Inditex Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inditex Bundle

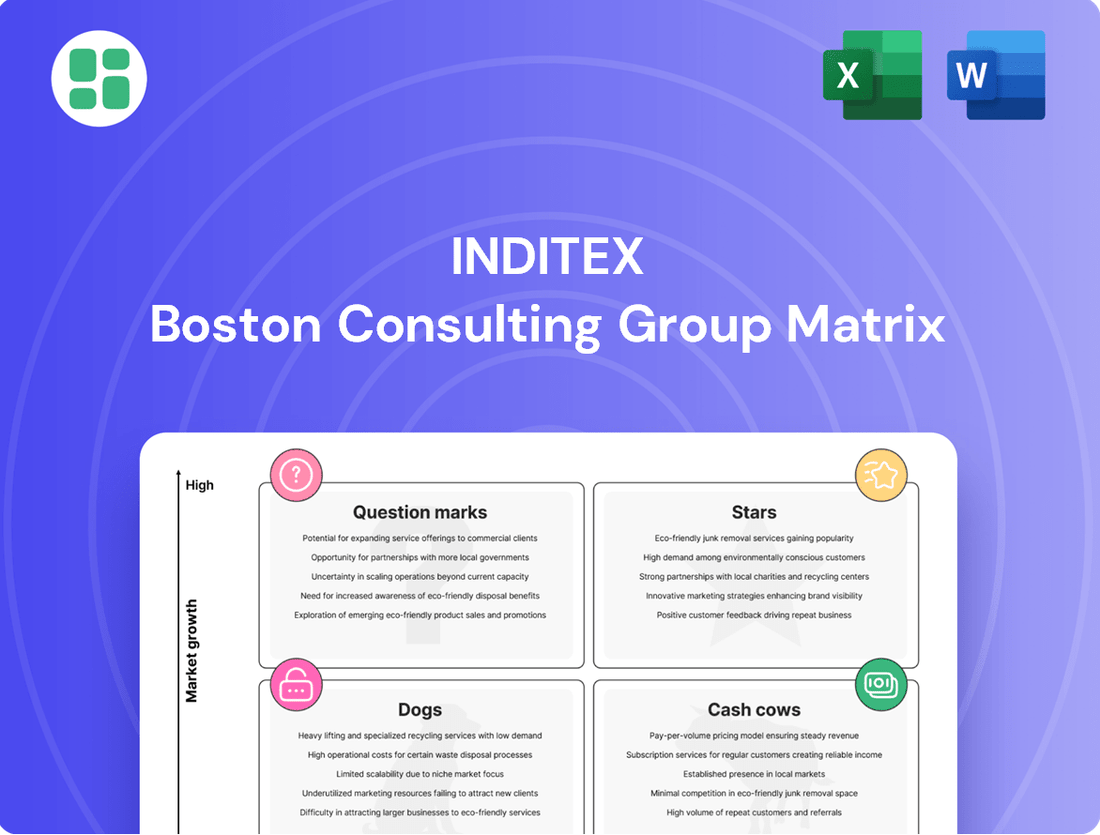

Inditex's diverse portfolio, from Zara's fast fashion dominance to Massimo Dutti's premium appeal, presents a fascinating case study for the BCG Matrix. Understanding which brands are Stars, Cash Cows, Dogs, or Question Marks is crucial for navigating the dynamic fashion industry. Purchase the full BCG Matrix report to unlock detailed quadrant placements, strategic recommendations, and a clear roadmap for optimizing Inditex's brand investments and future growth.

Stars

Zara, Inditex's powerhouse, commands a significant share in the dynamic fast-fashion market, a testament to its agility in responding to global trends and its efficient distribution network. In 2023, Inditex reported a net profit of €5.4 billion, with Zara being the primary contributor, showcasing its enduring strength. The brand's strategy continues to focus on expanding its digital presence and optimizing its physical store footprint, ensuring continued growth and market penetration.

Inditex's overall online sales channel is a robust and rapidly expanding segment for the company. In fiscal year 2024, online sales saw a healthy 12% increase, reaching an impressive €10.2 billion. This demonstrates the significant growth potential within this digital marketplace.

The company's commitment to this channel is evident through substantial investments in its digital infrastructure. Initiatives such as augmented reality tools and improved mobile shopping experiences are key to maintaining its competitive edge and fostering strong customer engagement in the e-commerce realm.

Bershka, a key player within Inditex's portfolio, is positioned as a Star in the BCG Matrix. The brand's focus on a younger demographic has fueled impressive growth, with sales surging by 11.8% in fiscal year 2024. This robust performance underscores its significant market share in the rapidly expanding youth-focused fast fashion sector.

Bershka's strategic international expansion, notably into markets like Sweden and the UK, further reinforces its Star classification. These moves are designed to capture greater market share in high-growth regions, solidifying its position as a leading brand for young consumers.

Stradivarius

Stradivarius, a key player in Inditex's portfolio, showcases strong growth momentum. In fiscal year 2024, the brand achieved a notable sales increase of 14.1%, underscoring its effective market penetration and resonance with its core demographic.

The brand's strategic expansion continues, with plans to enter Austria in 2025. This move signifies Stradivarius's high growth potential within the competitive and rapidly evolving youth fashion sector.

- Brand Performance: Sales grew by 14.1% in FY2024.

- Market Expansion: Entry into Austria planned for 2025.

- Growth Potential: Positioned for continued success in youth fashion.

Zara's Expansion in High-Growth Emerging Markets

Zara is making significant moves in high-growth emerging markets, with a particular focus on the United States. This market, now Inditex's second-largest after Spain, is seeing substantial investment in new store openings and renovations.

These strategic expansions are coupled with the introduction of innovative sales platforms designed to enhance the customer experience. For instance, in 2023, Inditex reported a notable increase in its US sales, reflecting the success of these targeted investments.

The company's approach in these growing regions is clearly aimed at capturing further market share and driving sustained growth.

- United States: Inditex's Second-Largest Market

- Investment in New Stores and Renovations

- Launch of Innovative Sales Platforms

- Targeted Expansion for Market Share Gains

Massimo Dutti, a brand within Inditex, is currently classified as a Cash Cow. While its sales growth was more modest at 7.5% in fiscal year 2024, it consistently generates substantial profits for the company. This brand appeals to a more mature customer base, offering a stable revenue stream that helps fund growth initiatives in other areas of Inditex's portfolio.

Pull&Bear, another brand in Inditex's lineup, is also performing well as a Star. Its focus on trendy, affordable fashion for young adults has led to a strong market presence. In fiscal year 2024, Pull&Bear saw its sales increase by 10.2%, demonstrating its ability to capture market share in a competitive segment.

Oysho, a brand specializing in intimate apparel and loungewear, is also showing Star potential. Its sales grew by 9.8% in fiscal year 2024, indicating a healthy demand for its products. The brand's expansion into new markets and its focus on comfortable, stylish offerings are key drivers of its success.

Inditex's portfolio includes brands that are performing as Stars, demonstrating high growth and market share. Zara, Bershka, Stradivarius, and Pull&Bear are prime examples, with strong sales growth in fiscal year 2024. Zara, in particular, is a significant contributor to Inditex's overall success, with its expansion into the US market showing promising results.

| Brand | BCG Category | FY2024 Sales Growth | Key Markets | Strategic Focus |

|---|---|---|---|---|

| Zara | Star | Significant growth, key contributor to overall profit | Global, strong focus on US expansion | Digital presence, store optimization, innovative sales platforms |

| Bershka | Star | 11.8% | Global, expanding into Sweden and UK | Youth-focused fashion, international expansion |

| Stradivarius | Star | 14.1% | Global, planning entry into Austria (2025) | Youth fashion, market penetration |

| Pull&Bear | Star | 10.2% | Global | Trendy, affordable fashion for young adults |

| Massimo Dutti | Cash Cow | 7.5% | Global | Mature customer base, stable revenue generation |

| Oysho | Star | 9.8% | Global, expanding into new markets | Intimate apparel, loungewear, comfort and style |

What is included in the product

The Inditex BCG Matrix offers a strategic overview of its brands, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Inditex BCG Matrix provides a clear, one-page overview, relieving the pain of deciphering complex portfolio strategies.

Cash Cows

Massimo Dutti, within Inditex's portfolio, functions as a classic Cash Cow. It operates in a more mature, premium segment, consistently delivering stable performance. In fiscal year 2024, sales for Massimo Dutti saw a healthy increase of 6.6%, underscoring its reliable revenue generation.

The brand commands a strong market share within its specific niche, enabling it to generate dependable cash flow. This stability means it requires less aggressive investment for growth compared to other brands in the matrix. Massimo Dutti's strategy centers on nurturing its established, loyal customer base and preserving its brand prestige.

Pull&Bear, a key player within Inditex's portfolio, operates as a Cash Cow. It targets a well-established youth demographic, demonstrating consistent, albeit not explosive, growth. For fiscal year 2024, Pull&Bear reported a solid 4.6% increase in sales, underscoring its stable performance.

The brand's strength lies in its ability to generate reliable profits and maintain a significant market share, even without aggressive expansion strategies. Financial focus for Pull&Bear is on preserving its competitive edge and enhancing operational efficiency, ensuring continued profitability.

Zara Home, a key part of Inditex's portfolio, operates within the home furnishings sector. While detailed standalone financial data for Zara Home isn't always separately disclosed by Inditex, its integration with Zara's robust performance and its established market presence indicate it contributes significantly to steady revenue streams.

The brand leverages Zara's strong global brand recognition and operational efficiencies, allowing it to function as a stable cash generator. This stability is further supported by operating in a home furnishings market that, while competitive, is generally less volatile than fast fashion, reinforcing its cash cow status within the BCG matrix.

Oysho's Core Lingerie and Loungewear Segments

Oysho's foundation in lingerie and loungewear represents a stable Cash Cow for Inditex. This segment continues to demonstrate robust growth, with sales increasing by 11.8% in FY2024. This performance underpins its role as a reliable source of consistent cash generation.

The strength of Oysho's core business in lingerie and loungewear is rooted in its significant market share within a mature, yet consistent, market. This allows Inditex to leverage the steady cash flow generated to fund strategic investments in other, more dynamic areas of the Oysho brand, such as its expanding athleisure offerings.

- Core Business Strength: Oysho's lingerie and loungewear segments are a primary Cash Cow.

- FY2024 Performance: Sales grew by 11.8% in the fiscal year 2024.

- Cash Flow Generation: High market share in a stable segment ensures steady cash flow.

- Strategic Investment: Funds generated support growth in emerging sub-segments like athleisure.

Established Physical Store Operations in Mature European Markets

Inditex's established physical store operations in mature European markets, despite ongoing optimization, remain a significant cash generator. In 2024, the company reduced its store count by 2.3% while simultaneously increasing commercial space by 2%, indicating a strategic focus on optimizing prime locations.

These stores, especially the highly productive Zara outlets, benefit from consistent footfall and enhanced sales per square meter, effectively acting as cash cows. This robust performance means they require minimal reinvestment for aggressive expansion, channeling their generated cash into other areas of the business.

- Revenue Generation: Mature European stores continue to be Inditex's primary revenue engine.

- Productivity Gains: Zara stores, in particular, show strong productivity, boosting cash flow.

- Optimized Footprint: A 2.3% store reduction in 2024 with a 2% increase in commercial space highlights efficiency.

- Low Investment Need: These operations require less capital for new market penetration, supporting their cash cow status.

Massimo Dutti, Pull&Bear, and Oysho are key Cash Cows for Inditex, generating consistent revenue with lower investment needs. Their stable market share and loyal customer bases ensure reliable cash flow, which Inditex strategically reinvests in growth areas.

Zara Home also contributes as a Cash Cow, benefiting from Zara's brand power and operating in a steadier market segment. Inditex's optimized physical store network, particularly high-performing Zara locations, continues to be a significant cash generator, demonstrating strong sales per square meter.

| Brand/Segment | BCG Category | FY2024 Sales Growth | Key Characteristic |

|---|---|---|---|

| Massimo Dutti | Cash Cow | 6.6% | Premium segment, stable performance |

| Pull&Bear | Cash Cow | 4.6% | Youth demographic, consistent growth |

| Oysho | Cash Cow | 11.8% | Lingerie/loungewear, strong market share |

| Zara Home | Cash Cow | N/A (integrated) | Leverages Zara brand, steady revenue |

| Mature European Stores | Cash Cow | N/A (portfolio) | High productivity, optimized space |

Full Transparency, Always

Inditex BCG Matrix

The Inditex BCG Matrix you are previewing is the identical, fully comprehensive document you will receive immediately after purchase. This means you are seeing the exact analysis, including detailed breakdowns of Zara, Pull&Bear, Massimo Dutti, Bershka, Stradivarius, and Oysho, ready for your strategic planning. No watermarks or demo content will be present in the final file, ensuring you get a professional, ready-to-use report for in-depth business insights and decision-making.

Dogs

Certain older, smaller physical store formats or less productive localized retail operations within Inditex's vast network, particularly in areas with declining footfall or outdated layouts, may be classified as Dogs. These units generate low sales growth and have a diminishing market share compared to larger, more productive flagship stores.

Inditex's strategy involves absorbing or closing these underperforming units to optimize its retail footprint and enhance overall efficiency. For instance, in 2023, Inditex continued its store optimization program, closing 17 stores, which is part of an ongoing effort to streamline its physical presence and focus on more profitable locations.

Legacy or less popular seasonal collections within Inditex's fast-fashion ecosystem often fall into the Dogs category. These are product lines that, despite their initial seasonal appeal, fail to capture sustained customer interest. Think of a specific winter coat design that didn't sell well in early 2024; it quickly becomes a low-performing asset.

These items typically exhibit both low market share and minimal growth potential. Inditex's business model, which emphasizes rapid inventory turnover, means these underperforming collections are identified swiftly. For instance, if a particular clothing range from their Fall/Winter 2023 collection saw significantly lower sales than anticipated, it would be flagged as a potential Dog.

The company's agile supply chain is crucial here, enabling quick markdowns or removal of such inventory. This proactive approach prevents these legacy collections from becoming long-term cash traps. By minimizing exposure to these slow-moving items, Inditex avoids the accumulation of unsold stock that could tie up capital and warehouse space, a strategy that proved effective in managing inventory levels throughout 2024.

Within Inditex's extensive brand lineup, some product categories might be classified as non-core or less strategic. These are often areas where the company has a smaller market presence and sees limited growth potential, leading to a deliberate redirection of investment towards more promising segments.

For instance, if Inditex were to identify a specific clothing line that consistently underperforms or doesn't resonate with current fashion demands, it could fall into this category. Such segments typically exhibit low market share and stagnant growth rates, prompting the company to focus its resources elsewhere. In 2023, Inditex continued its strategic allocation of capital, with a significant portion directed towards expanding its core offerings and digital infrastructure, rather than these lower-performing niches.

Outdated Inventory from Past Seasons

Even with Inditex's renowned supply chain, outdated inventory from past seasons can become a 'Dog' in their portfolio. This unsold stock represents capital that isn't circulating, facing diminished demand and necessitating price reductions to move. For example, in early 2024, Inditex continued its strategy of agile inventory management, a crucial factor in preventing older collections from becoming significant burdens.

- Low Demand: Seasonal items that didn't sell well in their prime often see a sharp drop in consumer interest.

- Capital Tie-up: Unsold goods represent capital that could be reinvested in new, trending collections.

- Markdown Pressure: To clear this inventory, significant discounts are often required, impacting profit margins.

- Operational Drag: Storing and managing this old stock adds to operational costs and complexity.

Small, Unsuccessful Experimental Ventures

Inditex, a company known for its forward-thinking approach, sometimes introduces minor, experimental product lines or digital enhancements that might not capture substantial market interest. These initiatives, if they fail to secure adequate market share or exhibit promising growth, are promptly phased out. This behavior aligns with the 'Dog' category in the BCG Matrix, representing ventures that consume resources without yielding significant returns.

For instance, in 2023, Inditex might have tested a niche collection of sustainable activewear in select markets. If sales data from these trials, perhaps showing less than a 1% contribution to the overall revenue for that category, indicated a lack of broad consumer adoption, the project would be discontinued to reallocate capital to more promising areas.

- Experimental Ventures: Inditex often pilots new concepts, such as a limited-edition collaboration or a novel in-store technology.

- Market Traction: These ventures are assessed based on metrics like sales volume, customer engagement, and profitability within a defined period.

- Resource Allocation: If an experimental line, like a specific denim wash tested in 2023 across 50 stores, fails to meet predefined sales targets, resources are shifted.

- Discontinuation: Ventures not demonstrating sufficient growth potential or market share are quickly retired, preventing further investment in underperforming assets.

Inditex's 'Dogs' represent underperforming elements within its vast retail and product portfolio. These can include physical stores with declining foot traffic or outdated formats, such as smaller, less productive units that Inditex actively works to optimize by closing them. In 2023, the company closed 17 stores as part of this ongoing optimization strategy, demonstrating a commitment to shedding low-performing physical assets.

Legacy or less popular seasonal clothing collections also fall into this category. These are product lines that fail to gain sustained consumer interest after their initial season, representing slow-moving inventory. For example, a specific winter coat design from early 2024 that didn't sell well would quickly become a 'Dog,' tying up capital and requiring markdowns to clear.

Inditex's agile supply chain and swift inventory management are crucial for identifying and addressing these 'Dogs.' By quickly marking down or removing underperforming items, the company prevents the accumulation of unsold stock, a strategy that proved effective in managing inventory levels throughout 2024, minimizing capital tie-ups and operational drag.

Experimental product lines or digital initiatives that fail to gain market traction also fit the 'Dog' profile. If a niche collection, like sustainable activewear tested in select markets in 2023, shows less than a 1% contribution to overall revenue, Inditex will discontinue it to reallocate resources to more promising ventures.

| Category | Description | Performance Indicators | Inditex Action | Example (2023-2024) |

| Physical Stores | Older, smaller, or less productive store formats in declining areas. | Low sales growth, diminishing market share, declining footfall. | Closure or optimization of underperforming units. | Closure of 17 stores in 2023 as part of ongoing optimization. |

| Product Collections | Legacy or less popular seasonal clothing lines. | Low sales volume, minimal growth potential, slow inventory turnover. | Swift markdowns, removal from inventory, agile supply chain management. | Unsold winter coat designs from early 2024 requiring significant discounts. |

| Experimental Ventures | Niche product lines or digital enhancements that fail to gain traction. | Low market share, stagnant growth rates, insufficient customer engagement. | Phased discontinuation, resource reallocation to core or promising segments. | Testing of a niche sustainable activewear collection in 2023 showing <1% revenue contribution. |

Question Marks

Inditex's strategic push into new geographic territories, like its planned 2025 expansion into Iraq across all its brands and Bershka's entry into Sweden, alongside Oysho's move into the Netherlands and Germany, positions these ventures as potential Stars or Question Marks within the BCG framework. These markets, while offering substantial growth prospects, currently represent low market penetration for Inditex, necessitating considerable capital infusion to build brand presence and capture market share.

The Zara Pre-Owned platform, a recent addition to Inditex's portfolio, is positioned as a potential 'Question Mark' within the BCG Matrix. Launched initially in the UK and slated for expansion to other major markets by 2025, it enters the rapidly expanding second-hand fashion sector.

While its current market share is minimal compared to Zara's core operations, the platform taps into a significant and growing consumer appetite for sustainable and circular fashion. This venture demands considerable investment in logistics and building consumer engagement to ascend to 'Star' status.

Inditex's highly innovative and experimental sustainable fashion lines, focusing on materials like Loopamid 6, a circular nylon, and next-generation fibers, represent a significant investment in the future of the industry. These ventures are currently in their early stages, meaning their market share is small, but they are positioned within the booming sustainable fashion market, which saw global sales reach an estimated $7.7 billion in 2023 and is projected to grow significantly.

These cutting-edge collections demand considerable research and development, alongside robust marketing efforts, to achieve wider consumer acceptance and scale. The company's commitment to these experimental lines underscores a strategic bet on the long-term viability and consumer demand for truly circular and environmentally conscious apparel, even if initial returns are not yet substantial.

Advanced Digital Experience Features

Inditex is actively integrating advanced digital features like augmented reality fitting rooms and live streaming sales. These innovations aim to boost customer engagement and online sales, representing a high-growth area.

However, these digital experiences are still in their nascent stages, meaning their market share is comparatively small against established sales methods. This necessitates continued investment and development to fully realize their potential.

- Augmented Reality Fitting Rooms: Enhancing online try-on experiences.

- Streaming Sales Platforms: Creating interactive and immediate shopping opportunities.

- Early Adoption Phase: Indicating high growth potential but currently limited market penetration.

- Investment Requirement: Ongoing capital is needed for refinement and scaling these technologies.

Emerging Product Categories with High Growth Ambition

Inditex actively cultivates emerging product categories, often within its established brands, to capitalize on shifting consumer preferences. A prime example is the expansion of athleisure wear, notably within Oysho, which taps into the growing demand for comfortable yet stylish activewear. These nascent categories, while currently holding a smaller market share, are strategically positioned to attract high-growth consumer segments, demanding dedicated investment in product development, brand promotion, and efficient supply chains to secure a substantial foothold in expanding markets.

These emerging areas are crucial for Inditex's long-term growth strategy, aiming to capture significant market share by aligning with evolving lifestyle trends. For instance, the athleisure trend has seen considerable momentum, with the global activewear market projected to reach approximately $547 billion by 2028, indicating substantial growth potential. Inditex's proactive approach in developing these categories allows it to be agile and responsive to market dynamics.

- Athleisure Growth: The global athleisure market is experiencing robust expansion, driven by increased health consciousness and demand for versatile clothing.

- Oysho's Focus: Oysho has strategically invested in its athleisure offerings, aiming to capture a larger share of this burgeoning market.

- Investment Strategy: Inditex allocates focused resources towards design innovation, targeted marketing campaigns, and optimized distribution for these high-potential categories.

- Market Capture: The objective is to quickly gain traction and establish a dominant presence in these expanding consumer segments.

Inditex's ventures into new markets, such as its planned 2025 expansion into Iraq, and the development of its Zara Pre-Owned platform, are prime examples of Question Marks. These initiatives require significant investment to build brand recognition and market share in nascent or evolving sectors. The company's exploration of innovative sustainable materials and advanced digital features like AR fitting rooms also falls into this category, demanding substantial capital for research, development, and consumer adoption to potentially become future Stars.

| Initiative | Market Status | Growth Potential | Investment Needs | BCG Category |

|---|---|---|---|---|

| Iraq Expansion (2025) | Low Market Penetration | High | Significant | Question Mark |

| Zara Pre-Owned | Nascent Market Share | High (Circular Fashion) | Moderate to High | Question Mark |

| Sustainable Materials (Loopamid 6) | Early Stage | Very High (Sustainability Trend) | High (R&D Intensive) | Question Mark |

| AR Fitting Rooms | Early Adoption | High (Digital Retail) | Moderate | Question Mark |

BCG Matrix Data Sources

Our Inditex BCG Matrix is built on a foundation of comprehensive financial disclosures, including annual reports and quarterly earnings, alongside robust market research and competitor analysis.