IMA Klessmann GmbH Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IMA Klessmann GmbH Bundle

IMA Klessmann GmbH faces a dynamic competitive landscape, with moderate buyer power and significant threat from substitutes impacting their market position. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping IMA Klessmann GmbH’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

IMA Klessmann GmbH, a key player within the HOMAG Group, faces a significant challenge due to its reliance on a limited number of suppliers for highly specialized components. These critical parts, including advanced electronics and precision mechanical elements, are often produced by a concentrated group of manufacturers, granting them substantial bargaining power. For instance, in 2024, the global semiconductor shortage highlighted how a few key suppliers in the electronics sector could dictate terms and lead times, directly impacting production schedules for machinery manufacturers like IMA Klessmann.

Technology and software providers hold considerable bargaining power for IMA Klessmann GmbH, especially as automation, AI, and IoT become critical in woodworking machinery. These specialized digital solutions are essential for IMA's advanced product lines, allowing a limited number of key suppliers to dictate terms and pricing.

The ongoing digital transformation and the move towards Industry 4.0 solutions amplify the importance of these technology partners. For instance, the global market for industrial automation is projected to reach over $300 billion by 2027, highlighting the significant value and demand for such integrated systems, which IMA relies upon.

Fluctuations in the prices of common raw materials such as steel, aluminum, and various metals can impact IMA Klessmann GmbH's cost structure, even if they are not as critical as specialized components. Suppliers of these basic materials, particularly during periods of global supply chain instability or inflationary pressures, possess the ability to transfer higher costs to manufacturers like IMA.

For instance, the London Metal Exchange (LME) reported significant price increases for industrial metals in early 2024, with aluminum prices seeing a notable uptick of over 5% in the first quarter compared to the previous year. This volatility necessitates robust strategic sourcing and diligent inventory management practices to effectively mitigate associated risks for IMA.

High Switching Costs for Integrated Systems

High switching costs significantly bolster the bargaining power of suppliers for IMA Klessmann GmbH, particularly when dealing with deeply integrated systems. For instance, if IMA relies on a specific supplier for a core component or a proprietary software solution that is integral to its manufacturing processes, the effort to switch can be immense.

The transition involves substantial investment in re-designing machinery, re-tooling production lines, rigorous testing of new components or software, and comprehensive employee training. These multifaceted expenses create a formidable barrier to entry for new suppliers and a strong incentive for IMA to maintain its existing relationships, even if alternative suppliers offer slightly lower prices. This situation effectively grants incumbent suppliers leverage in price negotiations and other contract terms.

- High Switching Costs: IMA faces considerable expenses and operational disruption when changing suppliers for integrated systems.

- Re-design and Re-tooling: Significant investment is needed for adapting production lines and machinery to new supplier offerings.

- Testing and Training: Thorough validation of new components/software and retraining of staff add to the overall cost of switching.

- Supplier Leverage: These barriers empower existing suppliers, allowing them greater influence in contract negotiations and pricing.

Supplier Concentration and Unique Offerings

IMA Klessmann GmbH's reliance on suppliers offering unique or proprietary technologies significantly bolsters supplier bargaining power. For instance, suppliers of advanced CNC control systems or specialized tooling, critical for the precision and efficiency demanded in woodworking machinery, can dictate terms when alternatives are limited. This is particularly true in 2024, where supply chain disruptions have highlighted the importance of securing these specialized components.

Consider the impact of specialized components. If a supplier holds patents on key sub-systems that enhance IMA's machine performance, their ability to charge premium prices or impose less favorable contract terms increases. The woodworking machinery sector, driven by innovation, makes these specialized suppliers indispensable, potentially leading to less advantageous agreements for IMA if sourcing options are scarce.

- Supplier Dependence: IMA's need for specific, high-performance components can create a strong reliance on a few key suppliers.

- Proprietary Technology: Suppliers with patented technologies or unique manufacturing processes gain leverage due to the difficulty of finding substitutes.

- Market Value: The woodworking machinery market's emphasis on precision and efficiency elevates the importance of suppliers providing cutting-edge solutions.

- Impact on Terms: Scarcity of alternative suppliers for critical inputs can result in less favorable pricing and contract conditions for IMA.

The bargaining power of suppliers for IMA Klessmann GmbH is substantial, particularly due to the critical nature of specialized components and the high costs associated with switching suppliers. In 2024, the continued emphasis on advanced automation and Industry 4.0 solutions means that technology and software providers hold significant leverage, dictating terms for essential digital integration. This dependence is amplified by the fact that many of these specialized parts, like precision mechanical elements and advanced electronics, come from a concentrated group of manufacturers.

The reliance on suppliers with unique or proprietary technologies further strengthens their position. For example, if a supplier holds patents on key sub-systems that directly enhance IMA's machine performance, they can command premium prices and less favorable contract terms. This situation is exacerbated when alternative sourcing options for these cutting-edge solutions are scarce, giving these specialized suppliers considerable influence.

Common raw materials like steel and aluminum also present a challenge. Fluctuations in their prices, as seen with aluminum prices increasing over 5% in Q1 2024 according to the LME, allow suppliers to pass on higher costs to manufacturers like IMA, especially during periods of global supply chain instability.

| Factor | Impact on IMA Klessmann GmbH | Example/Data (2024) |

|---|---|---|

| Specialized Components | High dependence on limited suppliers for critical parts | Semiconductor shortage impacting electronics suppliers' terms |

| Technology & Software | Leverage for providers of automation, AI, IoT solutions | Global industrial automation market projected to exceed $300B by 2027 |

| Switching Costs | Significant expenses and disruption for IMA when changing suppliers | Costs include re-design, re-tooling, testing, and training |

| Proprietary Technology | Suppliers with patents or unique processes gain pricing power | Difficulty finding substitutes for advanced CNC control systems |

| Raw Material Prices | Volatility in prices of steel, aluminum, etc., affects cost structure | LME reported over 5% increase in aluminum prices in Q1 2024 |

What is included in the product

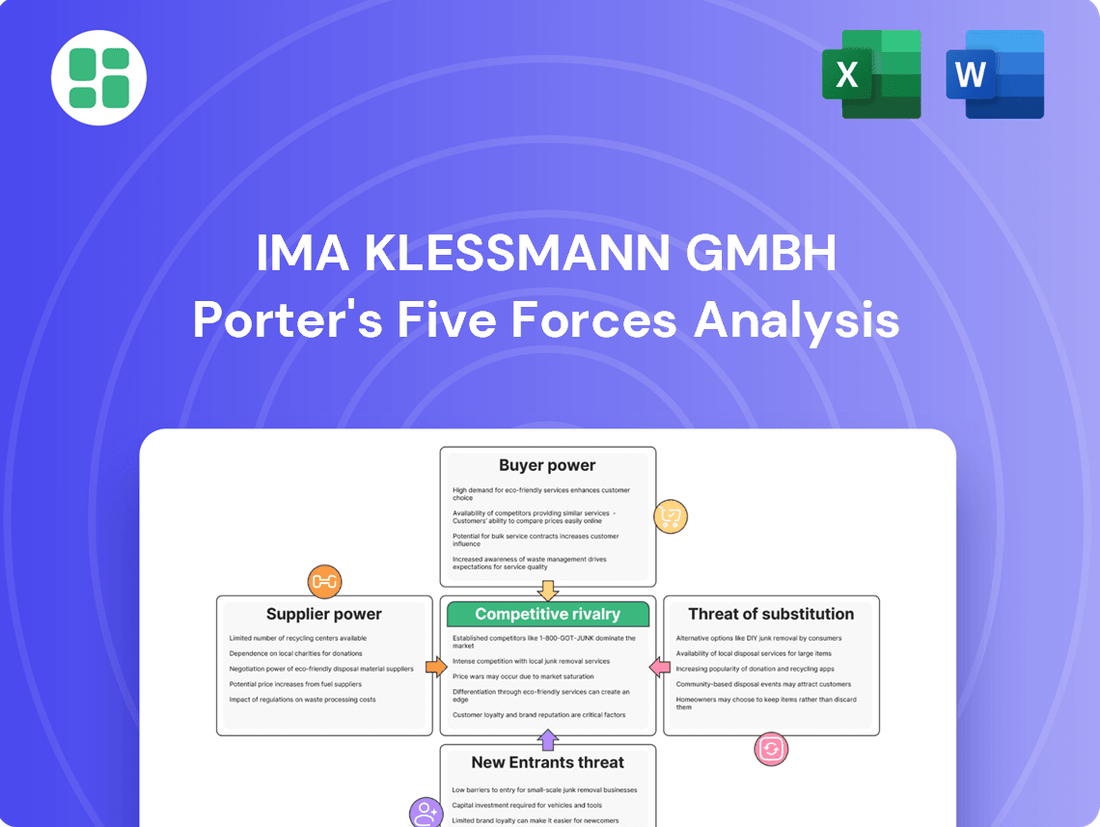

IMA Klessmann GmbH's Porter's Five Forces Analysis reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its market position.

Effortlessly identify and mitigate competitive threats by visually mapping IMA Klessmann GmbH's Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Customers investing in IMA Klessmann GmbH's machinery, from single units to complete production lines, are making substantial capital outlays. For instance, a fully automated production line could easily represent an investment of several million euros, depending on the complexity and scale. This significant financial commitment naturally leads customers to conduct extensive due diligence and expect exceptional performance, unwavering reliability, and robust long-term service from their machinery purchases.

Because customers are committing such large sums, often representing a significant portion of their own capital expenditure budget, they wield considerable bargaining power. This power is evident throughout the negotiation process, from initial quoting to final contract signing. They demand not only competitive pricing but also favorable terms, extended warranties, and guaranteed uptime, all of which influence IMA Klessmann's pricing and service strategies.

Many of IMA Klessmann GmbH's customers, especially large furniture manufacturers, have a strong bargaining power. This is because they often demand highly customized and integrated production solutions that are specifically designed for their unique operational requirements. This need for bespoke systems means they can negotiate for better terms.

This demand for personalization and complex system integration directly translates into customer leverage. They can effectively negotiate for specific features, more favorable pricing structures, and comprehensive service and support packages. For instance, a large furniture manufacturer might negotiate a 5% discount on a complex integrated line if it precisely meets their production volume and material handling needs.

IMA's capability to deliver these tailored, integrated solutions is therefore a crucial element in managing this customer bargaining power. The ability to adapt and provide exactly what a major client needs allows IMA to maintain strong relationships and secure significant orders, even when facing demanding negotiation tactics.

Customer switching costs for IMA Klessmann GmbH's production lines are substantial. Once a customer invests in and integrates IMA machinery, the expense and operational disruption involved in transitioning to a competitor's system are significant. This includes the capital outlay for new equipment, potential production downtime, the cost of retraining personnel, and overcoming compatibility challenges with existing infrastructure.

These high switching costs create a notable lock-in effect for customers after their initial purchase. This post-purchase inertia can temper the bargaining power of customers, particularly concerning aftermarket services and ongoing support, as the immediate cost of changing suppliers outweighs the perceived benefits of exploring alternatives.

Global Customer Base and Market Knowledge

IMA Klessmann GmbH caters to a wide array of manufacturers worldwide, from small operations to major industrial enterprises. This diverse customer reach means the company interacts with a broad spectrum of market participants, each with varying levels of influence.

Sophisticated and larger clients, in particular, often come armed with significant market intelligence. They are well-versed in industry trends and pricing structures, allowing them to effectively negotiate terms. For instance, in 2024, major players in the woodworking machinery sector, like those served by IMA, frequently engaged in competitive bidding processes. These customers would solicit quotes from multiple leading providers, such as Biesse and SCM Group, to secure more favorable pricing and contract conditions.

- Global Reach: IMA Klessmann GmbH's customer base spans across continents, encompassing small workshops to large industrial manufacturers.

- Informed Buyers: Larger and more experienced customers possess substantial market knowledge, enabling them to negotiate effectively.

- Competitive Bidding: Customers often leverage competitive bids from other key machinery suppliers, such as Biesse and SCM Group, to drive down prices.

- Price Sensitivity: The ability of customers to compare offers and negotiate terms puts pressure on IMA Klessmann GmbH to maintain competitive pricing and value propositions.

Demand for Efficiency and Automation

Customers are increasingly focused on efficiency and automation, driving demand for solutions that streamline production and reduce reliance on manual labor. This trend is particularly evident in the manufacturing sector, where companies are investing heavily in digitalization to gain a competitive edge. For instance, a 2024 report indicated that 65% of manufacturers plan to increase their investment in automation technologies over the next two years.

IMA's advanced technological offerings are well-positioned to meet these evolving customer needs. However, this heightened demand for efficiency translates into significant bargaining power for customers. They will scrutinize the return on investment (ROI) of IMA's solutions and expect continuous innovation to maintain their own operational advantages. The push towards smart factory concepts means customers will exert pressure on IMA to deliver not only cutting-edge technology but also cost-effective solutions that demonstrably improve productivity.

- Customer Demand for Efficiency: Increased focus on optimizing production processes and reducing labor costs.

- Digitalization and Automation Trends: Manufacturers are prioritizing smart factory solutions.

- ROI and Innovation Pressure: Customers require clear proof of value and ongoing technological advancements.

- Cost-Effectiveness Expectation: Demand for advanced technology that also offers significant cost savings.

Customers of IMA Klessmann GmbH, especially larger ones, possess considerable bargaining power due to their significant capital investments in machinery, often running into millions of euros for integrated production lines. This financial commitment necessitates rigorous scrutiny of performance, reliability, and service, allowing them to negotiate favorable pricing, extended warranties, and guaranteed uptime, directly impacting IMA's strategic decisions.

The demand for highly customized and integrated production solutions further amplifies customer leverage. Bespoke systems mean clients can negotiate specific features, flexible pricing, and comprehensive support packages, as seen when a major furniture manufacturer might secure a discount for a line precisely matching their production needs. This ability to tailor solutions is key for IMA in managing these demanding negotiations.

High switching costs following an initial investment in IMA's machinery create a customer lock-in effect, tempering their bargaining power for aftermarket services. However, informed buyers, particularly in 2024, actively leverage competitive bidding from rivals like Biesse and SCM Group to drive down prices and secure better contract conditions, reflecting a strong price sensitivity across the market.

| Customer Factor | Impact on IMA | 2024 Market Trend Example |

|---|---|---|

| High Capital Investment | Increased customer scrutiny and negotiation leverage | Multi-million euro investments in automated lines |

| Customization Demand | Customer ability to negotiate specific terms and features | Bespoke integrated solutions for unique operational needs |

| Competitive Bidding | Downward pressure on pricing and contract terms | Customers soliciting multiple quotes from Biesse, SCM Group |

| Market Intelligence | Informed customers negotiate effectively on price and value | Clients comparing offers based on industry trends and pricing |

Same Document Delivered

IMA Klessmann GmbH Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for IMA Klessmann GmbH, detailing the competitive landscape and strategic implications for the company.

The document you see here is the exact, fully formatted analysis that will be delivered to you immediately upon purchase, ensuring you receive precisely what you preview.

Gain immediate access to this in-depth analysis of IMA Klessmann GmbH's market position, including insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry.

Rivalry Among Competitors

The woodworking machinery sector is highly competitive, with major global players like HOMAG Group, Biesse Group, SCM Group, and Michael Weinig AG vying for market share. These established companies compete intensely by focusing on technological advancements, product innovation, expanding their international presence, and delivering superior customer service. Despite a growing market, this intense rivalry means that companies must constantly differentiate themselves to succeed.

The competitive landscape for IMA Klessmann GmbH is intensified by high fixed costs inherent in the industry. These costs stem from significant investments in research and development, the establishment of sophisticated manufacturing plants, and the creation of expansive global sales and service infrastructures. For instance, in 2023, the machinery and equipment sector, which IMA Klessmann operates within, saw continued investment in automation and advanced manufacturing technologies, contributing to elevated fixed cost bases for all players.

This substantial fixed cost structure creates a strong imperative for companies to achieve high capacity utilization. When market demand softens or overcapacity emerges, firms face immense pressure to keep their production lines running efficiently to spread these fixed expenses. This often translates into aggressive pricing tactics as companies vie for market share, further fueling competitive rivalry and potentially eroding profit margins across the board.

Competitive rivalry within the panel processing machinery sector, where IMA Klessmann GmbH operates, is notably tempered by a strong emphasis on product differentiation through technological innovation and superior service. This approach moves customer loyalty beyond simple price considerations, creating a stickier customer base.

IMA Klessmann, as a key entity within the HOMAG Group, leverages advanced technology in areas like panel processing and the development of integrated production lines. This technological edge, coupled with robust after-sales support, significantly reduces direct price-based competition.

Market Growth and Regional Dynamics

The global woodworking machinery market is anticipated to experience robust growth, fueled by increasing demand from the construction and furniture manufacturing sectors, with a significant contribution expected from the Asia-Pacific region. Estimates suggest the market could reach USD 18.5 billion by 2028, growing at a CAGR of 5.2% from 2023.

While this expansion presents lucrative opportunities, the competitive landscape remains fiercely contested. Emerging markets are increasingly becoming significant production hubs, intensifying regional rivalries and requiring established players to navigate evolving geographical production patterns and localized competitive pressures.

- Market Growth Projection: Global woodworking machinery market expected to reach USD 18.5 billion by 2028.

- Key Drivers: Demand from construction and furniture manufacturing sectors.

- Regional Focus: Asia-Pacific identified as a key growth region.

- Competitive Dynamics: Emerging markets are becoming new production hubs, increasing regional competition.

High Exit Barriers

High exit barriers significantly contribute to competitive rivalry within the industrial machinery and automation sector, impacting companies like IMA Klessmann GmbH. The substantial capital outlay required for specialized manufacturing equipment, often running into millions of euros, alongside the development and protection of proprietary intellectual property, makes leaving the market a costly proposition. For instance, a recent report from the German Engineering Federation (VDMA) indicated that capital expenditures for advanced manufacturing technologies in 2023 averaged over 15% of revenue for machinery manufacturers.

Furthermore, the extensive global distribution and service networks that are crucial for supporting complex industrial machinery represent another formidable exit barrier. Companies have invested heavily in establishing sales offices, spare parts depots, and skilled technical support teams worldwide. This infrastructure, built over years, is difficult and expensive to dismantle or sell off, effectively locking companies into the market. Consequently, even when facing economic downturns, these high exit costs compel firms to remain competitive rather than withdraw, intensifying the struggle for market share.

- Significant Capital Investment: Specialized manufacturing assets and R&D for industrial machinery demand substantial, often irreversible, capital commitments.

- Intellectual Property Protection: Patents and trade secrets represent valuable assets that are costly to abandon, deterring market exit.

- Global Network Costs: Establishing and maintaining worldwide distribution and service infrastructure creates high exit costs due to the difficulty in divesting these assets.

- Sustained Rivalry: The inability to easily exit the market due to these barriers ensures continuous and often fierce competition among existing players.

The competitive rivalry for IMA Klessmann GmbH is intense, driven by a market characterized by numerous global players and significant investments in innovation and service. This rivalry is further amplified by high fixed costs associated with advanced manufacturing and global infrastructure, pushing companies to maintain high production levels and often engage in price competition. However, a strong focus on technological differentiation and customer service, as exemplified by IMA Klessmann's integration within the HOMAG Group, helps to mitigate purely price-driven competition.

High exit barriers, including substantial capital investments in specialized machinery and extensive global service networks, lock companies into the market. This means firms must remain competitive even during downturns, intensifying the struggle for market share and reinforcing the existing competitive landscape. The woodworking machinery market, projected to reach USD 18.5 billion by 2028, continues to see emerging markets become production hubs, adding another layer of regional competitive pressure.

| Key Competitor | Primary Focus | 2023/2024 Market Insights |

|---|---|---|

| HOMAG Group | Integrated production solutions, digitalization | Continued investment in smart factory technologies, expansion in Asia-Pacific. |

| Biesse Group | CNC machinery, automation | Focus on high-performance solutions, strong presence in North America and Europe. |

| SCM Group | Woodworking machinery, integrated systems | Emphasis on sustainability and energy efficiency in new product lines. |

| Michael Weinig AG | Solid wood processing, automation | Strategic partnerships for enhanced service offerings and market penetration. |

SSubstitutes Threaten

The rise of alternative furniture manufacturing technologies, like advanced 3D printing and additive manufacturing, presents a growing threat. These innovations allow for highly customized and complex designs, potentially diminishing the need for traditional panel processing equipment in specific market niches.

While these new methods are not yet dominant in mass production, their ability to create intricate pieces could shift demand away from conventional woodworking machinery. For example, the global 3D printing market, including its applications in manufacturing, was projected to reach over $50 billion by 2027, indicating significant growth and potential disruption.

A significant threat comes from the growing preference for non-wood materials in furniture and construction. For instance, the global market for engineered wood products, a key area for woodworking machinery, is projected to reach $234.8 billion by 2028, but the rise of metal and plastic alternatives, especially in modern design and durable applications, could dampen this growth.

Innovations in metal furniture manufacturing, such as advanced laser cutting and robotic assembly, offer greater customization and integration of smart technology, presenting a compelling substitute to traditional wood furniture. This trend is evident in the increasing market share of metal furniture in commercial spaces and even in residential sectors, directly impacting the demand for machinery used in woodworking.

The rise of modular and prefabricated construction, particularly timber panelization, presents a significant threat of substitution for traditional on-site woodworking. This trend could reduce the demand for individual woodworking machines as the industry shifts towards factory-produced components.

While IMA Klessmann GmbH's machinery can adapt to produce prefabricated elements, a substantial market shift away from traditional workshop setups could still impact sales of its more specialized, individual woodworking machines. For instance, the global modular construction market was valued at approximately $172.5 billion in 2023 and is projected to grow significantly, indicating a substantial potential shift in demand away from traditional methods.

Labor-Intensive or Lower-Tech Alternatives for Smaller Players

For smaller workshops or businesses in developing economies, the threat of substitutes comes from less automated, more labor-intensive, or simply cheaper, lower-tech woodworking equipment. These alternatives can fulfill basic production needs without the significant capital investment required for IMA's advanced machinery. While not a direct competitor for IMA's primary industrial clients, this segment represents a market that may not transition to high-end automation, effectively capping their demand for sophisticated solutions.

The global woodworking machinery market is substantial, with projections indicating continued growth. For instance, the market size was estimated to be around USD 15 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of approximately 5% through 2030. This growth is driven by demand from construction, furniture manufacturing, and automotive sectors.

- Market Segmentation: The woodworking machinery market includes various product categories, such as cutting, drilling, sanding, and finishing machines.

- Regional Dominance: Asia-Pacific often leads in market share due to its robust manufacturing base and significant furniture production.

- Technological Trends: Automation, CNC technology, and Industry 4.0 integration are key trends influencing the adoption of advanced machinery.

- Impact on Substitutes: Lower-tech alternatives remain relevant in regions or for businesses where cost-effectiveness and simpler operation are prioritized over advanced features.

Software-Driven Optimization and Design

Advancements in software, such as AI-driven design and augmented reality for virtual furniture experiences, offer powerful alternatives to traditional manufacturing methods. These technologies optimize machine utilization and material efficiency, potentially lessening the demand for new equipment or shifting the need towards different machine types. For instance, in 2024, the global market for AI in manufacturing was projected to reach over $10 billion, highlighting the significant impact of software-driven optimization.

These software solutions can streamline production planning and enhance material usage, effectively acting as a substitute for increased physical capacity. By improving the output from existing machinery, companies might postpone or eliminate the need for capital expenditure on new equipment. This trend is particularly relevant as the manufacturing sector increasingly embraces Industry 4.0 principles, aiming for greater agility and resourcefulness.

- Software-driven optimization can reduce the need for additional machinery by improving existing equipment's utilization.

- AI in design and material optimization offers a viable alternative to physical capacity expansion.

- Augmented reality enhances customer experience, potentially influencing demand for certain machine types.

- The growing adoption of Industry 4.0 principles fuels the threat of software-based substitutes in manufacturing.

The threat of substitutes for IMA Klessmann GmbH's woodworking machinery is multifaceted, encompassing alternative materials, advanced manufacturing technologies, and software-driven optimization. Innovations in 3D printing and additive manufacturing offer highly customized designs, potentially reducing reliance on traditional panel processing. Similarly, the increasing use of metal and plastic in furniture and construction directly impacts the demand for woodworking equipment.

The growing adoption of modular and prefabricated construction methods, particularly timber panelization, signals a shift towards factory-produced components, potentially decreasing the need for individual woodworking machines. Furthermore, advancements in AI and augmented reality for design and virtual experiences can optimize machine utilization and material efficiency, acting as substitutes for new equipment purchases.

| Substitute Category | Example | Potential Impact on IMA Klessmann GmbH | Relevant Market Data (2023/2024 Projections) |

|---|---|---|---|

| Alternative Materials | Metal, Plastic, Composites | Reduced demand for wood processing machinery; shift in machinery requirements | Global metal furniture market growth |

| Advanced Manufacturing | 3D Printing, Additive Manufacturing | Niche market disruption; demand for highly specialized machinery | Global 3D printing market projected to exceed $50 billion by 2027 |

| Construction Methods | Modular, Prefabricated Timber | Reduced demand for on-site woodworking machines; increased demand for panelization equipment | Global modular construction market valued at ~$172.5 billion in 2023 |

| Software & AI | AI-driven design, AR experiences | Optimized machine utilization; potential postponement of new equipment investment | Global AI in manufacturing market projected over $10 billion in 2024 |

Entrants Threaten

Entering the industrial woodworking machinery market, like the one IMA Klessmann GmbH operates in, demands significant upfront capital. This includes substantial investment in research and development to create innovative and efficient machinery, as well as establishing state-of-the-art manufacturing facilities capable of producing high-quality, complex equipment.

Furthermore, building a robust global sales and service network is crucial for supporting customers worldwide, adding another layer of financial commitment. These high capital requirements act as a considerable deterrent, effectively limiting the number of potential new entrants who can realistically compete.

IMA Klessmann, a key player within the HOMAG Group, benefits from a substantial foundation of advanced technological expertise and a robust portfolio of intellectual property. This includes deep-seated know-how in automation, digitalization, and precision engineering, areas critical for success in the modern manufacturing landscape. For instance, HOMAG's commitment to innovation is reflected in its significant R&D investments, with the group consistently allocating a notable percentage of its revenue towards developing cutting-edge solutions. In 2023, HOMAG reported a revenue of €1.5 billion, underscoring the scale of its operations and its capacity for technological advancement.

Developing comparable levels of advanced technology and intellectual property presents a considerable hurdle for potential new entrants. The sheer investment required in research and development, coupled with the time needed to acquire or develop specialized skills and patents, creates a formidable barrier to entry. This technological moat, built over years of dedicated innovation and strategic patent acquisition, makes it exceptionally difficult for newcomers to compete on a level playing field with established leaders like IMA Klessmann.

Established brand reputation and customer relationships represent a significant barrier for new entrants. Competitors like HOMAG Group have cultivated decades-long trust and loyalty with global manufacturers, a testament to their proven reliability and extensive after-sales support. For instance, HOMAG's reported revenue of over €1.5 billion in 2023 underscores their market presence and the depth of their customer engagement.

Economies of Scale and Experience Curve

IMA Klessmann GmbH benefits significantly from established economies of scale in production and procurement. For instance, in 2024, large-scale manufacturers in the industrial machinery sector often achieve 10-20% lower per-unit costs compared to smaller operations due to bulk purchasing power and optimized production lines.

The experience curve also presents a formidable barrier. As IMA Klessmann has refined its processes over years of operation, it has likely reduced its production costs by a similar margin, perhaps 5-15% for each doubling of cumulative output. This continuous improvement loop makes it exceptionally difficult for new entrants to compete on cost from the outset.

- Economies of Scale: IMA Klessmann leverages bulk purchasing of raw materials and components, leading to lower input costs.

- Production Efficiency: Large-scale manufacturing allows for specialized machinery and optimized workflows, reducing per-unit production expenses.

- Distribution Advantages: Established global distribution networks offer cost savings and wider market reach compared to new entrants.

- Experience Curve Benefits: Years of operational experience translate into process improvements and cost reductions that are hard for newcomers to replicate quickly.

Complex Global Distribution and Service Networks

Building and maintaining extensive global distribution and service networks for industrial machinery is a monumental and expensive challenge. IMA Klessmann GmbH's established infrastructure in this area presents a substantial hurdle for potential newcomers. Customers in this sector prioritize dependable support and immediate access to spare parts across various international locations, a requirement that new entrants would find difficult and costly to replicate quickly.

The capital investment needed to establish a worldwide sales, logistics, and after-sales service framework is immense. For instance, a new competitor would need to invest significantly in warehousing, transportation, and training specialized service technicians in numerous countries. IMA's existing network, which likely includes numerous service centers and spare parts depots, provides a competitive advantage by ensuring rapid response times and minimizing customer downtime, a critical factor in industrial operations.

- High Capital Expenditure: Establishing global distribution and service requires substantial upfront investment in infrastructure, logistics, and personnel.

- Customer Service Expectations: Industrial clients demand reliable support and readily available spare parts, creating a high service standard that new entrants must meet.

- Geographical Reach: The complexity of managing operations across diverse international markets acts as a significant barrier to entry.

The threat of new entrants for IMA Klessmann GmbH is relatively low due to several significant barriers. High capital requirements, estimated to be in the tens to hundreds of millions of euros for establishing manufacturing and global distribution, deter many potential competitors. Furthermore, the need for advanced technological expertise, including specialized software and engineering capabilities, requires substantial investment in R&D and skilled personnel, a hurdle that few can overcome quickly.

IMA Klessmann benefits from established economies of scale, with large-scale manufacturers in 2024 often achieving 10-20% lower per-unit costs. The experience curve also plays a role, with cost reductions of 5-15% for each doubling of cumulative output being common. Building a global distribution and service network is also a considerable challenge, demanding immense investment in infrastructure and personnel to meet customer expectations for reliable support and readily available spare parts across diverse international markets.

| Barrier | Estimated Cost/Challenge | Impact on New Entrants |

| Capital Requirements | Tens to hundreds of millions of euros for manufacturing and distribution | Significant deterrent due to high upfront investment |

| Technological Expertise | Substantial R&D investment, specialized software, skilled personnel | Difficult to replicate advanced capabilities quickly |

| Economies of Scale | 10-20% lower per-unit costs for large-scale operations (2024 estimate) | New entrants face higher initial production costs |

| Experience Curve | 5-15% cost reduction per doubling of cumulative output | Established players have a cost advantage from learned efficiencies |

| Distribution & Service Network | Immense investment in global infrastructure, logistics, and personnel | Challenging to match established reach and customer support standards |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for IMA Klessmann GmbH is built upon a foundation of robust data, including the company's official annual reports, industry-specific market research from reputable firms, and publicly available financial disclosures.