IOOF PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IOOF Bundle

Navigate the complex external forces shaping IOOF's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting the financial services landscape. Gain the strategic foresight needed to capitalize on opportunities and mitigate risks.

Unlock actionable intelligence on the social, technological, legal, and environmental factors influencing IOOF's operations. This expertly crafted analysis is your essential tool for informed decision-making and competitive advantage. Purchase the full report now to equip yourself with critical market insights.

Political factors

The Australian government, via ASIC and APRA, is actively refining financial services regulations, building on the recommendations of the Financial Services Royal Commission. These ongoing reforms, focused on consumer protection and market integrity, significantly shape Insignia Financial's compliance burdens and strategic direction. For instance, the Treasury Laws Amendment (Delivering Better Financial Outcomes and Other Measures) Act 2024 directly impacts the landscape for financial advisers.

Mandatory climate-related financial disclosure requirements will begin on January 1, 2025, impacting large Australian businesses and financial institutions. This new legislation, enacted in 2024, obligates companies such as Insignia Financial to produce annual sustainability reports alongside their standard financial statements.

Compliance will demand substantial changes in how data is gathered, governance structures are managed, and reporting frameworks are implemented, with an estimated 300 of Australia's largest companies expected to be in scope for the initial phase.

The Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Amendment Bill 2024, enacted in December 2024, significantly bolsters Australia's financial crime defenses. This legislation mandates stricter compliance for entities like Insignia Financial, requiring updates to their risk management and operational procedures to align with enhanced regulatory expectations.

AUSTRAC's ongoing consultations on draft rules for this bill are crucial, aiming to refine the effectiveness of the AML/CTF system. Financial institutions must adapt their frameworks, impacting areas such as customer due diligence and transaction monitoring, to meet these evolving standards and avoid potential penalties.

Foreign Investment Review and Approvals

Large-scale acquisitions, like the potential takeover of Insignia Financial by CC Capital, face rigorous review by Australian authorities such as the Foreign Investment Review Board (FIRB) and the Australian Prudential Regulation Authority (APRA). These regulatory bodies assess deals to ensure they align with national interests and financial stability. The outcome of such reviews can significantly impact a company's future, including its ownership and strategic direction.

While Australia is implementing reforms to encourage foreign investment, these changes can also introduce complexities for major transactions. For instance, the proposed acquisition of Insignia Financial by CC Capital is undergoing this scrutiny, with the approval process anticipated to conclude around mid-2026. This timeline highlights the deliberate nature of foreign investment reviews for substantial deals.

- Regulatory Scrutiny: Acquisitions exceeding certain thresholds, like the CC Capital bid for Insignia Financial, require approval from bodies like FIRB and APRA.

- Investment Reforms: Efforts to attract foreign capital are underway, but significant deals still navigate a detailed approval process.

- Strategic Impact: Approval outcomes can reshape a company's ownership structure and long-term strategic planning.

- Timeline: The approval process for major foreign investment deals, such as the Insignia Financial acquisition, is expected to be completed by mid-2026.

Government Support for Innovation and Infrastructure

Government initiatives like the National Reconstruction Fund (NRF) and the Future Made in Australia Act, enacted in 2023-2024, are channeling significant investment into innovation and critical infrastructure. The NRF, for instance, has an initial $15 billion allocation aimed at fostering growth in key sectors. This focus presents a direct opportunity for financial services firms, particularly those in superannuation and wealth management, to align their expertise with national priorities.

By supporting these government-backed projects, financial institutions can potentially benefit from expedited regulatory approvals and a more favorable investment landscape. This strategic alignment allows companies to leverage government policy to drive growth and secure long-term value, especially in areas like renewable energy and advanced manufacturing.

- National Reconstruction Fund (NRF): $15 billion initial allocation to support strategic industries.

- Future Made in Australia Act (2023-2024): Policy framework designed to boost domestic manufacturing and innovation.

- Sector Focus: Emphasis on areas like renewable energy, critical minerals, and advanced manufacturing.

- Financial Services Alignment: Opportunities for superannuation and wealth management firms to partner in national projects.

Australia's financial sector is navigating a period of significant regulatory evolution, driven by reforms stemming from the Financial Services Royal Commission and new legislation like the Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Amendment Bill 2024. These changes, including mandatory climate-related financial disclosures commencing January 1, 2025, necessitate substantial adjustments in compliance and reporting for firms like Insignia Financial. Furthermore, large-scale foreign investment proposals, such as the CC Capital bid for Insignia Financial, face rigorous scrutiny from bodies like FIRB and APRA, with approvals anticipated around mid-2026, highlighting a deliberate approach to maintaining financial stability.

What is included in the product

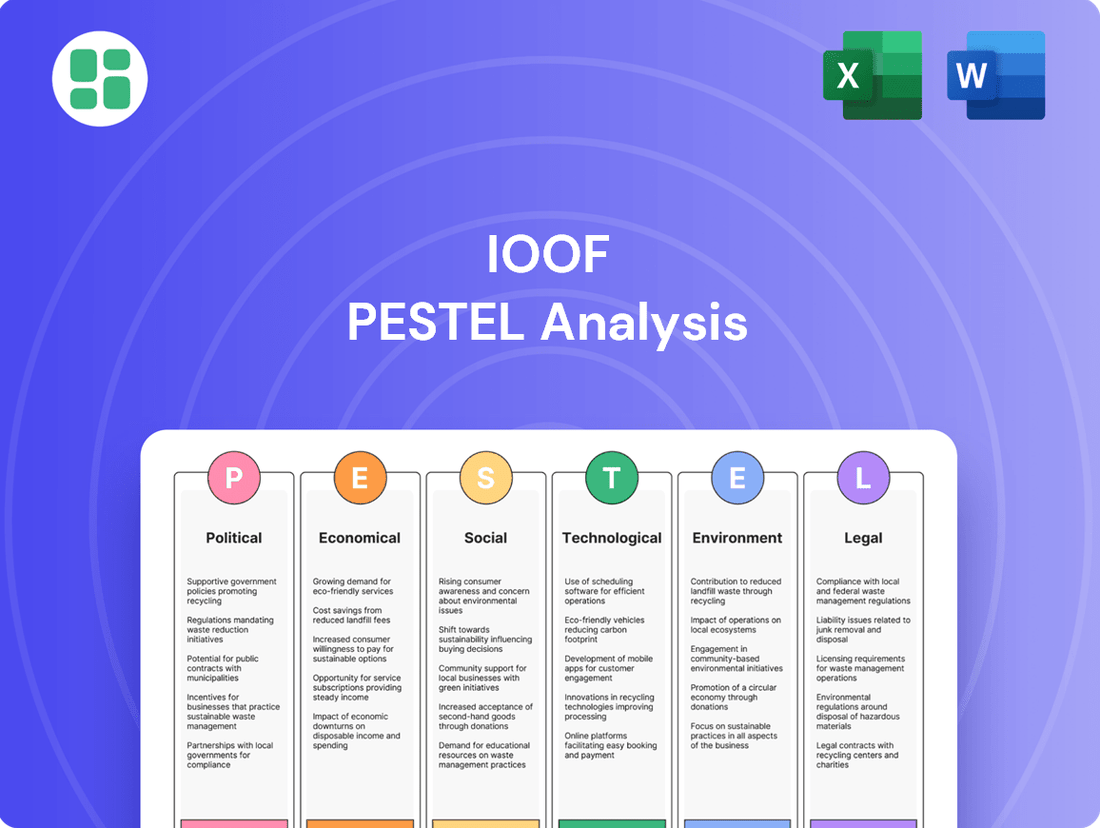

This IOOF PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the organization. It provides a comprehensive understanding of the external landscape to inform strategic decision-making.

The IOOF PESTLE Analysis offers a structured framework to proactively identify and mitigate external threats, thereby alleviating the pain of unforeseen market disruptions and regulatory changes.

Economic factors

Australian consumers are feeling the pinch, with high living costs and interest rates creating a sustained period of negative consumer sentiment. This financial strain is directly impacting household spending, as many individuals are planning to reduce or eliminate discretionary expenses.

Insurances and wealth management firms like Insignia Financial are particularly exposed to these shifts. For instance, a significant portion of Australian households report difficulty meeting essential expenses, with ABS data from late 2023 showing around 30% of adults struggled to afford an unexpected expense. This directly translates to less disposable income available for investments and wealth building, a core area for Insignia's business.

The Reserve Bank of Australia's (RBA) aggressive interest rate hikes, with the cash rate reaching 4.35% by late 2023, have significantly impacted consumer finances, leading to widespread financial stress. This tightening monetary policy is expected to continue dampening economic growth, with forecasts for 2024 and 2025 pointing to slower expansion.

Persistent inflation, hovering around 5-6% in early 2024, continues to erode household purchasing power, directly influencing consumer spending and investment choices. This environment pressures individuals to re-evaluate their financial products and savings strategies.

In response, Insignia Financial needs to strategically adjust its product suite and pricing to align with these challenging economic realities. Offering solutions that provide greater value or flexibility will be crucial for maintaining customer engagement and market share amidst heightened economic uncertainty.

Insignia Financial's Funds Under Management and Administration (FUMA) saw significant shifts in late 2024 and early 2025. This volatility was a direct result of market performance and client activity, with net inflows into products like MLC Expand and retail Asset Management boosting overall figures.

However, this growth was tempered by outflows from legacy products such as Master Trust and Wrap. These movements highlight a dynamic client base actively reallocating assets, directly influencing Insignia's revenue streams and overall profitability.

Impact of Major Acquisition on Valuation and Strategy

The proposed acquisition of Insignia Financial by CC Capital for approximately $3.3 billion underscores robust investor confidence in Australia's wealth management landscape. This significant premium suggests a strong belief in Insignia's future prospects and strategic direction.

However, the valuation remains susceptible to broader economic conditions. For instance, global capital market volatility, which saw the ASX 200 experience fluctuations throughout 2024, can directly impact asset values and, consequently, the perceived worth of such acquisitions.

Key considerations for valuation and strategy include:

- Market Sentiment: Investor appetite for Australian financial services, influenced by global economic stability and interest rate movements.

- Regulatory Environment: Changes in financial services regulation could impact Insignia's operational costs and revenue streams, affecting its long-term valuation.

- Synergies and Integration: The successful realization of anticipated cost and revenue synergies from the acquisition will be critical for justifying the valuation and achieving strategic objectives.

Cost Optimisation and Efficiency Programs

Insignia Financial's commitment to cost optimisation and simplification is a significant driver of its financial performance. For the first half of FY25, these programs contributed to a notable increase in underlying net profit after tax, demonstrating their effectiveness. The strategic transformation of its Master Trust business, for instance, is designed to unlock substantial scale benefits and enhance overall operating efficiency.

These ongoing initiatives are vital for Insignia Financial to maintain sustainable growth and profitability, especially considering the current challenging economic climate. The company's focus on streamlining operations and reducing costs directly impacts its bottom line and competitive positioning.

- FY25 H1 Underlying NPAT Growth: Demonstrates the positive impact of cost optimisation.

- Master Trust Transformation: A key program aimed at achieving scale and efficiency.

- Sustainable Growth Focus: Highlighting the importance of these programs for long-term success.

Economic headwinds continue to shape consumer behaviour in Australia, with high inflation and interest rates impacting disposable income. This trend is expected to persist through 2024 and into 2025, forcing households to prioritise essential spending over discretionary investments.

The Reserve Bank of Australia's monetary policy, including interest rate decisions, directly influences the financial landscape for firms like Insignia Financial. Persistent inflation, projected to remain elevated into 2025, further erodes purchasing power, creating a challenging environment for wealth management services.

Insurers and wealth managers must adapt to this economic reality by offering flexible and value-driven products to retain clients. Insignia Financial's focus on cost optimisation and operational efficiency, as seen in its FY25 H1 results, is a critical strategy to navigate these economic pressures and maintain profitability.

| Economic Factor | Impact on Insignia Financial | Data/Trend (2024-2025) |

|---|---|---|

| Consumer Sentiment | Reduced discretionary spending, lower demand for wealth products | Sustained negative sentiment, ~30% of adults struggling with unexpected expenses (late 2023) |

| Interest Rates | Increased borrowing costs, potential impact on investment returns | RBA cash rate at 4.35% (late 2023), expected to influence growth |

| Inflation | Erosion of purchasing power, pressure on savings | Hovering around 5-6% (early 2024), impacting consumer choices |

Preview the Actual Deliverable

IOOF PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive IOOF PESTLE analysis covers all key external factors impacting the organization, providing valuable insights for strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a detailed understanding of the Political, Economic, Social, Technological, Legal, and Environmental landscape relevant to IOOF.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis is designed to be a practical tool, offering a thorough examination of IOOF's operating environment.

Sociological factors

Modern consumers expect financial services to be instant, seamless, and tailored to their individual needs, with a strong leaning towards digital channels. Data from 2024 indicates that over 70% of banking customers prefer digital self-service options for routine transactions.

Despite this preference, a significant gap persists between what consumers expect from digital banking and their actual satisfaction levels. For instance, a late 2024 survey revealed that only 55% of users felt their digital banking experience was intuitive and efficient, highlighting a critical area for improvement.

In response, Insignia Financial must prioritize substantial investment in digital innovation. This includes enhancing user interfaces, streamlining online processes, and leveraging data analytics to deliver personalized experiences, ensuring they remain competitive in a rapidly digitizing financial landscape.

Australia's demographic landscape is shifting significantly, with an aging population becoming a defining characteristic. This trend directly fuels a heightened demand for superannuation, retirement income products, and expert financial advice. As of 2024, projections indicate continued growth in the over-65 demographic, underscoring the long-term nature of this societal change.

Insignia Financial, a prominent wealth management firm, is well-positioned to capitalize on this evolving market. Their comprehensive suite of services, from superannuation management to tailored retirement income strategies, directly addresses the needs of this expanding client base. The company's focus on assisting individuals in achieving their long-term financial objectives aligns perfectly with the challenges and opportunities presented by an aging populace.

There's a notable shift in society towards prioritizing financial wellbeing, particularly in vulnerable communities aiming to bridge the financial literacy gap. This growing awareness means consumers are increasingly discerning, seeking clear value and straightforward financial solutions.

Insignia Financial's strategic goal to foster financial wellbeing for all Australians directly addresses this societal demand. This focus is a key driver in how they shape their services and offerings, ensuring they resonate with an informed and pragmatic consumer base.

For instance, the Australian Securities and Investments Commission (ASIC) reported in 2023 that financial literacy remains a challenge, with a significant portion of the population struggling with basic financial concepts. This underscores the market opportunity for entities like Insignia Financial that champion accessible financial education and support.

Responsible Investing and ESG Integration

Societal expectations are increasingly prioritizing responsible investing and the integration of Environmental, Social, and Governance (ESG) factors. This trend significantly influences investor decisions and shapes corporate strategies, pushing companies to adopt more sustainable and ethical practices.

Insignia Financial, for instance, has embedded ESG considerations into its operations and decision-making, evidenced by its approved Group ESG strategy and its partnerships with responsible investment organizations. This proactive approach aligns with a growing global demand for financial products and services that reflect broader societal values.

- Growing Investor Demand: Global sustainable investment assets reached $37.8 trillion in early 2024, indicating a strong preference for ESG-aligned investments.

- Regulatory Push: Governments worldwide are implementing regulations to encourage ESG disclosure and sustainable finance practices.

- Corporate Accountability: Companies are facing increased scrutiny from stakeholders regarding their social and environmental impact.

- Talent Attraction: A strong ESG commitment can improve a company's ability to attract and retain top talent, particularly among younger generations.

Changing Workforce Dynamics and Talent Retention

The Australian service industry, particularly financial services, is grappling with evolving workforce expectations. A significant challenge is the demand for greater flexibility, including widespread adoption of remote and hybrid work models. This shift directly impacts talent attraction and retention, as companies like Insignia Financial must adapt their policies to meet these new employee desires.

Skills gaps also present a hurdle, contributing to higher employee attrition rates and reduced productivity. For instance, the Australian Bureau of Statistics reported in late 2024 that a notable percentage of businesses across service sectors identified a shortage of appropriately skilled workers as a key constraint on growth. This necessitates continuous investment in upskilling and reskilling programs to maintain a competitive edge.

- Workforce Flexibility: Insignia Financial needs to offer adaptable work arrangements to attract and keep skilled employees in the current market.

- Skills Gaps: The financial services sector faces challenges in finding staff with the necessary expertise, leading to potential service delivery disruptions.

- Employee Expectations: Modern employees prioritize work-life balance and flexible working conditions, influencing retention rates significantly.

Societal shifts towards digital-first interactions are paramount, with over 70% of Australian banking customers preferring digital self-service options as of 2024. However, only 55% of users in a late 2024 survey found their digital banking experience intuitive, highlighting a need for enhanced user interfaces and personalized services from firms like Insignia Financial.

Australia's aging population, a trend continuing into 2024, drives demand for retirement income products and financial advice, areas where Insignia Financial's expertise is well-aligned. Simultaneously, a growing societal emphasis on financial wellbeing and literacy, underscored by ASIC's 2023 findings on financial knowledge gaps, creates opportunities for firms that offer accessible education and straightforward solutions.

Investor preferences are increasingly shaped by ESG factors, with global sustainable investment assets reaching $37.8 trillion by early 2024. Insignia Financial's commitment to ESG, demonstrated through its approved Group ESG strategy, positions it favorably to meet this demand for responsible investing.

Evolving workforce expectations, including a demand for flexibility and concerns over skills gaps, impact talent attraction and retention in financial services. The Australian Bureau of Statistics noted in late 2024 that skills shortages were a key constraint for businesses, necessitating ongoing investment in employee development.

Technological factors

Insignia Financial is actively pursuing digital transformation, highlighted by its recent move of administration and technology functions for its Master Trust business to SS&C Technologies. This strategic partnership is designed to streamline operations, achieve economies of scale, and reduce the cost of serving clients, mirroring a wider industry push to adopt technology for greater efficiency.

This move is a key component of Insignia's Vision2030 strategy, aiming to modernize its technological infrastructure and enhance service delivery. The financial services sector, in general, is seeing significant platform consolidation as companies seek to leverage technology to improve cost-to-serve ratios and operational agility, a trend expected to continue through 2025.

The financial services industry, including entities like IOOF, is grappling with escalating cybersecurity threats. Recent incidents, such as those affecting superannuation funds and Insignia Financial's encounters with credential stuffing, highlight the pervasive nature of these risks.

In response to this challenging landscape, Insignia Financial is making significant investments in bolstering its cybersecurity. This includes allocating a dedicated budget and implementing a new operating model designed to enhance cyber resilience and protect sensitive information assets.

Australian financial services are rapidly integrating AI and data analytics to enhance customer experiences and operational efficiency. Insignia Financial, for instance, is investing in its data and digital infrastructure to deliver personalized engagement, aiming to connect with clients through timely and relevant offers.

This technological shift is driven by a need to meet evolving customer expectations for personalized and seamless interactions. The responsible deployment of AI is paramount, with a focus on transparency and human oversight to foster consumer trust in these advanced systems.

Innovation in Financial Products and Services

Technological advancements are fundamentally reshaping the financial landscape, leading to innovative products and services. The growth in Separately Managed Account (SMA) menus and the creation of modern managed account solutions are prime examples of this evolution. These innovations are crucial for financial institutions aiming to attract and retain assets in a competitive market.

Insignia Financial, for instance, is actively investing in its Expand platform and other digital offerings. This strategic investment aims to boost functionality and elevate both the adviser and client experience. Such enhancements are vital for maintaining a competitive edge and fostering client loyalty.

The push for innovation is directly tied to attracting and retaining funds. For example, in the 2024 financial year, the Australian managed funds industry saw significant inflows, with technological capabilities playing a role in adviser platform choices. Institutions that can offer seamless digital experiences and sophisticated product suites are better positioned to capture market share.

- Digital Platforms: Investment in platforms like Insignia's Expand enhances adviser efficiency and client engagement.

- Product Innovation: The expansion of SMA menus and development of contemporary managed accounts cater to evolving investor needs.

- Fund Flows: Technological innovation is a key differentiator in attracting and retaining assets under management in the competitive financial services sector.

Cloud Computing and IT Infrastructure Modernization

Insignia Financial's successful IT separation from NAB, a key component of its modernization efforts, marked a significant operational milestone. This move, completed in 2023, allows for greater independence and efficiency, directly supporting the company's simplification program. The modernized, separated IT infrastructure is crucial for future technological advancements and scalability, underpinning the delivery of strategic objectives.

This infrastructure modernization is vital for Insignia Financial to adapt to evolving technological landscapes. For instance, the Australian cloud computing market is projected to grow significantly, with IDC forecasting a 17.7% increase in IT spending on cloud services in 2024. This trend highlights the importance of Insignia's investment in its own robust IT capabilities to leverage these advancements.

The benefits of this IT overhaul are multifaceted:

- Enhanced Operational Independence: Reduced reliance on legacy systems allows for greater agility and control.

- Improved Efficiency and Cost Savings: Streamlined operations and modern infrastructure can lead to reduced IT operational costs.

- Foundation for Innovation: A flexible and scalable IT backbone enables faster adoption of new technologies and services.

- Scalability for Growth: The infrastructure is designed to support Insignia Financial's future growth and strategic initiatives.

Technological advancements are significantly reshaping the financial services sector, driving efficiency and innovation. Insignia Financial's strategic move to SS&C Technologies for its Master Trust administration and technology functions exemplifies this trend, aiming for streamlined operations and cost reduction. This aligns with a broader industry focus on leveraging technology for improved cost-to-serve ratios and operational agility, a trend expected to intensify through 2025.

The industry faces escalating cybersecurity threats, with incidents impacting superannuation funds and Insignia Financial underscoring the need for robust defenses. Insignia is investing heavily in cybersecurity, implementing a new operating model and dedicated budget to enhance resilience and protect sensitive data.

AI and data analytics are increasingly integrated to personalize customer experiences and boost operational efficiency. Insignia's investment in its data and digital infrastructure supports this, aiming for timely, relevant client engagement. The responsible deployment of AI, with transparency and human oversight, is crucial for building consumer trust.

Technological innovation is also evident in product development, such as the expansion of Separately Managed Account (SMA) menus and modern managed account solutions. These innovations are vital for attracting and retaining assets, with institutions offering seamless digital experiences and sophisticated product suites better positioned to gain market share. For instance, technological capabilities were a key factor in adviser platform choices within the Australian managed funds industry during the 2024 financial year.

Legal factors

Insignia Financial operates under the watchful eyes of the Australian Securities and Investments Commission (ASIC) and the Australian Prudential Regulation Authority (APRA). These bodies are constantly updating rules and ensuring companies like Insignia stick to them, covering everything from how financial markets should work to protecting consumers. For instance, APRA has been actively consulting on proposed changes to the prudential framework specifically for RSE licensees, which directly impacts entities within the superannuation sector that Insignia serves.

A significant legal development impacting financial institutions like Insignia Financial is the mandatory climate-related financial disclosure regime, which officially began on January 1, 2025. This new legislation mandates that large financial entities report on their exposure to climate-related risks and opportunities, aligning with globally recognized accounting standards.

Failure to comply with these stringent requirements can result in substantial financial penalties, with potential fines escalating significantly for repeated offenses. Beyond financial repercussions, non-compliance also poses considerable reputational risks, potentially eroding investor confidence and market standing.

The Australian Securities and Investments Commission (ASIC) remains committed to shielding consumers from scams and financial misconduct. This focus is underscored by the new Scams Prevention Framework, enacted in 2024. This legislation grants regulators enhanced powers to investigate and penalize non-compliance with substantial fines, compelling financial institutions like Insignia Financial to bolster their fraud prevention strategies.

Obligations for Managing Conflicts of Interest

Australian Financial Services (AFS) licensees, such as Insignia Financial, are legally bound to implement robust systems for managing conflicts of interest. This commitment is underscored by ASIC's ongoing review and update of Regulatory Guide 181 (RG 181) concerning conflicts management. These updates are designed to reflect recent legislative changes, policy shifts, and court rulings, demanding continuous adaptation of Insignia Financial's internal policies and operational procedures to ensure compliance.

The regulatory landscape requires proactive management of potential conflicts. For instance, ASIC's focus on conflicts of interest aligns with broader efforts to enhance consumer protection in the financial services sector. Insignia Financial, like other AFS licensees, must demonstrate that its arrangements are not only in place but also effective in practice. This involves a commitment to transparency and fair dealing with clients, especially in areas where personal or corporate interests might diverge from client best interests.

Key obligations for managing conflicts of interest include:

- Establishing clear policies and procedures for identifying, assessing, and managing conflicts.

- Ensuring staff are adequately trained on their responsibilities regarding conflicts of interest.

- Implementing disclosure mechanisms to inform clients about any identified conflicts.

- Regularly reviewing and testing the effectiveness of conflict management frameworks.

Privacy and Data Security Regulations

The financial services sector, including companies like Insignia, operates under a strict framework of privacy and data security regulations. With cyber threats constantly evolving and the vast amounts of customer data handled daily, compliance is paramount. For instance, in 2024, the global average cost of a data breach reached $4.45 million, highlighting the financial ramifications of security failures.

While specific recent data breaches impacting Insignia directly aren't publicly detailed in the provided context, the broader industry faces continuous scrutiny. Failure to adhere to these regulations can lead to significant legal penalties and damage to customer trust. For example, the European Union's General Data Protection Regulation (GDPR) has set a precedent for stringent data protection, with fines potentially reaching up to 4% of annual global turnover.

- Ongoing Regulatory Scrutiny: Financial institutions are under constant review for their data handling practices and cybersecurity measures.

- Customer Trust Imperative: Robust data privacy is crucial for maintaining client confidence in an increasingly digital financial landscape.

- Financial and Legal Risks: Non-compliance with data protection laws can result in substantial fines and legal action, impacting profitability and reputation.

The Australian financial sector faces evolving legal mandates, including new climate-related financial disclosure requirements effective January 1, 2025, impacting entities like Insignia Financial. Furthermore, the 2024 Scams Prevention Framework grants ASIC enhanced powers to combat financial misconduct, necessitating robust fraud prevention strategies.

Environmental factors

A significant environmental shift for large Australian entities, including Insignia Financial, is the introduction of mandatory climate-related financial reporting, effective January 1, 2025. This new regime compels these businesses to disclose their climate-related risks and opportunities, aiming to furnish investors with reliable and comparable data.

Insignia Financial will need to produce a dedicated Sustainability Report to comply with these new regulations. This reporting requirement is designed to enhance transparency and enable more informed investment decisions by clearly outlining an entity's exposure to and management of climate change impacts.

Insignia Financial is actively aligned with the global push to reach net zero greenhouse gas emissions by 2050, integrating these ambitious targets into its own operational framework. This commitment is not just a statement; it directly supports national climate policy and showcases the company's forward-thinking stance on environmental stewardship.

This dedication to net zero significantly shapes Insignia Financial's strategic direction, influencing key operational choices and, crucially, its investment strategies. A prime example is how MLC Asset Management, a part of Insignia Financial, is increasingly factoring climate considerations into its portfolio management, reflecting a growing trend in the financial sector towards sustainable investing.

Insignia Financial has embraced environmental, social, and governance (ESG) principles by approving a Group ESG strategy that will guide its decision-making through to the end of 2026. This strategic integration aims to embed ESG factors into the core of its operations, addressing critical material topics and responding to evolving stakeholder demands.

The company's commitment is further evidenced by its active participation in organizations such as the Investor Group on Climate Change (IGCC) and the Responsible Investment Association Australasia (RIAA). These affiliations are instrumental in shaping Insignia Financial's approach to ESG-related risk management and strategy development, ensuring alignment with industry best practices and investor expectations for sustainable financial services.

Assessment and Disclosure of Climate Risks

Regulated entities, such as superannuation trustees like Insignia Financial, are increasingly mandated to pinpoint, manage, and reveal the financial implications of climate change. This aligns with prudential practice guides, emphasizing the need for robust climate risk management frameworks.

The Australian Prudential Regulation Authority (APRA) has actively surveyed financial institutions to gauge their preparedness for climate-related financial risks. This proactive approach underscores a significant regulatory push towards enhancing climate resilience across the financial sector.

- Regulatory Expectation: APRA expects entities to integrate climate risk into their governance, risk management, and disclosure processes, mirroring global trends in financial regulation.

- APRA's Climate Risk Survey: In 2023, APRA's survey highlighted that while many entities are developing climate risk capabilities, there's a recognized need for further maturity in data collection and scenario analysis.

- Disclosure Frameworks: The Task Force on Climate-related Financial Disclosures (TCFD) framework is a key influence, guiding how entities report on governance, strategy, risk management, and metrics and targets related to climate.

- Insignia Financial's Position: As a trustee, Insignia Financial, like its peers, must demonstrate how it is managing climate-related financial risks to protect member assets and ensure long-term sustainability.

Scrutiny on Greenwashing Practices

The Australian Securities and Investments Commission (ASIC) is actively increasing its oversight of financial product disclosures that may inaccurately portray environmental benefits, a practice commonly referred to as greenwashing. This heightened regulatory attention directly impacts how companies like Insignia Financial can market their investment strategies and develop new products, demanding greater precision in sustainability claims.

ASIC's focus on greenwashing is a significant environmental factor for Insignia Financial, requiring robust substantiation for all environmental, social, and governance (ESG) claims. For instance, in 2023, ASIC reported issuing numerous infringement notices and commencing several court actions related to misleading sustainability claims, signaling a clear intent to penalize non-compliance.

- Increased Regulatory Scrutiny: ASIC's ongoing efforts to combat greenwashing mean financial institutions must provide verifiable evidence for their sustainability assertions.

- Impact on Marketing and Product Development: Insignia Financial needs to ensure its marketing materials and product offerings accurately reflect their ESG credentials to avoid regulatory penalties.

- Demand for Transparency: Investors are increasingly demanding transparency regarding the environmental impact of their investments, pushing for clearer and more reliable ESG reporting.

- Potential for Fines and Reputational Damage: Non-compliance with greenwashing regulations can lead to significant financial penalties and damage a company's reputation.

Mandatory climate-related financial reporting from January 1, 2025, will require entities like Insignia Financial to disclose climate risks and opportunities, enhancing investor transparency. Insignia Financial's commitment to net zero by 2050 influences its operational and investment strategies, as seen with MLC Asset Management's climate-focused portfolio management.

Insurers and superannuation trustees are increasingly mandated to identify, manage, and disclose the financial implications of climate change, aligning with prudential guidance. The Australian Prudential Regulation Authority (APRA) is actively surveying financial institutions to assess their preparedness for climate-related financial risks, pushing for greater climate resilience.

The Australian Securities and Investments Commission (ASIC) is intensifying its scrutiny of financial product disclosures to prevent greenwashing, impacting how companies like Insignia Financial market sustainability claims. This means robust substantiation for all ESG claims is crucial, with ASIC taking action against misleading statements, as evidenced by infringement notices issued in 2023.

PESTLE Analysis Data Sources

Our IOOF PESTLE Analysis is meticulously constructed using data from reputable financial institutions, governmental economic reports, and leading market research firms. This ensures that every aspect, from political stability to technological advancements, is grounded in current and verifiable information.