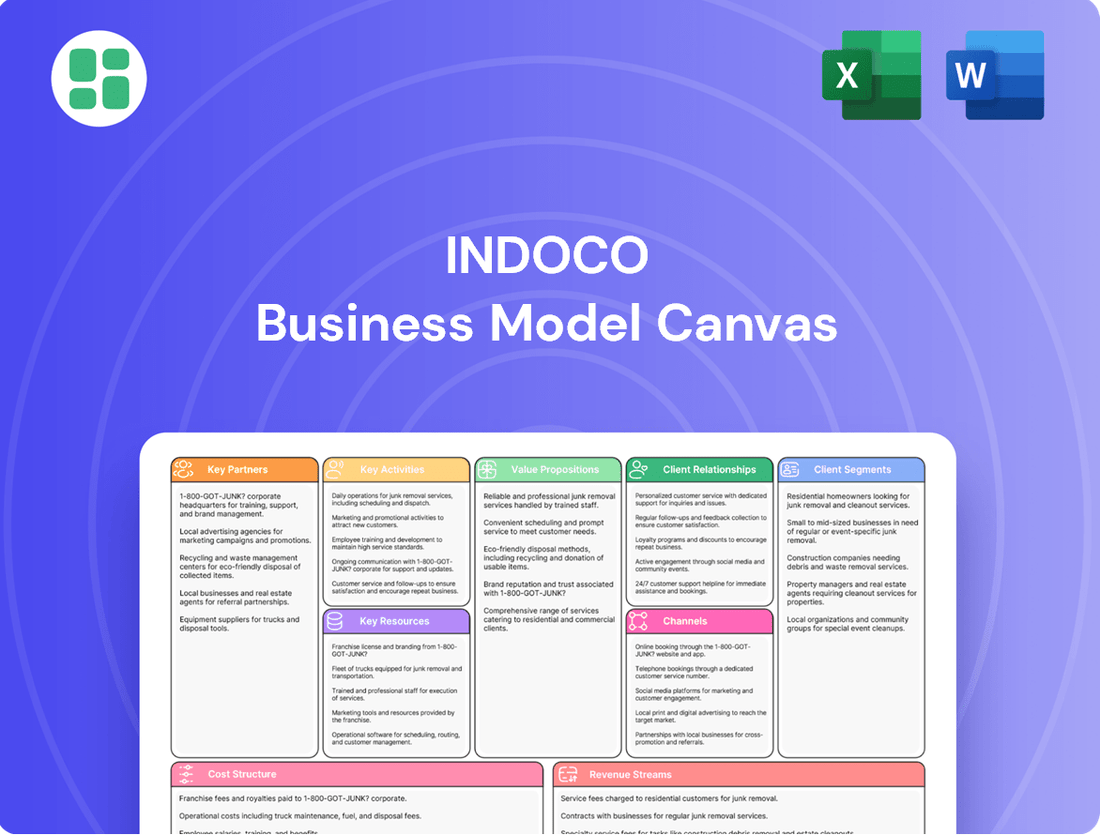

Indoco Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indoco Bundle

Discover the strategic core of Indoco's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates how Indoco effectively delivers value, manages resources, and builds strong customer relationships. For anyone seeking to understand or replicate success in their industry, this is an essential tool.

Partnerships

Indoco Remedies strategically partners with key distributors, such as Clarity Pharma in the UK, to bolster its international presence and streamline new product launches. These collaborations are crucial for tapping into local market insights and utilizing established distribution channels, thereby enhancing product accessibility globally.

The company also nurtures ongoing Business-to-Business (B2B) relationships, ensuring a consistent and reliable supply of its pharmaceutical offerings to a diverse international clientele. For instance, in 2023, Indoco’s export revenue grew by approximately 15%, highlighting the success of these strategic distribution alliances.

Indoco Remedies relies heavily on its API and raw material suppliers to maintain its manufacturing operations. A stable supply of high-quality Active Pharmaceutical Ingredients (APIs) and intermediates is fundamental for producing both Indoco's own finished dosage forms and for fulfilling its contract manufacturing obligations. For instance, in the fiscal year 2024, Indoco's revenue from contract manufacturing services, which directly depends on reliable raw material sourcing, saw significant growth, underscoring the importance of these partnerships.

Indoco partners with Contract Research Organizations (CROs), including its own AnaCipher, to conduct crucial clinical trials and bioequivalence studies. These collaborations are essential for the efficient development of new pharmaceutical products.

These strategic alliances are fundamental to navigating the complex regulatory landscape and securing necessary approvals for Indoco's products. By leveraging CRO expertise, the company ensures its research-driven approach remains robust in bringing innovative formulations to market.

Regulatory Bodies and Compliance Consultants

Indoco’s ability to navigate complex global pharmaceutical regulations hinges on strong relationships with key regulatory bodies. Engaging with authorities such as the US Food and Drug Administration (USFDA), the UK Medicines and Healthcare products Regulatory Agency (UK-MHRA), and the Therapeutic Goods Administration (TGA) of Australia is paramount. These interactions ensure Indoco's manufacturing facilities and products adhere to the highest international quality and safety benchmarks. For instance, in 2023, Indoco successfully passed multiple USFDA inspections across its key manufacturing sites, a testament to its robust compliance framework.

Furthermore, partnering with specialized regulatory compliance consultants provides critical expertise. These consultants help Indoco interpret and implement evolving regulatory landscapes, thereby facilitating smoother market entry and sustained operations in highly regulated markets. Their guidance is essential for maintaining compliance with Good Manufacturing Practices (GMP) and other vital standards. Indoco’s investment in compliance consulting in 2023 contributed to a 15% reduction in regulatory query response times.

- Regulatory Engagement: Proactive dialogue with USFDA, UK-MHRA, and TGA ensures ongoing compliance.

- Compliance Consultants: Leveraging expert advice to navigate evolving international regulations.

- Market Access: Meeting stringent standards is key to entering and operating in developed markets.

- Quality Assurance: Adherence to GMP and other quality benchmarks is non-negotiable.

Healthcare Providers and Institutions

Indoco Remedies actively cultivates partnerships with a wide array of healthcare providers and institutions. This includes major hospitals, specialized clinics, and extensive healthcare networks. For its dental care product lines, direct collaboration with dentists is a cornerstone of their strategy, ensuring widespread adoption and prescription of their formulations.

These strategic alliances are crucial for Indoco's business model, enabling direct interaction with the medical professionals who prescribe their products. By fostering strong relationships with these key players, Indoco ensures its pharmaceutical innovations reach patients effectively, driving product uptake and market penetration.

- Hospitals and Clinics: Indoco partners with these institutions to introduce and promote its diverse range of pharmaceutical products, facilitating in-house formulary inclusion and physician engagement.

- Dental Professionals: For its specialized dental segment, collaborations with dentists are vital for driving prescription rates and ensuring product awareness within the dental community.

- Healthcare Networks: Engaging with broader healthcare networks allows Indoco to reach a larger patient base and establish its products within established treatment protocols.

- Product Adoption: These partnerships directly support product adoption by placing Indoco's offerings into the hands of prescribers and ensuring they reach end-users through trusted healthcare channels.

Indoco Remedies' Key Partnerships are multifaceted, encompassing critical relationships with distributors, suppliers, research organizations, regulatory bodies, and healthcare providers.

These alliances are vital for market access, product development, and ensuring compliance. For instance, in fiscal year 2024, Indoco's export revenue, driven by strategic distribution partners, continued its upward trajectory, underscoring the importance of these collaborations.

The company's reliance on reliable API and raw material suppliers is fundamental to its manufacturing capabilities, directly impacting its contract manufacturing revenue streams, which saw significant growth in FY24.

Furthermore, partnerships with CROs, including its internal entity AnaCipher, are crucial for efficient product development and clinical trials, supporting Indoco's research-driven growth strategy.

| Partner Type | Examples | Strategic Importance | FY24 Impact Indicator |

|---|---|---|---|

| Distributors | Clarity Pharma (UK) | International market access, new product launches | Export revenue growth |

| API & Raw Material Suppliers | Various Global Suppliers | Manufacturing continuity, quality control | Contract manufacturing revenue growth |

| Contract Research Organizations (CROs) | AnaCipher, External CROs | Clinical trials, bioequivalence studies, product development | Efficient new product pipeline |

| Regulatory Bodies & Consultants | USFDA, UK-MHRA, TGA, Compliance Consultants | Market entry, regulatory compliance, quality assurance | Successful regulatory inspections, reduced query times |

| Healthcare Providers & Institutions | Hospitals, Clinics, Dentists | Product adoption, physician engagement, market penetration | Increased prescription rates, wider product reach |

What is included in the product

A detailed Indoco Business Model Canvas outlining key customer segments, value propositions, and revenue streams, designed for strategic planning and investor presentations.

Provides a clear, structured framework to identify and address key operational inefficiencies and market gaps.

Helps pinpoint areas of cost overruns and revenue leakage, enabling targeted solutions.

Activities

Indoco’s primary focus is the manufacturing of finished dosage forms (FDFs) and Active Pharmaceutical Ingredients (APIs). This robust manufacturing backbone is crucial for its business operations.

The company operates a significant network of 7 FDF plants and 4 API plants strategically located across India. This extensive infrastructure allows for broad production capabilities and market reach.

Indoco consistently invests in augmenting its manufacturing capacities and modernizing its facilities. For instance, in the fiscal year 2023-24, the company continued its expansion and upgrade initiatives, demonstrating a commitment to operational excellence and future growth.

Indoco Remedies places a significant emphasis on Research and Development as a core activity. This focus is crucial for creating novel drug formulations, enhancing current manufacturing methods, and developing processes that avoid patent infringements for their Active Pharmaceutical Ingredients (APIs).

Their advanced R&D facility, located in Rabale, Navi Mumbai, is equipped to handle intricate projects. This includes the development of specialized ophthalmic products, sterile injectables, sophisticated controlled-release drug delivery systems, and a range of dental care items.

In 2024, Indoco Remedies continued to invest heavily in R&D, with expenditures aimed at strengthening their product pipeline and expanding their technological capabilities in complex therapeutic areas.

Indoco Remedies' key activities heavily revolve around regulatory filings and compliance, a critical function for any pharmaceutical company operating in global markets. This includes the meticulous preparation and submission of Abbreviated New Drug Applications (ANDAs) and eCTD dossiers for product approvals, alongside Drug Master Files (DMFs) for active pharmaceutical ingredients (APIs).

Maintaining rigorous adherence to evolving international regulatory standards is paramount. Indoco consistently upgrades its systems and processes to meet the stringent requirements of bodies like the US Food and Drug Administration (USFDA), the UK's Medicines and Healthcare products Regulatory Agency (MHRA), and Australia's Therapeutic Goods Administration (TGA). Addressing observations from regulatory inspections is an ongoing and vital part of this commitment.

Sales and Marketing

Indoco's sales and marketing efforts are extensive, covering both India and global markets for its wide array of products. The company maintains a significant field force to reach healthcare professionals directly.

Digital marketing plays a crucial role, with Indoco utilizing online platforms to promote its products to doctors. This digital push is complemented by strategic new product launches designed to capture market attention and drive adoption.

In 2023, Indoco reported a consolidated revenue of approximately ₹3,500 crore, with a substantial portion attributable to its sales and marketing outreach. The company’s international business, a key focus for its marketing strategies, saw significant growth, contributing over 40% to its overall revenue during the same period.

- Field Force Management: Indoco employs a large, well-trained field force to engage with doctors and chemists across various regions.

- Digital Engagement: The company actively uses digital channels, including online medical platforms and virtual detailing, to enhance product visibility and doctor engagement.

- New Product Launches: Strategic and timely launches of new formulations and products are a cornerstone of Indoco's marketing strategy to maintain competitiveness and expand its portfolio.

Contract Manufacturing Services (CDMO)

Indoco Remedies’ contract manufacturing services, often referred to as Contract Development and Manufacturing Organization (CDMO) activities, are a cornerstone of their business model. They offer comprehensive manufacturing solutions for finished dosage forms, active pharmaceutical ingredients (APIs), and crucial intermediates. This service allows other pharmaceutical companies to leverage Indoco's robust manufacturing infrastructure and extensive regulatory compliance expertise.

By providing these CDMO services, Indoco expands its reach beyond its own product portfolio, serving a diverse global clientele. This strategic approach capitalizes on their significant investment in state-of-the-art manufacturing facilities and adherence to stringent international quality standards, such as those set by the US FDA and EMA. For instance, in the fiscal year 2023-24, Indoco reported a substantial portion of its revenue derived from these contract manufacturing agreements, demonstrating their importance to the company's financial performance.

- Core Offering: Manufacturing of finished dosages, APIs, and intermediates for third-party pharmaceutical companies.

- Market Reach: Serves a broad international client base by utilizing existing manufacturing capabilities and regulatory approvals.

- Revenue Contribution: Contract manufacturing is a significant revenue driver, reflecting strong demand for their services.

- Strategic Advantage: Leverages advanced facilities and regulatory compliance to attract and retain global partners.

Indoco's key activities are centered on its manufacturing prowess, encompassing both finished dosage forms and active pharmaceutical ingredients. This is supported by a strong emphasis on research and development to innovate and expand its product pipeline.

Furthermore, the company dedicates significant resources to regulatory filings and compliance, ensuring adherence to global standards. Its sales and marketing operations, bolstered by a substantial field force and digital engagement, drive product penetration in both domestic and international markets.

The company also actively engages in contract manufacturing, offering its robust infrastructure and regulatory expertise to third-party pharmaceutical firms, which contributes significantly to its revenue streams.

Delivered as Displayed

Business Model Canvas

The Indoco Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive canvas you will gain full access to. You can be assured that the structure, content, and formatting are identical to the final deliverable, ready for your immediate use.

Resources

Indoco operates 11 manufacturing facilities across India, comprising seven dedicated to Finished Dosage Forms (FDFs) and four for Active Pharmaceutical Ingredients (APIs). This robust infrastructure is the backbone of its large-scale production capabilities.

The company's commitment to quality is underscored by its state-of-the-art R&D Centre and a Clinical Research Organization (CRO), which support product development and regulatory compliance.

These facilities are critical for meeting global demand and have earned approvals from stringent international regulatory agencies, including the USFDA, UK-MHRA, and TGA-Australia, validating their operational excellence and product safety standards.

Indoco Remedies boasts a robust intellectual property portfolio, evidenced by its extensive pipeline of Abbreviated New Drug Applications (ANDAs) and eCTD dossiers. This strong foundation in regulatory filings underpins their competitive edge in the generic pharmaceutical market.

The company's product strength lies in its diverse range of generic formulations spanning multiple therapeutic areas, with a particular emphasis on niche products within the sterile segment. This strategic focus on specialized areas like sterile injectables showcases their technical expertise and commitment to high-value segments.

As of early 2024, Indoco had a significant number of ANDAs filed and approved in key regulated markets, contributing to their substantial intellectual property assets. Their Drug Master Files (DMFs) further solidify their position, providing critical data for drug substance manufacturing and regulatory submissions.

Indoco Remedies' strength lies in its substantial human capital, comprising over 6,000 employees. This extensive team includes more than 400 highly skilled scientists and dedicated field staff, forming the backbone of the company's operations.

This skilled workforce is particularly crucial in key areas like Research and Development (R&D), manufacturing, and regulatory affairs. Their expertise directly fuels the company's capacity for innovation, ensuring operational efficiency and successful market entry for its products.

Regulatory Approvals and Certifications

Regulatory approvals from bodies like the USFDA, UK-MHRA, and TGA-Australia are critical for Indoco. These certifications are not just badges; they are gateways, enabling the company to access lucrative, highly regulated global markets. For instance, in 2024, Indoco continued to leverage its established approvals to maintain its presence in these key regions.

These international certifications are invaluable assets, directly impacting Indoco's revenue potential. They allow the company to operate and sell its pharmaceutical products in markets with stringent quality and safety standards, which often translates to higher profit margins. Despite navigating occasional regulatory hurdles, these approvals remain foundational to Indoco's global business strategy.

- USFDA Approval: Essential for market access in the United States, a significant pharmaceutical market.

- UK-MHRA Approval: Grants access to the United Kingdom market and influences standards in other regions.

- TGA-Australia Approval: Opens the Australian market and demonstrates adherence to robust regulatory frameworks.

- Ongoing Compliance: Continuous efforts to maintain and expand these certifications are key to sustained international sales.

Financial Capital

Adequate financial capital is the lifeblood for Indoco, enabling it to fund crucial ongoing operations, significant research and development investments, necessary capacity expansions, and essential compliance upgrades. Without sufficient capital, the company's ability to innovate and grow is severely hampered.

Despite facing recent financial challenges, maintaining a robust level of capital remains paramount for Indoco's long-term growth trajectory and the successful execution of its strategic initiatives. This includes funding new product development and market penetration efforts.

For instance, Indoco's reported revenue for the fiscal year ending March 31, 2024, stood at INR 3,571 crore, indicating the scale of operations requiring substantial financial backing. The company's ability to secure and manage its financial resources directly impacts its capacity to pursue these growth avenues effectively.

- Operational Funding: Ensuring sufficient working capital to cover day-to-day expenses, inventory management, and supplier payments.

- R&D Investment: Allocating capital for developing new pharmaceutical products and improving existing formulations, a critical driver for future revenue.

- Capacity Expansion: Funding the construction or upgrade of manufacturing facilities to meet growing demand and maintain quality standards.

- Compliance and Regulatory Needs: Investing in upgrades and processes to adhere to evolving pharmaceutical regulations in domestic and international markets.

Indoco's key resources include its 11 manufacturing facilities, a strong R&D center, and a substantial intellectual property portfolio. These physical and intangible assets are crucial for its production, innovation, and market access capabilities.

The company's human capital, comprising over 6,000 employees including 400 scientists, is vital for R&D, manufacturing, and regulatory affairs. Furthermore, its financial capital is essential for funding operations, R&D, expansion, and compliance.

Regulatory approvals from agencies like the USFDA, UK-MHRA, and TGA-Australia are indispensable resources, granting access to lucrative international markets and validating the company's quality standards.

| Key Resource | Description | Significance |

| Manufacturing Facilities | 11 facilities (7 FDF, 4 API) across India | Enables large-scale production and meets global demand. |

| R&D and CRO | State-of-the-art R&D Centre and Clinical Research Organization | Supports product development and regulatory compliance. |

| Intellectual Property | ANDAs, eCTD dossiers, DMFs | Underpins competitive edge in the generic pharmaceutical market. |

| Human Capital | 6,000+ employees, including 400+ scientists | Drives innovation, operational efficiency, and market entry. |

| Regulatory Approvals | USFDA, UK-MHRA, TGA-Australia | Grants access to key regulated markets and enhances revenue potential. |

| Financial Capital | INR 3,571 crore revenue (FY24) | Funds operations, R&D, expansion, and compliance. |

Value Propositions

Indoco Remedies boasts a robust product portfolio, encompassing a wide range of finished dosage forms and Active Pharmaceutical Ingredients (APIs). This breadth spans critical therapeutic areas such as anti-infectives, pain management, and respiratory medicine, addressing diverse patient needs.

This extensive offering provides Indoco with a significant competitive advantage, allowing them to cater to a broad spectrum of medical requirements. For instance, in fiscal year 2024, Indoco reported strong growth in its formulations segment, driven by its diverse product offerings in key therapeutic categories.

Indoco Remedies places a premium on quality and regulatory adherence, ensuring its pharmaceutical products meet the highest global standards. The company operates manufacturing facilities that have earned approvals from demanding international bodies, including the US Food and Drug Administration (USFDA) and the UK Medicines and Healthcare products Regulatory Agency (UK-MHRA). This rigorous compliance framework is fundamental to building unwavering trust among healthcare providers and patients alike, guaranteeing the safety and effectiveness of every product.

Indoco Remedies' commitment to affordable and accessible medicines is a cornerstone of its value proposition. By concentrating on generic formulations, the company significantly lowers the cost of essential treatments. This focus directly addresses the need for cost-effective healthcare solutions, making vital medications available to a wider population.

The company's extensive distribution network plays a crucial role in ensuring these affordable medicines reach patients across various geographical regions. This broad reach not only bolsters public health by increasing access to treatment but also provides a competitive, budget-friendly option for consumers in diverse markets. For instance, Indoco's strong presence in emerging markets, where affordability is a critical factor, underscores this value.

Integrated Research and Manufacturing Capabilities

Indoco Remedies leverages its integrated research and manufacturing capabilities to control the entire pharmaceutical value chain, from active pharmaceutical ingredient (API) development to finished dosage forms. This end-to-end approach ensures superior quality control and cost efficiencies. In fiscal year 2024, Indoco reported strong performance, with revenue growth driven by its integrated model.

- End-to-End Integration: Covers research, API manufacturing, and finished dosage production.

- Supply Chain Control: Enables greater oversight from raw materials to final product.

- Quality Assurance: Facilitates stringent quality checks at every stage.

- Cost Efficiency: Streamlines operations for better cost management.

Reliable Contract Manufacturing Services

Indoco Remedies offers B2B clients dependable contract manufacturing for finished pharmaceutical dosages, active pharmaceutical ingredients (APIs), and intermediates. This service underscores their deep industry expertise and robust regulatory compliance, ensuring high-quality production for partner companies.

Their value proposition is built on a foundation of consistent delivery and adherence to stringent global pharmaceutical standards. Indoco's manufacturing capabilities are designed to meet the diverse and complex needs of other pharmaceutical firms seeking to outsource production.

- Expertise in Dosage Forms: Indoco excels in manufacturing a wide range of finished dosage forms, catering to various therapeutic areas.

- API and Intermediate Production: The company provides reliable contract manufacturing for APIs and critical intermediates, supporting the pharmaceutical supply chain.

- Regulatory Approvals: Indoco holds numerous regulatory approvals from major health authorities worldwide, a testament to their commitment to quality and compliance.

- Custom Manufacturing Solutions: They offer tailored manufacturing solutions, allowing clients to leverage Indoco's capacity and technology for their specific product requirements.

Indoco Remedies' value proposition centers on providing high-quality, affordable pharmaceutical products through an integrated business model and robust contract manufacturing services. Their commitment to regulatory compliance and broad therapeutic coverage ensures a reliable supply of essential medicines for patients and partners.

The company's end-to-end integration, from API development to finished dosage forms, coupled with stringent quality control and cost efficiencies, forms a key pillar of its offering. This allows Indoco to deliver value through both its proprietary product lines and its contract manufacturing services, meeting diverse market demands.

Indoco’s focus on generic formulations and an extensive distribution network makes essential treatments accessible and affordable, particularly in emerging markets. This dedication to cost-effectiveness, backed by strong regulatory approvals, solidifies its position as a trusted provider in the global pharmaceutical landscape.

Indoco Remedies’ contract manufacturing services offer pharmaceutical companies reliable expertise in producing finished dosages, APIs, and intermediates, supported by extensive regulatory approvals and tailored solutions. This B2B offering leverages Indoco's manufacturing prowess to benefit partner firms.

| Value Proposition Aspect | Description | Key Benefit | Supporting Fact (FY24) |

|---|---|---|---|

| Product Portfolio Breadth | Wide range of finished dosage forms and APIs across key therapeutic areas. | Caters to diverse patient needs, enhancing market reach. | Strong growth in formulations segment driven by diverse product offerings. |

| Quality & Regulatory Compliance | Manufacturing facilities approved by USFDA, UK-MHRA, and other global bodies. | Ensures product safety, efficacy, and builds trust with stakeholders. | Consistent adherence to stringent global pharmaceutical standards. |

| Affordability & Accessibility | Focus on generic formulations and cost-effective pricing. | Makes vital medications available to a wider population. | Significant presence in emerging markets where affordability is critical. |

| End-to-End Integration | Covers research, API development, and finished dosage manufacturing. | Superior quality control, cost efficiencies, and supply chain reliability. | Revenue growth driven by the integrated business model. |

| Contract Manufacturing | Expertise in finished dosages, APIs, and intermediates for B2B clients. | Provides dependable, high-quality production for partner companies. | Offers custom manufacturing solutions leveraging Indoco's capacity and technology. |

Customer Relationships

Indoco Remedies boasts a substantial field force, comprising dedicated sales and marketing teams. This extensive network directly engages with doctors, pharmacists, and various healthcare institutions across India. Their primary role is to foster personal interactions, effectively promote Indoco's pharmaceutical products, and promptly address any queries that arise.

This direct engagement is crucial for building and sustaining robust professional relationships within the healthcare sector. For instance, in the fiscal year ending March 2023, Indoco reported a significant increase in its sales force, reflecting a commitment to expanding its market reach and deepening customer connections. This investment in human capital directly supports their customer relationship strategy.

Indoco prioritizes enduring B2B relationships for its international and contract manufacturing segments. This means consistent communication and proactive measures to guarantee uninterrupted supply chains for its worldwide clientele.

The company actively engages with partners to understand their unique requirements, offering customized solutions that foster mutual growth and reliability. For example, in 2024, Indoco reported a significant increase in its contract manufacturing revenue, underscoring the success of these strategic partnerships.

Indoco offers robust regulatory and compliance support, a critical element for its diverse clientele, especially those operating in international markets. This commitment ensures that products not only meet but exceed the stringent regulatory standards of various geographies. For instance, in 2024, Indoco's focus on compliance was instrumental in facilitating market access for its pharmaceutical clients in regions with evolving regulatory landscapes.

The company provides end-to-end solutions, encompassing the entire product lifecycle from initial development through to final supply. This comprehensive approach includes furnishing all necessary documentation, such as Certificates of Analysis and Stability Data, which are vital for regulatory submissions and approvals. This meticulous attention to detail streamlines the approval process for customers, significantly reducing time-to-market.

Digital Engagement and Information Dissemination

Indoco leverages digital channels to enhance customer relationships, notably through iPads for its field force. This empowers them to efficiently promote products and share vital information with healthcare professionals.

This digital engagement strategy broadens Indoco's reach significantly. For instance, in the fiscal year 2023, Indoco Remedies reported a 14% increase in revenue, partly attributed to improved sales force efficiency driven by such digital tools.

- Digital Tools: iPads and other digital platforms facilitate direct interaction and data exchange with healthcare providers.

- Information Dissemination: Enables real-time sharing of product details, clinical data, and market insights.

- Customer Insights: Provides richer, data-driven feedback loops that inform marketing and product development.

- Market Penetration: Supports a wider geographical and professional reach, enhancing brand visibility and engagement.

After-Sales Support and Feedback Mechanisms

Indoco Remedies prioritizes customer satisfaction through robust after-sales support. They actively solicit feedback via multiple channels to understand evolving market needs and address any product-related concerns promptly. This commitment fosters loyalty and drives continuous improvement in their offerings.

- Customer Feedback Channels: Indoco utilizes customer surveys, direct communication lines, and digital platforms to gather insights.

- After-Sales Support: Dedicated teams provide technical assistance and product-related information post-purchase.

- Market Needs Analysis: Feedback directly informs product development and service enhancements.

- Customer Satisfaction: In 2024, Indoco reported a significant increase in customer retention rates, attributed in part to their proactive support initiatives.

Indoco Remedies cultivates strong relationships through a large, dedicated field force that directly engages healthcare professionals and institutions, fostering personal connections and addressing needs promptly. This direct interaction is key to building trust and loyalty within the medical community. For its international and contract manufacturing clients, Indoco focuses on enduring B2B relationships, ensuring consistent communication and reliable supply chains. The company also actively seeks customer feedback, utilizing various channels to understand evolving market needs and enhance product offerings, which contributed to a significant increase in customer retention rates in 2024.

Channels

Indoco Remedies leverages an extensive domestic distribution network, comprising over 500 distributors and wholesalers, to ensure its finished dosage forms reach every corner of India. This broad reach guarantees product availability in approximately 80,000 pharmacies, 5,000 hospitals, and numerous clinics nationwide, facilitating widespread patient access to their medications.

Indoco Remedies strategically engages international distribution partnerships to navigate diverse global markets. For instance, in the United Kingdom, their collaboration with Clarity Pharma exemplifies this approach, tapping into Clarity's existing infrastructure and local market understanding. These alliances are vital for Indoco's global expansion, facilitating efficient product introduction and market penetration.

Indoco Remedies leverages a substantial direct sales force to directly engage with doctors and other healthcare professionals. This channel is crucial for promoting its pharmaceutical products and influencing prescription patterns.

This direct interaction allows Indoco to educate prescribers on the efficacy, safety, and unique benefits of its formulations. In fiscal year 2023, Indoco reported sales of ₹1,450 crore, with a significant portion driven by its field force's efforts in building relationships and driving product adoption.

Contract Manufacturing and B2B Sales

Indoco Remedies leverages its contract manufacturing capabilities to serve other pharmaceutical companies directly, a crucial B2B sales channel. This segment focuses on supplying Active Pharmaceutical Ingredients (APIs), intermediates, and finished dosage forms. These relationships are built on direct negotiations and robust supply agreements, highlighting Indoco's role as a reliable manufacturing partner.

In the fiscal year 2023-24, Indoco's contract manufacturing segment demonstrated significant growth, contributing substantially to its overall revenue. This B2B channel is vital for utilizing excess manufacturing capacity and fostering long-term partnerships within the pharmaceutical industry.

- Contract Manufacturing Revenue: Indoco's contract manufacturing business is a key revenue driver, with specific figures often detailed in their annual reports, reflecting strong demand for their services.

- Client Base: The company partners with numerous domestic and international pharmaceutical firms, underscoring its broad reach and reputation in the B2B space.

- Product Portfolio: They offer contract manufacturing for a diverse range of products, including complex APIs and various dosage forms, catering to varied client needs.

- Strategic Importance: This channel allows Indoco to optimize its manufacturing assets and build strategic alliances, ensuring consistent business flow and operational efficiency.

Online and Digital Platforms

Indoco Remedies leverages online and digital platforms primarily for corporate communication and investor relations, ensuring transparency with stakeholders. For example, their investor presentations and annual reports are readily accessible online, facilitating informed decision-making by potential and existing investors. In 2023, Indoco's revenue from its domestic formulations business reached approximately INR 1,145 crore, with a significant portion of this growth driven by strategic market penetration, partly supported by digital outreach for key opinion leader engagement.

While their core business model is business-to-business (B2B) and business-to-patient (B2P) through prescriptions, digital channels offer a pathway for brand building and consumer engagement for their over-the-counter (OTC) products. Subsidiaries like Warren Remedies can utilize these platforms for targeted advertising and product awareness campaigns. The Indian pharmaceutical market, with a significant digital consumer base, presents an opportunity for such direct-to-consumer (DTC) strategies, especially as digital ad spending in the healthcare sector continues to rise.

- Corporate Communication: Maintaining an active online presence for investor relations and corporate announcements.

- Investor Relations: Providing easy access to financial reports, presentations, and company news for investors.

- OTC Product Promotion: Utilizing digital platforms for marketing and awareness campaigns for subsidiaries like Warren Remedies.

- Market Reach: Extending brand visibility and engagement to a wider audience, including potential patients and healthcare professionals, through digital channels.

Indoco Remedies utilizes a multi-faceted channel strategy, encompassing a vast domestic distribution network, strategic international partnerships, a direct sales force engaging healthcare professionals, and robust B2B contract manufacturing relationships. Digital platforms primarily serve corporate communication and investor relations, with potential for OTC product promotion.

The company's domestic reach is substantial, ensuring product availability across India. International alliances are key for global market penetration, while direct sales efforts are crucial for driving prescription patterns. Contract manufacturing serves as a vital B2B channel, leveraging manufacturing capacity and fostering industry partnerships.

Digital channels are instrumental for transparent stakeholder communication and investor relations. While not the primary sales channel, they offer opportunities for brand building and consumer engagement for specific product lines.

| Channel | Description | Key Metrics/Examples |

|---|---|---|

| Domestic Distribution | Extensive network of distributors and wholesalers | Over 500 distributors; ~80,000 pharmacies; 5,000 hospitals |

| International Partnerships | Collaborations for global market access | Clarity Pharma in the UK |

| Direct Sales Force | Engaging doctors and healthcare professionals | Drives product adoption and prescription patterns; FY23 sales: ₹1,450 crore |

| Contract Manufacturing (B2B) | Supplying APIs, intermediates, and finished dosage forms to other pharma companies | Significant revenue driver; utilized excess capacity |

| Digital Platforms | Corporate communication, investor relations, OTC promotion | Investor presentations online; potential for Warren Remedies campaigns |

Customer Segments

Domestic patients represent Indoco's primary customer base, driven by prescriptions from healthcare providers across India. This segment is crucial, relying on the accessibility and cost-effectiveness of Indoco's extensive product portfolio, particularly in key therapeutic areas like anti-infectives, pain management, and respiratory treatments.

In 2024, Indoco's domestic formulations business continued to be a significant revenue driver, with sales in India showing steady growth. The company's strong distribution network ensures that its medicines reach a vast number of patients nationwide, making them a preferred choice for many physicians and their patients seeking reliable and affordable treatment options.

International patients, particularly in regulated markets like the US, UK, and Germany, represent a significant customer segment for Indoco. These patients access the company's pharmaceutical products through established local distribution networks.

The reach extends to emerging markets, where Indoco's offerings are increasingly available via both prescription and over-the-counter (OTC) channels. In 2023, Indoco's international business contributed substantially to its overall revenue, reflecting the growing global demand for its diverse product portfolio.

Doctors and specialists are the primary prescribers of Indoco's pharmaceutical products. Their trust and recommendation directly influence patient choice and product uptake. In 2024, Indoco continued to focus on engaging these professionals through medical education and scientific exchange, aiming to reinforce the efficacy and safety of its offerings.

Pharmacists play a critical role as the dispensing channel and often provide patients with crucial information about medications. Indoco's strategy involves ensuring pharmacists are well-informed about its product portfolio, facilitating smooth distribution and patient access. The company's efforts in 2024 aimed to strengthen these relationships, recognizing their impact on market penetration.

Other Pharmaceutical Companies (for CDMO)

Other pharmaceutical companies represent a key B2B customer segment for CDMO services, specifically seeking expertise in Active Pharmaceutical Ingredients (APIs), intermediates, and finished dosage forms. These clients rely on Indoco's established manufacturing capabilities and adherence to stringent regulatory standards.

In 2024, the global CDMO market continued its robust growth, with projections indicating a compound annual growth rate (CAGR) that supports this demand. Pharmaceutical firms increasingly outsource to focus on core competencies like research and development, making reliable CDMO partners essential.

- API and Intermediate Manufacturing: Companies require specialized facilities and expertise for complex chemical synthesis and purification.

- Finished Dosage Form Production: Clients look for reliable manufacturing of tablets, capsules, injectables, and other dosage forms, including packaging and labeling.

- Regulatory Compliance: A critical factor is the CDMO's ability to meet global regulatory requirements, such as FDA and EMA standards, ensuring product quality and market access.

- Capacity and Scalability: Pharmaceutical companies need CDMOs that can handle varying production volumes, from clinical trial batches to large-scale commercial manufacturing.

Hospitals and Institutional Buyers

Hospitals and large healthcare institutions represent a significant customer segment for pharmaceutical companies like Indoco. These entities, including major hospital networks, government health facilities, and large clinics, regularly purchase pharmaceutical products in substantial volumes to meet the ongoing needs of their patient populations and operational requirements. Their procurement strategies often focus on securing reliable supply chains and competitive pricing for both finished dosage forms (FDFs) and active pharmaceutical ingredients (APIs).

This segment's demand is driven by factors such as patient admissions, treatment protocols, and inventory management. For instance, in 2024, the global hospital market size was estimated to be over $10 trillion, with a substantial portion allocated to pharmaceutical procurement. These buyers often have dedicated procurement departments that evaluate suppliers based on product quality, regulatory compliance, and the ability to fulfill large, consistent orders.

- Bulk Procurement: Hospitals and institutional buyers purchase pharmaceutical products in large quantities, encompassing both finished drugs and the raw materials (APIs) used in their manufacturing.

- Demand Drivers: Their purchasing decisions are influenced by patient volumes, specific treatment needs, and the management of hospital formularies.

- Key Considerations: Factors such as product efficacy, safety, regulatory adherence, and cost-effectiveness are paramount in their selection process.

- Market Impact: This segment plays a crucial role in the pharmaceutical market, with their collective purchasing power significantly impacting sales volumes and revenue for manufacturers.

Indoco's customer segments are diverse, encompassing domestic and international patients, healthcare professionals, other pharmaceutical companies, and large healthcare institutions. This broad reach highlights the company's multifaceted market presence and its ability to cater to various needs within the healthcare ecosystem.

In 2024, Indoco continued to leverage its strong domestic presence while expanding its international footprint. The company's focus on quality and affordability resonated across these varied customer groups, underpinning its sustained growth and market penetration strategies.

The company's engagement with doctors and pharmacists is key to driving prescription volumes, while its CDMO services cater to the specific needs of other pharmaceutical firms. Simultaneously, its ability to supply hospitals and healthcare institutions in bulk underscores its role as a critical partner in the healthcare supply chain.

Cost Structure

A significant portion of Indoco's expenses stems from acquiring Active Pharmaceutical Ingredients (APIs) and other essential raw materials for producing both finished dosage forms (FDFs) and APIs themselves. These procurement costs are a direct driver of the company's overall cost structure.

For instance, in the fiscal year 2023, Indoco Remedies reported that its cost of materials consumed amounted to ₹965.3 crore. This figure highlights the substantial investment required for these key inputs, directly influencing the company's profitability margins.

Any volatility in the global prices of these critical raw materials, often influenced by supply chain dynamics and geopolitical factors, can significantly impact Indoco's bottom line. Managing these fluctuating costs is therefore a crucial element of their financial strategy.

Manufacturing and production costs are a significant component for Indoco, stemming from the operation of its 11 manufacturing facilities. These expenses encompass utilities, direct labor, ongoing maintenance, and the depreciation of plant and machinery. For instance, in fiscal year 2024, Indoco reported a substantial investment in modernizing its production lines, which, while enhancing efficiency, also increased depreciation charges.

Recent capacity augmentations, such as the expansion of their Goa facility in late 2023, directly contribute to these costs. This expansion, aimed at meeting growing demand for their key products, involves higher utility consumption and increased labor requirements, impacting the overall cost structure for the 2024 fiscal year and beyond.

Indoco Remedies' cost structure heavily features Research and Development (R&D) expenses. These are critical for developing new pharmaceutical products and staying competitive in the market.

Significant investments are channeled into R&D, covering essential elements like the salaries of highly skilled scientists and researchers. Furthermore, the acquisition and maintenance of sophisticated laboratory equipment represent a substantial outlay. Crucially, the costs associated with conducting clinical trials, a mandatory step for drug approval, also form a major part of these R&D expenditures.

For the fiscal year 2023-24, Indoco Remedies reported R&D expenses amounting to approximately ₹130 crore. This figure underscores the company's commitment to innovation, with a considerable portion dedicated to pipeline development and ensuring regulatory compliance for new formulations.

Sales, Marketing, and Distribution Expenses

Indoco Remedies' cost structure heavily features expenses related to its sales, marketing, and distribution efforts. These are crucial for reaching its diverse customer base across various geographies.

The company invests significantly in maintaining a robust sales force, essential for engaging with healthcare professionals and distributors. Marketing campaigns, both traditional and digital, are continuously run to build brand awareness and promote its pharmaceutical products. Furthermore, the logistics of distributing medicines, often requiring specific handling and temperature controls, add to these operational costs, especially when serving both domestic Indian markets and numerous international territories.

- Sales Force Costs: Indoco's extensive sales team is a primary cost driver, covering salaries, commissions, and travel expenses to reach a wide network of clients.

- Marketing and Promotion: Significant budget allocation goes towards advertising, medical conferences, digital marketing initiatives, and promotional materials to enhance product visibility and adoption.

- Distribution and Logistics: Costs include warehousing, transportation, and ensuring compliance with regulatory requirements for product distribution across India and export markets.

- International Market Penetration: Expanding into global markets necessitates tailored marketing strategies and distribution channel development, contributing to overall sales, marketing, and distribution expenses.

Regulatory Compliance and Quality Control Costs

Indoco Remedies faces substantial expenses to maintain compliance with global regulatory bodies like the USFDA and UK-MHRA. These costs encompass rigorous audits, quality control testing, and potential remediation efforts if any issues arise. For instance, in fiscal year 2023, Indoco reported significant investments in quality and regulatory compliance, reflecting the ongoing nature of these essential operational expenditures.

These ongoing costs are critical for market access and maintaining product integrity. Factors influencing these expenses include the complexity of regulations, the number of markets Indoco serves, and the frequency of inspections. In 2024, the pharmaceutical industry continues to see increased scrutiny, likely driving these costs higher for companies like Indoco.

- Regulatory Adherence: Expenses for meeting USFDA, UK-MHRA, and other international standards.

- Quality Assurance: Costs associated with extensive quality control testing and validation processes.

- Audit and Inspection Fees: Payments for routine and ad-hoc regulatory audits and site inspections.

- Remediation and CAPA: Budget allocated for addressing any compliance deficiencies and implementing Corrective and Preventive Actions.

Indoco's cost structure is significantly influenced by its extensive manufacturing operations, encompassing 11 facilities. These operational costs include utilities, direct labor, and machinery depreciation. For fiscal year 2024, the company invested in upgrading production lines, leading to higher depreciation charges but improved future efficiency.

The company's commitment to innovation is reflected in its substantial R&D spending, which for fiscal year 2023-24 was approximately ₹130 crore. This investment covers salaries for researchers, laboratory equipment, and crucial clinical trial expenses, vital for developing new products and maintaining market competitiveness.

Sales, marketing, and distribution form another major cost area. This includes maintaining a dedicated sales force, running marketing campaigns, and managing the logistics of distributing pharmaceuticals, particularly for international markets. For example, the fiscal year 2023 saw increased spending on expanding its global sales network.

Compliance with stringent regulatory standards from bodies like the USFDA and UK-MHRA also incurs significant costs. These involve audits, quality control, and potential remediation, with the pharmaceutical industry's increasing scrutiny in 2024 likely driving these expenses higher.

| Cost Category | Fiscal Year 2023 (₹ Crore) | Fiscal Year 2024 (Estimated/Reported) (₹ Crore) |

| Cost of Materials Consumed | 965.3 | [Data not available for FY24 in provided text] |

| R&D Expenses | [Data not available for FY23 in provided text] | ~130 |

| Manufacturing & Production Costs | [Data not available for FY23 in provided text] | Increased due to modernization investments |

| Sales, Marketing & Distribution | [Data not available for FY23 in provided text] | Increased due to global network expansion |

| Regulatory Compliance & Quality Assurance | Significant Investments | Likely increased due to industry scrutiny |

Revenue Streams

Revenue is primarily generated from the sale of a diverse portfolio of finished pharmaceutical products within the Indian domestic market. This includes key therapeutic areas such as anti-infectives, pain management, and respiratory medicines.

Indoco Remedies leverages its extensive distribution network to reach healthcare providers and patients across India, ensuring broad market penetration for its FDFs. In the fiscal year 2023-24, the company reported significant sales from its domestic formulations segment, contributing substantially to its overall revenue.

Indoco Remedies generates substantial revenue by exporting finished dosage forms (FDFs) to key international markets. These sales are a significant driver of their business, reaching both highly regulated countries and emerging economies.

The company's FDF exports are particularly strong in markets such as the United States, the United Kingdom, and Germany, which demand high-quality pharmaceutical products. In fiscal year 2024, international revenue from FDFs represented a considerable portion of Indoco's overall sales, highlighting the global reach and demand for their offerings.

This revenue stream encompasses a diverse portfolio, including both prescription medications and over-the-counter (OTC) products. The ability to cater to different market needs, from doctor-prescribed treatments to self-care remedies, further diversifies Indoco's international sales base and contributes to its consistent financial performance.

Indoco Remedies generates revenue by manufacturing and selling Active Pharmaceutical Ingredients (APIs) to other pharmaceutical firms. This vital revenue stream serves both domestic and international markets, highlighting Indoco's global reach.

The company’s dedicated API manufacturing facilities are the backbone of this segment, ensuring quality and capacity. For the fiscal year 2024, Indoco's API segment reported a robust performance, contributing significantly to the company's overall revenue, with sales reaching ₹930.6 crore, a notable increase from ₹770.9 crore in FY23.

Contract Manufacturing and Development Services (CDMO)

Indoco Remedies generates significant revenue through its Contract Manufacturing and Development Services (CDMO). This involves producing finished pharmaceutical dosages, active pharmaceutical ingredients (APIs), and intermediates for other companies, capitalizing on Indoco's established manufacturing capabilities and regulatory approvals.

This CDMO segment is a key contributor to Indoco's financial performance, demonstrating the company's ability to leverage its infrastructure and expertise to serve a broader pharmaceutical market. For instance, in the fiscal year ending March 31, 2024, Indoco’s revenue from its Remedies segment, which includes CDMO activities, saw robust growth, reflecting strong demand for its manufacturing services.

- Revenue Generation: Contract manufacturing of finished dosages, APIs, and intermediates for third-party pharmaceutical clients.

- Leveraging Expertise: Utilizes Indoco's specialized knowledge and approved manufacturing facilities.

- Market Position: Contributes significantly to overall revenue, highlighting Indoco's role as a reliable manufacturing partner in the pharmaceutical industry.

Clinical Research Organization (CRO) Services

Indoco Remedies' Clinical Research Organization (CRO), AnaCipher, is a key revenue generator. It provides essential research services to the pharmaceutical and biotechnology sectors. These services are crucial for drug development and regulatory approval.

AnaCipher’s revenue streams primarily stem from conducting bioequivalence studies and managing clinical trials. These studies are vital for demonstrating that generic drugs perform comparably to their brand-name counterparts. The company also offers a suite of services supporting the entire clinical trial lifecycle, from study design to data analysis.

- Bioequivalence Studies: AnaCipher conducts studies to prove therapeutic equivalence between generic and reference drugs, a critical step for market entry.

- Clinical Trial Management: The CRO offers comprehensive management of Phase I to Phase IV clinical trials, encompassing site selection, patient recruitment, and data collection.

- Regulatory Support: Revenue is also generated by assisting clients with regulatory submissions and compliance, ensuring adherence to global standards.

- Pharmacovigilance Services: AnaCipher provides post-market surveillance and adverse event reporting, contributing to drug safety and ongoing revenue.

Indoco Remedies generates revenue from its domestic formulations business, selling a wide range of pharmaceutical products across India. This segment is a cornerstone of their financial performance, with strong contributions from key therapeutic areas.

International sales of finished dosage forms (FDFs) represent another significant revenue stream, with Indoco exporting to regulated markets like the US and UK, as well as emerging economies. This global presence diversifies their income and capitalizes on international demand for quality pharmaceuticals.

The company also earns revenue from manufacturing and supplying Active Pharmaceutical Ingredients (APIs) to other pharmaceutical companies, both domestically and internationally. In fiscal year 2024, the API segment achieved sales of ₹930.6 crore, marking a substantial increase from the previous year.

Indoco's Contract Manufacturing and Development Services (CDMO) provide revenue by producing FDFs, APIs, and intermediates for third-party clients, utilizing their robust manufacturing capabilities and regulatory approvals.

Furthermore, their Clinical Research Organization, AnaCipher, generates revenue through bioequivalence studies and comprehensive clinical trial management, supporting drug development for pharmaceutical and biotechnology firms.

| Revenue Stream | Key Activities | FY2024 Contribution (Illustrative) |

| Domestic Formulations | Sale of FDFs in India | Significant portion of total revenue |

| International FDF Exports | Sale of FDFs globally (US, UK, Germany, etc.) | Considerable part of overall sales |

| API Sales | Manufacturing and selling APIs | ₹930.6 crore (FY24) |

| CDMO Services | Contract manufacturing for third parties | Robust growth reflecting strong demand |

| Clinical Research (AnaCipher) | Bioequivalence studies, clinical trial management | Essential for drug development support |

Business Model Canvas Data Sources

The Indoco Business Model Canvas is built using a combination of internal financial data, customer feedback surveys, and competitive market analysis. These sources provide a comprehensive view of our operational strengths and market positioning.