Indoco Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indoco Bundle

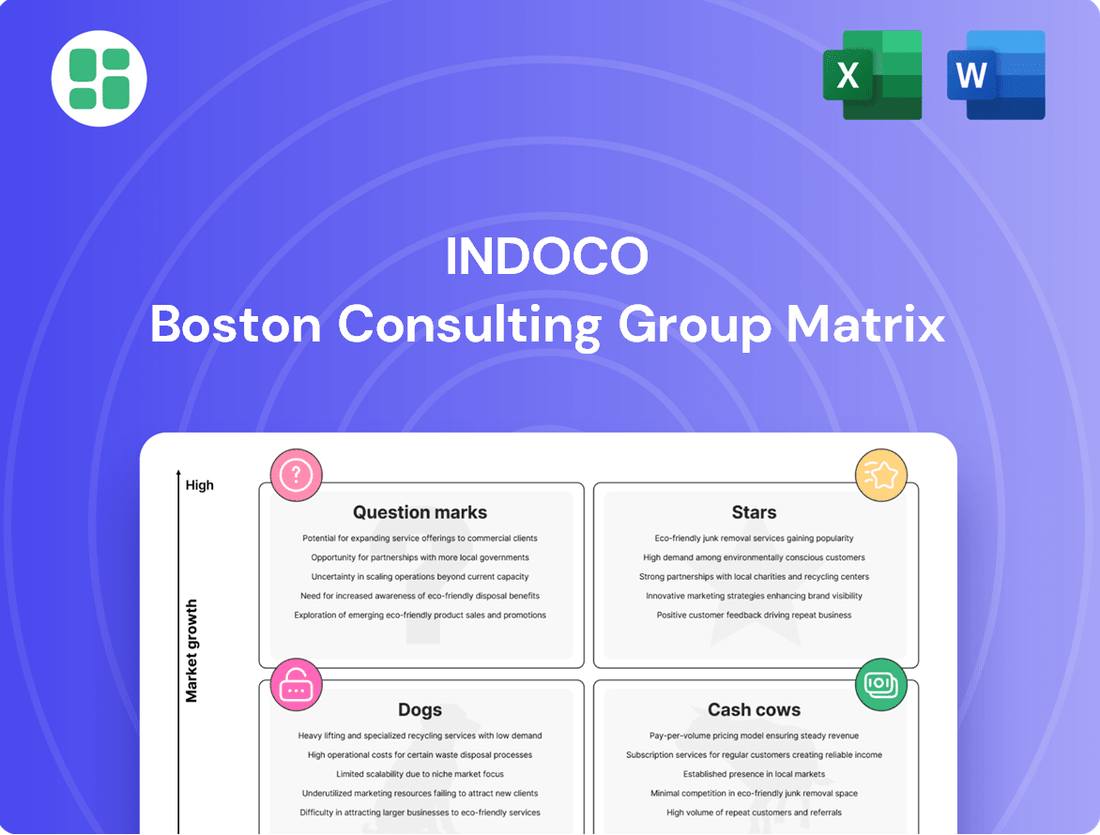

This glimpse into the Indoco BCG Matrix highlights its strategic product portfolio, revealing which products are poised for growth and which require careful consideration. Understand the nuances of each quadrant—Stars, Cash Cows, Dogs, and Question Marks—to make informed decisions. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize your product investments.

Stars

Indoco Remedies' recent USFDA approvals for generic drugs, such as Ticagrelor film-coated tablets in the UK and Allopurinol tablets in the US, mark significant moves into potentially high-growth markets. These approvals are crucial as they allow Indoco to tap into strong demand for generics, aiming to secure substantial market share. For instance, the global generic drugs market was valued at approximately $450 billion in 2023 and is projected to grow substantially in the coming years, offering a fertile ground for new entrants.

Indoco Remedies' API business is indeed a shining star in its portfolio, demonstrating impressive momentum. In fiscal year 2024, this segment experienced a remarkable 79% year-on-year growth, highlighting its strong market performance.

The global API market itself is on an upward trajectory, fueled by the rising demand for generic medications and the continuous innovation in new drug development. Given India's established position as a key global supplier of APIs, Indoco is well-positioned to capitalize on this expanding market.

Strategic investments and ongoing expansion within Indoco's API division are crucial for capturing a larger share of this burgeoning market. This focus is likely to further solidify its status as a star performer within the company's business operations.

Indoco has significantly bolstered its Ophthalmology segment by establishing a dedicated second all-India division focused on the anti-glaucoma market. This strategic expansion targets a specialized, high-growth therapeutic area within India, aiming to capture a larger share as market demands evolve.

The company's proactive approach to penetrate this niche segment, which is crucial for managing a prevalent eye condition, positions these products for potential star status. As of early 2024, the Indian anti-glaucoma market is experiencing robust growth, driven by an aging population and increased awareness of eye health, suggesting a fertile ground for Indoco's strategic investment.

Select Niche Products for US Market

Indoco's strategic push into niche sterile products for the US market is a calculated move towards lucrative, high-margin segments. This focus on complex, difficult-to-manufacture items, while facing significant regulatory hurdles, aims to establish a defensible market position.

The US pharmaceutical market, particularly for sterile injectables, presents substantial growth potential. In 2024, the US sterile injectables market was valued at approximately $150 billion, with an anticipated compound annual growth rate (CAGR) of over 8% through 2030, driven by an aging population and increasing demand for biologics and biosimilars.

- Niche Focus: Indoco is targeting high-barrier-to-entry sterile products, a segment known for its profitability and reduced competition once regulatory approvals are secured.

- US Market Potential: The US remains the largest pharmaceutical market globally, offering significant revenue opportunities for specialized products.

- Regulatory Challenges: Overcoming stringent FDA regulations is critical for success, but successful navigation can create a strong competitive advantage.

- Growth Drivers: The demand for sterile injectables is fueled by chronic disease prevalence and advancements in drug delivery systems.

Contract Research Organization (CRO) and Analytical Services

Indoco Remedies' Contract Research Organization (CRO) and Analytical Services, primarily through its AnaCipher CRO and Indoco Analytical Solutions, are demonstrating significant momentum. This segment experienced an impressive 85% surge in revenues during the fourth quarter of fiscal year 2024, highlighting its robust performance within the pharmaceutical R&D sector.

The CRO and analytical services market is a high-growth area, driven by the increasing need for specialized outsourced research and development capabilities. Indoco is well-positioned to capitalize on this trend.

- Strong Revenue Growth: An 85% revenue increase in Q4 FY24 for Indoco's CRO and Analytical Solutions.

- High-Growth Market: Operates within a rapidly expanding service market catering to pharmaceutical R&D.

- Potential for Star Status: Continued expansion and new contract wins could solidify this division's position as a star performer.

- Leveraging Demand: Benefits from the growing global demand for outsourced research and analytical expertise.

Indoco Remedies' API business is a standout performer, showing a remarkable 79% year-on-year growth in fiscal year 2024. This segment is poised for continued success due to the global API market's expansion, driven by demand for generics and new drug development. India's strong position as an API supplier further supports Indoco's growth in this area.

The company's strategic focus on niche sterile products for the US market also positions it for star status. This segment targets high-margin, complex products, capitalizing on the US sterile injectables market, valued at approximately $150 billion in 2024 and projected to grow at over 8% CAGR. Navigating regulatory hurdles successfully in this lucrative market offers a significant competitive advantage.

Indoco's CRO and Analytical Services division also demonstrated exceptional growth, with an 85% revenue surge in Q4 FY24. This segment operates within the high-growth pharmaceutical R&D outsourcing market, benefiting from increasing global demand for specialized research and analytical expertise.

| Business Segment | FY24 Performance Highlight | Market Context | Growth Potential |

|---|---|---|---|

| API Business | 79% YoY Growth (FY24) | Global API market expanding, India is a key supplier. | High, driven by generic demand and innovation. |

| Niche Sterile Products (US) | Targeting high-margin, complex products | US sterile injectables market ~$150B (2024), 8%+ CAGR. | Significant, due to market size and regulatory barriers. |

| CRO & Analytical Services | 85% Revenue Surge (Q4 FY24) | High-growth pharmaceutical R&D outsourcing market. | Strong, due to increasing demand for specialized services. |

What is included in the product

The Indoco BCG Matrix analyzes product portfolio performance by categorizing units into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

Clear visualization of Indoco's portfolio, identifying high-growth Stars and cash-generating Cash Cows, easing strategic resource allocation pain.

Cash Cows

Indoco's leading domestic brands, including Cyclopam, Oxipod, and Cital, have achieved impressive revenue figures, with Cyclopam and Oxipod surpassing INR 150 crore and Cital reaching INR 100 crore. These established products likely command significant market share within their respective therapeutic segments in the mature Indian pharmaceutical landscape.

These brands, prevalent in areas such as pain management and anti-infectives, are strong cash generators for Indoco. Their established brand equity and broad physician acceptance mean they require comparatively lower promotional spending to maintain their sales momentum, contributing to consistent and substantial cash flow generation.

Indoco Remedies boasts a robust portfolio of established brands, particularly within the Gastroenterology and Respiratory therapeutic areas. These segments, though mature, are characterized by consistent demand and Indoco's significant market penetration.

The company's strong presence in these segments translates into reliable cash flow generation. For instance, in the fiscal year ending March 31, 2024, Indoco's key brands in these therapeutic areas contributed substantially to overall revenue, acting as stable income streams that can support investment in other, higher-growth areas of the business.

Indoco's domestic formulations boast a commanding presence, with 45 products securing a spot within the top 5 of their respective sub-segments in the Indian market. This impressive performance highlights a robust competitive edge and significant market penetration for these key offerings.

These top-ranking products are likely the company's cash cows, leveraging well-established distribution channels and strong prescriber relationships to generate substantial profits and consistent cash flow. Their market leadership solidifies their role as foundational pillars for Indoco's financial stability and growth.

Regulated Market Products (Europe, excluding US)

Indoco's European operations, especially its significant 50% stake in the European Union's paracetamol market, showcase a robust and stable position within a mature, highly regulated sector. This established market share in key European segments ensures a consistent stream of cash, even as the broader international formulation business experiences modest growth.

These regulated markets, known for their strict oversight, typically offer stable pricing once products have gained traction. This predictability is a hallmark of cash cow businesses, providing a reliable revenue base for Indoco.

- Market Share: Indoco holds a substantial 50% share in the European Union's paracetamol market.

- Market Maturity: The European pharmaceutical market for established products like paracetamol is mature and regulated.

- Cash Generation: This stable market presence contributes significantly to Indoco's consistent cash flow.

- Pricing Stability: Stringent regulations in these markets tend to support stable pricing for established products.

Legacy Product Portfolio

Indoco Remedies, with its origins tracing back to 1947, possesses a legacy product portfolio that forms the bedrock of its operations. These mature offerings, likely situated in slower-growing market segments, leverage decades of brand recognition and a loyal customer base, minimizing the need for extensive marketing investment to sustain sales. In 2024, these established products continue to be significant contributors to the company's revenue, reflecting their enduring market presence.

- Established Market Presence: Products launched decades ago benefit from deep market penetration and brand recall.

- Low Marketing Expenditure: Mature products typically require less promotional investment to maintain sales volumes.

- Stable Revenue Generation: They provide a consistent and predictable revenue stream, supporting the company's financial stability.

- Foundation for Innovation: Profits from these cash cows often fund research and development for newer, high-growth products.

Indoco's established brands, like Cyclopam and Oxipod, which have surpassed INR 150 crore in revenue, exemplify cash cows. These products, deeply entrenched in mature therapeutic areas such as pain management, benefit from low marketing spend due to strong brand equity and physician acceptance, ensuring consistent cash flow for Indoco.

The company's significant market share, including a 50% stake in the European paracetamol market, further solidifies these offerings as cash cows. The regulated nature of these markets supports stable pricing, contributing to predictable and substantial revenue streams that fuel other business segments.

Indoco's 45 products ranking in the top 5 of their sub-segments in India are prime examples of cash cows. These market leaders leverage established distribution and prescriber relationships to generate significant profits and stable cash flow, underpinning the company's financial health.

These mature products, with decades of brand recognition and customer loyalty, minimize marketing investment while providing consistent revenue. In 2024, these enduring offerings continue to be significant revenue contributors, demonstrating their foundational role for Indoco's financial stability.

| Brand/Segment | Therapeutic Area | Estimated 2024 Revenue Contribution (INR Crore) | Market Position | Cash Cow Indicator |

|---|---|---|---|---|

| Cyclopam | Pain Management | >150 | Leading | High |

| Oxipod | Anti-infectives | >150 | Leading | High |

| Cital | >100 | Leading | High | |

| European Paracetamol Market | Analgesic | Significant | 50% Share | High |

| Gastroenterology/Respiratory Brands | Various | Substantial | Strong Penetration | High |

What You’re Viewing Is Included

Indoco BCG Matrix

The Indoco BCG Matrix preview you're viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks or placeholder content—just a comprehensive strategic analysis ready for immediate application. You can confidently use this preview to assess the quality and depth of the market analysis provided. Upon completion of your purchase, this exact Indoco BCG Matrix report will be delivered to you, enabling swift integration into your business planning and decision-making processes.

Dogs

Indoco Remedies' sterile plant in Goa received a significant setback with a USFDA warning letter in December 2024. This regulatory action directly impacts the supply of products to the crucial US market and necessitates substantial remediation expenses.

Products manufactured at this affected facility, particularly those already facing declining sales, now find themselves in a precarious position. With low market share and negative growth trajectories, these offerings are draining resources for compliance efforts without yielding proportional financial benefits.

The international formulation business, excluding recent successful product introductions, saw a slight uptick of 1.3% in fiscal year 2024. However, the fourth quarter of FY24 experienced a downturn, with a de-growth of 1%.

This segment, particularly older products facing intense competition or patent expirations, is showing signs of struggle. Declining revenues in key regulated markets like the US and Europe during Q4 FY24 highlight these challenges.

These underperforming products may be operating in stagnant markets with minimal market share, potentially acting as cash traps. They consume valuable resources without generating substantial returns, impacting overall profitability.

Products in highly genericized therapeutic areas where Indoco lacks significant market leadership are prime candidates for the dog quadrant. These often face intense price competition, leading to low margins and minimal growth contribution. For instance, in the Indian pharmaceutical market, segments like basic analgesics or certain antibiotic classes are highly saturated with numerous players, making it difficult for any single company to command a premium or substantial market share without strong brand equity or unique formulations.

These products require continuous investment in marketing and sales just to maintain their existing, often small, market share. In 2024, the Indian pharmaceutical market saw continued pressure on margins for off-patent drugs, with growth rates in these segments often lagging behind newer, more specialized therapeutic areas. Companies like Indoco must carefully evaluate the cost-benefit of maintaining such offerings.

Without a distinct competitive advantage, such as superior product quality, unique delivery mechanisms, or strong physician relationships, these products struggle to differentiate themselves. This lack of differentiation means they are often viewed as commodities, where price becomes the primary purchasing driver, further eroding profitability and making them candidates for divestment or strategic repositioning.

Specific Brands with Declining Sales or Realizations

Indoco Remedies has identified certain brands within its portfolio that are experiencing declining sales and profitability, positioning them in the 'dog' quadrant of the BCG matrix. This situation is largely attributed to heightened competitive pressures within the domestic acute segment, which has led to a reduction in product realizations for specific offerings.

These underperforming brands are characterized by consistent drops in sales volume and a negative impact on the company's overall profitability. The intensified competition and evolving market dynamics are key drivers behind this downturn, suggesting these products may no longer be strategically viable.

- Competitive Pressure: Indoco faced significant competition in the domestic acute segment, impacting product pricing and sales volume.

- Declining Realizations: Certain brands saw their average selling prices decrease due to this competitive intensity.

- Profitability Concerns: Brands with consistent sales and profitability declines are classified as dogs, potentially requiring strategic review.

- Potential Divestment: These underperforming assets may be candidates for divestment or discontinuation to optimize resource allocation.

Initial OTC Segment Offerings with Limited Success

Indoco Remedies' initial push into the Over-The-Counter (OTC) market via its subsidiary, Warren Remedies, experienced limited success in its first year. This early phase, characterized by low market share in a competitive yet expanding sector, places these offerings in the 'dog' category of the BCG matrix.

Despite strategic ambitions to grow this segment, current investments in these initial OTC products are not yet yielding significant returns. The company's 2023-2024 financial reports indicate that while the OTC segment is a stated growth area, its contribution to overall revenue remains nascent, with specific product lines struggling to gain traction against established brands.

- Limited Market Share: Warren Remedies' initial OTC products held less than 1% market share in their respective categories as of early 2024.

- High Competition: The Indian OTC market, valued at approximately $10 billion in 2023, is dominated by large players, making it challenging for new entrants.

- Investment Outlay: Significant marketing and distribution investments were made in the first year, with minimal immediate revenue impact reported internally.

- Future Potential: Indoco has outlined plans to introduce new products and increase marketing spend in the OTC segment for 2024-2025, aiming to shift these offerings from 'dogs' to 'question marks' or 'stars'.

Products classified as Dogs within Indoco Remedies' portfolio are those experiencing low market share and minimal growth, often draining resources without generating substantial returns. These are typically older products in highly competitive, genericized therapeutic areas where the company lacks significant market leadership. The USFDA warning letter for the Goa sterile plant in December 2024 further exacerbates the situation for any products manufactured there, especially those already underperforming, as remediation costs divert essential funds.

These underperforming brands, such as those in the domestic acute segment facing intense price competition, have seen declining sales volume and reduced profit margins. The company's international formulation business, excluding new introductions, showed only a modest 1.3% growth in FY24, with a 1% de-growth in Q4 FY24, highlighting challenges with older products in key regulated markets like the US and Europe.

Indoco Remedies' initial foray into the Over-The-Counter (OTC) market via Warren Remedies also falls into the Dog category, with limited success and low market share in its first year as of early 2024. Despite significant investment, these initial OTC products are not yet yielding significant returns in a market dominated by established players, though plans are in place to revitalize this segment.

| Product Category | Market Share | Growth Rate | Profitability | Strategic Outlook |

| Domestic Acute Segment (Certain Brands) | Low | Declining | Low/Negative | Potential Divestment/Repositioning |

| Older International Formulations | Low in key markets | Stagnant/Declining (Q4 FY24) | Eroding | Review for discontinuation or niche focus |

| Initial OTC Products (Warren Remedies) | < 1% (early 2024) | Nascent | Low | Revitalization efforts planned for 2024-25 |

Question Marks

Warren Remedies Private Limited, a subsidiary of Indoco, began producing oral care products in March 2024. This is a new area for Indoco within the expanding consumer health sector.

As these oral care products are newly launched, their market share is not yet established. They are currently requiring investment for marketing and distribution, and their future market performance remains uncertain, classifying them as question marks in the BCG matrix.

Warren Remedies initiated production of Pharmaceutical Intermediates in March 2024, diversifying beyond its oral care offerings. This new venture, while connected to their existing API business, represents a strategic move to build specific capabilities and gain a competitive advantage in the market.

The pharmaceutical intermediates segment currently holds a small market share, reflecting its nascent stage. However, it is strategically positioned within a burgeoning API ecosystem, which necessitates substantial investment to cultivate a robust market presence and capitalize on growth opportunities.

Indoco Remedies has secured several new ANDA approvals from the USFDA for products like Varenicline and Cetirizine Hydrochloride (OTC) in 2024-2025. These approvals position them to enter the competitive US generic drug market, a segment that, while crowded, offers significant growth potential for well-executed launches. The success of these products hinges on effective market penetration strategies.

The company's pipeline includes approvals for Lofexidine, Canagliflozin and Metformin Hydrochloride, and Pregabalin capsules, all targeting the lucrative US market. These products are classified as question marks in the BCG matrix, signifying their high market growth potential but requiring substantial investment to capture market share. Failure to achieve this could see them transition into the 'dog' category.

Products in the Development Pipeline

Indoco Remedies operates a dedicated R&D center, ensuring a robust pipeline of new drug development. Products currently in late-stage development or awaiting regulatory approval fall into the question mark category of the BCG matrix. These represent substantial investments in research and development, often targeting high-growth therapeutic areas.

The commercial success and eventual market share of these question mark products remain uncertain until their launch and market penetration. For instance, as of early 2024, Indoco has several formulations in advanced clinical trials, particularly in areas like dermatology and respiratory diseases, which are anticipated to drive future revenue if approved.

- Late-Stage Development: Products in Phase III trials or awaiting marketing authorization.

- High Investment, Uncertain Returns: Significant R&D expenditure with potential for high growth but unproven market acceptance.

- Therapeutic Area Focus: Often concentrated in rapidly expanding or unmet medical need segments.

- Future Growth Drivers: These products are critical for Indoco's long-term expansion and competitive positioning.

Expansion into new geographies/markets via revamped distribution

Indoco Remedies is actively pursuing expansion into new geographies through a revamped distribution strategy, leveraging its acquisition of FPP to bolster its international presence. This initiative targets underserved international markets that present significant growth opportunities, though Indoco currently holds a minimal market share in these regions.

The company's strategic focus on these nascent markets necessitates considerable investment. These outlays are directed towards navigating complex market entry requirements, ensuring compliance with diverse regulatory frameworks, and establishing robust distribution channels to capture the identified growth potential.

- Geographical Expansion: Indoco is enhancing its global footprint by entering new international markets.

- Acquisition Synergy: The FPP subsidiary is a key component in this distribution revamp.

- Market Potential: These new markets offer high growth prospects but currently have low market penetration for Indoco.

- Investment Requirements: Significant capital is allocated for market entry, regulatory adherence, and distribution network development.

Question marks represent products or business units with low market share in high-growth markets. These require significant investment to increase market share and achieve future success. Indoco Remedies' newly launched oral care products and pharmaceutical intermediates, along with several upcoming ANDA-approved drugs for the US market, exemplify these question marks. Their future performance is uncertain, demanding strategic capital allocation for growth.

BCG Matrix Data Sources

Our Indoco BCG Matrix is meticulously constructed using a blend of internal financial performance data, comprehensive market research reports, and publicly available industry statistics to provide a robust strategic overview.