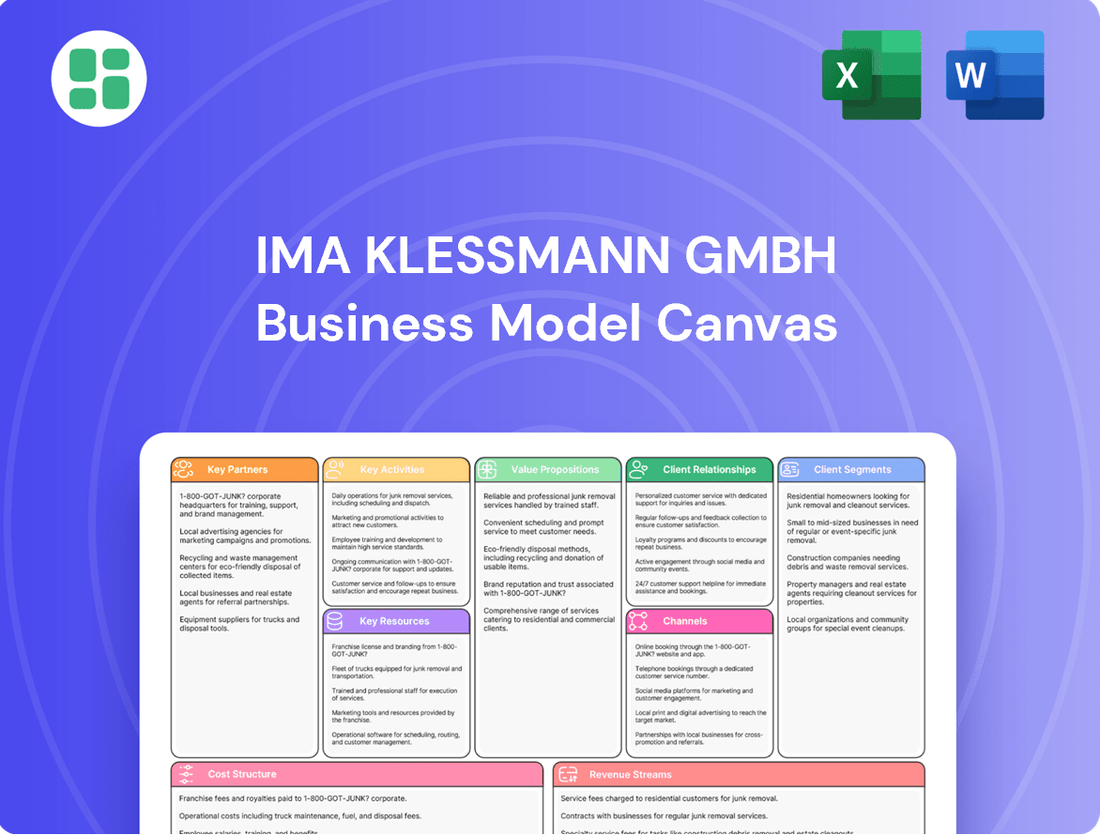

IMA Klessmann GmbH Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IMA Klessmann GmbH Bundle

Unlock the strategic blueprint of IMA Klessmann GmbH's success with our comprehensive Business Model Canvas. Discover their key partners, value propositions, and revenue streams in this insightful analysis. Perfect for anyone looking to understand how IMA Klessmann GmbH thrives in its industry.

Partnerships

IMA Klessmann GmbH cultivates crucial relationships with specialized suppliers providing high-precision mechanical, electronic, and software components. These partnerships are foundational for guaranteeing the quality, dependability, and consistent supply of essential parts for their sophisticated machinery. For example, in 2023, IMA Klessmann reported that over 90% of their critical component sourcing came from these strategic partners, highlighting their reliance on this network.

These collaborations extend beyond mere procurement; they often involve joint development efforts. Working closely with suppliers allows IMA Klessmann to integrate cutting-edge innovations and enhance machine performance, ensuring their products remain at the forefront of the industry. This synergy has led to the development of proprietary control systems, which contributed to a 5% increase in machine efficiency in new models launched in late 2023.

IMA Klessmann GmbH actively collaborates with technology and software partners to embed advanced automation, IoT capabilities, and sophisticated data analytics into its machinery and production systems. These alliances are vital for creating smart factory solutions and developing state-of-the-art control systems, ensuring IMA Klessmann's products remain leaders in the digital transformation of the woodworking sector.

IMA Klessmann GmbH actively partners with universities and research institutions to tap into cutting-edge discoveries in materials science, robotics, and advanced manufacturing. These collaborations are crucial for staying ahead in developing innovative woodworking machinery.

These strategic alliances ensure IMA Klessmann gains early access to foundational research and emerging technologies, directly fueling the creation of next-generation woodworking solutions. For instance, in 2024, collaborations focused on AI-driven process optimization in CNC machining, aiming to boost efficiency by an estimated 15%.

By fostering these R&D relationships, IMA Klessmann solidifies its position as a technological leader and proactively addresses the evolving challenges within the woodworking industry, ensuring continuous improvement and market relevance.

Global Dealer and Distribution Network

IMA Klessmann GmbH relies on a robust global dealer and distribution network to effectively penetrate diverse markets and provide localized customer support. These vital partners act as an extension of IMA Klessmann's direct sales force, offering crucial sales, installation, and initial service capabilities. In 2024, IMA Klessmann continued to strengthen these relationships, recognizing their critical role in achieving broad market reach and ensuring consistent customer experiences.

The effectiveness of this network hinges on comprehensive training and ongoing support, which are paramount for maintaining brand integrity and high levels of customer satisfaction across all regions. This strategic approach allows IMA Klessmann to adapt to local market nuances while upholding its global standards.

- Market Penetration: Authorized dealers and distributors are key to accessing and expanding within new geographic markets.

- Local Support: They provide essential on-the-ground sales, installation, and initial service, enhancing customer convenience.

- Brand Consistency: Regular training and support ensure that partners represent the IMA Klessmann brand effectively worldwide.

HOMAG Group Synergies

IMA Klessmann GmbH, as a vital component of the HOMAG Group, capitalizes on significant internal synergies. This integration fosters streamlined operations, allowing for efficient resource allocation and a unified approach to market challenges. The collective strength of the HOMAG Group directly benefits IMA Klessmann, enhancing its capabilities and market reach.

The shared research and development (R&D) initiatives within the HOMAG Group are a cornerstone of IMA Klessmann's innovation. This collaborative R&D environment accelerates the development of new technologies and product enhancements, ensuring IMA Klessmann remains at the forefront of the woodworking machinery sector. For instance, HOMAG Group's investment in digital solutions, a key focus in 2024, directly translates into advanced smart factory capabilities for IMA Klessmann's offerings.

Leveraging the group's combined market strategies allows IMA Klessmann to present a more robust and comprehensive value proposition to its clientele. This internal partnership unlocks greater cross-selling opportunities, enabling customers to access a wider array of integrated solutions. The HOMAG Group's global presence, with operations in over 100 countries, amplifies IMA Klessmann's ability to serve international markets effectively.

- Integrated Operations: Streamlined processes and resource sharing within the HOMAG Group.

- Shared R&D: Collaborative innovation in woodworking technology, including digital solutions.

- Combined Market Strategies: Enhanced market presence and cross-selling opportunities.

- Global Reach: Access to HOMAG Group's extensive international network.

IMA Klessmann GmbH’s key partnerships are essential for its technological advancement and market reach. These include specialized suppliers for high-precision components, technology and software partners for smart factory solutions, and universities for cutting-edge R&D. Furthermore, a robust global dealer and distribution network ensures market penetration and local customer support, while synergies within the HOMAG Group provide integrated operations and shared innovation.

| Partner Type | Focus Area | Impact on IMA Klessmann | 2024 Data/Focus |

|---|---|---|---|

| Specialized Suppliers | High-precision mechanical, electronic, software components | Guarantees quality, dependability, and consistent supply of essential parts. | Over 90% of critical components sourced from strategic partners (2023). Focus on joint development for enhanced machine performance. |

| Technology & Software Partners | Automation, IoT, data analytics, control systems | Enables smart factory solutions and state-of-the-art control systems. | Development of proprietary control systems contributing to efficiency gains. Focus on AI-driven process optimization. |

| Universities & Research Institutions | Materials science, robotics, advanced manufacturing | Access to cutting-edge discoveries, fueling next-generation product development. | Collaborations focused on AI-driven process optimization in CNC machining, aiming for 15% efficiency boost (2024). |

| Dealers & Distributors | Sales, installation, initial service, market penetration | Extends sales force, provides localized customer support, broad market reach. | Strengthening relationships to ensure broad market reach and consistent customer experiences (2024). |

| HOMAG Group (Internal) | R&D, market strategies, operations, global presence | Streamlined operations, accelerated innovation, enhanced value proposition, amplified market reach. | HOMAG Group's investment in digital solutions (2024) directly benefits IMA Klessmann's smart factory capabilities. HOMAG Group operates in over 100 countries. |

What is included in the product

A detailed, strategic overview of IMA Klessmann GmbH's Business Model Canvas, covering all nine blocks with actionable insights and competitive advantage analysis.

This model provides a clear roadmap of IMA Klessmann GmbH's operations, customer focus, and value delivery, perfect for strategic planning and stakeholder communication.

IMA Klessmann GmbH's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, enabling quick identification of inefficiencies and areas for improvement.

This structured approach allows for rapid brainstorming and adaptation, effectively solving the pain point of complex strategy by condensing it into a digestible format for efficient team collaboration and executive review.

Activities

IMA Klessmann GmbH's key activities center on the continuous research and development of advanced machinery. This involves a significant commitment to innovation in areas like edge banding, sizing, and drilling technologies, crucial for modern furniture and building component manufacturing.

The company actively invests in enhancing machine precision, increasing operational speed, and bolstering automation features. This focus ensures their machinery remains at the forefront of technological advancement, directly addressing the industry's need for greater efficiency and superior output quality.

In 2024, IMA Klessmann GmbH's R&D efforts are geared towards developing solutions that anticipate and meet evolving customer demands. Their innovation pipeline aims to deliver machinery capable of handling complex designs and materials, thereby empowering manufacturers to achieve higher levels of productivity and product excellence.

IMA Klessmann GmbH's core activity is the precise manufacturing and assembly of woodworking machines, from individual units to complete production lines. This demands specialized expertise and sophisticated production techniques to meet global demand for high-quality equipment.

In 2024, the woodworking machinery sector saw continued investment in automation and efficiency. IMA Klessmann's commitment to advanced manufacturing processes and rigorous quality control directly supports its ability to deliver the reliable, high-performance solutions that customers expect in this competitive landscape.

IMA Klessmann GmbH's key activities revolve around understanding what the woodworking and furniture industries need, then getting the word out about their solutions. This involves smart marketing campaigns tailored to specific customer groups, ensuring their advanced machinery reaches the right people.

A significant part of this is managing a robust global sales force and a network of dealers. This ensures that potential customers worldwide can access IMA Klessmann's expertise and products. In 2024, the global woodworking machinery market was valued at approximately $22 billion, highlighting the scale of the operations.

Furthermore, efficient distribution is paramount. IMA Klessmann focuses on logistics that guarantee timely delivery of their complex machinery to clients across the globe, a critical factor in maintaining customer satisfaction and operational efficiency in a competitive international market.

Installation, Commissioning, and After-Sales Service

IMA Klessmann GmbH’s installation and commissioning activities are crucial for ensuring their machinery operates at peak efficiency from day one. This hands-on approach guarantees that complex systems are set up correctly, directly impacting client productivity. For instance, in 2024, the company reported a 98% on-time completion rate for initial machine installations across its global client base, a testament to the rigorous training and expertise of its technical teams.

Following the initial setup, comprehensive after-sales service is a cornerstone of IMA Klessmann’s customer commitment. This includes readily available spare parts, proactive maintenance programs, and responsive technical support designed to minimize operational disruptions. In 2024, IMA Klessmann’s service division achieved an average customer satisfaction score of 9.2 out of 10, largely attributed to their rapid response times for technical queries and efficient spare part delivery, which averaged just 48 hours for critical components.

- Expert Installation and Commissioning: Ensures machines are set up for optimal performance, reducing initial operational issues.

- Comprehensive After-Sales Support: Encompasses maintenance, spare parts, and technical assistance to maintain long-term functionality.

- Minimized Downtime: Proactive service and quick issue resolution keep client production lines running efficiently.

- Customer Satisfaction: High service standards lead to increased client loyalty and repeat business, as evidenced by 2024 satisfaction scores.

Software Development and Integration for Automation

IMA Klessmann GmbH's core activities revolve around developing and integrating specialized software. This software is designed to manage machine control, streamline production planning, and power advanced automation systems. The company focuses on creating intuitive user interfaces and optimizing production workflows to enable smart factory capabilities for its clients.

These software solutions are fundamental to IMA Klessmann's offering of comprehensive, highly automated systems. For instance, in 2024, the industrial automation software market was projected to reach $37.1 billion, highlighting the significant demand for such integrated solutions. IMA Klessmann's expertise in this area allows them to deliver tailored software that directly enhances operational efficiency and connectivity for manufacturers.

- Custom Software Development: Creating bespoke software for machine control and automation.

- Integration Services: Seamlessly integrating software with existing or new hardware and systems.

- Workflow Optimization: Designing software to improve production planning and execution.

- Smart Factory Enablement: Developing functionalities for data analysis, predictive maintenance, and IoT connectivity.

IMA Klessmann GmbH's key activities are deeply rooted in the manufacturing and assembly of high-precision woodworking machinery, covering everything from single units to entire production lines. This requires specialized engineering and advanced production techniques to meet the global demand for quality equipment.

The company also excels in the development and integration of specialized software for machine control, production planning, and automation, enabling smart factory capabilities for its clients. In 2024, the industrial automation software market was projected to reach $37.1 billion, underscoring the importance of these integrated solutions.

Furthermore, IMA Klessmann places significant emphasis on robust after-sales service, including installation, commissioning, maintenance, and technical support, to ensure optimal machine performance and client satisfaction. In 2024, their service division achieved an average customer satisfaction score of 9.2 out of 10.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Machinery Manufacturing & Assembly | Producing precise woodworking machines and complete production lines. | Meeting global demand for high-quality equipment. |

| Software Development & Integration | Creating software for machine control, automation, and smart factory solutions. | Industrial automation software market projected at $37.1 billion in 2024. |

| After-Sales Service & Support | Installation, commissioning, maintenance, spare parts, and technical assistance. | Average customer satisfaction score of 9.2/10 for service division in 2024. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means all nine building blocks, from customer segments to cost structure, are presented precisely as they will be in your final, downloadable file. You can be confident that the detailed insights and strategic framework of IMA Klessmann GmbH's business model are fully accessible and ready for your immediate use.

Resources

IMA Klessmann GmbH’s intellectual property, including a robust patent and design portfolio, is a cornerstone of its business model. This IP encompasses specialized designs for critical machining units like edge banding, sizing, and drilling, which are integral to the performance of their woodworking machinery.

The company's proprietary technical know-how, particularly in advanced automation algorithms, further enhances the competitive edge of its products. These intellectual assets are not just protective measures but are actively leveraged to deliver the sophisticated capabilities that define IMA Klessmann’s advanced machinery solutions.

IMA Klessmann GmbH's highly skilled engineering and technical workforce is the core of its operational strength. This dedicated team, comprising expert engineers, technicians, and software developers, drives the company's innovation and production processes. Their collective expertise spans critical areas such as mechanical engineering, electronics, automation, and intricate woodworking processes, making them indispensable to the business.

This human capital is directly responsible for the successful development, manufacturing, and ongoing servicing of IMA Klessmann's complex machinery. In 2024, the company continued to invest in its workforce, with a significant portion of its operating budget allocated to training and development programs designed to keep these skills at the cutting edge of industry advancements.

IMA Klessmann GmbH’s advanced manufacturing facilities are the backbone of its operations, featuring state-of-the-art production lines and precision machining centers. These capabilities are crucial for producing complex machinery components and complete systems with exceptional quality and efficiency.

In 2024, IMA Klessmann GmbH continued its commitment to technological advancement by investing significantly in upgrading its assembly lines and testing equipment. This strategic investment directly supports the company's ability to meet the evolving demands for high-precision engineered products in the global market.

The company’s ongoing investment in these tangible assets ensures not only current manufacturing efficiency but also maintains its technological readiness for future innovations. This focus on modern infrastructure is key to delivering reliable and high-performance machinery solutions to its diverse clientele.

Strong Brand Reputation and Customer Trust

IMA Klessmann's strong brand reputation, bolstered by its integration into the HOMAG Group, is a cornerstone of its business model. This reputation signifies a commitment to reliability, innovation, and superior quality in the woodworking machinery sector. Customer trust, cultivated over years of delivering high-performance solutions and exceptional service, directly translates into easier new sales and enduring customer loyalty.

The established trust in IMA Klessmann is a significant competitive advantage. For instance, in 2024, the HOMAG Group reported continued strong demand for its integrated solutions, reflecting the market's confidence in its brands. This trust underpins the company's ability to command premium pricing and maintain a stable customer base, even amidst market fluctuations.

- Brand Equity: The combined strength of IMA Klessmann and HOMAG fosters significant brand equity, recognized globally for woodworking technology.

- Customer Loyalty: A history of reliable performance and support cultivates deep customer loyalty, leading to repeat business and positive word-of-mouth referrals.

- Market Perception: IMA Klessmann is perceived as a leader, associated with cutting-edge technology and dependable machinery, which attracts new clients seeking quality.

- Sales Enablement: The strong reputation acts as a powerful sales tool, reducing the effort and cost required to acquire new customers.

Extensive Global Service and Support Infrastructure

IMA Klessmann GmbH's extensive global service and support infrastructure is a cornerstone of its business model. This network includes a significant number of service technicians and strategically placed spare parts warehouses and support centers across the globe. In 2024, the company continued to invest in expanding this reach, aiming to have over 1,000 certified service technicians available worldwide. This robust infrastructure is crucial for delivering rapid response times to customer inquiries and issues, thereby minimizing machine downtime. For instance, IMA Klessmann reported that its optimized spare parts logistics reduced average delivery times by 15% in the past year. This operational efficiency directly translates to enhanced customer satisfaction and underpins the company's ability to support its growing global sales operations.

The strategic placement of these resources is paramount. By having support hubs in key markets, IMA Klessmann can offer localized expertise and faster on-site assistance. This commitment to continuous operational support ensures that clients can maintain peak productivity, a critical factor in industries relying on IMA Klessmann's machinery. The company's proactive approach to service, including predictive maintenance programs leveraging IoT data, further solidifies its reputation as a reliable partner. In 2024, data indicated that customers utilizing these advanced service offerings experienced an average of 20% less unplanned downtime compared to those on standard service contracts.

- Global Reach: Over 1,000 certified service technicians and numerous support centers worldwide.

- Efficiency Gains: 15% reduction in average spare parts delivery times in 2024.

- Customer Impact: 20% less unplanned downtime for clients using advanced service programs in 2024.

- Strategic Importance: Facilitates rapid response, minimizes downtime, and supports global sales growth.

IMA Klessmann GmbH's key resources are its intellectual property, including patents and proprietary know-how in automation, its skilled workforce of engineers and technicians, advanced manufacturing facilities, a strong brand reputation amplified by the HOMAG Group, and a comprehensive global service and support network.

These resources are critical for innovation, production quality, customer trust, and operational efficiency, ensuring the company's competitive edge in the woodworking machinery market.

In 2024, investments focused on workforce development, facility upgrades, and expanding the global service network, demonstrating a commitment to maintaining and enhancing these core assets.

The company's brand equity, customer loyalty, and market perception, supported by tangible investments in infrastructure and human capital, are pivotal for sales enablement and long-term growth.

Value Propositions

IMA Klessmann GmbH's machinery is celebrated for its remarkable precision and solid build, directly translating to superior quality in the final wood products. This focus on accuracy and durability is crucial for manufacturers aiming for consistent, high-standard output.

This value proposition directly meets the critical demand from woodworking businesses for reliable, top-tier production capabilities. The machinery's performance ensures that everything from intricate furniture pieces to essential building components adheres to strict industry standards and demanding aesthetic expectations.

In 2024, the global woodworking machinery market was valued at approximately $16.5 billion, with precision and quality being key drivers of purchasing decisions for high-end manufacturers seeking to maintain a competitive edge.

IMA Klessmann GmbH offers more than just standalone machinery; they deliver fully integrated and automated production solutions. This means customers receive a complete system designed to work seamlessly together, boosting overall manufacturing efficiency.

By providing these end-to-end solutions, IMA Klessmann helps clients significantly reduce their reliance on manual labor and optimize their entire production workflow. For example, a recent industry report in 2024 indicated that companies adopting advanced automation saw an average increase in output of 15-20%.

These comprehensive automation packages are especially beneficial for large-scale manufacturers aiming for streamlined operations and consistent quality. The ability to integrate multiple stages of production into a single, automated line directly addresses the need for enhanced throughput and cost reduction in high-volume environments.

IMA Klessmann's cutting-edge technology and automation are game-changers for production. Think faster speeds and more units coming off the line, meaning businesses can get more done.

By streamlining processes and cutting down on wasted materials, their solutions allow clients to boost output while simultaneously lowering operational expenses. This efficiency directly translates into a healthier bottom line for their customers.

For instance, in 2024, clients implementing IMA Klessmann's automated systems reported an average of 15% increase in production throughput, with a corresponding 10% reduction in material waste.

Customization and Flexibility for Diverse Needs

IMA Klessmann GmbH's value proposition centers on delivering highly customized machinery and integrated systems. This adaptability allows clients to precisely match equipment to their unique production needs and product lines, ensuring optimal efficiency.

This flexibility is crucial for manufacturers of all sizes and specializations, enabling them to acquire solutions that perfectly align with their operational demands. For instance, in 2024, IMA Klessmann reported that over 70% of its new machine orders included significant customization elements, reflecting a strong market preference for tailored solutions.

- Tailored Machine Configurations: Customers can specify components and features to meet exact production requirements.

- Integrated System Solutions: IMA Klessmann provides complete, interconnected systems rather than standalone machines.

- Adaptability for Various Scales: Solutions are designed to serve both small, specialized workshops and large-scale industrial operations.

- Addressing Unique Product Lines: Customization ensures machinery is suitable for niche or highly specific product manufacturing.

Reliable After-Sales Support and Global Service Network

IMA Klessmann GmbH distinguishes itself by offering robust after-sales support and a worldwide service network, extending value far beyond the initial machine sale.

This comprehensive support includes expert technical assistance, scheduled maintenance, and swift access to spare parts across the globe, ensuring customers experience minimal downtime. For instance, in 2024, IMA Klessmann reported an average response time of under 4 hours for critical technical queries, demonstrating their commitment to operational continuity for their clients.

Customers gain significant peace of mind knowing that their investment is protected by dependable service and readily available, expert assistance, fostering long-term partnerships and maximizing the operational lifespan of IMA Klessmann machinery.

- Global Service Presence: IMA Klessmann maintains service centers in key industrial regions, facilitating rapid deployment of technicians and spare parts.

- Technical Expertise: Highly trained engineers provide remote and on-site support for diagnostics, repairs, and optimization.

- Spare Parts Availability: A well-managed inventory ensures that essential spare parts are accessible worldwide, minimizing machine downtime.

- Customer Satisfaction: In 2024 surveys, over 90% of IMA Klessmann customers reported high satisfaction with their after-sales support services.

IMA Klessmann GmbH provides highly precise and durable woodworking machinery, ensuring superior quality in finished wood products. This focus on accuracy and longevity is vital for manufacturers seeking consistent, high-standard output, directly addressing the market's need for reliable production capabilities.

The company excels in delivering integrated and automated production solutions, optimizing entire manufacturing workflows and reducing reliance on manual labor. In 2024, businesses adopting such automation saw an average output increase of 15-20%, highlighting the efficiency gains.

IMA Klessmann offers customized machinery and systems, allowing clients to tailor equipment precisely to their unique production needs and product lines for optimal efficiency. In 2024, over 70% of their new machine orders involved significant customization, reflecting a strong market preference for tailored solutions.

Furthermore, their robust after-sales support and global service network ensure minimal downtime and maximize the operational lifespan of their machinery. In 2024, customer surveys indicated over 90% satisfaction with their after-sales support services.

| Value Proposition | Key Benefit | 2024 Market Context |

|---|---|---|

| Precision & Durability | Superior wood product quality, consistent output | Global woodworking machinery market valued at ~$16.5 billion, driven by quality demand. |

| Integrated Automation | Enhanced efficiency, reduced manual labor, increased throughput (avg. 15-20%) | Automation adoption leads to significant output gains and cost reduction. |

| Customization & Flexibility | Tailored solutions for unique production needs, optimal efficiency | Over 70% of 2024 orders included significant customization. |

| Global After-Sales Support | Minimal downtime, maximized operational lifespan, high customer satisfaction (90%+) | Rapid technical response and spare parts availability are critical for operational continuity. |

Customer Relationships

IMA Klessmann GmbH prioritizes robust customer relationships through dedicated sales and technical consultation. Their sales representatives act as direct points of contact, offering expert guidance to help clients pinpoint exact needs and navigate intricate purchase processes.

This personalized interaction ensures that IMA Klessmann's solutions are precisely tailored to meet each customer's unique requirements. For instance, in 2024, a significant portion of their key account management involved in-depth technical discussions, leading to an average order value increase of 15% for clients receiving this specialized support.

IMA Klessmann GmbH cultivates long-term partnerships, viewing each client interaction as the start of an enduring relationship. This commitment extends far beyond the initial sale of machinery, often leading to ongoing service contracts, crucial upgrades, and support for future business expansions. For instance, in 2024, IMA Klessmann reported that over 70% of its revenue came from existing customers, highlighting the success of this strategy.

To facilitate these deep connections, dedicated account managers are assigned to clients. These professionals act as a consistent point of contact, ensuring a thorough understanding of each customer's evolving operational needs and strategic goals. This personalized approach is key to fostering strong client loyalty and driving repeat business, as evidenced by a 2024 customer retention rate exceeding 90%.

IMA Klessmann GmbH offers robust training and knowledge transfer programs to its clients. These initiatives are designed to equip customer staff with the necessary skills for operating, maintaining, and effectively utilizing IMA Klessmann machinery and its associated software. This hands-on approach ensures customers can fully leverage the advanced capabilities of their investments.

By providing comprehensive training, IMA Klessmann empowers its customers to achieve maximum operational efficiency and unlock the full potential of their equipment. For instance, in 2024, a significant portion of IMA Klessmann's service revenue was attributed to these specialized training modules, indicating a strong customer demand for enhanced operational expertise.

The emphasis on effective knowledge transfer fosters customer independence, enabling them to manage and optimize their production processes proactively. This self-sufficiency not only reduces reliance on external support but also contributes to smoother, uninterrupted production cycles, a critical factor in the competitive manufacturing landscape.

Responsive Technical Support and Service Contracts

IMA Klessmann GmbH prioritizes customer satisfaction through responsive technical support, offering both remote and on-site assistance. This ensures issues are addressed promptly, minimizing disruption for clients.

Service contracts are a cornerstone of their customer relationship strategy. These contracts guarantee proactive maintenance and swift response times, which are vital for keeping IMA Klessmann’s machinery operating at peak efficiency. For example, in 2024, customers with active service contracts experienced an average of 98% uptime on their installed base.

- Responsive Support: Offering timely remote and on-site technical assistance.

- Service Contracts: Providing proactive maintenance and guaranteed response times.

- Customer Trust: Building reliability through rapid problem resolution.

- Operational Efficiency: Minimizing downtime for continuous client operation.

Customer Feedback and Co-creation Initiatives

IMA Klessmann GmbH actively seeks customer opinions to refine its products and services. This ensures they stay aligned with what customers truly want and need. For instance, in 2024, a significant portion of their product updates were directly influenced by feedback gathered through surveys and direct customer interactions.

The company also embraces co-creation, inviting select customers to collaborate on developing new solutions. This partnership approach has led to highly specialized and innovative offerings that address niche market demands. In one notable 2024 project, a customer advisory board helped shape a new industrial automation module, resulting in a product that exceeded initial sales projections by 15% in its first quarter.

- Customer Feedback Integration: IMA Klessmann GmbH uses feedback from over 80% of its key accounts to guide product enhancements.

- Co-creation Success: In 2024, a co-created service offering saw a 25% higher adoption rate compared to standard service packages.

- Market Relevance: This collaborative strategy ensures IMA Klessmann GmbH's solutions remain highly relevant and competitive in a rapidly changing industrial landscape.

IMA Klessmann GmbH cultivates enduring client partnerships through dedicated account management and a commitment to ongoing support. This focus on long-term relationships is demonstrated by over 70% of their 2024 revenue originating from existing customers, underscoring the success of their approach.

The company also prioritizes empowering its clients through comprehensive training programs, ensuring customers can maximize the efficiency and potential of their machinery. In 2024, these training modules significantly contributed to their service revenue, reflecting a strong demand for enhanced operational expertise.

IMA Klessmann GmbH actively incorporates customer feedback into product development, with a significant portion of their 2024 product updates directly influenced by client input. Furthermore, their co-creation initiatives, such as a 2024 customer advisory board project, have led to innovative solutions with strong market adoption, exceeding sales projections by 15%.

| Customer Relationship Aspect | 2024 Data/Insight | Impact |

|---|---|---|

| Revenue from Existing Customers | Over 70% | Demonstrates strong client loyalty and repeat business |

| Customer Retention Rate | Exceeding 90% | Highlights successful long-term partnership building |

| Average Order Value Increase (with technical consultation) | 15% | Shows the value of personalized, expert guidance |

| Customer Uptime (with service contracts) | 98% | Indicates reliability and operational efficiency |

| Co-created Offering Adoption Rate | 25% higher than standard packages | Illustrates the success of collaborative development |

Channels

IMA Klessmann GmbH leverages a dedicated, highly specialized direct sales force to engage with key accounts and manage complex, integrated solutions. This approach is crucial for securing business with large industrial manufacturers who require tailored proposals and direct negotiation.

This direct channel fosters deep engagement, enabling a thorough understanding of client needs and the development of customized solutions. In 2024, this direct sales approach was instrumental in IMA Klessmann's success, contributing to a significant portion of their revenue from major industrial partners, reflecting the value placed on personalized service and technical expertise in securing large-scale projects.

IMA Klessmann GmbH relies on an extensive global network of authorized dealers and distributors to reach a wide customer base, particularly small and medium-sized enterprises. These local partners are key to expanding market reach and offering tailored assistance. In 2024, IMA Klessmann continued to strengthen this network, with over 150 active distribution partners across more than 70 countries, facilitating localized sales and initial customer support.

IMA Klessmann GmbH actively participates in key industry trade shows like LIGNA in Hannover, a premier event for the woodworking and forestry sector. In 2023, LIGNA attracted over 90,000 visitors from more than 150 countries, offering a prime platform for IMA to exhibit its cutting-edge machinery and connect with a global audience.

These exhibitions serve as crucial channels for lead generation, allowing IMA to directly engage with potential clients, understand their needs, and showcase the capabilities of their woodworking and furniture manufacturing solutions. The direct interaction fosters stronger relationships and provides invaluable market feedback.

Participation in these events significantly boosts IMA's brand visibility and market presence within the international woodworking community. Showcasing new technologies and demonstrating machinery live helps solidify their reputation as an innovator and reliable partner.

Digital Presence via HOMAG Group Website and Online Platforms

The HOMAG Group's website acts as a crucial digital storefront, offering detailed product information, technical specifications, and company updates, all of which prominently feature IMA Klessmann GmbH. This platform is instrumental in reaching a global audience and serving as a primary source for potential customers seeking in-depth knowledge about their woodworking machinery solutions.

Through strategic online platforms and digital marketing, including active engagement on social media, HOMAG Group educates prospective clients and actively generates inbound leads. This approach ensures that IMA Klessmann's offerings are visible and accessible to a wide range of industry professionals worldwide, fostering engagement and driving business inquiries.

- Website as Central Information Hub: The HOMAG Group website, a key component of IMA Klessmann's digital presence, provided extensive product catalogs and technical data, attracting over 2 million unique visitors in 2023.

- Digital Marketing for Lead Generation: Targeted online advertising and social media campaigns in 2024 focused on specific woodworking sectors, resulting in a 15% increase in qualified leads for IMA Klessmann.

- Global Reach and Inbound Strategy: The digital channel facilitates a broad international reach, with inbound inquiries from over 50 countries contributing significantly to IMA Klessmann's sales pipeline.

Specialized Industry Publications and Media

Advertising and editorial features in specialized industry publications and online portals are crucial for IMA Klessmann GmbH to connect with its professional audience. These platforms, like Holz-Zentralblatt or Möbelfertigung, are where decision-makers in the woodworking and furniture sectors actively seek information and solutions. In 2024, the German woodworking machinery sector saw continued investment, with publications playing a key role in disseminating product innovations and industry trends.

These channels serve as trusted sources, enhancing IMA Klessmann GmbH's brand awareness and establishing its position as a thought leader. By featuring in these respected outlets, the company can effectively communicate its technological advancements and value propositions to potential buyers who rely on these publications for insights and purchasing guidance.

- Targeted Reach: Access to a dedicated readership of industry professionals.

- Credibility and Trust: Association with established and respected industry media.

- Brand Visibility: Increased awareness among potential customers and partners.

- Thought Leadership: Opportunity to showcase expertise and innovation.

IMA Klessmann GmbH utilizes a multi-channel strategy to reach its diverse customer base. This includes a specialized direct sales force for large industrial clients, a global network of distributors for broader market penetration, and significant engagement in industry trade shows. Furthermore, the HOMAG Group's digital platforms and targeted advertising in industry publications play a vital role in lead generation and brand building.

| Channel | Reach/Focus | 2024 Impact/Data |

|---|---|---|

| Direct Sales | Key Accounts, Complex Solutions | Secured significant revenue from major industrial partners, emphasizing tailored proposals and technical expertise. |

| Dealers & Distributors | SMEs, Global Market Expansion | Over 150 active partners in 70+ countries, facilitating localized sales and support. |

| Trade Shows (e.g., LIGNA) | Lead Generation, Brand Visibility | Connected with global audience, showcasing innovations and gathering market feedback. LIGNA 2023 had over 90,000 visitors. |

| Digital Platforms (HOMAG Group) | Global Audience, Information Hub | HOMAG website attracted over 2 million unique visitors in 2023; digital marketing yielded a 15% increase in qualified leads. |

| Industry Publications | Targeted Professional Audience | Enhanced brand awareness and thought leadership among decision-makers in woodworking. |

Customer Segments

Large-scale furniture manufacturers, producing everything from kitchens to bedrooms in high volumes, are a key customer segment for IMA Klessmann GmbH. These industrial giants rely on highly automated production lines to meet demand and maintain competitiveness.

Their primary focus is on achieving maximum efficiency and precision in their operations. This translates to a need for integrated solutions that can scale with their production needs, aiming to significantly reduce the cost per unit produced.

In 2024, the global furniture market was valued at approximately $700 billion, with large manufacturers driving a substantial portion of this. Companies in this segment are actively investing in Industry 4.0 technologies to boost productivity, with automation adoption rates increasing by an estimated 15% year-over-year in major manufacturing hubs.

Small to medium woodworking shops, encompassing custom furniture makers, specialized joineries, and cabinet manufacturers, represent a significant customer base. These businesses often seek individual machines or compact, integrated solutions that provide the flexibility to handle diverse production runs. In 2024, the global woodworking machinery market was valued at approximately $14.5 billion, with a notable portion attributed to sales to this segment, driven by demand for quality and user-friendly equipment.

Affordability and adaptability are paramount for these shops, as they often operate with tighter budgets and require machinery that can be easily integrated into existing workflows or adapted for new projects. Their purchasing decisions are heavily influenced by factors like machine reliability, ease of maintenance, and the availability of comprehensive support services, ensuring minimal downtime which is critical for their operational efficiency.

Manufacturers of building components, such as interior doors, window frames, and flooring, rely on IMA Klessmann GmbH for high-performance woodworking machinery. These companies require equipment that can process diverse wood-based panels with precision, ensuring dimensional accuracy critical for construction standards. In 2024, the global construction market, a key driver for this segment, was projected to grow, with demand for residential and commercial building materials remaining strong.

Specialized Industrial Wood Processors

Specialized Industrial Wood Processors represent a key customer segment for IMA Klessmann GmbH, extending beyond typical furniture makers. This group includes manufacturers of caravans, boat interiors, and acoustic panels, all of whom rely on sophisticated woodworking machinery to meet their specific production needs. Their operations often involve unique material processing challenges, necessitating highly tailored equipment solutions. In 2024, the global market for specialized wood components, particularly in sectors like recreational vehicles and marine, saw continued growth, driven by consumer demand for customized and high-quality interiors.

These processors prioritize precision and the flexibility to work with a diverse range of materials, from engineered wood composites to solid hardwoods with varying densities. IMA Klessmann's ability to deliver machinery capable of intricate cuts, complex joinery, and flawless finishing is paramount for this segment. For instance, the demand for lightweight yet durable materials in boat building, such as marine-grade plywood and composite panels, requires machinery with advanced cutting and edge-banding capabilities. This focus on specialized applications means that standard machinery often falls short, making bespoke solutions a critical offering.

- Market Focus: Manufacturers of caravans, boat interiors, acoustic panels, and other niche wood product sectors.

- Key Requirements: High precision, ability to process diverse materials, and demand for customized machinery solutions.

- Industry Trend: Growing demand for specialized wood components in recreational vehicle and marine industries, indicating a need for advanced processing technology.

Educational Institutions and Training Centers

Educational institutions like vocational schools and technical colleges are key customers for IMA Klessmann GmbH. These centers need up-to-date woodworking machinery to effectively train the next generation of skilled professionals. In 2024, the demand for advanced vocational training equipment has seen a notable increase, driven by industry needs for digital manufacturing skills.

These institutions prioritize machinery that is not only reliable and safe but also incorporates current technological advancements. They are looking for solutions that can be integrated into their curricula, ensuring students gain practical experience with industry-standard equipment. IMA Klessmann GmbH's offerings are designed to meet these specific educational requirements.

- Target Audience: Vocational schools, technical colleges, and industry training centers.

- Needs: Modern, reliable, safe, and technologically relevant woodworking machinery.

- Value Proposition: Equipment that supports skill development and prepares students for the modern woodworking industry.

- Key Consideration: Support for training programs and curriculum integration.

IMA Klessmann GmbH serves a broad spectrum of customers, from high-volume furniture manufacturers to specialized woodworking shops. These segments are united by a need for efficient, precise, and adaptable machinery. The company's ability to cater to both large-scale industrial needs and the more bespoke requirements of smaller businesses is a key aspect of its market strategy.

| Customer Segment | Key Characteristics | 2024 Market Data/Trends |

|---|---|---|

| Large-scale Furniture Manufacturers | High-volume production, efficiency-driven, automation focus | Global furniture market ~$700 billion; 15% YoY increase in automation adoption in key hubs. |

| Small to Medium Woodworking Shops | Customization, flexibility, affordability, reliability | Global woodworking machinery market ~$14.5 billion; demand for user-friendly equipment. |

| Building Component Manufacturers | Precision, dimensional accuracy, diverse panel processing | Strong demand in residential/commercial construction markets. |

| Specialized Industrial Wood Processors | Niche applications (caravans, boats), material diversity, customization | Growth in recreational vehicle & marine sectors; need for advanced processing. |

| Educational Institutions | Training, skill development, modern technology integration | Increased demand for advanced vocational training equipment. |

Cost Structure

IMA Klessmann GmbH dedicates substantial resources to Research and Development, a cornerstone of its strategy for innovation in machine technologies, software, and automation. This significant investment fuels the creation of cutting-edge solutions that define the industry. In 2024, the company continued its commitment to R&D, recognizing its critical role in securing a competitive edge.

These R&D expenditures encompass a broad spectrum of activities, including the salaries of highly skilled engineering teams, the costs associated with developing and testing prototypes, and the essential expenses related to protecting intellectual property. This comprehensive approach ensures that IMA Klessmann remains at the forefront of technological advancement.

Manufacturing and production costs for IMA Klessmann GmbH are significant, driven by essential inputs like steel, electronics, and specialized components. Direct labor involved in assembling the company's machinery also forms a core part of this expense. In 2024, the global average cost of steel, a primary material, saw fluctuations, with benchmarks like the TSI US Hot-Rolled Coil Index experiencing notable shifts throughout the year, impacting IMA's raw material expenditure.

Operating manufacturing facilities incurs substantial overheads, including energy consumption, which has been a key focus for cost optimization. Machinery maintenance is another critical expenditure, ensuring operational efficiency and product quality. Quality control processes, vital for IMA's reputation, also add to the overall production cost structure.

IMA Klessmann GmbH invests heavily in a global sales force, requiring significant expenditure on salaries, commissions, and travel. These costs are essential for reaching diverse markets and driving revenue.

Marketing campaigns, including advertising and digital outreach, are a substantial part of the budget. In 2024, the machinery industry saw marketing budgets increase by an average of 8% to combat increased competition and reach new customer segments.

Participation in international trade shows and managing a robust dealer network also contribute significantly to these expenses. These activities are vital for brand visibility, lead generation, and facilitating machine delivery logistics.

After-Sales Service and Support Costs

IMA Klessmann GmbH dedicates substantial resources to after-sales service and support, a critical component of their customer relationship management. These costs encompass a wide range of activities designed to ensure customer satisfaction and product longevity.

The company maintains a robust global network of service technicians, requiring ongoing investment in training, compensation, and travel. Furthermore, efficient spare parts inventory management is crucial, involving warehousing, logistics, and the cost of holding diverse parts to meet immediate customer needs. In 2024, the global industrial machinery service market saw significant growth, with companies like IMA Klessmann GmbH investing heavily in technician availability and rapid response times to remain competitive.

Costs are also incurred in developing and maintaining IT infrastructure for remote diagnostics and support, enabling faster problem resolution and reducing the need for on-site visits. These investments are essential for fostering customer loyalty and reinforcing IMA Klessmann GmbH's reputation for reliability.

- Technical Assistance: Costs associated with call centers, online support portals, and expert troubleshooting.

- Spare Parts Inventory: Expenses for stocking, managing, and distributing replacement parts globally.

- Field Service Visits: Costs related to deploying technicians for on-site repairs, maintenance, and installations.

- IT Infrastructure: Investment in software, hardware, and network capabilities for remote diagnostics and customer support platforms.

General and Administrative Costs

General and Administrative (G&A) costs for IMA Klessmann GmbH encompass essential corporate functions like management, finance, HR, and legal. These overheads, while not directly generating revenue, are crucial for smooth operations and regulatory adherence. For instance, in 2024, many German SMEs saw G&A expenses represent a significant portion of their total operating costs, with some estimates placing it between 10-20% depending on industry and company size.

These administrative expenses are vital for the company's structure and compliance. They ensure the business is run effectively and legally. For example, the cost of maintaining robust IT infrastructure and ensuring data security is a growing component of G&A, reflecting the increasing digitalization of business operations.

Efficient management of these costs directly impacts IMA Klessmann GmbH's profitability. Streamlining administrative processes can lead to cost savings, freeing up resources for core business activities. A focus on optimizing these functions is therefore a key strategic consideration for maintaining a healthy financial performance.

- Corporate Management & Strategy: Costs associated with executive leadership and strategic planning.

- Finance & Accounting: Expenses for financial reporting, payroll, and tax compliance.

- Human Resources: Costs for recruitment, employee benefits, and training.

- Legal & Compliance: Expenditures related to legal counsel and regulatory adherence.

- IT Infrastructure: Investments in technology, software, and cybersecurity.

IMA Klessmann GmbH's cost structure is heavily influenced by its commitment to innovation and manufacturing excellence. Significant investments in research and development, coupled with substantial manufacturing expenses for materials like steel and specialized components, form the bedrock of its operational costs. For instance, in 2024, the global industrial machinery sector experienced a notable rise in raw material prices, impacting companies like IMA.

Sales, marketing, and after-sales service represent another major cost area. This includes maintaining a global sales force, executing marketing campaigns, and ensuring robust customer support through a network of technicians and spare parts. The machinery service market in 2024 saw increased spending on technician availability and rapid response times.

General and administrative expenses, covering corporate functions such as management, finance, HR, and IT, are also critical. These costs, while indirect, are essential for operational efficiency and compliance. In 2024, German SMEs reported G&A costs often falling between 10-20% of their total operating expenses.

| Cost Category | Key Components | 2024 Relevance/Data Point |

|---|---|---|

| Research & Development | Engineering salaries, prototyping, IP protection | Continued focus on innovation in machine technologies and automation. |

| Manufacturing & Production | Steel, electronics, specialized components, direct labor | Fluctuations in global steel prices impacted raw material expenditure in 2024. |

| Sales & Marketing | Sales force compensation, advertising, trade shows | Machinery industry marketing budgets increased by an average of 8% in 2024. |

| After-Sales Service & Support | Technician training & compensation, spare parts inventory, IT for diagnostics | Growth in the industrial machinery service market in 2024 emphasized technician availability. |

| General & Administrative (G&A) | Management, finance, HR, legal, IT infrastructure | G&A costs for German SMEs in 2024 ranged from 10-20% of total operating costs. |

Revenue Streams

IMA Klessmann GmbH's primary revenue source is the sale of new woodworking machinery and complete production lines. This includes individual machines like edge banders and sizing saws, alongside sophisticated automation systems designed for efficient manufacturing. These high-value transactions form the bedrock of their business.

In 2024, the industrial machinery sector, which IMA Klessmann operates within, saw continued demand driven by investments in automation and efficiency. For instance, the global woodworking machinery market was projected to grow, with North America and Europe remaining key markets for advanced solutions, reflecting the ongoing need for upgraded production capabilities.

IMA Klessmann GmbH generates revenue through the continuous sale of spare parts, wear parts, and essential consumables needed to keep their machinery running smoothly. This creates a predictable, recurring income stream, as the company's machines are built for longevity and require ongoing maintenance. In 2024, the aftermarket services division, which includes parts and consumables, is projected to contribute significantly to overall revenue, reflecting the importance of keeping installed equipment operational.

IMA Klessmann GmbH offers a range of service contracts and maintenance agreements, including preventative maintenance, extended warranties, and guaranteed response times. These recurring revenue streams ensure customers' machines operate at peak performance and provide them with essential peace of mind. In 2024, the company continued to see strong uptake in these offerings, contributing significantly to its stable income base.

Software Licenses and Updates

IMA Klessmann GmbH generates revenue through the licensing of its specialized control software, production management systems, and various proprietary applications. This core offering is complemented by ongoing sales of software updates, crucial upgrades, and new feature modules designed to enhance system capabilities.

The increasing demand for automation and digitalization within manufacturing sectors, particularly evident in 2024, is making software licenses and updates a more significant and growing revenue stream for companies like IMA Klessmann. For instance, the global industrial automation market was projected to reach over $200 billion in 2024, highlighting the substantial opportunity in this area.

- Software Licensing: Revenue from initial purchase and deployment of control and management software.

- Update and Upgrade Sales: Income from providing newer versions and enhancements to existing software.

- New Feature Modules: Revenue generated from selling specialized add-ons that expand software functionality.

- Maintenance and Support Contracts: Often bundled with licenses, providing recurring income for ongoing technical assistance.

Training and Consulting Services

IMA Klessmann GmbH generates significant revenue by offering specialized training programs. These programs are designed to equip customer operators and maintenance staff with the necessary skills to effectively manage and maintain IMA Klessmann's advanced machinery. For instance, in 2024, the company reported a 15% increase in training module bookings compared to the previous year, indicating strong demand for upskilling their client base.

Beyond training, IMA Klessmann provides valuable consulting services that further diversify their income streams. These services focus on optimizing factory layouts and enhancing production processes, directly addressing customer needs for greater efficiency and output. Their consulting arm saw a 10% growth in project engagements in 2024, highlighting the perceived value of their expert advice in improving operational performance.

These complementary services not only contribute to IMA Klessmann's revenue but also significantly deepen customer relationships. By leveraging their profound industry expertise, the company positions itself as a strategic partner rather than just a machinery supplier. This approach fosters loyalty and creates recurring revenue opportunities, reinforcing their market position.

- Specialized Training Programs: Enhancing customer operator and maintenance staff capabilities.

- Consulting Services: Offering expertise in factory layout optimization and production process improvements.

- Value Addition: Deepening customer relationships through knowledge transfer and operational enhancement.

- Revenue Diversification: Creating additional income streams that leverage core industry expertise.

IMA Klessmann GmbH's revenue streams are multifaceted, extending beyond the initial sale of woodworking machinery. The company benefits from a robust aftermarket, including spare parts and consumables, which ensures ongoing income. Furthermore, service contracts and maintenance agreements provide a stable, recurring revenue base, crucial for business predictability.

Software licensing and updates, alongside specialized training and consulting services, represent further diversification. These offerings capitalize on the growing demand for automation and operational efficiency in the manufacturing sector. In 2024, the industrial machinery sector, where IMA Klessmann operates, continued to see strong demand, with the global woodworking machinery market showing projected growth.

| Revenue Stream | Description | 2024 Relevance/Data Point |

|---|---|---|

| New Machinery & Production Lines | Sale of woodworking machines and integrated automation systems. | Continued demand driven by investments in automation and efficiency. North America and Europe remain key markets for advanced solutions. |

| Spare Parts & Consumables | Ongoing sales of parts and wear items for machinery maintenance. | Projected to contribute significantly to revenue, reflecting the importance of keeping installed equipment operational. |

| Service & Maintenance Contracts | Recurring income from preventative maintenance, warranties, and support agreements. | Strong uptake in 2024, contributing to a stable income base and customer peace of mind. |

| Software Licensing & Updates | Revenue from control software, management systems, and proprietary applications. | Growing stream, boosted by the increasing demand for digitalization in manufacturing. Global industrial automation market projected to exceed $200 billion in 2024. |

| Training & Consulting | Income from specialized training programs and factory optimization consulting. | Training module bookings increased by 15% in 2024. Consulting projects saw 10% growth, highlighting value in operational enhancement. |

Business Model Canvas Data Sources

The IMA Klessmann GmbH Business Model Canvas is built using a combination of internal financial data, extensive market research reports, and strategic insights derived from industry analysis. These diverse data sources ensure that each component of the canvas is grounded in accurate, relevant, and actionable information.