Indoco PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indoco Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Indoco's trajectory. Our expertly crafted PESTLE analysis provides the essential external intelligence you need to anticipate challenges and seize opportunities. Download the full version now to gain a strategic advantage and make informed decisions.

Political factors

The Indian government's commitment to bolstering the pharmaceutical sector is evident through schemes like the Production Linked Incentive (PLI) programs. These initiatives, focusing on Active Pharmaceutical Ingredients (APIs), Key Starting Materials (KSMs), and bulk drugs, are designed to significantly decrease reliance on imports and foster domestic manufacturing capabilities. This strategic push directly benefits companies like Indoco Remedies by creating a more supportive ecosystem for their operations and growth.

The 'Make in India' and 'Discover in India for the world' campaigns underscore the government's ambition to position India as a global powerhouse in pharmaceutical innovation and manufacturing. These policies are crucial for companies like Indoco, encouraging investment in research and development and enhancing their competitive edge on the international stage. For instance, the PLI scheme for bulk drugs has seen substantial uptake, with many companies, including those in Indoco's supply chain, expanding their API production capacity.

The National Pharmaceutical Pricing Authority (NPPA) plays a significant role in managing drug prices in India, impacting companies like Indoco. Through the Drug Price Control Order (DPCO), the NPPA sets price ceilings for essential medicines, aiming to make them affordable. This regulation directly affects the revenue potential of pharmaceutical firms, as seen in the ongoing adjustments to the prices of various scheduled drugs.

While price controls are designed for public good, they can influence company strategies. For instance, if profit margins on regulated drugs shrink, manufacturers might divert resources towards less regulated or premium product segments. This dynamic can lead to shifts in product portfolios and marketing focus within the industry.

The government's approach to drug pricing is not static; it can adjust prices for essential medicines based on factors like public interest and rising input costs. For example, recent government decisions have seen price increases for certain essential drugs, reflecting the evolving economic and policy environment that pharmaceutical companies must navigate.

India's pharmaceutical industry is navigating a dynamic regulatory landscape, with the Uniform Code of Pharmaceutical Marketing Practices (UCPMP) 2024 aiming to bolster integrity and transparency in marketing activities. This evolving framework requires companies like Indoco to stay agile.

Further significant shifts are anticipated with amendments to the New Drugs and Clinical Trials Rules, effective April 1, 2025. These updates include crucial provisions for the registration of Clinical Research Organizations (CROs), impacting the clinical trial ecosystem.

These regulatory adjustments demand continuous adaptation and strategic investment in compliance measures from pharmaceutical firms. For Indoco, staying ahead of these changes is paramount to maintaining operational efficiency and market standing.

International Trade Agreements and Harmonization

India's commitment to aligning its pharmaceutical regulations with international standards, such as those set by the USFDA, EMA, and WHO-GMP, is a significant political factor boosting exports and global confidence in Indian drug manufacturing. This harmonization facilitates smoother market access for companies like Indoco Remedies.

Trade agreements are actively shaping India's pharmaceutical landscape. For instance, the recent Trade and Economic Partnership Agreement (TEPA) with EFTA states, which includes Switzerland, Norway, Iceland, and Liechtenstein, is designed to reduce trade barriers and promote economic cooperation. This agreement is expected to enhance market access for Indian pharmaceutical products, potentially benefiting Indoco Remedies' export ambitions.

- Regulatory Alignment: India's adoption of international pharmaceutical standards is crucial for expanding market reach.

- Trade Facilitation: Agreements like TEPA with EFTA states aim to lower tariffs and streamline trade processes for pharmaceuticals.

- Global Competitiveness: These political moves are fostering a more globally competitive environment for Indian pharmaceutical companies.

- Export Growth: Harmonization and trade pacts directly support the growth of exports for firms like Indoco Remedies.

Political Stability and Healthcare Focus

Political stability is a cornerstone for the pharmaceutical sector's expansion. A consistent government focus on bolstering healthcare infrastructure and public health programs directly fuels demand for medicines and medical supplies. For instance, India's Ayushman Bharat scheme, launched in 2018, has been instrumental in expanding healthcare access, with over 500 million people covered as of early 2024, significantly boosting drug consumption, especially in underserved regions.

The government's commitment to healthcare resilience and achieving self-reliance in pharmaceutical manufacturing, particularly highlighted during global supply chain disruptions in 2020-2023, creates a favorable political climate. Initiatives like the Production Linked Incentive (PLI) scheme for pharmaceuticals, with an outlay of INR 15,000 crore (approximately USD 1.8 billion) until 2025-26, are designed to encourage domestic production of key starting materials and active pharmaceutical ingredients, thereby supporting companies like Indoco.

- Ayushman Bharat Coverage: Over 500 million individuals enrolled by early 2024, increasing healthcare service utilization and drug demand.

- PLI Scheme for Pharma: INR 15,000 crore allocated to boost domestic manufacturing of critical pharmaceutical components.

- Government Support: Policies promoting healthcare access and domestic production foster a stable environment for pharmaceutical growth.

Government initiatives like the Production Linked Incentive (PLI) schemes are actively shaping the pharmaceutical landscape, aiming to boost domestic manufacturing and reduce import reliance. The 'Make in India' and 'Discover in India' campaigns further signal a strong political will to elevate India's position in global pharmaceutical innovation and production, directly benefiting companies like Indoco.

The National Pharmaceutical Pricing Authority (NPPA) continues to influence pricing strategies through regulations like the Drug Price Control Order (DPCO), impacting revenue streams for firms. However, recent adjustments have seen price increases for certain essential medicines, reflecting an evolving policy approach to balance affordability with industry viability.

Regulatory alignment with international standards, such as those of the USFDA and EMA, is a key political driver, enhancing market access for Indian pharmaceutical exports. Furthermore, trade agreements, like the recent TEPA with EFTA states, are designed to reduce trade barriers, fostering a more competitive and globally integrated environment for companies such as Indoco Remedies.

What is included in the product

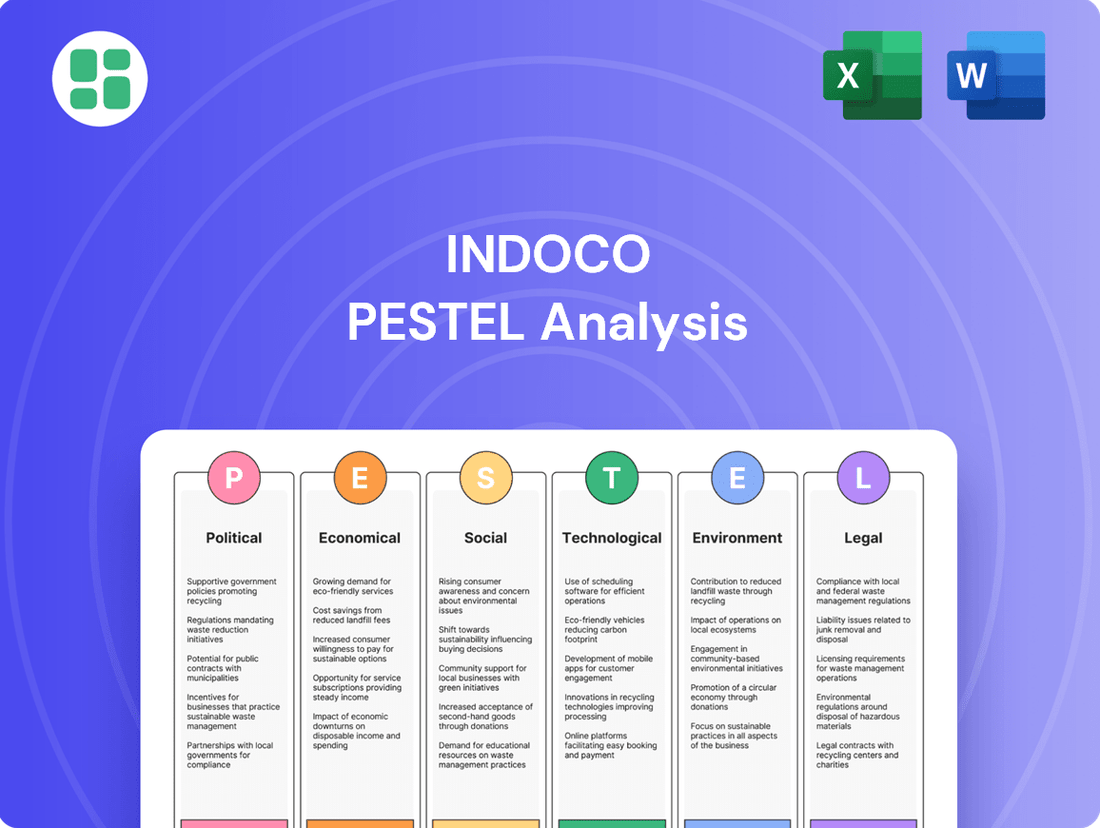

This Indoco PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

It provides a comprehensive understanding of the external landscape, highlighting key opportunities and potential challenges for Indoco.

Provides a clear, actionable framework that helps Indoco identify and mitigate external threats, transforming potential market challenges into strategic opportunities.

Economic factors

India's strong economic expansion, with a projected GDP growth rate of around 6.5% for fiscal year 2024-25, directly fuels increased healthcare spending. This surge in consumer spending power, coupled with a burgeoning middle class, is a significant catalyst for the domestic pharmaceutical market.

The Indian pharmaceutical sector is on a strong growth trajectory, with projections indicating it could reach USD 120-130 billion by 2030. This expansion is further bolstered by government initiatives aimed at improving healthcare access and affordability across the nation, creating a fertile ground for companies like Indoco to enhance their market presence and sales within India.

For Indoco Remedies, a company with significant international operations, fluctuations in currency exchange rates directly affect its export revenues and overall profitability. When the Indian Rupee weakens against major currencies like the US Dollar or Euro, Indoco's export earnings translate into more Rupees, boosting its top line and potentially its margins.

India's pharmaceutical export sector has demonstrated robust growth, evolving from a net importer to a prominent net exporter of bulk drugs. This strong export performance is vital for Indoco, as it contributes to revenue diversification and solidifies its presence in global markets, making it less reliant on domestic sales alone.

In 2023, India's pharmaceutical exports reached approximately $25.3 billion, marking a substantial contribution to the country's trade balance. A favorable exchange rate environment, therefore, directly enhances the competitiveness of Indian pharmaceutical products like those from Indoco on the international stage.

Inflationary pressures are a significant concern for Indoco Remedies, directly impacting manufacturing costs. The rising prices of raw materials, especially Active Pharmaceutical Ingredients (APIs) and Key Starting Materials (KSMs), squeeze profit margins. For instance, global API prices saw an average increase of 5-10% in 2023 due to supply chain disruptions and increased energy costs, directly affecting companies like Indoco.

While Production Linked Incentive (PLI) schemes are in place to boost domestic manufacturing of critical pharmaceutical components and reduce import reliance, their full impact on mitigating input cost volatility is still unfolding. These schemes aim to create a more stable cost environment for essential inputs, potentially offering some relief to companies like Indoco in the medium to long term.

However, Indoco's ability to pass these increased costs onto consumers is limited. Government price controls on essential medicines, a common practice in India, cap the maximum retail price. This means that even if input costs rise substantially, the company cannot freely adjust selling prices, thereby directly impacting its profitability and financial performance.

Investment and R&D Expenditure

The pharmaceutical industry globally, including India, is experiencing a significant uptick in investment, driven by both foreign direct investment and robust government backing for research and development. This focus is essential for fostering innovation and ensuring long-term competitiveness in a rapidly evolving market. For instance, India's pharmaceutical sector attracted approximately $2.6 billion in FDI between April 2020 and March 2023, highlighting the growing investor confidence.

Companies are strategically channeling their resources into high-value segments such as biosimilars and specialty drugs. These areas demand considerable R&D expenditure due to their complexity and the rigorous clinical trials involved. The global biosimilars market alone was valued at over $20 billion in 2023 and is projected to grow substantially.

Indoco Remedies's commitment to sustained investment in R&D and the modernization of its manufacturing facilities is paramount for its future growth trajectory and ability to capture greater market share. In FY23, Indoco reported an R&D spend of ₹135.5 crore, underscoring its dedication to innovation. This strategic allocation of capital is crucial for developing new products and enhancing existing ones to meet global standards and market demands.

- Increased FDI: India's pharmaceutical sector saw around $2.6 billion in FDI from April 2020 to March 2023.

- R&D Focus: Companies are prioritizing high-value segments like biosimilars and specialty drugs, requiring significant R&D investment.

- Market Growth: The global biosimilars market exceeded $20 billion in 2023, indicating strong growth potential.

- Indoco's Investment: Indoco Remedies spent ₹135.5 crore on R&D in FY23, signaling a commitment to innovation and facility upgrades.

Global Market Demand and Competition

The global demand for cost-effective generic medicines and vaccines, with India as a key producer, offers substantial economic avenues. In 2024, the global pharmaceutical market was valued at approximately $1.6 trillion, with generics comprising a significant portion.

However, Indoco Remedies faces fierce competition in both Indian and international arenas, especially within the generics sector. This intense rivalry often leads to price erosion, impacting profit margins and market share. For instance, the Indian generics market alone is projected to reach $20 billion by 2025.

To thrive, Indoco must prioritize cost efficiency and strategically grow its presence in higher-value therapeutic areas. This dual approach is crucial for sustaining global competitiveness.

- Global Generics Market Growth: The global generics market is expected to grow at a CAGR of around 7-8% through 2025, driven by patent expirations and healthcare cost containment efforts.

- Indian Pharmaceutical Exports: India's pharmaceutical exports, predominantly generics, reached over $25 billion in the fiscal year 2023-24, highlighting its global role.

- Competitive Landscape: The top 10 generic drug manufacturers globally hold a substantial market share, indicating the high level of competition Indoco navigates.

India's economic growth, projected at 6.5% for FY2024-25, fuels healthcare spending and benefits the domestic pharmaceutical market, which is expected to reach $120-130 billion by 2030. Indoco's export revenue is positively impacted by a weaker Rupee, as seen in India's $25.3 billion pharmaceutical exports in 2023. However, inflation drives up manufacturing costs for raw materials like APIs, with global prices rising 5-10% in 2023, squeezing margins due to government price controls on essential medicines.

| Economic Factor | Impact on Indoco | Supporting Data (2023-2025) |

| GDP Growth | Increased healthcare spending, market expansion | Projected 6.5% for FY2024-25 |

| Currency Fluctuations | Boosts export revenue with weaker Rupee | India's pharma exports reached $25.3 billion in 2023 |

| Inflation | Increases manufacturing costs (APIs, KSMs) | Global API prices up 5-10% in 2023 |

| Price Controls | Limits ability to pass on cost increases | Common for essential medicines in India |

| Foreign Direct Investment (FDI) | Supports R&D and sector growth | $2.6 billion FDI in pharma (Apr 2020 - Mar 2023) |

Full Version Awaits

Indoco PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Indoco PESTLE Analysis provides a comprehensive overview of the external factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental influences on Indoco.

The content and structure shown in the preview is the same document you’ll download after payment. This analysis is designed to offer actionable insights for strategic planning and risk assessment.

Sociological factors

India's population is aging rapidly, with the proportion of citizens over 60 projected to reach 20.7% by 2050, up from 10.1% in 2022. This demographic shift, coupled with a rising incidence of non-communicable diseases (NCDs) such as diabetes and cardiovascular ailments, is significantly boosting the demand for pharmaceutical products. For instance, the prevalence of diabetes in India was estimated at 10.1% in 2023, affecting over 100 million people.

This sustained demand for therapeutic solutions, particularly for chronic conditions, presents a significant opportunity for pharmaceutical companies with diversified product portfolios. Indoco Remedies, with its strong presence in pain management, anti-infectives, and respiratory segments, is well-positioned to cater to these evolving healthcare needs. The company’s product mix directly addresses key areas of concern within India’s growing burden of chronic diseases.

Growing health consciousness in India is a significant sociological driver. This is evident in the increasing expenditure on wellness and preventive healthcare. For instance, the Indian wellness market was valued at approximately $27 billion in 2023 and is projected to grow substantially, driven by consumer demand for healthier lifestyles and early disease management.

This shift means consumers are actively seeking out products and services that promote well-being, from organic foods to fitness programs and advanced diagnostic tools. Pharmaceutical companies like Indoco Remedies are responding by expanding their portfolios to include more preventive and diagnostic solutions, aligning with this proactive consumer approach to health.

Government initiatives like the Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP) are significantly boosting drug consumption across India. This program aims to make quality medicines available at affordable prices, thereby expanding the overall pharmaceutical market. For companies like Indoco Remedies, this trend underscores the importance of developing cost-effective products to tap into this growing segment of the population.

The focus on affordability presents a strategic challenge for pharmaceutical firms. Indoco Remedies must carefully balance its pricing strategies to remain competitive while ensuring profitability. As of 2024, the Indian government continues to emphasize universal healthcare access, which directly influences demand for a wider range of affordable medications, impacting market dynamics for all players.

Urbanization and Rural Healthcare Needs

India's rapid urbanization, with an estimated 35% of its population residing in urban areas as of 2023, is significantly reshaping healthcare demands. This trend fuels a greater need for specialized medical services and advanced pharmaceutical products in metropolitan hubs. Simultaneously, it underscores the critical requirement to enhance healthcare accessibility and infrastructure in rural and semi-urban regions, which often lag behind in quality and availability of services.

Tier II and Tier III cities are projected to be key drivers of domestic pharmaceutical sales growth, with some analysts predicting their contribution to reach over 50% by 2025. This presents a substantial opportunity for pharmaceutical companies. To capitalize on this, companies like Indoco must develop nuanced distribution and marketing strategies. These strategies need to effectively address the distinct needs and purchasing power of both the burgeoning urban consumer base and the often underserved rural populations.

- Urban Demand: Increased concentration of population in cities drives demand for specialized treatments and branded generics.

- Rural Opportunity: Tier II and Tier III cities are crucial for future pharma sales growth, requiring targeted market penetration.

- Distribution Strategy: Companies must adapt their supply chains and marketing efforts to reach diverse geographic and socio-economic segments.

- Healthcare Access: Urbanization highlights disparities, necessitating a focus on improving rural healthcare infrastructure and affordability.

Changing Consumer Preferences and Digital Health Adoption

Consumer preferences are shifting significantly towards digital health solutions. By 2024, it's estimated that over 70% of healthcare providers will be using telehealth services, a trend that directly impacts pharmaceutical access and marketing strategies. This digital shift includes a rise in the use of wearable health trackers and online pharmacies, fundamentally altering how patients interact with healthcare and medication.

There's a pronounced move towards personalized medicine, driven by a growing demand for patient-centric healthcare models. This means consumers are seeking treatments tailored to their individual genetic makeup and lifestyle, pushing pharmaceutical companies to innovate beyond one-size-fits-all approaches. For instance, advancements in pharmacogenomics are enabling more targeted drug development and prescription.

Companies that effectively integrate digital tools and prioritize patient engagement are poised for greater success. This includes leveraging data from wearables for better treatment adherence and using online platforms for direct patient communication and support. By 2025, the digital health market is projected to reach over $600 billion globally, underscoring the competitive advantage for digitally adept pharmaceutical firms.

- Digital Health Adoption: Over 70% of healthcare providers expected to utilize telehealth by 2024.

- Personalized Medicine: Growing consumer demand for treatments tailored to individual genetic and lifestyle factors.

- Competitive Edge: Companies integrating digital tools and focusing on patient engagement gain significant market advantage.

- Market Growth: The global digital health market is forecasted to exceed $600 billion by 2025.

India's aging population, with over 10% already above 60 in 2022 and projected to reach over 20% by 2050, directly fuels demand for pharmaceuticals, especially for age-related and chronic conditions like diabetes, which affects over 100 million people as of 2023. This demographic shift, combined with increasing health consciousness leading to a $27 billion wellness market in 2023, creates a strong market for companies like Indoco Remedies that offer solutions for these prevalent health concerns.

The government's push for affordable medicines through initiatives like PMBJP is expanding drug consumption, making cost-effectiveness a key strategic factor for pharmaceutical firms. Urbanization, with 35% of the population in cities by 2023, drives demand for specialized treatments, while Tier II and III cities are becoming growth engines, expected to contribute over 50% of domestic pharma sales by 2025, necessitating tailored distribution strategies.

Digital health is transforming patient interaction, with over 70% of providers expected to use telehealth by 2024, impacting medication access and marketing. Furthermore, a growing demand for personalized medicine, driven by advancements in pharmacogenomics, is pushing companies towards tailored treatments, with the global digital health market projected to exceed $600 billion by 2025.

Technological factors

Technological leaps, particularly in Artificial Intelligence (AI) and Machine Learning (ML), are dramatically reshaping drug discovery. These tools can sift through vast biological and chemical datasets, identifying promising new drug candidates at an unprecedented pace. For instance, by mid-2024, AI platforms have been instrumental in identifying potential therapeutic targets for diseases like Alzheimer's, a process that traditionally took years.

This acceleration directly translates to reduced research and development timelines and costs. Companies leveraging AI in their drug development processes can see a significant decrease in the time it takes to bring a new medicine from the lab to the market. Some estimates suggest AI can cut early-stage drug discovery timelines by up to 25%, potentially saving billions in R&D expenditure annually.

Indoco Remedies has a clear opportunity to harness these advancements. By integrating AI and ML into its research and development efforts, the company can boost the efficiency of its R&D processes, identify novel compounds more effectively, and ultimately strengthen its product pipeline for future growth.

The Indian pharmaceutical sector is heavily investing in modernizing its manufacturing. This includes embracing automation, adopting continuous manufacturing techniques, and enhancing quality control systems. For example, in 2023, the Indian pharmaceutical industry saw significant investments in upgrading facilities to meet global standards, with many companies allocating substantial capital for technological advancements.

The implementation of Revised Schedule M is a key driver, mandating stricter adherence to Good Manufacturing Practices (GMP) and robust quality assurance. This regulatory push is compelling manufacturers to upgrade their infrastructure and processes, ensuring higher product integrity and compliance. By 2024, a significant portion of Indian pharma facilities are expected to have undergone these upgrades to align with the revised guidelines.

These technological shifts are crucial for boosting product quality and operational efficiency. Companies adopting these advanced methods are better positioned to meet international regulatory requirements, thereby expanding their export potential. This modernization is not just about compliance; it's about building a more competitive and reliable pharmaceutical manufacturing base for India on the global stage.

Digital transformation is significantly boosting supply chain efficiency for companies like Indoco. By leveraging smart sensors, automated systems, and advanced data analytics, businesses can better manage inventory and ensure regulatory compliance. For instance, in 2024, the global supply chain management market was valued at over $25 billion and is projected to grow substantially, indicating a strong trend towards digital integration.

Blockchain technology offers promising avenues for enhanced transparency, data security, and traceability, particularly relevant for industries like pharmaceuticals. Companies are exploring its use in clinical trials and supply chains to build trust and streamline processes. This technology is seen as a key enabler for overcoming challenges in complex, international operations, ensuring product integrity from origin to consumer.

Optimizing the supply chain is paramount for companies with global footprints, directly impacting timely delivery and cost management. In 2025, the pharmaceutical supply chain faces increasing complexity due to global health demands and stringent quality controls. Indoco, with its international presence, must continually refine its logistics and operational strategies to maintain competitiveness and meet customer expectations in this dynamic environment.

Biotechnology and Biosimilars Development

India's biotechnology sector is experiencing robust growth, particularly in the development of biosimilars and advanced therapies such as cell and gene treatments. This expansion is fueled by increasing R&D investments and government support, positioning India as a key player in the global biopharmaceutical landscape.

The impending patent expiries of several blockbuster biologic drugs worldwide create a substantial opening for Indian pharmaceutical companies. This trend is expected to drive significant demand for biosimilar alternatives, a segment where Indian manufacturers have demonstrated increasing capability and cost-effectiveness. For instance, the global biosimilars market was valued at approximately $20.4 billion in 2023 and is projected to reach $82.5 billion by 2030, growing at a CAGR of 21.7% during this period.

Indoco Remedies could strategically leverage these technological advancements and market dynamics. By venturing into high-value segments like biosimilars and novel biologics, the company can effectively diversify its existing product offerings. This diversification not only strengthens its market position but also opens avenues for capturing new revenue streams and expanding its global footprint in lucrative therapeutic areas.

- Biosimilar Market Growth: The global biosimilar market is projected to surge, offering significant revenue potential for Indian firms.

- Patent Expiries: Key biologic patents expiring between 2024 and 2026 are creating a fertile ground for biosimilar development.

- Advanced Therapies: Investments in cell and gene therapies represent a future growth frontier for companies like Indoco.

- Portfolio Diversification: Entering these advanced segments allows Indoco to move up the value chain and reduce reliance on traditional generics.

Data Analytics and Cybersecurity

The pharmaceutical industry's increasing reliance on digital tools and data analytics, particularly in areas like drug discovery and clinical trials, underscores the critical need for advanced data management. For instance, by 2025, the healthcare data market is projected to reach over $67 billion, highlighting the sheer volume of information being generated and analyzed.

This digital transformation makes robust cybersecurity measures indispensable. Protecting sensitive patient data, proprietary research, and operational integrity from cyber threats is a non-negotiable priority. Reports indicate that the healthcare sector remains a prime target for cyberattacks, with the average cost of a data breach in healthcare exceeding $10 million in 2024.

Consequently, investing in secure IT infrastructure and sophisticated data management systems is paramount for maintaining trust and operational continuity. Companies like Indoco Remedies must prioritize these investments to safeguard their intellectual property and ensure compliance with evolving data privacy regulations, such as GDPR and its global equivalents.

Key considerations include:

- Enhanced Data Analytics Capabilities: Leveraging AI and machine learning for predictive analytics in R&D and supply chain optimization.

- Advanced Cybersecurity Protocols: Implementing multi-factor authentication, encryption, and regular vulnerability assessments.

- Data Governance and Compliance: Ensuring adherence to global data protection laws and maintaining audit trails.

- Secure Cloud Infrastructure: Migrating sensitive data to secure, compliant cloud environments for scalability and resilience.

Technological advancements, especially in AI and ML, are revolutionizing drug discovery, speeding up identification of potential drug candidates. By mid-2024, AI platforms were instrumental in finding Alzheimer's drug targets, a process that previously took years. This acceleration significantly reduces R&D timelines and costs, with AI potentially cutting early-stage drug discovery by up to 25%, saving billions annually.

Indoco can leverage these AI/ML tools to enhance R&D efficiency and identify novel compounds, strengthening its future product pipeline. The Indian pharmaceutical sector is investing heavily in automation and continuous manufacturing, driven by Revised Schedule M's stricter GMP requirements. By 2024, many facilities are upgrading to meet these global standards, improving product quality and export potential.

Digital transformation is boosting supply chain efficiency through smart sensors and data analytics, with the global supply chain management market exceeding $25 billion in 2024. Blockchain technology is also being explored for enhanced transparency and security in clinical trials and supply chains. Optimizing these complex global supply chains is crucial for timely delivery and cost management in 2025.

India's biotechnology sector is growing rapidly, particularly in biosimilars and advanced therapies, supported by R&D investments and government initiatives. With major biologic drug patents expiring between 2024 and 2026, there's a substantial market opening for biosimilars. The global biosimilars market was valued at $20.4 billion in 2023 and is expected to reach $82.5 billion by 2030.

| Technological Factor | Impact on Indoco | Data/Fact (2024-2025) |

| AI & ML in Drug Discovery | Accelerated R&D, cost reduction | AI can cut early-stage drug discovery by 25%; AI identified Alzheimer's targets by mid-2024. |

| Manufacturing Automation & Upgrades | Improved quality, efficiency, global compliance | Indian pharma investing in automation; Revised Schedule M compliance driving upgrades by 2024. |

| Digital Supply Chain Management | Enhanced efficiency, transparency, compliance | Global SCM market >$25 billion in 2024; Blockchain for supply chain integrity. |

| Biotechnology & Biosimilars | New market opportunities, revenue growth | Global biosimilars market $20.4 billion (2023); Patent expiries (2024-2026) create demand. |

Legal factors

The Central Drugs Standard Control Organization (CDSCO) in India, responsible for drug approval, has seen updates with the New Drugs and Clinical Trials Rules, 2024. These changes aim to simplify clinical trial regulations and the registration of Contract Research Organizations (CROs). For Indoco Remedies, adhering to these evolving, strict rules is critical for successfully launching new products and maintaining its presence in the market.

Navigating these regulatory landscapes is paramount. Indoco Remedies must consistently demonstrate that its pharmaceutical products meet the rigorous safety, effectiveness, and quality benchmarks set by both Indian regulatory bodies like the CDSCO and international health authorities. This commitment to compliance underpins market access and consumer trust.

Intellectual Property Rights, especially patents, are vital for safeguarding novel drug formulas and manufacturing methods, thereby encouraging research and development spending in pharmaceuticals. India's Patent Rules 2024 amendments are designed to speed up patent applications and examinations, bringing the country's IP framework closer to international standards.

Robust IP protection fosters innovation, but it can also contribute to increased pharmaceutical prices. For instance, the average patent pendency in India was around 24 months as of early 2024, a figure the new rules aim to shorten.

The Drug Price Control Order (DPCO) 2013 in India, administered by the National Pharmaceutical Pricing Authority (NPPA), directly influences Indoco Remedies by setting ceiling prices for a list of essential medicines. This framework, designed to ensure affordability, can exert downward pressure on profit margins for Indoco's products falling under its purview.

For instance, in 2023, the NPPA revised ceiling prices for several scheduled formulations, impacting companies like Indoco. Navigating these price controls requires strategic portfolio management to maintain profitability while adhering to government mandates, a key consideration for Indoco's financial planning.

Marketing and Promotion Regulations

The Uniform Code of Pharmaceutical Marketing Practices (UCPMP) 2024 has established stricter guidelines for ethical marketing within the pharmaceutical sector. This code specifically targets the promotion of drugs, aiming to prevent inducements that could influence prescribing habits. Indoco Remedies, like all pharmaceutical companies, must navigate these regulations to ensure their promotional activities are compliant and uphold professional integrity.

Key provisions of the UCPMP 2024 include a ban on offering gifts or any form of pecuniary advantage to healthcare professionals. Furthermore, the code emphasizes the importance of transparency in all marketing communications. Failure to adhere to these mandates can result in significant penalties, including fines and reputational damage, impacting Indoco's market standing and operational continuity.

- UCPMP 2024 Enforcement: Regulatory bodies are increasing scrutiny on pharmaceutical marketing, with potential penalties for non-compliance ranging from warnings to substantial financial sanctions.

- Transparency Mandates: Indoco must ensure all promotional materials clearly disclose relevant information, avoiding misleading claims or selective data presentation.

- Ethical Marketing Investment: Companies are investing in training and compliance programs to align marketing strategies with the UCPMP 2024, recognizing the long-term benefits of an ethical approach.

- Reputational Risk: Breaches in marketing regulations can severely damage a company's reputation, affecting trust among healthcare providers and patients.

Environmental and Manufacturing Compliance

Pharmaceutical manufacturing operates under stringent environmental laws and Good Manufacturing Practices (GMP). These regulations are critical for ensuring product quality and patient safety. For instance, India's revised Schedule M of the Drugs and Cosmetics Rules 1945 mandates enhanced standards for premises, plant, and equipment, reflecting a global push for higher manufacturing integrity.

Compliance extends to rigorous environmental management, including the legal obligation for proper waste disposal and pollution control. Failure to adhere to these manufacturing and environmental standards can result in significant penalties and operational disruptions, impacting a company's ability to produce and market its products. As of early 2024, regulatory bodies continue to increase scrutiny on these aspects.

- Environmental Regulations: Pharmaceutical companies must comply with national and international environmental protection laws.

- Good Manufacturing Practices (GMP): Adherence to GMP is a legal requirement for all drug manufacturers.

- Schedule M (India): Revised Schedule M sets updated benchmarks for manufacturing facilities, emphasizing quality and safety.

- Waste Management & Pollution Control: Legal mandates cover the responsible handling of pharmaceutical waste and emissions.

Legal frameworks significantly shape Indoco Remedies' operations, from drug approvals to marketing practices. The New Drugs and Clinical Trials Rules, 2024, alongside updated IP regulations, necessitate strict adherence to ensure market access and foster innovation. Price controls, like the DPCO, directly impact profitability, requiring strategic management of Indoco's product portfolio to balance affordability mandates with financial viability.

The Uniform Code of Pharmaceutical Marketing Practices (UCPMP) 2024 imposes stricter ethical guidelines, banning gifts to healthcare professionals and demanding transparency in promotions. Non-compliance risks substantial penalties and reputational damage. Furthermore, stringent environmental laws and Good Manufacturing Practices (GMP), exemplified by India's revised Schedule M, are legal imperatives for product quality, safety, and operational continuity.

| Legal Area | Key Regulations/Changes | Impact on Indoco | Data Point/Example |

|---|---|---|---|

| Drug Approval & Trials | New Drugs and Clinical Trials Rules, 2024 | Streamlined processes, but requires strict adherence to safety and efficacy standards. | CDSCO approval times are a key metric. |

| Intellectual Property | India's Patent Rules 2024 amendments | Aims to expedite patent applications, crucial for protecting R&D investments. | Average patent pendency targeted to reduce from ~24 months (early 2024). |

| Pricing | Drug Price Control Order (DPCO) 2013 | Sets ceiling prices for essential medicines, potentially pressuring profit margins. | NPPA revised ceiling prices for scheduled formulations in 2023. |

| Marketing Practices | Uniform Code of Pharmaceutical Marketing Practices (UCPMP) 2024 | Mandates ethical promotion, banning gifts to HCPs and requiring transparency. | Penalties for non-compliance can include fines and reputational damage. |

| Manufacturing & Environment | Revised Schedule M of Drugs and Cosmetics Rules 1945 | Establishes higher standards for manufacturing facilities and waste management. | Focus on enhanced quality and safety in production environments. |

Environmental factors

Pharmaceutical manufacturing, by its nature, produces chemical waste and active pharmaceutical ingredients (APIs) that pose environmental risks if not handled with care. Indoco Remedies, like other players in the sector, must contend with the potential impact of these byproducts on air, water, and soil.

The Indian government has implemented robust regulations to mitigate these risks, including the Environmental Protection Act and guidelines from the Central Pollution Control Board (CPCB). These mandates cover stringent requirements for wastewater discharge, chemical waste treatment, and air quality control, ensuring that companies operate within defined environmental parameters.

To comply and minimize its ecological footprint, Indoco Remedies is compelled to allocate capital towards sophisticated waste treatment technologies and implement conscientious disposal protocols. For instance, in FY23, the Indian pharmaceutical industry saw increased investments in environmental compliance, with many companies reporting higher spending on effluent treatment plants (ETPs) and air pollution control devices.

The pharmaceutical industry, including companies like Indoco, faces increasing pressure to adopt sustainable manufacturing practices. This involves integrating greener technologies, such as renewable energy sources and water recycling systems, into production processes. For instance, the push towards Net Zero emissions by 2050 is driving significant investment in eco-friendly manufacturing, with many Indian pharmaceutical companies actively exploring solar power for their facilities.

Government initiatives, like the National Clean Development Mechanism (CDM), further incentivize environmentally responsible manufacturing by offering support for projects that reduce greenhouse gas emissions. This regulatory and societal push means companies are increasingly evaluated not just on their financial performance but also on their demonstrable commitment to environmental stewardship.

Pharmaceutical manufacturing, like that of Indoco Remedies, is inherently resource-intensive, demanding substantial quantities of water and energy. For instance, global pharmaceutical production in 2024 is projected to consume billions of kilowatt-hours of electricity and trillions of liters of water annually, highlighting the scale of this challenge.

By optimizing resource consumption through efficiency improvements and embracing cleaner production technologies, companies such as Indoco can significantly mitigate their environmental footprint and simultaneously lower operational costs. This strategic focus includes actively reducing energy usage within manufacturing processes and implementing advanced water management systems to ensure optimal utilization.

In 2024, Indoco Remedies, like its peers, faces increasing pressure to demonstrate tangible progress in reducing its environmental impact. Initiatives aimed at enhancing energy efficiency, such as upgrading to more energy-saving equipment and optimizing production schedules, are crucial. Similarly, water conservation efforts, including water recycling and wastewater treatment technologies, are becoming paramount for sustainable operations.

Climate Change and Supply Chain Resilience

Climate change poses significant threats to supply chain operations, impacting everything from raw material availability to the efficiency of logistics. Extreme weather events, such as floods, droughts, and severe storms, can disrupt production cycles and transportation networks, leading to delays and increased costs. For instance, the 2023 global supply chain disruptions, partly exacerbated by climate-related events, saw shipping costs surge by as much as 80% on some routes.

Building resilience is paramount for companies like Indoco to navigate these environmental challenges. This involves a proactive approach to risk assessment and mitigation. Diversifying sourcing locations is a key strategy, reducing reliance on any single region vulnerable to climate impacts. Implementing robust risk management frameworks, including contingency planning and inventory management, helps buffer against unforeseen disruptions.

- Supply Chain Vulnerability: Extreme weather events in 2024 have already impacted agricultural yields in several key regions, potentially affecting raw material availability for industries reliant on these inputs.

- Logistical Disruptions: Increased frequency of severe storms in coastal areas in 2025 could lead to port closures and rerouting of shipments, adding 5-10% to transportation costs.

- Mitigation Strategies: Companies are investing in diversified sourcing, with reports indicating a 15% increase in dual-sourcing strategies among manufacturers in the past year to build resilience.

- Production Process Impact: Water scarcity, a growing concern due to climate change, could impact manufacturing processes requiring significant water usage, potentially leading to production slowdowns or increased operational costs.

Environmental Regulations and Corporate Responsibility

The pharmaceutical industry faces increasingly stringent environmental regulations, particularly concerning pollution. Companies like Indoco Remedies are under pressure to adhere to evolving norms and demonstrate accountability for their environmental footprint. For instance, in 2024, several countries intensified scrutiny on pharmaceutical wastewater discharge, leading to updated permissible limits for active pharmaceutical ingredients (APIs) in effluents.

Beyond mere compliance, there's a growing societal demand for proactive corporate environmental stewardship. This translates into expectations for companies to go beyond regulatory minimums, investing in sustainable practices and demonstrating a genuine commitment to reducing their ecological impact. This shift is reflected in the rise of ESG (Environmental, Social, and Governance) investing, where environmental performance is a key differentiator.

Indoco Remedies's dedication to environmental sustainability can significantly bolster its corporate image. By actively managing its environmental impact, the company can attract a growing segment of environmentally conscious investors and consumers. For example, companies with strong sustainability reports often see improved access to capital and a more loyal customer base, as evidenced by the increasing correlation between high ESG scores and stock performance in the pharmaceutical sector during 2024-2025.

- Evolving Regulations: Stricter norms for pharmaceutical pollution are being implemented globally, impacting effluent discharge standards.

- Corporate Responsibility: Growing expectation for proactive environmental stewardship beyond basic compliance.

- Investor and Consumer Demand: Increased preference for companies with strong environmental, social, and governance (ESG) performance.

- Reputational Benefits: Commitment to sustainability can enhance brand image and attract environmentally conscious stakeholders.

Environmental factors significantly influence pharmaceutical operations, demanding careful management of chemical waste and API byproducts to protect air, water, and soil. Indoco Remedies, like its peers, must navigate stringent Indian regulations, such as the Environmental Protection Act, which dictate wastewater treatment and air quality control, requiring substantial investment in compliant technologies.

The industry faces growing pressure for sustainable practices, including adopting renewable energy and water recycling, driven by global Net Zero targets and incentives like the National Clean Development Mechanism. Resource intensity, with billions of kilowatt-hours of electricity and trillions of liters of water consumed globally by the sector annually, necessitates efficiency improvements and cleaner production methods.

Climate change introduces supply chain vulnerabilities, with extreme weather potentially disrupting raw material availability and logistics, as seen in 2023's shipping cost surges. Companies like Indoco must build resilience through diversified sourcing, with a 15% increase in dual-sourcing strategies observed, and robust risk management to mitigate these impacts.

Beyond compliance, societal demand for environmental stewardship and strong ESG performance is rising, influencing investor and consumer choices. Companies demonstrating a commitment to sustainability, such as improved ESG scores, often experience better capital access and brand loyalty, a trend strongly evident in the pharmaceutical sector during 2024-2025.

PESTLE Analysis Data Sources

Our Indoco PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading market research firms. We meticulously gather insights on political stability, economic indicators, technological advancements, and regulatory changes to ensure comprehensive and accurate assessments.