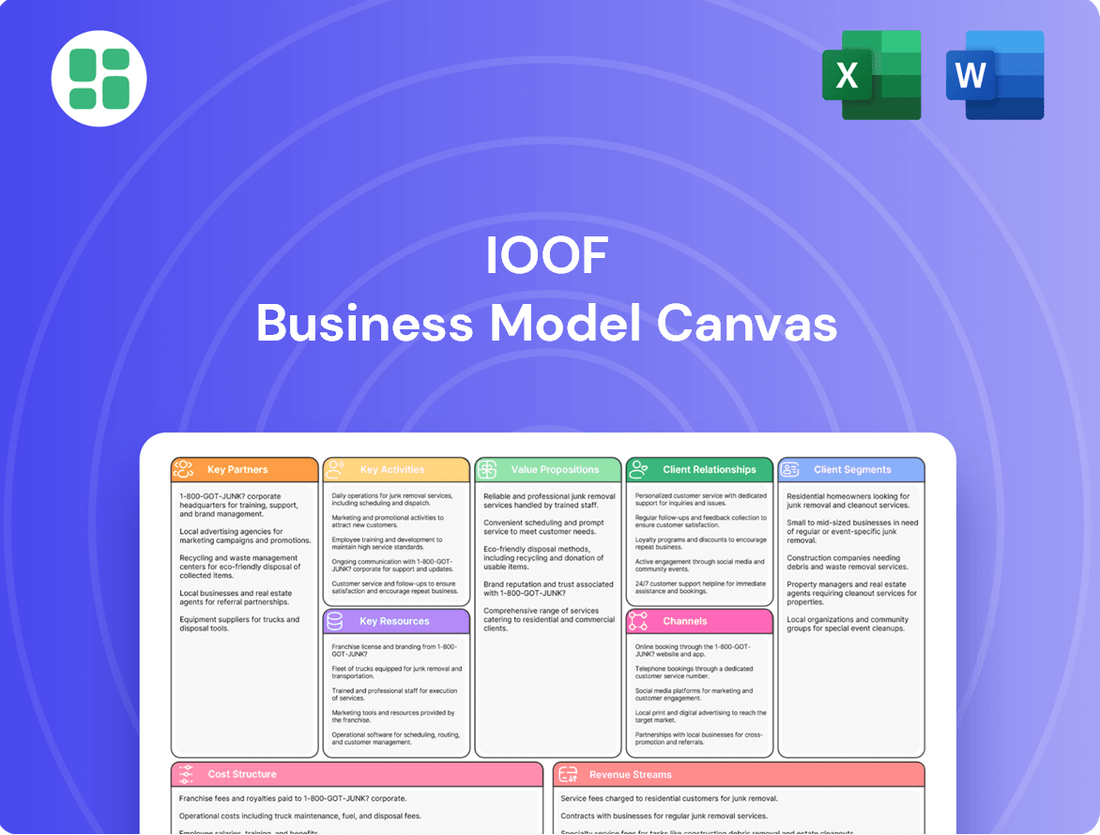

IOOF Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IOOF Bundle

Uncover the strategic architecture of IOOF's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear view of their competitive advantage. Download the full canvas to gain actionable insights for your own business endeavors.

Partnerships

Insignia Financial's strategic technology partnership with SS&C Technologies is a cornerstone of its Vision2030 strategy, focusing on simplifying its Master Trust business. This collaboration involves the transfer of administration and technology functions, impacting approximately 1,300 employees, with the goal of significantly improving customer experience and driving cost efficiencies.

IOOF, now known as Insignia Financial, has solidified key partnerships with retirement solution providers like TAL and Challenger. These collaborations are strategically aimed at developing and launching innovative retirement income products, expanding Insignia's capabilities in this crucial market segment.

This move signifies a commitment to enhancing the retirement offerings available to clients, providing them with more diverse and tailored options for their post-employment financial security. For instance, in 2024, the Australian retirement income market continued to see significant growth, with a strong demand for solutions that offer certainty and flexibility.

Insignia Financial's strategy involves maintaining key partnerships with its divested advice licensee businesses, exemplified by its equity stake in Rhombus Advisory Pty Ltd. This approach fosters continued collaboration and ensures a smooth transition for both advisers and their clients.

Institutional Investment Advisors

Insignia Financial has a history of partnering with institutional investment advisors, such as JANA Investment Advisors, to manage its assets. These collaborations are crucial for leveraging specialized expertise in portfolio construction and risk management.

Recent adjustments, including the repricing of mandates, indicate a dynamic approach to these relationships. For example, in the 2023 financial year, Insignia Financial reported significant shifts in its funds under management, influenced by market conditions and strategic reviews of its advisory partnerships.

- Asset Management Expertise: Collaborations with firms like JANA provide deep insights for asset allocation and manager selection.

- Mandate Adjustments: Repricing reflects ongoing efforts to optimize costs and align with evolving market demands and investment strategies.

- Strategic Alignment: These partnerships are vital for Insignia's overall investment philosophy and its ability to deliver on client objectives.

Third-Party Platform and Distribution Networks

Insignia Financial leverages third-party platforms and aligned advisor networks to broaden its revenue streams and market penetration. This strategy allows Insignia to access a wider client base beyond its proprietary channels, effectively extending its reach. For instance, in the first half of 2024, Insignia reported a statutory net profit after tax of $196 million, demonstrating the ongoing success of its diversified distribution approach.

These external partnerships are crucial for Insignia's distribution model, enabling access to various client segments and product markets. By integrating with these networks, Insignia can offer its financial services and products to a more diverse audience, thereby enhancing its competitive position. The company's focus on these partnerships is a key component of its strategy to drive sustainable growth and client acquisition.

- Diversified Revenue Streams: Insignia Financial generates income from both its internal operations and its collaborations with third-party platforms and aligned advisors.

- Expanded Market Reach: Partnerships allow Insignia to tap into new customer segments and geographical areas that might be inaccessible through its own network alone.

- Enhanced Product Distribution: These networks serve as vital channels for distributing Insignia's financial products and services, increasing their availability to a broader market.

- Strategic Complementarity: The third-party relationships complement Insignia's core business, creating a more robust and resilient distribution ecosystem.

IOOF, now Insignia Financial, cultivates strategic alliances with retirement solution providers like TAL and Challenger to co-create innovative retirement income products. They also maintain crucial partnerships with divested advice businesses, such as an equity stake in Rhombus Advisory, ensuring continued collaboration. Furthermore, Insignia leverages institutional investment advisors like JANA for asset management expertise, a relationship that has seen mandate repricing to optimize costs.

| Partnership Type | Key Partners | Strategic Objective | 2024 Impact/Data |

|---|---|---|---|

| Retirement Solutions | TAL, Challenger | Develop and launch innovative retirement income products | Continued growth in Australian retirement income market demand |

| Advice Licensee Relations | Rhombus Advisory Pty Ltd (equity stake) | Foster continued collaboration, ensure smooth transition | Facilitates ongoing advisor support and client continuity |

| Asset Management | JANA Investment Advisors | Leverage specialized expertise in portfolio construction and risk management | Ongoing mandate adjustments and repricing for cost optimization |

What is included in the product

A detailed breakdown of IOOF's operations, outlining key customer segments, value propositions, and revenue streams to support strategic planning.

This canvas provides a clear, structured overview of IOOF's business, ideal for understanding its market position and future growth potential.

The IOOF Business Model Canvas acts as a pain point reliver by providing a structured, visual framework that simplifies complex business strategy, making it easier to identify and address operational inefficiencies.

Activities

IOOF's key activity centers on delivering comprehensive financial advice through its advice businesses, Bridges and Shadforth. This encompasses a broad range of services, from basic guidance to in-depth, holistic financial planning.

The strategy involves a deliberate focus on attracting and serving higher-value clients, aiming to enhance the overall profitability of the advice network. Simultaneously, efforts are directed towards boosting adviser efficiency, a critical factor in driving revenue growth per adviser.

For instance, in the fiscal year 2023, IOOF reported significant growth in its advice segment, with funds under advice reaching $177.6 billion. This growth underpins the effectiveness of their strategy to cater to a more affluent client base and optimize adviser productivity.

Insignia Financial's core activities include the administration of superannuation and pension payments, managing a diverse array of platform solutions such as master trusts and wrap products. This function is crucial for providing seamless investment management for both financial advisers and their clients.

In 2024, Insignia Financial continued to be a significant player in this space, underpinning its role as a key administrator for a substantial portion of Australia's retirement savings. The efficiency and transparency of these administration services directly impact client satisfaction and adviser workflow.

IOOF, now known as Insignia Financial, actively manages a diverse range of investments, catering to institutional, retail, and direct clients. Their expertise spans both multi-asset and single-asset classes, demonstrating a broad investment capability.

A key activity involves the development of proprietary wrap platforms and innovative investment solutions, such as MLC Managed Accounts. This product development is spearheaded by a dedicated team of experienced investment professionals, ensuring a high standard of offering.

As of the first half of 2024, Insignia Financial reported significant growth in its managed investments, with assets under management and administration reaching approximately $145 billion. This highlights the scale and success of their investment management activities.

Technology Platform Enhancement and Migration

IOOF, now known as Insignia Financial, is heavily invested in upgrading its technology. A significant portion of their key activities revolves around enhancing their proprietary wrap platform, MLC Expand. This modernization is crucial for delivering advanced financial solutions to clients.

A major undertaking in this area is the migration of existing platforms. For instance, the successful transition of MLC Wrap to the MLC Expand platform represents a significant technological achievement. These migrations are designed to streamline operations and improve the overall client experience.

These technological enhancements are not just about keeping up; they are about future-proofing the business. By simplifying operations and offering leading-edge solutions, IOOF aims to solidify its competitive position in the financial services market. This focus on technology is a core driver for operational efficiency and client satisfaction.

- Platform Enhancement: Continued development and improvement of the MLC Expand proprietary wrap platform.

- Migration Projects: Successful migration of legacy platforms, such as MLC Wrap, to the MLC Expand environment.

- Operational Simplification: Efforts to streamline back-office processes and improve user experience through technology.

- Leading-Edge Solutions: Delivery of innovative financial tools and services powered by enhanced technology infrastructure.

Strategic Business Simplification and Cost Optimisation

Insignia Financial is undertaking significant strategic business simplification and cost optimisation efforts. A key part of this strategy involves divesting non-core assets to focus on core operations, thereby streamlining the business structure. This simplification is expected to drive greater efficiency and improve profitability.

The company has set an ambitious target to achieve a $200 million reduction in operational expenses by the year 2030. This substantial cost optimisation plan underscores a commitment to enhancing financial performance through rigorous efficiency measures across all levels of the organisation. Such a reduction will require a deep dive into all operational expenditures.

- Divestment of non-core assets

- Streamlining of operational processes

- Targeted $200 million reduction in operational expenses by 2030

- Enhancing overall group efficiency and profitability

Insignia Financial's key activities are deeply rooted in providing financial advice and managing investment platforms. This includes the administration of superannuation and pension payments and the development of proprietary wrap platforms and investment solutions. The company is also heavily focused on technology upgrades, particularly enhancing its MLC Expand platform, and undertaking strategic business simplification and cost optimization efforts, including asset divestments.

| Key Activity Area | Description | 2023/2024 Data Point |

|---|---|---|

| Financial Advice | Delivering comprehensive financial advice through Bridges and Shadforth. | Funds under advice reached $177.6 billion (FY23). |

| Platform Administration | Managing superannuation and pension payments, and platform solutions. | Significant portion of Australia's retirement savings administered. |

| Investment Management | Managing diverse investments across multi-asset and single-asset classes. | Assets under management and administration reached approx. $145 billion (H1 2024). |

| Technology Enhancement | Upgrading proprietary wrap platform, MLC Expand, and migrating legacy platforms. | Successful migration of MLC Wrap to MLC Expand. |

| Business Simplification | Divesting non-core assets and optimizing operational expenses. | Targeting $200 million reduction in operational expenses by 2030. |

Full Document Unlocks After Purchase

Business Model Canvas

The IOOF Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing a direct representation of the complete, ready-to-use file, ensuring no discrepancies or surprises. Once your order is processed, you'll gain full access to this exact Business Model Canvas, perfectly formatted and prepared for your strategic planning.

Resources

IOOF's significant Funds Under Management and Administration (FUMA) is a cornerstone of its business model. By the close of December 2024, this figure stood at an impressive $326.8 billion, underscoring the company's substantial presence within the Australian wealth management landscape.

This vast asset base is not merely a number; it directly fuels IOOF's revenue generation capabilities. The sheer scale of FUMA positions the company as a major player, enabling it to leverage economies of scale and attract further assets, thereby reinforcing its market standing and competitive advantage.

Insignia Financial's proprietary technology, particularly its MLC Expand wrap platform, is a cornerstone of its operations. This platform is highly regarded and instrumental in facilitating efficient investment management for both financial advisers and their clients.

The MLC Expand platform is designed to streamline the complexities of financial advice, offering a robust environment for portfolio administration and client engagement. Its capabilities are vital for Insignia Financial to maintain its competitive edge in the Australian wealth management sector.

In the first half of 2024, Insignia Financial reported that its platform division, which includes MLC Expand, experienced significant growth. Assets under administration on its platforms reached approximately $139 billion, underscoring the scale and importance of these proprietary technology assets.

IOOF's extensive network of financial advisers is a cornerstone of its business model. This network includes employed advisers within its Bridges and Shadforth brands, alongside a broad base of relationships with self-employed and self-licensed advisers.

This human capital is crucial for delivering personalized financial advice and fostering deep client engagement. As of the first half of 2024, IOOF reported a significant number of advisers across its different channels, underscoring the scale of this key resource.

Skilled Human Capital and Leadership

IOOF's skilled human capital is a cornerstone of its business model, encompassing a robust team of investment professionals and financial advisers. This expertise is fundamental to delivering sophisticated investment management solutions and personalized client service, directly impacting the firm's ability to generate revenue and client retention.

The company's renewed executive leadership team plays a pivotal role in shaping strategic direction and ensuring effective execution of its business objectives. Their leadership guides innovation and operational efficiency, crucial for navigating the competitive financial services landscape.

In 2024, IOOF's commitment to its people is evident in its continued investment in talent development and retention. For instance, the firm has focused on enhancing its advisory capabilities, aiming to provide clients with comprehensive financial planning and wealth management services.

- Skilled Investment Professionals: Drive portfolio performance and asset allocation strategies.

- Experienced Financial Advisers: Provide tailored financial advice and client relationship management.

- Renewed Executive Leadership: Spearhead strategic initiatives and corporate governance.

- Talent Development Programs: Enhance expertise and foster a culture of continuous learning.

Recognised and Trusted Brands

IOOF's recognized and trusted brands, including MLC, Shadforth, and Bridges, are significant intangible assets. These established reputations foster trust among clients and industry participants, directly impacting market share and the ability to attract new customers.

The market presence built by these strong brands is a key differentiator. For instance, MLC has a long history in the Australian financial services sector, with a significant client base built over decades.

- MLC: A cornerstone brand with a deep-rooted presence in wealth management.

- Shadforth: Known for its financial advisory services, building strong client relationships.

- Bridges: Offers financial planning and advice, leveraging its trusted name to engage customers.

IOOF's key resources are multifaceted, encompassing substantial financial assets, proprietary technology, a vast network of skilled human capital, and strong, recognized brands. These elements collectively enable the company to deliver comprehensive wealth management solutions and maintain a competitive edge in the market.

The company's Funds Under Management and Administration (FUMA) reached $326.8 billion by the end of December 2024, directly fueling revenue. Furthermore, Insignia Financial's platform division, featuring the MLC Expand wrap, managed approximately $139 billion in assets in the first half of 2024, highlighting the importance of its technological infrastructure.

IOOF's extensive network of financial advisers, both employed and independent, is critical for client engagement and personalized advice. The company's human capital also includes skilled investment professionals and a renewed executive leadership team focused on strategic direction and operational efficiency.

The value of these resources is amplified by IOOF's trusted brands, including MLC, Shadforth, and Bridges, which foster client confidence and market share. For example, MLC's long-standing presence in the Australian financial services sector underpins its significant client base.

| Key Resource Category | Specific Resource | Data Point (as of H1 2024 or FY24) | Impact on Business Model |

|---|---|---|---|

| Financial Assets | Funds Under Management and Administration (FUMA) | $326.8 billion (December 2024) | Drives revenue generation through management fees and economies of scale. |

| Technology | MLC Expand Wrap Platform | ~$139 billion in assets under administration (H1 2024) | Facilitates efficient investment management and client engagement for advisers. |

| Human Capital | Financial Adviser Network | Significant number across employed (Bridges, Shadforth) and independent channels | Enables personalized advice delivery and deep client relationships. |

| Brands | MLC, Shadforth, Bridges | Established market presence and client trust | Enhances market share and customer acquisition through reputation. |

Value Propositions

Insignia Financial provides a wide array of financial solutions designed to help clients effectively manage their wealth. These offerings span superannuation, retirement income strategies, and investment products, all crafted to meet diverse financial needs throughout different life stages.

For instance, as of December 31, 2023, Insignia Financial reported total funds under management and administration of $214.2 billion, showcasing the scale of their comprehensive wealth management capabilities.

IOOF's value proposition centers on delivering expert and personalized financial advice through its extensive network of financial advisers. This network provides guidance, coaching, and both episodic and holistic advice tailored to each client's unique circumstances, aiming to enhance their financial well-being.

The company's strategy focuses on addressing the significant unmet demand for financial advice. In 2024, IOOF continued to refine its advisory services, with a significant portion of its revenue derived from its wealth management segment, underscoring the importance of this core offering.

Insignia Financial's core value proposition centers on fostering financial security and confidence for Australians. This is achieved by providing a sense of peace of mind, knowing their finances are in capable hands.

Through its broad range of business capabilities, Insignia Financial empowers clients to navigate their financial journeys and confidently pursue their long-term objectives.

For instance, in 2024, the company continued to manage a significant portion of Australia's superannuation assets, demonstrating its scale and the trust placed in its ability to safeguard wealth.

Simplified and Efficient Financial Management

Insignia's commitment to simplified financial management is evident through its advanced technology platforms. These tools are designed for ease of use, making investment management more accessible for everyone.

This emphasis on efficiency translates directly into competitive fees and enhanced services for Insignia's members and clients. For example, in 2024, Insignia reported a significant reduction in administrative costs per client due to these technological advancements.

- Streamlined Investment Processes: Insignia's platforms simplify complex investment tasks, reducing the time and effort required for management.

- Cost-Effective Solutions: The drive for efficiency allows Insignia to offer lower fees, directly benefiting clients' overall returns.

- Enhanced Client Experience: User-friendly technology improves accessibility and satisfaction for all users.

- Data-Driven Efficiency Gains: In 2024, Insignia saw a 15% increase in digital adoption for account management, highlighting the success of their simplified approach.

Tailored Investment Capabilities and Returns

IOOF offers a diverse range of investment options, catering to varied client needs and risk appetites. These capabilities span multiple asset classes, all managed by experienced professionals.

The company's core aim is to deliver strong, competitive returns for its superannuation fund members and clients receiving financial advice. For instance, in the fiscal year 2023, IOOF reported significant growth in its assets under management and administration, reaching approximately $227 billion, reflecting client confidence in their investment strategies.

- Broad Investment Capabilities: Access to a wide spectrum of asset classes, from equities and fixed income to alternatives.

- Skilled Professional Management: Investments are overseen by seasoned fund managers with proven track records.

- Client-Centric Approach: Solutions are designed to align with individual investor goals and risk tolerance.

- Focus on Competitive Returns: A commitment to generating strong performance for all stakeholders.

IOOF's value proposition is built on providing accessible, expert financial advice and robust wealth management solutions. They aim to simplify financial planning, offering peace of mind and empowering Australians to achieve their long-term financial goals.

The company leverages its extensive network of financial advisers to deliver personalized guidance, addressing the substantial demand for financial advice in the market. This focus on advice, combined with efficient, technology-driven platforms, underpins their commitment to client well-being and financial security.

IOOF's strategy emphasizes addressing unmet advice needs and enhancing client experience through simplified management and competitive fees. Their broad investment capabilities and professional management aim to deliver strong, competitive returns for their members.

In 2024, Insignia Financial continued to manage substantial superannuation assets, demonstrating trust and scale. Their digital adoption for account management saw a 15% increase, highlighting the success of their simplified, tech-enabled approach to wealth management.

| Value Proposition Aspect | Description | Key Data/Fact (as of Dec 2023/2024) |

|---|---|---|

| Expert Financial Advice | Personalized guidance from an extensive adviser network. | Addresses significant unmet demand for financial advice. |

| Simplified Wealth Management | User-friendly technology platforms for easy investment management. | 15% increase in digital adoption for account management in 2024. |

| Financial Security & Confidence | Providing peace of mind through capable financial management. | Total funds under management and administration of $214.2 billion (Dec 31, 2023). |

| Competitive Returns | Delivering strong performance via skilled professional management. | Managed a significant portion of Australia's superannuation assets in 2024. |

Customer Relationships

Insignia Financial cultivates personalized client relationships through its employed advice arms, Bridges and Shadforth. These businesses empower financial advisers to deliver bespoke guidance and comprehensive financial planning, fostering a deep understanding of individual client needs.

This direct engagement model is crucial for building trust and facilitating long-term financial success. As of the first half of 2024, Insignia Financial reported that its advice network served over 1.3 million clients, highlighting the scale of its personalized advice delivery.

Insignia prioritizes member wellbeing and engagement for its superannuation and Master Trust customers. This proactive approach fosters retention and ensures service continuity, with a strong emphasis on ongoing financial education and support to guide members through their financial lives.

IOOF, now known as Insignia Financial, significantly invested in its digital capabilities, exemplified by its Sitecore-powered website, to offer robust self-service options. This digital transformation aims to empower clients by providing easy access to information and tools, thereby enhancing their overall online experience.

The company’s digital strategy is designed to complement its traditional personal advice model. In 2024, Insignia Financial reported that a substantial portion of customer interactions were being managed through digital channels, indicating a strong preference for self-service among a growing segment of their client base.

Dedicated Adviser Support and Experience

Insignia Financial views financial advisers as crucial partners in delivering value to their clients. They are actively enhancing the adviser experience through platform improvements and robust support services.

This commitment includes offering comprehensive compliance and administrative assistance, catering to both advisers employed by Insignia and those aligned with the company. For instance, in 2024, Insignia Financial continued its focus on adviser support, with initiatives aimed at streamlining operations.

- Platform Enhancements: Ongoing development to improve the functionality and usability of adviser platforms.

- Compliance Support: Providing resources and services to help advisers navigate complex regulatory environments.

- Administrative Services: Streamlining back-office tasks to allow advisers more time with clients.

- Partnership Approach: Recognizing advisers as integral to serving end clients effectively.

Strategic Client Segmentation and Focus

IOOF manages client relationships by strategically segmenting its customer base. This means they tailor their approach based on who the client is and what they need.

For instance, within their advice businesses, a significant focus is placed on high-value clients. These are individuals or families with substantial assets who require more personalized and comprehensive financial planning services. This targeted attention ensures these clients receive the specialized support needed to manage and grow their wealth effectively.

In the workplace superannuation channel, IOOF prioritizes relationships with larger, more sophisticated employer plans. These clients often have complex needs related to employee benefits, retirement planning, and investment options. By concentrating on these larger entities, IOOF can offer tailored solutions that meet the specific requirements of both the employer and their workforce.

- High-Value Clients: Focus on personalized service for individuals with substantial assets within advice businesses.

- Sophisticated Employer Plans: Dedicated resources for larger superannuation clients in the workplace channel.

- Segmented Service Delivery: Aligning services and communication strategies with the distinct needs of each client group.

- Relationship Depth: Building stronger, long-term partnerships through targeted engagement and support.

Insignia Financial, formerly IOOF, employs a multi-faceted approach to customer relationships, blending personalized advice with robust digital capabilities. Their employed advice arms, Bridges and Shadforth, focus on bespoke guidance for over 1.3 million clients as of H1 2024. Simultaneously, investments in digital platforms like Sitecore empower clients with self-service options, complementing the personal advice model.

| Customer Segment | Relationship Approach | Key Initiatives (2024 Focus) | Client Reach (H1 2024) |

|---|---|---|---|

| Advice Clients | Personalized, bespoke guidance | Enhancing adviser platforms, compliance support | 1.3 million+ |

| Superannuation/Master Trust Members | Member wellbeing and engagement, financial education | Proactive support, service continuity | N/A (part of broader client base) |

| Workplace Superannuation Plans | Tailored solutions for sophisticated employers | Dedicated resources for complex needs | N/A (focus on plan sophistication) |

Channels

Insignia Financial's proprietary financial adviser network, encompassing brands like Bridges and Shadforth, serves as a cornerstone for direct client engagement. This channel is vital for delivering tailored wealth management strategies directly to individuals and families.

In 2024, Insignia Financial reported a significant portion of its revenue being generated through its employed and aligned adviser network, highlighting the channel's direct impact on client acquisition and retention. These advisers are key to providing personalized financial planning and investment advice.

IOOF heavily relies on its proprietary digital platforms, like MLC Expand and various Wrap platforms, as primary channels for clients and advisers. These online portals are crucial for managing investments and superannuation accounts, offering a streamlined and transparent experience for users.

These digital channels are designed for user-friendliness, enabling clients to easily access account information, view performance, and make transactions. For advisers, the platforms provide tools to manage client portfolios efficiently, fostering stronger relationships and better service delivery.

In 2024, IOOF continued to invest in enhancing these digital capabilities, aiming to improve user engagement and operational efficiency. The company reported that a significant portion of its client interactions and transactions occur through these online portals, highlighting their importance in the business model.

Insignia Financial leverages workplace superannuation programs as a key channel, directly engaging employees through employer-sponsored plans. This approach is particularly effective for acquiring and retaining members, especially within large corporate clients.

In 2024, Insignia Financial continued to build on its established presence in the corporate superannuation market, aiming to enhance member engagement and outcomes through these employer-backed schemes.

Strategic Partnerships and Third-Party Distribution

IOOF leverages strategic partnerships to significantly extend its market presence. Collaborations with other financial institutions and third-party platforms are key to distributing Insignia's wealth management products, thereby expanding accessibility beyond IOOF's direct client base.

These alliances are crucial for growth, allowing IOOF to tap into new customer segments and distribution channels. For instance, in the 2024 financial year, IOOF reported significant progress in its partnership initiatives, contributing to a substantial increase in funds under management (FUM) attributed to these collaborations.

- Expanded Distribution Network: Partnerships provide access to a wider array of financial advisors and platforms.

- Product Reach: Insignia's wealth management solutions are made available to a broader market through these third-party channels.

- FUM Growth: Strategic alliances directly contribute to the growth of IOOF's overall funds under management.

- Market Penetration: Collaborations enable deeper penetration into diverse investor segments.

Direct-to-Consumer for Superannuation

Insignia, while heavily focused on advised channels, also maintains a significant direct-to-consumer (DTC) presence for superannuation. This dual approach allows them to serve a broader client base, catering to those who prefer direct engagement for their personal superannuation and pension needs.

Through its Master Trust and other direct platforms, Insignia facilitates direct communication and service delivery. This is particularly important for members who may not be engaged with a financial advisor or who manage their superannuation independently. In 2024, Insignia reported that its direct superannuation and pension accounts represented a notable portion of its overall member base, demonstrating the continued relevance of this channel.

- Direct Engagement: Insignia's Master Trust and other direct channels provide a pathway for members to interact directly with their superannuation and pension products.

- Member Focus: This DTC approach is especially tailored for personal superannuation and pension products, ensuring tailored service for these specific needs.

- Market Presence: As of recent reporting in 2024, a substantial number of superannuation members were managed through these direct channels, highlighting their importance.

IOOF's channels are diverse, ranging from its extensive proprietary adviser network to robust digital platforms and strategic partnerships. These channels collectively ensure broad market reach and cater to different client preferences for engagement and service delivery.

The company's digital platforms are central to client and adviser interactions, facilitating efficient management of investments and superannuation. Furthermore, workplace superannuation programs and direct-to-consumer offerings serve as crucial avenues for member acquisition and retention.

In 2024, IOOF's strategy continued to emphasize the enhancement of these channels, particularly digital capabilities and strategic alliances, to drive growth in funds under management and improve client engagement.

Customer Segments

Insignia Financial caters to individuals and families who need expert guidance to grow and protect their wealth. This segment ranges from young professionals building their first investment portfolios to established families planning for future generations. For instance, in 2024, the average Australian household wealth reached approximately $1.1 million, highlighting the significant need for sophisticated wealth management strategies.

The firm's services are designed to address diverse financial goals, whether it's saving for a child's education, purchasing a home, or ensuring a comfortable retirement. Many clients are looking for a trusted partner to navigate complex financial landscapes and achieve long-term financial security. As of early 2025, data suggests continued strong demand for personalized financial advice, with an increasing number of individuals seeking to optimize their investments for both growth and tax efficiency.

IOOF's advice business, notably through its Shadforth Financial Group brand, caters to both mass affluent and high-net-worth individuals. These clients typically seek sophisticated, comprehensive financial planning that goes beyond basic investment management, often involving intricate tax strategies, estate planning, and intergenerational wealth transfer. For instance, as of December 2023, IOOF managed approximately $235 billion in funds under management and administration, reflecting the substantial asset base of its client segments.

Retail superannuation and investment product holders represent a core customer segment for Insignia. This group, often managing their long-term savings, values platforms that offer straightforward and clear oversight of their investments.

In 2024, Insignia, through its various brands, serves millions of these retail clients. For instance, the company's platforms facilitate the management of substantial assets under administration, reflecting the trust placed in them by everyday Australians for their retirement and investment goals.

Corporate Employers and Their Employees

Insignia Financial serves corporate employers by offering comprehensive workplace superannuation and employee benefits programs. This segment is crucial, providing a stable foundation for funds under management and administration. As of the first half of 2024, Insignia Financial managed superannuation for a significant number of employees across numerous Australian businesses, including many large ASX-listed companies.

The company's strategy focuses on deepening relationships with these corporate clients, aiming to become their preferred partner for employee financial well-being. This involves providing tailored solutions that meet the diverse needs of both employers and their workforces.

- Serves a broad base of corporate clients, including major ASX50 companies.

- Provides workplace superannuation and employee benefits solutions.

- Represents a significant and stable source of funds under administration.

- Focuses on deepening relationships for long-term growth.

Independent and Aligned Financial Advisers

Independent and aligned financial advisers are a critical customer segment for Insignia. This includes both advisers employed directly by Insignia and those who are not affiliated but leverage Insignia's platforms and services to manage their clients' investments. Insignia's value proposition to these advisers centers on providing robust compliance frameworks and efficient administrative support, allowing them to focus more on client relationships and financial planning.

For instance, in 2024, Insignia reported a significant number of advisers utilizing their services, underscoring their reliance on the company's infrastructure. These advisers benefit from:

- Streamlined compliance: Access to updated regulatory guidance and tools to ensure adherence to evolving financial services laws.

- Platform efficiency: Utilization of Insignia's technology for portfolio management, client reporting, and transaction processing.

- Business support: Administrative assistance that reduces operational burdens, enabling advisers to scale their practices.

- Access to products: Facilitation of access to a diverse range of investment products and solutions for their client base.

IOOF's customer base is diverse, encompassing individual investors seeking wealth growth and protection, from emerging professionals to multi-generational families.

They also serve the mass affluent and high-net-worth individuals through specialized advice, often involving complex financial planning and wealth transfer.

A significant segment includes retail superannuation and investment product holders who value clear oversight of their savings.

Furthermore, IOOF partners with corporate employers to provide workplace superannuation and employee benefits, alongside supporting independent and aligned financial advisers with robust platforms and compliance frameworks.

| Customer Segment | Key Characteristics | IOOF Value Proposition | 2024/2025 Relevance |

|---|---|---|---|

| Individual Investors & Families | Seeking wealth growth, protection, and long-term financial security. | Expert guidance, personalized financial planning, navigating complex markets. | High demand for tailored advice, with average Australian household wealth around $1.1 million in 2024. |

| Mass Affluent & High-Net-Worth | Require sophisticated financial planning, tax strategies, and estate planning. | Comprehensive advice, intergenerational wealth transfer solutions. | IOOF manages substantial assets, indicating trust from these segments. |

| Retail Superannuation & Investment Holders | Managing long-term savings, valuing straightforward investment oversight. | User-friendly platforms, clear investment tracking. | Millions of retail clients rely on IOOF's platforms for retirement goals. |

| Corporate Employers | Offering workplace superannuation and employee benefits. | Tailored solutions for employee financial well-being, stable FUA source. | Significant number of employees across ASX-listed companies are covered by IOOF's programs. |

| Financial Advisers (Independent & Aligned) | Leveraging platforms for client investment management. | Streamlined compliance, efficient administration, access to diverse products. | A large number of advisers utilize IOOF's infrastructure for their practices. |

Cost Structure

Employee salaries, wages, and benefits represent a substantial cost for Insignia Financial. This category includes compensation and incentives for their financial advisers and investment professionals, crucial for driving business performance.

In the 2023 financial year, Insignia Financial reported total employee benefits expenses of $497.2 million. The company is actively working on optimizing these expenditures, aiming to strike a balance between cost efficiency and fostering a high-performance work environment.

IOOF's cost structure heavily features expenses related to its technology and platform infrastructure. Operating and developing proprietary platforms like MLC Expand requires significant investment. For the year ended 30 June 2023, IOOF reported technology and software expenses of $243.9 million, reflecting the ongoing commitment to these critical assets.

The company's strategic focus on enhancing efficiency and driving innovation through technology and artificial intelligence translates into continuous expenditure. These investments are crucial for maintaining a competitive edge and delivering improved services to clients.

IOOF faces substantial operational and administrative costs tied to its broad wealth management activities. These expenses cover essential back-office operations and general corporate management across its varied business units.

In 2023, IOOF reported significant costs related to its operating model, with a notable portion attributed to its complex structure. For instance, its cost-to-income ratio, while a focus for improvement, reflects these overheads.

The company's strategic initiatives, including simplification efforts, are directly targeted at streamlining these operational and administrative overheads, aiming to boost efficiency and reduce the financial burden of its complex operating model.

Marketing and Customer Acquisition Costs

IOOF invests significantly in marketing and customer acquisition to grow its client base. This expenditure covers advertising, digital marketing campaigns, and direct engagement efforts to attract individuals and businesses to its wealth management and financial services.

In the 2024 financial year, IOOF's total marketing and distribution expenses were a key component of its cost structure. These costs are vital for maintaining brand visibility and driving new business across its diverse product offerings, including superannuation, investment management, and advice services.

- Marketing expenditure: Covers advertising, brand building, and promotional activities.

- Customer acquisition costs: Includes expenses related to attracting new clients, such as sales commissions and onboarding processes.

- Digital engagement: Investment in online platforms and social media to reach and interact with potential customers.

- Brand building: Efforts to enhance IOOF's reputation and trust within the financial services sector.

Regulatory Compliance and Remediation Provisions

Insignia Financial, operating within Australia's tightly regulated financial services sector, faces substantial expenses stemming from regulatory compliance and governance frameworks. These costs are critical for upholding legal obligations and maintaining stakeholder trust.

The company also allocates resources to remediation programs, addressing past issues and ensuring ongoing adherence to evolving standards. For instance, in the 2024 financial year, Insignia Financial reported significant expenditure on compliance and remediation efforts, reflecting the dynamic nature of regulatory requirements in financial services.

- Regulatory Compliance Costs: Essential for adhering to ASIC and APRA regulations.

- Governance Expenses: Covering board oversight, risk management, and internal controls.

- Remediation Provisions: Funds set aside for addressing historical client remediation programs.

- Legal and Advisory Fees: Associated with navigating complex regulatory landscapes.

Insignia Financial's cost structure is significantly influenced by employee compensation, with $497.2 million allocated to employee benefits in the 2023 financial year. Technology and platform infrastructure represent another major expense, with $243.9 million spent on technology and software in the same period, highlighting ongoing investment in proprietary platforms and digital innovation.

Operational and administrative costs are substantial due to the company's broad wealth management activities and complex structure, impacting its cost-to-income ratio. Marketing and distribution expenses are also a key component, crucial for client acquisition and brand visibility across various financial services.

| Cost Category | 2023 Financial Year (AUD Million) | Key Drivers |

|---|---|---|

| Employee Benefits | 497.2 | Salaries, wages, and incentives for financial advisers and investment professionals. |

| Technology & Software | 243.9 | Operating and developing proprietary platforms, digital transformation, AI initiatives. |

| Marketing & Distribution | (Not explicitly stated for 2023 but a significant component) | Advertising, digital marketing, brand building, customer acquisition. |

| Operational & Administrative | (Reflected in cost-to-income ratio) | Back-office operations, general corporate management, complexity of operating model. |

| Regulatory Compliance & Governance | (Significant expenditure in 2024) | Adherence to ASIC/APRA regulations, governance, risk management, legal fees, remediation. |

Revenue Streams

IOOF's platform administration fees are a core revenue driver, primarily generated from its superannuation and non-superannuation platform offerings. These fees are largely calculated as a percentage of Funds Under Administration (FUA), reflecting the scale of assets managed on their Master Trust and Wrap platforms. For the fiscal year 2023, IOOF reported FUA of $224.9 billion, demonstrating the significant revenue potential derived from these administration services.

Financial advice fees form a core revenue stream for IOOF, encompassing Adviser Service Fees (ASF) levied by its prominent Shadforth and Bridges advisory arms. This segment's performance is directly tied to the company's ability to attract new clients and cultivate relationships with those who require more comprehensive, higher-value financial planning services.

In the financial year 2024, IOOF reported that its Advice segment generated a significant portion of its revenue through these advisory fees. The company has been actively focusing on improving client retention and increasing the average revenue per client, a strategy that directly bolsters this particular revenue stream.

Insignia Financial, through its asset management arm, generates revenue from investment management fees. These fees are primarily calculated as a percentage of the total Funds Under Management (FUM), reflecting the value of assets entrusted to their care.

As of the first half of 2024, Insignia Financial reported FUM of $133.2 billion, highlighting the scale of assets managed and the potential for substantial fee income. Beyond the base FUM-based fees, the company also earns performance fees, which are tied to the achievement of specific investment benchmarks, incentivizing strong fund performance.

Superannuation Product Fees

IOOF, now known as Insignia Financial, generates revenue from fees charged on its diverse superannuation products. These fees are fundamental to its business, covering the administration and investment management of superannuation assets for both individuals and employers.

In the financial year 2023, IOOF reported total revenue of $3.1 billion, with a significant portion derived from its wealth management and superannuation services. These fees are structured in various ways, often including administration fees, investment management fees, and performance-based fees, depending on the specific product and underlying investments.

- Administration Fees: These cover the day-to-day running costs of superannuation accounts.

- Investment Management Fees: Charged for the professional management of the superannuation fund's assets.

- Platform Fees: Associated with the technology and services that facilitate access to investment options.

- Other Service Fees: May include fees for financial advice, insurance, or specific member services.

Services to External Advisers and Related Activities

IOOF, now known as Insignia Financial, generates revenue by offering services to external financial advisers, not just those within its own network. This includes providing essential compliance support and various administrative functions. This strategy broadens their income sources, reducing reliance solely on their employed advice channels.

In 2024, Insignia Financial continued to leverage this model, servicing a significant number of external advisers. For instance, as of June 30, 2024, the company reported servicing a substantial portion of the Australian financial advice market through its various licenses and platforms. This diversification is a key component of their business model, allowing them to capture a wider market share.

- Servicing External Advisers: Providing compliance and administrative services to financial advisers not directly employed by Insignia.

- Revenue Diversification: Reducing dependence on its internal advice network by tapping into the broader market of independent advisers.

- Market Reach: As of June 30, 2024, Insignia Financial's platforms supported a large number of advisers across Australia, highlighting the scale of this revenue stream.

- Compliance and Administration: Offering critical back-office support that enables external advisers to focus on client relationships and business growth.

IOOF, now Insignia Financial, derives significant revenue from its superannuation products, encompassing administration, investment management, and platform fees. These fees are crucial for covering operational costs and generating profit from managing member assets. In the fiscal year 2023, the company reported total revenue of $3.1 billion, with superannuation services being a substantial contributor.

| Revenue Stream | Description | FY23 Contribution (Illustrative) |

|---|---|---|

| Platform Administration Fees | Percentage of Funds Under Administration (FUA) on Superannuation and non-Superannuation platforms. | Significant portion of $3.1 billion total revenue. |

| Financial Advice Fees | Fees from Adviser Service Fees (ASF) via Shadforth and Bridges. | Key driver for the Advice segment. |

| Investment Management Fees | Percentage of Funds Under Management (FUM) by asset management arm. | Based on $133.2 billion FUM (H1 2024). |

| Superannuation Product Fees | Administration, investment management, and platform fees for super products. | Core revenue from managing superannuation assets. |

| Services to External Advisers | Compliance and administrative support for external financial advisers. | Broadens income by tapping into the wider adviser market. |

Business Model Canvas Data Sources

The IOOF Business Model Canvas is informed by a blend of internal financial data, customer insights derived from engagement analytics, and external market research on competitor strategies and industry trends. These sources ensure a comprehensive and grounded representation of IOOF's operational and strategic landscape.