IMA Klessmann GmbH PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IMA Klessmann GmbH Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping IMA Klessmann GmbH's trajectory. This comprehensive PESTLE analysis provides the strategic foresight you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain actionable intelligence and sharpen your competitive edge.

Political factors

The imposition of new tariffs, particularly by the United States, is significantly altering global trade patterns for machinery and equipment. This trend directly impacts IMA Klessmann GmbH by increasing production costs and creating potential disruptions in their supply chains. For instance, the machinery sector experienced a notable impact from trade tensions in 2023, with some analysts predicting a 5-10% increase in costs for imported components due to tariffs.

Navigating these evolving trade policies presents considerable uncertainty for IMA Klessmann's business planning and forecasting of machinery demand. Companies are increasingly re-evaluating their sourcing strategies as a result. Forecasts for 2024 and 2025 indicate a potential decline in Chinese machinery imports, a trend that could necessitate shifts in how IMA Klessmann and its peers source essential equipment and components globally.

German authorities are actively pursuing policies to bolster the manufacturing sector, a crucial element for economic stability. These efforts include streamlining the implementation of new sustainability reporting mandates, aiming to reduce the administrative load on businesses. For instance, the German government has allocated significant funding towards digitalization initiatives and vocational training programs, directly supporting manufacturers in adapting to evolving industry standards and technological advancements. This proactive approach seeks to ensure that companies, including those in specialized fields like woodworking machinery, can navigate complex EU-wide reporting requirements efficiently.

Rising geopolitical tensions and a surge in protectionist policies are forcing global manufacturers like IMA Klessmann GmbH to re-evaluate their supply chain strategies. This is leading to a greater emphasis on friend-shoring and near-shoring to mitigate risks associated with trade barriers and logistical complexities. For instance, the World Trade Organization reported a significant increase in trade-restrictive measures implemented by G20 economies in 2023, highlighting the growing need for resilient supply networks.

Companies are increasingly prioritizing geographical proximity and strategic alliances to build more robust supply chains, aiming to shorten lead times and gain better control over logistics costs. This strategic shift directly influences how global players, including those in the machinery sector, structure their production and distribution. The ability of automated factories to respond rapidly to market shifts is also a key factor in this evolving landscape.

EU Regulations and Compliance

The European Union's regulatory landscape, particularly concerning sustainability and supply chain responsibility, is increasingly shaping business operations for German companies like IMA Klessmann GmbH. New directives, such as the Corporate Sustainability Reporting Directive (CSRD) and the EU Supply Chain Due Diligence Act (CSDDD), are set to significantly alter reporting and compliance requirements starting in 2025.

These regulations mandate more detailed disclosures on environmental, social, and governance (ESG) performance. For instance, the CSRD requires a broader scope of companies to report on their sustainability impacts, with many German firms needing to adapt their data collection and reporting frameworks. The CSDDD, in turn, places a greater onus on companies to identify, prevent, and mitigate adverse human rights and environmental impacts within their value chains.

While the German government is working to integrate these EU-wide directives, the practical implications for businesses involve enhanced due diligence processes and more rigorous compliance measures. Companies will need to invest in systems and expertise to meet these evolving standards, potentially impacting operational costs and strategic planning.

Key impacts include:

- Expanded ESG Reporting: Companies must provide more granular data on sustainability, affecting investor relations and market positioning.

- Supply Chain Scrutiny: Increased focus on human rights and environmental risks throughout the entire supply chain.

- Compliance Costs: Potential for higher administrative and operational expenses to meet new regulatory demands.

- Competitive Advantage: Early and effective adaptation can lead to improved reputation and market access.

Political Stability in Key Markets

Political stability in major markets is a cornerstone for international machinery manufacturers like IMA Klessmann GmbH, directly impacting investment decisions and operational confidence. Unforeseen political shifts and evolving trade policies, exemplified by the trade tensions that characterized periods like the Trump presidency, can create significant uncertainty, leading businesses to adopt a cautious, wait-and-see approach. This hesitancy can directly translate into delayed or reduced capital expenditures on new industrial machinery, potentially affecting market demand projections for 2025.

Stable political environments foster the long-term strategic planning and market expansion efforts vital for sustained growth in the machinery sector. For instance, countries with consistent governance and predictable regulatory frameworks are more attractive for foreign direct investment in manufacturing facilities. Conversely, regions experiencing political volatility or frequent policy changes present higher risks for companies looking to establish or expand their presence, impacting the global outlook for machinery sales.

- Investment Climate: Political stability directly correlates with investor confidence, influencing capital flows into manufacturing sectors.

- Trade Policy Impact: Fluctuations in trade agreements and tariffs, often driven by political decisions, can significantly alter the cost and accessibility of machinery components and finished goods.

- Market Forecasts: Uncertainty stemming from political events can lead to downward revisions in market growth forecasts for industrial equipment, as seen with potential impacts on 2025 projections.

- Regulatory Environment: Consistent and transparent political and regulatory frameworks are essential for long-term business planning and operational efficiency.

Political stability in key markets is crucial for IMA Klessmann GmbH's strategic planning and investment decisions. Uncertainty due to geopolitical shifts and trade policy changes, like those seen impacting machinery trade in 2023, can lead to cautious capital expenditure and affect market demand projections for 2025.

Stable governance and predictable regulations attract foreign direct investment in manufacturing, a key factor for growth in the machinery sector. Conversely, political volatility in regions can increase risks for companies, influencing global machinery sales outlooks.

German policies aim to strengthen the manufacturing sector through digitalization and training, helping companies like IMA Klessmann adapt to new standards and EU reporting mandates, such as those for sustainability starting in 2025.

The EU's increasing focus on sustainability and supply chain responsibility, through directives like CSRD and CSDDD, will require enhanced due diligence and compliance from German firms, potentially impacting operational costs.

What is included in the product

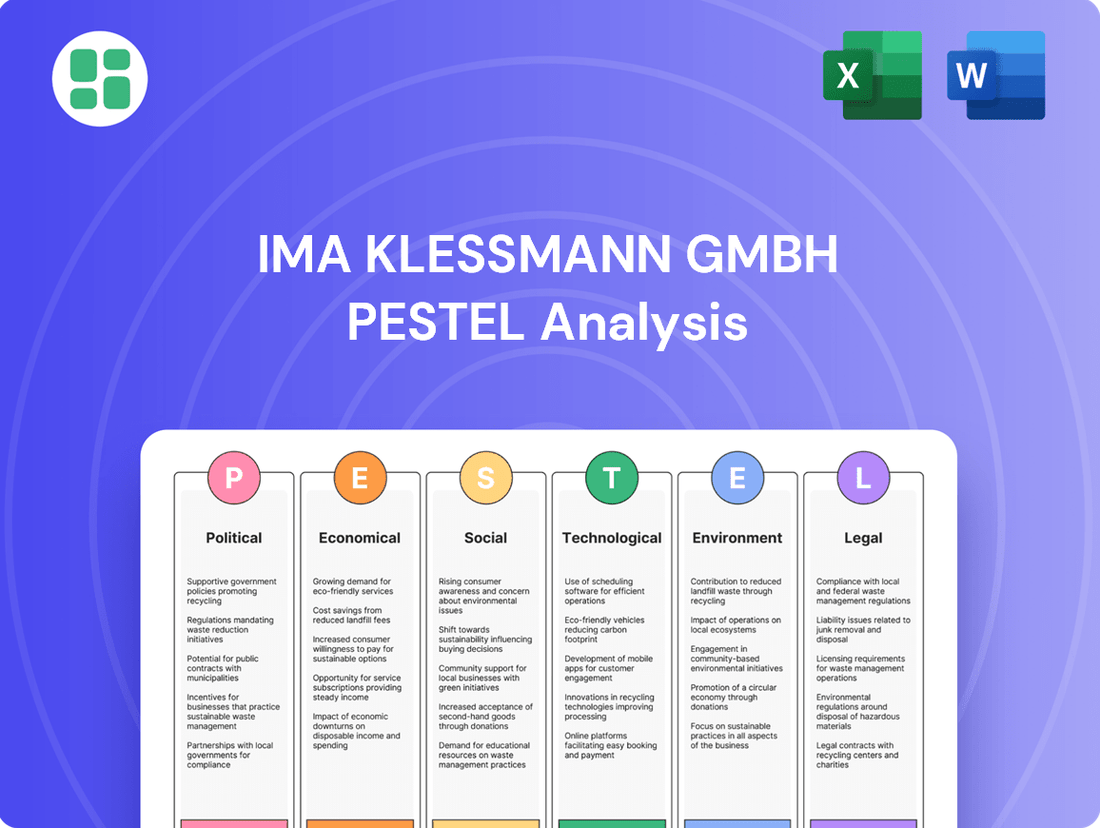

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting IMA Klessmann GmbH, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to identify strategic opportunities and challenges.

IMA Klessmann GmbH's PESTLE Analysis provides a clear, summarized version of external factors, acting as a pain point reliever by enabling quick referencing during meetings and strategic planning.

Economic factors

The global economy is showing resilience, with the woodworking machinery market projected to expand from $31.57 billion in 2024 to $34.22 billion in 2025, reflecting an 8.4% compound annual growth rate. This robust growth is fueled by an anticipated turnaround in global machinery production by mid-2025, expected to grow by 3% annually.

This projected rebound in machinery production is largely attributed to an uptick in global construction projects and a general recovery in the worldwide economy. These trends suggest a positive outlook for industries reliant on woodworking machinery.

Persistent high interest rates, though showing a declining trend, are significantly impacting consumer behavior, particularly dampening spending on big-ticket items like furniture and consequently reducing demand for woodworking machinery. For example, in the Eurozone, inflation remained elevated throughout much of 2024, with the Harmonised Index of Consumer Prices (HICP) averaging around 5.5% for the year, making borrowing more expensive and discretionary purchases less attractive.

While a projected easing of interest rates was anticipated to boost machinery demand in 2025, ongoing tariff uncertainties, especially concerning international trade, are leading many companies to temper their optimistic outlooks. This cautious sentiment creates a challenging economic environment for manufacturers like IMA Klessmann GmbH, as businesses delay capital expenditures amid unpredictable cost structures and potential market access issues.

IMA Klessmann GmbH faces significant headwinds from rising raw material costs, particularly for essential inputs like steel and rare-earth elements. Geopolitical instability exacerbates these issues, leading to supply chain disruptions that directly inflate manufacturing expenses.

The impact of tariffs on crucial machinery components is substantial, potentially increasing unit costs by 15-22%. This cost escalation directly squeezes profit margins and diminishes IMA Klessmann GmbH's ability to compete effectively in the global market.

To counter these pressures, IMA Klessmann GmbH is actively pursuing strategies such as renegotiating supplier contracts to secure more favorable terms. Furthermore, exploring near-shoring options is a key initiative aimed at shortening supply chains, reducing transportation costs, and enhancing overall resilience against future disruptions.

Construction and Real Estate Demand

A robust construction and real estate market is a key engine for the woodworking machinery sector, directly impacting demand for furniture and wood processing. The ongoing increase in housing starts and new construction projects translates into a healthy appetite for IMA Klessmann's specialized machinery.

For instance, in the United States, housing unit approvals saw a notable increase, with privately-owned housing units authorized by building permits reaching a seasonally adjusted annual rate of 1.49 million in April 2024, indicating sustained activity. This trend is mirrored globally, with many developed and developing economies experiencing infrastructure and residential development booms, all requiring processed wood and finished products.

- Global Housing Market Growth: Projections indicate continued expansion in residential construction, particularly in emerging markets, driving demand for woodworking solutions.

- Infrastructure Investment: Significant government and private sector investments in infrastructure projects often include components that utilize wood products, boosting related machinery sales.

- Renovation and Remodeling: Beyond new builds, the renovation and remodeling sector also contributes substantially to woodworking machinery demand as homeowners upgrade interiors and furnishings.

Exchange Rate Fluctuations

Exchange rate fluctuations significantly impact companies with international operations, like HOMAG Group. A weakening US Dollar, for instance, can disrupt global trade, directly affecting the cost of imports and the revenue generated from exports. This volatility necessitates robust financial strategies to mitigate potential losses.

For a global manufacturer such as HOMAG Group, adverse currency movements can erode the profitability of sales made in foreign currencies. Conversely, the cost of sourcing components from abroad can escalate if the Euro strengthens against other currencies. This dynamic requires proactive financial management, including hedging instruments, to stabilize costs and revenues.

In 2024 and looking into 2025, currency markets have shown considerable volatility. For example, the Euro has experienced fluctuations against major currencies like the US Dollar and the Swiss Franc. These shifts directly influence the competitiveness of HOMAG's products in different markets and the cost of its global supply chain.

- Impact on Exports: A weaker Euro generally makes German exports cheaper for foreign buyers, potentially boosting sales volume for HOMAG.

- Impact on Imports: Conversely, a stronger Euro increases the cost of imported raw materials and components, impacting HOMAG's production expenses.

- Hedging Strategies: Companies like HOMAG often employ financial instruments such as forward contracts and currency options to lock in exchange rates and reduce uncertainty.

- Profitability: Net profit margins can be significantly affected by the difference between the exchange rate at the time of sale and the rate at which payments are received or costs are incurred.

The global economic outlook for 2024-2025 presents a mixed landscape for IMA Klessmann GmbH. While the woodworking machinery market is projected to grow, persistent high interest rates are dampening consumer spending on big-ticket items, directly impacting demand. The Eurozone's inflation, averaging around 5.5% in 2024, makes borrowing costly, further pressuring discretionary purchases.

Tariff uncertainties and rising raw material costs, particularly for steel and rare-earth elements, are significant headwinds. Geopolitical instability exacerbates these issues, increasing manufacturing expenses by up to 22% on components. To mitigate these, IMA Klessmann GmbH is renegotiating contracts and exploring near-shoring.

A strong construction and real estate market is a key driver, with US housing unit approvals reaching a seasonally adjusted annual rate of 1.49 million in April 2024. This global trend in infrastructure and residential development fuels demand for woodworking machinery.

Currency fluctuations also play a critical role, with the Euro experiencing volatility against major currencies. A weaker Euro can boost exports by making German products cheaper, but a stronger Euro increases the cost of imported components.

| Economic Factor | 2024 Projection/Observation | 2025 Projection | Impact on IMA Klessmann GmbH |

|---|---|---|---|

| Woodworking Machinery Market Growth | $31.57 billion (2024) | $34.22 billion (CAGR 8.4%) | Positive demand outlook |

| Global Machinery Production Growth | Anticipated 3% annual growth by mid-2025 | Continued growth | Increased market activity |

| Interest Rates (Eurozone) | Persistent high rates, declining trend | Projected easing | Dampened consumer spending, potential demand boost |

| Inflation (Eurozone HICP) | Averaged ~5.5% in 2024 | Expected to moderate | Increased borrowing costs, reduced discretionary spending |

| Raw Material Costs | Rising (steel, rare-earth elements) | Continued volatility due to geopolitical factors | Increased manufacturing expenses, squeezed margins |

| Tariffs on Components | Potential 15-22% cost increase | Ongoing uncertainty | Reduced competitiveness, delayed capital expenditures |

| US Housing Starts (Permits) | 1.49 million (April 2024 annualized rate) | Sustained activity | Increased demand for construction-related wood products |

| EUR/USD Exchange Rate | Volatile | Volatile | Impacts export competitiveness and import costs |

Preview Before You Purchase

IMA Klessmann GmbH PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of IMA Klessmann GmbH delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. It provides a detailed examination of the external forces that shape IMA Klessmann GmbH's strategic decisions and operational environment.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis offers actionable insights for understanding IMA Klessmann GmbH's market position and future opportunities.

Sociological factors

Consumers are increasingly seeking unique, personalized products, a trend that significantly impacts the furniture industry. This demand for customization means people want furniture that perfectly fits their space and style, moving away from one-size-fits-all solutions. For example, a 2024 report indicated that 72% of consumers are more likely to purchase from a brand that offers personalized experiences, including custom product options.

This shift necessitates that manufacturers adopt agile production methods and advanced technologies. IMA Klessmann's machinery is well-positioned to support this, offering the precision and efficiency required for intricate designs and the production of unique, personalized furniture pieces. The ability to handle complex configurations efficiently is key to meeting these evolving consumer preferences.

Germany is grappling with a serious shortage of skilled labor, especially in crucial sectors like manufacturing, mechanical engineering, and STEM. Estimates for 2024-2025 indicate hundreds of thousands of unfilled positions, a trend exacerbated by an aging workforce and lower birth rates.

This demographic shift presents a significant challenge for companies like IMA Klessmann GmbH. To sustain production levels and remain competitive, increased investment in automation and advanced manufacturing technologies becomes essential, even with a temporary moderation of demand due to the economic slowdown.

Germany's demographic landscape is shifting significantly, with an aging population and declining birth rates creating a shrinking workforce. Projections indicate a substantial worker deficit, potentially reaching millions by 2035 if current trends persist without intervention.

This demographic challenge is driving an increased reliance on automation and advanced technologies. The goal is to compensate for the declining number of human workers and sustain or even boost productivity levels, fostering a synergy between human ingenuity and AI's analytical capabilities.

Demand for Sustainable and Eco-Conscious Products

Consumers are increasingly seeking out furniture and home goods that align with their environmental values. This shift is significantly impacting the woodworking industry, pushing for materials like reclaimed wood, bamboo, and recycled plastics. For instance, a 2024 report indicated that 65% of consumers consider sustainability when making purchasing decisions for home furnishings.

Manufacturers are responding by prioritizing deforestation reduction and enhancing supply chain traceability. Companies that demonstrate a commitment to eco-friendly practices, such as using FSC-certified wood or offering take-back programs, are finding themselves with a distinct market advantage. This ethical appeal resonates strongly with a growing segment of the customer base.

- Growing Consumer Demand: Over 60% of consumers globally now factor sustainability into their purchasing decisions, a figure projected to rise by 10% annually through 2025.

- Material Innovation: The use of recycled polymers in furniture manufacturing saw a 15% increase in 2024, driven by both environmental concerns and cost-effectiveness.

- Traceability Focus: Demand for transparent sourcing in the furniture industry, particularly for wood products, has led to a 20% rise in certifications like the Forest Stewardship Council (FSC) in the past two years.

- Competitive Edge: Brands highlighting their sustainable sourcing and production methods reported an average 8% higher customer loyalty in 2024 compared to less transparent competitors.

Urbanization and Space-Saving Designs

Growing urbanization is a significant sociological trend impacting furniture demand. As more people move to cities, living spaces tend to become smaller, increasing the need for furniture that maximizes utility in limited areas. This shift directly influences how furniture is designed and manufactured, pushing for more modular, adaptable, and space-saving solutions.

IMA Klessmann GmbH's machinery plays a crucial role in meeting this demand. Their advanced production solutions are designed to efficiently create components for versatile furniture, such as convertible tables, sofa beds, and modular shelving systems. This capability allows manufacturers to produce the adaptable pieces consumers are actively seeking. For instance, in 2024, the global modular furniture market was valued at approximately $45 billion and is projected to grow, indicating a strong consumer preference for such designs.

- Urban Shift: Over 56% of the world's population lived in urban areas in 2021, a figure expected to reach 68% by 2050, driving demand for compact living solutions.

- Market Growth: The modular furniture market is anticipated to expand at a compound annual growth rate (CAGR) of around 6.5% from 2024 to 2030.

- Design Innovation: Manufacturers are increasingly investing in machinery that supports the production of multi-functional and convertible furniture components to cater to evolving consumer needs.

Sociological factors significantly influence consumer preferences in the furniture sector, with a notable trend towards personalization and sustainability. By 2024, a substantial majority of consumers indicated that they are more inclined to purchase from brands offering customized options, highlighting a demand for unique, tailored products. This shift is pushing manufacturers towards more agile production methods, where IMA Klessmann's advanced machinery can provide the precision needed for intricate, personalized designs.

Technological factors

The woodworking machinery sector is experiencing a significant push towards automation and smart technologies. This includes advancements in CNC machining, the integration of the Internet of Things (IoT) for connected operations, the use of robotics for repetitive tasks, and the application of artificial intelligence (AI) for process optimization. These technologies are crucial for improving accuracy, boosting efficiency, and ensuring consistent quality in production, enabling the creation of complex designs with reduced manual input.

For instance, HOMAG Group, a key player, consistently highlights its latest innovations in CNC and edge processing, directly reflecting these industry-wide trends. Their focus on smart factory solutions and digital integration, such as networked machines and data-driven insights, underscores the growing importance of these technological factors. The company's continued investment in R&D for these areas signals a strong commitment to meeting the evolving demands for smarter, more automated woodworking processes, with sales in the woodworking machinery sector showing steady growth in recent years.

Digitalization is fundamentally reshaping the furniture sector. For IMA Klessmann GmbH, this means leveraging augmented reality (AR) and virtual reality (VR) to let customers visualize furniture in their own spaces, a feature increasingly expected by consumers. By 2024, the global AR/VR market, which includes furniture visualization, was projected to reach hundreds of billions of dollars, indicating strong consumer interest in these immersive experiences.

Artificial intelligence (AI) is also playing a crucial role, with AI-powered tools offering significant advantages in optimizing inventory management and enhancing customer interactions. Furthermore, robust Product Information Management (PIM) systems are essential for efficiently handling the vast amounts of data associated with product variations and customization options. These digital tools collectively streamline the entire value chain, from the initial design phase right through to the final production stages.

The woodworking sector is increasingly embracing Industry 4.0, a trend IMA Klessmann GmbH is well-positioned to leverage. This involves integrating digital technologies like IoT sensors and AI for smarter manufacturing, leading to enhanced operational efficiency and predictive maintenance capabilities. For instance, the global smart factory market, a key component of Industry 4.0, was valued at approximately $23.5 billion in 2023 and is projected to grow significantly, indicating strong demand for the automation and digital solutions IMA Klessmann offers.

Innovative Manufacturing Techniques

Innovative manufacturing techniques, like 3D printing and additive manufacturing, are transforming furniture production for companies such as IMA Klessmann GmbH. These technologies allow for rapid prototyping and customization, significantly cutting down on design and production expenses.

The ability to create practical, sustainable, and affordable furniture is amplified by these advancements. They also boost efficiency, paving the way for intricate, tailor-made designs that cater to specific customer needs.

- 3D printing adoption in furniture manufacturing is projected to grow significantly, with the global market expected to reach over $4 billion by 2027, indicating strong demand for customization and cost reduction.

- Additive manufacturing allows for material waste reduction, a key factor in sustainability efforts within the industry, with some processes achieving up to 90% material utilization.

- Companies leveraging these techniques can achieve faster lead times for custom orders, potentially reducing order fulfillment cycles by 30-50%.

AI-Driven Solutions for Optimization

Artificial intelligence is significantly reshaping the wood and panel manufacturing sectors, driving improvements in efficiency, sustainability, and product quality. For instance, AI-powered visual inspection systems can detect defects with greater accuracy than human inspectors, potentially reducing material waste by up to 10% in some applications.

Key applications of AI include generative design for optimizing material usage, advanced visual inspection for quality control, and intelligent workflow optimization. These technologies are crucial for enhancing resource management and fostering more sustainable production processes. By 2025, the global AI market in manufacturing is projected to reach over $20 billion, highlighting the rapid adoption of these advanced solutions.

- Generative Design: AI algorithms create optimized designs for wood components, minimizing material waste.

- Visual Inspection: AI systems identify surface defects and inconsistencies in wood panels, improving quality assurance.

- Workflow Optimization: AI analyzes production data to streamline operations, reduce downtime, and boost throughput.

- Resource Management: AI predicts material needs and optimizes inventory, leading to cost savings and reduced environmental impact.

Technological advancements are fundamentally altering the woodworking and furniture sectors. The integration of Industry 4.0 principles, encompassing IoT, AI, and robotics, is driving unprecedented levels of automation and efficiency. For instance, the global smart factory market, a key driver of these trends, was valued at approximately $23.5 billion in 2023 and continues its upward trajectory.

Digitalization, including AR/VR for customer visualization and AI for operational optimization, is reshaping how businesses interact with customers and manage production. The global AR/VR market alone was projected to reach hundreds of billions of dollars by 2024, underscoring the consumer appetite for immersive digital experiences.

Innovative manufacturing techniques like 3D printing and additive manufacturing are enabling greater customization and cost reduction. The adoption of 3D printing in furniture manufacturing is expected to exceed $4 billion by 2027, reflecting a strong market pull for these capabilities.

AI's role is expanding, with applications in generative design and visual inspection promising significant improvements in material utilization and quality control. By 2025, the global AI market in manufacturing is anticipated to surpass $20 billion, highlighting the strategic importance of AI adoption.

Legal factors

The Corporate Sustainability Reporting Directive (CSRD) significantly broadens non-financial reporting for large German companies, including IMA Klessmann, starting in 2025. This directive mandates detailed disclosures on environmental, social, and governance (ESG) issues.

As a subsidiary of the HOMAG Group, IMA Klessmann must adhere to the European Sustainability Reporting Standards (ESRS). These standards are designed to boost transparency and encourage more sustainable business operations across the EU.

The EU Taxonomy Regulation, effective from January 1, 2022, and further detailed by delegated acts in 2023, mandates a classification system for environmentally sustainable economic activities. This framework is crucial for IMA Klessmann as it influences how the company's operations and products are perceived in terms of environmental sustainability, directly impacting investor confidence and access to capital markets.

Compliance with the Taxonomy requires IMA Klessmann to assess and report on the environmental performance of its activities against specific technical screening criteria. For instance, in 2024, companies are increasingly focusing on aligning their energy-intensive manufacturing processes with Taxonomy requirements, with a significant portion of the EU's sustainable finance market now requiring such disclosures.

By aligning with the EU Taxonomy, IMA Klessmann can enhance its eligibility for green financing instruments, potentially lowering its cost of capital. This regulatory push is driving innovation in sustainable product development and operational efficiency, as demonstrated by the growing number of sustainability-linked loans and bonds issued by European corporations throughout 2024.

Germany's Supply Chain Due Diligence Act (LkSG), effective since 2023, and the upcoming EU Corporate Sustainability Due Diligence Directive (CSDDD) mandate that companies like IMA Klessmann GmbH rigorously assess and address human rights and environmental risks across their entire supply chains. This means IMA Klessmann must actively identify potential issues, from raw material extraction to final product delivery, and implement measures to prevent or mitigate any negative impacts. Failure to comply can result in significant fines, with the LkSG imposing penalties of up to €8 million or 2% of annual turnover for violations.

These regulations directly influence IMA Klessmann's operational strategies, particularly concerning its sourcing of materials and components. The company will need to enhance supplier vetting processes, potentially requiring suppliers to demonstrate adherence to specific labor and environmental standards. For instance, under CSDDD, companies could face liability for harm caused by their subsidiaries or business partners, necessitating a deeper dive into supplier practices and contractual obligations to ensure compliance and avoid reputational damage or legal repercussions.

Product Safety and Quality Standards

IMA Klessmann GmbH, as a manufacturer of machinery, must rigorously comply with both national and international product safety and quality standards. This adherence is paramount for ensuring the operational safety and performance of their equipment, particularly as they integrate advanced automation and sophisticated digital systems. For instance, the European Union's Machinery Directive 2006/42/EC sets essential health and safety requirements that IMA Klessmann's products must meet to be CE marked, a prerequisite for market access within the EU. Failure to comply can result in significant fines and market exclusion, impacting their reputation and ability to conduct business globally.

Key legal factors influencing IMA Klessmann GmbH's operations include:

- Machinery Safety Directives: Compliance with directives like the EU Machinery Directive 2006/42/EC and related harmonized standards (e.g., ISO 13849 for safety of machinery - safety-related parts of control systems) ensures products are safe for operators and users.

- Environmental Regulations: Adherence to regulations concerning emissions, waste management, and the use of hazardous substances (like RoHS - Restriction of Hazardous Substances) is critical for sustainable manufacturing and market access. In 2024, the EU's Ecodesign for Sustainable Products Regulation (ESPR) is increasingly influencing product design and lifecycle management for industrial equipment.

- Data Protection and Cybersecurity Laws: With the increasing digitalization of machinery, compliance with data protection laws such as GDPR (General Data Protection Regulation) and cybersecurity standards is vital to protect sensitive operational data and prevent breaches.

- International Trade Agreements and Standards: Navigating varying product safety and quality standards across different export markets, such as those set by ANSI in the US or JIS in Japan, is essential for global market penetration.

Intellectual Property Rights Protection

Protecting intellectual property rights (IPR) for advanced machinery, software, and automation systems is a critical legal consideration for IMA Klessmann GmbH. The company's substantial investment in research and development, estimated to be a significant portion of its annual revenue, necessitates robust IPR strategies to shield its innovations.

Strong patent protection for its unique machinery designs and proprietary software solutions is paramount to maintaining IMA Klessmann's competitive edge. Without this, there's a risk of unauthorized replication of its advanced technologies in the global marketplace, potentially eroding market share and profitability.

- Patent Filings: IMA Klessmann likely maintains a portfolio of patents covering its core technological advancements in woodworking machinery and automation.

- Software Licensing: Agreements for its proprietary software are crucial for controlling usage and preventing unauthorized distribution.

- Trade Secrets: Certain manufacturing processes and design elements may be protected as trade secrets, requiring internal security measures.

- Global Enforcement: IMA Klessmann must navigate varying IPR laws across different countries to effectively enforce its rights.

IMA Klessmann GmbH must navigate a complex web of legal requirements, including machinery safety directives like the EU Machinery Directive 2006/42/EC, which mandates CE marking for market access. Furthermore, the company must comply with environmental regulations such as RoHS and the increasingly influential Ecodesign for Sustainable Products Regulation (ESPR) as of 2024, impacting product lifecycle management. Protecting its intellectual property through patents and software licensing is also critical, especially given its R&D investments, to maintain a competitive edge against potential replication of its advanced technologies.

| Legal Area | Key Regulations/Standards | Impact on IMA Klessmann | 2024/2025 Focus |

|---|---|---|---|

| Machinery Safety | EU Machinery Directive 2006/42/EC, ISO 13849 | Ensures product safety, market access (CE marking) | Continued integration of advanced safety features into automated systems. |

| Environmental | RoHS, ESPR (EU 2024), CSRD (EU 2025) | Sustainable manufacturing, waste management, reporting | Designing for circularity, enhanced ESG disclosures under CSRD. |

| Intellectual Property | Patent Law, Software Licensing Agreements | Protects R&D investments, maintains competitive advantage | Strengthening global patent portfolio and licensing frameworks. |

| Supply Chain Due Diligence | LkSG (Germany), CSDDD (EU upcoming) | Mitigates human rights/environmental risks in supply chain | Deepening supplier audits and contractual compliance measures. |

Environmental factors

Sustainability is now a critical element in how furniture and woodworking companies operate and make choices. For IMA Klessmann, a part of the HOMAG Group, this means a strong push towards eco-friendly manufacturing. This includes efforts to lower their carbon footprint and achieve certifications such as FSC for responsible sourcing and LEED for green building standards.

This growing emphasis on sustainability directly influences IMA Klessmann's innovation, driving the creation of machinery and production processes that are not only efficient but also environmentally conscious. For instance, the global market for sustainable building materials, which often utilize wood products, is projected to reach over $300 billion by 2027, indicating a significant demand for greener solutions.

Consumers are increasingly seeking furniture made from sustainable materials like reclaimed wood, bamboo, and recycled plastics. This shift, fueled by growing environmental awareness and stricter regulations, directly influences the furniture industry. For IMA Klessmann, this means their machinery must be adaptable to process these diverse, eco-friendly inputs effectively.

The woodworking sector is placing a significant emphasis on reducing waste and adopting circular economy models. This means a strong push to cut down on material loss during manufacturing and to enhance the recycling and reuse of wood-based products. For instance, the European Union's Circular Economy Action Plan, updated in 2023, sets ambitious targets for resource efficiency across industries.

IMA Klessmann's advanced automation solutions are well-positioned to support these environmental objectives. Their cutting and material handling systems, for example, are designed for precision, which directly translates to optimized material usage and a tangible reduction in production waste. This technological capability helps companies like IMA Klessmann's clients meet stringent environmental regulations and sustainability goals.

Energy Efficiency and Eco-Design Requirements

Manufacturers like IMA Klessmann are seeing a significant push towards energy efficiency and eco-design in their machinery. New equipment is increasingly built with features such as advanced dust extraction systems and noise reduction technologies. This is driven by evolving environmental regulations and a growing emphasis on workplace safety and reduced emissions.

The drive for greener manufacturing means IMA Klessmann must innovate to develop machines that consume less energy. For instance, the adoption of more efficient drives and optimized operational cycles directly addresses this need. This focus not only helps companies meet compliance but also lowers operational costs through reduced energy usage.

- Energy Efficiency: By 2024, the EU’s Ecodesign directive continues to mandate energy performance improvements for industrial equipment, impacting machinery design and operational standards.

- Workplace Safety: Regulations like those concerning occupational noise exposure (e.g., EU Directive 2003/10/EC) necessitate the integration of noise suppression technologies in new machinery.

- Emissions Control: Stricter emissions standards for industrial processes encourage the development of machinery with integrated dust extraction and filtration systems, improving air quality.

Regulatory Pressure from Deforestation Regulations

Regulatory pressure, such as the EU's Deforestation Regulation (EUDR), is significantly impacting supply chains. This legislation mandates that companies ensure their products, including wood-based materials, are deforestation-free. Consequently, brands are increasingly demanding traceable and certified wood, pushing the entire supply chain, from sourcing to processing, to adapt.

IMA Klessmann GmbH, as a provider of wood processing solutions, must consider how these regulations influence client needs. Manufacturers are looking for processing technologies that can handle sustainably sourced wood and provide the necessary documentation for compliance. This could mean developing or adapting machinery to work with different wood types or to integrate traceability features into the production process.

- EUDR Compliance: The EUDR, effective from late 2024, requires due diligence to ensure commodities like timber are not linked to deforestation or forest degradation.

- Supply Chain Traceability: Brands are investing in technologies and processes to track wood from forest to finished product, demanding similar capabilities from their suppliers and equipment providers.

- Market Demand Shift: Consumer and regulatory pressure is driving a market shift towards certified sustainable wood, influencing investment in processing solutions that support these materials.

- Impact on Wood Processing: IMA Klessmann may need to innovate its machinery to efficiently process a wider range of certified wood species and to support clients' traceability efforts.

Environmental factors are increasingly shaping the furniture and woodworking industries, pushing companies like IMA Klessmann towards sustainable practices and eco-friendly machinery. This includes a focus on reducing carbon footprints, utilizing certified wood sources, and adapting to consumer demand for greener products, with global sustainable building materials projected to exceed $300 billion by 2027.

The push for circular economy models and waste reduction directly influences IMA Klessmann's innovation, driving the development of machinery optimized for material efficiency and recycling. Stricter regulations, such as the EU's Deforestation Regulation (EUDR), are also compelling a greater emphasis on supply chain traceability and the processing of certified, deforestation-free wood.

Energy efficiency and eco-design are becoming paramount in machinery development, with directives like the EU's Ecodesign mandate improving performance and reducing operational costs. Furthermore, regulations concerning workplace safety and emissions control necessitate advancements in dust extraction and noise suppression technologies within new equipment.

PESTLE Analysis Data Sources

Our PESTLE analysis for IMA Klessmann GmbH is built upon a robust foundation of data from official government publications, reputable economic forecasting agencies, and leading industry-specific market research reports. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in current and verifiable information.