IOOF Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IOOF Bundle

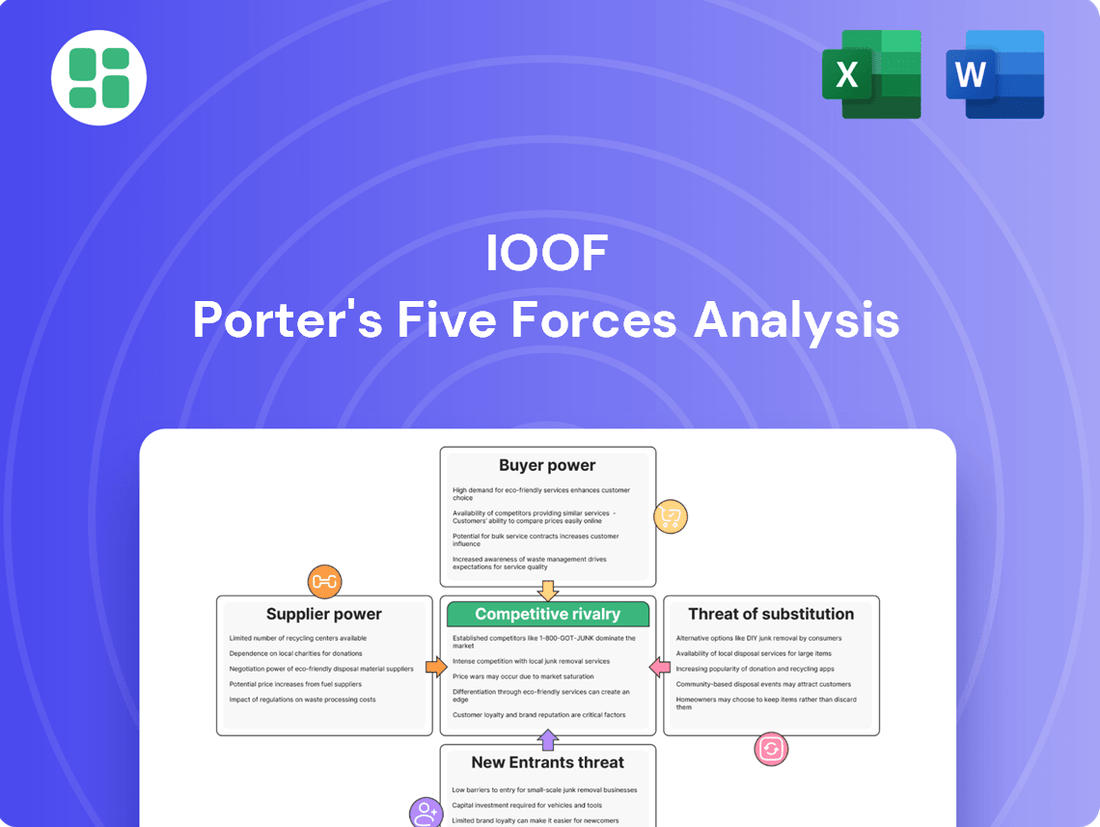

Understanding the competitive landscape for IOOF is crucial for any strategic decision. This analysis delves into the five key forces shaping their market, revealing the intensity of rivalry and the bargaining power of both buyers and suppliers.

The full Porter's Five Forces Analysis goes deeper, uncovering the threat of new entrants and the ever-present danger of substitute products. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Insignia Financial's dependence on technology and software providers for critical operations like wealth management and superannuation administration means these suppliers hold considerable sway. The complexity and integration of these systems often result in substantial switching costs for Insignia, tipping the balance towards supplier power. For instance, the 2024 financial year saw Insignia invest significantly in upgrading its core technology infrastructure, highlighting the ongoing need for specialized software solutions.

The bargaining power of suppliers, particularly specialized talent like financial advisers and IT professionals, significantly impacts Insignia Financial. The demand for highly qualified financial advisers and IT experts, especially those proficient in AI and data analytics, is robust. In 2024, the Australian financial services sector continued to grapple with a shortage of experienced financial planners, a trend exacerbated by regulatory reforms and industry consolidation.

This scarcity of skilled professionals, particularly those adept at navigating complex regulatory landscapes and leveraging new technologies, grants them a moderate degree of bargaining power. Insignia Financial, like its peers, must therefore offer competitive remuneration and attractive working conditions to secure and retain this vital talent, influencing operational costs and strategic execution.

Data and research providers wield moderate bargaining power over IOOF. Access to accurate market data, economic research, and client insights is crucial for IOOF's investment management and personalized advice services. These services are often indispensable for competitive analysis and informed decision-making, giving providers a degree of leverage.

While IOOF's significant scale allows it to negotiate favorable terms, the uniqueness of certain data sets can amplify a supplier's influence. For instance, specialized alternative data or proprietary research can be difficult to replicate, strengthening the provider's position in negotiations.

Regulatory Compliance and Legal Services

In Australia's tightly regulated financial sector, Insignia Financial relies heavily on legal and compliance professionals to manage intricate and changing legislation, including the Financial Accountability Regime (FAR) and ASIC's enforcement focus. The specialized knowledge required means these service providers possess a moderate to significant degree of bargaining power, especially when dealing with complex regulatory challenges.

This reliance translates into potential cost pressures for Insignia Financial, as specialized legal advice can be substantial. For instance, the cost of compliance for financial institutions has been a growing concern, with reports indicating significant investments in regulatory adherence. In 2024, the ongoing implementation of new regulatory frameworks continues to demand expert legal interpretation and guidance.

- Specialized Expertise: The unique and evolving nature of financial regulations creates a demand for highly specialized legal and compliance talent.

- Regulatory Burden: The increasing complexity of Australian financial laws, such as the FAR, necessitates expert advice, increasing supplier leverage.

- Cost Implications: The need for ongoing legal and compliance support represents a significant operational cost for firms like Insignia Financial.

Investment Product Manufacturers (Third-Party Fund Managers)

Insignia Financial, while possessing its own investment expertise, also relies on a range of products from external, third-party fund managers. The influence these managers hold is directly tied to how distinctive, how well-performing, and how reputable their investment offerings are.

For instance, if a third-party fund manager provides a particularly unique or high-performing investment product that Insignia Financial finds essential for its clients, that manager's bargaining power increases significantly. This is especially true when these products are in high demand and difficult to replicate.

- Unique Product Offerings: Fund managers with niche or proprietary investment strategies have greater leverage.

- Performance Metrics: Consistently strong historical returns can command better terms. For example, in 2024, top-quartile performing Australian equity funds have seen increased inflows, giving their managers more pricing power.

- Brand Reputation: Well-established and trusted fund management brands can negotiate more favorable distribution agreements.

Suppliers of specialized technology and software are key to Insignia Financial's operations, with high switching costs amplifying their power. The company's 2024 investment in core technology infrastructure underscores this reliance. Similarly, the scarcity of skilled financial advisers and IT professionals in Australia, particularly those with AI expertise, grants these individuals considerable bargaining power, forcing Insignia to offer competitive compensation to attract and retain them.

Data and research providers also hold moderate influence, as accurate market insights are vital for Insignia's advisory services. While Insignia's scale aids negotiations, unique data sets can strengthen a provider's position. Furthermore, legal and compliance professionals, essential for navigating Australia's complex regulatory environment, possess moderate to significant bargaining power due to their specialized knowledge, impacting Insignia's operational costs.

Third-party fund managers offering unique or high-performing products also exert considerable influence. For instance, top-performing Australian equity funds in 2024 attracted significant inflows, boosting their managers' pricing power. Reputable brands and strong performance metrics are critical factors in these negotiations.

| Supplier Type | Bargaining Power Level | Key Factors Influencing Power | Impact on Insignia Financial |

|---|---|---|---|

| Technology & Software Providers | Considerable | High switching costs, system complexity, specialized needs | Potential for increased costs, reliance on vendor roadmaps |

| Specialized Talent (Advisers, IT) | Moderate to High | Talent scarcity, demand for specific skills (AI, data analytics), regulatory expertise | Pressure on remuneration, retention challenges, impact on service delivery |

| Data & Research Providers | Moderate | Indispensability of data for decision-making, uniqueness of data sets | Negotiation leverage for data access and pricing |

| Legal & Compliance Professionals | Moderate to Significant | Specialized regulatory knowledge, complexity of legislation (FAR) | Significant operational costs for compliance, reliance on expert advice |

| Third-Party Fund Managers | Variable (Moderate to High) | Product uniqueness, historical performance, brand reputation | Influence on product shelf, potential for higher fees on successful products |

What is included in the product

This analysis dissects the competitive forces impacting IOOF, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Effortlessly pinpoint competitive threats and opportunities with a visual, interactive dashboard that simplifies complex market dynamics.

Customers Bargaining Power

Customers today have unprecedented access to information about financial products and services. Online platforms and comparison websites allow individuals and businesses to easily research fees, adviser performance, and product features across numerous providers. This heightened transparency directly impacts Insignia Financial by increasing customer awareness and their ability to compare options.

This readily available information empowers customers to make more informed decisions, driving a stronger demand for competitive pricing and demonstrable value. For instance, in 2024, the growth of financial comparison sites has continued, with many reporting double-digit percentage increases in user engagement as consumers actively seek the best deals.

For certain financial products, like superannuation, portability rules and regulatory shifts have significantly lowered the effort required for customers to switch providers. This ease of movement directly bolsters customer bargaining power, pushing companies like Insignia to prioritize customer retention through enhanced service and competitive value propositions.

The demand for personalized and digital services significantly amplifies customer bargaining power. Modern clients, particularly millennials, expect intuitive digital onboarding, tailored advice, and smooth online interactions. Insignia's capacity to deliver these advanced digital features is crucial for customer satisfaction and retention, as dissatisfied clients can readily switch to competitors offering superior digital experiences.

Consolidation of Super Funds and Institutional Clients

The Australian superannuation sector is seeing a trend towards consolidation, creating larger super funds and institutional clients. For instance, by the end of 2023, the total assets under management in Australian superannuation funds reached approximately AUD 3.5 trillion, with the largest funds managing hundreds of billions each.

This increased scale grants these mega-funds significant bargaining power. They can negotiate for lower management fees and demand customized services from financial service providers like IOOF, leveraging the sheer volume of assets they control.

- Increased Asset Volume: Larger funds manage greater sums, enhancing their negotiation leverage.

- Fee Pressure: Consolidation allows funds to demand reduced fees from service providers.

- Demand for Tailored Solutions: Mega-funds seek bespoke services aligning with their specific investment strategies.

- Industry Trend: The ongoing consolidation signifies a lasting shift in client power dynamics.

Regulatory Focus on Best Financial Interest Duty

Regulatory bodies, such as the Australian Prudential Regulation Authority (APRA), are intensifying their focus on ensuring superannuation funds and financial service providers operate in the best financial interests of their members and clients. This heightened scrutiny directly translates into increased customer bargaining power.

By mandating that providers prioritize member outcomes, regulators hold these entities accountable for delivering value and strong performance. This accountability mechanism empowers customers, as providers must actively demonstrate their commitment to members' financial well-being to remain competitive and compliant.

For instance, in 2023, APRA reported that superannuation funds under its supervision saw a collective net return of 8.4% for the year ending June 30, 2023. This focus on performance, driven by regulatory pressure, directly impacts customer perception and their ability to switch providers if dissatisfied.

- Increased Accountability: Regulatory emphasis on the best financial interest duty forces providers to be more transparent and performance-oriented.

- Consumer Empowerment: Customers gain leverage as they can expect and demand value, performance, and fair treatment from financial institutions.

- Market Competition: Providers must differentiate themselves based on demonstrable member benefits, intensifying competition and benefiting consumers.

Customers today possess significant leverage due to readily available information and reduced switching costs, compelling financial institutions to offer competitive pricing and superior service. The rise of comparison websites and regulatory focus on member outcomes in 2024 has further amplified this power.

The consolidation trend in the Australian superannuation sector, with total assets under management reaching approximately AUD 3.5 trillion by the end of 2023, has created institutional clients with substantial bargaining power. These larger entities can negotiate lower fees and demand tailored services, directly impacting providers like Insignia Financial.

| Factor | Impact on Customer Bargaining Power | Example/Data (2023-2024) |

|---|---|---|

| Information Access | Increased awareness and ability to compare providers | Growth in financial comparison site engagement |

| Switching Costs | Lowered barriers to changing financial providers | Portability rules in superannuation |

| Digital Expectations | Demand for personalized and seamless online experiences | Millennial preference for digital financial services |

| Institutional Consolidation | Larger clients negotiate better terms due to asset volume | AUD 3.5 trillion in Australian superannuation assets (end 2023) |

| Regulatory Scrutiny | Focus on member outcomes and provider accountability | APRA's emphasis on best financial interests duty |

Preview Before You Purchase

IOOF Porter's Five Forces Analysis

This preview showcases the comprehensive IOOF Porter's Five Forces analysis, detailing the competitive landscape of the organization, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

The Australian wealth management and superannuation sector is a mature landscape, marked by substantial consolidation. This trend intensifies rivalry as a dwindling number of larger entities vie for dominance. For Insignia Financial, this means organic growth is a significant hurdle, and companies must aggressively battle for existing market share.

Insignia Financial contends with intense rivalry from the wealth management divisions of large Australian banks and significant industry superannuation funds. These entities often possess considerable market share, established brand loyalty, and broad distribution channels, intensifying the competitive pressures Insignia faces.

While the financial services industry strives for unique offerings, many fundamental products, such as superannuation and standard investment portfolios, often appear quite similar to consumers. This inherent similarity means companies like Insignia must aggressively compete on factors like pricing, fee structures, and the overall perceived value of their services, which naturally amplifies the competitive rivalry within the sector.

Adviser Exodus and Industry Restructuring

The Australian financial advice landscape has undergone significant upheaval, with a notable exodus of advisers. This decline, driven by stringent regulatory reforms and escalating compliance costs, has reshaped the competitive environment. For instance, by the end of 2023, the number of financial advisers in Australia had fallen considerably compared to previous years, a trend that continued into early 2024.

This restructuring impacts firms that depend on extensive adviser networks for client acquisition and service delivery. While there are indications of some advisers re-entering the market, the overall reduction in numbers intensifies competition for talent and client relationships among remaining firms.

- Adviser Numbers Decline: The Australian financial advice sector experienced a substantial drop in adviser numbers leading up to and throughout 2023 and into 2024, a direct consequence of regulatory pressures.

- Increased Compliance Burden: Higher compliance requirements and associated costs have been a primary driver for advisers leaving the industry.

- Network Impact: Firms relying on large adviser networks face challenges in maintaining client coverage and service levels due to this reduction.

- Market Restructuring: The ongoing consolidation and restructuring within the industry create a more competitive environment for the remaining advisers and advice businesses.

Technology and Digital Transformation Race

Competitors in the financial services sector are aggressively pursuing digital transformation, pouring significant resources into areas like artificial intelligence and sophisticated data analytics. This intense focus aims to elevate client experiences, streamline operations, and introduce novel financial products. For instance, major players are investing billions in AI-powered financial advice platforms and personalized digital banking solutions, aiming to capture market share through superior technology.

Insignia Financial faces a critical challenge to match this pace. Failing to keep up with these technological advancements risks a loss of competitive advantage, potentially leaving the company outmanoeuvred by more digitally agile rivals. The imperative is clear: continued investment in and adoption of cutting-edge technologies are essential for maintaining market relevance and client engagement in 2024 and beyond.

- Digital Investment: Competitors are allocating substantial capital to AI and data analytics. For example, many large banks have publicly announced multi-year digital transformation budgets exceeding $5 billion.

- Client Experience Focus: The primary driver for these investments is enhancing client satisfaction through personalized digital offerings and seamless service delivery.

- Operational Efficiency: Technology adoption also targets cost reduction and improved internal processes, a key factor in profitability.

- Competitive Necessity: Insignia Financial must invest to avoid falling behind in a rapidly evolving technological landscape.

Competitive rivalry in the Australian wealth management sector is fierce, fueled by industry consolidation and a mature market. Insignia Financial faces strong competition from large banks and superannuation funds with established customer bases and extensive distribution networks. The similarity of core financial products necessitates competition on price and service value, intensifying the battle for market share.

The Australian financial advice landscape has seen a significant reduction in adviser numbers, with a notable decline continuing into 2023 and early 2024 due to regulatory changes and increased compliance costs. This exodus creates intense competition for the remaining advisers and their client relationships, impacting firms like Insignia that rely on these networks.

Furthermore, competitors are heavily investing in digital transformation, particularly in AI and data analytics, to enhance client experience and operational efficiency. For example, many financial institutions have multi-year digital transformation budgets exceeding $5 billion, underscoring the necessity for Insignia Financial to maintain pace with technological advancements to remain competitive.

| Competitor Type | Key Competitive Factors | Example Impact on Insignia |

|---|---|---|

| Large Banks | Brand recognition, existing customer base, broad distribution | Difficulty in acquiring new customers, pressure on fees |

| Industry Super Funds | Low fees, strong member loyalty, government backing | Direct competition for superannuation assets, potential for bundled services |

| Fintechs & Digital Platforms | Agile technology, lower cost structures, personalized digital experience | Risk of disintermediation, need for digital investment |

| Independent Financial Advisers | Personalized service, niche expertise, flexibility | Competition for adviser talent, need to support adviser value proposition |

SSubstitutes Threaten

The proliferation of direct investment platforms and DIY investing tools presents a significant threat of substitution for traditional financial advisory services. These platforms, like CommSec, SelfWealth, and Superhero, empower individuals to manage their own portfolios, bypassing intermediaries. In 2024, the number of active users on these platforms continued to grow, with many reporting increased engagement in self-directed trading and portfolio management, directly impacting demand for managed solutions.

Robo-advisors and digital financial planning tools present a significant threat of substitutes for traditional financial advisory services. These platforms leverage algorithms to offer automated investment management and financial advice, often at a fraction of the cost of human advisors. For instance, by mid-2024, the assets under management for leading robo-advisors in Australia were projected to exceed $20 billion, indicating their growing appeal.

These digital solutions are particularly attractive to younger investors and those with simpler financial needs, providing accessible and low-cost alternatives for basic portfolio management and financial planning. While they may not replicate the nuanced, personalized advice of a human advisor, they effectively substitute for a portion of the market seeking convenience and affordability.

The threat of substitutes for managed funds is significant, particularly from property investments. In 2024, Australians continue to demonstrate a strong cultural inclination towards property as a primary wealth-building tool, often viewing it as a more tangible and understandable alternative to managed funds.

Beyond traditional housing, direct investments in other asset classes like unlisted real estate funds or private equity also present compelling substitutes. These options allow investors to bypass managed fund structures entirely, seeking potentially higher returns or different risk profiles directly from the underlying assets.

General Personal Finance Education and Self-Reliance

The increasing accessibility of personal finance education, often through free online platforms and readily available resources, significantly lowers the barrier for individuals to manage their own money. This surge in financial literacy empowers consumers to make informed decisions, potentially reducing their reliance on traditional financial advisory services.

In 2024, a significant portion of the population is actively seeking out financial knowledge. For instance, search trends indicate a substantial uptick in queries related to budgeting, investing basics, and retirement planning. This self-directed learning reduces the perceived necessity of professional guidance for routine financial matters.

- Growing Digital Resources: Platforms like Investopedia, Khan Academy, and numerous financial blogs offer comprehensive, often free, educational content.

- Increased DIY Investing: The rise of low-cost brokerage platforms has further enabled individuals to manage their own investment portfolios, bypassing traditional advisors.

- Reduced Perceived Value: For those with simpler financial needs or a high degree of financial confidence, the cost of professional advice may outweigh the perceived benefits.

Alternative Lending and Fintech Solutions

The rise of alternative lending and broader fintech solutions presents a growing threat of substitutes for traditional wealth management services. Platforms offering peer-to-peer lending, crowdfunding, and specialized digital payment systems provide individuals with new avenues to manage and grow their capital outside of conventional superannuation or investment products. For instance, in 2024, the global P2P lending market was projected to reach over $150 billion, demonstrating a significant shift in capital allocation.

These fintech innovations, while not directly replacing superannuation's core function, offer alternative ways to achieve financial goals. They cater to different risk appetites and liquidity needs, potentially drawing capital away from traditional channels. The increasing adoption of these digital platforms, with some reporting user growth rates exceeding 30% year-over-year in 2023, highlights their competitive appeal.

- Fintech lending platforms offer alternative investment opportunities.

- Crowdfunding provides access to capital for various projects.

- Digital payment systems streamline financial transactions.

- These alternatives compete for investor capital and financial engagement.

The threat of substitutes for traditional financial services is substantial, driven by accessible digital platforms and a growing appetite for self-directed financial management. These alternatives offer lower costs and greater convenience, directly challenging established models.

In 2024, the continued expansion of robo-advisors and direct investment platforms, such as Stake and Pearler, is a key indicator. These services are attracting significant assets, with many reporting double-digit growth in user numbers and funds under management, demonstrating a clear preference for low-cost, digital solutions among a growing segment of investors.

Furthermore, the increasing availability of free financial education resources empowers individuals to take more control of their finances, reducing their reliance on professional advice for everyday financial planning and investment decisions.

Property remains a strong substitute, with a significant portion of Australian household wealth allocated to real estate, often perceived as a more tangible and understandable investment compared to managed funds.

Entrants Threaten

The Australian financial services sector is a minefield of regulations, demanding rigorous licensing, robust capital reserves, and adherence to strict compliance protocols overseen by bodies like APRA and ASIC. These substantial regulatory obstacles effectively deter new players, particularly those aspiring to offer a comprehensive suite of financial services, thereby limiting the threat of new entrants.

Significant capital investment is a major hurdle for new entrants in the Australian wealth management and superannuation sectors. Establishing a competitive presence necessitates substantial outlays for advanced technology infrastructure, robust compliance systems, and extensive marketing campaigns to build essential brand awareness and trust. For instance, in 2024, the average cost for a new fintech to acquire a single customer in financial services often ranges from $300 to $500, underscoring the capital intensity involved.

Furthermore, the industry demands considerable scale to achieve meaningful cost efficiencies and compete effectively on fees. Smaller players often struggle to reach this critical mass, making it difficult to match the operational leverage and pricing power of established institutions. This inherent need for scale acts as a significant deterrent, effectively raising the barrier to entry for potential new competitors aiming to disrupt the market.

Client trust and established brand reputation are paramount in financial services, as individuals entrust their life savings to providers. Insignia Financial, for instance, benefits from a long history, making it difficult for new entrants to build comparable trust and brand recognition.

In 2024, the financial services sector continues to see a strong emphasis on customer loyalty, with a significant portion of clients remaining with established institutions due to perceived stability and reliability. This inertia presents a substantial barrier for new players attempting to gain market share.

Access to Distribution Networks and Client Bases

New entrants face a significant hurdle in accessing established distribution networks and client bases. Building these channels, whether through financial adviser relationships or direct customer outreach, is a lengthy and resource-intensive process. For instance, in 2024, the cost of acquiring a new retail customer in the financial services sector can range from hundreds to thousands of dollars, depending on the service offered.

Established firms possess a distinct advantage due to their existing relationships and robust referral ecosystems. This makes it challenging for newcomers to rapidly gain substantial market share. In 2023, the top five Australian wealth management firms collectively managed over AUD 1.5 trillion in assets, a testament to their entrenched client bases and distribution power.

- Distribution Network Costs: Building and maintaining adviser networks and direct client channels require substantial upfront and ongoing investment.

- Client Acquisition Challenges: New entrants struggle to replicate the trust and inertia that keeps clients with incumbent providers.

- Established Relationships: Existing firms benefit from long-standing customer loyalty and intergenerational wealth transfer.

Technological and Data Infrastructure Investment

The significant capital outlay for establishing and maintaining advanced technological and data infrastructure presents a considerable hurdle for potential new entrants. This includes the need for secure cloud computing, sophisticated data analytics platforms, and robust cybersecurity protocols to protect client information and ensure operational integrity.

For instance, a comprehensive wealth management platform requires substantial investment in areas like AI-driven financial planning tools and secure client portals. In 2024, the global cybersecurity market alone was projected to reach over $200 billion, highlighting the scale of investment needed to simply secure operations, let alone innovate.

- High Upfront Costs: Building secure, scalable, and compliant technological infrastructure demands significant initial capital.

- Cybersecurity Investment: Protecting sensitive client data necessitates substantial ongoing expenditure on advanced cybersecurity measures.

- Data Analytics Capabilities: Developing and integrating sophisticated data analytics for personalized financial advice requires considerable investment in technology and expertise.

- Competitive Technology Landscape: Existing players often have established, integrated systems, forcing new entrants to invest heavily to match or surpass these capabilities.

The threat of new entrants in the Australian financial services sector is generally low, primarily due to high barriers to entry. These include stringent regulatory requirements, substantial capital investment needs, the importance of client trust and brand reputation, and the difficulty in accessing established distribution networks. For instance, in 2024, the cost of acquiring a new customer can range from hundreds to thousands of dollars, making it a capital-intensive endeavor for newcomers.

| Barrier to Entry | Description | 2024/2023 Data Point |

|---|---|---|

| Regulatory Hurdles | Strict licensing, capital reserves, and compliance overseen by APRA and ASIC. | Ongoing compliance costs represent a significant portion of operational expenses for new firms. |

| Capital Investment | Need for advanced technology, compliance systems, and marketing. | Customer acquisition costs in financial services often range from $300-$500 per client. |

| Brand Reputation & Trust | Clients entrust life savings to established, reputable institutions. | Client inertia favors established providers, making it hard for new entrants to gain traction. |

| Distribution Networks | Accessing adviser networks and client bases is resource-intensive. | Top Australian wealth managers held over AUD 1.5 trillion in assets in 2023, indicating entrenched market share. |

| Technological Infrastructure | Investment in secure, scalable, and compliant tech platforms. | Global cybersecurity market projected over $200 billion in 2024, highlighting essential security investment. |

Porter's Five Forces Analysis Data Sources

Our IOOF Porter's Five Forces analysis is built upon a foundation of publicly available financial statements, industry-specific market research reports, and regulatory filings from both IOOF and its competitors. We also incorporate insights from reputable financial news outlets and analyst reports to provide a comprehensive view of the competitive landscape.