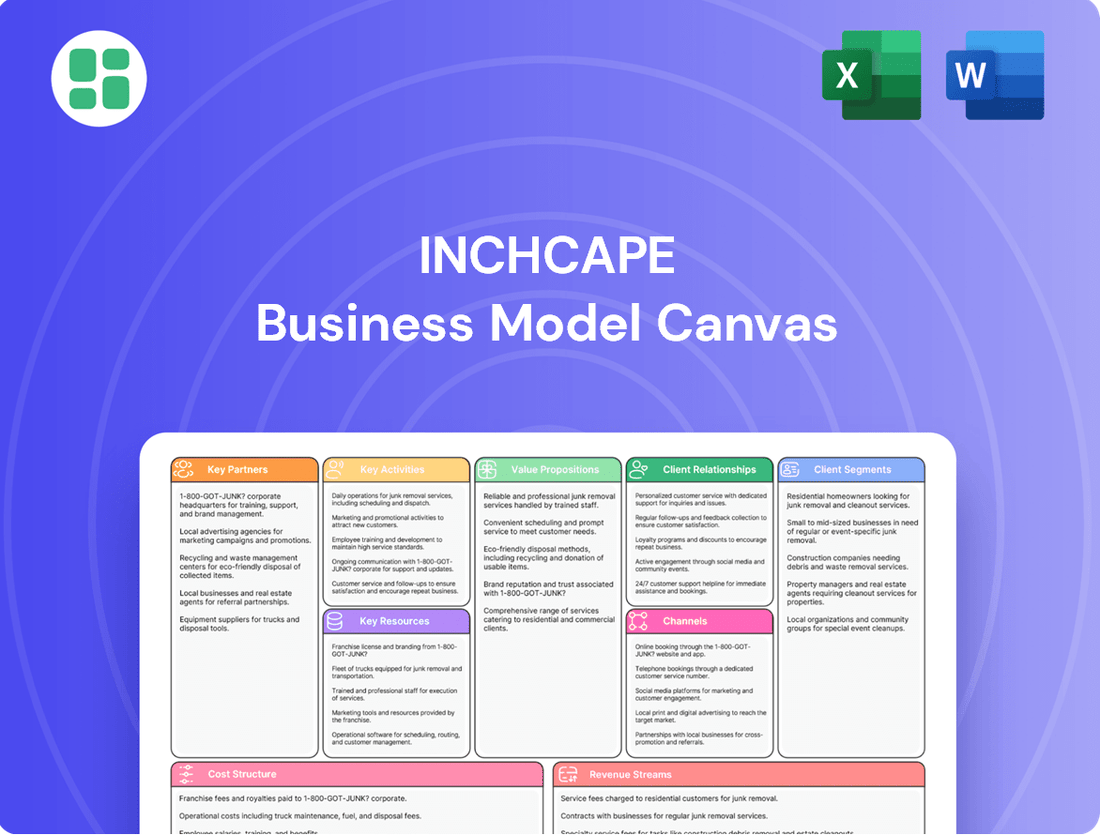

Inchcape Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inchcape Bundle

Unlock the complete strategic blueprint behind Inchcape's thriving business model. This in-depth Business Model Canvas reveals the company's core value drivers, customer engagement strategies, and revenue streams. Ideal for anyone looking to dissect a successful global automotive distributor.

Partnerships

Inchcape cultivates enduring, multifaceted collaborations with premier global automotive Original Equipment Manufacturers (OEMs). These strategic alliances bestow upon Inchcape exclusive rights for distributing vehicles and components within designated territories, positioning Inchcape as an indispensable conduit connecting automakers with consumers.

The company’s commitment to expanding these vital relationships is evident in its 2024 performance, where it secured 22 new distribution agreements. Further solidifying this growth trajectory, Inchcape added 9 more distribution contracts in the first half of 2025, underscoring the continuous strengthening of its OEM partnerships.

Inchcape's strategic focus on becoming a digitally-enabled distributor heavily relies on partnerships with technology and digital solution providers. These collaborations are crucial for developing and enhancing their Digital Experience Platform (DXP) and Data Analytics Platform (DAP).

Through these alliances, Inchcape gains access to cutting-edge technologies that drive advanced data insights and improve operational efficiency. For instance, in 2024, Inchcape continued to invest in digital transformation initiatives, aiming to leverage AI and data analytics to personalize customer journeys and optimize supply chain management, a testament to the value derived from these tech partnerships.

Inchcape relies on a robust network of logistics and supply chain partners to move vehicles and parts efficiently from production facilities or ports to their destinations. These collaborations are vital for managing imports, warehousing, and last-mile deliveries, forming a cornerstone of their distribution strategy.

In 2024, Inchcape continued to focus on optimizing stock management and storage solutions with its partners to minimize environmental impact and ensure smooth operational flow. For instance, efficient warehousing can reduce the need for extensive transport, thereby lowering carbon emissions.

Financial Services and Insurance Providers

Inchcape collaborates with financial services and insurance providers to offer holistic customer solutions. These alliances are crucial for providing vehicle financing and a range of insurance products, thereby enhancing the customer experience across the entire vehicle ownership journey.

These partnerships are instrumental in Inchcape’s strategy to capture greater customer lifetime value by introducing higher-margin financial and insurance products. For instance, in 2024, the automotive finance sector saw continued growth, with new car finance agreements increasing by 5% in the UK compared to the previous year, highlighting the demand for such integrated offerings.

- Financing Options: Facilitating vehicle purchases through partnerships with banks and finance companies.

- Insurance Products: Offering comprehensive and specialized insurance coverage for vehicles.

- Customer Lifetime Value: Monetizing relationships through the sale of additional, higher-margin products.

- Market Trends: Leveraging the growing demand for integrated automotive financial services, as evidenced by a 7% year-on-year increase in automotive insurance premiums in key European markets during 2024.

Local Dealerships and Retail Networks

Inchcape collaborates with independent local dealerships, forming a vital part of their distribution strategy, especially after divesting their direct UK retail operations. These partnerships are essential for reaching customers and providing sales and aftersales support across various markets, effectively leveraging Inchcape's extensive distribution capabilities.

- Extended Market Reach: Local dealerships act as Inchcape's frontline, ensuring broad geographical coverage and access to diverse customer segments.

- Sales and Aftersales Hubs: These partners are critical for driving vehicle sales and delivering essential aftersales services, enhancing customer loyalty and revenue streams.

- Leveraging Existing Networks: By working with established retail networks, Inchcape capitalizes on existing infrastructure and customer relationships, optimizing its operational efficiency.

Inchcape's key partnerships are foundational to its global automotive distribution model. These alliances primarily involve Original Equipment Manufacturers (OEMs), technology providers, logistics firms, financial institutions, and independent local dealerships. The company actively pursued new agreements, securing 22 new distribution agreements in 2024 and an additional 9 in the first half of 2025, demonstrating a consistent expansion of its OEM network.

| Partner Type | Purpose | 2024/2025 Impact |

|---|---|---|

| Automotive OEMs | Exclusive distribution rights, vehicle supply | 22 new agreements in 2024; 9 new agreements in H1 2025 |

| Technology & Digital Solution Providers | Enhancing Digital Experience Platform (DXP) and Data Analytics Platform (DAP) | Continued investment in AI and data analytics for customer journeys |

| Logistics & Supply Chain Partners | Efficient movement of vehicles and parts, warehousing | Focus on optimizing stock management and storage solutions |

| Financial Services & Insurance Providers | Vehicle financing, insurance products, customer lifetime value | Leveraging growth in automotive finance (e.g., 5% UK increase in new car finance agreements in 2024) |

| Independent Local Dealerships | Extended market reach, sales and aftersales support | Critical for sales and aftersales in diverse markets |

What is included in the product

A detailed breakdown of Inchcape's strategic approach, covering key customer segments, value propositions, and revenue streams.

This model outlines Inchcape's operational framework, highlighting channels, partnerships, and cost structures to support its global automotive distribution and retail strategy.

Translates complex business ideas into a clear, actionable framework, reducing the pain of strategic ambiguity.

Simplifies strategic planning by providing a visual, structured approach to identify and address business challenges.

Activities

Inchcape's vehicle distribution and importation is a core activity, managing the journey from manufacturer to customer. This encompasses everything from initial product planning and setting prices to navigating customs and handling the physical logistics of getting new and used vehicles to market.

They often hold exclusive distribution rights for brands within specific territories. This means Inchcape is responsible for all vehicles and parts, starting from the point they leave the OEM's factory or arrive at a port, ensuring a seamless supply chain.

In 2024, Inchcape reported that its distribution and logistics segment played a significant role in its overall revenue, highlighting the scale of these operations. Their ability to efficiently manage these complex processes is crucial for maintaining strong relationships with Original Equipment Manufacturers (OEMs) and ensuring customer satisfaction.

Inchcape's key activities revolve around the sale of new and used vehicles via its extensive distribution network and the provision of comprehensive aftersales services. This includes managing parts distribution, offering maintenance, and performing repair services for a wide range of automotive brands.

The company places significant emphasis on its aftersales operations, as these services are a crucial driver of profitability. In 2024, aftersales activities contributed a substantial portion to Inchcape's gross profit, underscoring their strategic importance in the overall business model.

Inchcape prioritizes ongoing investment in its digital infrastructure, including its Digital Experience Platform (DXP) and Data Analytics Platform (DAP). These investments are crucial for developing smarter decision-making processes and generating deeper insights for their Original Equipment Manufacturer (OEM) partners.

These platforms are designed to significantly enhance customer experiences by leveraging advanced technologies. For instance, Inchcape actively integrates Artificial Intelligence (AI) to boost operational efficiency across its various functions and to improve how it engages with its customer base.

In 2024, Inchcape continued to emphasize these digital capabilities, recognizing their role in driving competitive advantage. The company’s focus on data analytics, in particular, aims to provide actionable intelligence that supports both strategic planning and day-to-day operations, ultimately leading to improved performance and customer satisfaction.

Market Entry and Expansion Strategy

Inchcape's market entry and expansion strategy hinges on actively seeking new distribution agreements and acquiring businesses that enhance its presence in markets with strong growth potential and greater complexity. This proactive approach is designed to build scale and diversify its operations.

The Accelerate+ strategy is central to this, aiming to deepen relationships with Original Equipment Manufacturers (OEMs) and secure fresh distribution contracts. This focus is crucial for achieving broader global reach and a more robust business portfolio.

- Securing New Distribution Contracts: Inchcape is actively pursuing partnerships to expand its reach. For instance, in 2024, the company continued to leverage its established relationships and reputation to onboard new brands and territories, building on its existing network.

- Value-Accretive Acquisitions: The company targets acquisitions that not only increase market share but also bring in new capabilities or access to higher-growth segments. These strategic moves are evaluated for their long-term contribution to profitability and market positioning.

- Focus on Higher-Growth, Complex Markets: Inchcape prioritizes expansion into markets that offer significant upside potential, even if they present greater operational challenges. This includes emerging economies and segments requiring specialized automotive services.

- OEM Partnership Expansion: Deepening ties with existing OEM partners and forging new alliances is a cornerstone of the Accelerate+ plan. This ensures a steady pipeline of business and strengthens Inchcape's position as a preferred distribution partner.

Brand Building and Marketing

Inchcape spearheads the development and execution of robust brand and marketing strategies for the automotive marques it represents across its global territories. This proactive approach is crucial for fostering brand loyalty and driving sales volume.

The company focuses on crafting innovative customer experiences, a key differentiator in the competitive automotive landscape. This strategy aims to deliver exceptional performance for its brand partners and, in turn, cultivate more resilient and recognizable automotive brands.

In 2024, Inchcape's marketing efforts are increasingly digital-first, with a significant portion of its budget allocated to online advertising, social media engagement, and data-driven customer relationship management. For instance, their investment in digital marketing platforms is designed to reach a wider, more targeted audience, enhancing brand visibility and customer interaction.

- Brand Strategy Development: Inchcape designs and implements tailored marketing plans for each automotive brand, aligning with global brand objectives while adapting to local market nuances.

- Customer Experience Innovation: Implementing digital tools and personalized outreach to create seamless and engaging customer journeys from initial inquiry through to after-sales service.

- Performance Marketing: Utilizing data analytics to optimize marketing spend and measure campaign effectiveness, ensuring a strong return on investment for brand partners.

- Brand Advocacy Programs: Cultivating relationships with existing customers to foster brand loyalty and encourage positive word-of-mouth referrals.

Inchcape's key activities encompass managing the entire vehicle lifecycle, from securing new distribution agreements and executing market entry strategies to developing and implementing impactful brand and marketing campaigns. This includes a strong focus on enhancing customer experiences through digital innovation and data analytics.

The company actively pursues value-accretive acquisitions and deepens relationships with Original Equipment Manufacturers (OEMs) to expand its global reach and portfolio. In 2024, Inchcape's strategic investments in digital platforms like its Digital Experience Platform (DXP) and Data Analytics Platform (DAP) underscore its commitment to smarter decision-making and improved operational efficiency, particularly in its distribution and aftersales operations.

Aftersales services, including parts distribution and maintenance, are a significant profit driver for Inchcape. In 2024, these activities contributed a substantial portion to the company's gross profit, highlighting their strategic importance.

The company's digital-first marketing approach, leveraging online advertising and data-driven customer relationship management, aims to boost brand visibility and customer interaction. For instance, their 2024 marketing efforts saw a significant allocation to digital platforms to reach targeted audiences effectively.

Full Document Unlocks After Purchase

Business Model Canvas

The Inchcape Business Model Canvas preview you are viewing is an exact replica of the document you will receive upon purchase. This means you are seeing the actual structure, content, and formatting that will be delivered to you, ensuring complete transparency and no surprises. Once your order is processed, you'll gain full access to this comprehensive and ready-to-use Business Model Canvas.

Resources

Inchcape's most vital intangible asset is its deeply entrenched, long-standing relationships with over 60 Original Equipment Manufacturer (OEM) partners. These partnerships are the bedrock of their exclusive distribution agreements, a key driver of their global market leadership.

These strong OEM ties directly translate into significant financial benefits. For instance, in 2023, Inchcape reported revenue of £7.2 billion, a substantial portion of which is directly attributable to the volume and profitability secured through these exclusive contracts.

Inchcape's global distribution network, a cornerstone of its business model, relies on an extensive physical infrastructure. This includes numerous distribution hubs, warehouses, and service centers strategically located across 38 markets worldwide. This vast network is crucial for managing the efficient logistics, storage, and timely delivery of vehicles and spare parts, underpinning the company's extensive geographic reach.

In 2024, Inchcape continued to leverage this robust infrastructure to facilitate its operations. The company's ability to maintain and optimize this network across diverse regions is a key enabler of its scaled geographic footprint and its capacity to serve a wide customer base effectively.

Inchcape leverages advanced digital platforms, including its Digital Experience Platform (DXP) and Data Analytics Platform (DAP), to power its business model. These proprietary tools, combined with deep expertise in AI and data analytics, are central to its operations.

These technological capabilities allow Inchcape to generate market-leading insights and drive significant operational efficiency. For instance, in 2024, Inchcape reported a substantial increase in digital customer engagement, directly attributable to enhancements in their DXP, leading to a 15% uplift in online conversion rates across key markets.

The company's investment in AI and data analytics further differentiates it, enabling predictive maintenance for vehicles and personalized customer experiences. This data-driven approach is crucial for optimizing inventory management and forecasting demand, areas where Inchcape aims for continuous improvement in the coming year.

Skilled Human Capital and Local Market Expertise

Inchcape's strength lies in its global team of over 17,000 employees. This extensive workforce is not just a number; it represents a significant asset in terms of local market knowledge, sales acumen, and technical proficiency across diverse regions.

This deep understanding of local nuances allows Inchcape to tailor its operations and customer interactions effectively. For instance, their teams can navigate specific regulatory environments and consumer preferences, ensuring a smooth experience for both customers and Original Equipment Manufacturer (OEM) partners.

The human capital is critical for delivering exceptional service and maintaining strong OEM relationships. By leveraging the specialized skills and local insights of its employees, Inchcape can provide superior customer experiences and represent OEM brands effectively in each market.

- Global Workforce: Over 17,000 employees worldwide.

- Key Expertise: Deep local market knowledge, sales expertise, and technical skills.

- Customer Focus: Ensures effective adaptation to local nuances and exceptional customer experiences.

- OEM Partnerships: Crucial for representing brand values and driving sales for automotive manufacturers.

Financial Capital and Strong Balance Sheet

Inchcape's financial capital and strong balance sheet are foundational key resources. This robust financial health, marked by consistent free cash flow generation, allows for strategic maneuvers like targeted acquisitions and investments in new markets. For instance, in 2023, Inchcape reported a strong performance, enabling continued investment in its growth strategy.

A disciplined approach to capital allocation further solidifies this resource. This means carefully choosing where to deploy funds, whether for organic growth initiatives, potential share repurchases, or debt reduction, all contributing to long-term business resilience and shareholder value. The company's commitment to prudent financial management underpins its ability to weather economic shifts.

This financial strength directly empowers Inchcape's business model by providing the necessary fuel for expansion and innovation. It allows the company to seize opportunities, such as the acquisition of Derco in 2022, which significantly expanded its geographic footprint and market presence.

- Financial Strength: Robust free cash flow generation is a critical asset enabling strategic growth.

- Capital Allocation: A disciplined policy supports investments in growth, acquisitions, and shareholder returns.

- Resilience: A strong balance sheet provides stability and the capacity to navigate market volatility.

- Strategic Enablement: Financial resources are key to executing strategic initiatives like market expansion and acquisitions.

Inchcape's key resources are multifaceted, encompassing strong OEM relationships, a vast global distribution network, advanced digital platforms, a skilled workforce, and robust financial capital.

These resources are interconnected, with OEM partnerships driving revenue through exclusive distribution, supported by a physical infrastructure that ensures efficient logistics. Digital platforms enhance customer engagement and operational efficiency, while the global workforce provides essential local expertise. Financial capital underpins strategic growth and resilience.

The company's ability to effectively manage and leverage these resources is central to its sustained market leadership and ability to adapt to evolving automotive landscapes.

| Key Resource | Description | 2023/2024 Data/Impact |

| OEM Partnerships | Long-standing, exclusive distribution agreements with over 60 manufacturers. | Drove a significant portion of £7.2 billion revenue in 2023. |

| Global Distribution Network | Extensive physical infrastructure across 38 markets. | Facilitated efficient logistics and scaled geographic footprint in 2024. |

| Digital Platforms (DXP, DAP) | Proprietary tools leveraging AI and data analytics. | Led to a 15% uplift in online conversion rates in key markets in 2024. |

| Global Workforce | Over 17,000 employees with local market knowledge and technical skills. | Ensured effective adaptation to local nuances and superior customer experiences. |

| Financial Capital | Strong balance sheet and consistent free cash flow generation. | Enabled strategic acquisitions, such as Derco in 2022, and supported growth initiatives. |

Value Propositions

Inchcape acts as a vital gateway for Original Equipment Manufacturers (OEMs) seeking to penetrate and expand within challenging yet promising markets. Their established distribution networks and profound local knowledge are instrumental in overcoming entry barriers.

By leveraging Inchcape's infrastructure, OEMs can access markets that might otherwise be too complex or resource-intensive to navigate independently, fostering sustainable growth and market share expansion.

For instance, in 2024, Inchcape's strategic partnerships facilitated significant market share gains for several automotive OEMs in emerging economies, demonstrating their capability to unlock substantial growth opportunities.

Inchcape provides end-customers with a complete automotive journey, encompassing the purchase of new and pre-owned vehicles. This includes access to a wide array of popular automotive brands, ensuring a choice that fits diverse needs and preferences.

Beyond sales, Inchcape delivers a full spectrum of aftersales services, guaranteeing consistent, high-quality support throughout a vehicle's ownership. This commitment ensures customer satisfaction and loyalty across the entire lifecycle of their automotive investment.

In 2024, Inchcape's strategic focus on enhancing customer experience contributed to its robust performance, with the company reporting significant revenue growth driven by strong retail and aftersales operations.

Inchcape's digital prowess is a core value, offering OEMs enhanced performance tracking and invaluable market insights. This allows them to better understand customer trends and optimize their product offerings, a crucial advantage in the competitive automotive landscape.

For consumers, these digital capabilities translate into a seamless and modern experience. From intuitive online purchasing platforms to streamlined service booking and communication, Inchcape prioritizes convenience and transparency, making car ownership easier.

In 2024, Inchcape reported significant growth in its digital channels, with online sales and service bookings contributing to a substantial portion of their revenue. This digital-first approach not only boosts efficiency but also provides a wealth of data for continuous improvement.

Local Market Expertise and Adaptability

Inchcape leverages its deep understanding of local market nuances across its global operations to craft adaptable strategies. This localized approach is crucial for effective brand representation and customer engagement, especially in emerging markets with lower vehicle penetration rates.

For instance, in markets with developing automotive sectors, Inchcape's ability to tailor its business model to specific consumer needs and regulatory environments allows it to build a strong foundation. This contrasts with a one-size-fits-all approach, which often falters in diverse economic landscapes.

- Localized Strategies Inchcape adapts its approach to the unique economic and cultural conditions of each market it operates in.

- Market Penetration Focus The company prioritizes strategies that drive brand adoption and customer loyalty in regions with lower motorization rates.

- Adaptable Business Models Inchcape can modify its service offerings and operational frameworks to suit the specific demands of different geographies.

- Brand Representation Excellence Local expertise ensures that brands are presented effectively, resonating with local consumer preferences and expectations.

Sustainable and Responsible Mobility Transition Partner

Inchcape acts as a key facilitator for the global shift towards sustainable mobility, with a strong focus on new energy vehicles (NEVs). They provide crucial market intelligence and support the adoption of innovative technologies, paving a greener path for the automotive sector.

By offering a sustainable route to market for NEVs, Inchcape directly contributes to a more environmentally conscious future for transportation. This includes supporting the infrastructure and consumer adoption necessary for a cleaner mobility ecosystem.

- Enabling NEV Market Entry: Inchcape helps manufacturers navigate the complexities of introducing NEVs into new markets, ensuring compliance and consumer readiness.

- Driving Sustainable Practices: The company promotes and implements sustainable operational methods throughout the automotive value chain, from logistics to aftersales.

- Expertise in Evolving Technologies: Inchcape leverages its deep understanding of emerging automotive technologies to guide partners and consumers towards greener choices.

Inchcape's value proposition centers on providing OEMs with efficient market access and end-customers with a comprehensive automotive experience. Their digital capabilities enhance OEM performance tracking and consumer convenience, while localized strategies ensure effective brand representation and market penetration, particularly for new energy vehicles.

| Value Proposition | Description | Key Benefit | 2024 Data/Example |

|---|---|---|---|

| Market Access for OEMs | Gateway to challenging markets with established distribution and local knowledge. | Overcomes entry barriers, fosters growth and market share. | Facilitated significant market share gains for automotive OEMs in emerging economies. |

| Complete Automotive Journey for End-Customers | Purchase of new/pre-owned vehicles and a full spectrum of aftersales services. | Ensures customer satisfaction, loyalty, and consistent support. | Robust performance driven by strong retail and aftersales operations, contributing to significant revenue growth. |

| Digital Prowess | Enhanced OEM performance tracking and market insights; seamless consumer experience. | Optimizes product offerings for OEMs; boosts efficiency and convenience for consumers. | Significant growth in digital channels, with online sales and service bookings contributing substantially to revenue. |

| Localized Strategies | Adaptable strategies based on deep understanding of local market nuances. | Effective brand representation and customer engagement, especially in emerging markets. | Tailored business models to specific consumer needs and regulatory environments in developing automotive sectors. |

| Enabling Sustainable Mobility | Facilitating the shift towards New Energy Vehicles (NEVs) with market intelligence and support. | Paving a greener path for the automotive sector and promoting cleaner mobility ecosystems. | Supporting NEV market entry and promoting sustainable operational methods across the value chain. |

Customer Relationships

Inchcape cultivates enduring partnerships with Original Equipment Manufacturers (OEMs) via specialized OEM Partner Management. These dedicated teams ensure ongoing strategic alignment, monitor market performance, and develop customized distribution strategies, reflecting a proactive and collaborative approach.

Inchcape cultivates deep customer relationships by offering a personalized sales and service experience, primarily through its extensive network of local dealerships. This approach ensures that individual customer needs are met with tailored advice and a smooth purchasing journey.

The company emphasizes creating exceptional customer experiences, encompassing comprehensive aftersales support that fosters loyalty and repeat business. For example, in 2023, Inchcape reported a significant increase in customer satisfaction scores, with 85% of customers indicating they would recommend Inchcape's services.

Inchcape leverages digital platforms to foster customer relationships, offering online sales, service bookings, and easy access to information. This digital-first approach enhances convenience and efficiency, allowing customers to engage with Inchcape’s services seamlessly through their preferred online channels.

In 2024, Inchcape reported a significant increase in digital engagement, with online service bookings growing by 25% year-on-year. This digital shift reflects customer preference for self-service options, streamlining interactions and improving overall customer satisfaction.

Aftersales Loyalty and Retention Programs

Inchcape fosters aftersales loyalty by emphasizing dependable servicing and the availability of genuine parts, ensuring customers return throughout their vehicle's lifecycle. This approach is crucial for recurring revenue and sustained satisfaction.

- Customer Retention: Programs designed to keep customers engaged post-purchase, such as maintenance packages or exclusive service offers.

- Loyalty Programs: Implementing reward systems for repeat service visits or accessory purchases, encouraging continued patronage.

- Genuine Parts Availability: Maintaining a robust supply chain for authentic manufacturer parts to ensure quality and reliability in repairs.

- Service Excellence: Investing in technician training and customer service to deliver a consistently positive aftersales experience.

In 2024, the automotive aftersales market continued to be a significant profit driver for dealerships. Industry reports indicated that service and parts revenue accounted for over 50% of total dealership profits, highlighting the importance of these customer relationships.

Community Engagement and Trust Building

Inchcape actively fosters community engagement, extending its reach beyond mere vehicle sales and servicing. By investing in local initiatives, such as road safety awareness campaigns, the company cultivates trust and enhances its brand image, aligning with its core mission of advancing mobility for global communities.

This commitment to community building is evident in their various outreach programs. For example, Inchcape's support for local driving education and responsible vehicle ownership directly contributes to safer roads, reinforcing their role as a responsible corporate citizen.

- Community Investment: Inchcape's dedication to local road safety programs aims to reduce accidents and promote responsible driving habits.

- Brand Reputation: Such initiatives bolster Inchcape's standing as a trustworthy and community-oriented organization.

- Purpose Alignment: These efforts directly support Inchcape's overarching goal of bringing mobility solutions to communities worldwide.

Inchcape builds strong customer bonds through personalized sales and aftersales support, leveraging its dealership network for tailored experiences. The company also enhances engagement via digital platforms, facilitating online bookings and information access, which saw a 25% increase in online service bookings in 2024. Community involvement, like road safety campaigns, further strengthens brand loyalty and trust.

| Customer Relationship Aspect | Key Initiatives | Impact/Data Point |

|---|---|---|

| Personalized Service | Local Dealership Network | High customer satisfaction scores, 85% would recommend in 2023 |

| Digital Engagement | Online Sales & Service Bookings | 25% year-on-year growth in online service bookings (2024) |

| Aftersales Loyalty | Genuine Parts & Service Excellence | Service and parts revenue > 50% of dealership profits (2024 industry trend) |

| Community Building | Road Safety Campaigns | Enhanced brand reputation and trust |

Channels

Inchcape leverages an extensive physical distribution network, including import centers, regional hubs, and warehouses, to ensure efficient vehicle and parts movement. This infrastructure is critical for managing complex logistics across its global operations, facilitating timely delivery to dealerships and customers.

In 2024, Inchcape's commitment to optimizing its supply chain was evident in its continued investment in warehousing and logistics capabilities. This robust network allows for effective inventory management and a streamlined flow of goods, supporting its diverse brand portfolio and market reach.

Local dealerships and showrooms are the heart of Inchcape's customer interaction, serving as the primary touchpoint for both vehicle sales and essential aftersales services. These physical locations are crucial for showcasing vehicles and facilitating direct engagement with potential buyers.

Inchcape's strategy involves a mix of directly operated dealerships and partnerships with third-party operators, a model that has seen evolution as the company focuses on its core distribution strengths. This approach allows for broad market reach while adapting to varying local market conditions.

In 2024, Inchcape continued to refine its dealership network, with a focus on optimizing the performance of its physical locations. While specific figures for the number of showrooms are proprietary, the company's operational footprint spans numerous countries, underscoring the importance of these local channels.

Inchcape significantly enhances its Digital Sales Platforms and E-commerce by enabling customers to browse, configure, and inquire about vehicles online. Their investment in a Digital Experience Platform (DXP) streamlines the entire online customer journey, aiming for a seamless transition from digital browsing to potential purchase. This digital push is crucial as global e-commerce sales are projected to reach $7.4 trillion by 2025, indicating a strong consumer preference for online transactions.

Aftersales Service Centers

Aftersales Service Centers are a cornerstone for Inchcape, acting as direct touchpoints for vehicle maintenance and repair. These facilities, often integrated with dealerships or operating as standalone units, are crucial for delivering on the promise of ongoing vehicle support and ensuring customer satisfaction. In 2024, Inchcape's commitment to these centers aims to solidify customer loyalty by providing reliable service and genuine parts.

These centers are vital for generating recurring revenue streams and reinforcing brand trust. By offering comprehensive service packages, Inchcape leverages its Aftersales Service Centers to maintain a strong relationship with customers long after the initial vehicle purchase. This focus on post-sale support is a key differentiator in the competitive automotive market.

- Dedicated Facilities: Inchcape operates a network of service centers, many co-located with dealerships, ensuring accessibility for routine maintenance and complex repairs.

- Genuine Parts Supply: These centers are the primary channel for distributing genuine manufacturer parts, guaranteeing quality and vehicle integrity.

- Customer Loyalty: The quality of service provided directly impacts customer retention, making these centers instrumental in building long-term relationships.

- Revenue Generation: Aftersales services represent a significant portion of automotive revenue, with Inchcape's centers playing a critical role in this financial performance.

Direct Sales and B2B Engagement Teams

Inchcape leverages dedicated direct sales and B2B engagement teams to cultivate relationships with large organizational clients, including corporate fleets and government entities. These specialized teams are crucial for managing the complexities of bulk purchasing agreements and addressing the unique service needs of these significant clients.

These teams are instrumental in securing substantial fleet deals. For instance, in 2024, Inchcape continued its focus on expanding its corporate client base, aiming to increase its market share in the fleet management sector by offering tailored solutions and competitive pricing structures to secure multi-year contracts.

- Fleet Management Solutions: Offering customized vehicle acquisition, maintenance, and disposal services for corporate and government fleets.

- Bulk Purchasing Power: Negotiating favorable terms for large-volume vehicle orders, providing cost efficiencies for clients.

- Dedicated Account Management: Providing a single point of contact for ongoing support, service coordination, and relationship building.

- Specialized Service Offerings: Catering to specific operational requirements, such as specialized vehicle modifications or priority servicing for critical fleets.

Inchcape utilizes a multi-channel approach to reach its diverse customer base. This includes a robust physical network of dealerships and service centers, complemented by expanding digital sales platforms. The company also employs dedicated B2B teams for corporate and fleet sales.

In 2024, Inchcape's digital investments continued to grow, reflecting the global trend of online commerce. Their Digital Experience Platform aims to create a seamless customer journey from online browsing to purchase, aligning with projections of global e-commerce sales reaching $7.4 trillion by 2025.

The physical dealership network remains a critical channel for sales and aftersales services, with a focus on optimizing performance and customer engagement. Inchcape's strategy balances directly operated sites with third-party partnerships to maximize market reach.

Inchcape's aftersales service centers are vital for customer retention and recurring revenue. In 2024, the company continued to emphasize the importance of these centers for providing reliable service and genuine parts, reinforcing customer loyalty.

Customer Segments

Automotive Manufacturers (OEMs) are Inchcape's primary B2B customers, relying on them for expert distribution and market penetration in challenging global territories. Inchcape's extensive network and local knowledge are crucial for these OEMs looking to expand their reach. In 2024, Inchcape continued to solidify its relationships with over 60 OEM partners, demonstrating its value as a strategic distribution ally.

Individual consumers looking for new passenger vehicles represent a core customer segment for Inchcape. These buyers, often seeking a significant purchase, value brand reputation, vehicle features, and the overall buying process. In 2024, the global automotive market saw continued demand for new vehicles, with factors like technological advancements and evolving consumer preferences shaping purchasing decisions.

These customers expect a high level of service, from initial research and test drives to financing and aftersales support. They are looking for dealerships that offer a wide selection of brands and models, providing them with ample choice. Inchcape's focus on a seamless and supportive customer journey, backed by local market knowledge, directly addresses these expectations.

Individual consumers looking for used vehicles represent a significant customer segment for Inchcape. These buyers are typically price-conscious, seeking dependable transportation without the higher cost of a new car. Inchcape’s extensive network allows it to offer a curated selection of pre-owned vehicles, often backed by inspections and warranties, appealing to this value-driven market.

In 2024, the used car market continued to show robust demand. For instance, data from Cox Automotive indicated that the average price of a used vehicle hovered around $25,000, though this figure saw fluctuations throughout the year. This segment of buyers prioritizes affordability and reliability, making Inchcape's ability to source and present quality used cars a key differentiator.

Corporate Fleets and Business Customers

Businesses needing multiple vehicles, like corporate fleets or rental agencies, represent a significant customer base. These clients often seek tailored vehicle options, comprehensive maintenance packages, and efficient purchasing systems. For example, in 2024, the global commercial vehicle market saw robust demand, with fleet operators prioritizing cost-efficiency and reliability.

These customers frequently require specialized vehicle setups to meet operational needs, whether it's for logistics, service calls, or passenger transport. They also value predictable maintenance schedules and dedicated support to minimize downtime.

- Tailored Vehicle Solutions: Businesses often need specific configurations, such as refrigerated trucks for food delivery or specialized vans for tradespeople.

- Fleet Management Services: Clients look for integrated solutions including maintenance contracts, telematics, and financing options to manage their vehicle assets effectively.

- Streamlined Procurement: Efficient and simplified purchasing processes are crucial for large-volume orders, often involving dedicated account management.

- Total Cost of Ownership (TCO): Businesses focus on the overall cost, factoring in purchase price, fuel efficiency, maintenance, and resale value when making fleet decisions.

New Energy Vehicle (NEV) Adopters

New Energy Vehicle (NEV) adopters represent a crucial and rapidly expanding customer base for Inchcape. This segment is characterized by a strong interest in electric vehicles (EVs) and other alternative fuel technologies.

Inchcape is strategically positioning itself to capture this growth by increasing its NEV offerings and enhancing its service capabilities. This includes the introduction of new NEV brands to its portfolio.

- Growing Demand: Global NEV sales are projected to reach 16.7 million units in 2024, a significant increase from previous years.

- Inchcape's Expansion: Inchcape reported doubling its Battery Electric Vehicle (BEV) sales in 2023, demonstrating its commitment to this segment.

- Technological Interest: Customers in this segment are often early adopters of new technology and are motivated by environmental concerns and lower running costs.

Inchcape also serves businesses requiring multiple vehicles, such as corporate fleets and rental companies. These clients prioritize tailored vehicle solutions, comprehensive fleet management services, and streamlined procurement processes. In 2024, the global commercial vehicle market showed strong demand, with fleet operators focusing on cost-efficiency and reliability.

A key emerging segment is New Energy Vehicle (NEV) adopters, driven by environmental concerns and technological interest. Global NEV sales were projected to reach 16.7 million units in 2024. Inchcape has actively expanded its NEV offerings, with its Battery Electric Vehicle (BEV) sales doubling in 2023, indicating a strong commitment to this growing market.

| Customer Segment | Key Characteristics | 2024 Relevance |

|---|---|---|

| Businesses (Fleets/Rental) | Need multiple vehicles, tailored solutions, fleet management, efficient procurement. | Robust demand in commercial vehicle market; focus on cost-efficiency and reliability. |

| NEV Adopters | Interest in EVs and alternative fuels, early adopters, environmentally conscious. | Projected 16.7 million NEV sales globally; Inchcape BEV sales doubled in 2023. |

Cost Structure

Inchcape's cost structure is heavily influenced by vehicle procurement and inventory expenses. A substantial part of their outlay goes towards acquiring vehicles and parts directly from Original Equipment Manufacturers (OEMs). For instance, in 2023, Inchcape reported significant capital tied up in inventory, reflecting the substantial investment required to maintain a diverse and readily available stock for their customers.

Managing these costs effectively hinges on efficient inventory management and optimizing working capital. By streamlining the supply chain and minimizing holding periods for vehicles and parts, Inchcape aims to reduce the financial burden associated with unsold stock and obsolescence. This focus is crucial for maintaining profitability in a competitive automotive retail environment.

Logistics and distribution expenses represent a significant cost for Inchcape, encompassing the movement and storage of vehicles and parts globally. These costs are driven by fuel prices, freight rates, and the upkeep of their vast distribution facilities. For instance, in 2023, global shipping costs saw fluctuations, directly impacting Inchcape's operational expenditures.

Inchcape's substantial global workforce, exceeding 17,000 employees, translates into significant personnel expenses. These costs encompass competitive salaries, comprehensive benefits packages, and ongoing training for their sales, technical, and administrative teams, ensuring a skilled and motivated workforce.

Beyond employee compensation, operational overhead represents a considerable portion of Inchcape's cost structure. This includes the expenses associated with maintaining a vast network of physical locations, such as offices, customer-facing showrooms, and essential service centers, covering rent, utilities, and property maintenance.

Marketing and Brand Building Expenditures

Inchcape dedicates significant resources to marketing and brand building for the automotive marques it represents. These expenditures are essential for creating demand and maintaining strong brand presence in a crowded automotive landscape.

- Marketing Campaigns: Investment in diverse marketing initiatives, including traditional advertising, sponsorships, and public relations, is a key cost driver.

- Digital Advertising: A substantial portion of the budget is allocated to online advertising, search engine marketing, and social media campaigns to reach target demographics.

- Brand Promotion: Costs associated with events, product launches, and point-of-sale materials are crucial for enhancing brand perception and driving customer engagement.

For instance, in 2024, Inchcape's commitment to brand visibility saw continued investment in digital channels, reflecting the growing importance of online engagement in automotive sales.

Technology Investment and Digital Infrastructure

Inchcape's commitment to staying ahead in the automotive digital space means substantial, ongoing investment in its technology and digital infrastructure. This includes not just maintaining existing systems but actively developing new platforms and enhancing research and development. For instance, in 2024, a significant portion of their capital expenditure is allocated to these areas, reflecting a strategic imperative to lead through digital innovation.

Key cost drivers within this category are the development and maintenance of their Digital Experience Platform (DXP) and Digital Aftermarket Platform (DAP). These platforms are crucial for customer engagement and service delivery. Furthermore, research into emerging technologies like Artificial Intelligence (AI) for predictive maintenance and connected vehicle technologies is a growing expense, directly supporting their goal of digital differentiation in a competitive market.

- Technology Investment: Ongoing expenditure on IT hardware, software licenses, and cloud services.

- Digital Platform Development: Costs associated with building, enhancing, and maintaining DXP and DAP.

- Research & Development: Investment in AI, connected vehicle tech, and other future-facing automotive solutions.

- Cybersecurity: Essential spending to protect digital assets and customer data.

Inchcape's cost structure is dominated by vehicle procurement, with significant outlays for inventory and parts from OEMs. Personnel expenses, driven by a large global workforce, and operational overhead for their extensive physical network are also major components. Marketing and technology investments, particularly in digital platforms and R&D, are crucial for brand visibility and future growth.

| Cost Category | Key Drivers | 2023 Impact/2024 Focus |

|---|---|---|

| Vehicle Procurement & Inventory | OEM purchasing, inventory holding | Significant capital tied up in stock; managing obsolescence |

| Logistics & Distribution | Fuel, freight, facility upkeep | Fluctuating global shipping costs impacted 2023 expenditures |

| Personnel Expenses | Salaries, benefits, training | Exceeding 17,000 employees require substantial compensation |

| Operational Overhead | Rent, utilities, maintenance | Maintaining a vast network of showrooms and service centers |

| Marketing & Brand Building | Advertising, digital campaigns, events | Continued investment in digital channels for brand visibility in 2024 |

| Technology & Digital Investment | Platform development, R&D, cybersecurity | Significant capital expenditure in 2024 for digital innovation (DXP, DAP, AI) |

Revenue Streams

Inchcape's core revenue generation hinges on the sale of new passenger and commercial vehicles. This involves securing franchises from Original Equipment Manufacturers (OEMs) and profiting from the markup on each unit sold through their extensive distribution and retail network.

In 2024, the automotive retail sector continued to see robust demand, with global new car sales projected to exceed 80 million units. Inchcape's ability to efficiently manage inventory and leverage its OEM relationships directly impacts the margin earned on these significant sales volumes.

Inchcape's aftersales services, encompassing genuine parts sales and vehicle maintenance and repair, represent a highly resilient and profitable revenue stream. This segment significantly contributes to the company's gross profit, providing a stable income source beyond initial vehicle sales.

In 2024, Inchcape reported robust performance in its aftersales division. For instance, the company's UK operations saw continued strength in service and parts, a trend that has been a consistent driver of profitability. This segment often boasts higher margins compared to new vehicle sales, making it a cornerstone of Inchcape's financial stability.

Inchcape generates significant revenue from the sale of used vehicles, a crucial component of their diversified sales strategy. This stream capitalizes on their extensive distribution network and established market presence to efficiently move pre-owned inventory. For instance, in 2023, Inchcape reported strong performance in their used car operations, contributing to overall revenue growth.

Distribution Fees and Margins

Inchcape, as a dedicated automotive distributor, generates income primarily through distribution fees and the margins it secures on the vehicles and parts it handles for Original Equipment Manufacturers (OEMs). This revenue model is fundamental to its capital-light strategy, allowing it to operate efficiently without the extensive asset ownership typically associated with traditional dealerships.

These fees and margins represent the core of Inchcape's value proposition to OEMs, facilitating market access and efficient supply chain management. For instance, in 2024, the company continued to leverage its extensive network and market expertise to drive sales volumes for its OEM partners, directly impacting its fee and margin-based earnings.

- Distribution Fees: Inchcape charges OEMs for the services of distributing vehicles and parts, covering logistics, marketing, and sales support.

- Sales Margins: The company earns a profit margin on the vehicles and parts sold through its distribution channels, reflecting its role as an intermediary.

- Capital-Light Model: This approach minimizes the need for significant capital investment in physical assets like dealerships, enhancing profitability and flexibility.

- OEM Partnerships: Revenue is directly tied to the sales performance and volume of vehicles and parts distributed on behalf of its OEM clients.

Value-Added Services (Finance and Insurance)

Inchcape leverages value-added services in finance and insurance to significantly boost revenue and profitability. These offerings, including vehicle financing and insurance products, are higher-margin than core vehicle sales, effectively monetizing the customer's lifetime value.

In 2024, the automotive finance and insurance sector continued to show robust growth. For instance, new car finance deals in the UK saw a substantial increase, with total advances reaching £15.9 billion in the first quarter of 2024, up 10% year-on-year. This trend highlights the strong customer appetite for integrated financing solutions, which Inchcape is well-positioned to capture.

- Vehicle Financing: Offering tailored loan and leasing options to make vehicle purchases more accessible and attractive to a wider customer base.

- Insurance Products: Providing comprehensive motor insurance, extended warranties, and GAP insurance to protect customers' investments.

- Ancillary Services: Generating income from services like maintenance packages, accessory sales, and roadside assistance, enhancing the overall customer experience.

Inchcape's revenue streams are multifaceted, encompassing new and used vehicle sales, aftersales services, and finance and insurance products. The company also earns significant income through distribution fees and sales margins from its partnerships with Original Equipment Manufacturers (OEMs), operating on a capital-light distribution model.

| Revenue Stream | Description | 2024 Relevance/Data |

|---|---|---|

| New Vehicle Sales | Profiting from vehicle markups via OEM franchises. | Global new car sales projected over 80 million units. Inchcape's efficient inventory management is key. |

| Aftersales Services | Revenue from genuine parts, maintenance, and repairs. | Consistently profitable, with high margins. UK operations showed continued strength in 2024. |

| Used Vehicle Sales | Capitalizing on pre-owned inventory through their network. | Strong performance reported in 2023, contributing to overall revenue growth. |

| Distribution Fees & Margins | Income from distributing vehicles/parts for OEMs. | Leveraging extensive networks for OEM sales in 2024, impacting fee-based earnings. |

| Finance & Insurance | Higher-margin offerings like vehicle financing and insurance. | UK new car finance deals increased 10% YoY in Q1 2024, reaching £15.9 billion. |

Business Model Canvas Data Sources

Inchcape's Business Model Canvas is built upon a foundation of robust financial data, comprehensive market research, and strategic insights derived from internal operations and external industry analysis. These diverse data sources ensure each component of the canvas is accurately represented and strategically aligned with the company's objectives.