Inditex Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inditex Bundle

Inditex navigates a complex competitive landscape, where buyer bargaining power is significant due to readily available fashion alternatives, and the threat of new entrants is moderate, mitigated by established brands and supply chain efficiencies. Supplier power is generally low, allowing Inditex to dictate terms, while rivalry among existing competitors is intense, driving constant innovation and price adjustments.

The complete report reveals the real forces shaping Inditex’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Inditex, especially with its brand Zara, exhibits strong vertical integration. This means they control everything from the initial design to the final sale in stores. This ownership of the production process significantly limits the bargaining power of their suppliers because Inditex doesn't need to rely as heavily on outside manufacturers for its core operations.

By managing its own manufacturing facilities, Inditex can set the terms, ensure quality standards, and maintain rapid production cycles. This direct control over production means suppliers have less leverage to negotiate higher prices or dictate terms, as Inditex has alternative internal capabilities.

Inditex benefits from a broad and geographically dispersed supplier base, which significantly diminishes the bargaining power of any individual supplier. This strategy allows Inditex to source materials and components from numerous locations, preventing undue dependence on a single entity.

The company's emphasis on manufacturing within or near its primary markets, such as Spain and Portugal, further bolsters its position. This proximity reduces lead times and logistical costs, and crucially, provides the flexibility to shift production if supplier terms become unfavorable.

In 2023, Inditex reported that 58% of its production was located in Spain, Portugal, and Morocco, countries known for their proximity and established supply chains. This concentration in nearby regions, coupled with a global network for other needs, ensures that no single supplier can dictate terms effectively.

Inditex's commitment to ambitious sustainability targets, such as sourcing 100% lower-impact cotton, linen, and polyester by 2025, can influence its bargaining power with suppliers. This focus might elevate the power of specialized sustainable textile suppliers, as their numbers are limited and demand is high, potentially leading to increased costs for Inditex.

However, Inditex's sheer scale and its strategy of cultivating long-term partnerships with suppliers serve as a crucial counterbalance. These established relationships enable collaborative efforts to achieve sustainability goals, thereby mitigating the increased power of these specialized suppliers and maintaining a more balanced negotiation dynamic.

Raw Material Price Volatility

Raw material price volatility is a significant factor influencing the bargaining power of suppliers for companies like Inditex. Fluctuations in the cost of cotton, polyester, and other essential fibers directly impact production expenses. For instance, cotton prices can be highly sensitive to weather patterns and global demand, with significant price swings observed throughout 2024, impacting the cost base for textile manufacturers.

While Inditex benefits from its vertical integration, which allows for some control over its supply chain, it remains exposed to external market dynamics for its raw materials. Supply shortages or sharp price increases from raw material producers can therefore strengthen their negotiating position. The global textile sector, as of mid-2024, continues to grapple with the aftermath of various supply chain disruptions, including geopolitical events and climate-related impacts, which can indirectly bolster the leverage of raw material suppliers.

- Cotton Price Volatility: Global cotton prices experienced notable fluctuations in early 2024, influenced by crop yields in key producing regions and global demand.

- Synthetic Fiber Costs: Prices for synthetic fibers, often derived from petrochemicals, are subject to energy market volatility, impacting their overall cost structure.

- Supply Chain Pressures: Ongoing global logistics challenges and geopolitical instability continue to create upward pressure on raw material costs, empowering suppliers.

- Inditex's Mitigation: Despite these pressures, Inditex's diversified sourcing strategy and commitment to efficient inventory management aim to mitigate the impact of raw material price volatility.

Supplier's Importance to Inditex's Fast-Fashion Model

Inditex's fast-fashion success hinges on its incredibly quick design-to-shelf process, often completing the cycle in just two to three weeks. This demanding pace requires suppliers who are not only efficient but also highly responsive to Inditex's evolving needs.

Suppliers who can consistently meet these tight deadlines and maintain high quality, particularly those involved in crucial manufacturing steps, can wield a degree of bargaining power. This is amplified by the specialized nature of their services and the significant costs associated with finding and onboarding new, less agile suppliers.

- Inditex's rapid supply chain: A typical design-to-store cycle of 2-3 weeks.

- Supplier dependency: Critical for maintaining speed and quality.

- Potential supplier leverage: Arises from specialized services and high switching costs for Inditex.

Inditex's extensive vertical integration and diversified supplier base significantly limit the bargaining power of individual suppliers. By controlling much of its production, Inditex reduces reliance on external manufacturers, allowing it to dictate terms and maintain rapid cycles. For instance, in 2023, 58% of its production was in nearby Spain, Portugal, and Morocco, showcasing a strategy to mitigate supplier dependence.

However, the company's ambitious sustainability goals, like sourcing 100% lower-impact materials by 2025, could empower specialized sustainable suppliers. Raw material price volatility, as seen with cotton in early 2024, also grants suppliers more leverage, especially amidst ongoing global supply chain pressures.

| Factor | Inditex's Position | Supplier Bargaining Power |

|---|---|---|

| Vertical Integration | High control over production | Low |

| Supplier Diversification | Broad, global network | Low for individual suppliers |

| Sustainability Targets | Increased demand for specialized suppliers | Potentially High for sustainable suppliers |

| Raw Material Volatility | Exposure to external price swings | High for raw material producers |

What is included in the product

Inditex's Porter's Five Forces analysis reveals how supplier power, buyer bargaining, threat of new entrants, substitutes, and rivalry shape its competitive environment, highlighting strategies for sustained market leadership.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing Inditex's competitive landscape to pinpoint and address key pain points.

Customers Bargaining Power

Customers in the fast-fashion sector, including Inditex's core demographic, exhibit extreme price sensitivity. They are perpetually on the hunt for the latest styles at the lowest possible cost, making price a primary driver of purchasing decisions. This characteristic is a significant factor in their bargaining power.

The sheer volume of competitors in the fast-fashion landscape means consumers have a vast array of choices. If a brand like Inditex is perceived to be too expensive or not offering enough value, customers can readily shift their allegiance to another retailer. This ease of switching amplifies customer leverage.

In 2023, the global apparel market saw continued growth, with fast fashion remaining a dominant segment. For instance, Inditex's net sales reached €35.9 billion in fiscal year 2023, a testament to its ability to meet demand, but also highlighting the scale of competition and the constant need to offer competitive pricing to retain its customer base.

The cost for a consumer to switch from an Inditex brand, like Zara or H&M, to a competitor is remarkably low. It often involves no more than a simple choice of visiting a different store or navigating a new online shopping site.

This minimal friction in changing brands significantly bolsters customer power. With virtually no financial or practical barriers, shoppers are free to explore various fashion retailers, seeking the best prices, styles, or quality available.

In 2023, the fast fashion market saw continued intense competition, with many brands vying for consumer attention. This environment means that Inditex, and its rivals, must constantly innovate and offer compelling value propositions to retain their customer base, as switching remains exceptionally easy for the average shopper.

The fashion retail landscape is incredibly crowded, with countless brands providing very similar clothing options, whether you're shopping online or in a brick-and-mortar store. This sheer volume of choice means customers can easily switch from one retailer to another if they aren't satisfied. For instance, in 2024, the global online fashion market was valued at over $800 billion, showcasing the vast number of players vying for consumer attention.

Furthermore, the digital age has brought about unprecedented information transparency. Customers today have instant access to pricing, style trends, product quality assessments, and even a brand's ethical and sustainability practices through websites, review platforms, and social media. This ease of comparison empowers shoppers, allowing them to make more informed decisions and negotiate better value, thereby increasing their bargaining power against retailers like Inditex.

Influence of Social Media and Trends

Social media platforms have become powerful arbiters of taste, profoundly shaping consumer preferences and purchasing habits within the fast fashion sector. Customers actively engage by sharing opinions and reviewing products, creating a dynamic environment where trends can emerge and spread with unprecedented speed. This collective digital voice empowers consumers, allowing them to influence demand and compel brands like Inditex to adapt swiftly to maintain relevance and customer engagement.

The rapid dissemination of trends via social media means that Inditex must maintain agility to capitalize on fleeting consumer interests. For instance, a viral TikTok trend showcasing a particular style can create immediate demand, requiring Inditex to quickly source and stock similar items. In 2024, the fashion industry continued to see social media drive significant purchasing decisions, with platforms like Instagram and TikTok playing a crucial role in product discovery and brand perception.

- Customer Voice Amplification: Social media allows individual customer opinions to reach a vast audience, increasing their collective bargaining power.

- Trend Velocity: The speed at which trends propagate online necessitates rapid response from retailers to meet evolving consumer desires.

- Brand Responsiveness: Inditex's ability to monitor and react to social media sentiment directly impacts its capacity to satisfy customer demand and maintain loyalty.

- Data-Driven Insights: Tracking social media conversations provides valuable, real-time data on emerging styles and customer feedback, informing inventory and design decisions.

Brand Loyalty and Experiential Shopping

While customers are often price-conscious, Inditex has cultivated significant brand loyalty, especially with Zara. This loyalty is bolstered by a focus on creating an engaging, omnichannel shopping experience that goes beyond mere price points, making customers feel connected to the brand.

Inditex actively works to integrate its online and physical store offerings, creating a seamless journey for shoppers. By tailoring experiences to local tastes and preferences, the company aims to build a dedicated customer base that values the overall brand proposition.

- Brand Recognition: Inditex's key brands, particularly Zara, benefit from high global brand recognition, which can mitigate price sensitivity.

- Experiential Retail: Investments in store design, visual merchandising, and increasingly, digital integration, aim to create a compelling shopping experience that fosters loyalty.

- Omnichannel Strategy: The smooth blending of online and offline channels provides convenience and reinforces brand presence, contributing to customer stickiness.

Customers in the fast-fashion market, including Inditex's clientele, are highly sensitive to price and constantly seek the latest styles at the lowest cost. This price consciousness is a major driver of their bargaining power, especially given the vast number of competitors offering similar products.

The ease with which consumers can switch between brands in the fashion sector, with minimal financial or practical barriers, significantly enhances their leverage. In 2023, the global apparel market continued its growth, with fast fashion remaining a dominant segment, underscoring the intense competition and the need for retailers to offer competitive pricing to retain customers.

The digital age has empowered customers with unprecedented access to information, allowing for easy comparison of prices, styles, and quality across numerous retailers. This transparency further strengthens their bargaining position.

| Metric | Value (2023/2024 Data) | Implication for Inditex |

|---|---|---|

| Inditex Net Sales | €35.9 billion (FY 2023) | Demonstrates scale but highlights need for competitive pricing to maintain market share. |

| Global Online Fashion Market Value | Over $800 billion (2024 estimate) | Indicates a highly competitive online landscape where customer switching is easy. |

| Social Media Influence on Fashion Purchases | Significant driver in 2024 | Requires Inditex to be agile and responsive to social media trends to meet evolving consumer desires. |

What You See Is What You Get

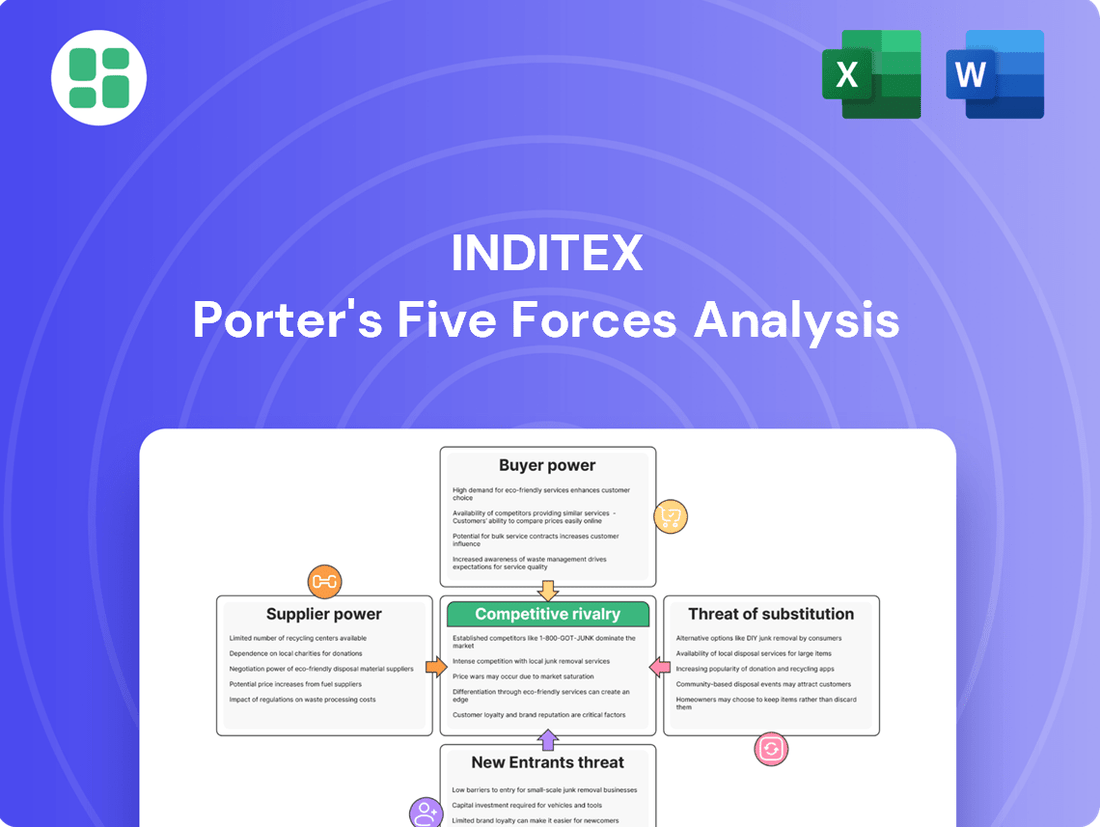

Inditex Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Inditex, detailing the competitive landscape that shapes its strategic decisions. You are looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing a thorough examination of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry.

Rivalry Among Competitors

The fast fashion arena is a battlefield with global giants like H&M, Shein, Primark, and UNIQLO constantly duking it out. They flood the market with new styles at breakneck speeds and often at prices that are hard to beat. Shein, in particular, has carved out a significant niche with its online-only model, demonstrating the power of digital-first strategies in capturing market share, especially among younger demographics.

The fast fashion model thrives on quickly copying popular styles, resulting in products that don't stay on shelves for long. This means companies like Inditex must constantly innovate in design, production, and delivery to remain competitive. In 2024, the industry saw continued pressure on this front, with brands needing to turn around new collections in as little as two weeks to capture fleeting consumer interest.

The retail landscape's rapid digital transformation and the rise of omnichannel strategies are intensifying competitive rivalry. Inditex, with its robust online and physical store integration, faces increasing pressure from rivals like H&M and Nike, both of which are making substantial investments in their digital capabilities.

In 2024, the global e-commerce market continued its upward trajectory, with fashion remaining a dominant sector. For instance, online fashion sales are projected to grow significantly, forcing all players to refine their digital offerings to meet consumer expectations for seamless experiences, from browsing on a user-friendly app to convenient in-store pickup options.

Pricing Strategies and Promotional Activities

The fast-fashion market thrives on price sensitivity, leading to intense competition among players like Inditex. This rivalry frequently translates into aggressive pricing, frequent discounts, and promotional campaigns designed to capture market share. For instance, during the 2023 holiday season, many apparel retailers, including those competing with Inditex, offered significant markdowns to clear inventory and attract shoppers.

While Inditex's strategy emphasizes delivering value and rapid product turnover, the constant need to remain competitive on price can exert downward pressure on profit margins throughout the sector. This dynamic means that even efficient players must carefully balance pricing to maintain profitability while still appealing to budget-conscious consumers. The average discount rate across the apparel industry in early 2024 saw an uptick compared to previous years, reflecting this competitive pressure.

- Price Wars: Competitors frequently engage in price wars, particularly during seasonal sales events, forcing Inditex to respond to maintain its market position.

- Promotional Intensity: The frequency and depth of promotions, including flash sales and loyalty program benefits, are key battlegrounds for customer acquisition and retention.

- Margin Squeeze: Aggressive pricing tactics can lead to reduced profit margins for all participants in the fast-fashion segment.

Sustainability and Ethical Practices as Competitive Differentiators

Competitive rivalry is intensifying as sustainability and ethical practices emerge as key differentiators. Consumers and regulators increasingly demand transparency and accountability regarding environmental and social impact. Brands are now vying for market share not just on fashion and price, but on their commitment to responsible operations.

This shift is compelling companies like Inditex to integrate sustainability deeply into their strategies. For instance, Inditex has set ambitious targets, aiming for 100% of its cotton to be sourced sustainably by 2025 and for all its facilities to operate with net-zero emissions by the same year. These initiatives are designed to bolster brand loyalty and attract environmentally conscious consumers, thereby carving out a distinct competitive advantage.

- Consumer Demand: A 2024 survey indicated that over 70% of consumers consider a brand's sustainability efforts when making purchasing decisions.

- Regulatory Landscape: New legislation in 2024, such as extended producer responsibility schemes, places greater emphasis on circularity and waste reduction, impacting all players.

- Inditex's Commitment: By 2023, Inditex reported that 53% of its raw materials were sourced sustainably, demonstrating progress towards its 2025 goals.

The competitive landscape for Inditex is fierce, characterized by rapid product cycles and aggressive pricing strategies from global players like H&M, Shein, and UNIQLO. Shein's online-first model, for example, has significantly disrupted the market, especially by capturing younger consumers with its speed and affordability. This intense rivalry means companies must constantly innovate in design and logistics, with some brands turning around new collections in as little as two weeks to meet fleeting consumer demand, a trend that continued to intensify in 2024.

The ongoing digital transformation of retail further fuels this rivalry. Inditex faces increased pressure from competitors investing heavily in their online capabilities, as evidenced by Nike's substantial digital investments. The global e-commerce fashion market saw continued growth in 2024, pushing all players to enhance their digital offerings for seamless customer experiences, from app browsing to convenient in-store pickups.

Price sensitivity is a cornerstone of the fast-fashion market, leading to frequent discounts and promotions. This competitive pressure was visible in early 2024, with average discount rates across the apparel industry showing an uptick compared to previous years, impacting profit margins for all participants. Inditex, like its rivals, must carefully balance pricing to remain attractive to budget-conscious consumers while maintaining profitability.

| Competitor | Key Strategy | 2024 Focus Area |

|---|---|---|

| H&M | Omnichannel integration, brand collaborations | Enhancing online personalization |

| Shein | Ultra-fast fashion, online-only model | Expanding into new markets, influencer marketing |

| UNIQLO | Quality basics, functional apparel | Strengthening supply chain efficiency |

SSubstitutes Threaten

The rise of the second-hand and resale market, encompassing both physical thrift stores and online platforms like ThredUp and Poshmark, poses a substantial threat of substitution to new fast fashion. This growing segment attracts consumers prioritizing affordability and sustainability, directly impacting sales for brands like Inditex. The global second-hand apparel market was valued at approximately $100 billion in 2023 and is expected to reach $350 billion by 2027, highlighting its increasing competitive pressure.

Clothing rental services present a growing threat by offering consumers access to a diverse wardrobe without the commitment of ownership. This model is particularly appealing for special occasions or for individuals seeking to refresh their style sustainably. For instance, the global online clothing rental market was valued at approximately USD 1.1 billion in 2023 and is projected to grow significantly, indicating a tangible shift in consumer behavior away from traditional purchasing.

The rise of durable, timeless, and slow fashion alternatives presents a significant threat to Inditex's fast-fashion model. A growing consumer segment is increasingly prioritizing quality and longevity over fleeting trends, driven by sustainability concerns. This shift means consumers are willing to invest in fewer, higher-quality pieces designed to last, directly substituting the constant consumption fostered by fast fashion.

Customization and DIY Fashion

The growing trend of customization and Do-It-Yourself (DIY) fashion, including upcycling and personalized garment services, presents a significant threat of substitutes for traditional fast fashion retailers like Inditex. Consumers are increasingly seeking unique items that reflect their individual style, moving away from mass-produced apparel. This shift directly challenges the core offering of fast fashion, which relies on rapid turnover of trendy, ready-to-wear collections.

This movement towards personalization offers consumers an alternative that caters to their desire for individuality and creative expression. For instance, platforms facilitating custom clothing orders or providing materials for upcycling allow individuals to craft or modify garments themselves. This reduces their dependence on off-the-rack options, directly impacting the demand for Inditex's extensive product lines.

The economic viability of these substitutes is also growing. Consider the resale market, which saw significant growth in 2023, with platforms like Depop and Vinted reporting millions of active users. This indicates a consumer willingness to engage with pre-owned or modified clothing, further diverting spending from new, mass-produced items.

- DIY Fashion Growth: The global DIY fashion market is expanding as consumers embrace personalization.

- Upcycling Trend: Upcycling initiatives are gaining traction, offering sustainable and unique fashion alternatives.

- Consumer Demand: There's a rising consumer preference for individuality over mass-produced clothing.

- Market Impact: These trends pose a direct challenge to the traditional fast fashion model.

Non-Apparel Spending

The threat of substitutes for Inditex, particularly from non-apparel spending, is significant. During economic downturns or times when consumers are more budget-conscious, they often shift their discretionary income away from fashion. This means that money that might have been spent on a new Zara dress could instead go towards experiences like travel, new electronics, or even essential goods if household budgets are tight.

This broader substitution dynamic means that Inditex's core product – clothing – is in constant competition with a wide array of other consumer wants and needs for a limited pool of disposable income. For instance, in 2024, with inflation still a concern in many markets, consumers might prioritize spending on groceries or utility bills over discretionary fashion purchases.

- Consumer Spending Shifts: In 2023, global consumer spending on experiences and technology saw robust growth, indicating a potential diversion of funds that could otherwise be allocated to apparel.

- Price Sensitivity Impact: Higher inflation rates in key markets like Spain and Germany during early 2024 increased price sensitivity among consumers, making non-apparel essentials more attractive relative to fashion items.

- Competition for Disposable Income: Inditex competes not just with other fashion retailers, but with the entire spectrum of consumer goods and services vying for the same discretionary euro or dollar.

The rise of the second-hand and rental markets, alongside a growing preference for durable, slow fashion, presents a significant threat of substitution for Inditex. Consumers are increasingly prioritizing affordability, sustainability, and unique style, diverting spending from traditional fast fashion purchases. This trend is amplified by the growing appeal of customization and DIY fashion, directly challenging the mass-produced model.

The global second-hand apparel market's projected growth to $350 billion by 2027, up from an estimated $100 billion in 2023, underscores this shift. Similarly, clothing rental services, valued at approximately $1.1 billion in 2023, offer an alternative to ownership, particularly for occasion wear.

| Substitute Category | 2023 Value (USD) | Projected Growth | Key Drivers |

|---|---|---|---|

| Second-hand Apparel | $100 Billion | Reaching $350 Billion by 2027 | Affordability, Sustainability, Uniqueness |

| Clothing Rental | $1.1 Billion | Significant projected growth | Access to variety, Sustainability, Occasion wear |

| Slow/Durable Fashion | N/A (Trend-based) | Increasing consumer adoption | Longevity, Quality, Reduced environmental impact |

Entrants Threaten

Establishing an integrated business model like Inditex's, encompassing design, manufacturing, logistics, and a global retail presence, demands enormous capital. This investment covers production facilities, distribution hubs, advanced technology, and an extensive physical store footprint.

For instance, in 2023, Inditex reported capital expenditure of €1.8 billion, primarily directed towards store refurbishments, logistics, and technology upgrades. Such significant financial outlays create a formidable barrier for new entrants seeking to replicate their end-to-end operational model.

Inditex's formidable brand equity, exemplified by Zara's global appeal, presents a significant barrier to new entrants. Building comparable brand recognition and fostering customer loyalty in the fast-fashion sector requires immense marketing expenditure and a lengthy period to cultivate trust, making it difficult for newcomers to divert established customer bases.

Inditex leverages massive economies of scale, a significant barrier for new entrants. Its vast sourcing and production volumes in 2024 allowed for substantial cost efficiencies across its supply chain, from raw materials to finished garments. For example, Inditex's ability to negotiate favorable terms with suppliers due to its sheer purchasing power is a cost advantage that newcomers would find nearly impossible to replicate quickly.

Complex and Agile Supply Chain Expertise

The fast-fashion industry hinges on an incredibly nimble and efficient supply chain, allowing for swift transitions from design conception to product availability. Inditex has honed this capability over many years, utilizing sophisticated logistics and AI for accurate trend prediction.

Replicating Inditex's intricate and responsive supply chain is a significant hurdle for any new competitor. Their established infrastructure and deep understanding of rapid production cycles create a substantial barrier to entry.

- Supply Chain Agility: Inditex's ability to move products from design to store in as little as two weeks is a key differentiator.

- Logistical Prowess: The company operates a highly integrated network of factories, distribution centers, and stores, enabling rapid stock replenishment.

- AI and Forecasting: Inditex invests heavily in AI for real-time sales analysis and trend forecasting, ensuring they stay ahead of consumer demand.

- Cost Efficiency: Decades of optimizing their supply chain have resulted in significant cost efficiencies that are difficult for newcomers to match.

Regulatory Hurdles and Sustainability Demands

Newcomers to the fashion retail sector, particularly those aiming to compete with established players like Inditex, encounter significant regulatory challenges. For instance, in 2024, the European Union continued to strengthen its due diligence requirements for companies regarding human rights and environmental protection in their supply chains. This means any new entrant must demonstrate robust compliance from day one, which can be resource-intensive.

Furthermore, the escalating consumer demand for sustainable and ethically sourced apparel presents another formidable barrier. Companies entering the market in 2024 and beyond are expected to have transparent supply chains and verifiable eco-friendly practices. This necessity to build sustainability into operations from the outset, rather than retrofitting, significantly increases initial investment and operational complexity for potential new competitors.

- Increased Regulatory Scrutiny: New fashion retailers face growing compliance burdens concerning labor standards and environmental impact, as seen in evolving EU regulations throughout 2024.

- Sustainability as a Prerequisite: The market now demands ethical and sustainable production, requiring new entrants to invest heavily in these costly practices from their inception.

- Higher Barrier to Entry: These combined regulatory and sustainability demands create a substantial financial and operational hurdle for potential new competitors, protecting established firms like Inditex.

The threat of new entrants for Inditex is relatively low due to several significant barriers. The capital required to establish a comparable integrated business model, covering design, manufacturing, logistics, and a global retail presence, is immense. For example, Inditex's 2023 capital expenditure reached €1.8 billion, highlighting the substantial investment needed for facilities, technology, and retail infrastructure.

Porter's Five Forces Analysis Data Sources

Our Inditex Porter's Five Forces analysis leverages a comprehensive set of data sources including Inditex's annual reports, investor presentations, and financial statements, alongside industry-specific market research reports and competitor financial disclosures.