Inchcape PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inchcape Bundle

Navigate the complex external environment impacting Inchcape with our expert PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both challenges and opportunities for the automotive distributor. Gain a competitive edge by leveraging these critical insights to inform your strategic decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government policies, including trade agreements, tariffs, and import regulations, significantly influence Inchcape's global distribution network. For instance, the USMCA agreement, which replaced NAFTA, has reshaped trade dynamics for automotive components and finished vehicles between Canada, Mexico, and the United States, impacting supply chain costs and operational strategies for companies like Inchcape.

Recent pledges of tariffs, such as those impacting Canadian and Mexican imports into the US, can lead to increased costs and disrupted supply chains for automotive distributors operating across multiple regions. While specific tariff announcements fluctuate, the general trend of protectionist measures in various economies presents ongoing challenges for global trade.

Inchcape's ability to navigate these complex international trade dynamics is crucial for maintaining competitive pricing and market access. For example, in 2023, the automotive sector continued to grapple with the lingering effects of global trade tensions, with some nations implementing new import duties or adjusting existing ones, directly affecting the landed cost of vehicles Inchcape distributes.

Geopolitical instability is a significant concern for Inchcape, given its global footprint across 38 markets. Tensions and conflicts in key manufacturing or distribution hubs can disrupt the automotive supply chain, affecting the availability of parts and finished vehicles. For instance, ongoing conflicts in Eastern Europe and the Middle East continue to pose risks to global logistics and trade routes, potentially impacting shipping times and costs for Inchcape's operations.

The automotive sector is navigating significant regulatory changes, especially regarding emissions and the burgeoning new energy vehicle (NEV) market. Many governments are tightening CO2 limits and actively encouraging electric vehicle (EV) uptake through subsidies and mandates, creating a dynamic environment for distributors like Inchcape.

Inchcape must strategically adapt to these evolving regulations by broadening its portfolio to include more NEVs and ensuring strict adherence to compliance standards across its diverse operational regions. For instance, the European Union's Fit for 55 package aims for a 55% reduction in CO2 emissions for new cars by 2030, a key driver for the NEV transition.

Government Incentives for EV Adoption

Government incentives play a crucial role in driving electric vehicle (EV) adoption, directly influencing consumer purchasing decisions. For Inchcape, understanding and adapting to these incentives across different markets is key to maximizing EV sales. For instance, the United States' Inflation Reduction Act of 2022 offers up to $7,500 in tax credits for eligible new EVs, a significant driver of demand. Conversely, markets with fewer or expiring incentives require different sales strategies.

The varying levels of government support necessitate localized approaches for Inchcape. Markets with robust incentives, like Norway, which has consistently led EV penetration with policies such as VAT exemptions, present significant opportunities. In contrast, regions where incentives are being phased out or are less generous, such as some European countries in 2024, demand a greater focus on the total cost of ownership and the inherent benefits of EVs to maintain sales momentum. Inchcape's strategy must therefore be agile, leveraging favorable policies where they exist and building a strong case for EV ownership even where direct subsidies are reduced.

- Government incentives, such as tax credits and subsidies, directly influence consumer demand for EVs.

- Inchcape's EV sales success is linked to the varying levels of government support across its operating markets.

- Localized strategies are essential to leverage favorable policies and address markets with reduced or absent incentives.

- For example, the US Inflation Reduction Act provides up to $7,500 in EV tax credits, boosting demand, while Norway's VAT exemptions have historically driven high EV adoption rates.

Political Stability in Operating Markets

Inchcape's global operations across 38 markets mean that political stability is a critical factor. In 2024, many developed markets like the UK and Australia continued to offer stable political landscapes, supporting consistent business operations. However, emerging markets present a more varied picture. For instance, while some regions in Asia Pacific have seen steady governance, others experienced shifts that could impact regulatory certainty and consumer spending.

Political instability directly affects Inchcape by increasing operational risks, potentially disrupting supply chains and distribution networks. For example, in markets with frequent government changes or policy reversals, securing long-term investment and maintaining predictable tax structures becomes challenging. This uncertainty can also dampen consumer confidence, leading to reduced demand for automotive products and services.

Conversely, stable political environments are crucial for Inchcape's growth strategy. They foster a climate conducive to foreign direct investment and ensure that regulatory frameworks, such as import duties and environmental standards, remain consistent. As of early 2025, countries with strong rule of law and transparent governance continue to be preferred markets for expansion and capital allocation.

Key considerations for Inchcape regarding political stability include:

- Geopolitical Risk Assessment: Continuously monitoring political developments in all 38 operating countries to identify and mitigate potential disruptions.

- Regulatory Environment: Assessing the predictability and fairness of legal and regulatory frameworks, which directly impact business costs and market access.

- Economic Impact of Political Events: Evaluating how political stability or instability influences consumer purchasing power and business investment appetite.

- Diversification Strategy: Leveraging its presence in multiple markets to offset risks associated with political instability in any single region.

Government policies, including trade agreements and import regulations, significantly influence Inchcape's global distribution network. For instance, the USMCA agreement has reshaped trade dynamics for automotive components between Canada, Mexico, and the United States, impacting supply chain costs. Recent pledges of tariffs can lead to increased costs and disrupted supply chains for automotive distributors operating across multiple regions, with the automotive sector continuing to grapple with global trade tensions.

Geopolitical instability is a significant concern for Inchcape, given its global footprint. Tensions and conflicts in key manufacturing or distribution hubs can disrupt the automotive supply chain, affecting the availability of parts and finished vehicles. Ongoing conflicts in Eastern Europe and the Middle East continue to pose risks to global logistics and trade routes, potentially impacting shipping times and costs.

The automotive sector is navigating significant regulatory changes, especially regarding emissions and new energy vehicles (NEVs). Many governments are tightening CO2 limits and actively encouraging electric vehicle (EV) uptake through subsidies and mandates, creating a dynamic environment for distributors like Inchcape. The European Union's Fit for 55 package aims for a 55% reduction in CO2 emissions for new cars by 2030, a key driver for the NEV transition.

Government incentives play a crucial role in driving EV adoption, directly influencing consumer purchasing decisions. For Inchcape, understanding and adapting to these incentives across different markets is key to maximizing EV sales. For instance, the United States' Inflation Reduction Act of 2022 offers up to $7,500 in tax credits for eligible new EVs, a significant driver of demand, while markets with fewer incentives require different sales strategies.

Inchcape's global operations across 38 markets mean that political stability is a critical factor. In 2024, many developed markets continued to offer stable political landscapes, supporting consistent business operations. However, emerging markets present a more varied picture, with some regions experiencing shifts that could impact regulatory certainty and consumer spending.

| Political Factor | Impact on Inchcape | Example/Data Point (2024/2025) |

| Trade Agreements & Tariffs | Affects supply chain costs and market access. | USMCA reshaping North American trade dynamics. Tariffs increase landed costs. |

| Geopolitical Instability | Disrupts supply chains and logistics. | Conflicts in Eastern Europe and Middle East impact shipping times and costs. |

| Environmental Regulations | Drives NEV adoption and compliance needs. | EU's Fit for 55 aims for 55% CO2 reduction by 2030. |

| Government Incentives (EVs) | Influences consumer demand for EVs. | US IRA offers up to $7,500 EV tax credit. Norway's VAT exemptions historically drive high adoption. |

| Political Stability | Impacts operational risks and investment climate. | Stable markets (e.g., UK, Australia) support consistent operations; emerging markets show varied governance. |

What is included in the product

This Inchcape PESTLE analysis offers a comprehensive examination of how political, economic, social, technological, environmental, and legal factors influence the company's operations and strategic positioning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Inchcape's strategic discussions.

Economic factors

Global economic growth and consumer spending are crucial for Inchcape. Strong economic expansion generally translates to higher consumer confidence and increased purchasing power, directly boosting demand for new vehicles and related aftersales services. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight uptick from previous years, which could support Inchcape's performance.

Conversely, economic slowdowns, elevated inflation, and rising interest rates can significantly impact Inchcape's business. These factors tend to erode consumer confidence, leading to reduced discretionary spending. In 2023, many economies experienced persistent inflation, and central banks continued to raise interest rates, making vehicle financing more expensive and potentially dampening sales volumes for Inchcape.

Currency fluctuations present a significant challenge for Inchcape, a global distributor with operations spanning numerous countries. When Inchcape converts earnings from foreign markets back into its reporting currency, shifts in exchange rates can materially affect its reported revenue, costs, and overall profitability. For instance, a strengthening of the pound sterling against currencies like the euro or US dollar could lead to lower reported profits, even if the company's underlying business performance in those regions remains robust.

In 2023, Inchcape reported that adverse currency movements had a notable impact on its financial results. While specific figures vary by quarter, the company has indicated that currency headwinds have reduced the translation of its overseas profits. This exposure means that Inchcape's financial performance is not solely dependent on its operational efficiency but also on the volatility of global currency markets, a factor that requires careful management and hedging strategies.

Rising interest rates directly impact Inchcape's financing costs for inventory and operational expansion. For instance, the Bank of England's base rate, which influences broader lending, saw multiple increases throughout 2023, reaching 5.25% by August 2023, a significant jump from the 0.1% seen in late 2021. This upward trend in borrowing costs for Inchcape translates to higher expenses for managing its extensive vehicle stock and funding new ventures.

Furthermore, elevated interest rates dampen consumer demand for vehicles. Higher borrowing costs for car loans make purchasing a new or used car less affordable for many customers. With the average car loan interest rate in the UK hovering around 8-10% in early 2024, this economic pressure can lead to a slowdown in sales volumes for Inchcape, impacting revenue and potentially increasing the time vehicles remain on the forecourt, thereby raising holding costs.

Supply Chain Costs and Disruptions

Ongoing supply chain challenges, including the persistent semiconductor shortage and elevated global shipping expenses, continue to significantly impact the automotive sector. These disruptions directly translate into higher manufacturing expenses for original equipment manufacturers (OEMs) and can lead to increased inventory holding costs for Inchcape, ultimately pressuring profit margins and affecting vehicle supply.

The automotive industry's reliance on complex global networks means that even localized disruptions can have widespread effects. For instance, the International Monetary Fund (IMF) noted in its October 2024 World Economic Outlook that while some supply chain pressures had eased, risks remained, particularly concerning geopolitical tensions and climate-related events that could trigger new bottlenecks.

- Semiconductor Shortage Impact: Despite improvements, the automotive industry still faced an estimated global shortage of approximately 10% of its semiconductor needs in early 2024, according to industry analysis firms, impacting production volumes.

- Shipping Cost Volatility: Freight rates, while down from their 2021 peaks, remained volatile. For example, the Shanghai Containerized Freight Index (SCFI) saw fluctuations throughout 2024, with certain routes experiencing significant cost increases due to port congestion and capacity constraints.

- Increased Production Costs: These combined factors contributed to an average increase in production costs for new vehicles by an estimated 5-8% globally in 2024 compared to pre-pandemic levels, directly affecting the cost base for companies like Inchcape.

Competitive Landscape and Pricing Pressure

The automotive distribution and retail sector is highly competitive, with new players, especially from China, employing aggressive pricing. This intense rivalry puts pressure on margins for established distributors like Inchcape.

OEMs are increasingly using direct-to-consumer sales models, further intensifying competition and potentially impacting traditional distributor roles. Inchcape must navigate these shifts by focusing on value-added services and operational efficiency.

- Intensified Competition: The influx of Chinese automotive brands, known for their competitive pricing, is a significant factor reshaping the market landscape. For instance, BYD's rapid global expansion and aggressive pricing strategies in 2024 have put established players on notice.

- Margin Compression Risk: Distributors face the challenge of maintaining profitability as price wars become more common. This necessitates a focus on cost management and exploring new revenue streams beyond traditional vehicle sales and servicing.

- OEM Direct Sales Models: Several major automotive manufacturers, including some in the premium segment, are exploring or implementing direct sales models, bypassing traditional dealership networks. This trend, gaining momentum through 2024 and projected to continue into 2025, requires distributors to adapt their business models and emphasize their unique value propositions.

Global economic growth is a key driver for Inchcape, with the IMF projecting 3.2% growth in 2024, potentially boosting consumer spending on vehicles. However, persistent inflation and rising interest rates, exemplified by the Bank of England's base rate reaching 5.25% in August 2023, increase financing costs and dampen demand, making car loans less affordable for consumers.

Currency fluctuations significantly impact Inchcape's reported profits, as seen in 2023 when adverse movements reduced the translation of overseas earnings. Supply chain issues, including an estimated 10% semiconductor shortage in early 2024 and volatile shipping costs, also increase production expenses and inventory holding costs for the company.

Intense competition, particularly from Chinese brands like BYD with aggressive pricing strategies in 2024, pressures Inchcape's profit margins. The trend of OEMs adopting direct-to-consumer sales models further challenges traditional distributors, requiring Inchcape to focus on value-added services and efficiency to adapt.

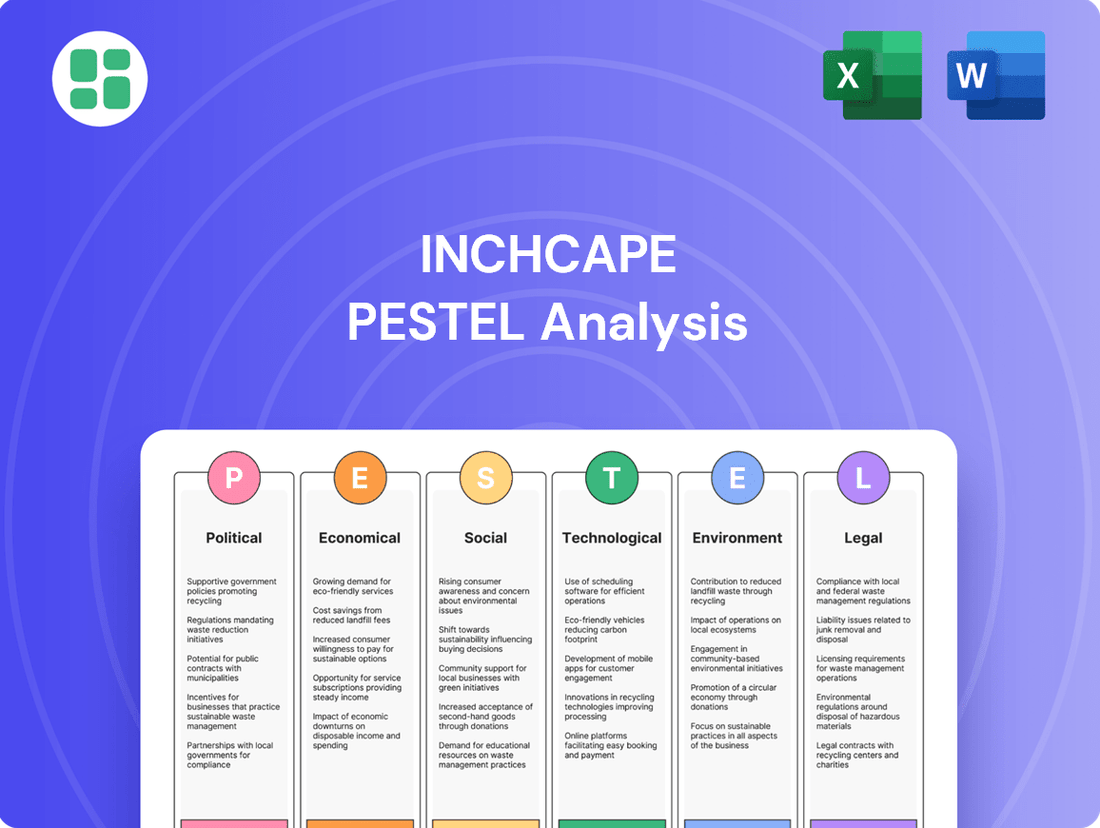

Preview Before You Purchase

Inchcape PESTLE Analysis

The Inchcape PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Inchcape.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive strategic overview.

Sociological factors

Consumer preferences are rapidly shifting away from traditional car ownership. There's a growing interest in flexible mobility solutions, such as electric vehicles (EVs) and the broader concept of mobility-as-a-service (MaaS). This trend is particularly evident in younger demographics and urban areas.

Inchcape must adapt by expanding its portfolio to include more electric and new energy vehicles. For instance, by the end of 2024, the global EV market share is projected to reach approximately 18-20% of all new car sales, a significant jump from previous years. Furthermore, investing in digital platforms for customer engagement and offering subscription-based or pay-per-use mobility services will be crucial for staying competitive.

Demographic shifts are a powerful force shaping the automotive market. Globally, the population continues to grow, with projections indicating a further increase in the coming years, directly impacting the sheer volume of potential car buyers. Urbanization is a key trend, with more people moving to cities, which often increases the need for personal transportation solutions. For instance, by 2050, it's estimated that 68% of the world's population will live in urban areas, a significant jump from today.

Inchcape's strategic focus on high-growth markets, many of which are experiencing rapid urbanization, positions them well to capitalize on these demographic trends. As cities expand and become more densely populated, the demand for personal mobility, including vehicles, tends to rise. This is particularly true in developing economies where rising incomes often accompany urbanization, further fueling vehicle sales.

Growing consumer awareness of environmental issues is significantly impacting the automotive sector, creating a strong demand for sustainable and fuel-efficient vehicles. This societal shift directly influences Inchcape's strategic direction, prompting a greater focus on distributing electric vehicles (EVs) and other eco-friendly transportation solutions.

Consumers are increasingly scrutinizing companies' environmental footprints. For instance, in 2024, a significant percentage of car buyers indicated that environmental impact was a key factor in their purchasing decisions, with many willing to pay a premium for greener options. This trend necessitates Inchcape to not only offer sustainable vehicle choices but also to transparently communicate its own sustainability efforts across its operations and supply chain to meet these evolving expectations.

Digital Adoption and Customer Experience Expectations

Consumers in 2024 and 2025 are demanding highly integrated digital experiences from start to finish when buying and owning a car. This means everything from initial research and online configuration to financing applications and after-sales service bookings needs to be smooth and intuitive.

Inchcape's ability to meet these evolving expectations hinges on its strategic adoption of digital tools and robust data analytics. By doing so, the company can foster deeper customer engagement, optimize the efficiency of its sales funnels, and deliver superior after-sales support, directly addressing the heightened customer demands.

- Digitalization of Sales: In 2024, an estimated 75% of car buyers began their purchase journey online, a figure projected to rise.

- Customer Data Utilization: Companies leveraging customer data effectively see an average 10-15% increase in customer retention rates.

- Aftersales Service Trends: By 2025, over 60% of vehicle servicing appointments are expected to be booked online.

- Personalized Experiences: Data analytics allows for personalized offers and communication, boosting conversion rates by up to 20%.

Workforce Dynamics and Talent Attraction

Changing workforce expectations are significantly influencing how companies like Inchcape attract and keep skilled employees. There's a growing demand for flexible working arrangements, a strong emphasis on diversity and inclusion, and a desire for meaningful work. For instance, a 2024 survey indicated that over 70% of professionals prioritize work-life balance, impacting recruitment strategies.

Inchcape's ability to adapt to these shifts is vital for its global talent pool. Companies that offer flexible options and foster inclusive environments are more likely to secure top talent. This means rethinking traditional office structures and embracing hybrid or remote models where feasible, alongside robust diversity and inclusion programs.

Investing in employee engagement and development is paramount. Inchcape's commitment to early careers programs and continuous learning can cultivate a high-performance culture. For example, companies with strong employee engagement scores often see a 21% increase in profitability, as reported by Gallup in their 2024 State of the Global Workplace report.

- Demand for Flexibility: Over 70% of professionals in 2024 prioritize work-life balance, influencing recruitment.

- Diversity and Inclusion: Inclusive workplaces are key to attracting a wider talent pool and fostering innovation.

- Employee Engagement: High engagement correlates with increased profitability, with top companies seeing a 21% boost.

- Talent Retention: Investing in development and flexible work enhances employee loyalty and reduces turnover.

Societal values are increasingly prioritizing sustainability and ethical consumption. This translates into a growing demand for environmentally friendly products and corporate social responsibility. For instance, by 2025, it's estimated that over 50% of global consumers will actively choose brands that demonstrate strong environmental and social governance (ESG) practices.

Inchcape's brand reputation and long-term success are intrinsically linked to its ability to align with these evolving societal values. Embracing a commitment to sustainability, from its vehicle offerings to its operational practices, will be key. This includes transparently communicating its ESG initiatives and ensuring ethical sourcing throughout its supply chain.

| Societal Factor | Trend (2024-2025) | Impact on Inchcape |

|---|---|---|

| Environmental Awareness | Growing demand for EVs and sustainable practices; consumers willing to pay a premium for eco-friendly options. | Necessitates expansion of EV portfolio and transparent sustainability reporting. |

| Digital Expectations | Consumers expect seamless online purchasing and after-sales experiences. | Requires investment in digital platforms and data analytics for customer engagement. |

| Workforce Expectations | Preference for flexible work, diversity, and inclusion; strong link between engagement and profitability. | Influences recruitment, retention strategies, and the need for inclusive workplace cultures. |

Technological factors

The automotive sector is rapidly shifting towards electric and new energy vehicles, driven by significant technological leaps. Battery efficiency is improving, leading to longer ranges, while charging infrastructure is expanding, making EVs more practical for everyday use. Vehicle performance in EVs is also closing the gap with, and in some cases surpassing, traditional internal combustion engine vehicles.

Inchcape is actively participating in this transformation. Their strategy includes a commitment to doubling battery electric vehicle (BEV) sales, introducing new energy vehicle brands to their portfolio, and broadening the availability of NEVs across the diverse markets they serve. This proactive approach positions Inchcape to capitalize on the growing demand for sustainable transportation solutions.

In 2024, global EV sales are projected to reach over 17 million units, a substantial increase from previous years, highlighting the accelerating adoption rate. Inchcape's focus on BEV sales aligns with this trend, aiming to capture a larger share of this burgeoning market. By expanding their NEV offerings, they are catering to a wider consumer base seeking cleaner mobility options.

Inchcape is heavily investing in digital transformation and data analytics to sharpen its competitive edge. By leveraging technologies like artificial intelligence (AI), the company aims to boost operational efficiency and deepen customer relationships. For instance, Inchcape is employing AI for tasks like generating body shop quotes, streamlining a key service process.

Data analytics plays a crucial role in understanding local market nuances and optimizing Inchcape's extensive distribution network. This data-driven approach allows for more informed strategic decisions, ensuring resources are allocated effectively. In 2024, Inchcape continued to expand its digital capabilities, with digital channels contributing to a significant portion of customer interactions and sales leads.

The rise of connected and autonomous vehicle (CAV) technologies presents a dual-edged sword for automotive distributors like Inchcape. These advancements will reshape vehicle features, demanding new skill sets for maintenance and repair, and potentially altering the traditional aftersales service landscape. For instance, by 2030, it's projected that 30% of new vehicles sold globally will be equipped with advanced driver-assistance systems (ADAS), a precursor to full autonomy, according to industry forecasts from 2024.

Inchcape needs to proactively adapt to the evolving demands of CAVs. This includes investing in technician training for complex electronic systems and cybersecurity, as well as exploring new revenue streams beyond traditional parts and labor. The emergence of mobility-as-a-service (MaaS) platforms, where vehicles are accessed on demand rather than owned, could significantly impact sales volumes and require distributors to rethink their business models, potentially focusing more on fleet management and integrated service offerings.

Supply Chain Technology and Optimization

Technological advancements are reshaping supply chain management, with innovations like advanced logistics software, real-time tracking, and predictive analytics becoming crucial for efficiency and resilience. Inchcape's commitment to a 'sustainable route to market' directly benefits from these technologies, aiming to optimize logistics and minimize environmental impact. For instance, in 2024, the automotive logistics sector saw increased investment in AI-powered route optimization, which can reduce fuel consumption by up to 15%.

These technological factors enable Inchcape to enhance its operational performance and sustainability efforts.

- Advanced Logistics Software: Streamlining inventory management and order fulfillment processes.

- Real-time Tracking: Providing end-to-end visibility of vehicle and cargo movement, improving delivery accuracy.

- Predictive Analytics: Forecasting demand and potential disruptions to proactively manage the supply chain.

Cybersecurity Risks in Automotive Ecosystem

As vehicles become increasingly connected, the automotive ecosystem faces escalating cybersecurity risks. This digital integration means more data is being shared and stored, making it a prime target for cyber threats. For Inchcape, a significant distributor, safeguarding customer information and its own operational systems is paramount to maintaining trust with both original equipment manufacturers (OEMs) and consumers.

The growing reliance on data within the automotive sector amplifies these vulnerabilities. A breach could compromise sensitive personal data, disrupt supply chains, or even impact vehicle functionality. Inchcape's role in the distribution chain means it handles substantial amounts of data, making robust cybersecurity measures not just a best practice but a critical necessity.

Industry reports highlight the escalating nature of these threats. For instance, in 2023, the automotive industry experienced a significant uptick in cyberattacks targeting connected car systems and dealership networks. Protecting against these evolving threats is crucial for business continuity and reputation management.

- Data Breach Impact: A successful cyberattack could lead to the theft of millions of customer records, resulting in substantial fines and reputational damage, potentially costing millions in remediation and lost business.

- Operational Disruption: Incidents could halt Inchcape's distribution operations, impacting vehicle delivery and after-sales services, leading to significant revenue loss.

- OEM Trust: Maintaining strong cybersecurity is vital for continued partnerships with OEMs, who increasingly scrutinize the security practices of their distribution partners.

- Consumer Confidence: Consumers expect their data to be secure; any breach erodes trust, impacting future sales and brand loyalty.

Technological advancements are fundamentally reshaping the automotive landscape, with a significant push towards electric and new energy vehicles (NEVs). Global EV sales are projected to exceed 17 million units in 2024, underscoring this rapid transition. Inchcape's strategic focus on doubling battery electric vehicle (BEV) sales and introducing new energy vehicle brands directly aligns with these market shifts, positioning them to capture growth in sustainable mobility.

The integration of connected and autonomous vehicle (CAV) technologies presents both opportunities and challenges, requiring new skill sets for maintenance and repair. By 2030, forecasts suggest 30% of new vehicles sold globally will feature advanced driver-assistance systems (ADAS), necessitating proactive adaptation from distributors like Inchcape in training and service offerings.

Furthermore, Inchcape is leveraging digital transformation and AI to enhance operational efficiency and customer engagement, with AI already being used for tasks like generating body shop quotes. Data analytics is also critical for understanding market dynamics and optimizing their extensive distribution network, with digital channels contributing significantly to customer interactions and sales leads in 2024.

Legal factors

Stricter global and regional emissions regulations, especially concerning CO2 and other pollutants, significantly shape the vehicle types Inchcape can distribute. For instance, the US Environmental Protection Agency's proposed standards for 2027-2032 aim for a substantial reduction in vehicle emissions, while the European Union has set ambitious CO2 targets for 2025.

Adhering to these evolving environmental mandates is crucial for Inchcape to avoid hefty fines and maintain its market position. Non-compliance could lead to significant financial penalties and damage brand reputation, impacting sales and profitability across its diverse markets.

Trade tariffs and import duties directly affect Inchcape's bottom line by increasing the cost of imported vehicles and parts. For instance, the potential for renewed US tariffs on vehicles imported from countries like China could significantly impact supply chain costs and pricing strategies for Inchcape's automotive distribution business. This necessitates agile management of sourcing and inventory to mitigate adverse financial effects.

Inchcape's increasing reliance on digital platforms necessitates strict adherence to consumer protection and data privacy laws like GDPR and CCPA. Failure to comply can lead to significant fines; for instance, GDPR violations can incur penalties up to 4% of global annual turnover or €20 million, whichever is higher. Maintaining robust data security and transparent handling practices is paramount to safeguarding customer trust and avoiding costly legal battles.

Competition and Antitrust Laws

Inchcape's global operations mean it must navigate a complex web of competition and antitrust regulations across various jurisdictions. Failure to comply can result in significant fines and operational disruptions. For instance, in 2024, the European Commission continued to scrutinize large-scale mergers and acquisitions to prevent market monopolization, impacting potential expansion strategies for companies like Inchcape.

The company's growth strategy, which often involves acquiring or partnering with other entities, is under constant review by regulatory bodies. These bodies assess whether such moves could unfairly disadvantage competitors or limit consumer choice. In 2025, antitrust enforcement is expected to remain robust, particularly concerning digital platforms and supply chain consolidation, areas where Inchcape may seek opportunities.

- Regulatory Scrutiny: Inchcape faces ongoing scrutiny from competition authorities in key markets like the EU, UK, and Australia.

- Merger & Acquisition Compliance: Acquisitions must be structured to avoid market dominance, as demonstrated by regulatory reviews in 2024.

- Fair Market Practices: Adherence to antitrust laws ensures fair competition, preventing practices that could harm consumers or smaller players.

- Global Enforcement Trends: Anticipated increased enforcement in 2025, especially around supply chain control, necessitates proactive compliance.

Vehicle Safety Standards and Recalls

Inchcape, as an automotive distributor, faces significant legal obligations concerning vehicle safety standards and the management of recalls. Compliance with these regulations is paramount to consumer protection and maintaining brand integrity across its diverse markets. For instance, in 2024, the National Highway Traffic Safety Administration (NHTSA) in the U.S. continued to enforce rigorous safety standards, with manufacturers issuing numerous recalls impacting millions of vehicles.

Failure to meet these standards can result in substantial fines and reputational damage. Inchcape must meticulously ensure that all distributed vehicles adhere to the specific safety regulations of each operating country, a complex task given varying international requirements. The company's proactive approach to safety compliance and recall management directly impacts its legal standing and consumer trust.

- Regulatory Compliance: Adherence to diverse national and international vehicle safety standards is a core legal requirement for Inchcape.

- Recall Management: Efficiently handling vehicle recalls is crucial to mitigate legal liabilities and protect consumer safety.

- Consumer Protection: Ensuring vehicles meet safety benchmarks safeguards customers and bolsters Inchcape's reputation.

- Market-Specific Laws: Navigating and complying with the unique legal frameworks for vehicle safety in each of Inchcape's operational regions is essential.

Inchcape must navigate a complex landscape of international trade laws, including tariffs and import/export regulations, which directly impact vehicle sourcing and pricing. For example, the ongoing trade discussions between major economic blocs in 2024 and 2025 could introduce new duties or quotas, necessitating flexible supply chain strategies. Compliance with these varied regulations is vital to avoid penalties and maintain competitive pricing for its distributed vehicles.

The company's commitment to environmental regulations, such as the EU's CO2 emission targets for 2025 and proposed US standards for 2027-2032, dictates the types of vehicles Inchcape can offer. Non-compliance could lead to substantial fines, impacting profitability and market access. For instance, the EU's fleet-wide CO2 emission targets require manufacturers to continuously innovate towards lower-emission vehicles, influencing Inchcape's product portfolio.

Inchcape's digital operations are governed by data privacy laws like GDPR and CCPA, with potential fines up to 4% of global annual turnover for violations, as seen in cases throughout 2024. Maintaining robust data security and transparent practices is essential for customer trust and avoiding costly legal repercussions. The company must ensure its digital platforms and customer data handling are fully compliant with these stringent requirements.

| Legal Area | Impact on Inchcape | Example/Data Point (2024-2025) |

|---|---|---|

| Trade Regulations | Affects cost of imported vehicles and parts, supply chain strategy. | Potential for renewed US tariffs on vehicles from China could increase costs. |

| Environmental Mandates | Shapes vehicle types distributed, requires compliance to avoid fines. | EU CO2 targets for 2025 and proposed US EPA standards for 2027-2032. |

| Data Privacy | Requires adherence to laws like GDPR/CCPA, risk of significant fines. | GDPR violations can incur penalties up to 4% of global annual turnover. |

Environmental factors

The automotive sector is under significant pressure to curb its carbon emissions, a trend fueled by international climate accords and growing consumer awareness. Inchcape is actively addressing this by aiming for a 46% reduction in its Scope 1 and 2 emissions by 2030, with a broader goal of reaching net zero by 2040.

These decarbonization efforts are being woven into Inchcape's operations across all its global markets. For instance, in 2023, Inchcape reported a 15% reduction in its Scope 1 and 2 absolute emissions compared to its 2019 baseline, demonstrating tangible progress toward its ambitious targets.

The global shift towards electric and new energy vehicles (NEVs) significantly shapes Inchcape's operational landscape, influencing its product offerings and investment strategies. This environmental trend is a crucial consideration for the company's long-term planning.

Inchcape is actively participating in this transition by growing its NEV sales volume and introducing new electric vehicle brands across its diverse markets. For instance, in 2023, the global NEV market saw remarkable growth, with sales projected to exceed 13 million units, a substantial increase from previous years, indicating strong consumer adoption and regulatory support.

Inchcape is actively addressing the environmental factors impacting its operations by prioritizing sustainable supply chains and logistics. The company's commitment to providing the 'most sustainable route to market' involves a thorough evaluation of its CO2 footprint. For instance, in 2024, Inchcape continued its efforts to optimize logistics, including initiatives like warehouse consolidation, which directly contribute to reducing emissions and waste.

This focus on sustainability is crucial as global regulations and consumer expectations increasingly demand environmentally responsible business practices. By actively managing and reducing its environmental impact, Inchcape aims to enhance its brand reputation and ensure long-term operational resilience in a changing regulatory landscape. The company's strategic investments in greener logistics solutions are designed to meet these evolving demands.

Waste Management and Recycling

Environmental regulations are increasingly pushing automotive companies like Inchcape towards robust waste management and recycling. This covers everything from the production floor to the end-of-life of the vehicles they sell. For instance, in 2024, the European Union's End-of-Life Vehicles (ELV) Directive continues to mandate higher recycling and recovery rates for vehicles, impacting how Inchcape handles vehicle disposal and parts sourcing.

Inchcape's commitment to corporate responsibility also means addressing the environmental footprint of its operations and the vehicles in its portfolio. A key area is the responsible handling of batteries from electric vehicles (EVs), which are becoming a larger part of the automotive market. By 2025, global EV battery recycling is projected to become a significant industry, with companies needing to establish clear processes for collection and material recovery.

Effective waste management and recycling practices are not just about compliance; they represent an opportunity for Inchcape to enhance its brand image and potentially reduce operational costs through resource efficiency. This includes:

- Implementing comprehensive recycling programs for manufacturing by-products and dealership waste.

- Developing partnerships for the efficient recycling of end-of-life vehicles and their components.

- Establishing protocols for the safe and environmentally sound management of EV batteries.

- Tracking and reporting on waste reduction and recycling metrics to demonstrate progress.

Resource Scarcity and Raw Material Sourcing

The automotive sector, including distributors like Inchcape, grapples with increasing resource scarcity, especially for materials vital to electric vehicle (EV) batteries. Cobalt, lithium, and nickel prices have seen significant volatility, with lithium carbonate prices in China fluctuating dramatically throughout 2024, impacting production costs.

Inchcape's reliance on Original Equipment Manufacturers (OEMs) means it's indirectly affected by how these manufacturers secure raw materials. The industry's push for sustainable and ethical sourcing practices, driven by consumer demand and regulatory pressure, shapes the availability and cost of vehicles distributed by Inchcape.

For instance, the global demand for lithium is projected to rise significantly, with estimates suggesting it could more than double by 2030 compared to 2023 levels. This increasing demand, coupled with geopolitical factors and mining capacity limitations, presents a tangible challenge for the entire automotive supply chain.

- Lithium Price Volatility: Lithium carbonate prices in China experienced a sharp decline from highs in late 2023, falling by over 70% by mid-2024, highlighting supply-demand imbalances.

- Critical Mineral Demand: Projections indicate a substantial increase in demand for cobalt and nickel, essential for EV battery cathodes, with some forecasts suggesting a near tripling of demand by 2030.

- Supply Chain Resilience: OEMs are investing heavily in securing long-term supply contracts and exploring alternative battery chemistries to mitigate risks associated with critical mineral sourcing.

- Inchcape's Indirect Exposure: As a distributor, Inchcape's profitability and vehicle availability are influenced by the success of OEM strategies in navigating these raw material challenges.

Inchcape's environmental strategy is deeply intertwined with the automotive industry's global push for decarbonization. The company is actively reducing its carbon footprint, aiming for a 46% cut in Scope 1 and 2 emissions by 2030 and net zero by 2040. In 2023, Inchcape achieved a 15% reduction in these emissions compared to a 2019 baseline, showcasing tangible progress.

The accelerating shift towards electric and new energy vehicles (NEVs) is a defining environmental trend for Inchcape, influencing its product portfolio and investment decisions. Global NEV sales surged past 13 million units in 2023, underscoring strong market momentum and regulatory backing for this transition.

Inchcape is also prioritizing sustainable supply chains and logistics to minimize its environmental impact. Initiatives like warehouse consolidation in 2024 are key to reducing emissions and waste, aligning with increasing global demands for environmentally responsible business practices and enhancing operational resilience.

Stringent environmental regulations, such as the EU's End-of-Life Vehicles Directive, mandate higher recycling rates, impacting Inchcape's vehicle handling and parts sourcing. Furthermore, the responsible management of EV batteries is becoming critical, with global EV battery recycling projected to be a significant industry by 2025.

PESTLE Analysis Data Sources

Our Inchcape PESTLE Analysis draws from a comprehensive blend of official government publications, reputable financial institutions, and leading industry-specific research. This ensures that each factor, from political stability to technological advancements, is grounded in verifiable and current information.