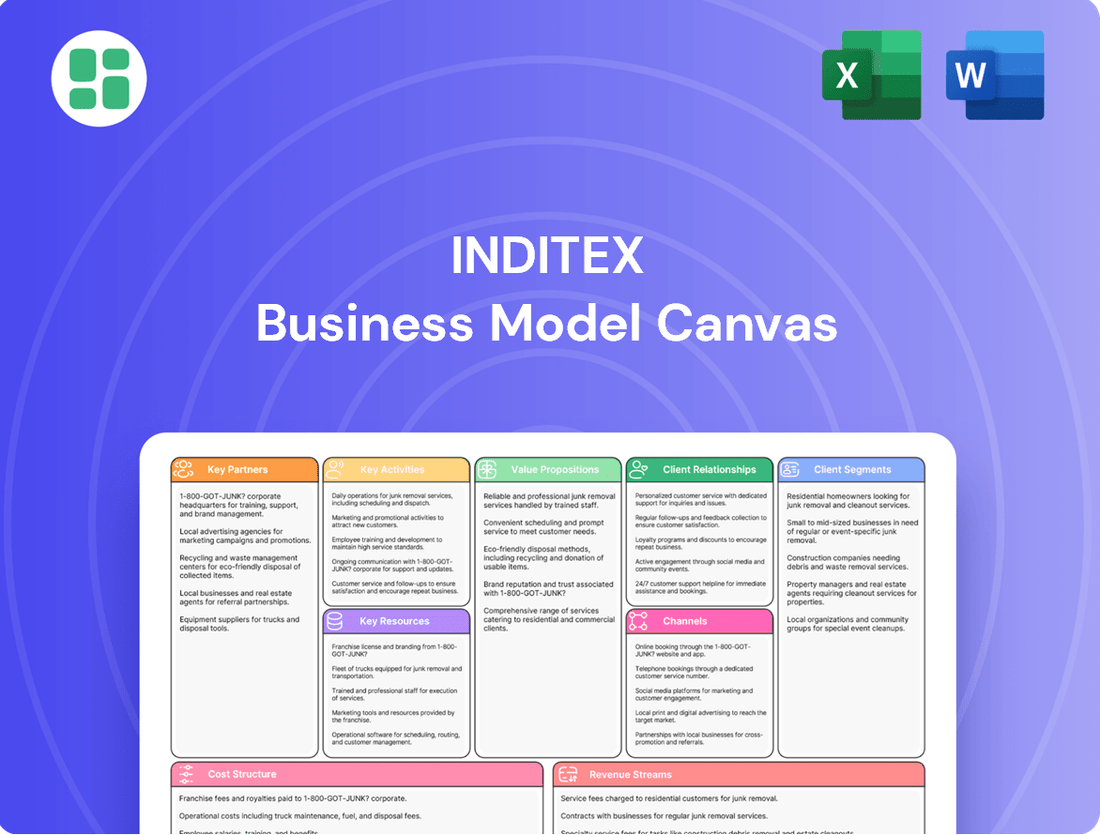

Inditex Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inditex Bundle

Discover the agile engine behind Inditex's fashion empire with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, key resources, and revenue streams, revealing the secrets to their rapid market responsiveness and global reach. Perfect for anyone seeking to understand and replicate fast-fashion success.

Partnerships

Inditex leverages a vast global supplier network for everything from raw materials like cotton and polyester to the actual manufacturing of garments. This extensive reach is a cornerstone of their fast-fashion strategy, enabling them to quickly adapt to changing trends and consumer demand. In 2023, Inditex worked with thousands of suppliers across various countries, highlighting the scale of this critical partnership.

This diverse sourcing capability is vital for maintaining product variety and ensuring competitive pricing. While Inditex does have some in-house production, relying on external partners allows them to scale efficiently and offer a wide array of styles. The company's commitment to supplier relationships is evident in their efforts to ensure ethical and sustainable practices throughout this complex supply chain.

Inditex relies heavily on its logistics and shipping providers to ensure its fast-fashion model thrives, enabling rapid movement of goods from production to its vast network of stores and online customers. These partnerships are critical for maintaining the speed and efficiency required to get new styles to market quickly.

The company's commitment to strengthening these capabilities is evident in its substantial investments in logistics infrastructure. For instance, in 2024, Inditex continued its expansion of distribution centers, aiming to optimize inventory management and delivery times across its global operations, reflecting the ongoing importance of these relationships.

Inditex actively collaborates with leading technology and innovation firms to integrate advanced solutions across its value chain. This includes partnerships for implementing RFID tracking, which significantly improves inventory management and stock accuracy. For instance, by 2024, Inditex has been a pioneer in utilizing RFID across its brands, enabling real-time visibility of garments from factory to store, a key factor in its efficient stock turnover.

These alliances are crucial for developing and deploying AI-driven demand forecasting models, allowing Inditex to better predict fashion trends and optimize production. Furthermore, collaborations extend to augmented reality applications for enhanced in-store and online customer experiences, as well as sophisticated e-commerce platforms. These technological integrations are fundamental to Inditex's strategy of maintaining operational excellence and a superior customer journey.

Sustainability Initiatives Partners

Inditex actively fosters key partnerships through its Sustainability Innovation Hub, engaging with over 350 startups. This collaboration is crucial for developing and implementing innovative sustainable practices, with a strong emphasis on lower-impact materials and circular economy principles.

These partnerships are vital for driving Inditex's commitment to environmental and social responsibility. The company supports a wide array of social and environmental projects globally, underscoring the broad reach and impact of these strategic alliances.

- Sustainability Innovation Hub: Collaborates with over 350 startups to advance sustainable practices.

- Focus Areas: Development of lower-impact materials and implementation of circular economy principles.

- Global Reach: Support for social and environmental projects worldwide signifies broad partnership impact.

Retail Space Landlords and Developers

Inditex’s vast network of physical stores necessitates strong collaborations with retail space landlords and property developers worldwide. These partnerships are crucial for securing prime locations and optimizing store footprints, ensuring visibility and accessibility for customers.

The company’s strategy emphasizes fewer, larger, and more technologically integrated stores. This approach aims to enhance the overall customer experience by offering a more engaging and seamless shopping journey, blending physical and digital elements.

For instance, in 2023, Inditex continued its store optimization program, which includes refurbishments and openings of larger, more advanced stores. This ongoing investment in physical retail real estate underscores the importance of these landlord and developer relationships.

- Strategic Location Acquisition: Partnerships enable Inditex to secure high-traffic retail spaces in key urban centers and shopping destinations globally.

- Store Format Optimization: Collaborations facilitate the development of larger, more efficient store formats designed for an enhanced customer experience and integration of digital services.

- Real Estate Portfolio Management: These relationships are vital for managing Inditex's extensive global real estate portfolio, ensuring alignment with the company's evolving retail strategy.

Inditex's key partnerships extend to financial institutions and technology providers, crucial for managing its global operations and e-commerce expansion. These collaborations support everything from payment processing to data analytics, underpinning the company's digital transformation.

In 2024, Inditex continued to invest in its digital infrastructure, working with partners to enhance its online platform and mobile applications, aiming for seamless customer experiences across all channels. This focus on digital integration is vital for its continued growth in the online retail space.

The company also collaborates with various industry associations and research institutions to stay ahead of fashion trends and sustainability regulations. These partnerships provide valuable insights and foster innovation across the apparel sector.

What is included in the product

A dynamic and agile business model focused on rapid trend response and vertical integration, allowing Inditex to efficiently serve a broad customer base with fast fashion.

The Inditex Business Model Canvas acts as a pain point reliever by offering a clear, visual structure that simplifies the complexity of their fast-fashion operations, making it easier to identify and address inefficiencies.

Activities

Inditex's core activity revolves around the rapid design and development of new fashion collections. This process is heavily influenced by a keen eye for emerging trends, allowing the company to stay ahead of the curve.

A significant investment is made in a large team of designers and product prototypers. This dedicated workforce ensures a continuous flow of fresh and appealing designs, crucial for maintaining Inditex's fast-fashion model.

For fiscal year 2023, Inditex reported a net profit of €5.4 billion, showcasing the success of its responsive design and development strategy in a competitive global market.

Inditex's manufacturing and production are heavily centered on vertical integration, a core element enabling its renowned fast-fashion agility. This allows for rapid adjustments to collections based on real-time sales data and emerging trends, ensuring products align closely with customer desires.

The company strategically operates production facilities in locations like Spain, Portugal, and Morocco. This proximity to key markets and control over these facilities are instrumental in achieving swift turnaround times from design to store shelves, a critical advantage in the dynamic apparel industry.

In 2023, Inditex reported that approximately 59% of its merchandise was produced in factories located in Spain, Portugal, and Morocco, highlighting the significant role of its vertically integrated production model in its operational strategy.

Inditex’s logistics and distribution management is a core activity, focusing on a highly efficient global network to ensure rapid product delivery to over 6,000 stores and online customers. This agility is key to their fast-fashion model, allowing them to respond swiftly to market trends.

The company is actively investing in its logistics infrastructure. For instance, in 2023, Inditex continued its expansion of distribution centers, including significant upgrades to its facility in Zaragoza, Spain, to enhance automation and capacity, supporting its growing online sales channels.

These investments are crucial for maintaining Inditex's competitive edge by minimizing lead times from production to point of sale. By optimizing its supply chain, Inditex can offer new collections frequently, a cornerstone of its business strategy.

Retail Operations (Physical & Online)

Inditex's key activity revolves around efficiently managing its expansive retail operations, encompassing both its extensive network of physical stores and its growing online presence. This dual focus ensures a cohesive customer journey, integrating the in-store experience with digital touchpoints for seamless shopping.

The company actively optimizes its store portfolio, focusing on prime locations and store formats that enhance customer engagement and accessibility. Simultaneously, it invests heavily in its e-commerce platforms, aiming for intuitive user interfaces and robust logistics to meet evolving consumer demands. For example, in the first quarter of 2024, Inditex reported a significant increase in online sales, demonstrating the ongoing success of its digital strategy.

- Store Network Optimization: Inditex continuously refines its physical store footprint, with a focus on strategic locations and store formats that align with customer traffic and brand positioning.

- Omnichannel Integration: The company prioritizes a seamless experience between online and offline channels, allowing customers to browse, purchase, and return items across platforms.

- E-commerce Platform Enhancement: Continuous investment in user experience, website functionality, and mobile app development drives online sales growth and customer satisfaction.

- Inventory Management: Sophisticated systems ensure efficient stock allocation across both physical stores and online warehouses, minimizing stockouts and maximizing product availability.

Brand Management and Marketing

Inditex excels at brand management, cultivating distinct identities for its diverse portfolio, including Zara, Pull&Bear, and Massimo Dutti. This strategy is heavily supported by a robust social media presence and compelling visual content rather than extensive traditional advertising.

The company's marketing approach prioritizes prime store locations and the rapid introduction of new fashion items, creating a sense of urgency and constant newness for consumers. This model proved highly effective, with Inditex reporting a net sales increase of 10% in 2023, reaching €35.9 billion.

- Brand Differentiation: Each Inditex brand maintains a unique market position and customer appeal.

- Digital Marketing Focus: Strong emphasis on social media and visual storytelling for customer engagement.

- Location Strategy: Prime retail locations are a key marketing asset, driving foot traffic and brand visibility.

- Fast Fashion Model: Rapid product turnover fuels consumer interest and repeat purchases.

Inditex's key activities are deeply rooted in its integrated supply chain and customer-centric approach. The company excels at rapid design and development, leveraging a vast network of designers to quickly translate trends into new collections. This agility is further amplified by its vertically integrated manufacturing and efficient logistics, ensuring products reach stores and online customers with remarkable speed. Furthermore, Inditex actively manages its extensive retail operations, optimizing both physical stores and e-commerce platforms to provide a seamless omnichannel experience.

In 2023, Inditex demonstrated exceptional financial performance, with net sales reaching €35.9 billion, a 10% increase year-on-year. This growth underscores the effectiveness of its business model. The company's commitment to innovation in its supply chain and retail operations is evident in its continued investments in logistics and digital platforms. For instance, ongoing upgrades to distribution centers aim to further enhance speed and efficiency, supporting its global expansion and fast-fashion strategy.

| Key Activity | Description | Recent Performance/Investment |

|---|---|---|

| Design & Development | Rapid creation of new fashion collections based on trend analysis. | Influenced by a large design team, driving continuous product innovation. |

| Manufacturing & Production | Vertically integrated model with production in Spain, Portugal, and Morocco. | In 2023, approximately 59% of merchandise was produced in these proximity locations. |

| Logistics & Distribution | Highly efficient global network for rapid product delivery. | Continued investment in distribution centers, such as Zaragoza, Spain, for automation and capacity. |

| Retail Operations | Management of a vast network of physical stores and growing e-commerce presence. | Significant increase in online sales reported in Q1 2024; optimization of store portfolio. |

| Brand Management & Marketing | Cultivating distinct brand identities with a focus on digital marketing and prime locations. | Net sales increased by 10% in 2023, reaching €35.9 billion, driven by rapid product turnover and visual content. |

What You See Is What You Get

Business Model Canvas

The Inditex Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you'll gain immediate access to the complete, professionally structured analysis, mirroring this preview precisely. You can be confident that what you see is precisely what you'll get, ready for your immediate use and customization.

Resources

Inditex's strength lies in its diverse and globally recognized brand portfolio, featuring names like Zara, Pull&Bear, Massimo Dutti, and Bershka. These brands cater to a wide array of customer preferences and price points, forming a significant competitive advantage.

In 2023, Inditex reported a net sales increase of 10% to €35.9 billion, demonstrating the continued appeal and market penetration of its established brands. This robust performance underscores the value and consumer loyalty associated with its brand portfolio.

Inditex’s vast global physical store network, numbering over 5,600 stores as of early 2024, continues to be a cornerstone of its business model. These locations serve as vital customer interaction points, reinforcing brand presence and facilitating the seamless integration of online and offline shopping experiences.

The company is strategically evolving its store portfolio, prioritizing fewer, larger, and more technologically advanced flagship stores. This approach enhances brand visibility and operational efficiency, supporting the growing demand for omnichannel services like click-and-collect and in-store returns.

Inditex’s integrated supply chain and logistics infrastructure is a cornerstone of its business model, enabling rapid response to fashion trends. This agile system, featuring strategically placed production facilities and an extensive distribution network, allows for efficient inventory management and quick delivery to stores worldwide.

The company consistently invests in upgrading this critical infrastructure. For instance, Inditex has been expanding its logistics capabilities, including the development of new distribution centers, to further streamline operations and reduce lead times, a crucial element in fast fashion.

This robust infrastructure is a significant competitive advantage, allowing Inditex to bring new designs from concept to store shelves in a matter of weeks. Their commitment to enhancing this network underscores its importance in maintaining market leadership and customer satisfaction.

Skilled Human Capital

Inditex's success hinges on its skilled human capital, especially its design and product development teams. These individuals are crucial for the rapid iteration and trend responsiveness that defines the company's fast-fashion approach. Their expertise ensures Inditex can quickly translate runway trends into commercially viable products for its global customer base.

The company recognizes its employees as a fundamental asset. Inditex's operational efficiency, particularly within its sophisticated supply chain, is directly attributable to the dedication and skill of its workforce. This human element is a key differentiator, allowing for agile production and distribution.

- Talented Workforce: Inditex employs a significant number of individuals globally, with a strong emphasis on creative and operational talent.

- Design and Development: The company's in-house design and product development teams are central to its ability to offer a constantly evolving range of fashion items.

- Supply Chain Expertise: Skilled professionals in logistics and supply chain management are vital for executing Inditex's efficient, just-in-time inventory model.

Advanced Technology and Data Analytics

Inditex leverages cutting-edge technology as a core resource, fundamentally shaping its operational efficiency and market responsiveness. This includes the widespread implementation of Radio Frequency Identification (RFID) tags across its garments, enabling real-time inventory tracking and significantly reducing stock discrepancies. For instance, by 2023, Inditex had successfully deployed RFID technology in 100% of its stores and distribution centers, enhancing inventory accuracy to over 98%.

Artificial intelligence (AI) plays a crucial role in Inditex's demand forecasting capabilities. By analyzing vast datasets, including sales history, social media trends, and even weather patterns, AI algorithms help predict consumer preferences and optimize production quantities. This data-driven approach is essential for Inditex's fast-fashion model, allowing the company to swiftly adapt to evolving market trends and minimize unsold inventory.

The company's robust e-commerce platforms are another critical technological resource, providing a seamless shopping experience for a global customer base. These platforms are continuously updated to incorporate personalized recommendations and efficient order fulfillment. In 2023, Inditex reported that online sales represented 18% of its total revenue, highlighting the importance of its digital infrastructure.

- RFID Technology: Enables precise, real-time inventory management across all channels, boosting stock efficiency.

- AI-Powered Demand Forecasting: Optimizes product assortment and production based on predictive analytics of consumer behavior and market trends.

- Advanced E-commerce Platforms: Facilitate a global, personalized, and efficient online shopping experience, driving significant revenue.

- Data Analytics: Underpins strategic decision-making, from supply chain optimization to store layout and marketing campaigns.

Inditex's intellectual property, particularly its proprietary technology and data analytics capabilities, forms a crucial part of its key resources. The company's advanced RFID system, fully implemented by 2023 across all stores and distribution centers, ensures over 98% inventory accuracy. This technological edge, combined with AI-driven demand forecasting, allows for unparalleled responsiveness to fashion trends.

The company's brand reputation and customer loyalty are invaluable intangible assets, built over years of consistent product delivery and strategic marketing. This strong brand equity allows Inditex to command market presence and maintain customer engagement across its diverse portfolio.

Inditex's integrated business model, which combines design, production, distribution, and retail, represents a significant operational resource. This end-to-end control allows for rapid adaptation and efficiency, a hallmark of its fast-fashion strategy.

Inditex's financial resources are substantial, enabling continuous investment in its global operations, technology, and store portfolio. In 2023, the company reported net sales of €35.9 billion, with a strong cash flow generation that supports its strategic growth initiatives and operational enhancements.

| Resource Category | Specific Resource | Key Benefit | 2023 Data/Impact |

|---|---|---|---|

| Intellectual Property | RFID Technology | Real-time inventory accuracy, reduced stock discrepancies | 100% store and distribution center implementation, >98% inventory accuracy |

| Intellectual Property | AI-Powered Demand Forecasting | Optimized production and assortment, minimized unsold inventory | Essential for fast-fashion responsiveness |

| Brand Equity | Global Brand Recognition (Zara, etc.) | Customer loyalty, market penetration, premium pricing potential | Net sales of €35.9 billion |

| Operational Model | Integrated Supply Chain | Rapid product-to-market speed, efficient inventory management | Enables bringing new designs to stores in weeks |

| Financial Resources | Strong Cash Flow & Investment Capacity | Funding for expansion, technology upgrades, and strategic initiatives | €35.9 billion in net sales |

Value Propositions

Inditex's core value proposition is its remarkable speed in bringing the latest fashion trends from concept to store shelves, often in as little as 15 days. This agility ensures customers consistently find the most current styles readily available.

This rapid adoption of trends means Inditex's inventory is always fresh, directly addressing consumer demand for immediate gratification in fashion. In 2024, this model continues to be a significant driver of their market leadership.

Inditex's core value proposition revolves around delivering fashion-forward, high-quality apparel at prices that are accessible to a broad consumer base. This strategy allows customers to stay on-trend without incurring the costs associated with luxury brands.

This commitment to affordability and trendiness is a significant competitive advantage. For instance, in 2024, Inditex continued to leverage its agile supply chain to rapidly introduce new collections, ensuring that its offerings reflect the latest styles seen on runways and social media.

The company's ability to offer this blend of desirable design and economic accessibility is a primary driver of its customer loyalty and market penetration. This approach has consistently translated into strong financial performance, with Inditex reporting significant revenue growth in its recent fiscal periods.

Inditex’s diverse product range, spread across brands like Zara, Pull&Bear, and Massimo Dutti, offers a vast selection of apparel, accessories, and home goods. This strategy effectively caters to varied customer preferences, age groups, and specific needs, from fast fashion trends to more classic styles.

In 2023, Inditex reported a net sales increase of 10% to €35.9 billion, demonstrating the success of its broad product offering in attracting and retaining a wide customer base across its portfolio of brands.

Seamless Omnichannel Shopping Experience

Inditex provides a seamless omnichannel shopping journey, allowing customers to transition effortlessly between its physical stores and digital channels. This integration means you can browse online, buy in-store, or even pick up online orders at a convenient location, creating a truly connected experience. This focus on digital and physical synergy significantly boosts customer convenience and satisfaction.

This commitment to an integrated experience is reflected in Inditex's robust digital infrastructure. For instance, in the first quarter of 2024, online sales represented a significant portion of their revenue, demonstrating the effectiveness of their omnichannel strategy in capturing customer engagement across all touchpoints. This approach ensures that whether a customer prefers the tactile experience of a store or the ease of online shopping, Inditex meets them where they are.

- Seamless Transition: Customers can browse online, purchase in-store, and return items purchased online to physical locations.

- Digital Integration: A consistent brand experience is maintained across all platforms, from the website to the mobile app and in-store digital touchpoints.

- Customer Convenience: Options like click-and-collect and easy returns enhance the overall shopping experience, driving loyalty.

- Data-Driven Personalization: The omnichannel approach allows Inditex to gather data for more personalized recommendations and offers, further strengthening customer relationships.

Constantly Fresh and Rotating Collections

Inditex's strategy of constantly fresh and rotating collections is a cornerstone of its business model. This approach involves releasing new items multiple times a week, creating a dynamic and ever-changing inventory. This scarcity and novelty foster a sense of urgency, compelling customers to visit stores and online platforms more frequently to avoid missing out on desirable pieces.

This rapid turnover ensures that the offering always feels new and exciting. For instance, in the first quarter of 2024, Inditex reported a 7% increase in sales, reaching €8.19 billion, a testament to the effectiveness of their fast-fashion model in driving consistent customer engagement and spending.

- Limited Inventory: Each collection has a finite amount of stock, making items feel exclusive and increasing the desire to purchase quickly.

- Frequent New Arrivals: New styles are introduced several times a week, encouraging repeat visits and impulse buys.

- Customer Urgency: The constant refresh creates a fear of missing out, driving immediate purchasing decisions.

- Brand Dynamism: This model keeps the brand perceived as trendy and relevant, adapting swiftly to evolving fashion trends.

Inditex offers fashion-forward designs at accessible price points, enabling a broad customer base to stay on-trend without the premium cost of luxury brands. This combination of style and affordability is a key differentiator.

The company's agile supply chain allows for rapid trend adoption, bringing new styles from concept to store in as little as 15 days. This speed ensures customers always find the latest fashion readily available.

Inditex provides a diverse product range across multiple brands, catering to varied tastes and needs. This breadth ensures a wide appeal and captures different market segments effectively.

An integrated omnichannel experience allows customers to seamlessly shop across physical and digital channels, enhancing convenience and satisfaction. This synergy drives customer engagement and loyalty.

| Value Proposition | Description | 2023/2024 Impact |

|---|---|---|

| Fast Fashion & Trend Responsiveness | Rapidly bringing latest styles to market, often within 15 days. | Drives consistent customer visits and purchases, reflected in strong sales growth. |

| Affordable Fashion | Offering stylish, on-trend clothing at accessible price points. | Broadens customer appeal and market penetration, supporting revenue generation. |

| Diverse Brand Portfolio | Catering to varied customer preferences with brands like Zara, Pull&Bear, Massimo Dutti. | Achieved €35.9 billion in net sales in 2023, demonstrating broad market capture. |

| Omnichannel Integration | Seamless shopping experience across online and physical stores. | Enhances customer convenience and loyalty, with significant online sales contribution in Q1 2024. |

Customer Relationships

Inditex excels in omnichannel customer service, seamlessly blending in-store and online experiences. Customers can utilize services like self-checkout and collect online orders in physical stores, demonstrating a commitment to convenience. This integrated approach ensures a consistent and supportive customer journey across all touchpoints.

Inditex actively cultivates digital engagement through its robust social media presence and dedicated online platforms. This strategy allows them to showcase new collections, share styling tips, and interact directly with their customer base, fostering a strong sense of community and brand loyalty.

By consistently updating its digital channels, Inditex keeps customers informed about the latest arrivals and trends, generating excitement and driving traffic both online and to physical stores. For instance, in the first quarter of 2024, Inditex's online sales continued to grow, reflecting the effectiveness of its digital engagement efforts.

Inditex is heavily investing in digital integration and data analytics to tailor shopping experiences. By understanding customer preferences, they aim to provide more personalized product recommendations both online and in-store. This focus on individual customer journeys is key to fostering loyalty and driving sales.

Looking ahead, Inditex is exploring innovative technologies like smart mirrors and augmented reality (AR) features within its physical stores. These advancements are designed to create more engaging and immersive environments, blurring the lines between digital and physical retail. For instance, in 2024, the company continued to expand its use of AI-driven styling tools, which analyze purchase history and browsing behavior to suggest outfits.

Post-Purchase Services and Convenience

Inditex enhances customer loyalty through convenient post-purchase services. Initiatives like easy returns and repairs, exemplified by the Zara Pre-Owned platform, extend the brand relationship beyond the initial sale, fostering ongoing engagement.

- Extended Relationship: Platforms like Zara Pre-Owned allow customers to resell or donate pre-loved Zara items, keeping them within the brand ecosystem and extending the product lifecycle.

- Convenience Focus: Easy returns and repair services are crucial touchpoints that build trust and reduce friction for customers, encouraging repeat business.

- Sustainability Angle: These services also align with growing consumer demand for sustainable fashion practices, positioning Inditex favorably.

- Customer Retention: By offering these conveniences, Inditex aims to increase customer lifetime value and reduce churn, a key metric in retail.

Loyalty and Repeat Purchases through Freshness

Inditex cultivates customer devotion not through traditional loyalty cards, but by consistently offering a stream of new, fashionable, and budget-friendly items. This rapid product turnover ensures customers always have a reason to return, fostering a sense of constant discovery and value.

The brand’s strategy taps into a 'see now, buy now' consumer mindset. This approach encourages frequent engagement, as shoppers anticipate and react to the continuous arrival of fresh styles. For instance, in the first quarter of 2024, Inditex reported a 7% increase in sales, demonstrating the effectiveness of this model in driving customer traffic and purchases.

- Constant New Arrivals: Inditex's fast fashion model ensures a high volume of new products hitting stores weekly, encouraging frequent visits.

- Affordability: Accessible price points make it easier for customers to make impulse purchases and return more often.

- Trend Responsiveness: The ability to quickly adapt to emerging fashion trends keeps the offering relevant and exciting for consumers.

- Reduced Need for Traditional Loyalty Programs: The inherent appeal of newness and affordability often negates the necessity for formal loyalty schemes.

Inditex focuses on building lasting relationships through convenient post-purchase services and a commitment to sustainability. Initiatives like Zara Pre-Owned, which facilitates the resale or donation of used items, keep customers engaged with the brand ecosystem and extend product lifecycles. These services not only foster loyalty but also align with the growing consumer demand for environmentally conscious practices.

| Customer Relationship Aspect | Description | Impact | 2024 Data/Example |

|---|---|---|---|

| Omnichannel Integration | Seamless blending of online and in-store experiences, including services like click-and-collect. | Enhanced convenience and consistent brand experience. | Continued expansion of integrated services across all markets. |

| Digital Engagement | Active presence on social media and online platforms for showcasing collections and interacting with customers. | Fosters community, brand loyalty, and drives traffic. | Strong online sales growth reported in early 2024. |

| Personalization | Utilizing data analytics to tailor product recommendations and shopping experiences. | Increases customer satisfaction and drives sales. | Investment in AI-driven styling tools to analyze customer behavior. |

| Post-Purchase Services | Offering services like easy returns, repairs, and platforms like Zara Pre-Owned. | Extends brand relationship, builds trust, and promotes sustainability. | Zara Pre-Owned platform aims to increase customer lifetime value. |

| Newness & Affordability | Rapid product turnover with fashionable and budget-friendly items. | Encourages frequent visits and impulse purchases, reducing reliance on traditional loyalty programs. | Inditex reported a 7% sales increase in Q1 2024, attributed to its responsive model. |

Channels

Inditex boasts an extensive global physical store presence, acting as crucial touchpoints for customers and vital components of its integrated online-offline strategy. As of early 2024, the company maintained over 5,800 stores worldwide, a testament to its commitment to physical retail.

The company is strategically refining its store footprint, favoring larger, more technologically advanced locations. This approach enhances the in-store experience and supports the growing trend of using stores as centers for online order pick-up and returns, a key element in its fast-fashion delivery model.

Inditex's robust e-commerce websites serve as a vital global shopping platform, seamlessly integrating with the physical store experience for each brand. These digital storefronts are crucial for reaching a wider customer base and offering a consistent brand experience worldwide.

Online sales represent a significant and growing revenue stream for Inditex. In the fiscal year 2023, the company reported that online sales grew by 16% compared to the previous year, reaching €5.86 billion, highlighting its importance as a major revenue channel.

Inditex's dedicated mobile apps for brands like Zara and Bershka provide a seamless shopping journey, allowing customers to browse, purchase, and even access in-store services like click-and-collect. These apps are crucial for driving online sales and customer loyalty.

In the first quarter of 2024, Inditex reported a significant increase in online sales, which accounted for 18% of total sales, up from 16% in the same period of 2023. This highlights the growing importance of their mobile platforms in reaching a wider customer base and facilitating transactions.

Social Media Platforms

Inditex leverages social media platforms such as Instagram, Facebook, and TikTok as key channels for customer engagement and brand promotion. These platforms are instrumental in showcasing new fashion lines, running targeted advertising campaigns, and fostering direct interaction with a vast international audience.

The company's social media strategy is designed to generate buzz around product launches and drive online traffic, effectively converting digital engagement into sales. By maintaining a consistent and visually appealing presence, Inditex cultivates brand loyalty and stays attuned to evolving consumer trends.

- Instagram: Over 10 million followers across its brands, used for visual storytelling and product highlights.

- TikTok: Rapidly growing platform for trend-driven content and influencer collaborations, reaching younger demographics.

- Facebook: Continues to be a channel for community building, customer service, and broader campaign reach.

- Engagement Metrics: Inditex brands consistently rank high in social media engagement rates within the fashion retail sector, indicating effective content strategies.

Integrated Omnichannel Approach

Inditex's integrated omnichannel strategy focuses on a fluid customer journey, blending online and physical store experiences. This means customers can easily move between shopping on their phones, computers, and in person without friction. For instance, they can buy something online and pick it up at their local Zara or pull up in-store inventory availability on their mobile device.

This seamless integration is a cornerstone of their customer engagement. By allowing online order collection in physical stores and providing in-store inventory checks through apps, Inditex enhances convenience and encourages store visits. Self-checkout options further streamline the in-store experience, reducing wait times and improving efficiency.

In 2023, Inditex reported that its online sales represented 15.5% of its total revenue, a testament to the success of its digital and integrated strategies. This demonstrates how effectively they are leveraging their physical footprint alongside their digital presence to meet evolving consumer shopping habits.

Key aspects of this approach include:

- Seamless online-to-offline transitions: Customers can order online and collect in any store.

- In-store digital tools: Mobile apps allow customers to check stock availability in real-time.

- Enhanced in-store convenience: Features like self-checkout optimize the physical shopping experience.

- Inventory visibility: Bridging the gap between online stock information and physical store availability.

Inditex's channels are a blend of physical stores and robust digital platforms, creating a truly integrated shopping experience. The company's extensive store network, numbering over 5,800 globally as of early 2024, serves as both points of sale and fulfillment centers for online orders. This physical presence is complemented by highly functional e-commerce websites and dedicated mobile apps for each brand, which are crucial for global reach and consistent brand messaging.

Online sales are a significant growth driver, accounting for 18% of total sales in Q1 2024, up from 16% in Q1 2023. This digital channel generated €5.86 billion in fiscal year 2023, a 16% increase year-over-year. Social media platforms like Instagram, TikTok, and Facebook are also vital for customer engagement, brand promotion, and driving traffic to both online and offline channels, with Inditex brands consistently showing high engagement rates.

| Channel | Key Features | 2023/2024 Data Points |

|---|---|---|

| Physical Stores | Global presence, brand experience, online order pickup/returns | Over 5,800 stores worldwide (early 2024); Larger, tech-advanced locations favored. |

| E-commerce Websites | Global shopping platform, integrated with physical stores | €5.86 billion in online sales (FY2023); 16% growth YoY. |

| Mobile Apps | Seamless shopping, in-store services (click-and-collect) | 18% of total sales in Q1 2024 (up from 16% in Q1 2023). |

| Social Media | Customer engagement, brand promotion, trend showcasing | High engagement rates; Instagram (10M+ followers across brands), TikTok for younger demographics. |

Customer Segments

Fashion-conscious consumers are the core of Inditex's strategy. These individuals actively seek out the newest styles and want to refresh their wardrobes frequently to reflect current trends. Inditex's ability to quickly bring runway looks to stores is a major draw for this segment.

In 2023, Inditex reported a net profit of €5.4 billion, a significant increase from previous years, underscoring the strong demand from consumers eager for the latest fashion. This financial performance directly reflects how well Inditex serves those who prioritize being on-trend.

Value-seeking shoppers are a cornerstone for Inditex, drawn to the company's consistent ability to deliver on-trend fashion at accessible price points. They actively seek out stylish apparel that doesn't strain their budget, appreciating that Inditex brands like Zara and Bershka offer the latest looks for significantly less than luxury or even mid-tier competitors.

This segment is particularly responsive to Inditex's fast-fashion model, which rapidly cycles through new collections, ensuring a constant stream of fresh, desirable items. For instance, in 2024, Inditex continued to emphasize its agile supply chain, allowing it to quickly translate runway trends into affordable garments, a key differentiator for these price-conscious consumers.

Inditex casts a wide net, aiming to capture the attention of fashion-conscious consumers across the globe. This broad appeal is evident in its expansive reach, touching down in over 200 markets worldwide.

The company's strategy involves tailoring its vast product assortment to resonate with diverse cultural tastes and seasonal demands, ensuring relevance from Europe to Asia and the Americas.

In 2023, Inditex reported a significant portion of its sales, approximately 43%, originating from markets outside of Spain, underscoring its robust international customer base.

Specific Demographics per Brand

Inditex masterfully segments its customer base by assigning distinct demographic and psychographic profiles to each of its brands. This strategy allows for highly targeted marketing and product development, ensuring each brand resonates with its intended audience.

- Zara: Targets fashion-conscious young adults and professionals, typically aged 18-40, who seek trendy, up-to-date styles at accessible price points.

- Pull&Bear: Caters to a younger demographic, primarily 15-25 year olds, focusing on casual, comfortable, and urban-inspired street style.

- Massimo Dutti: Appeals to a more mature and sophisticated consumer, often 25-50 years old, who prefers classic, elegant, and high-quality apparel with a focus on natural fabrics.

- Bershka: Aims at the 14-24 age group, offering bold, edgy, and trend-driven fashion reflecting youth culture and music influences.

- Stradivarius: Targets young women, generally 18-35, who appreciate feminine, bohemian, and romantic styles with a touch of vintage inspiration.

- Oysho: Specializes in lingerie, sleepwear, swimwear, and activewear for women aged 18-45, emphasizing comfort, sensuality, and well-being.

- Zara Home: Focuses on home décor enthusiasts, typically 25-55 years old, seeking stylish and contemporary furnishings and textiles to create curated living spaces.

Digitally Savvy Consumers

Digitally savvy consumers represent a core customer segment for Inditex, actively embracing online channels for their fashion purchases. These individuals are comfortable navigating e-commerce platforms and utilizing mobile applications for browsing, selecting, and buying products. Inditex's strategic focus on enhancing its digital presence, including its robust online store and integrated mobile app, directly addresses the preferences of this growing demographic.

This segment is characterized by a preference for convenience and seamless digital experiences. Inditex's investment in omnichannel integration, allowing for features like online order collection in-store, further appeals to their desire for flexibility. By 2024, Inditex reported that online sales represented a significant portion of its total revenue, underscoring the importance of this customer group.

- Digital Preference: Customers who prioritize online shopping and mobile interactions.

- Omnichannel Engagement: Consumers who value integrated online and physical store experiences.

- E-commerce Growth: This segment drives a substantial part of Inditex's digital sales.

- Technological Adoption: Early adopters and frequent users of fashion retail apps and websites.

Inditex's customer base is diverse, encompassing fashion-forward individuals who prioritize staying on-trend and value-conscious shoppers seeking stylish apparel at accessible prices. The company strategically targets different demographics and psychographics through its distinct brands, ensuring broad market appeal.

In 2023, Inditex's net profit reached €5.4 billion, reflecting strong consumer demand. Furthermore, approximately 43% of its sales in the same year came from international markets, highlighting its global reach and diverse customer engagement.

| Brand | Primary Target Age Group | Style Focus |

|---|---|---|

| Zara | 18-40 | Trendy, up-to-date |

| Pull&Bear | 15-25 | Casual, urban street style |

| Massimo Dutti | 25-50 | Classic, elegant, high-quality |

| Bershka | 14-24 | Bold, edgy, youth culture |

| Stradivarius | 18-35 | Feminine, bohemian, vintage-inspired |

| Oysho | 18-45 | Lingerie, sleepwear, activewear |

| Zara Home | 25-55 | Home décor, contemporary furnishings |

Cost Structure

Manufacturing and production represent a substantial cost for Inditex, encompassing everything from sourcing raw materials like cotton and polyester to the wages of factory workers and the upkeep of production facilities. This includes costs incurred both in their own integrated factories and with third-party manufacturers.

Inditex's commitment to operational efficiency is evident in its efforts to manage these significant manufacturing expenses. For instance, in the fiscal year 2023, the company reported cost of sales at €16,753 million, a figure that directly reflects these production-related expenditures.

Inditex’s expansive global reach necessitates significant investment in logistics and distribution. This includes the costs associated with maintaining a vast network of warehouses, managing air and sea freight for rapid product movement, and executing efficient last-mile delivery to thousands of stores worldwide. These operational complexities are a substantial component of their cost structure.

In 2023, Inditex reported that its cost of sales, which includes many of these logistics expenses, amounted to €14.1 billion. The company continues to prioritize investments in supply chain optimization, aiming to reduce transit times and improve inventory management. This focus on efficiency is crucial for maintaining competitive pricing and product availability across its diverse markets.

Inditex's extensive physical store network incurs significant operating costs, including rent for prime retail locations, utilities to power these spaces, and salaries for a large retail workforce. For instance, in 2023, Inditex reported €12.1 billion in selling, general and administrative expenses, a substantial portion of which is tied to store operations.

The company is actively optimizing its store footprint, a strategy that involves both opening new, strategically located stores and closing less productive ones. This approach aims to enhance efficiency and boost sales productivity per square meter across its global retail presence.

Technology and Digital Infrastructure Investment

Inditex consistently allocates substantial resources to its technology and digital infrastructure. These ongoing investments are fundamental to supporting its integrated online and physical store operations, a cornerstone of its omnichannel approach.

Key areas of expenditure include the continuous enhancement of its e-commerce platforms, advanced data analytics capabilities for customer insights and inventory management, and the integration of smart technology within its physical stores to improve customer experience and operational flow.

For example, in 2023, Inditex reported capital expenditure of €1.8 billion, a significant portion of which was directed towards technology and store refurbishments, reflecting the importance of digital transformation. This investment fuels operational efficiency and the ability to respond rapidly to market trends.

- E-commerce Platform Development: Ongoing upgrades to ensure a seamless and engaging online shopping experience.

- Data Analytics and AI: Investment in systems to process vast amounts of data for personalized recommendations and optimized inventory.

- In-Store Technology: Implementation of RFID technology for inventory tracking and enhanced point-of-sale systems.

- Logistics and Supply Chain Tech: Upgrades to distribution centers and IT systems to support efficient global operations.

Marketing, Design, and Staffing Costs

Inditex's cost structure heavily features expenses tied to its creative and operational backbone. This includes significant outlays for its design teams, crucial for developing the fast-fashion collections that define its brands. Product prototyping and the ongoing efforts in brand management also contribute substantially to these costs.

While Inditex maintains a relatively restrained marketing spend compared to some competitors, it is strategically focused on maintaining brand visibility and customer engagement. The salaries and associated costs for its vast global workforce across all operational functions, from design and production to retail and logistics, represent a major ongoing expenditure.

- Design and Prototyping: Investment in creative talent and sample development.

- Brand Management: Costs associated with maintaining and enhancing brand image.

- Marketing: Strategic, often digital-first, promotional activities.

- Staffing: Salaries and benefits for a large, diverse global workforce.

Inditex's cost structure is significantly influenced by its extensive supply chain and inventory management. The company's ability to quickly move merchandise from design to store relies on a complex network of logistics, including warehousing and transportation. In 2023, Inditex reported cost of sales at €16,753 million, reflecting these operational necessities.

The company also incurs substantial costs related to its vast physical retail presence. This includes expenses for prime retail space leases, store maintenance, and the salaries of its large sales associate workforce. Selling, general and administrative expenses, which encompass many of these store-related costs, were €12.1 billion in 2023.

Technology and digital infrastructure are critical cost drivers for Inditex, supporting its integrated online and offline model. Investments in e-commerce platforms, data analytics, and in-store technology are ongoing. Capital expenditure in 2023 was €1.8 billion, with a notable portion allocated to technology and store upgrades.

| Financial Metric | 2023 Value (€ million) | Key Cost Components |

| Cost of Sales | 16,753 | Manufacturing, raw materials, logistics |

| Selling, General and Administrative Expenses | 12,100 | Store operations, staff salaries, marketing |

| Capital Expenditure | 1,800 | Technology, store refurbishments, logistics infrastructure |

Revenue Streams

Inditex generates substantial revenue from its extensive network of physical stores worldwide, selling a wide array of clothing, accessories, and home furnishings. These brick-and-mortar locations are crucial, contributing significantly to overall sales even as online channels grow.

For instance, in the first quarter of 2024, Inditex reported a notable increase in store sales, reflecting the continued importance of physical retail. This performance underscores the brand's ability to attract customers to its physical spaces, driving a significant portion of its revenue stream.

Inditex generates substantial revenue through its robust online sales channels, encompassing both its e-commerce websites and dedicated mobile applications. This digital presence is a cornerstone of its business strategy, experiencing significant growth and representing a critical area for future investment and expansion.

In 2024, online sales constituted a considerable percentage of Inditex's overall revenue. This digital channel not only drives immediate sales but also enhances brand engagement and customer loyalty, making it indispensable to the company's ongoing success and market penetration.

Inditex generates substantial revenue through sales across its diverse brand portfolio. Key contributors include Zara, Pull&Bear, Massimo Dutti, Bershka, Stradivarius, Oysho, and Zara Home, each appealing to distinct customer segments and fashion trends. This multi-brand strategy effectively diversifies income streams, reducing reliance on any single brand and mitigating overall business risk.

For the fiscal year 2023, Inditex reported a net profit of €5.4 billion, a significant increase from the previous year, underscoring the success of its broad brand appeal. This financial performance highlights how the varied offerings across its brands consistently drive sales and contribute to the group's robust financial health.

Global Market Sales

Inditex generates substantial revenue through its extensive global sales network, operating in over 200 markets. This widespread presence, particularly strong in Europe, Asia, and the Americas, underpins its robust sales performance.

The company's ability to cater to diverse consumer preferences across these regions is a key driver of its sales volume. For instance, in the first quarter of fiscal year 2024, Inditex reported a 7% increase in net sales, reaching €8.19 billion, demonstrating continued growth across its international operations.

- Europe: Continues to be a foundational market, contributing significantly to overall sales.

- Asia: Shows strong growth potential and increasing sales contributions, particularly in key Asian economies.

- Americas: Represents a vital and expanding market, with consistent revenue generation.

Zara Pre-Owned Platform (Emerging)

Zara's new pre-owned platform is an emerging revenue stream, allowing customers to resell and repair their Zara garments. This initiative, launched in select markets, taps into the growing second-hand clothing market and supports Inditex's commitment to sustainability.

While the exact revenue contribution for 2024 is not yet publicly detailed, the platform's expansion signifies a strategic move towards circular fashion. This model not only diversifies revenue but also fosters customer loyalty by extending the lifecycle of Zara products.

- Platform Focus: Facilitates resale and repair of Zara garments.

- Market Alignment: Addresses the growing demand for sustainable and second-hand fashion.

- Revenue Potential: Aims to diversify income and create new value from existing products.

- Sustainability Goal: Supports Inditex's broader environmental objectives.

Inditex's revenue streams are multifaceted, encompassing both its extensive physical store network and a rapidly growing online presence. The company's multi-brand strategy, featuring popular names like Zara and Pull&Bear, diversifies its income across various consumer segments.

In the first quarter of fiscal year 2024, Inditex saw a 7% increase in net sales, reaching €8.19 billion, a testament to its global sales network's strength. This growth highlights the continued importance of both its physical stores and digital channels in driving revenue.

| Revenue Stream | Description | Fiscal Year 2023 (Approximate Contribution) | Q1 2024 Performance |

| Physical Stores | Sales from brick-and-mortar locations worldwide. | Dominant contributor | Continued strong performance |

| Online Sales | E-commerce websites and mobile applications. | Significant and growing percentage | Key growth driver |

| Brand Portfolio | Sales across diverse brands (Zara, Pull&Bear, etc.). | Drives overall group sales | Underpins robust financial health |

| New Initiatives (e.g., Pre-owned Platform) | Emerging streams like garment resale and repair. | Nascent, focused on sustainability | Strategic expansion area |

Business Model Canvas Data Sources

The Inditex Business Model Canvas is informed by a blend of internal financial reports, customer purchasing behavior analytics, and extensive market research on fashion trends and competitor strategies. These sources provide a comprehensive view of Inditex's operations and market positioning.