Inchcape SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inchcape Bundle

Inchcape's strengths lie in its extensive global network and diversified product portfolio, offering significant competitive advantages. However, potential threats from evolving market dynamics and regulatory changes require careful navigation.

Want to understand the full strategic landscape of Inchcape, including their vulnerabilities and opportunities for expansion? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Inchcape's strength lies in its undisputed global leadership as an independent automotive distributor, a position bolstered by operations in 38 countries spanning Asia, Australasia, the Americas, Europe, and Africa. This vast geographical diversification, which included a significant presence in key growth markets as of early 2024, shields the company from localized economic shocks.

Inchcape's strength lies in its deep-rooted partnerships with major automotive manufacturers, evidenced by securing a record number of new distribution agreements. These long-standing relationships are crucial for accessing new models and markets.

The company's 'Accelerate+' strategy, initiated in fiscal year 2024, is a clear testament to its strategic focus. This plan aims to expand Inchcape's reach into new geographical territories and diversify its portfolio across various vehicle segments, solidifying its position as a favored distribution partner for Original Equipment Manufacturers (OEMs).

Inchcape's advanced digital and data capabilities are a significant strength, driven by their strategic investment in differentiated technology like AI and data analytics. This focus directly translates into enhanced operational efficiency and a more engaging customer experience across their global operations.

The company’s Digital Delivery Centres (DDCs), notably in Colombia and the Philippines, are a testament to this strength. These centers house over 1,400 digital specialists who are actively developing cutting-edge solutions. These innovations span a wide range, from streamlining body shop quotes to creating seamless omnichannel e-commerce platforms and optimizing complex supply chains.

Highly Cash Generative and Capital-Light Business Model

Inchcape's strategic pivot to a pure-play automotive distribution model following the sale of its UK retail operations has unlocked a highly cash-generative and capital-light business. This streamlined approach is designed to deliver robust returns, supporting a disciplined capital allocation strategy. The company has set an ambitious target of achieving over 10% Earnings Per Share (EPS) Compound Annual Growth Rate (CAGR) through to 2030, underscoring the expected financial benefits of this new structure.

This capital-light model is a significant strength, enabling Inchcape to focus resources on value-accretive activities such as share buybacks and strategic acquisitions. For instance, in 2023, Inchcape continued its share repurchase program, demonstrating a commitment to returning capital to shareholders. The efficiency inherent in distribution compared to retail operations means less capital is tied up in physical assets, leading to improved return on capital employed.

The focus on distribution also enhances the company's ability to generate consistent cash flow. This is crucial for funding future growth initiatives and weathering economic fluctuations. The company's financial performance in recent periods, particularly post-divestment, has shown the positive impact of this shift, with strong cash conversion metrics.

- Capital-Light Model: Reduced need for physical retail assets, freeing up capital.

- Cash Generative: Distribution focus leads to strong and consistent cash flow generation.

- Attractive Returns: Aiming for over 10% EPS CAGR to 2030.

- Disciplined Capital Allocation: Supports share buybacks and strategic acquisitions.

Robust Aftersales and Value-Added Services

Inchcape’s robust aftersales network is a significant strength, encompassing comprehensive parts distribution and servicing capabilities. This focus on after-market support is crucial for customer retention and generating consistent revenue streams.

The company is actively investing in advanced infrastructure to bolster its aftersales operations. For example, its state-of-the-art parts distribution center in the Philippines is designed to dramatically cut down delivery times and improve parts availability, directly impacting customer loyalty and supporting healthy profit margins.

These investments in digital platforms and logistics are key differentiators. By ensuring high parts availability and efficient service delivery, Inchcape strengthens its value proposition, particularly in competitive markets. This strategic emphasis on aftersales contributes to resilient financial performance.

Key aspects of Inchcape's aftersales strength include:

- Comprehensive parts distribution and servicing network.

- Investments in modern parts distribution centers, like the one in the Philippines.

- Focus on reducing lead times and increasing parts availability.

- Enhancing customer satisfaction and ensuring resilient margins through efficient aftersales.

Inchcape's global reach is a cornerstone strength, operating in 38 countries across multiple continents as of early 2024. This extensive geographical footprint, including significant engagement in emerging markets, provides a crucial buffer against regional economic downturns.

The company's strategic focus on distribution, particularly after divesting its UK retail operations, has created a capital-light and highly cash-generative business model. This efficiency is projected to drive over 10% EPS CAGR through 2030, supporting disciplined capital deployment like share buybacks.

Inchcape's commitment to digital transformation, exemplified by its Digital Delivery Centres and AI investments, enhances operational efficiency and customer engagement. These capabilities are vital for optimizing supply chains and developing seamless e-commerce platforms.

The company maintains robust partnerships with leading automotive manufacturers, consistently securing new distribution agreements. This reliance on long-term OEM relationships is fundamental to accessing new vehicle models and expanding market presence.

Inchcape's strong aftersales network, featuring comprehensive parts distribution and servicing, is a key revenue driver. Investments in modern distribution centers, such as the facility in the Philippines, aim to reduce delivery times and improve parts availability, bolstering customer retention.

What is included in the product

Analyzes Inchcape’s competitive position through key internal and external factors, highlighting its strengths in distribution, opportunities in emerging markets, weaknesses in brand recognition, and threats from digital disruption.

Offers a clear, actionable framework to identify and address strategic weaknesses and threats.

Weaknesses

Despite efforts to diversify geographically, Inchcape's financial health remains susceptible to downturns in specific markets. For instance, the Asia-Pacific region, a significant contributor to its revenue, has experienced dampened demand, partly due to evolving trade policies and a cautious business outlook. This regional economic volatility can directly affect Inchcape's overall performance.

Global economic headwinds are also a concern. Elevated vehicle prices, coupled with increasing consumer debt and the impact of rising interest rates, are collectively putting pressure on consumer spending. This makes discretionary purchases, such as new vehicles, less accessible for many, thereby constraining demand across Inchcape's operating territories.

Inchcape's heavy reliance on relationships with a few major Original Equipment Manufacturers (OEMs) presents a significant vulnerability. A deterioration in any key OEM partnership, or a strategic shift by an OEM regarding its distribution approach, could directly impact contract renewals and, consequently, Inchcape's revenue streams. For instance, if a major OEM like BMW or Toyota were to alter its distribution model in a key market, it could create substantial headwinds for Inchcape's operations in that region.

Inchcape faces significant hurdles in managing its extensive global inventory. The sheer scale of its operations, coupled with the unpredictable nature of supply and demand across diverse markets, makes maintaining optimal stock levels a constant challenge.

Holding excessive inventory for specific brands can directly impact profitability. This can result in slower sales, eroding gross profits at the point of sale, and escalating costs associated with advertising to move the stock and floor plan financing, which is particularly burdensome with the elevated interest rates seen in 2024 and projected into 2025.

Vulnerability to Cybersecurity Threats

Inchcape's growing dependence on digital platforms for its operations and customer interactions exposes it to significant cybersecurity risks. A breach could disrupt critical systems like dealer management, leading to substantial operational and financial setbacks. In 2023, the automotive retail sector experienced several high-profile cyberattacks, underscoring the industry-wide vulnerability to such threats.

The potential impact of these threats is considerable, affecting everything from sales processes to after-sales service delivery. Imagine a scenario where a ransomware attack encrypts essential data, halting vehicle sales and service appointments across multiple dealerships. This could translate into lost revenue and damage to customer trust, which is hard to rebuild.

- Increased exposure to data breaches

- Disruption of critical dealer management systems

- Potential for significant financial losses due to operational downtime

- Damage to brand reputation and customer confidence

Market Share Growth Challenges

Inchcape faces significant hurdles in expanding its market share, particularly as it targets a 10% penetration across its operating regions. The automotive sector is notoriously competitive, with a dynamic landscape that presents ongoing challenges to growth.

Achieving substantial organic volume increases is a complex undertaking. This is largely due to subdued global automotive sales growth projections and the formidable competition posed by other established distributors. Furthermore, the rise of direct-to-consumer sales channels by original equipment manufacturers (OEMs) directly impacts traditional distribution models.

- Intense Competition: The automotive distribution market is highly fragmented, with numerous global and regional players vying for market share.

- OEM Direct Sales: A growing trend of OEMs bypassing traditional distributors and engaging directly with consumers online or through their own retail networks erodes Inchcape's traditional role and customer access.

- Economic Headwinds: Global economic uncertainties and potential recessions in key markets can dampen consumer demand for new vehicles, directly impacting sales volumes for distributors like Inchcape. For instance, the International Organization of Motor Vehicle Manufacturers (OICA) reported a modest 3% increase in global production for 2023, indicating a still-recovering market.

Inchcape's reliance on a limited number of major Original Equipment Manufacturers (OEMs) creates a significant dependency. A shift in strategy or a decline in partnership with a key OEM, such as Toyota or BMW, could directly impact Inchcape's revenue and market position. This concentration risk is amplified by the fact that a substantial portion of its business is tied to these relationships.

The company faces challenges in managing its extensive global inventory, a task made difficult by fluctuating supply and demand across diverse markets. Holding excess stock, especially with the elevated interest rates seen in 2024 and continuing into 2025, can significantly erode profitability through slower sales and increased financing costs.

Inchcape's increasing digital presence exposes it to substantial cybersecurity threats. A breach could disrupt critical dealer management systems, leading to operational downtime and potential financial losses, as evidenced by several high-profile automotive sector cyberattacks in 2023.

The company's expansion efforts are hampered by intense competition and the growing trend of OEMs adopting direct-to-consumer sales models. This shift challenges Inchcape's traditional distribution role and customer access, particularly in a market where global automotive sales growth remains subdued, with OICA reporting only a modest 3% increase in global production for 2023.

Preview Before You Purchase

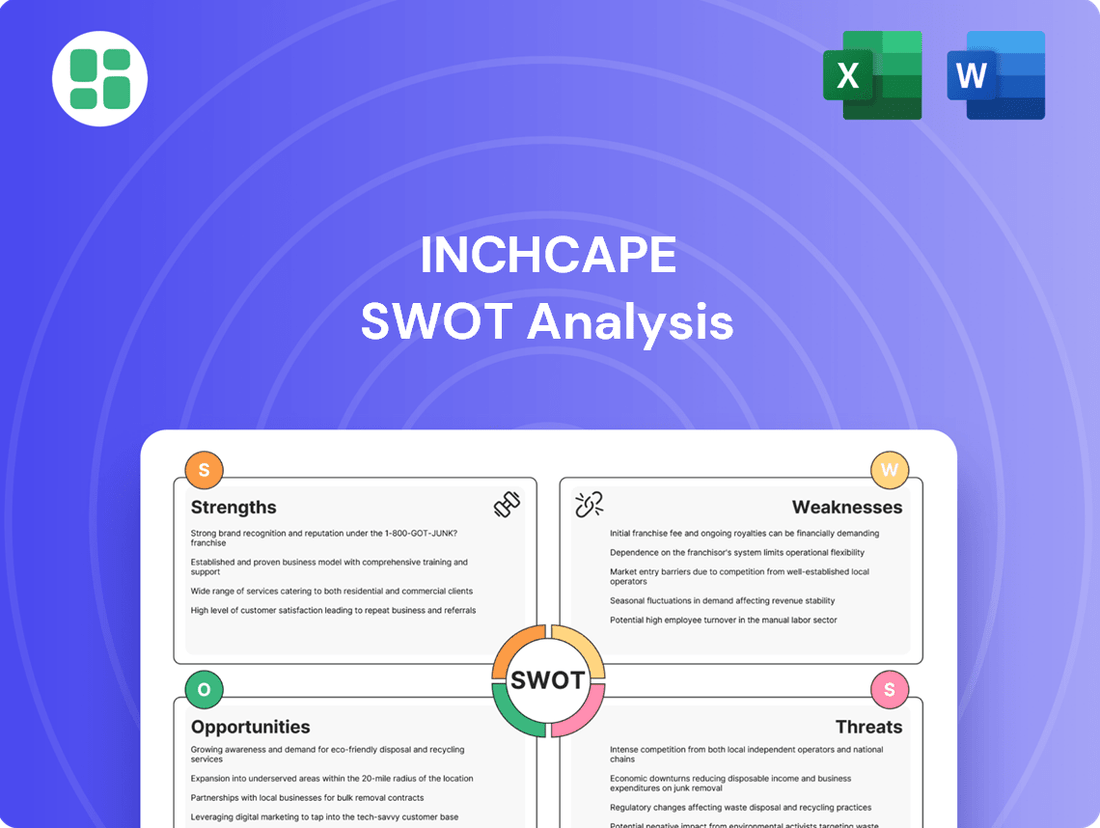

Inchcape SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing an actual excerpt of the Inchcape SWOT analysis. Once purchased, you’ll receive the full, editable version.

Opportunities

Inchcape's strategic focus on smaller, more complex, and higher-growth markets, especially those with low motorization rates, opens substantial avenues for expansion. These regions, particularly within Asia-Pacific and Latin America, are poised for significant growth in new car sales and after-market services. For instance, emerging economies in Southeast Asia are projected to see a compound annual growth rate (CAGR) of over 6% in vehicle sales through 2027, driven by a burgeoning middle class and increasing disposable incomes.

Inchcape's commitment to digital transformation, including substantial investments in AI, is a significant opportunity. For instance, by expanding AI for repair quotes and developing digital parts platforms, the company can streamline operations and improve customer interactions. This focus on data analytics and AI is projected to boost efficiency by an estimated 15-20% in key operational areas by the end of 2025, as indicated by industry benchmarks.

Further leveraging AI for personalized customer experiences presents another avenue for growth. By analyzing customer data, Inchcape can offer tailored services, financing options, and insurance products through strategic partnerships. This data-driven approach is expected to increase customer retention rates by up to 10% in the coming year, according to recent market analyses.

Inchcape's strategic acquisition of Askja in Iceland in early 2024 exemplifies its commitment to expansion. This move not only broadens its geographic reach but also strengthens its brand portfolio, a key driver for growth in diverse markets.

The company's proven ability to execute value-accretive acquisitions, coupled with a robust pipeline of potential bolt-on deals, positions it well for continued market consolidation. This M&A approach is instrumental in scaling operations and enhancing market leadership, particularly in fragmented automotive distribution sectors.

Growth in Aftersales and Value-Added Services

The automotive aftermarket is a robust sector, projected to see continued expansion. This growth is fueled by a couple of key trends: cars are generally getting older, meaning more maintenance is needed, and consumers are increasingly seeking higher quality, original equipment manufacturer (OEM) certified parts and specialized services. Inchcape is well-positioned to leverage this trend by enhancing its digital offerings for premium parts.

Furthermore, as the automotive landscape shifts towards new energy vehicles (NEVs), there's a significant opportunity in developing specialized services. This includes crucial battery maintenance and repair, a high-margin area that aligns with the evolving needs of the market.

- Expanding OEM-certified parts sales through digital channels offers a direct route to higher-margin revenue.

- The increasing average age of vehicles globally necessitates more aftermarket servicing and parts replacement.

- Developing specialized battery services for the growing NEV fleet addresses a critical and emerging market demand.

- The aftermarket sector provides a consistent revenue stream, often less cyclical than new vehicle sales.

Partnerships with New Energy Vehicle (NEV) and Chinese OEMs

Inchcape can capitalize on the accelerating global shift towards New Energy Vehicles (NEVs), including hybrids and fully electric models. This presents a significant opportunity to forge strategic partnerships with burgeoning Chinese automotive manufacturers and other NEV brands seeking international market access.

By leveraging its extensive global distribution network and deep market expertise, Inchcape can act as a crucial facilitator for these NEV players, enabling their entry and expansion into diverse geographical regions. For instance, Chinese NEV exports saw a substantial surge, with sales reaching approximately 5.2 million units in 2023, a 57% increase year-on-year, indicating a strong demand for these vehicles abroad.

- Expanding NEV Portfolio: Partnering with NEV manufacturers allows Inchcape to diversify its product offerings and cater to a rapidly growing segment of the automotive market.

- Market Entry Facilitation: Inchcape's established infrastructure and regulatory knowledge can significantly de-risk and accelerate market entry for new NEV brands.

- Leveraging Chinese OEM Growth: Chinese automakers, such as BYD and SAIC, are increasingly competitive in the NEV space, offering a strong base for potential distribution agreements. BYD, for example, became the world's largest EV seller in Q4 2023.

- Future-Proofing Business: Aligning with the NEV trend ensures Inchcape's long-term relevance and competitiveness in an evolving automotive landscape.

Inchcape's strategic focus on emerging markets with low motorization rates offers significant growth potential, particularly in Asia-Pacific and Latin America, where new car sales and after-market services are expected to expand. The company's investment in digital transformation, including AI for operational efficiency and personalized customer experiences, is projected to boost productivity and customer retention. Furthermore, Inchcape is well-positioned to benefit from the expanding automotive aftermarket, driven by the increasing average age of vehicles and the demand for OEM-certified parts. The accelerating global shift towards New Energy Vehicles (NEVs) presents a key opportunity to partner with NEV manufacturers, facilitating their international market entry and expanding Inchcape's own portfolio.

Threats

Geopolitical instability poses a significant threat to Inchcape, as exemplified by the ongoing trade tensions between major economic blocs like the US, China, and the EU. These tensions can manifest as import tariffs, directly impacting the cost of components and finished vehicles, potentially raising prices for consumers and reducing overall sales volume. For instance, the automotive sector has already seen disruptions due to such policies, with projections indicating continued volatility in global trade flows throughout 2024 and into 2025.

Election cycles in key markets can further exacerbate these risks, leading to unpredictable shifts in trade policy and affecting supply chain stability. For Inchcape, this means navigating a complex and potentially volatile operating environment where sudden changes in tariffs or trade agreements could disrupt sourcing, manufacturing, and distribution networks. The company's reliance on global supply chains makes it particularly vulnerable to these geopolitical headwinds, which could strain profitability and operational efficiency.

While electric vehicles (EVs) are a key growth area, the anticipated rapid adoption has faced some challenges. In 2023, EV sales growth, while still positive, showed signs of moderating in certain regions compared to earlier, more aggressive projections. This slowdown, coupled with a noticeable resurgence in demand for traditional internal combustion engine (ICE) and hybrid vehicles, presents a potential shift in the automotive market landscape.

The automotive distribution sector faces escalating competition, particularly from cost-effective Chinese brands entering global markets. For instance, BYD's rapid expansion and competitive pricing strategies in 2024 present a significant challenge. This intensified rivalry, coupled with original equipment manufacturers (OEMs) increasingly adopting direct-to-consumer sales models, could compress Inchcape's profit margins and erode its market share, demanding agile adjustments to its established distribution networks.

Supply Chain Disruptions and Inventory Volatility

Global supply chains continue to present ongoing challenges, with potential shortages of critical minerals impacting production timelines and creating inventory imbalances for companies like Inchcape. For instance, in 2024, the automotive sector, a key market for Inchcape, experienced persistent disruptions affecting the availability of components like semiconductors, leading to significant production slowdowns.

While holding higher inventory levels can bolster operational resilience against these disruptions, it directly impacts liquidity. This can strain financial resources, affecting Inchcape's profitability and overall operational efficiency due to increased holding costs and the risk of obsolescence.

- Supply chain vulnerabilities persist, impacting component availability.

- Increased inventory, while improving resilience, ties up capital.

- Inventory volatility can lead to both stockouts and excess stock, affecting sales and costs.

- Financial strain arises from higher inventory carrying costs and potential write-downs.

Economic Pressures and Consumer Affordability

Global economic headwinds, including elevated interest rates and persistent inflation, are significantly impacting household budgets. This squeeze on consumer affordability directly translates to a potential delay in major purchase decisions like new vehicles, which is a core business for Inchcape. For instance, as of early 2024, many economies are still grappling with inflation rates above central bank targets, forcing consumers to prioritize essential spending over discretionary items.

This reduced purchasing power can lead to a noticeable contraction in overall new vehicle market demand. Inchcape, as a major automotive distributor and retailer, is particularly susceptible to these shifts, which could directly affect its sales volumes and overall revenue generation throughout 2024 and into 2025.

- High Interest Rates: Increased borrowing costs make car financing more expensive, deterring potential buyers.

- Inflationary Impact: Rising costs for everyday goods leave consumers with less disposable income for vehicle purchases.

- Consumer Debt Levels: Growing household debt further limits the capacity for new financial commitments like car loans.

- Market Demand Constraint: These combined pressures directly shrink the pool of willing and able car buyers.

The automotive sector's transition to electric vehicles (EVs) presents a nuanced threat. While EV adoption is growing, its pace is moderating in some regions, with a resurgence in demand for internal combustion engine (ICE) and hybrid vehicles observed through 2023 and into 2024. This market shift requires Inchcape to adapt its strategy, balancing investment in EV infrastructure and sales with continued demand for traditional powertrains.

Intensified competition, particularly from cost-effective Chinese automotive brands like BYD, is a significant threat. BYD's aggressive market entry and pricing in 2024 are pressuring established players. Furthermore, Original Equipment Manufacturers (OEMs) increasingly adopting direct-to-consumer sales models could erode Inchcape's traditional distribution margins and market share.

Geopolitical instability, including trade tensions and election cycles in key markets, poses a risk to Inchcape's global supply chains. Tariffs and policy shifts can disrupt component sourcing and increase costs, impacting profitability. For instance, the automotive industry has faced ongoing supply chain volatility, with projections indicating continued disruptions through 2024 and 2025.

Global economic headwinds, such as high interest rates and persistent inflation, are dampening consumer affordability. This reduced purchasing power can lead to delays in major purchases like new vehicles, directly impacting Inchcape's sales volumes. As of early 2024, many economies are still experiencing inflation above central bank targets, further constraining consumer spending.

| Threat Category | Specific Example/Data | Impact on Inchcape |

| Intensified Competition | BYD's aggressive market entry and pricing in 2024. OEM direct-to-consumer sales models. | Margin compression, potential market share erosion. |

| Economic Headwinds | Inflation above targets in early 2024, high interest rates impacting affordability. | Reduced new vehicle demand, lower sales volumes. |

| Geopolitical Instability | Trade tensions (e.g., US-China), election cycles impacting trade policy. | Supply chain disruptions, increased component costs. |

| EV Market Transition | Moderating EV sales growth in some regions (2023-2024), resurgence of ICE/hybrid demand. | Need to balance EV investment with traditional powertrain strategies. |

SWOT Analysis Data Sources

This Inchcape SWOT analysis is built upon a robust foundation of data, including the company's official financial filings, comprehensive market research reports, and expert commentary from industry analysts. These sources provide a well-rounded view of Inchcape's operational landscape and strategic positioning.