IMA Klessmann GmbH SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IMA Klessmann GmbH Bundle

IMA Klessmann GmbH possesses significant strengths in its established market presence and technological expertise, but faces potential threats from evolving industry regulations and competitive pressures. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind IMA Klessmann GmbH's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

IMA Klessmann's integration within the HOMAG Group, a global leader in woodworking solutions, is a significant strength. This affiliation grants IMA Klessmann access to a vast global sales and service network, significantly expanding its market reach and customer support capabilities. For instance, HOMAG Group's extensive presence in over 100 countries allows IMA Klessmann to tap into diverse international markets more effectively.

Being part of HOMAG Group provides IMA Klessmann with access to a broader spectrum of resources, including advanced research and development capabilities and a larger pool of technical expertise. This synergy enables IMA Klessmann to enhance its product offerings and innovate more rapidly. The combined strength of the group’s portfolio allows IMA Klessmann to present more comprehensive and integrated solutions to its clientele.

IMA Klessmann GmbH stands out due to its advanced technology in processing panel materials. Their expertise covers crucial areas like edge banding, precise sizing, and intricate drilling, alongside efficient material handling systems. This technological prowess is a significant asset in delivering high-quality woodworking solutions.

As a vital part of the HOMAG Group, IMA Klessmann is at the forefront of innovation, actively contributing to and leveraging advancements in automation, sophisticated CNC machining, and the integration of IoT and AI. These cutting-edge solutions are essential for staying competitive in the rapidly evolving woodworking and furniture sectors, with the global woodworking machinery market projected to reach approximately $20 billion by 2027, highlighting the demand for such technological leadership.

IMA Klessmann boasts a comprehensive product portfolio, ranging from individual machines to fully integrated production lines and sophisticated automation systems. This broad spectrum of offerings allows them to serve a diverse customer base, from smaller workshops to large-scale, industrialized furniture manufacturers.

The company's ability to provide end-to-end solutions for digitized production is a significant strength. For instance, in 2024, IMA Klessmann reported a strong order intake, particularly for their integrated solutions, indicating a growing market demand for their holistic approach to manufacturing.

Global Presence and Market Leadership

IMA Klessmann GmbH, as a key entity within the HOMAG Group, benefits from an expansive global presence. This network includes specialized production facilities and a widespread sales and service infrastructure that spans numerous countries, ensuring localized support and market penetration.

This extensive international reach is a cornerstone of IMA Klessmann's market and technology leadership. The company's ability to serve customers across diverse geographical regions directly contributes to its strong competitive standing.

The HOMAG Group reported a revenue of €1.5 billion in 2023, underscoring the scale and market influence of its subsidiaries, including IMA Klessmann. This global operational capacity allows for efficient distribution and responsive customer service, reinforcing its leadership position.

- Global Network: Operates specialized production sites and sales/service companies worldwide.

- Market Leadership: Leverages its global footprint to maintain a leading position in its sector.

- Customer Support: Provides strong and responsive support to a broad international customer base.

- HOMAG Group Scale: Benefits from the €1.5 billion revenue of its parent company (2023), reflecting significant market influence.

Commitment to Sustainability and Efficiency

IMA Klessmann, as part of the HOMAG Group, demonstrates a strong commitment to sustainability and operational efficiency. This focus translates into manufacturing processes designed to minimize environmental impact and maximize resource utilization. For example, the HOMAG Group has been actively investing in renewable energy sources for its production sites, aiming to reduce its carbon footprint.

The company's machine designs prioritize efficiency and resource savings. This includes the development of smart software solutions that optimize material usage, thereby reducing waste. In 2023, the HOMAG Group reported a continued focus on reducing emissions across its operations, aligning with increasing global demand for eco-conscious manufacturing. This dedication to sustainability is a key strength, appealing to a growing market segment that values environmentally responsible products and partners.

- Sustainable Manufacturing: Emphasis on reducing emissions and waste in production processes.

- Efficient Machine Design: Development of machinery that optimizes resource usage and energy consumption.

- Smart Software Integration: Utilization of advanced software to improve material yield and operational efficiency.

- Renewable Energy Investment: Commitment to powering operations with cleaner energy sources to lower environmental impact.

IMA Klessmann's integration within the HOMAG Group is a significant strength, offering access to a vast global sales and service network. This allows for expanded market reach and enhanced customer support across over 100 countries. The group's resources also fuel rapid innovation and the development of more comprehensive solutions.

The company excels in advanced technology for panel material processing, including edge banding, sizing, and drilling, complemented by efficient material handling. This technological expertise is crucial for delivering high-quality woodworking solutions. Furthermore, IMA Klessmann is a leader in automation and CNC machining, integrating IoT and AI to meet the demands of the evolving woodworking market, which was projected to reach approximately $20 billion by 2027.

IMA Klessmann offers a broad product portfolio, from individual machines to fully integrated production lines and automation systems, catering to diverse clients from small workshops to large manufacturers. Their ability to provide end-to-end solutions for digitized production is a key advantage, evidenced by strong order intake for integrated solutions in 2024.

The company's commitment to sustainability is another core strength, with a focus on reducing emissions and waste in manufacturing processes. Investments in renewable energy and the development of resource-efficient machine designs, supported by smart software for material optimization, align with growing market demand for eco-conscious partners. The HOMAG Group's 2023 revenue of €1.5 billion further highlights the scale and influence of its subsidiaries.

| Strength | Description | Supporting Data/Fact |

| HOMAG Group Integration | Leverages global network, resources, and R&D. | HOMAG Group operates in over 100 countries; 2023 revenue €1.5 billion. |

| Technological Expertise | Advanced panel processing, automation, CNC, IoT/AI integration. | Woodworking machinery market projected to reach ~$20 billion by 2027. |

| Comprehensive Portfolio | Individual machines to integrated production lines and automation. | Strong 2024 order intake for integrated solutions. |

| Sustainability Focus | Efficient design, waste reduction, renewable energy investment. | HOMAG Group focused on reducing operational emissions in 2023. |

What is included in the product

Delivers a strategic overview of IMA Klessmann GmbH’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats to inform future business decisions.

Offers a clear, actionable SWOT analysis for IMA Klessmann GmbH, pinpointing key areas for strategic improvement and risk mitigation.

Weaknesses

IMA Klessmann GmbH's focused expertise in the furniture and woodworking sectors, while a core strength, also presents a significant weakness. This specialization makes the company particularly susceptible to economic downturns or fluctuations in demand specifically within these industries. For instance, the furniture market has recently seen customers delaying significant investments, a trend that directly impacts IMA Klessmann's order volumes and revenue streams.

Economic headwinds like inflation and rising interest rates are significantly impacting the woodworking and furniture sectors. For instance, consumer confidence in Germany, a key market for IMA Klessmann GmbH, saw a dip in early 2024, indicating potential reduced spending on durable goods like furniture. This uncertainty directly translates to cautious investment in new machinery by potential clients, affecting IMA Klessmann's order pipeline.

IMA Klessmann GmbH's commitment to staying at the forefront of technological advancement necessitates significant and ongoing investment in research and development. This dedication to innovation, while crucial for maintaining a competitive edge, represents a substantial financial outlay.

For instance, the machinery and plant engineering sector, where IMA operates, typically sees R&D expenditure as a percentage of sales. While specific figures for IMA are proprietary, industry averages often hover in the 5-10% range for leading technology firms. This continuous R&D spend, estimated to be in the tens of millions of Euros annually for a company of IMA's scale, can strain profitability, particularly if market demand softens or if new product development cycles are extended.

Potential for Supply Chain Disruptions

IMA Klessmann GmbH's reliance on global supply chains presents a significant weakness. The company's manufacturing processes, spread across various international locations, are inherently vulnerable to disruptions. This global footprint means that sourcing raw materials and components can be challenging, with potential for increased costs and lead times.

Recent geopolitical events and trade tensions have underscored these vulnerabilities. For instance, the semiconductor shortage experienced globally in 2021-2023 significantly impacted various manufacturing sectors, leading to production delays and increased component costs. Such external shocks can directly affect IMA Klessmann GmbH's ability to maintain consistent production schedules and manage operational expenses effectively.

- Global Sourcing Risks: Dependence on international suppliers for critical components exposes IMA Klessmann GmbH to potential shortages and price volatility.

- Logistical Vulnerabilities: Shipping delays, port congestion, and rising freight costs, as seen in late 2024, can impede timely delivery of materials and finished goods.

- Geopolitical Impact: Trade disputes or political instability in key sourcing regions can disrupt the flow of goods, leading to production stoppages and increased operational costs.

Competition from Alternative Materials and Technologies

IMA Klessmann GmbH operates within the woodworking sector, which is increasingly challenged by alternative materials like advanced plastics, composites, and metal alloys. These materials often boast superior durability, moisture resistance, or unique design possibilities, directly impacting demand for traditional wood products. For instance, the global market for advanced composites is projected to reach over $25 billion by 2025, indicating a significant shift in material preferences across various industries.

The rapid evolution of manufacturing technologies also presents a weakness. Competitors leveraging advanced automation, 3D printing, or novel finishing techniques can achieve greater efficiency and offer customized solutions that IMA Klessmann might find difficult to match without substantial investment. Staying competitive requires constant adaptation and innovation to avoid technological obsolescence in a fast-moving market.

- Material Substitution: Growing use of engineered wood products, plastics, and composites in furniture and construction, potentially reducing demand for solid wood components.

- Technological Lag: Risk of falling behind competitors who adopt advanced manufacturing processes like AI-driven optimization or robotic assembly, impacting cost-efficiency and product innovation.

- Sustainability Demands: Increasing consumer and regulatory pressure for sustainably sourced materials and eco-friendly production methods, which could favor competitors with more established green credentials.

IMA Klessmann GmbH's reliance on specialized machinery for the furniture and woodworking industries makes it vulnerable to sector-specific downturns. For example, a slowdown in new home construction or a consumer shift away from wood furnishings directly impacts demand for IMA's products. The German furniture industry, a key market, experienced a 3.5% decline in sales in 2023, highlighting this exposure.

The company's significant investment in R&D, while crucial for innovation, represents a substantial ongoing cost. In the capital-intensive machinery sector, R&D expenditure can range from 5-10% of sales for leading firms. For a company like IMA, this could translate to tens of millions of Euros annually, potentially impacting profitability during periods of reduced market demand.

Global supply chain dependencies expose IMA Klessmann to risks such as material shortages and logistical disruptions. For instance, the 2021-2023 semiconductor shortage demonstrated how geopolitical events and logistical bottlenecks can increase costs and delay production, directly affecting IMA's operational efficiency and delivery timelines.

| Weakness | Impact | Example/Data |

|---|---|---|

| Industry Specialization | Susceptibility to furniture/woodworking sector downturns | German furniture sales declined 3.5% in 2023. |

| High R&D Investment | Strain on profitability, especially during market slowdowns | Industry R&D spending can be 5-10% of sales; significant annual cost for IMA. |

| Global Supply Chain Reliance | Vulnerability to disruptions, shortages, and cost increases | Semiconductor shortage (2021-2023) caused production delays and higher costs across manufacturing. |

Preview Before You Purchase

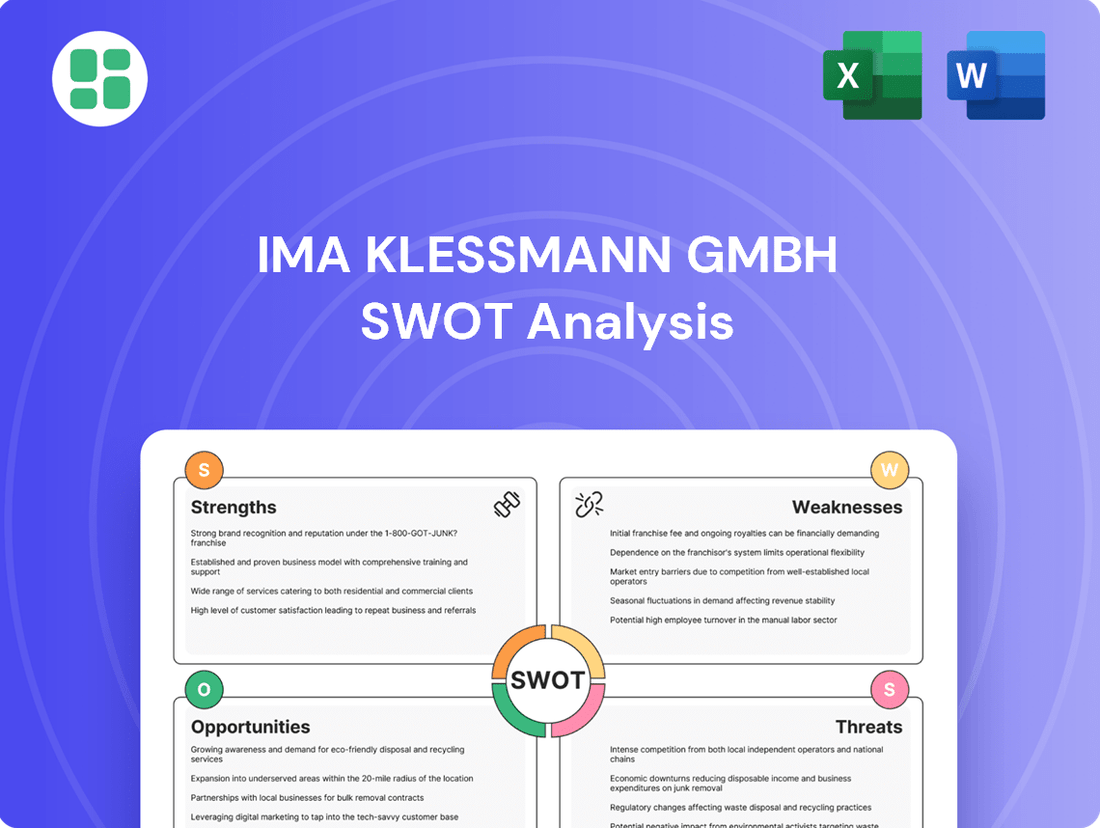

IMA Klessmann GmbH SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a concise overview of IMA Klessmann GmbH's Strengths, Weaknesses, Opportunities, and Threats. Upon purchase, you'll unlock the complete, in-depth analysis for strategic decision-making.

Opportunities

The furniture and woodworking sector is experiencing a substantial surge in demand for automation and digitalization, often referred to as Industry 4.0. This includes a growing appetite for Internet of Things (IoT) integration, artificial intelligence (AI) driven solutions, and advanced digital tools to streamline operations.

IMA Klessmann, leveraging the deep expertise within the HOMAG Group, is well-positioned to meet this demand by offering comprehensive smart factory solutions. These solutions are designed to significantly boost efficiency, improve precision, and enable greater customization for their clientele in the manufacturing space.

For instance, the global market for industrial automation is projected to reach over $300 billion by 2027, with a significant portion driven by manufacturing sectors like furniture. IMA Klessmann's ability to provide integrated digital platforms and automated machinery directly addresses this burgeoning market need.

The timber house construction sector is experiencing robust growth, which is a positive development that helps to counterbalance any challenges faced in the furniture market. This trend is particularly evident in the increasing demand for prefabricated wooden houses, driven by their inherent sustainability and efficiency advantages.

Globally, the prefabricated housing market is projected to reach over $170 billion by 2026, with timber construction playing a significant role. IMA Klessmann GmbH can capitalize on this by leveraging its established expertise in wood processing to broaden its product portfolio and capture a larger share of this expanding market.

Consumers are increasingly prioritizing unique and personalized furniture and wooden products, creating a significant market opportunity. This trend fuels demand for adaptable manufacturing processes that can accommodate individual customer preferences. For instance, the global custom furniture market was valued at approximately $20.5 billion in 2023 and is projected to reach $33.6 billion by 2030, demonstrating robust growth.

IMA Klessmann GmbH is well-positioned to capitalize on this shift with its cutting-edge machinery and digital integration capabilities. Technologies such as augmented reality (AR) and virtual reality (VR) for design visualization, alongside AI-driven design assistance, empower the company to offer mass customization efficiently. This allows IMA Klessmann to directly address the consumer's desire for bespoke items, turning a market trend into a competitive advantage.

Emphasis on Sustainable and Eco-Friendly Practices

The growing global emphasis on environmental sustainability and increasingly stringent regulations are driving a significant demand for eco-friendly materials and responsible production methods across industries. This trend presents a substantial opportunity for companies like IMA Klessmann GmbH to align their offerings with market expectations.

IMA Klessmann's existing commitment to sustainability, demonstrated through investments in energy-efficient machinery and initiatives for waste reduction, positions the company to effectively capitalize on this evolving market. This proactive approach allows them to meet growing customer demand for greener solutions and secure a competitive advantage.

- Growing Market Demand: Consumer and business preferences are increasingly shifting towards environmentally conscious products and services.

- Regulatory Tailwinds: Governments worldwide are implementing stricter environmental standards, favoring companies with sustainable practices. For example, the EU's Green Deal aims for climate neutrality by 2050, impacting manufacturing supply chains.

- Competitive Differentiation: Demonstrating a strong commitment to sustainability can set IMA Klessmann apart from competitors, attracting environmentally aware clients and investors.

- Operational Efficiency: Investments in energy efficiency and waste reduction often lead to cost savings, further enhancing profitability.

Market Growth in Emerging Regions and Strategic Partnerships

Emerging markets in Asia, including India, Vietnam, and Indonesia, are showing significant potential for growth in the woodworking machinery sector, offering a counterpoint to potential slowdowns in established European markets. These regions are increasingly investing in manufacturing capabilities, driving demand for advanced machinery. For instance, the global woodworking machinery market is projected to reach approximately $20 billion by 2028, with a substantial portion of this growth anticipated from these developing economies.

Strategic alliances are key to unlocking this potential. IMA Klessmann GmbH can leverage partnerships to navigate these new territories effectively. A prime example is HOMAG's successful joint venture with Luli Wood Industry in China, which has demonstrably strengthened its market position and facilitated access to a rapidly expanding customer base. Such collaborations allow for shared expertise, localized market understanding, and more efficient distribution networks.

- Asia's growing manufacturing sector presents a significant opportunity for woodworking machinery sales.

- Strategic partnerships can accelerate market penetration and build a stronger presence in dynamic emerging economies.

- HOMAG's collaboration with Luli Wood Industry in China exemplifies successful market expansion through strategic alliances.

- The global woodworking machinery market is expected to see considerable growth driven by demand from emerging production hubs.

The increasing demand for automation and digitalization in furniture and woodworking, often termed Industry 4.0, presents a significant opportunity for IMA Klessmann. The company can capitalize on the global industrial automation market, projected to exceed $300 billion by 2027, by offering smart factory solutions that enhance efficiency and precision.

The robust growth in timber house construction, with the prefabricated housing market expected to reach over $170 billion by 2026, allows IMA Klessmann to expand its product portfolio and capture share in this expanding sector.

A growing consumer preference for personalized and custom furniture, a market valued at approximately $20.5 billion in 2023 and projected to reach $33.6 billion by 2030, can be addressed by IMA Klessmann's advanced machinery and digital integration capabilities for mass customization.

The global emphasis on sustainability and stricter environmental regulations create an opportunity for IMA Klessmann to leverage its existing eco-friendly initiatives and energy-efficient machinery to meet market expectations and gain a competitive edge.

Emerging markets in Asia, with the global woodworking machinery market projected to reach around $20 billion by 2028, offer substantial growth potential. Strategic alliances, such as HOMAG's successful joint venture in China, can facilitate effective market penetration and expansion in these dynamic economies.

Threats

Broader economic instability, including persistent inflation and elevated interest rates, presents a significant threat to IMA Klessmann GmbH. These macroeconomic factors can directly dampen demand for capital goods such as woodworking machinery. For instance, the furniture sector, a key customer base, experienced a challenging market environment in early 2025, leading to reduced investment and consequently impacting order intake for machinery manufacturers.

The global woodworking machinery market is a crowded space, with established giants and agile newcomers vying for dominance. This intense competition means IMA Klessmann GmbH must constantly stay ahead of the curve. For instance, in 2024, the market saw significant investment in advanced automation solutions, with companies like Homag and Biesse showcasing new robotic integration and AI-driven optimization at industry trade shows.

To thrive, IMA Klessmann needs to differentiate itself. Competitors are not just offering similar products; they are actively investing in cutting-edge automation and digital technologies. This necessitates continuous innovation in areas like smart factory integration and advanced software solutions to maintain market share and pricing power in a landscape where technological parity can quickly erode competitive advantages.

IMA Klessmann GmbH faces a significant threat from the declining availability and rising prices of wood, a key raw material. This trend, exacerbated by increasing competition from non-wood alternatives, directly impacts production costs. For instance, global lumber prices saw substantial volatility throughout 2024, with some benchmarks experiencing double-digit percentage increases year-on-year, directly affecting input costs for machinery manufacturers.

These escalating raw material expenses can translate into higher prices for IMA Klessmann's machinery. Consequently, customers may see their investment capacity in new equipment reduced, potentially leading to slower sales cycles or a deferral of capital expenditures, particularly in sectors heavily reliant on wood processing.

Talent Shortages and Aging Workforce

The woodworking sector, including companies like IMA Klessmann GmbH, is grappling with a significant shortage of skilled labor. This scarcity is exacerbated by an aging workforce, with many experienced professionals nearing retirement. For instance, in Germany, the average age in skilled trades is steadily increasing, posing a challenge for knowledge transfer and operational continuity.

This talent deficit directly impacts the market's capacity to adopt advanced manufacturing technologies. Customers may hesitate to invest in sophisticated machinery if they lack personnel trained to operate and maintain it effectively. This can slow down innovation and efficiency gains across the industry.

Furthermore, IMA Klessmann GmbH itself faces internal workforce challenges. The shortage affects the company's ability to staff its manufacturing operations with qualified individuals and also impacts the availability of skilled technicians for crucial after-sales services and support. This dual pressure can strain production capacity and customer satisfaction.

- Skilled Labor Gap: The woodworking industry is experiencing a pronounced lack of trained professionals.

- Demographic Shift: An aging workforce in Germany and other key markets means a loss of experience and expertise.

- Technology Adoption Barrier: Customers' inability to find trained staff may hinder their investment in advanced woodworking machinery.

- Internal Workforce Strain: IMA Klessmann GmbH faces challenges in both manufacturing and service departments due to these talent shortages.

Technological Obsolescence and Rapid Innovation Cycle

The relentless pace of technological change, exemplified by the ongoing integration of Industry 4.0 principles and advancements in artificial intelligence and robotics, presents a significant challenge for IMA Klessmann GmbH. Failure to keep pace with these innovations risks rendering current product lines outdated, thereby diminishing the company's competitive edge and market standing.

For instance, the global market for industrial automation, a key area impacted by these trends, was projected to reach over $200 billion in 2024, highlighting the scale of investment and rapid evolution within this sector. IMA Klessmann GmbH must actively invest in research and development to ensure its offerings remain relevant and cutting-edge.

- The accelerating innovation cycle necessitates continuous investment in R&D to avoid product obsolescence.

- Failure to adopt Industry 4.0 technologies could lead to a loss of market share to more agile competitors.

- The integration of AI and robotics in manufacturing processes by competitors could create a significant efficiency gap.

Intensifying global competition, particularly from emerging markets with lower production costs, poses a significant threat to IMA Klessmann GmbH. Companies in these regions are increasingly offering comparable machinery at more aggressive price points, eroding market share for established European manufacturers. For example, by early 2025, several Asian manufacturers had significantly expanded their export capabilities, capturing a noticeable portion of the mid-range market segment.

The woodworking machinery sector is highly cyclical, making it vulnerable to economic downturns. A slowdown in construction and furniture manufacturing, key end-user industries, directly impacts demand for IMA Klessmann's products. For instance, a projected 2% contraction in global construction output for 2025, driven by higher interest rates, could lead to a substantial drop in machinery orders.

Regulatory changes, such as stricter environmental standards or evolving safety requirements for industrial machinery, can necessitate costly product redesigns and compliance efforts. Failure to adapt quickly to these evolving regulations could result in market access restrictions or penalties. For example, new EU directives on energy efficiency for industrial equipment, expected to be fully implemented by late 2025, will require significant updates to many machine designs.

| Threat Category | Specific Threat | Impact on IMA Klessmann GmbH | Example/Data Point (2024/2025) |

|---|---|---|---|

| Economic Factors | Broader economic instability (inflation, interest rates) | Reduced customer investment capacity, dampened demand | Furniture sector experienced reduced investment in early 2025 due to challenging market. |

| Market Dynamics | Intense global competition | Pressure on pricing, potential loss of market share | Asian manufacturers expanding exports, capturing mid-range market by early 2025. |

| Industry Cycles | Cyclical nature of end-user industries | Vulnerability to economic downturns, fluctuating order intake | Projected 2% contraction in global construction output for 2025 impacting machinery demand. |

| Regulatory Environment | Evolving environmental and safety regulations | Need for costly product redesigns, compliance risks | New EU directives on energy efficiency for industrial equipment by late 2025 requiring design updates. |

SWOT Analysis Data Sources

This SWOT analysis for IMA Klessmann GmbH is built upon a robust foundation of internal financial statements, comprehensive market research reports, and expert industry analysis, ensuring a data-driven and accurate strategic assessment.