions of dollars in 2024, making it a formidable barrier for smaller players.

Established players like Interface benefit significantly from economies of scale in manufacturing, procurement, and distribution. This allows them to achieve lower per-unit costs, making it difficult for new entrants to compete on price. For instance, in 2024, global flooring manufacturers with significant production volumes reported up to a 15% cost advantage compared to smaller operations.

The experience curve also plays a crucial role. As Interface has accumulated experience over years, it has optimized its processes, leading to further cost reductions and efficiency gains. New entrants would face a steep learning curve and higher initial operating costs, creating a substantial barrier to entry.

Interface's global supply chain optimization further solidifies its cost advantage. By managing a vast network of suppliers and logistics, they can secure better pricing and ensure consistent material availability, a feat that is challenging and expensive for newcomers to replicate quickly.

Interface benefits from strong brand loyalty, especially in the commercial and institutional flooring markets. Its reputation for sustainability and product quality makes customers hesitant to switch. For example, Interface reported net sales of $1.3 billion in 2023, a testament to its established market presence.

New competitors face a significant hurdle in replicating Interface's extensive distribution networks. Building these relationships and infrastructure takes considerable time and capital investment, making it difficult for newcomers to gain market access and compete effectively on a broad scale.

Proprietary Technology and Sustainability Expertise

Interface's significant investment in proprietary manufacturing technology, such as its advanced tufting and dyeing processes, creates a substantial hurdle for potential new entrants. These innovations are not easily replicated and require considerable capital outlay and specialized knowledge to develop and implement effectively.

The company's deep-seated expertise in sustainable practices and the circular economy, including its pioneering work with carbon-negative products and high percentages of recycled content, further deters new competitors. Developing comparable eco-friendly solutions and certifications demands extensive R&D and a proven track record, which new entrants would struggle to establish quickly.

- Proprietary Technology: Interface's manufacturing processes are a key barrier, requiring substantial investment to replicate.

- Sustainability Expertise: Decades of developing carbon-negative products and utilizing recycled materials set a high bar for newcomers.

- R&D Investment: New entrants must invest heavily in research and development to match Interface's innovative and eco-friendly product offerings.

- Market Demand: The growing consumer and business demand for sustainable flooring solutions means new entrants must also meet these stringent environmental criteria from the outset.

Regulatory and Environmental Hurdles

The commercial flooring sector, particularly for sustainable options, faces significant regulatory and environmental challenges. Newcomers must navigate a complex web of compliance, including evolving standards for material safety and carbon footprints, as well as obtaining crucial certifications like LEED and Cradle to Cradle. For instance, achieving LEED Platinum certification, a benchmark for green building, requires extensive documentation and adherence to stringent material sourcing and lifecycle criteria, a process that can cost tens of thousands of dollars and take months to complete.

Interface, a leader in sustainable flooring, has already invested heavily in meeting and exceeding these requirements. Their long-standing commitment means they possess established processes and a deep understanding of these regulatory landscapes. This existing infrastructure and expertise act as a substantial barrier for any new company attempting to enter the market, especially those prioritizing eco-friendly products.

- Environmental Regulations: Compliance with standards like the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) impacts material selection and supply chain transparency.

- Green Building Certifications: The cost and time associated with obtaining certifications like LEED or BREEAM can be prohibitive for startups. In 2023, the global green building market was valued at over $100 billion, highlighting the importance of these credentials.

- Material Safety and Lifecycle Assessment: New entrants must invest in rigorous testing and lifecycle assessments to prove the safety and sustainability of their products, adding to upfront costs.

The threat of new entrants into the commercial flooring market, particularly for sustainable products, is significantly mitigated by Interface's established advantages. These include substantial capital requirements for manufacturing, economies of scale, and a well-developed experience curve. For instance, in 2024, the cost of setting up a new carpet tile manufacturing facility could easily exceed tens of millions of dollars, a considerable barrier for emerging companies.

Interface's strong brand loyalty, extensive distribution networks, and proprietary technology further deter new competitors. Their deep expertise in sustainability, including carbon-negative products, also presents a high bar. In 2023, Interface reported net sales of $1.3 billion, underscoring its significant market penetration.

Navigating complex environmental regulations and obtaining green building certifications like LEED or BREEAM adds further cost and time for new entrants. The global green building market, valued at over $100 billion in 2023, emphasizes the importance of these credentials, which Interface has already secured.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from industry-specific market research reports, public company financial statements, and relevant trade association publications to provide a comprehensive view of competitive dynamics.