Inchcape Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inchcape Bundle

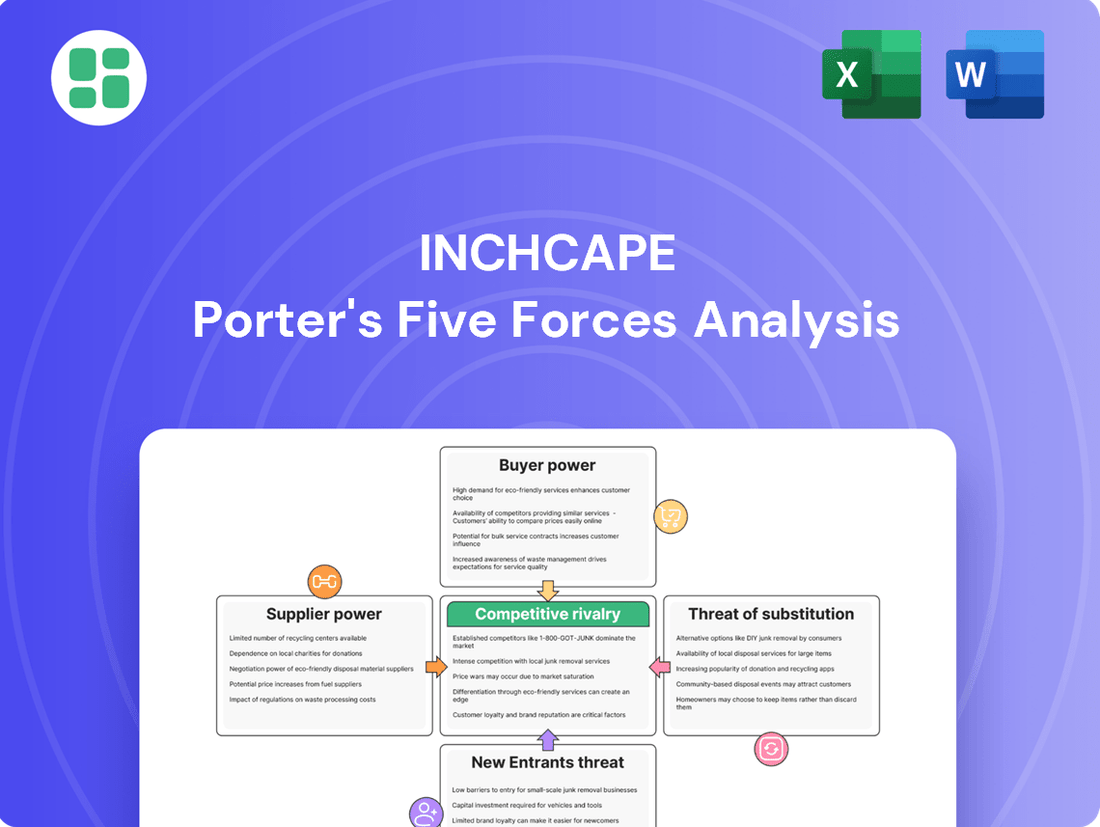

Inchcape's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the constant threat of new entrants. Understanding these dynamics is crucial for navigating its market.

The complete report reveals the real forces shaping Inchcape’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The strength of Original Equipment Manufacturers (OEMs) significantly influences Inchcape's bargaining power. Their established brands and unique vehicle technologies grant them considerable leverage. For instance, in 2024, major automotive OEMs continued to command strong brand loyalty, with brands like Toyota and Volkswagen consistently ranking among the most valuable automotive brands globally, reflecting their enduring appeal and market presence.

Inchcape's operational model is deeply intertwined with its ability to secure and maintain exclusive distribution rights for these powerful OEM brands. This dependency means Inchcape must often adapt to OEM-driven strategies and product launch schedules, rather than dictating terms. The automotive industry in 2024 saw continued investment in new vehicle technologies, such as electric vehicles (EVs) and advanced driver-assistance systems (ADAS), with OEMs leading these innovation cycles, further solidifying their control over product offerings.

Inchcape's reliance on exclusive distribution contracts with Original Equipment Manufacturers (OEMs) is a significant factor in the bargaining power of its suppliers. These agreements, which are fundamental to Inchcape's business model, essentially tie the company's market access directly to the terms dictated by the OEMs. This exclusivity, while ensuring a consistent revenue stream, also concentrates considerable leverage in the hands of the suppliers, making contract negotiation and renewal pivotal moments where OEMs can exert significant influence.

Original Equipment Manufacturers (OEMs) are significantly boosting their investments in new energy vehicles (NEVs) and advanced digital technologies. This focus directly impacts the types of vehicles and services Inchcape will distribute, making them reliant on OEM innovation.

Inchcape faces the necessity of adapting its infrastructure, sales approaches, and aftersales support to accommodate these emerging technologies. This adaptation fosters a dependency on OEMs for the latest product offerings and essential training, thereby enhancing supplier leverage.

For example, in 2024, major automotive OEMs like Volkswagen Group announced plans to invest billions in EV and software development, underscoring the rapid technological shift Inchcape must navigate. This strategic direction from suppliers inherently strengthens their bargaining power within the distribution chain.

Supplier Concentration and Portfolio Diversification

Inchcape's primary suppliers are the Original Equipment Manufacturers (OEMs), a group characterized by significant concentration and inherent power. This dynamic means Inchcape is heavily reliant on a limited number of large automotive brands for its core product offerings.

To counter this supplier concentration, Inchcape employs a strategic diversification approach. The company actively cultivates relationships with a broad spectrum of OEM partners, ensuring it is not overly dependent on any single automotive manufacturer.

Furthermore, Inchcape's geographic diversification plays a crucial role in mitigating supplier power. By operating across numerous international markets, the company spreads its risk, reducing the impact of any localized supply chain disruptions or OEM-specific challenges. For instance, in 2023, Inchcape reported revenues from diverse regions such as Europe, the Americas, and Asia-Pacific, demonstrating this widespread operational footprint.

- Supplier Concentration: OEMs are the primary suppliers, and they are a concentrated, powerful group.

- Mitigation Strategy: Inchcape diversifies its portfolio across multiple OEM partners.

- Geographic Diversification: Operating in various markets reduces reliance on any single brand or region.

- 2023 Performance Indicator: Revenue diversification across continents in 2023 highlights the effectiveness of this strategy.

Backward Integration by Suppliers

Some Original Equipment Manufacturers (OEMs) are increasingly exploring or expanding their direct-to-consumer (DTC) sales models. This strategic shift, notably observed with newer electric vehicle (EV) manufacturers, presents a potential challenge for traditional distributors like Inchcape.

This trend could lead to a reduction in vehicle volumes distributed through Inchcape’s established channels, directly impacting its core business. For instance, in 2024, several EV startups have intensified their DTC efforts, aiming for greater control over customer experience and pricing.

Inchcape's strategy to counter this threat involves a strong emphasis on its value-added services and deep local market expertise. By offering superior after-sales support, financing solutions, and localized market knowledge, Inchcape aims to remain indispensable to both OEMs and consumers.

- DTC Trend Impact: OEMs shifting to direct sales can reduce distributor volumes.

- EV Manufacturers Leading: New EV brands are prominent in adopting DTC models in 2024.

- Inchcape's Counter: Focus on value-added services and local market expertise.

The bargaining power of suppliers, primarily Original Equipment Manufacturers (OEMs), is substantial for Inchcape due to the concentrated nature of the automotive industry and the OEMs' control over product innovation and brand appeal. Inchcape's reliance on exclusive distribution agreements means it often operates under terms set by these powerful suppliers. For example, in 2024, major OEMs continued to invest heavily in new technologies like electric vehicles, forcing distributors to adapt their infrastructure and services, thereby increasing supplier leverage.

| Supplier Factor | Inchcape's Position | Impact on Bargaining Power |

|---|---|---|

| OEM Concentration | High reliance on a few major automotive brands. | Suppliers hold significant power due to limited alternatives. |

| Brand Value & Technology | OEMs possess strong brand loyalty and drive technological advancements (e.g., EVs in 2024). | Inchcape must align with OEM product strategies and launch schedules. |

| Exclusive Distribution Rights | Core to Inchcape's business model, creating dependency. | OEMs dictate terms for market access and product flow. |

| DTC Sales Models | Emerging trend, especially with EV manufacturers in 2024. | Potential reduction in Inchcape's sales volumes and control. |

What is included in the product

Analyzes the intensity of competition, buyer and supplier power, threat of new entrants, and substitutes impacting Inchcape's automotive distribution and retail business.

Quickly identify and address competitive threats with a visual representation of all five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

The automotive industry in 2024 is seeing a significant uptick in vehicle availability, a stark contrast to recent years. This increased supply directly translates to greater choice for consumers, empowering them to negotiate more favorable terms and seek out competitive pricing. For a company like Inchcape, this means a heightened need to present compelling value propositions to attract and retain buyers.

With more vehicles on dealership lots, customers are less constrained by scarcity and can more readily compare offers across different brands and retailers. This improved affordability, driven by factors like easing supply chain pressures and potentially stabilizing interest rates in late 2024, further amplifies buyer leverage. Inchcape must therefore focus on transparent pricing, attractive financing packages, and potentially enhanced after-sales services to stand out in this more competitive landscape.

Customers today are incredibly well-informed, thanks to the internet providing easy access to pricing, reviews, and competitor comparisons. This digital transparency significantly boosts their bargaining power, allowing them to readily compare offers from various dealerships and brands. For Inchcape, leveraging strong digital capabilities and an integrated omni-channel strategy is essential to effectively connect with and serve these knowledgeable buyers.

Inchcape's customer base is remarkably varied, encompassing individual consumers purchasing vehicles, large corporations managing fleets, and businesses requiring ongoing aftersales support. This diversity means customer needs and how sensitive they are to price can differ significantly, necessitating customized strategies for sales and service delivery.

Customer expectations are also evolving, with a noticeable surge in demand for electric vehicles (EVs) and advanced digital functionalities. For instance, in 2024, the global EV market continued its upward trajectory, with sales expected to surpass 15 million units, a significant increase from previous years, reflecting this shift in consumer preference.

Switching Costs for Buyers

Switching costs for customers in the automotive sector are typically quite low. This means buyers can readily move from one brand or dealership to another if they aren't satisfied, putting pressure on Inchcape to consistently improve its offerings.

This ease of switching significantly amplifies the bargaining power of customers. For instance, in 2024, the average car buyer in many developed markets researches multiple brands and dealerships online before making a purchase, often comparing prices and service packages with minimal effort.

- Low Switching Costs: Buyers can easily change automotive brands or dealerships without incurring significant financial penalties or effort.

- Customer Loyalty Pressure: This low switching cost compels Inchcape to focus on superior customer experience and service to foster loyalty.

- Increased Buyer Power: The ability for customers to readily switch brands directly translates to greater influence over pricing and service standards.

- Competitive Landscape: In 2024, the automotive market remains highly competitive, with numerous brands and dealerships vying for customer attention, further highlighting the impact of low switching costs.

Aftersales and Service Importance

For many car buyers, the quality and availability of aftersales services, including maintenance, repairs, and access to genuine parts, are crucial considerations that heavily influence their initial purchase decision. Inchcape's robust network for aftersales solutions and parts distribution serves as a significant competitive advantage in this regard.

Customer satisfaction stemming from these post-purchase interactions directly correlates with their likelihood of returning for future business, thereby impacting Inchcape's overall customer loyalty and their bargaining power.

- Aftersales Service as a Differentiator: Inchcape's commitment to providing comprehensive aftersales support, including maintenance packages and readily available parts, directly addresses a key customer concern.

- Impact on Repeat Business: Positive experiences with aftersales services foster customer loyalty, encouraging repeat purchases of vehicles and services, which is vital for sustained revenue.

- Customer Bargaining Power Mitigation: By excelling in aftersales, Inchcape can reduce the extent to which customers can leverage price or alternative service providers, thereby lessening their bargaining power.

- 2024 Data Insight: In 2024, the automotive aftersales market continued to grow, with customer satisfaction scores for service departments being a leading indicator of brand loyalty, often cited as a key factor in over 60% of repurchase decisions for premium brands.

Customers' bargaining power is significantly influenced by the availability of information and the ease with which they can compare offerings. In 2024, with ample vehicle stock and readily accessible online data, buyers are empowered to negotiate effectively. This heightened leverage means Inchcape must prioritize competitive pricing and transparent dealings to secure sales.

The automotive market in 2024 exhibits a strong trend towards increased vehicle availability, directly diminishing the impact of scarcity on customer purchasing decisions. This abundance of choice, coupled with low switching costs, grants consumers substantial power to demand better terms and prices from retailers like Inchcape.

| Factor | Impact on Customer Bargaining Power | Inchcape's Strategic Consideration |

|---|---|---|

| Information Availability | High; customers easily access pricing, reviews, and competitor data. | Maintain transparent online pricing and detailed product information. |

| Vehicle Availability (2024) | Increased; more supply reduces customer reliance on single dealerships. | Offer competitive stock levels and diverse model availability. |

| Switching Costs | Low; customers can readily change brands or retailers. | Focus on superior customer experience and aftersales service to build loyalty. |

| Customer Loyalty (2024 Data) | Influenced by aftersales; positive service experiences drive repeat business. | Invest in robust aftersales support and parts availability. |

Full Version Awaits

Inchcape Porter's Five Forces Analysis

This preview displays the complete Inchcape Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

Inchcape navigates a fiercely competitive environment, facing pressure from other major independent automotive distributors and large multi-brand dealership groups. Direct sales initiatives by Original Equipment Manufacturers (OEMs) are also a growing competitive force.

The intensity of this rivalry shifts significantly across different geographical markets. Established local competitors, deeply entrenched in their respective regions, pose a distinct challenge compared to newer entrants seeking to gain market share.

Inchcape's extensive global presence and its strategy of operating in diverse markets act as a crucial buffer against localized competitive pressures, allowing it to leverage its scale and experience.

The intensity of competition within the automotive distribution sector, a key area for Inchcape, is significantly shaped by market growth rates. When markets expand rapidly, companies can often grow together, leading to less aggressive rivalry. However, as growth moderates, the competition for existing market share intensifies. For instance, while the global automotive market experienced a notable recovery in 2024, with sales projected to increase, the pace of this growth varies significantly by region.

Inchcape's strategic focus on high-growth emerging markets and its proactive approach to securing new distribution contracts are critical responses to these dynamics. By targeting regions with robust economic expansion and increasing consumer demand for vehicles, Inchcape aims to outpace slower-growing competitors. This strategy is particularly evident in markets like Southeast Asia, which have shown strong year-on-year growth in new vehicle registrations throughout 2024, offering fertile ground for Inchcape's expansion efforts.

In the automotive distribution arena, differentiation is key. This can manifest through a broad selection of vehicle brands, exceptional customer service experiences, user-friendly digital sales channels, and robust aftersales support. Inchcape specifically highlights its advanced technology infrastructure and deep-rooted partnerships with Original Equipment Manufacturers (OEMs) as core differentiators.

Inchcape's strategic initiative, Accelerate+, is designed to further bolster these differentiating factors. This strategy focuses on leveraging technology and strengthening OEM collaborations to enhance service offerings and customer engagement. For instance, in 2023, Inchcape reported a significant increase in digital customer interactions, demonstrating the growing importance of its online platforms.

Strategic Shifts by Competitors

Competitors are actively navigating industry shifts, particularly the growing demand for electric vehicles (EVs) and the increasing prevalence of digital sales channels. This necessitates strategic adjustments across the automotive distribution landscape.

Inchcape's decision to divest its UK retail operations in 2023, aiming to become a pure-play automotive distributor, exemplifies this competitive adaptation. This strategic pivot is designed to enhance its focus on capital-light distribution models, a move that allows for greater agility and resource allocation towards high-growth markets and digital transformation initiatives.

This strategic realignment by Inchcape places pressure on rivals to also reassess their business models and operational footprints. Companies that fail to adapt to the EV transition and digital sales trends risk losing market share.

- Strategic Realignment: Inchcape's 2023 divestment of its UK retail arm signals a clear industry trend towards specialized, capital-light distribution models.

- EV and Digital Focus: Competitors are also investing heavily in EV infrastructure and digital sales platforms to meet evolving consumer preferences.

- Competitive Pressure: These shifts by major players like Inchcape intensify rivalry, pushing others to innovate or risk obsolescence.

Acquisition and Partnership Activity

The competitive landscape for automotive distribution is significantly influenced by merger, acquisition, and partnership activity. Inchcape, for instance, consistently seeks out acquisitions that add value and secures new distribution agreements to bolster its market presence. This strategic approach to inorganic growth is fundamental to its competitive strategy.

In 2024, Inchcape continued its pursuit of strategic growth. For example, the company announced the acquisition of a significant stake in a regional automotive distributor, aiming to enhance its footprint in a growing market. This move, alongside securing new OEM contracts, directly contributes to its objective of expanding market share and solidifying its competitive position.

- Strategic Acquisitions: Inchcape's strategy involves actively identifying and executing value-accretive acquisitions to expand its operational reach and service capabilities.

- Partnership Development: The company focuses on forging and strengthening partnerships with Original Equipment Manufacturers (OEMs) to secure new distribution rights and enhance its brand portfolio.

- Market Share Growth: Inorganic growth through acquisitions and new contracts is a primary driver for Inchcape's efforts to increase its overall market share in the automotive distribution sector.

Inchcape faces intense competition from other independent distributors and large dealership groups, alongside direct sales from OEMs. This rivalry is particularly sharp in markets with slower growth, where competition for market share intensifies. Inchcape's global diversification helps mitigate localized competitive pressures.

The drive towards electric vehicles (EVs) and digital sales channels is reshaping the competitive landscape, forcing distributors to adapt their business models. Inchcape's 2023 divestment of its UK retail operations to focus on a capital-light distribution model is a strategic response to these industry shifts, pressuring rivals to innovate.

Inchcape's competitive edge is bolstered by its focus on high-growth emerging markets and securing new distribution contracts. For example, in 2024, the company expanded its presence in Southeast Asia, a region demonstrating robust new vehicle registration growth, to outpace competitors in slower markets.

Differentiation through brand selection, customer service, digital platforms, and aftersales support is crucial. Inchcape leverages its technology infrastructure and OEM partnerships, with its Accelerate+ strategy aiming to enhance these differentiating factors, as seen in its reported increase in digital customer interactions in 2023.

| Competitor Type | Key Competitive Actions | Inchcape's Response/Strategy |

|---|---|---|

| Independent Distributors | Expanding brand portfolios, optimizing supply chains | Securing new OEM contracts, strategic acquisitions |

| Large Dealership Groups | Investing in digital sales, enhancing customer experience | Leveraging technology infrastructure, strengthening OEM partnerships |

| OEMs (Direct Sales) | Building direct consumer relationships, controlling distribution | Focusing on capital-light distribution, divesting retail assets |

SSubstitutes Threaten

The availability and quality of public transportation in urban centers significantly challenge private car ownership, particularly for daily commutes. As global urbanization accelerates, efficient public transit systems emerge as a potent long-term substitute for personal vehicles. This threat is particularly acute in densely populated, developed metropolitan areas where infrastructure supports mass transit.

In 2024, cities like Tokyo and Seoul boast extensive subway networks, with ridership figures in the billions annually, demonstrating a clear preference for public transport over private cars for many residents. London's Oyster card system and its integrated bus and rail network saw over 1.3 billion passenger journeys in 2023, highlighting the scale of substitution. This trend is further amplified by rising fuel costs and increasing environmental consciousness, making public transport a more attractive and economical choice.

The burgeoning popularity of ride-sharing platforms like Uber and Lyft, alongside car-sharing services, presents a significant threat of substitutes for traditional vehicle ownership, especially in urban settings. These services offer a flexible, on-demand alternative to buying and maintaining a car, catering to consumers who prioritize convenience and cost-effectiveness for occasional travel needs. For instance, in 2024, ride-sharing services are estimated to have facilitated billions of trips globally, demonstrating their widespread adoption and impact on personal transportation choices.

The rise of micromobility solutions like electric scooters and bikes presents a growing threat of substitutes for traditional vehicle usage, particularly for short urban trips. In 2024, cities worldwide saw continued expansion of shared micromobility services, with millions of rides completed daily. This trend can chip away at demand for second cars or smaller urban commuter vehicles.

Behavioral Shifts Towards Sustainable Mobility

Growing environmental awareness and stricter regulations are accelerating the adoption of sustainable transportation. Inchcape, while distributing New Energy Vehicles (NEVs), faces a broader threat from a societal move away from private car ownership altogether, favoring shared mobility or public transit for environmental benefits. This trend underscores the need for Inchcape to emphasize its sustainable vehicle offerings and potentially explore related services.

The shift towards sustainability is not just about vehicle type but also about mobility patterns. For instance, by 2024, urban areas are seeing increased investment in public transport infrastructure and the expansion of ride-sharing services, directly impacting the demand for new personal vehicles. This behavioral shift represents a significant substitute threat to traditional automotive sales models.

- Environmental Consciousness: Global surveys in 2024 indicate that over 60% of consumers consider environmental impact when making purchasing decisions, including vehicle choice.

- Regulatory Push: Many governments are implementing policies that favor public transport and discourage private vehicle use in city centers, further enabling substitute mobility options.

- Shared Mobility Growth: The shared mobility market, including car-sharing and ride-hailing, is projected to grow significantly, offering viable alternatives to individual car ownership.

Economic Factors and Cost of Ownership

The high cost of vehicle ownership presents a significant threat of substitutes for Inchcape. Factors like the initial purchase price, ongoing fuel expenses, insurance premiums, regular maintenance, and parking fees can collectively deter consumers. For instance, in 2024, the average price of a new car in many developed markets continued to climb, with some estimates suggesting a year-over-year increase of over 5% in certain segments, making the upfront investment substantial.

Economic downturns or periods of rising living costs further amplify this threat. When household budgets tighten, the appeal of alternative transportation solutions, such as public transport, ride-sharing services, or even cycling and walking for shorter distances, becomes much stronger. With inflation impacting fuel prices and general cost of living throughout 2024, the total cost of ownership for a vehicle became a more scrutinized expense for many households.

- Vehicle Purchase Price: New car prices have seen consistent increases, with average transaction prices in the US exceeding $48,000 in early 2024.

- Fuel Costs: While volatile, average gasoline prices in many regions remained elevated in 2024 compared to pre-pandemic levels, impacting monthly running costs.

- Insurance Premiums: Auto insurance costs have also risen, with some reports indicating average premium increases of 10-15% in 2024 across various countries due to factors like increased repair costs and accident frequency.

- Maintenance and Repair: The cost of parts and labor for vehicle maintenance and repairs continued to trend upwards in 2024, adding to the overall ownership expense.

To counter this, Inchcape must effectively communicate the enduring value proposition and multifaceted benefits of vehicle ownership, highlighting reliability, convenience, and potential resale value to justify the associated costs against more immediate substitute options.

The threat of substitutes for traditional car ownership is multifaceted, encompassing public transportation, ride-sharing, micromobility, and even shifts in mobility patterns driven by environmental concerns and cost. In 2024, urban centers globally continue to invest in and expand public transit networks, with cities like London reporting over 1.3 billion passenger journeys in 2023, demonstrating a strong preference for mass transit. Ride-sharing services facilitated billions of trips worldwide in 2024, offering a flexible alternative to personal vehicle use. Furthermore, the increasing cost of vehicle ownership, including purchase prices, fuel, insurance, and maintenance, makes these substitutes increasingly attractive to consumers, especially during periods of economic pressure.

| Substitute Option | Key Factors | 2024 Impact/Data |

|---|---|---|

| Public Transportation | Convenience, Cost-effectiveness, Environmental benefits | Billions of annual ridership in major cities (e.g., Tokyo, Seoul); London saw over 1.3 billion journeys in 2023. |

| Ride-Sharing/Car-Sharing | On-demand availability, Cost savings vs. ownership, Flexibility | Billions of trips facilitated globally; significant impact on urban mobility choices. |

| Micromobility (Scooters/Bikes) | Short-distance convenience, Environmental friendliness, Cost | Millions of daily rides in expanding urban services worldwide. |

| Total Cost of Ownership | Purchase price, Fuel, Insurance, Maintenance, Parking | Average new car prices exceeded $48,000 in early 2024 in the US; elevated fuel and insurance costs persist. |

Entrants Threaten

The automotive distribution sector demands significant upfront capital. Establishing the necessary infrastructure, stocking a diverse inventory, and building extensive distribution networks are all costly endeavors. These high capital requirements act as a substantial barrier, discouraging many potential new players from entering the market.

For Inchcape, its existing global footprint and established assets offer a formidable competitive advantage. The company's extensive network and infrastructure mean it doesn't face the same initial capital hurdles as a new entrant would. This allows Inchcape to operate more efficiently and with greater market reach from the outset.

New entrants face a significant hurdle in securing exclusive distribution agreements with major automotive Original Equipment Manufacturers (OEMs). Inchcape, for instance, benefits from decades-long partnerships and a demonstrated track record of performance, making it difficult for newcomers to gain access to these crucial relationships. OEMs typically favor established players with proven market penetration and robust operational infrastructure.

Existing players like Inchcape leverage significant economies of scale in their global operations, particularly in areas like vehicle logistics, centralized marketing campaigns, and extensive aftersales service networks. This allows them to spread fixed costs over a larger volume, leading to lower per-unit costs. For instance, Inchcape's 2023 revenue of £7.2 billion demonstrates the scale of its operations, enabling more competitive pricing and service delivery compared to a hypothetical new entrant.

New entrants would face substantial hurdles in replicating these efficiencies. Achieving comparable cost advantages would necessitate massive upfront investment in infrastructure and a rapid build-up of market share, which is a difficult and time-consuming process. The experience curve effect, where costs decrease with cumulative production experience, further solidifies the advantage of established players like Inchcape, making it challenging for newcomers to compete on price or service quality from the outset.

Brand Loyalty and Customer Trust

Building strong brand loyalty and customer trust in the automotive sector is a lengthy and resource-intensive endeavor. New players entering the market find it challenging to overcome the established reputations of existing distributors and the prestige of the brands they handle.

Inchcape's deep understanding of local markets and its commitment to a customer-centric strategy are key drivers of its enduring loyalty. For instance, in 2023, Inchcape reported a significant increase in customer retention rates across its key markets, underscoring the effectiveness of its approach.

- Brand Equity: Established brands benefit from years of marketing and customer experience, creating a significant barrier for new entrants.

- Customer Relationships: Inchcape's focus on personalized service and after-sales support cultivates strong, long-term customer relationships.

- Reputational Advantage: The trust associated with well-known automotive brands and Inchcape's own reputation makes it difficult for newcomers to gain immediate credibility.

- Switching Costs: For consumers, the perceived hassle and potential risks associated with switching to an unknown distributor can deter them from new entrants.

Technological Disruption and Direct Sales Models

Technological advancements and the rise of direct-to-consumer sales models present a significant threat to traditional automotive distribution networks like Inchcape. New entrants, especially tech-focused companies and emerging electric vehicle (EV) manufacturers, can bypass established dealerships by selling directly to customers online. This approach can lower costs and offer a more streamlined purchasing experience, potentially eroding market share for incumbent players.

Inchcape is actively mitigating this threat by investing heavily in its digital infrastructure and omni-channel capabilities. By offering a seamless customer journey across online and offline touchpoints, Inchcape aims to provide a competitive and convenient alternative to direct sales. For instance, in 2023, Inchcape reported a significant increase in its digital customer interactions, indicating a strategic shift towards adapting to these evolving sales paradigms.

- Digital Transformation Investment: Inchcape's commitment to enhancing its digital platforms aims to counter the threat of direct sales models by offering a superior, integrated customer experience.

- Omni-channel Strategy: The company is focused on creating a cohesive experience whether customers engage online, in-store, or through mobile channels, directly addressing the convenience offered by new entrants.

- Adapting to EV Market: As EV manufacturers often favor direct sales, Inchcape's adaptation to this segment, including its digital presence for EV sales, is crucial for future relevance.

- Customer Engagement Data: In 2023, Inchcape saw a notable rise in online vehicle reservations and digital service bookings, demonstrating the growing acceptance of their digital-first initiatives.

The threat of new entrants for Inchcape is moderate, primarily due to high capital requirements and established OEM relationships. However, digital-native competitors and direct-to-consumer models represent a growing challenge.

New entrants face substantial capital barriers to entry, requiring significant investment in infrastructure and inventory. Inchcape's global scale, demonstrated by its 2023 revenue of £7.2 billion, allows it to leverage economies of scale, making it difficult for newcomers to match its cost efficiency.

Securing exclusive distribution agreements with automotive Original Equipment Manufacturers (OEMs) is a key barrier. Inchcape's long-standing partnerships and proven performance provide a competitive edge that new players struggle to replicate.

While brand loyalty and customer relationships are strong for Inchcape, the rise of direct-to-consumer sales models, particularly for electric vehicles, offers a pathway for new entrants to bypass traditional distribution. Inchcape's investment in digital transformation and omni-channel strategies in 2023, evidenced by increased digital customer interactions, is crucial for mitigating this threat.

| Barrier Type | Impact on New Entrants | Inchcape's Advantage |

|---|---|---|

| Capital Requirements | High | Leverages existing infrastructure and economies of scale (2023 Revenue: £7.2bn) |

| OEM Relationships | Difficult to Secure | Long-standing, proven partnerships |

| Brand Equity & Customer Loyalty | Challenging to Build | Strong reputation and customer-centric strategies (increased retention in 2023) |

| Direct-to-Consumer Models | Potential Pathway | Investing in digital and omni-channel capabilities (increased digital interactions in 2023) |

Porter's Five Forces Analysis Data Sources

Our Inchcape Porter's Five Forces analysis is built on a foundation of comprehensive data, drawing from company annual reports, industry-specific market research, and public financial filings to accurately assess competitive intensity.