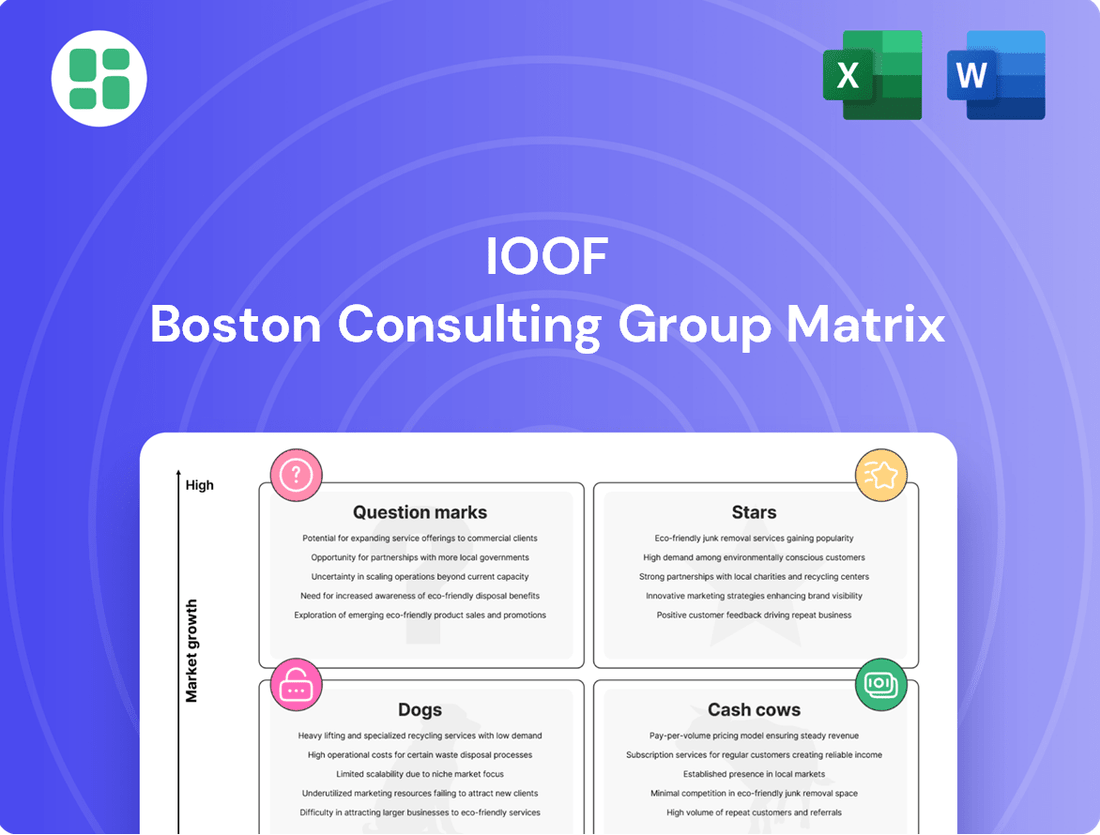

IOOF Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IOOF Bundle

Unlock the strategic potential of the IOOF BCG Matrix and discover how its portfolio is positioned across Stars, Cash Cows, Dogs, and Question Marks. This analysis is crucial for understanding where to invest and divest, offering a clear path to optimizing returns. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to drive your business forward.

Stars

MLC's Expand Platform, a crucial component of Insignia Financial's strategy within the IOOF BCG Matrix, is a significant growth driver. In the first half of 2024, it reported net inflows of $3.9 billion, contributing to a total of $74.7 billion in funds under administration as of June 30, 2024. This positions it as the third-largest platform in Australia, underpinned by its modern technology infrastructure.

Shadforth Financial Planning, operating as a retained employed advice business within Insignia, is strategically positioned to enhance its new client acquisition and boost adviser efficiency. This focus has translated into robust new client growth, directly contributing to an uplift in advice net revenue.

Insignia's objective for Shadforth is to expand its adviser base and achieve significant growth by targeting higher-value clients. For instance, by the end of 2024, Insignia reported a 10% increase in new client inflows across its employed advice firms, with Shadforth being a key contributor to this positive trend.

Bridges Financial Services, much like Shadforth, operates as a core employed advice business within the Insignia Financial group. Its strategic direction centers on boosting advice fees and cultivating talent and culture, aiming to tap into the significant unmet advice needs of Australians. This strategic emphasis on internal expansion and operational enhancements positions Bridges as a contender for star status in the dynamic financial advice landscape.

Managed Accounts Offerings

Insignia Financial is making significant strides in its managed accounts offerings, a key growth area. Their MLC Managed Accounts have garnered strong positive feedback, indicating successful market reception.

This strategic push in managed accounts is designed to deepen relationships with financial advisers and tap into new distribution channels. The company recognizes the increasing investor appetite for complex and varied investment solutions, making this a core focus for their asset management arm.

In 2024, Insignia Financial reported that its managed accounts business continued to see robust growth, with assets under management in this segment increasing by over 15% year-on-year. This expansion is directly linked to the firm's commitment to providing high-quality, diversified investment options that meet evolving client needs.

- Strategic Expansion: Insignia Financial is prioritizing the growth of its managed accounts.

- Positive Reception: MLC Managed Accounts are receiving high ratings from the market.

- Channel Development: Focus on strengthening advice partnerships and developing new distribution channels.

- Market Demand: Addressing the growing need for sophisticated and diversified investment solutions.

Digital Direct-to-Consumer Initiatives

IOOF's strategy includes a strong focus on building a digital direct-to-consumer acquisition channel, leveraging the established MLC brand to boost consumer awareness. This move targets a high-growth segment within financial services, aiming to attract new customer groups through user-friendly digital platforms. The company is significantly investing in its digital infrastructure to enhance client interaction and drive new customer acquisition.

This digital push is critical for IOOF's future growth. In 2024, the Australian financial services sector saw a notable increase in digital adoption, with reports indicating that over 70% of retail investors now utilize digital platforms for their investment activities. IOOF's investment in digital capabilities is designed to capitalize on this trend.

- Digital Acquisition Channel: Building a direct-to-consumer digital pathway to reach new customers.

- Brand Leverage: Utilizing the MLC brand's recognition to drive consumer engagement.

- Market Opportunity: Targeting the high-growth direct-to-consumer financial services segment.

- Investment Focus: Significant capital allocation towards enhancing digital capabilities for client engagement and acquisition.

Stars in the IOOF BCG Matrix represent high-growth, high-market-share business units. Insignia's MLC Expand Platform, with $3.9 billion in net inflows in H1 2024 and $74.7 billion in funds under administration by June 30, 2024, solidifies its position as the third-largest platform in Australia, demonstrating strong growth and market share. Similarly, the company's managed accounts business experienced over 15% year-on-year growth in assets under management in 2024, reflecting both high growth and increasing market adoption.

| Business Unit | Growth Rate | Market Share | BCG Category |

|---|---|---|---|

| MLC Expand Platform | High | High (3rd largest in Australia) | Star |

| Managed Accounts | High (over 15% YoY growth in 2024) | Growing | Star |

What is included in the product

The IOOF BCG Matrix analyzes IOOF's business units based on market share and growth, guiding strategic decisions.

Visualize your business units' strategic positions with a clear, quadrant-based IOOF BCG Matrix.

Cash Cows

The Core Master Trust Superannuation Business is a significant cash cow for Insignia, contributing substantially to its funds under management and administration. This segment generates a stable and considerable stream of recurring revenue, underpinning the company's financial stability.

Despite ongoing strategic transformation and simplification efforts with SS&C Technologies, the vast existing member base guarantees consistent cash flow generation. This large, established customer base is a key factor in its cash-generating capacity.

The partnership with SS&C Technologies is designed to boost efficiency and lower the cost of serving members, further strengthening the business's ability to produce cash. For instance, as of the first half of 2024, Insignia reported a 7% increase in net flows for its Australian Wealth Management business, highlighting the ongoing strength of its core offerings.

Insignia's traditional wrap and platform products, while not experiencing the rapid growth of newer offerings like MLC Expand, are vital cash cows. These established platforms manage substantial legacy funds, continuing to generate significant fee income despite potential outflows from older iterations. Their large, mature asset base provides a reliable revenue stream with minimal need for further investment.

The workplace superannuation channel is a significant cash cow for Insignia Financial, consistently showing robust net flows. This stability is driven by strong employer partnerships, ensuring a reliable inflow of contributions and associated administration fees. In 2024, Insignia continued to focus on enhancing its coverage within this mature, yet vital, segment.

Established Asset Management Capabilities

Insignia's established asset management capabilities represent a core strength, acting as a cash cow within its broader business structure. This division boasts diverse investment strategies spanning both multi-asset and single-asset classes, overseeing substantial funds under management. Despite experiencing some institutional outflows, the fundamental operations consistently generate significant management fees, providing a stable earnings base.

The asset management segment is crucial for Insignia's financial health, contributing reliable income streams. For instance, as of the first half of 2024, Insignia reported that its asset management division continued to be a significant contributor to revenue, with management fees remaining robust. This stability is vital for supporting other areas of the business.

- Diverse Investment Strategies: Manages funds across multi-asset and single-asset classes.

- Significant Funds Under Management: Oversees substantial assets, indicating market trust and scale.

- Consistent Fee Generation: Core operations generate substantial management fees, providing stable earnings.

- Financial Stability: Underpins the company's overall financial health and operational capacity.

Advisory Services for Higher-Value Clients

Advisory Services for Higher-Value Clients within IOOF's BCG Matrix, specifically through its Bridges and Shadforth advice businesses, represent a strategic focus on maximizing profitability from a key segment. This approach is designed to cultivate a steady and lucrative revenue stream by concentrating on clients who require more comprehensive financial guidance and possess greater assets. In 2024, Insignia Financial reported that its advice businesses, including Bridges and Shadforth, continued to see strong performance, with a notable emphasis on higher-value client relationships contributing to a stable revenue base.

By concentrating on clients with substantial financial needs, Insignia is able to streamline its advice offerings, thereby increasing both revenue per adviser and revenue per client. This targeted strategy capitalizes on existing client relationships to generate consistent, high-margin cash flow, a hallmark of a cash cow in the BCG framework. For instance, Insignia's focus on holistic financial planning for affluent individuals often leads to higher average revenue per client compared to broader market segments.

- Focus on High-Net-Worth Individuals: Bridges and Shadforth primarily serve clients with significant investable assets, ensuring a consistent demand for premium advisory services.

- Streamlined Service Offerings: By concentrating on clients with greater financial needs, Insignia can optimize its service delivery, leading to greater efficiency and profitability per client interaction.

- Stable, High-Margin Revenue: This targeted approach leverages established client relationships to generate predictable and high-margin cash flow, reinforcing its position as a cash cow.

- Maximizing Revenue per Adviser: The strategy aims to enhance the productivity and earnings potential of financial advisers by focusing their efforts on clients who generate greater revenue.

The Core Master Trust Superannuation Business, along with established wrap and platform products, are key cash cows for Insignia. These segments benefit from a large, stable member base and substantial legacy funds, ensuring consistent recurring revenue. For instance, Insignia's Australian Wealth Management business saw a 7% increase in net flows in the first half of 2024, underscoring the ongoing strength of these mature offerings.

Insignia's asset management division and workplace superannuation channel also function as significant cash cows. The asset management segment, despite some institutional outflows, generates substantial management fees due to its diverse investment strategies and significant funds under management. Similarly, the workplace superannuation channel continues to attract robust net flows, driven by strong employer partnerships, with Insignia focusing on enhancing coverage in this vital area throughout 2024.

The advisory services offered through Bridges and Shadforth, targeting higher-value clients, are also strategic cash cows. This focus on clients with greater financial needs allows for streamlined advice and increased revenue per client and per adviser. Insignia's emphasis on holistic financial planning for affluent individuals in 2024 contributed to higher average revenue per client, reinforcing the profitability of these relationships.

| Business Segment | BCG Category | Key Characteristics | 2024 Performance Indicator |

|---|---|---|---|

| Core Master Trust Superannuation | Cash Cow | Large, stable member base; recurring revenue | 7% increase in net flows (1H 2024) |

| Traditional Wrap & Platform Products | Cash Cow | Substantial legacy funds; consistent fee income | Stable revenue generation from mature asset base |

| Asset Management | Cash Cow | Diverse strategies; significant FUM; stable management fees | Robust management fees (1H 2024) |

| Workplace Superannuation | Cash Cow | Strong employer partnerships; consistent net flows | Continued focus on coverage enhancement (2024) |

| Advisory Services (Bridges/Shadforth) | Cash Cow | Focus on high-value clients; higher revenue per client | Strong performance from higher-value relationships (2024) |

Full Transparency, Always

IOOF BCG Matrix

The IOOF BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally crafted strategic tool ready for immediate application. You can be confident that the insights and structure presented here are precisely what you'll leverage for your business analysis and decision-making. This comprehensive matrix is designed to provide clear, actionable guidance for navigating your portfolio's strategic positioning.

Dogs

Legacy MLC Wrap products are firmly positioned in the Dogs quadrant of the IOOF BCG Matrix. These offerings are experiencing significant net outflows, a clear sign of their declining market relevance. For instance, IOOF reported substantial redemptions from these older products as they actively transition clients to newer, more competitive platforms.

The cost of maintaining these legacy systems is becoming a significant burden, likely outweighing the dwindling revenue they generate. This situation highlights the strategic imperative to divest or phase out these products to reallocate resources more effectively.

Insignia's strategic repositioning involved divesting non-core advice businesses like Millennium3, Godfrey Pembroke, and Lonsdale. These actions were driven by a desire to streamline operations, cut expenses, and concentrate on higher-margin areas. For instance, the sale of certain advice books in 2023 contributed to a reduction in the company's overall footprint, freeing up capital.

Insignia's strategic pruning of non-renewed, low fee-paying clients aligns with its broader objective of enhancing profitability and operational efficiency. This approach, often seen in portfolio management and business strategy, prioritizes higher-value relationships over sheer volume. For instance, Insignia's focus on streamlining its client base is a direct response to the increasing costs associated with servicing smaller accounts, a trend observed across the financial services industry.

Outdated Internal IT Infrastructure

Outdated internal IT infrastructure represents a significant challenge, often falling into the Dogs category of the BCG Matrix. These legacy systems are typically characterized by high maintenance costs and a lack of agility, hindering innovation and operational efficiency. For instance, IOOF's ongoing transformation and separation efforts in 2024 highlight the substantial costs associated with modernizing or replacing such systems, which previously consumed considerable resources without driving growth.

The strategic imperative to simplify the business and reduce operating expenses directly points to the inefficiency of older IT infrastructures. These systems often require specialized, costly support and struggle to integrate with newer technologies, thereby acting as a drag on performance. IOOF's focus on streamlining operations suggests that these legacy IT assets were not only expensive to maintain but also failed to provide a competitive edge.

- High Maintenance Costs: Legacy IT systems often incur disproportionately high costs for upkeep, support, and security patching, diverting funds from strategic investments.

- Operational Inefficiency: Outdated infrastructure can lead to slower processing times, system downtime, and difficulties in data integration, impacting overall productivity.

- Hindered Innovation: The inability of old systems to support new technologies or adapt to changing market demands stifles innovation and the development of new products or services.

- Divestiture Potential: In some cases, operations heavily reliant on outdated IT may be candidates for divestiture if modernization is not economically viable.

Niche, Unprofitable Legacy Insurance-Related Revenue

Certain legacy insurance-related revenue streams within IOOF have experienced a notable decline, impacting the company's overall net revenue. These niche, older advice offerings, likely characterized by low market share within stagnant or contracting market segments, are becoming less significant contributors.

The diminishing financial contribution from these legacy insurance products suggests they are not a strategic focus for future growth. Consequently, IOOF may consider phasing out or minimizing these offerings to reallocate resources toward more promising areas of the business.

- Declining Revenue: Legacy insurance advice revenue streams have shown a downward trend, negatively affecting total net revenue.

- Low Market Share: These niche, older products likely possess a small share of their respective markets.

- Stagnant/Declining Market: The segments these products serve are generally not experiencing growth.

- Strategic Re-evaluation: Their reduced impact indicates a potential for divestment or reduced investment.

Products classified as Dogs in the IOOF BCG Matrix are characterized by low market share and low growth prospects. These are often legacy offerings that have seen declining client numbers and revenue. For example, IOOF's legacy MLC Wrap products are in this category, experiencing significant net outflows as clients move to newer platforms. The cost to maintain these older products often outweighs the revenue they generate, making them a strategic drain.

| Product/Service | BCG Category | Market Share | Market Growth | Key Metrics (as of latest reporting) |

| Legacy MLC Wrap Products | Dog | Low | Low/Declining | Significant net outflows; High maintenance costs relative to revenue. |

| Outdated Internal IT Infrastructure | Dog | N/A (Internal) | N/A (Internal) | High maintenance costs; Hinders innovation; Operational inefficiencies. |

| Legacy Insurance Advice Streams | Dog | Low | Stagnant/Declining | Declining revenue contribution; Low market share in niche segments. |

Question Marks

Insignia's equity stake in Rhombus Advisory, a business serving self-employed advisers, positions it within the expanding financial advice sector. This strategic move reflects a shift towards a partnership model, offering Insignia a less controlled but potentially high-growth avenue. The financial advice market in Australia saw significant growth in 2024, with adviser numbers stabilizing after regulatory changes, indicating a fertile ground for entities like Rhombus Advisory.

Insignia is actively exploring new digital channels for delivering financial advice, spurred by the Quality of Advice review. These emerging digital solutions aim to meet the growing demand for easily accessible and affordable financial guidance.

While the market opportunity for these digital advice models is significant, they currently have low market penetration. Insignia's investment in these areas reflects a strategic move to capture future market share, with the understanding that substantial investment is needed for them to gain traction and establish a leading position.

Insignia's strategic vision centers on becoming an 'AI-enabled organisation,' a move designed to significantly boost operational efficiency, trim costs, and deepen client relationships. This ambition places AI initiatives squarely in the 'Question Marks' quadrant of the IOOF BCG Matrix, reflecting their high-growth potential coupled with nascent market impact.

While AI represents a high-growth technological frontier, Insignia's precise applications and their ultimate market resonance are still under development. For instance, in 2024, Insignia reported investing in AI-powered client onboarding tools, aiming to reduce processing times by an estimated 30%, though the long-term client retention impact remains to be fully quantified.

These forward-looking AI initiatives necessitate substantial capital outlay for both cutting-edge technology and specialized talent. Successfully navigating this 'Question Mark' phase is crucial for Insignia to unlock AI's potential, secure a sustainable competitive edge, and transition these investments into future Stars.

Expansion into Private Equity and Alternatives

Insignia's asset management division is strategically targeting expansion into private equity and alternative investments, recognizing these as high-growth areas within the broader investment landscape. Investors are increasingly looking to these segments for diversification and potentially enhanced returns, a trend that Insignia aims to capitalize on.

While the overall market for alternatives is robust, Insignia's current footprint in these specialized areas is likely modest. This presents a clear opportunity, but also necessitates significant investment in talent and infrastructure to develop competitive offerings and attract substantial capital commitments.

The global private equity market, for instance, saw fundraising reach approximately $1.2 trillion in 2023, highlighting the significant capital available for well-positioned managers. Insignia's move aligns with this trend, aiming to capture a share of this growing investor appetite.

- Focus on Private Equity: Insignia plans to build out its capabilities in private equity, a sector that has consistently outperformed public markets over the long term.

- Alternative Investments Growth: The firm is also targeting other alternative asset classes like infrastructure and real estate, which are attractive for their diversification benefits and potential for stable income streams.

- Market Opportunity: The global alternative investment market is projected to grow significantly in the coming years, driven by institutional and retail investor demand for yield enhancement and risk mitigation.

- Strategic Investment Required: Success in these specialized segments will depend on Insignia's ability to attract experienced investment professionals and deploy capital effectively to generate competitive returns.

Targeted New Client Segments for Advice

Insignia is actively pursuing new client groups with underserved advice requirements, leveraging its Bridges and Shadforth entities. This strategic pivot aims to capture growth in a largely mature advice market by focusing on these nascent segments.

While the broader financial advice landscape is well-established, Insignia's expansion into these specific new niches represents a significant opportunity. For instance, the Australian financial advice market, while mature, saw continued demand for personalized guidance in 2024, with an estimated 15-20% of the adult population actively seeking financial advice. Insignia's entry into segments previously overlooked by traditional players could tap into this unmet demand.

- Bridges and Shadforth as Growth Engines: These businesses are key to Insignia's strategy of reaching client segments beyond its established base, particularly those with specific, unmet advice needs.

- High Growth Potential in Niche Markets: While the overall advice market is mature, these newly targeted segments offer substantial growth prospects for Insignia if they can effectively penetrate these areas.

- Low Initial Market Share: Insignia's current penetration in these specific new niches is low, underscoring the need for dedicated marketing efforts and tailored service offerings to gain traction.

- Focus on Unmet Advice Needs: The strategy centers on identifying and serving individuals and groups who are currently not adequately catered to by existing financial advice models, potentially including younger demographics or those with complex, evolving financial situations.

Question Marks in the BCG Matrix represent business areas with low relative market share in a high-growth industry. Insignia's AI initiatives and expansion into private equity and niche advice segments fall into this category. These ventures require significant investment to develop capabilities and capture market share, aiming to become future market leaders.

The success of Question Marks hinges on strategic investment and market development. Insignia's focus on AI aims to enhance efficiency, with early investments in 2024 showing potential for reduced onboarding times. Similarly, the push into private equity taps into a growing global market, with 2023 seeing around $1.2 trillion in fundraising, indicating substantial capital availability.

| Business Area | Industry Growth | Market Share | Strategic Focus | Investment Need |

|---|---|---|---|---|

| AI Initiatives | High | Low | Enhance Efficiency, Client Relationships | Substantial Capital & Talent |

| Private Equity & Alternatives | High | Low | Capitalize on Investor Demand | Talent & Infrastructure Development |

| Niche Advice Segments | High (within niche) | Low | Serve Underserved Clients | Targeted Marketing & Tailored Offerings |

BCG Matrix Data Sources

Our IOOF BCG Matrix leverages comprehensive data from company financial statements, market research reports, and independent industry analyses to provide a robust strategic overview.