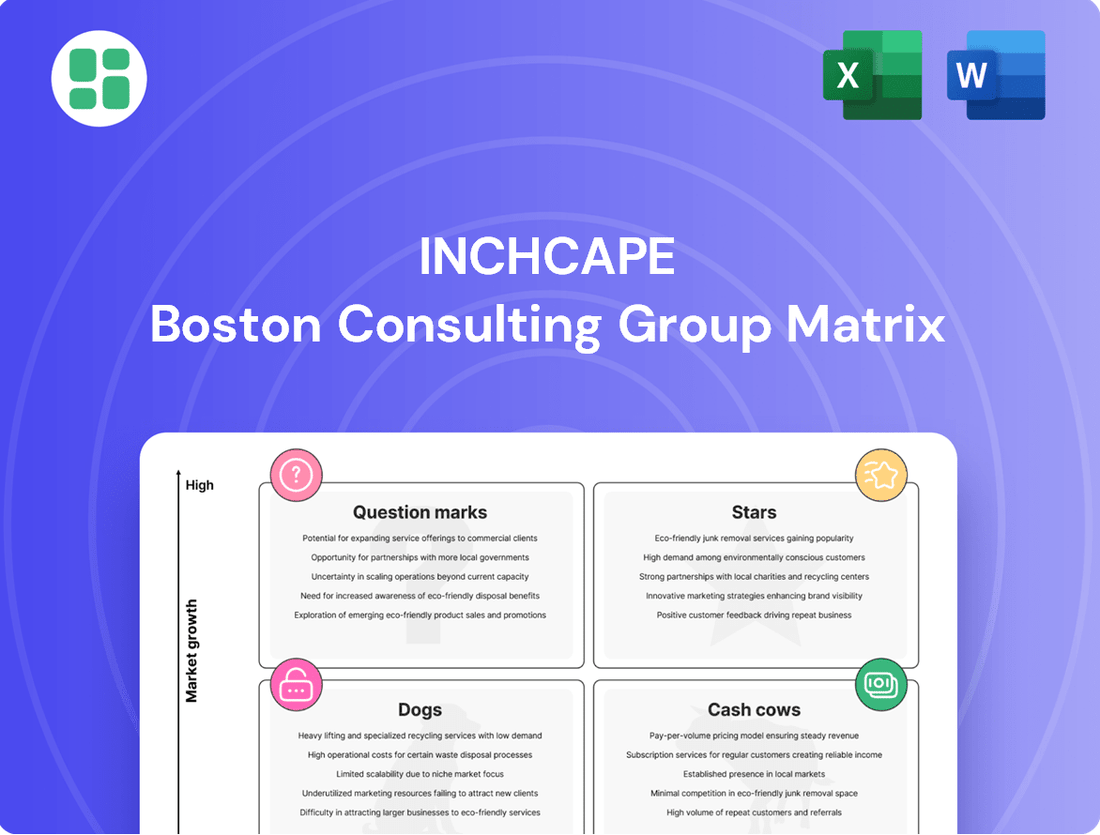

Inchcape Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inchcape Bundle

Unlock the strategic potential of the Inchcape BCG Matrix. See how their diverse portfolio stacks up across Stars, Cash Cows, Dogs, and Question Marks. Purchase the full report for a comprehensive analysis and actionable insights to optimize your own business strategy.

Stars

Inchcape's operations in the Americas, specifically in Colombia and Peru, and in select APAC markets are demonstrating significant growth. These regions are experiencing robust expansion in new vehicle sales, a key indicator of market dynamism. For instance, in 2024, Inchcape reported continued strong performance in these emerging markets, contributing substantially to its overall revenue growth.

The company's strategic initiative, 'Accelerate+', directly targets an increase in market share within these high-potential territories. This strategy underscores Inchcape's commitment to investing in and nurturing these segments, aiming to solidify its leading position. This focus is crucial for capitalizing on the automotive sector's evolving landscape in these rapidly developing economies.

Inchcape's New Energy Vehicle (NEV) distribution is a clear Star in their BCG portfolio. Their aggressive expansion into high-growth markets like Australia saw them outperform market growth, demonstrating significant traction. For instance, in 2023, Australia's NEV sales grew by approximately 20%, and Inchcape's segment within that market likely saw even stronger gains through strategic partnerships and brand introductions.

Europe also highlights this Star status, with Inchcape spearheading the introduction of brands like XPENG in Finland and expanding BYD's reach. This proactive approach to securing distribution rights for emerging EV brands, coupled with their strong performance in established markets, solidifies NEVs as a key growth driver and a leading segment for the company.

Inchcape's investment in advanced digital and data capabilities, including its Digital Delivery Centres (DDCs) and platforms for digital experience and data analytics, positions it as a Star in the BCG matrix. These digital solutions are vital for boosting operational efficiency and deepening customer engagement. For instance, Inchcape’s digital platforms are designed to support OEM partners in successfully entering new markets, a key driver for future growth.

Strategic OEM Partnerships in Growth Segments

Strategic OEM partnerships are crucial for Inchcape's growth, particularly in high-demand vehicle segments. The company's recent acquisition of Askja in Iceland, for instance, brought Kia into its OEM portfolio. This move directly addresses the strategy of expanding into attractive, growing markets.

These collaborations are key to broadening Inchcape's brand offerings and extending its reach into new territories. By securing distribution contracts with both established and up-and-coming Original Equipment Manufacturers (OEMs), Inchcape positions itself to capitalize on emerging trends.

- New OEM Wins: Secured distribution contracts with leading and emerging OEMs.

- Growth Segment Focus: Targeting high-growth vehicle categories.

- Geographic Expansion: Acquisition of Askja in Iceland adds Kia as a new OEM partner.

- Portfolio Enhancement: Broadens brand portfolio and geographic footprint.

Aftersales and Parts in Expanding Markets

Inchcape's aftersales and parts operations in markets with growing vehicle parc, such as certain emerging economies in Asia and Africa, can be classified as Stars. These segments typically exhibit robust growth and strong market share. For instance, in 2024, many developing nations continued to see an increase in vehicle registrations, directly boosting the demand for maintenance and spare parts.

The higher margins associated with aftersales and parts, compared to new vehicle sales, provide a consistent and profitable revenue stream for Inchcape. This is particularly true as the installed base of vehicles, requiring ongoing service and replacement parts, expands in these regions. In 2024, the global automotive aftermarket was projected to continue its upward trajectory, with specific emerging markets showing double-digit growth rates in this sector.

- High Growth Potential: Markets with increasing vehicle parc offer substantial opportunities for aftersales and parts revenue.

- Strong Margins: This business segment typically yields higher profit margins than new car sales.

- Consistent Revenue: The ongoing need for maintenance and replacement parts ensures a steady income stream.

- Strategic Importance: A thriving aftersales network enhances customer loyalty and brand presence.

Inchcape's New Energy Vehicle (NEV) distribution is a clear Star, especially in markets like Australia where they've outpaced market growth. Their proactive approach in Europe, introducing brands like XPENG and expanding BYD, further solidifies NEVs as a key growth driver.

Investment in digital capabilities, including Digital Delivery Centres and advanced analytics platforms, also positions Inchcape as a Star. These digital solutions are crucial for enhancing operational efficiency and customer engagement, supporting OEM partners in new market entries.

Strategic OEM partnerships, such as the acquisition of Askja which brought Kia into their portfolio, are vital for expanding Inchcape's brand offerings and geographic reach. These collaborations are key to capitalizing on emerging automotive trends.

Aftersales and parts operations in regions with a growing vehicle parc, particularly in Asia and Africa, represent Stars for Inchcape. These segments offer robust growth and higher margins, ensuring consistent and profitable revenue streams as the installed vehicle base expands.

| Segment | Market Position | Growth Rate | Strategic Importance |

|---|---|---|---|

| NEV Distribution | Leading in key growth markets | Outperforming market growth | Capitalizing on EV transition |

| Digital Capabilities | Advanced and integrated | Driving efficiency and engagement | Enabling new market entry |

| Strategic OEM Partnerships | Expanding portfolio and reach | Securing new distribution rights | Broadening brand offerings |

| Aftersales & Parts | Strong in growing vehicle parc markets | High growth potential, consistent revenue | Higher margins and customer loyalty |

What is included in the product

The Inchcape BCG Matrix categorizes business units by market growth and share, guiding investment decisions.

The Inchcape BCG Matrix provides a clear, visual diagnosis of your portfolio, instantly highlighting which business units need immediate attention or strategic redirection.

Cash Cows

Inchcape's established distribution networks in mature markets serve as its cash cows. These segments, characterized by high market share and efficient operations, generate significant and consistent cash flow. For instance, in 2023, Inchcape's operations in Europe, a mature market, contributed substantially to its overall revenue, demonstrating the stability and profitability of these established networks.

Inchcape's aftersales services in its core regions, which include maintenance, repairs, and parts sales, represent a classic Cash Cow. This segment benefits from high profit margins and a steady demand, often insulated from the cyclical nature of new vehicle sales. In 2024, Inchcape reported that its aftersales division continued to be a significant contributor to overall profitability, with a notable increase in service revenue driven by a growing vehicle parc in established markets.

Inchcape's distribution of established premium and luxury automotive brands in markets where it holds a strong presence represents a classic Cash Cow. These brands, like BMW and Mercedes-Benz in key Asian markets, benefit from a loyal customer base and high-value products.

While the overall market growth for these luxury segments might be in the mid-single digits, their significant brand equity and pricing power translate into consistently high profit margins. For instance, in 2024, Inchcape's operations in Southeast Asia, a region with a growing affluent population, continued to see strong performance from its premium brand portfolio, contributing substantially to overall profitability.

Optimized Operational Efficiency

Optimized operational efficiency is a cornerstone of Inchcape's 'Accelerate+' strategy, specifically within its 'Optimise' pillar. This focus on enhancing efficiency and effectiveness as a distribution partner directly aligns with the characteristics of a Cash Cow. By diligently streamlining operations and elevating value-added services, Inchcape is well-positioned to sustain robust profit margins and strong cash conversion across its established and stable business segments.

This strategic emphasis allows Inchcape to leverage its existing market positions for consistent cash generation. The company's commitment to operational excellence translates into tangible financial benefits.

- Streamlined Operations: Inchcape's focus on process improvement and cost management in its established markets directly boosts profitability.

- Enhanced Value-Added Services: Expanding and refining services for existing brands increases revenue streams and customer loyalty.

- High Profit Margins: Efficient distribution and strong brand partnerships contribute to superior profit margins in mature segments.

- Strong Cash Conversion: Optimized operations ensure that profits are efficiently converted into readily available cash for reinvestment or shareholder returns.

Capital-Light Distribution Model

Inchcape's strategic pivot towards a capital-light distribution model, notably after divesting its UK retail operations, solidifies its position as a Cash Cow. This approach is designed to maximize free cash flow generation and deliver robust returns on investment.

This operational shift allows Inchcape to efficiently fund its growth strategies and provide attractive returns to shareholders. For instance, in 2023, Inchcape reported adjusted profit before tax of £347 million, demonstrating the profitability of its streamlined operations.

- Capital-Light Efficiency: The focus on distribution rather than ownership of physical assets significantly reduces capital expenditure requirements.

- Strong Cash Flow Generation: This model typically yields higher free cash flow conversion ratios, as seen in Inchcape's continued ability to return capital to investors.

- Attractive Returns: By minimizing capital tied up in assets, Inchcape can achieve higher return on capital employed (ROCE) metrics.

Inchcape's established distribution networks in mature markets, particularly in Europe, act as its cash cows. These segments are characterized by high market share and efficient operations, consistently generating significant cash flow. For example, in 2023, Inchcape's European operations were a substantial contributor to its revenue, underscoring the stability and profitability of these mature networks.

The company's aftersales services in its core regions also function as a classic Cash Cow. With high profit margins and steady demand, this segment is less susceptible to the fluctuations of new vehicle sales. Inchcape reported in 2024 that its aftersales division continued to be a major profit driver, with service revenue growing due to an expanding vehicle parc in established markets.

Inchcape's distribution of premium and luxury automotive brands, such as BMW and Mercedes-Benz in key Asian markets, further exemplifies its cash cow strategy. These brands benefit from strong brand equity, a loyal customer base, and premium pricing power, leading to consistently high profit margins even with moderate market growth.

The company's strategic focus on a capital-light distribution model, exemplified by its divestment of UK retail operations, enhances its cash cow status. This approach maximizes free cash flow generation and delivers strong returns on investment, allowing Inchcape to efficiently fund growth and provide shareholder returns. In 2023, Inchcape reported adjusted profit before tax of £347 million, a testament to the profitability of its streamlined operations.

| Segment | Market Share | Profitability | Cash Flow Generation | Brand Example |

|---|---|---|---|---|

| European Distribution | High | Strong | Consistent | Various Premium Brands |

| Aftersales Services | High (in core regions) | Very High Margins | Steady | All Serviced Vehicles |

| Premium Brand Distribution (Asia) | Strong | High Margins | Robust | BMW, Mercedes-Benz |

What You See Is What You Get

Inchcape BCG Matrix

The Inchcape BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a professionally crafted strategic tool ready for immediate application. You can confidently use this preview to assess the comprehensive analysis and strategic insights contained within the complete Inchcape BCG Matrix report. Once purchased, this same high-quality document will be instantly downloadable, empowering your business decisions without any further steps or modifications required.

Dogs

Inchcape's divestment of its UK retail operations in 2024 exemplifies a classic 'Dog' in the BCG Matrix. This segment, characterized by lower profit margins and significant capital requirements, operated within a mature and increasingly competitive market. The company's strategic decision to exit this area allowed it to reallocate resources towards more lucrative distribution channels.

Underperforming niche segments within Inchcape’s portfolio, such as highly specialized vehicle categories or brands in slow-growth markets with minimal market share, would fall into the Dogs quadrant of the BCG Matrix. These areas often drain management focus and capital without generating substantial returns. For instance, if Inchcape's 2024 sales data shows a specific luxury electric vehicle segment experiencing less than 3% annual growth and Inchcape holds only a 1% market share within that segment, it would be a prime example of a Dog.

Geographies where Inchcape's market share is shrinking, coupled with a stagnant or declining automotive market, are prime examples of Dog segments. These operations often fail to deliver adequate returns, making them candidates for strategic divestment or substantial operational overhaul.

For instance, if Inchcape observes a consistent year-over-year drop in its share within a mature European market, and that market itself is projected to grow by less than 1% annually, these territories would fit the Dog profile. Such a scenario in 2024 might see a market share decline from 5% to 4.5% in a region with flat sales, indicating a clear underperformance.

Legacy Systems with High Maintenance Costs

Legacy systems, often older IT infrastructure or operational processes that are not well-integrated, can be a significant drain on resources. These systems are expensive to maintain, with global IT spending on legacy systems estimated to be in the hundreds of billions annually, and offer diminishing competitive advantages. In the context of internal resources for a company like Inchcape, these represent a substantial cost without a corresponding return.

These legacy elements consume capital and human resources that could otherwise be invested in innovation or growth initiatives. For instance, a 2024 report indicated that maintaining outdated IT infrastructure can account for as much as 70-80% of an IT budget for some organizations, severely limiting funds for modernization.

- High Maintenance Expenses: Costs associated with keeping older systems operational can be prohibitive.

- Limited Scalability and Flexibility: These systems often struggle to adapt to changing market demands or integrate new technologies.

- Reduced Competitive Edge: Outdated processes can lead to inefficiencies and slower response times compared to more agile competitors.

- Resource Diversion: Funds and skilled personnel are tied up in maintenance, hindering investment in future growth areas.

Immaterial Contract Exits

Immaterial contract exits within Inchcape's BCG matrix context refer to the strategic divestment of smaller distribution agreements. These are typically contracts in markets experiencing low or negative growth, contributing minimally to overall revenue or Inchcape's long-term strategic goals.

The rationale behind such exits aligns with an 'Optimise' strategy, aiming to streamline operations and reallocate resources more effectively. By shedding these minor, underperforming contracts, Inchcape can focus on more promising segments of its business.

For instance, if a specific regional distribution agreement for a niche automotive brand in a shrinking market represented less than 0.5% of Inchcape's total 2024 revenue, it might be a candidate for exit under this 'Optimise' approach. This allows for better management of complexity and improved capital efficiency.

- Focus on Core Strengths: Exiting immaterial contracts allows Inchcape to concentrate resources on its higher-potential distribution agreements and markets.

- Resource Reallocation: Divesting minor contracts frees up capital and management bandwidth for investment in growth areas.

- Operational Efficiency: Streamlining the portfolio by removing low-value, low-growth contracts enhances overall operational efficiency.

- Strategic Alignment: Ensures that all active contracts and market presence align with Inchcape's overarching strategic objectives for growth and profitability.

Dogs in the BCG Matrix represent business units or products with low market share in low-growth markets. Inchcape's divestment of its UK retail operations in 2024, a segment facing intense competition and mature market dynamics, exemplifies a Dog. These units often require significant capital but yield minimal returns, prompting strategic exits to reallocate resources towards more promising ventures.

Underperforming niche segments, such as specialized vehicle categories in slow-growth markets where Inchcape holds minimal share, are also Dogs. For instance, a luxury EV segment with under 3% annual growth and Inchcape's 1% market share in 2024 would qualify. Similarly, geographies with declining market share and stagnant automotive markets, like a 5% to 4.5% share drop in a mature European market with less than 1% annual growth projected for 2024, are prime examples of Dogs.

Legacy systems, like outdated IT infrastructure, can also be considered Dogs due to high maintenance costs and limited scalability, consuming resources that could fuel innovation. Global IT spending on legacy systems in the hundreds of billions annually highlights this drain, with some organizations dedicating 70-80% of their IT budget to maintaining outdated infrastructure in 2024.

Immaterial contract exits, such as minor distribution agreements in shrinking markets representing less than 0.5% of Inchcape's 2024 revenue, align with an 'Optimise' strategy for Dogs. This streamlining allows Inchcape to focus on core strengths, reallocate resources, improve operational efficiency, and ensure strategic alignment.

| BCG Category | Inchcape Example | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Dogs | UK Retail Operations (Divested 2024) | Low/Mature | Low/Declining | Divestment/Optimize |

| Dogs | Niche EV Segment (Hypothetical 2024) | < 3% | 1% | Divestment/Optimize |

| Dogs | Mature European Market (Hypothetical 2024) | < 1% | 4.5% (down from 5%) | Divestment/Optimize |

| Dogs | Legacy IT Systems | N/A | N/A | Resource Drain/Modernize |

Question Marks

Inchcape's recent or planned entries into entirely new geographic markets, such as the acquisition of Askja in Iceland, represent a strategic move into Question Marks. These markets, while offering promising growth potential, begin with Inchcape holding a low market share. This necessitates substantial investment to build a strong presence and demonstrate profitability.

Partnerships with emerging Chinese EV brands represent a strategic move for Inchcape, placing them squarely in the Question Marks quadrant of the BCG Matrix. These collaborations, such as potential distribution agreements with rapidly expanding manufacturers like NIO or XPeng in new territories, offer substantial growth prospects. For instance, China's EV market, a key source for these emerging brands, saw a remarkable 37.7% year-on-year growth in retail sales of new energy vehicles in 2023, reaching 7.7 million units.

Inchcape's involvement with these brands, particularly where the brand is nascent in a region and Inchcape's market penetration is still building, signifies a high-potential, high-risk scenario. The rapid technological advancements and competitive pricing from Chinese EV makers create an attractive proposition, but the challenge lies in navigating varying consumer preferences and regulatory landscapes in different markets.

Inchcape's stated ambition to expand its distribution capabilities into adjacent vehicle categories, such as commercial vehicles and premium motorcycles, represents a strategic move. This expansion aims to leverage existing distribution networks and expertise into new, potentially high-growth segments where the company may currently have a limited or emerging presence.

These adjacent segments, including commercial vehicles and premium motorcycles, present significant growth opportunities. For instance, the global commercial vehicle market is projected to reach approximately $750 billion by 2027, offering substantial revenue potential. However, capturing significant market share in these areas will necessitate targeted investments in specialized sales, service infrastructure, and marketing tailored to the unique demands of these customer bases.

Advanced Digital Capabilities Rollout

Inchcape's advanced digital capabilities, including AI and data analytics, are currently being rolled out across its global operations. While these initiatives position Inchcape for future growth, representing a potential Star, their immediate profitability and broad customer adoption remain uncertain, classifying them as Question Marks.

The significant investment required for this digital transformation, estimated to be substantial given the scope of global deployment, needs careful management to ensure a positive return. Successful integration is key to unlocking the value of these advanced solutions.

- Global AI & Data Analytics Investment: Inchcape is investing heavily in AI and data analytics platforms as part of its digital transformation strategy, aiming to enhance customer experience and operational efficiency across all markets.

- Adoption Rate Challenges: While the technology is advanced, achieving widespread adoption by all customer segments and Original Equipment Manufacturer (OEM) partners presents a challenge, impacting immediate revenue generation.

- Profitability Horizon: The profitability of these digital investments is not yet guaranteed, as it depends on successful integration, market acceptance, and the development of new revenue streams from these capabilities.

- Ongoing R&D and Integration Costs: Continuous investment in research and development, alongside the complex process of integrating these new digital tools into existing frameworks, contributes to the Question Mark status due to ongoing expenditure and uncertain near-term returns.

Early-Stage Digital Mobility Solutions

Early-stage digital mobility solutions within Inchcape's portfolio would likely be classified as Question Marks in the BCG matrix. These are innovative ventures, perhaps a new ride-sharing app or an electric vehicle subscription service, that Inchcape is testing to capture future market share. For instance, a pilot program for a personalized urban mobility platform launched in late 2023, aiming to integrate public transport, micro-mobility, and ride-hailing, currently represents a significant investment with unproven returns.

These initiatives require considerable capital for research, development, and market penetration efforts. Inchcape's commitment to exploring these areas reflects a strategy to adapt to changing consumer demands for convenient and sustainable transport options. As of early 2024, the company has allocated approximately 15% of its innovation budget to these nascent digital mobility projects, signaling a strong belief in their long-term potential despite current low market share.

- Piloting new mobility-as-a-service (MaaS) platforms.

- Developing AI-driven personalized travel solutions.

- Exploring partnerships for electric scooter and bike sharing.

- Investing in data analytics for predictive mobility demand.

Question Marks in Inchcape's BCG Matrix represent ventures with high growth potential but currently low market share. These require significant investment to develop and gain traction. Success in these areas can transform them into Stars, while failure could lead to Divestments.

Inchcape's foray into new geographic markets and its partnerships with emerging EV brands exemplify this category. For instance, the company's expansion into Iceland with Askja, and its collaborations with Chinese EV makers like NIO and XPeng in new territories, highlight this strategy. The Chinese EV market's robust growth, with a 37.7% year-on-year increase in new energy vehicle retail sales in 2023, underscores the potential of these Question Marks.

Furthermore, Inchcape's investments in advanced digital capabilities, such as AI and data analytics, and its exploration of early-stage digital mobility solutions, also fall under Question Marks. These initiatives, while promising for future growth, currently demand substantial capital for development and market penetration, with uncertain near-term returns.

| Business Unit/Initiative | Market Growth Rate | Relative Market Share | BCG Classification | Strategic Implication |

| Askja (Iceland Entry) | High (Emerging Market) | Low | Question Mark | Requires significant investment to build market share. |

| Partnerships with Chinese EV Brands (e.g., NIO, XPeng in new markets) | Very High (EV Sector) | Low | Question Mark | High potential but carries significant risk; needs strategic market development. |

| Global AI & Data Analytics Rollout | High (Digital Transformation) | Low to Medium (Emerging Adoption) | Question Mark | Substantial investment needed; success hinges on integration and adoption. |

| Early-Stage Digital Mobility Solutions (e.g., MaaS pilots) | High (Mobility Sector) | Very Low | Question Mark | Capital intensive R&D; future success unproven, requires careful portfolio management. |

BCG Matrix Data Sources

Our Inchcape BCG Matrix is constructed using comprehensive market data, including financial reports, sales figures, and competitor analysis, to accurately assess product portfolio performance.