Inditex SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inditex Bundle

Inditex, a global fashion giant, boasts impressive strengths like its agile supply chain and rapid trend adaptation, but also faces challenges such as increasing competition and sustainability pressures. Understanding these dynamics is crucial for anyone navigating the fashion retail landscape.

Want the full story behind Inditex’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Inditex's integrated business model is a significant strength, covering everything from design and manufacturing to logistics and retail. This end-to-end control allows for unparalleled speed in responding to the latest fashion trends.

This agility is most evident in Zara, Inditex's flagship brand, which can bring a garment from concept to store shelves in as little as two to three weeks, a stark contrast to the much longer typical industry cycles.

This rapid product cycle ensures that Inditex's offerings are consistently current, satisfying immediate consumer desires and leading to a high inventory turnover rate. A substantial percentage of these items are sold at full price, boosting profitability.

Inditex commands a powerful brand portfolio, featuring globally recognized names like Zara, Pull&Bear, and Massimo Dutti. This diversity allows them to effectively target a broad spectrum of consumers with distinct fashion tastes and needs.

The company's expansive global presence is a significant asset, with operations spanning over 213 markets. This reach is amplified by a strong omnichannel strategy, integrating a vast network of physical stores with sophisticated online sales channels.

Demonstrating its commitment to growth, Inditex strategically expanded into 47 new markets in 2024. This aggressive expansion further cements its leadership in the international fashion retail landscape.

Inditex showcases exceptional financial performance, with fiscal year 2024 sales reaching €38.6 billion, a 7.5% increase. This growth translated into a net income of €5.9 billion, up 9%, setting new company records.

The company's robust health is further underscored by a significant net cash position exceeding €11 billion. This financial buffer offers considerable flexibility for strategic investments and reinforces its ability to navigate economic uncertainties.

Inditex effectively manages its expenses, with operating costs rising at a slower pace than sales. This disciplined approach to cost control is a key driver of its sustained profitability and strong financial standing.

Efficient Supply Chain and Logistics

Inditex boasts a remarkably efficient and vertically integrated supply chain. By strategically locating a substantial portion of its production facilities close to its primary markets, the company significantly reduces lead times and enables rapid product turnover. This allows for twice-weekly shipments to stores globally, with orders typically arriving within 24 to 48 hours.

The company's commitment to its logistics is evident in its substantial investments. For 2025, Inditex has earmarked €1.8 billion to further bolster its commercial spaces, integrate advanced technology, and enhance its online platforms, underscoring the critical role of its supply chain in its operational success.

- Proximity to Markets: Production facilities are strategically placed near key consumer bases, reducing transit times.

- Rapid Replenishment: Stores receive shipments twice weekly, ensuring fresh inventory.

- Fast Order Fulfillment: Online and in-store orders are typically fulfilled within 24-48 hours.

- Significant Logistics Investment: €1.8 billion allocated for 2025 to upgrade infrastructure and technology.

Strong Digital and Omnichannel Integration

Inditex excels in its digital and omnichannel integration, a significant strength. The company reported a 12% increase in online sales for 2024, reaching €10.2 billion, and boasts 218 million active app users. This robust digital presence is complemented by a strategic store optimization program that turns physical locations into crucial hubs for both in-store and online fulfillment.

This seamless blend of physical and digital channels creates a superior customer experience, a key factor in Inditex's sustained global sales growth. The company's ability to connect with customers across multiple touchpoints, from mobile apps to well-integrated store operations, solidifies its market position.

- Online Sales Growth: 12% increase in 2024, reaching €10.2 billion.

- Active App Users: 218 million, indicating strong digital engagement.

- Omnichannel Strategy: Physical stores function as hubs supporting both in-store and online sales, enhancing customer experience.

Inditex's integrated supply chain is a core strength, allowing for rapid product delivery. Its proximity to manufacturing hubs means stores can receive new stock twice weekly, with orders typically fulfilled within 24-48 hours.

The company is heavily investing in its infrastructure, allocating €1.8 billion for 2025 to upgrade commercial spaces, technology, and online platforms, further solidifying its logistical advantage.

This operational efficiency, coupled with a strong brand portfolio and expansive global reach across 213 markets, positions Inditex favorably in the competitive fashion retail landscape.

Inditex demonstrated robust financial health in fiscal year 2024, achieving record sales of €38.6 billion, a 7.5% increase, and a net income of €5.9 billion, up 9%.

The company's strong digital integration is a key asset, with online sales growing 12% to €10.2 billion in 2024 and 218 million active app users, showcasing effective omnichannel strategies.

| Metric | Value (FY 2024) | YoY Change |

|---|---|---|

| Total Sales | €38.6 billion | +7.5% |

| Net Income | €5.9 billion | +9% |

| Online Sales | €10.2 billion | +12% |

| Active App Users | 218 million | N/A |

| Logistics Investment (2025) | €1.8 billion | N/A |

What is included in the product

Delivers a strategic overview of Inditex’s internal and external business factors, highlighting its strong brand portfolio and agile supply chain against market competition and evolving consumer trends.

Uncovers critical strategic advantages and potential risks for Inditex, enabling proactive management and informed decision-making.

Weaknesses

Inditex's reliance on the fast fashion model, while historically a driver of success, now presents a significant weakness. This model faces growing criticism for its substantial environmental footprint, including textile waste generation and high resource consumption. For instance, the fashion industry is estimated to be responsible for 10% of global carbon emissions, a figure that Inditex, as a major player, contributes to.

Furthermore, the constant need to predict and respond to rapidly changing fashion trends makes Inditex vulnerable. A misstep in trend forecasting or an abrupt shift in consumer preferences could lead to inventory issues and decreased sales, impacting profitability. This inherent unpredictability in consumer demand poses a continuous challenge to efficient supply chain management.

Inditex faces ongoing scrutiny over its extensive supply chain, with persistent allegations of poor working conditions and exploitation in manufacturing hubs. Despite a stated commitment to a strict code of conduct, ensuring consistent adherence across its vast network of suppliers remains a significant hurdle.

These labor concerns represent a substantial reputational risk, potentially leading to negative publicity and impacting consumer trust. For instance, reports in late 2023 and early 2024 continued to highlight challenges in monitoring and enforcing labor standards among sub-contractors in key production countries.

Despite Inditex's stated sustainability goals, its emissions from upstream transportation and distribution saw a notable increase. In 2024, these emissions rose by 10%, a significant jump primarily driven by a heightened reliance on air freight to navigate persistent shipping delays.

This escalation in carbon footprint, exacerbated by geopolitical events such as the disruptions in the Red Sea, creates a direct conflict with the company's environmental targets. Consequently, Inditex faces increased scrutiny and criticism regarding the sincerity of its commitment to sustainability initiatives.

Vulnerability to Geopolitical and Economic Instability

Inditex's vast global footprint, while a strength, also makes it susceptible to disruptions from geopolitical events and economic volatility. Trade wars, political unrest, or sudden shifts in international relations can directly impact its supply chains and market access.

Currency fluctuations present a constant challenge. For instance, the depreciation of the US dollar against the euro has already affected recent earnings, and further adverse movements could significantly erode profits from its international sales. This exposure is a key vulnerability for a company operating in so many countries.

Broader economic downturns also pose a significant risk. Reduced consumer spending power in key markets due to inflation or recessionary pressures can lead to lower sales volumes for Inditex's fashion products. The company’s reliance on discretionary spending makes it particularly sensitive to these economic cycles.

- Geopolitical Risk: Exposure to trade disputes and regional conflicts impacting operations.

- Currency Volatility: Recent impacts from dollar depreciation against the euro, with ongoing risk.

- Economic Sensitivity: Vulnerability to reduced consumer spending during economic downturns.

- Supply Chain Disruption: Potential for global events to interrupt the flow of goods.

Intense Competition and Market Saturation

Inditex operates in a highly competitive fashion retail environment. Global and local brands, including ultra-fast fashion newcomers like Shein and Temu, alongside established players such as H&M and Uniqlo, constantly challenge Inditex's market position. This intense rivalry can lead to price wars, impacting profit margins, and requires continuous investment in trend forecasting and supply chain agility to stay ahead.

The sheer volume of competitors means Inditex must constantly innovate to differentiate its offerings. For instance, while Inditex reported a 16% increase in net sales to €35.9 billion for the fiscal year ending January 31, 2024, the aggressive pricing strategies of ultra-fast fashion brands present a significant challenge to maintaining market share and pricing power.

- Market Saturation: The global apparel market is crowded, with numerous brands competing for consumer attention and spending.

- Ultra-Fast Fashion Threat: Emerging players like Shein and Temu are disrupting the market with rapid production cycles and aggressive pricing, putting pressure on traditional retailers.

- Price Sensitivity: Increased competition can lead to a more price-sensitive consumer base, forcing retailers to balance sales volume with profitability.

- Brand Differentiation: Maintaining brand loyalty and perceived value becomes more difficult when consumers have a vast array of choices at varying price points.

Inditex's reliance on the fast fashion model, while historically a driver of success, now presents a significant weakness. This model faces growing criticism for its substantial environmental footprint, including textile waste generation and high resource consumption. For instance, the fashion industry is estimated to be responsible for 10% of global carbon emissions, a figure that Inditex, as a major player, contributes to.

Furthermore, the constant need to predict and respond to rapidly changing fashion trends makes Inditex vulnerable. A misstep in trend forecasting or an abrupt shift in consumer preferences could lead to inventory issues and decreased sales, impacting profitability. This inherent unpredictability in consumer demand poses a continuous challenge to efficient supply chain management.

Inditex faces ongoing scrutiny over its extensive supply chain, with persistent allegations of poor working conditions and exploitation in manufacturing hubs. Despite a stated commitment to a strict code of conduct, ensuring consistent adherence across its vast network of suppliers remains a significant hurdle.

These labor concerns represent a substantial reputational risk, potentially leading to negative publicity and impacting consumer trust. For instance, reports in late 2023 and early 2024 continued to highlight challenges in monitoring and enforcing labor standards among sub-contractors in key production countries.

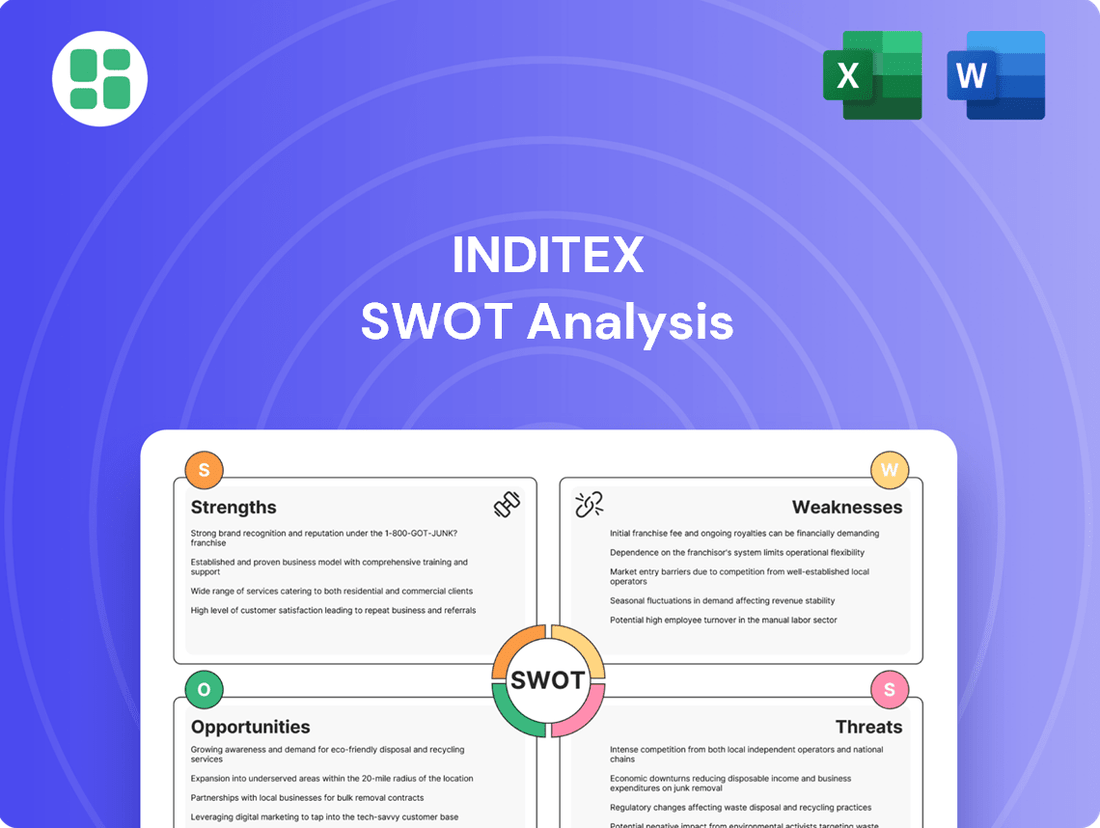

Preview the Actual Deliverable

Inditex SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Inditex SWOT analysis, offering a clear understanding of its Strengths, Weaknesses, Opportunities, and Threats. The complete, detailed report is unlocked upon purchase.

Opportunities

The persistent surge in e-commerce presents Inditex a prime chance to broaden its online sales, tapping into a wider international audience. In 2023, Inditex's online sales represented 18% of its total revenue, a figure expected to climb as digital adoption accelerates.

Strategic investments in digital advancements, such as AI for predicting customer demand and augmented reality features to improve online try-ons, are key. This focus on innovation is designed to deepen digital market share and enhance customer interaction, building on the 16% online sales growth reported in the first quarter of 2024.

Inditex has a significant opportunity to expand its reach in emerging markets, particularly in Asia. China, for instance, represents a massive consumer base with a growing middle class eager for fashion. While specific 2024/2025 figures for Inditex's emerging market growth are still unfolding, the company's historical success in similar regions suggests strong potential.

The company's recent re-entry into markets like Venezuela and its brand introductions in Peru underscore a strategy of geographical diversification. This approach allows Inditex to tap into new customer segments and mitigate risks associated with over-reliance on established markets, potentially boosting overall sales in the 2024-2025 period.

Consumer demand for sustainable fashion is a significant tailwind for Inditex. In 2024, a significant portion of Gen Z and Millennial shoppers indicated they would pay more for sustainable clothing, a trend Inditex is well-positioned to capitalize on.

By expanding initiatives like its participation in the Pack4Good campaign and investing in novel materials such as Loopamid 6, Inditex can further solidify its reputation. These actions directly address growing consumer concerns about environmental impact and ethical sourcing, potentially driving sales and brand loyalty.

Inditex's ambitious targets for increasing recycled materials and reducing emissions by 2025 present a clear opportunity to differentiate itself. Meeting these goals will not only resonate with eco-conscious consumers but also mitigate future regulatory risks and operational costs associated with environmental compliance.

Leveraging Data Analytics for Personalization and Efficiency

Inditex's vast retail network, encompassing both physical stores and its growing online presence, generates an immense volume of real-time sales data. This extensive dataset is a prime opportunity for advanced analytics, enabling deeper customer understanding and more precise business decisions.

By enhancing its data analytics capabilities, Inditex can significantly improve product personalization, offering tailored recommendations and collections to individual customers. This data-driven approach also sharpens trend forecasting, ensuring that inventory aligns with emerging market demands, thereby minimizing markdowns and maximizing sales. For instance, in 2023, Inditex reported a 7.1% increase in online sales, highlighting the growing importance of digital data streams for its business strategy.

- Enhanced Personalization: Utilizing purchase history and browsing behavior to offer customized product suggestions.

- Optimized Inventory: Predicting demand more accurately to reduce stockouts and overstock situations across its global operations.

- Streamlined Operations: Analyzing sales patterns to improve store layouts, staffing, and supply chain efficiency.

- Refined Trend Forecasting: Identifying emerging fashion trends faster by analyzing sales data across diverse markets and channels.

Diversification into New Product Categories and Services

Expanding into new product categories, like cosmetics and athletic wear, mirrors Zara's existing strategy and presents a substantial opportunity for Inditex to diversify revenue and capture broader market share. This move taps into growing consumer demand for specialized apparel and accessories.

Exploring innovative service models, such as clothing rental or resale platforms, aligns with the increasing consumer interest in sustainable and circular fashion. These initiatives could unlock new revenue streams and enhance Inditex's brand image as an adaptable and forward-thinking retailer.

- Revenue Diversification: Entering categories like cosmetics and athletic wear can reduce reliance on core fashion segments.

- Market Penetration: New product lines allow Inditex to reach customer demographics previously underserved.

- Circular Economy Alignment: Rental and resale services cater to the growing demand for sustainable consumption.

- Brand Enhancement: Embracing new service models positions Inditex as an innovative leader in retail.

Inditex can leverage its strong online presence to further penetrate emerging markets, particularly in Asia, where consumer spending power is on the rise. The company's ability to adapt to local fashion preferences and its growing digital infrastructure are key advantages. For instance, Inditex has been actively expanding its e-commerce operations in regions like India, aiming to capture a larger share of the rapidly growing online retail sector.

The increasing consumer demand for sustainable and ethically produced clothing presents a significant opportunity for Inditex to enhance its brand image and attract environmentally conscious shoppers. By expanding its use of recycled materials and transparent supply chains, Inditex can differentiate itself in a competitive market. The company has committed to increasing the use of more sustainable materials, with targets set for 2025, reflecting this growing market trend.

Inditex's extensive network of physical stores, combined with its robust online platform, provides a unique opportunity to gather vast amounts of real-time customer data. This data can be analyzed to personalize customer experiences, optimize inventory management, and refine trend forecasting, ultimately driving sales and improving operational efficiency. In 2023, Inditex saw a notable increase in its online sales, underscoring the value of its digital data streams.

Expanding into new, complementary product categories such as beauty, homeware, or activewear offers Inditex a chance to diversify its revenue streams and capture a broader customer base. This strategy aligns with consumer trends favoring lifestyle brands and allows Inditex to capitalize on the success of its existing fashion lines. The company has already begun exploring these avenues, with initial forays into areas like cosmetics showing promising results.

| Opportunity Area | Key Action | Potential Impact | 2024/2025 Relevance |

|---|---|---|---|

| Emerging Market Expansion | Deepen e-commerce penetration in Asia | Increased market share and revenue growth | Growing disposable incomes in Asian countries |

| Sustainable Fashion | Increase recycled materials and supply chain transparency | Enhanced brand loyalty and market differentiation | Heightened consumer awareness of environmental issues |

| Data Analytics | Leverage sales data for personalization and optimization | Improved customer engagement and operational efficiency | Accelerated digital transformation across retail |

| Product Diversification | Introduce new categories like beauty and activewear | Broader customer reach and diversified revenue streams | Consumer shift towards lifestyle and wellness products |

Threats

Inditex faces significant pressure from ultra-fast fashion brands such as Shein and Temu, which leverage incredibly low prices and rapid production cycles. This dynamic forces established players to constantly adapt to maintain relevance and market share.

Traditional retailers also present a formidable competitive landscape, often possessing established brand loyalty and extensive supply chains. The combined force of these two segments of the market can lead to price wars, directly impacting Inditex's profitability and requiring continuous investment in innovation and efficiency.

A major challenge for Inditex is the swift shift in what customers want, particularly a strong push for sustainability, ethical production, and openness in how clothes are made. If Inditex doesn't fully adapt its operations to meet these growing expectations for environmental and social accountability, it risks damaging its reputation, losing customer loyalty, and becoming less appealing to consumers who prioritize these values. For instance, a 2024 report indicated that over 60% of Gen Z consumers consider a brand's sustainability practices when making purchasing decisions.

Inditex's financial results are closely tied to the health of the global economy. When economic conditions worsen, people tend to spend less on non-essential items like clothing, directly affecting Inditex's sales. For example, during early 2025, the company experienced a noticeable slowdown in sales growth, underscoring its sensitivity to macroeconomic challenges and fluctuating consumer confidence.

Supply Chain Disruptions and Geopolitical Risks

Geopolitical conflicts, protectionist trade policies, and global events like the Red Sea crisis present significant threats to Inditex's intricate global supply chain. These disruptions can directly translate into elevated transportation expenses, extended shipping lead times, and difficulties in managing inventory levels. For instance, the Red Sea disruptions in early 2024 led to rerouting of vessels, adding an estimated 10-15 days to transit times for some routes and increasing freight costs by up to 50% for certain shipments.

Inditex's reliance on specific manufacturing locations and key transportation arteries creates inherent operational vulnerabilities. A concentrated manufacturing base, for example, could be severely impacted by regional instability or trade disputes, leading to higher operational costs and potential stockouts. The company's extensive network, while efficient, is not immune to the ripple effects of global trade tensions, which can escalate rapidly.

- Increased Logistics Costs: Freight rates saw significant spikes in late 2023 and early 2024 due to geopolitical events, impacting Inditex's cost of goods sold.

- Supply Chain Bottlenecks: Delays in shipping and port congestion, exacerbated by global events, can lead to inventory shortages and missed sales opportunities.

- Trade Policy Uncertainty: Shifting trade agreements and potential tariffs between major economic blocs could necessitate costly adjustments to sourcing and distribution strategies.

Reputational Risks from Ethical and Environmental Scrutiny

Inditex faces significant reputational risks due to ongoing scrutiny of its ethical and environmental practices. Concerns about labor conditions in its supply chain and its substantial carbon footprint, particularly from air freight, remain persistent threats. For instance, in 2023, the fashion industry continued to face pressure regarding sustainable sourcing and fair labor, with reports highlighting the environmental impact of fast fashion's rapid production cycles.

Negative publicity or consumer boycotts stemming from these issues could severely damage Inditex's brand image and erode consumer trust. Such events have the potential to directly impact sales and market share. For example, past controversies in the retail sector have shown that consumer sentiment can shift rapidly, leading to significant financial repercussions if not addressed proactively. The company's commitment to transparency and sustainability initiatives, such as its 2023 pledge to increase the use of sustainable materials, is crucial in mitigating these risks.

- Labor Practice Scrutiny: Inditex consistently faces examination regarding working conditions and wages within its extensive global supply chain.

- Environmental Footprint: The company's carbon emissions, amplified by its reliance on air freight for rapid inventory turnover, remain a key area of environmental concern.

- Consumer Boycott Potential: Negative media coverage or public outcry over ethical or environmental lapses could trigger consumer boycotts, directly impacting sales.

- Brand Trust Erosion: Reputational damage can lead to a significant loss of brand loyalty and a decline in its overall corporate image.

Inditex faces intense competition from ultra-fast fashion players like Shein, whose aggressive pricing and rapid production cycles challenge established brands. Additionally, traditional retailers with strong brand loyalty and robust supply chains can lead to price wars, impacting Inditex's profitability and necessitating continuous innovation.

A significant threat is the growing consumer demand for sustainability and ethical production. Failure to adapt to these expectations, such as by increasing transparency in its supply chain, could damage Inditex's reputation and alienate environmentally conscious consumers, with over 60% of Gen Z considering sustainability in purchasing decisions as of 2024.

Global economic downturns directly affect Inditex's sales, as discretionary spending on apparel decreases. For instance, a noticeable slowdown in sales growth was observed in early 2025, highlighting the company's sensitivity to macroeconomic shifts and consumer confidence levels.

Geopolitical instability and trade policy shifts pose risks to Inditex's global supply chain. Events like the Red Sea crisis in early 2024 led to increased freight costs by up to 50% and extended transit times by 10-15 days, impacting operational efficiency and inventory management.

| Threat Category | Specific Risk | Impact Example (2023-2025) |

|---|---|---|

| Competition | Ultra-fast fashion disruption | Shein and Temu's market share growth |

| Consumer Trends | Demand for sustainability | Potential loss of Gen Z customers (60%+ prioritize sustainability in 2024) |

| Economic Factors | Global economic slowdown | Sales growth deceleration observed in early 2025 |

| Supply Chain & Geopolitics | Logistics disruptions | Red Sea crisis (early 2024) increased freight costs by up to 50% |

| Reputation & Ethics | Labor practice scrutiny | Ongoing concerns regarding supply chain working conditions |

SWOT Analysis Data Sources

This Inditex SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.