IOOF SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IOOF Bundle

While the Independent Order of Odd Fellows (IOOF) boasts a strong community focus and a rich history as a key strength, understanding its full market position requires a deeper dive. Our comprehensive SWOT analysis reveals crucial insights into their competitive landscape and potential threats.

Want the full story behind IOOF's opportunities for expansion and the challenges they face in a changing philanthropic sector? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and future growth initiatives.

Strengths

Insignia Financial provides a wide array of wealth management services, encompassing superannuation, retirement income planning, and financial advice. This extensive portfolio allows them to serve a broad spectrum of clients, including individuals and corporations, assisting them in reaching their diverse financial objectives.

Insignia Financial, with roots stretching back to 1846, commands a formidable market position in Australian wealth management. As of June 30, 2025, its funds under management and administration (FUMA) reached an impressive $330.3 billion, underscoring its substantial scale and influence.

This extensive scale, bolstered by the well-recognized MLC brand, translates into a significant competitive edge, enabling Insignia to offer cost-effective and readily available financial solutions to a broad customer base.

Its leadership extends to being a premier wrap platform provider and a key player in the Master Trust superannuation sector, solidifying its status as a top-tier participant in the Australian financial landscape.

Insignia Financial leverages its robust network of financial advisers, including its own brands like Bridges and Shadforth, to distribute its offerings. This internal capability is complemented by strategic partnerships designed to amplify its reach.

The company actively cultivates relationships with independent financial advisers and asset consultants. This focus is aimed at broadening product distribution channels and expanding its overall client acquisition capabilities, a strategy that has proven effective in reaching a wider market.

For instance, as of the first half of 2024, Insignia Financial reported a significant number of advisers within its network, underscoring the scale of its distribution strength. This extensive adviser footprint is fundamental to delivering tailored financial advice and growing its client base.

Focus on Operational Efficiency and Cost Optimization

IOOF, now operating as Insignia Financial, has actively pursued operational efficiencies, notably completing a cost optimization program that yielded significant net cost reductions. This strategic push is central to their 2030 vision of becoming Australia's leading wealth management firm by leveraging technology and product innovation to streamline operations.

This commitment to efficiency is designed to foster sustainable growth and enhance profitability. For instance, in the first half of the 2024 financial year, Insignia Financial reported a statutory net profit after tax of $161 million, with underlying business improvements contributing to this performance.

- Cost Optimization: Achieved net cost reductions through strategic initiatives.

- 2030 Vision: Aiming to be Australia's most efficient wealth manager.

- Growth Driver: Focus on efficiency expected to improve profitability.

- H1 2024 Results: Statutory net profit after tax of $161 million reflects operational focus.

Strong Capital Position and Financial Health

Insignia Financial demonstrates a robust capital position, enabling it to sustain dividend payments and invest in future growth. The company recently bolstered its financial flexibility by extending and increasing its syndicated facility, providing enhanced balance sheet capacity.

Recent financial performance highlights a positive turnaround, with underlying net profit after tax showing an upward trend, largely attributed to the successful implementation of its optimization program. This suggests a strengthening financial health and a capacity to absorb potential market fluctuations.

- Strengthened Capital Base: The extension and increase of its syndicated facility provide greater financial maneuverability.

- Positive Profitability Trend: Recent results indicate a positive shift in underlying net profit after tax, signaling improved operational efficiency.

- Dividend Capacity: The company's financial health supports its ability to continue paying dividends to shareholders.

Insignia Financial's extensive scale, with $330.3 billion in FUMA as of June 30, 2025, provides significant operational leverage and brand recognition. Its broad distribution network, featuring a substantial number of financial advisers and strategic partnerships, ensures wide market reach and client acquisition capabilities.

The company's strong focus on cost optimization, demonstrated by net cost reductions and a 2030 vision for efficiency, directly contributes to improved profitability. This operational discipline is reflected in a statutory net profit after tax of $161 million for the first half of 2024.

Insignia's robust capital position, supported by an increased syndicated facility, offers financial flexibility for continued investment and dividend payments. This financial strength underpins its ability to navigate market dynamics and pursue strategic growth initiatives.

What is included in the product

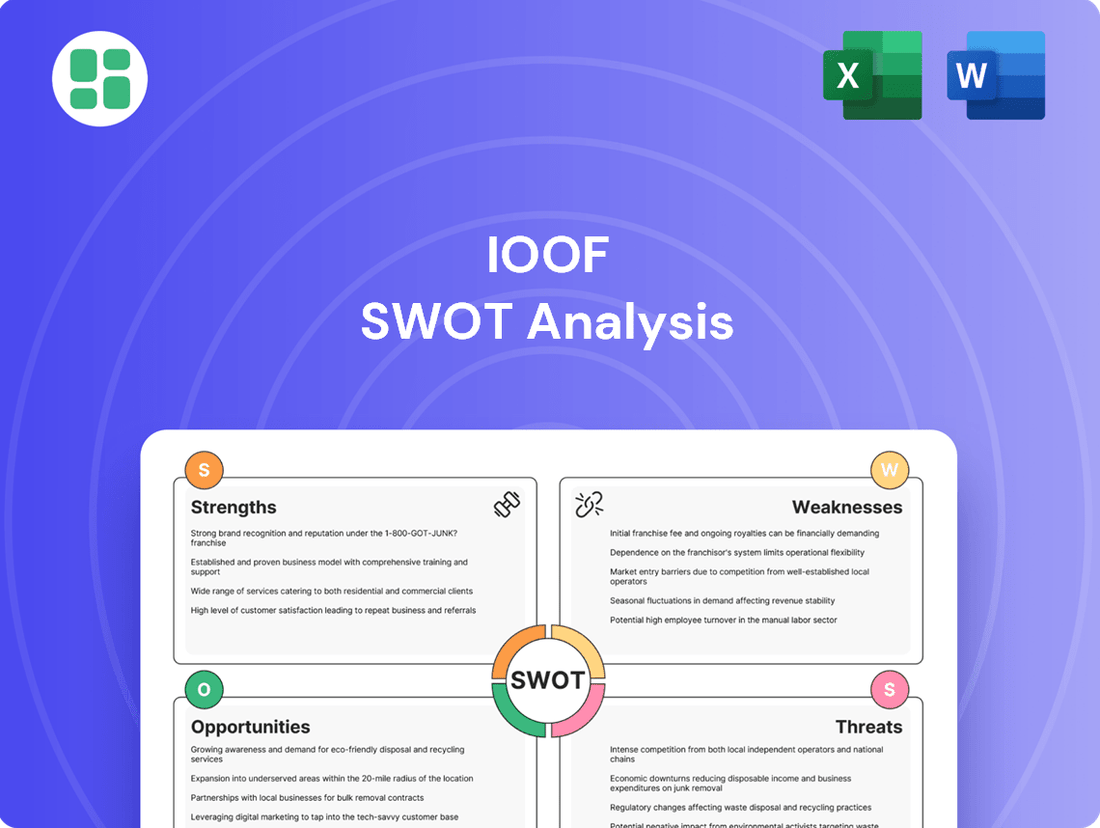

Delivers a strategic overview of IOOF’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats.

The IOOF SWOT Analysis offers a clear, actionable framework to identify and address internal weaknesses and external threats, thereby alleviating strategic uncertainty and guiding proactive problem-solving.

Weaknesses

Insignia Financial's history of acquisitions, notably MLC, has resulted in substantial IT separation and integration challenges. These complex and costly endeavors, even after the MLC IT separation from NAB in November 2024, can introduce operational risks and necessitate significant, ongoing capital expenditure to ensure seamless functionality and data security across its diverse platforms.

Insignia Financial operates within Australia's stringent financial services regulatory landscape, exposing it to significant compliance burdens and potential penalties. The company has previously entered into an enforceable undertaking with the Australian Prudential Regulation Authority (APRA) and paid infringement notices for past conduct, highlighting the financial and reputational costs associated with non-compliance. The introduction of new regulations like the Financial Accountability Regime (FAR) necessitates ongoing investment in robust risk management and compliance frameworks, which can divert resources.

Insignia Financial is facing a challenging outlook with revenue growth forecasts showing a decline. Analysts project an annual decrease of 4.9% in revenue over the coming years. This trend indicates potential headwinds in attracting new business or retaining existing revenue streams, despite ongoing strategic initiatives.

Dependence on Adviser Network Performance and Retention

IOOF's reliance on its adviser network presents a significant weakness. The company's overall performance is directly tied to the stability and productivity of its employed and affiliated advisers. For instance, in the fiscal year ending June 30, 2023, IOOF's adviser numbers experienced fluctuations, highlighting the ongoing challenge of maintaining a consistent and high-performing network.

Difficulties in retaining experienced advisers or attracting new talent can disrupt IOOF's distribution capabilities and hinder client acquisition efforts. A strategic move by advisers towards greater independence, for example, could dilute the company's direct market reach. This dependence means that any internal or external factors affecting adviser morale or business viability can have a disproportionate impact on IOOF's growth trajectory.

- Adviser Retention Challenges: Fluctuations in adviser numbers, as seen in recent fiscal years, indicate ongoing retention pressures.

- Distribution Model Vulnerability: A shift of advisers to independent models could weaken IOOF's established distribution channels.

- Client Acquisition Impact: Adviser turnover directly affects the company's ability to onboard new clients and grow its asset base.

- Network Productivity Variance: The performance of the network is not uniform, with some advisers potentially underperforming, impacting overall results.

Competitive Market Pressure on Fees and Margins

The Australian wealth management sector is intensely competitive, forcing companies like IOOF to contend with shrinking net revenue margins. This pressure stems from continuous price wars and aggressive fee reductions among market players.

Insignia Financial's experience, with its Master Trust margin projected to decrease in the second half of 2025 due to higher investment expenses and net pricing effects, highlights this trend. Even with the advantages of scale, profitability remains challenged by these market dynamics.

- Intense competition in Australian wealth management leads to fee compression.

- Net revenue margins are under significant pressure from ongoing price competition.

- Insignia Financial's Master Trust margin is expected to decline in 2H25.

- Increased investment costs and net pricing impacts are key drivers of margin erosion.

IOOF's significant reliance on its adviser network is a core weakness. The company's financial health is intrinsically linked to the stability and productivity of its employed and affiliated advisers. For instance, adviser numbers have seen fluctuations in recent fiscal periods, underscoring the persistent challenge of maintaining a robust and consistent network. This dependency means that any instability within the adviser force, whether through attrition or reduced productivity, directly impacts IOOF's distribution capabilities and client acquisition efforts.

Same Document Delivered

IOOF SWOT Analysis

The preview below is taken directly from the full IOOF SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of their strategic position.

This is the actual IOOF SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights. You're viewing a live preview of the actual file.

Get a look at the actual IOOF SWOT analysis file. The entire document, detailing their strengths, weaknesses, opportunities, and threats, will be available immediately after purchase.

Opportunities

The Australian wealth management sector is booming, with a growing number of high-net-worth individuals embracing digital platforms for their financial needs. This trend, coupled with an aging demographic's increasing focus on retirement planning, creates a fertile ground for Insignia Financial to broaden its reach and deliver specialized services aimed at securing long-term financial well-being.

The financial services sector is undergoing a significant technological overhaul, with AI and advanced analytics at its forefront. Insignia Financial is strategically positioning itself as an AI-enabled entity, channeling investments into digital tools designed to boost product capabilities and adviser efficiency. This focus aims to deliver more personalized advice and elevate the overall client experience.

Insignia Financial is actively pursuing product innovation by broadening its portfolio into sought-after areas like private equity and alternative investments, alongside developing sophisticated managed accounts. This strategic move aims to cater to evolving investor preferences and tap into growing market segments.

The recent collaboration to introduce 'MLC Retirement Boost' exemplifies this commitment to innovation, signaling a clear intent to create new revenue streams and capture previously untapped market opportunities. This diversification is crucial for sustained growth in a competitive financial landscape.

Strategic Acquisitions and Partnerships

IOOF, now operating as Insignia Financial, has a proven track record of pursuing growth through strategic acquisitions. This approach has consistently aimed to bolster its market presence and service offerings. For instance, the acquisition of MLC's wealth management business in 2021 for $1.47 billion was a significant move to consolidate its position in the Australian financial services landscape.

The recent takeover offer from CC Capital, valued at approximately $2.9 billion as of early 2024, underscores the inherent value and strategic appeal of Insignia's Australian market position. This event not only signals a potential change in ownership but also highlights the ongoing attractiveness of the company for further consolidation or strategic partnerships. Such opportunities could involve integrating complementary businesses or forming alliances to expand its capabilities in areas like digital wealth management or superannuation services.

- Acquisition History: Insignia Financial has a history of integrating acquired businesses to expand its scale and service capabilities.

- Market Attractiveness: The recent takeover bid from CC Capital highlights the strategic value of Insignia's established market presence in Australia.

- Future Growth Avenues: Potential exists for further strategic alliances or acquisitions that could enhance Insignia's technological infrastructure and product suite.

Enhanced Digital Client Engagement and Experience

Insignia Financial can capitalize on the growing demand for digital investment services, particularly among younger demographics. A substantial percentage of investors now prefer digital interactions for managing their finances. By investing in and refining its digital platforms, Insignia can cater to these expectations, leading to a better client experience.

A superior digital experience translates directly into tangible business benefits. It fosters higher client satisfaction, which in turn can drive increased engagement and loyalty. Furthermore, a smooth and intuitive digital onboarding process and ongoing management tools are crucial for improving conversion rates from prospects to clients and accelerating the growth of assets under management.

- Digital Adoption: As of late 2024, reports indicate over 70% of retail investors actively use digital platforms for investment research and transactions.

- Client Satisfaction: Financial institutions with highly-rated digital experiences often see a 15-20% higher client retention rate compared to those with lagging digital offerings.

- Growth Potential: Enhancing digital engagement is projected to contribute to a 5-10% uplift in new asset acquisition for wealth management firms in 2025.

- Younger Investor Segment: Millennials and Gen Z, who represent a significant future client base, overwhelmingly prioritize digital-first financial service providers.

Insignia Financial is well-positioned to leverage the increasing demand for personalized financial advice, driven by an aging population and a growing desire for retirement planning. The company's strategic focus on digital tools and AI aims to enhance adviser efficiency and client experience, creating opportunities for deeper client relationships and expanded service offerings.

Threats

The Australian wealth management sector is a battleground, with IOOF facing a formidable challenge from nimble fintech firms and challenger brands. These disruptors are leveraging technology to offer streamlined, often more affordable, digital wealth solutions, directly impacting established players.

This heightened competition poses a significant threat, potentially leading to a decline in IOOF's market share as customers are drawn to these innovative alternatives. Furthermore, the pressure to remain competitive could force further reductions in fees and profit margins.

For instance, by the end of 2024, the Australian fintech market is projected to reach a valuation of over AUD 30 billion, indicating the scale of innovation and investment in this space. This trend underscores the substantial threat posed by these agile competitors to traditional wealth managers like IOOF.

Insignia Financial operates within a highly regulated financial services landscape, where shifts in policy can significantly impact operations. For instance, the Australian government's ongoing review of the Retirement Income Covenant, which came into effect in 2022, could introduce new compliance requirements and alter existing business models. This dynamic environment necessitates continuous adaptation and investment in compliance infrastructure.

The increasing focus on accountability and transparency, exemplified by the mandatory climate-related financial disclosures expected to be phased in from 2024, presents another layer of complexity. Insignia Financial, like its peers, will need to invest in robust data collection and reporting systems to meet these evolving standards, potentially increasing operational costs and demanding specialized expertise.

Economic downturns and market volatility present a significant threat to Insignia Financial. Fluctuations in investment performance directly impact the company's funds under management and administration (FUMA), potentially leading to reduced revenue. For instance, during periods of economic uncertainty, clients may opt to reduce their investments or withdraw existing funds, creating a direct hit to Insignia's profitability.

Cybersecurity Risks and Data Breaches

Insignia Financial, as a prominent financial services provider, confronts substantial cybersecurity risks. A significant data breach could result in severe financial repercussions, including substantial remediation costs and potential regulatory fines, alongside irreparable damage to its reputation and client trust. For instance, the Australian financial sector experienced a notable increase in cyber threats in 2023, with reports indicating a rise in ransomware attacks targeting sensitive customer information.

Despite ongoing investments in advanced cybersecurity measures, the evolving nature of cyber threats presents a persistent challenge. The potential for data breaches not only impacts financial stability but also erodes the confidence clients place in the company's ability to safeguard their personal and financial details. In 2024, regulatory bodies like ASIC are intensifying scrutiny on data protection practices within the financial industry, increasing the potential penalties for non-compliance.

- Cybersecurity Threats: Insignia Financial is a prime target for cyberattacks due to the sensitive client data it handles.

- Consequences of a Breach: Potential impacts include significant financial losses, severe reputational damage, and substantial regulatory penalties.

- Evolving Threat Landscape: The company must continuously adapt its defenses against increasingly sophisticated cyber threats.

- Client Trust: Maintaining client confidence is paramount, and a data breach could severely undermine this trust.

Shifting Consumer Preferences and Adviser Independence

The financial advice landscape is evolving, with younger demographics increasingly favoring direct-to-consumer platforms and independent financial advice over traditional adviser-led models. This trend poses a significant threat to established firms like IOOF, requiring them to innovate rapidly. For instance, a 2024 report indicated that over 60% of Gen Z investors prefer digital-first financial solutions, highlighting a clear shift in client expectations.

Adapting to these changing client preferences, particularly the demand for greater transparency and personalized digital experiences, is crucial for IOOF's continued relevance. Failure to do so could lead to client attrition and difficulty attracting new business. The industry is seeing a rise in robo-advisors and fintech solutions that offer lower fees and greater accessibility, directly competing with traditional advisory services.

- Shifting Demographics: Younger investors prioritize digital access and lower costs.

- Rise of Independent Advice: Clients are seeking unbiased, specialized advice outside large institutions.

- Technological Disruption: Fintech and robo-advisors offer alternative, often cheaper, investment solutions.

- Need for Innovation: IOOF must continuously adapt its service models to meet evolving client demands.

IOOF faces intense competition from agile fintech companies offering streamlined, cost-effective digital wealth solutions, potentially eroding market share. The Australian fintech market's projected growth to over AUD 30 billion by the end of 2024 underscores this escalating threat.

Evolving client preferences, especially among younger demographics favoring digital-first platforms and independent advice, challenge traditional models. A 2024 report found over 60% of Gen Z investors prefer digital financial solutions, indicating a significant shift IOOF must address.

Regulatory changes, such as the Retirement Income Covenant and mandatory climate-related disclosures from 2024, introduce compliance burdens and increase operational costs. These shifts necessitate continuous adaptation and investment in robust systems.

Economic downturns and market volatility directly impact IOOF's funds under management and administration (FUMA), leading to reduced revenue as clients may withdraw or reduce investments.

Cybersecurity risks remain a significant threat, with a data breach potentially causing substantial financial losses, regulatory fines, and irreparable reputational damage. The Australian financial sector saw a rise in cyber threats in 2023, with increased ransomware attacks.

SWOT Analysis Data Sources

This IOOF SWOT analysis is built upon a robust foundation of verified financial disclosures, comprehensive market intelligence, and expert industry evaluations. These sources provide the necessary data-driven insights for a precise and strategic assessment.