Inditex Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inditex Bundle

Inditex masterfully leverages its agile product development, competitive pricing, expansive global reach, and dynamic promotional strategies to dominate the fast-fashion market. This analysis delves into how their integrated 4Ps create a powerful customer proposition.

Dive deeper into the specific product trends Inditex capitalizes on, their strategic pricing tiers, the effectiveness of their omnichannel distribution, and the innovative promotional campaigns that drive constant engagement. Unlock these actionable insights and a ready-to-use template.

Product

Inditex, primarily through Zara, exemplifies fast fashion by bringing new designs from concept to store in a remarkable two to three weeks. This agility ensures its collections are always current, treating fashion as a rapidly consumable item.

This speed is powered by a vertically integrated supply chain, allowing Inditex to minimize unsold stock and maintain a constant sense of novelty for shoppers. For instance, Zara's ability to respond to trends is a key driver of its success, with new items frequently appearing on racks, reflecting real-time fashion shifts.

Inditex masterfully leverages a diverse brand portfolio, encompassing names like Zara, Pull&Bear, Massimo Dutti, Bershka, Stradivarius, Oysho, and Zara Home. Each brand is meticulously crafted to appeal to specific customer segments, offering distinct styles and price architectures.

This strategic brand segmentation allows Inditex to capture a significant portion of the global fashion market. For instance, Zara is renowned for its fast-fashion approach, delivering runway-inspired looks at accessible price points, while Massimo Dutti appeals to a more sophisticated consumer seeking premium, enduring styles. This broad market coverage is a cornerstone of their product strategy.

In the first quarter of 2024, Inditex reported a notable 7% increase in net sales, reaching €8.19 billion, underscoring the success of its multi-brand approach in resonating with a wide consumer base across various fashion preferences.

Inditex's product strategy in clothing, accessories, and home furnishings is expansive, catering to a wide audience. Beyond apparel for men, women, and children, brands like Zara Home offer a comprehensive selection of accessories and home decor, fostering a complete lifestyle approach. This broad product portfolio encourages customers to engage with multiple Inditex brands, increasing overall customer lifetime value.

The company's commitment to variety and innovation is evident in its frequent launch of new collections across all its brands. For instance, in the first quarter of fiscal year 2024 (ending April 30, 2024), Inditex reported a 7% increase in net sales, reaching €8.19 billion, reflecting the success of its dynamic product offerings in meeting evolving consumer demands.

Commitment to Sustainability

Inditex's commitment to sustainability is a core element of its marketing strategy, influencing product development and customer perception. The company has set a clear target for 2030: 100% of its textile products will utilize lower-impact materials. As of 2024, they've already reached 73% of this goal, demonstrating significant progress.

This focus on materials extends to specific commitments for 2025, including the increased use of organic, sustainable, or recycled cotton, linen, and polyester. Inditex is also investing in innovative practices to further its environmental agenda.

- Materials Goal: Aiming for 100% lower-impact materials in textile products by 2030, with 73% achieved in 2024.

- 2025 Material Targets: Increased use of organic, sustainable, or recycled cotton, linen, and polyester.

- Operational Investments: Implementing water-saving dye technologies and supporting regenerative agriculture.

- Plastic Reduction: Elimination of single-use plastic bags from stores, with a broader goal for all customer-facing single-use plastics by 2023.

Data-Driven Development

Inditex's product development is deeply rooted in data, using real-time insights from its vast network of physical stores and online channels. This allows them to gauge immediate customer reactions and preferences, feeding directly into the creation of new collections. For instance, by analyzing sales data and online engagement, they can quickly identify trending styles and colors. This agile approach ensures their offerings remain highly relevant in a fast-paced fashion market.

The company actively integrates advanced technologies, including AI-powered trend forecasting, to anticipate future consumer demand. This proactive strategy helps Inditex stay ahead of market shifts and potential fads. Their ability to quickly adapt product lines based on this data minimizes the risk of overstocking unpopular items, leading to more efficient inventory management and reduced waste. In 2023, Inditex reported a significant increase in sales, partly attributed to their responsive product development cycles.

- Real-time Data Integration: Inditex analyzes sales, online traffic, and social media sentiment to inform product design.

- AI for Trend Forecasting: Utilizes artificial intelligence to predict upcoming fashion trends and consumer desires.

- Demand-Driven Production: Ensures collections align with current customer preferences, boosting sales and minimizing unsold inventory.

- Waste Reduction: Agile product development based on data insights leads to more efficient resource allocation and less environmental impact.

Inditex's product strategy is characterized by its rapid response to fashion trends, a diverse brand portfolio catering to distinct market segments, and an increasing focus on sustainability. Their ability to bring new designs from concept to store in a matter of weeks, exemplified by Zara, ensures collections are always current and highly desirable.

The company's broad product offering spans clothing, accessories, and home furnishings across brands like Zara, Pull&Bear, and Zara Home, fostering a comprehensive lifestyle approach. This multi-brand strategy, which saw Inditex achieve net sales of €8.19 billion in Q1 2024, allows them to capture a significant share of the global fashion market by appealing to a wide array of consumer preferences and price points.

Furthermore, Inditex is making significant strides in sustainability, aiming for 100% lower-impact materials in textile products by 2030, having already achieved 73% in 2024. This commitment is reinforced by 2025 targets for increased use of organic, sustainable, or recycled materials and operational investments in eco-friendly practices.

Data-driven product development, leveraging real-time sales and online engagement, is central to Inditex's success. This allows for agile adaptation to customer preferences and efficient inventory management, minimizing waste and maximizing relevance in the fast-paced fashion industry.

| Brand | Target Segment | Key Product Focus | Price Point |

|---|---|---|---|

| Zara | Trend-conscious, young adults | Fast-fashion apparel, accessories | Accessible |

| Pull&Bear | Youthful, casual | Streetwear, casual apparel | Accessible |

| Massimo Dutti | Sophisticated, professional | Premium apparel, classic styles | Mid-to-High |

| Bershka | Teenagers, young women | Trendy apparel, accessories | Accessible |

| Stradivarius | Young women, feminine | Fashionable apparel, accessories | Accessible |

| Oysho | Women | Lingerie, sleepwear, activewear | Accessible |

| Zara Home | Homeowners, design-conscious | Home decor, textiles, accessories | Mid-range |

What is included in the product

This analysis offers a comprehensive breakdown of Inditex's marketing mix, examining how its agile Product development, accessible Price points, strategically placed retail and online Place, and integrated Promotion efforts drive its global success.

It's designed for professionals seeking to understand Inditex's core marketing strategies, providing actionable insights into their fast-fashion model and competitive positioning.

Simplifies the complexities of Inditex's marketing strategy, offering a clear and actionable framework to address common challenges in fast fashion marketing.

Provides a concise overview of Inditex's 4Ps, enabling quick identification of strengths and weaknesses to overcome market entry or expansion hurdles.

Place

Inditex boasts an extensive global retail network, a cornerstone of its marketing strategy. As of the close of 2024, the company operated 5,563 stores across 97 markets, demonstrating a vast physical footprint designed for maximum customer reach. This network is set to expand further with planned entry into Iraq in 2025.

These retail locations are meticulously chosen, typically found in prime, high-traffic areas like major shopping streets and popular malls. This strategic placement ensures high visibility and easy accessibility for consumers, a key element in driving footfall and sales.

While Inditex optimized its store portfolio in 2024, leading to a slight decrease in the overall number of stores, the focus remains on enhancing the customer experience. The company is prioritizing larger, more productive flagship stores, which are designed to offer a superior shopping environment and better showcase its brands.

Inditex's robust online platforms are a cornerstone of its marketing strategy, complementing its vast physical store network. In 2024, e-commerce sales surged by 12%, exceeding €10 billion and underscoring the growing importance of digital channels. This digital presence spans 214 markets globally.

The company's commitment to digital infrastructure is evident in its substantial investments, aimed at ensuring seamless transactions and a unified omnichannel experience. This focus on user experience is crucial for customer retention in the competitive online retail landscape.

Customer engagement is exceptionally high, with 218 million active app users and a staggering 8.1 billion online visits recorded in 2024. These figures highlight the effectiveness of Inditex's digital strategy in attracting and retaining a massive customer base.

Inditex's integrated omnichannel strategy is a cornerstone of its success, seamlessly merging online and in-store experiences. This approach is evident in features like automated online order collection points in physical stores and the 'Store Mode' functionality within the Zara app, which enhances customer convenience and operational efficiency.

The company's commitment to optimizing its commercial spaces and integrating technology across all touchpoints directly supports its online platforms and boosts sales productivity. For instance, in the first half of fiscal year 2024, Inditex reported a 7% increase in online sales, contributing significantly to its overall revenue growth, demonstrating the effectiveness of this unified approach.

Strategic Logistics and Distribution

Inditex's strategic approach to logistics and distribution is a cornerstone of its success, enabling swift global product deployment. The company's vertically integrated supply chain allows for unparalleled speed in getting new fashion items from design to store shelves worldwide.

This efficiency is backed by substantial investment, with Inditex earmarking €1.8 billion for logistics enhancements across 2024 and 2025. This significant capital allocation aims to bolster capacity and support ongoing global expansion.

A prime example of this investment is the new Zara distribution center in Zaragoza, slated for operational launch in summer 2025. This facility is designed to further accelerate delivery times and optimize the flow of goods.

- €1.8 billion allocated for logistics investments in 2024-2025.

- Summer 2025 target for the opening of the new Zara distribution center in Zaragoza.

- Vertical integration of the supply chain as a key driver of rapid distribution.

Continuous Market Expansion

Inditex is aggressively pursuing continuous market expansion, a cornerstone of its global strategy. In 2024 alone, the company launched new stores across 47 different markets, notably entering Uzbekistan. This push signifies a commitment to reaching new customer bases and solidifying its international presence.

Looking ahead to 2025, Inditex is set to further deepen its penetration in key European regions. Specific brand expansions include Bershka's debut in Sweden, Oysho's entry into the Netherlands and Germany, and Stradivarius's launch in Austria. These strategic moves highlight Inditex's targeted approach to growth within established and emerging fashion markets.

Furthermore, Inditex has demonstrated resilience and a proactive stance by resuming operations in markets such as Venezuela and Ukraine. This re-engagement underscores the company's long-term vision and its ability to adapt to evolving geopolitical and economic landscapes, ensuring a persistent global growth trajectory.

- 2024: New store openings in 47 markets, including Uzbekistan.

- 2025 Plans: Bershka to launch in Sweden, Oysho in the Netherlands and Germany, Stradivarius in Austria.

- Market Re-entry: Resumed operations in Venezuela and Ukraine.

Inditex's 'Place' strategy is characterized by a vast, strategically located global store network and a robust, expanding online presence. The company operated 5,563 stores across 97 markets as of the end of 2024, with plans to enter Iraq in 2025. This physical footprint is complemented by a strong digital strategy, evidenced by e-commerce sales exceeding €10 billion in 2024, a 12% increase year-over-year, reaching 214 markets.

The company prioritizes prime, high-traffic locations for its physical stores, enhancing visibility and accessibility. Simultaneously, Inditex is investing heavily in its online infrastructure, aiming for a seamless omnichannel experience, evident in features like in-store online order collection. This integrated approach, supported by 218 million active app users in 2024, drives significant customer engagement and sales productivity.

| Metric | 2024 Data | 2025 Outlook |

|---|---|---|

| Global Store Count | 5,563 | Expansion into new markets planned |

| Markets Served (Physical) | 97 | Entry into Iraq |

| E-commerce Sales Growth | 12% | Continued growth expected |

| Markets Served (Online) | 214 | Ongoing expansion |

| Active App Users | 218 million | Expected to grow |

Preview the Actual Deliverable

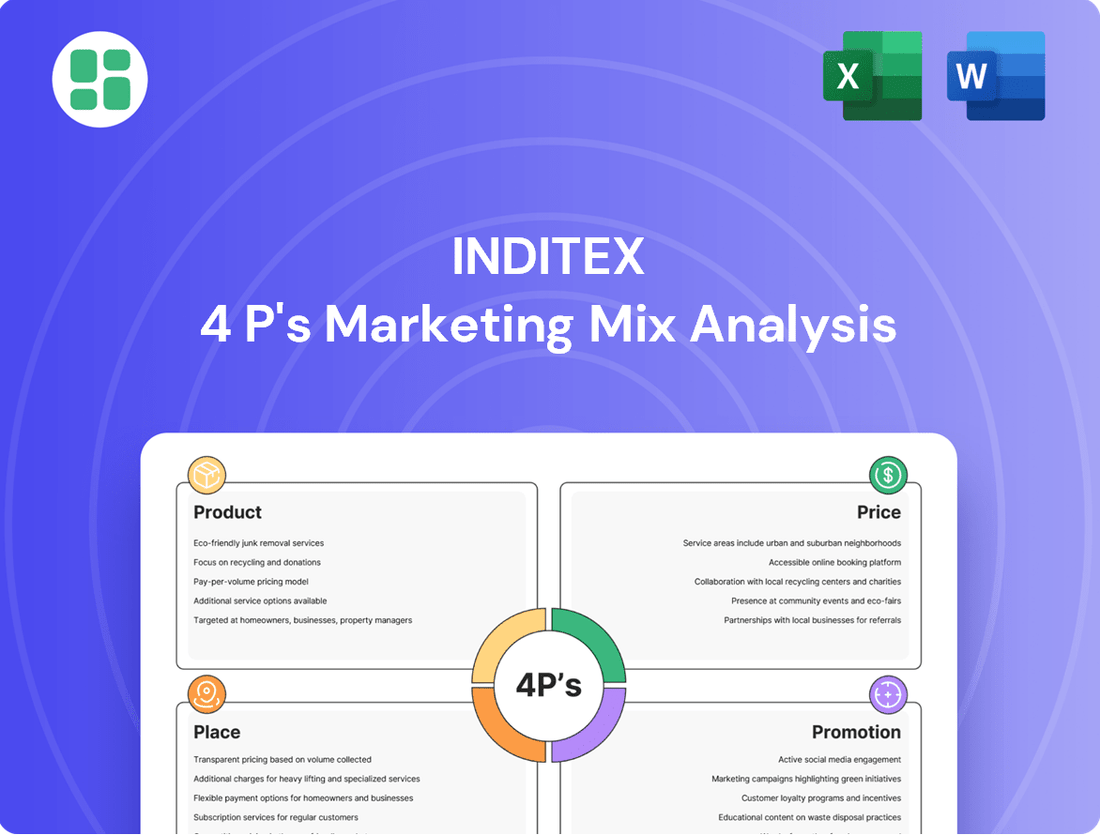

Inditex 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Inditex 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain valuable insights into how Inditex effectively manages these elements to maintain its competitive edge in the global fashion market.

Promotion

Inditex, especially its flagship brand Zara, largely sidesteps traditional advertising and celebrity endorsements. This focus on minimal paid promotion means the company relies heavily on organic buzz, social media, and the inherent appeal of its rapidly changing collections to capture consumer attention.

This strategy cultivates brand loyalty through consistent, high-frequency product releases and a distinctive in-store experience, rather than relying on overt promotional campaigns. For instance, Zara's approach prioritizes creating desire through product availability and visual merchandising, a stark contrast to competitors who often invest heavily in widespread advertising.

Zara's promotional strategy is intrinsically linked to its product, with new collections hitting stores every week. This rapid replenishment cycle ensures a constant stream of fresh inventory, making the product itself the primary driver of customer interest and repeat visits.

The speed at which Zara moves from design concept to shop floor is remarkable, often taking just a few weeks. This agility means that the latest fashion trends are quickly translated into tangible products, effectively turning the product's newness into a continuous marketing campaign. By the end of 2023, Inditex reported a 10% increase in sales, partly fueled by this product-centric approach.

Inditex views its physical stores as crucial brand ambassadors, investing heavily in creating immersive experiences. These aren't just places to buy clothes; they are designed to reflect the brand's identity, often featuring minimalist aesthetics and prime locations to attract shoppers. For instance, Zara's flagship stores, like the one on Fifth Avenue in New York, exemplify this, offering a sophisticated yet approachable atmosphere.

The strategic placement of stores in high-traffic, premium areas is a cornerstone of Inditex's retail strategy. This ensures maximum visibility and accessibility, reinforcing the brand’s image. By prioritizing prime real estate, Inditex ensures its stores are not just points of sale but also significant touchpoints for brand engagement and discovery.

Innovation in store design extends to integrating technology to enhance the customer journey. Some Inditex brands are experimenting with features like augmented reality for virtual try-ons, aiming to blend the digital and physical shopping realms. This forward-thinking approach, seen in pilot programs, aims to make shopping more interactive and convenient for the modern consumer.

Digital Marketing & Social Media Engagement

Inditex, particularly its flagship brand Zara, has significantly shifted its promotional strategy towards digital channels, minimizing traditional advertising. This approach focuses on building direct engagement with customers through social media platforms.

The company masterfully employs visually rich content, integrating user-generated posts and collaborations with influencers to foster a strong sense of community and brand loyalty. By 2025, Zara's digital presence is characterized by a substantial following across platforms like Instagram and TikTok, with millions of engaged users.

Further enhancing its digital promotion, Inditex has been evolving its online presentation. In 2025, Zara's website and mobile applications feature increasingly relatable, lifestyle-oriented imagery, moving beyond purely product-focused visuals to inspire and connect with consumer aspirations.

- Digital Focus: Inditex prioritizes digital marketing over traditional advertising to connect with its audience.

- Engagement Tactics: Utilizes visually appealing content, user-generated content, and influencer marketing for brand engagement.

- Social Media Reach: Zara boasts millions of followers across key social media platforms, demonstrating significant digital reach.

- Lifestyle Branding: By 2025, Zara's online platforms emphasize relatable, lifestyle-driven imagery to enhance customer connection.

Scarcity and Exclusivity

Inditex masterfully leverages scarcity and exclusivity within its marketing mix. By releasing new collections frequently in limited quantities, they cultivate an environment where popular items are quickly snapped up. This constant refresh means customers are motivated to buy immediately, fearing items might disappear.

This approach directly fuels impulse purchases. For instance, during peak seasons in 2024, reports indicated that certain Zara collections sold out within days of their release. This rapid turnover, combined with a deliberate policy of infrequent and minimal discounts, significantly elevates the perceived value of Inditex's offerings.

The result is a powerful reinforcement of brand desirability. Customers feel they are acquiring something special, not just another mass-produced item.

- Limited Inventory: Inditex's strategy of releasing small, frequently updated batches of styles.

- Impulse Purchase Driver: Scarcity encourages immediate buying due to the fear of items not being available later.

- Value Enhancement: Minimal discounting policy boosts the perceived worth of products.

- Brand Appeal: Exclusivity reinforces the unique and desirable image of Inditex brands.

Inditex's promotional strategy is characterized by a strong digital focus, emphasizing social media engagement and visually rich content over traditional advertising. By 2025, Zara commands millions of followers across platforms like Instagram and TikTok, utilizing user-generated content and influencer collaborations to build community and loyalty.

The brand's online presence, including its website and mobile apps, features increasingly relatable, lifestyle-oriented imagery, aiming to connect with consumer aspirations beyond just product display. This digital-first approach, coupled with a strategy of limited inventory and minimal discounting, drives desirability and impulse purchases, with certain collections reportedly selling out within days during 2024.

| Promotion Tactic | Description | Impact | 2024/2025 Data Point |

|---|---|---|---|

| Digital Marketing | Social media engagement, user-generated content, influencer collaborations | Brand loyalty, community building | Millions of followers across Instagram and TikTok by 2025 |

| Scarcity & Exclusivity | Limited quantities, frequent collection drops, minimal discounting | Impulse purchases, perceived value enhancement | Certain collections sold out within days in 2024 |

| In-Store Experience | Prime locations, minimalist aesthetics, experiential design | Brand reinforcement, customer attraction | Continued investment in flagship store presence |

Price

Inditex, with its flagship brand Zara, employs a market-oriented pricing strategy, adjusting prices based on what the market will bear and competitor pricing. This agile approach allows them to capitalize on fast fashion cycles and consumer demand. For instance, during their Spring/Summer 2024 collections, Zara was observed to strategically price new arrivals to capture immediate interest, with some items seeing minor adjustments within weeks based on initial sales velocity and competitor reactions.

This dynamic pricing model is crucial for Inditex's business. By closely monitoring sales data and inventory levels, they can quickly adjust prices to move stock efficiently and maximize revenue. For example, end-of-season sales in late 2024 saw significant price reductions on items that didn't meet initial sales targets, a direct reflection of this market-responsive strategy.

Zara masterfully positions itself as an affordable luxury brand, delivering on-trend, quality fashion at prices accessible to the middle market. This strategic balance allows fashion-forward consumers to embrace the latest styles without the prohibitive cost of designer labels.

The brand's core value proposition lies in offering fashion-forward products at reasonable price points, ensuring customers feel they are receiving excellent perceived value. For instance, in 2024, Inditex reported strong sales growth, with Zara’s performance a key driver, indicating the continued success of this accessible luxury model.

Inditex employs a dynamic pricing strategy, frequently adjusting prices based on real-time market data, demand, seasonality, and inventory. For instance, during the 2024 spring season, Inditex observed strong demand for lighter apparel, leading to strategic price adjustments on these items to capitalize on consumer interest while managing stock levels.

Geographical pricing is another cornerstone, with prices varying significantly across markets. This reflects local economic conditions, consumer purchasing power, and competitive landscapes. In 2024, for example, Inditex maintained competitive pricing in emerging markets like India, where average disposable incomes are lower, while adopting a slightly higher price point in countries with stronger economies and higher consumer spending, such as Germany.

Cost Leadership through Efficient Operations

Inditex's cost leadership is deeply rooted in its highly efficient and vertically integrated supply chain. This integration, from initial design to final distribution, allows for tight control and rapid response to market trends, minimizing lead times and inventory holding costs.

The company's 'just-in-time' production model is a cornerstone of this efficiency. By producing garments in smaller batches and frequently replenishing stock, Inditex significantly reduces the risk of overproduction and markdowns. For instance, in its fiscal year 2023, Inditex reported a net sales increase of 10% to €35.9 billion, demonstrating the effectiveness of its operational model in driving growth while maintaining competitive pricing.

- Vertical Integration: Inditex controls a substantial portion of its supply chain, enabling swift adaptation to fashion cycles.

- Just-in-Time Production: Minimizes inventory and waste, leading to lower operational costs.

- Efficient Distribution: Centralized distribution centers and rapid logistics ensure timely delivery to stores worldwide.

- Cost Savings: These efficiencies translate into competitive pricing for consumers and healthy profit margins for the company.

Strategic Use of Discounts & Promotions

Inditex, while aiming to preserve brand image through predominantly full-price offerings, strategically deploys discounts and promotions. These are typically concentrated around seasonal transitions or major shopping events, serving as a critical tool for inventory management. For example, Zara's 'high-low' pricing model sees initial higher prices for new collections, with subsequent markdowns to clear unsold stock efficiently. This dual approach supports profit maximization on trendy items while mitigating losses on slower-moving inventory.

In 2023, Inditex's commitment to managing inventory through strategic pricing was evident. While specific discount percentages are not publicly detailed for individual sales events, the company's operational model relies on swift inventory turnover. This allows for fewer deep, prolonged discounts compared to some competitors. The effectiveness of this strategy is reflected in Inditex's consistent financial performance, with reported net sales reaching €35.9 billion for the fiscal year ending January 31, 2024, indicating strong demand even at initial price points.

- Seasonal Sales: Promotions are often tied to the end of spring/summer and autumn/winter collections.

- Inventory Clearance: Discounts help move older stock to make way for new fashion arrivals.

- Zara's Pricing: A 'high-low' strategy is employed, starting with higher prices and reducing them if necessary.

- Brand Perception: The focus remains on full-price sales to maintain an image of value and exclusivity.

Inditex's pricing strategy is a dynamic blend of market responsiveness and value perception, positioning Zara as accessible luxury. They adjust prices based on demand, competitor actions, and inventory levels, a crucial element in their fast-fashion model. This is exemplified by their approach to new collections in 2024, where initial pricing aimed to capture immediate consumer interest, with some adjustments occurring based on sales velocity.

Geographical variations in pricing are also significant, reflecting local economic conditions and purchasing power. For instance, in 2024, pricing in emerging markets like India was more competitive than in stronger economies like Germany. This strategy ensures Inditex remains relevant across diverse global markets.

The company leverages its efficient, vertically integrated supply chain to maintain cost leadership, enabling competitive pricing. Their 'just-in-time' production minimizes inventory costs and waste, a key factor in their fiscal year 2023 net sales of €35.9 billion. This operational efficiency underpins their ability to offer trend-driven fashion at accessible price points.

Inditex strategically uses discounts primarily for inventory management, often during seasonal transitions. Zara's 'high-low' pricing model starts with higher prices for new arrivals, with subsequent markdowns to clear stock. This approach, evident in their 2023 performance, balances profit on trendy items with loss mitigation on slower-moving inventory, contributing to their robust financial results.

| Pricing Strategy Element | Description | Example/Data Point (2023-2024) |

|---|---|---|

| Market-Oriented Pricing | Adjusting prices based on market demand and competitor pricing. | Strategic pricing of Spring/Summer 2024 collections to capture immediate interest. |

| Dynamic Pricing | Frequent price adjustments based on real-time data, demand, and inventory. | End-of-season sales in late 2024 saw significant price reductions on unsold items. |

| Geographical Pricing | Varying prices across markets based on local economic conditions and purchasing power. | Competitive pricing in India versus slightly higher pricing in Germany during 2024. |

| Value-Based Pricing | Positioning as affordable luxury, offering trend-driven fashion at accessible price points. | Strong sales growth in 2024 driven by Zara's accessible luxury model. |

| Promotional Pricing | Strategic use of discounts for inventory clearance, often seasonally. | 'High-low' pricing model in Zara, with markdowns to clear stock efficiently. Fiscal year 2023 net sales: €35.9 billion. |

4P's Marketing Mix Analysis Data Sources

Our Inditex 4P's Marketing Mix Analysis leverages a comprehensive blend of proprietary retail data, including sales figures, inventory levels, and customer purchasing patterns. This is augmented by publicly available information such as annual reports, investor relations materials, and competitor pricing strategies.