Indoco SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indoco Bundle

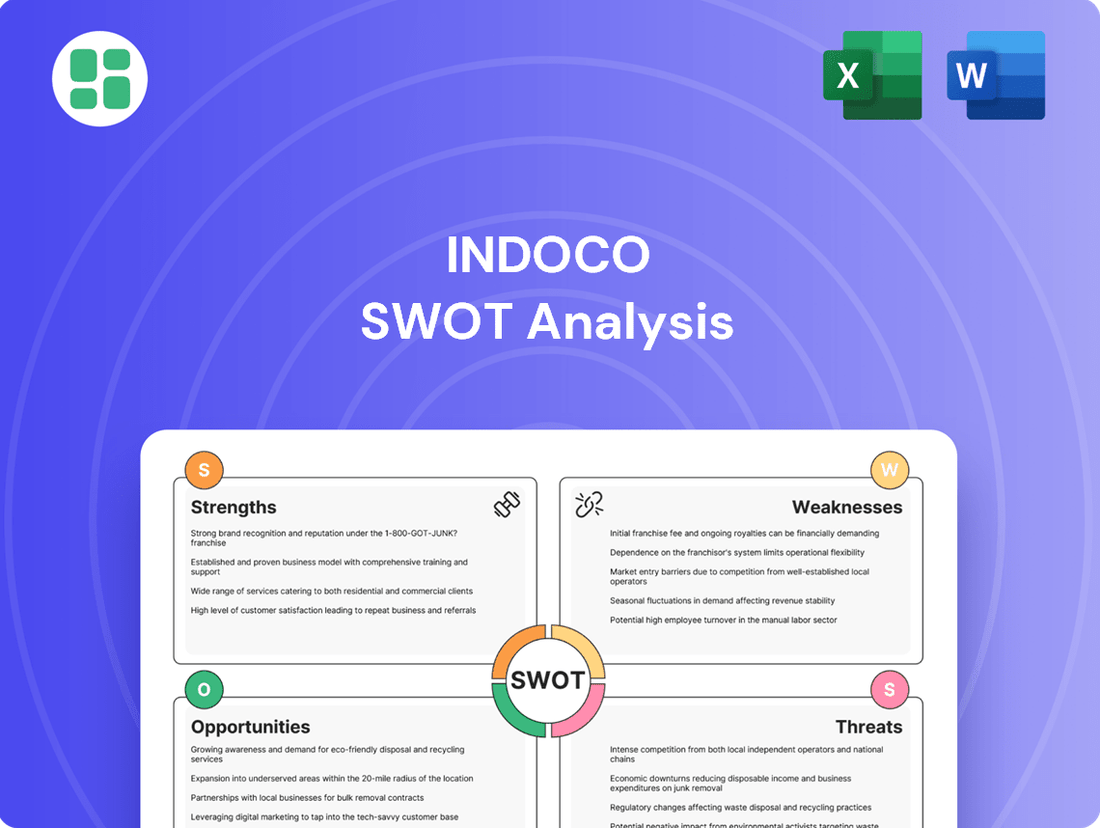

Indoco's market position is shaped by its robust R&D capabilities and a strong product pipeline, but also faces challenges from intense competition. Understanding these dynamics is crucial for navigating the pharmaceutical landscape.

Want the full story behind Indoco's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Indoco Remedies boasts a robust and diversified product portfolio, spanning finished dosage forms and Active Pharmaceutical Ingredients (APIs). This breadth covers critical therapeutic areas including anti-infectives, pain management, respiratory, gastro-intestinal, ophthalmology, and cardiovascular segments. Such diversification is a significant strength, mitigating risks associated with over-reliance on any single product or therapeutic category.

This strategic diversification translates into enhanced revenue stability and a wider market penetration for Indoco. For instance, in the fiscal year 2023-24, the company reported a strong performance across multiple product lines, contributing to its overall market presence and financial resilience. The ability to cater to a broad spectrum of healthcare needs solidifies its competitive position.

Indoco Remedies boasts a robust domestic presence, securing the 31st position in the Indian pharmaceutical market in FY24 according to IQVIA, demonstrating substantial prescription support from healthcare professionals.

Internationally, Indoco's reach extends to over 55 countries. This global footprint is underpinned by manufacturing facilities that have earned approvals from stringent regulatory bodies such as the USFDA, UK-MHRA, and TGA-Australia, facilitating significant market access worldwide.

Indoco Remedies' integrated manufacturing and R&D capabilities are a significant strength. The company operates 11 manufacturing facilities across India, with 7 dedicated to finished dosages and 4 for Active Pharmaceutical Ingredients (APIs). This robust infrastructure is complemented by a cutting-edge R&D Centre and a Clinical Research Organization (CRO).

This backward integration, particularly in API manufacturing, gives Indoco substantial control over its supply chain, leading to improved cost efficiencies. For instance, in FY2023, the company reported a revenue of INR 1,465 crore, with its API segment contributing significantly to this growth, underscoring the financial benefits of this integrated model.

Furthermore, strong R&D efforts are crucial for Indoco's sustained growth. The company's focus on developing new products and ensuring regulatory compliance, as evidenced by its numerous product approvals in regulated markets, directly stems from these integrated capabilities. This synergy between manufacturing and research allows for quicker adaptation to market demands and a competitive edge.

Strategic Partnerships and Approvals

Indoco Remedies has strategically leveraged partnerships to broaden its reach, exemplified by its distribution agreement with Clarity Pharma in the UK, aiming to enhance market penetration and facilitate new product introductions. This proactive approach to market expansion is a key strength.

The company's consistent success in obtaining approvals from regulatory bodies like the USFDA underscores its commitment to high-quality manufacturing and a strong pipeline of products ready for highly regulated markets. These approvals are critical for market access and revenue generation.

- Distribution Agreement: Partnership with Clarity Pharma for UK market expansion.

- Regulatory Approvals: Consistent USFDA and other international regulatory clearances.

- Product Pipeline: Robust approvals indicate a healthy pipeline for regulated markets.

Focus on High-Growth Segments and Capacity Expansion

Indoco Remedies is strategically expanding its capacity, particularly in its solid oral plants, to meet growing demand. This focus on high-growth segments is a key strength.

The company recently began commercial production of Active Pharmaceutical Ingredients (APIs) at its new greenfield facility, signaling a significant step in its growth trajectory. This expansion is crucial for capturing market share in the API segment.

Indoco's emphasis on growing segments, including APIs and specific domestic therapies, positions it well for sustained future growth.

- Capacity Augmentation: Indoco is actively increasing capacity at its solid oral plants.

- New Greenfield Facility: Commercial production of APIs has commenced at the new facility.

- Segment Focus: Emphasis on growing segments like APIs and domestic therapies.

Indoco Remedies' diversified product range across key therapeutic areas, including ophthalmology and respiratory, provides significant revenue stability. Its strong domestic market position, ranking 31st in India in FY24 according to IQVIA, highlights substantial prescription support. The company's global reach, spanning over 55 countries, is bolstered by manufacturing facilities approved by stringent regulators like the USFDA and UK-MHRA, ensuring broad market access.

The integrated manufacturing and R&D setup, with 11 facilities and a dedicated R&D center, offers supply chain control and cost efficiencies. This synergy facilitated a reported revenue of INR 1,465 crore in FY2023, with APIs being a key contributor. Strategic partnerships, such as the one with Clarity Pharma in the UK, further enhance market penetration and new product introductions.

Indoco's proactive capacity expansion, especially in solid oral plants, and the commencement of API production at its new greenfield facility underscore its commitment to growth. This focus on high-demand segments like APIs and domestic therapies positions the company for sustained future expansion.

| Strength | Description | Supporting Data/Fact |

| Product Diversification | Broad portfolio across therapeutic areas (e.g., ophthalmology, respiratory) | Mitigates reliance on single products, enhances revenue stability. |

| Domestic Market Position | Strong presence in India | Ranked 31st in Indian pharma market in FY24 (IQVIA). |

| Global Reach & Regulatory Compliance | Operations in 55+ countries with USFDA/MHRA approved facilities | Facilitates significant international market access. |

| Integrated Manufacturing & R&D | 11 manufacturing facilities, R&D center, CRO | Enables supply chain control, cost efficiencies, and product development. FY2023 revenue: INR 1,465 crore. |

| Strategic Partnerships | Collaborations for market expansion | Example: Distribution agreement with Clarity Pharma for UK market. |

| Capacity Expansion & Greenfield Development | Increasing capacity in solid oral plants; new API facility operational | Focus on high-growth segments like APIs and domestic therapies. |

What is included in the product

Delivers a strategic overview of Indoco’s internal strengths and weaknesses, alongside external market opportunities and threats.

The Indoco SWOT analysis provides a clear, actionable framework to identify and address key challenges, transforming potential roadblocks into strategic advantages.

Weaknesses

Indoco Remedies' debt metrics have weakened, with total debt climbing significantly in FY2024. This trend continued into 9M FY2025, driven by substantial debt-funded capital expenditures that outpaced initial expectations.

The increase in borrowing, coupled with a noticeable decline in operating margins, has prompted a reassessment of the company's financial health. Consequently, ICRA revised Indoco's credit outlook to Negative, reflecting concerns about its leverage and profitability.

Indoco Remedies faced significant regulatory hurdles in late 2024. Its Goa Plant II and III facilities were flagged with an Official Action Indicated (OAI) status by the USFDA, leading to a warning letter in December 2024.

This regulatory action directly hampered the company's ability to introduce new sterile and injectable products. Furthermore, it disrupted supplies to crucial export markets, with the United States being particularly affected by these compliance issues.

Indoco Remedies faced a challenging financial period, reporting a net loss for the fourth quarter of fiscal year 2025 and the entirety of FY2024-25. This marks a significant downturn from its prior profitable performance.

The company's operating margins have also seen a contraction. This decline is attributed to a weaker performance in crucial export markets, higher operating expenses stemming from new capacity additions, and costs associated with addressing USFDA observations.

Impact of European Market Performance

Indoco Remedies' export formulation segment saw only modest growth in FY2024, largely due to a substantial drop in revenue from Europe. This downturn was primarily driven by reduced demand for key products like paracetamol from a significant European client, coupled with disruptions caused by facility upgrades impacting supply chains.

The company's reliance on specific European markets and customers presents a clear weakness. For instance, the aforementioned decline in paracetamol offtake illustrates how the performance of a few key relationships can disproportionately affect overall export revenue. This concentration risk means that challenges in one major European market can have a significant ripple effect.

- European Revenue Decline: The export formulation segment's growth was hampered by a significant revenue drop in Europe during FY2024.

- Key Product Performance: Lower offtake for paracetamol from a major customer directly impacted European sales figures.

- Supply Chain Disruptions: Facility upgrades led to supply impacts, further contributing to the revenue challenges in the European market.

- Customer Concentration: A dependence on a few major customers in Europe exposes Indoco to significant risks if those relationships falter.

High Working Capital Intensity

Indoco's working capital intensity has remained at a moderately high level, suggesting a significant portion of its capital is currently tied up in its short-term assets. For instance, in the fiscal year ending March 2024, Indoco's working capital to sales ratio stood at approximately 28%, a slight increase from 27% in FY2023. This means a considerable amount of cash is locked in inventory and receivables, which could otherwise be used for growth initiatives or returned to shareholders.

While the company has demonstrated its ability to meet its short-term financial commitments, this high utilization of working capital can potentially limit its financial flexibility. It can also create headwinds for operational efficiency, as more cash is needed to support day-to-day business activities.

- High Working Capital Needs: Indoco's business model inherently requires substantial investment in inventory and accounts receivable, contributing to its elevated working capital intensity.

- Liquidity Constraints: A significant portion of capital being tied up in current assets can put pressure on immediate liquidity, especially during periods of rapid sales growth or unexpected economic downturns.

- Operational Efficiency Impact: High working capital levels can signal inefficiencies in inventory management or slower collection of receivables, potentially impacting the company's ability to generate free cash flow.

- FY2024 Working Capital to Sales: The company reported a working capital to sales ratio of around 28% for the fiscal year ending March 2024, indicating ongoing demands on its capital.

Indoco's financial performance in FY2024-25 was marked by a net loss, a stark contrast to previous profitability, driven by declining operating margins. This contraction stems from weaker export market performance, increased operating expenses due to new capacities, and costs associated with addressing regulatory observations.

The company experienced a significant revenue drop in Europe during FY2024, primarily due to reduced demand for key products like paracetamol from a major client and supply disruptions from facility upgrades. This highlights a considerable customer concentration risk within its European export segment.

Indoco's working capital intensity remains elevated, with a working capital to sales ratio of approximately 28% in FY2024. This ties up substantial capital in inventory and receivables, potentially limiting financial flexibility and impacting operational efficiency.

Full Version Awaits

Indoco SWOT Analysis

This is the actual Indoco SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can trust that the insights and structure you see here are representative of the complete, detailed report. Unlock the full analysis to leverage these strategic advantages.

Opportunities

The Indian pharmaceutical market is on a strong growth trajectory, with projections indicating domestic sales could hit USD 50 billion by 2030. This expansion is fueled by better healthcare accessibility, increasing disposable incomes, and a growing middle class.

This presents a prime opportunity for Indoco to bolster its domestic formulation business. The company can leverage the surging demand for cost-effective medicines to increase its market share and revenue.

India is rapidly becoming a go-to destination for contract development and manufacturing, often called CDMO or CRAMS. This is driven by competitive pricing, strong technical skills, and a supportive regulatory landscape. The Indian CDMO/CRAMS market is projected to exceed $25 billion by 2030, highlighting significant growth potential.

Indoco Remedies, with its established contract manufacturing operations and robust Active Pharmaceutical Ingredient (API) expertise, is well-positioned to capitalize on this global shift. The company can leverage these strengths to attract more international clients seeking outsourcing partnerships, thereby expanding its market share.

The growing burden of chronic diseases, such as diabetes and heart conditions, is a significant opportunity. These conditions require ongoing treatment, driving consistent demand for prescription drugs. In 2023, the Indian pharmaceutical market saw chronic therapies account for a substantial portion of sales, with diabetes drugs alone showing robust growth.

Indoco can capitalize on this trend by strengthening its offerings in these high-demand therapeutic segments. Expanding its product pipeline to include more specialized therapies for chronic ailments will position the company to capture a larger share of this expanding market, ensuring sustained revenue streams.

Leveraging Government Initiatives and PLI Schemes

Government initiatives, particularly the Production Linked Incentive (PLI) schemes for Active Pharmaceutical Ingredients (APIs) and bulk drugs, are strategically designed to curb India's import reliance and foster domestic manufacturing prowess. Indoco, with its established API production infrastructure, is well-positioned to capitalize on these incentives. This can significantly bolster its competitive edge in the market and attract further investment.

For instance, the PLI scheme for APIs and Key Starting Materials (KSMs) has already seen significant uptake, with the government approving substantial investments. Indoco's participation in such schemes could lead to:

- Enhanced cost competitiveness through direct financial incentives.

- Improved supply chain security by reducing dependence on imported raw materials.

- Opportunities for capacity expansion funded partly by government support.

- Strengthened market position domestically and potentially in export markets.

Strategic Geographical Expansion and New Product Launches

Indoco Remedies is strategically expanding its global footprint, with a key focus on the United Kingdom. Through targeted partnerships, the company is introducing new pharmaceutical products, aiming to diversify its revenue streams and reduce reliance on any single market. This international push is crucial for mitigating concentration risks inherent in its current market presence.

The company is also actively exploring opportunities to onboard new customers across Europe. This proactive approach to geographical expansion is designed to tap into new demand centers and solidify Indoco's position in diverse economic landscapes. By broadening its European reach, Indoco aims to unlock significant future revenue growth potential.

Furthermore, Indoco continues to prioritize gaining US market approvals for its specialized, niche product offerings. Success in these segments, coupled with expansion into promising emerging markets, represents a significant avenue for driving future sales and enhancing overall market share. For instance, in the fiscal year ending March 31, 2024, Indoco reported a consolidated revenue of INR 3,577.8 crore, with international markets playing a substantial role.

- UK Market Entry: Launching new products in the UK via strategic alliances to diversify revenue.

- European Expansion: Actively seeking new customers across Europe to mitigate geographical concentration risks.

- US Niche Products: Pursuing US regulatory approvals for specialized products, a key growth driver.

- Emerging Markets Focus: Targeting expansion into developing economies to capture new growth opportunities.

The expanding Indian pharmaceutical market, projected to reach USD 50 billion by 2030, offers Indoco a significant opportunity to grow its domestic formulation business by meeting the increasing demand for affordable medicines.

Leveraging India's rise as a global CDMO/CRAMS hub, valued at over $25 billion by 2030, Indoco can attract international clients with its established manufacturing and API expertise.

The rising prevalence of chronic diseases presents a consistent demand for prescription drugs, an area where Indoco can strengthen its product portfolio to capture a larger market share.

Government incentives like the PLI schemes for APIs provide a direct advantage, enhancing cost competitiveness and supply chain security for Indoco's domestic manufacturing capabilities.

Threats

Indoco Remedies faces significant threats from intensified regulatory scrutiny, as evidenced by the USFDA warning letter issued to its Goa facility. This underscores the persistent risk of compliance failures during stringent inspections, which can directly impact product approvals and market access.

Such non-compliance can trigger severe consequences, including import alerts and potential production stoppages, directly jeopardizing Indoco's substantial export revenues, particularly from regulated markets like the US and Europe. For instance, in fiscal year 2023-24, exports constituted a significant portion of Indoco's revenue, making any disruption particularly damaging.

The ongoing risk of regulatory actions not only threatens operational continuity but also poses a substantial reputational challenge. Rebuilding trust with regulatory bodies and the market after such incidents requires considerable time and resources, potentially diverting focus from growth initiatives and impacting investor confidence.

Indoco Remedies operates in a fiercely competitive Indian pharmaceutical market, where a multitude of companies actively pursue market share. This intense rivalry, particularly in the acute segment, means Indoco must constantly innovate and optimize to maintain its position.

The company also contends with global pharmaceutical giants, whose scale and resources can exert significant pressure on pricing strategies and overall profitability. For instance, in 2023, the Indian pharmaceutical market was valued at approximately $42 billion, with significant growth driven by both domestic demand and exports, highlighting the crowded landscape Indoco navigates.

Indoco Remedies, operating within the generics pharmaceutical sector, is susceptible to intense pricing pressure. Governments and healthcare payers globally are actively seeking cost reductions, which directly translates into lower prices for generic drugs. This trend, evident throughout 2024 and projected to continue into 2025, can significantly squeeze profit margins for companies like Indoco.

The generics market is inherently competitive, and as patents expire, new players often enter, further intensifying price wars. For instance, in many emerging markets where Indoco has a strong presence, the influx of multiple generic manufacturers for a single drug can lead to price erosion of 20-30% within months of launch. This dynamic poses a substantial threat to Indoco's revenue growth and profitability, as maintaining market share often requires aggressive pricing strategies.

Supply Chain Disruptions and Economic Volatility

Global supply chain disruptions continue to pose a significant challenge, potentially affecting the availability and cost of critical raw materials for Indoco's manufacturing. For instance, the ongoing geopolitical tensions and shipping bottlenecks observed throughout 2023 and into early 2024 have led to increased logistics expenses for many pharmaceutical companies.

Economic volatility, including fluctuating foreign exchange rates, directly impacts Indoco's international revenue streams. As of late 2024, currency fluctuations, particularly against major trading partners, could compress margins on export sales if not adequately hedged.

- Increased input costs: Supply chain issues can drive up the price of active pharmaceutical ingredients (APIs) and excipients.

- Production delays: Shortages of key components can lead to manufacturing slowdowns or halts.

- Currency headwinds: Adverse movements in exchange rates can reduce the value of foreign earnings when repatriated.

- Unpredictable demand: Economic downturns may dampen demand for certain pharmaceutical products.

High Capital Expenditure and Debt Servicing Obligations

Indoco Remedies has invested heavily in expanding its manufacturing capacity and upgrading facilities. This has resulted in a notable increase in its debt levels. For instance, as of the fiscal year ending March 31, 2024, the company's total debt stood at approximately INR 1,200 crore, a significant portion of which was incurred for these capital projects.

The company now faces substantial debt servicing obligations, including principal repayments and interest payments, over the next few fiscal years. This financial commitment could become a significant challenge if Indoco experiences a prolonged downturn in its revenue or profitability.

A sustained decline in sales or margins, perhaps due to increased competition or regulatory hurdles, could put pressure on Indoco's ability to meet its debt obligations, potentially impacting its financial liquidity and operational flexibility.

- Increased Debt Burden: Indoco's debt increased significantly due to capital expenditure for expansion and modernization.

- Substantial Servicing Obligations: The company has considerable debt servicing commitments in the near future.

- Liquidity Risk: A prolonged dip in revenue or profits could strain Indoco's cash flow and ability to manage its debt.

The intensifying competitive landscape, particularly within the generics sector, poses a significant threat due to constant pricing pressure. This is exacerbated by the entry of new players as patents expire, leading to price erosion. For example, in many emerging markets, a single drug can see price drops of 20-30% shortly after multiple generic manufacturers enter the market.

Global supply chain vulnerabilities and economic volatility, including fluctuating foreign exchange rates, present ongoing challenges. Geopolitical tensions and shipping bottlenecks observed throughout 2023 and into early 2024 have already increased logistics expenses, impacting raw material availability and costs. Currency fluctuations, particularly against major trading partners as of late 2024, could also compress export margins.

Indoco Remedies' substantial debt burden, approximately INR 1,200 crore as of March 31, 2024, stemming from expansionary capital expenditure, creates significant servicing obligations. A downturn in revenue or profitability could strain the company's ability to meet these commitments, potentially impacting liquidity and operational flexibility.

SWOT Analysis Data Sources

This Indoco SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry commentary to provide a well-rounded and accurate strategic assessment.