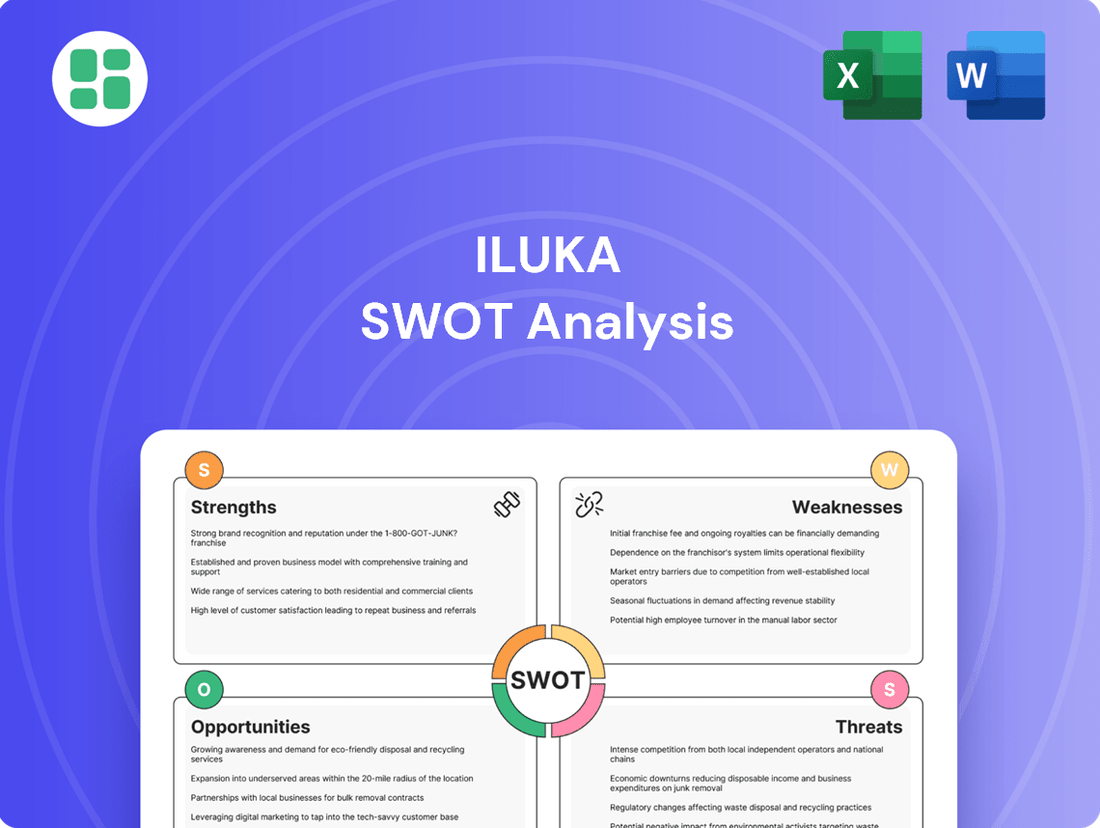

Iluka SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iluka Bundle

Iluka's strengths lie in its dominant position in the zircon market and its diversified mineral sands portfolio, but it faces significant threats from volatile commodity prices and increasing environmental regulations. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Iluka's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Iluka Resources is a powerhouse in the global mineral sands market, particularly for zircon and high-grade titanium feedstocks like rutile and synthetic rutile. This leadership position, honed over 70 years, gives them a solid competitive edge in supplying vital industrial materials.

Iluka Resources has showcased impressive financial fortitude, even amidst a demanding economic landscape. For the 2024 fiscal year, the company posted a net profit after tax reaching $231 million. This demonstrates a solid ability to generate earnings.

Furthermore, Iluka maintained a healthy mineral sands EBITDA margin of 42% in 2024. This figure highlights the company's operational efficiency and its capacity to translate revenue into profitability within its core segment.

The company's strategic approach to its balance sheet has resulted in a net cash position, when excluding non-recourse net debt. This financial strength offers significant flexibility for pursuing new investment opportunities and navigating any unexpected operational challenges.

Iluka's strategic move into rare earth elements, particularly with its Eneabba refinery in Western Australia, represents a significant strength. This facility is slated to be Australia's first fully integrated refinery for separated rare earth oxides, a critical step in diversifying its revenue streams beyond mineral sands.

This diversification is a major competitive advantage, as it positions Iluka as a key non-Chinese supplier of essential components for rapidly growing sectors like electric vehicles and renewable energy. By 2024, the global rare earths market was projected to reach over $6 billion, highlighting the substantial opportunity Iluka is tapping into.

Extensive Project Pipeline

Iluka's extensive project pipeline is a significant strength, ensuring its future operational capacity and market position. Key developments like Balranald and Wimmera are poised to bolster feedstock supply for its core mineral sands and burgeoning rare earths segments.

The Balranald project, a cornerstone of this pipeline, is slated for commissioning in the latter half of 2025, signaling a tangible step towards expanded production. This pipeline not only extends Iluka's mine lives but also provides a clear pathway for long-term growth and diversification.

- Balranald Project: On track for commissioning in H2 2025, securing future feedstock.

- Wimmera Project: A crucial development for extending mine life and supply.

- Tutunup Development: Further strengthens the company's project portfolio.

- Rare Earths Expansion: Pipeline projects support Iluka's strategic move into high-value rare earths.

Advanced Processing Capabilities and Technology

Iluka's vertically integrated model, from mining to refining, is a significant strength, allowing it to control more of the value chain and mitigate supply chain risks. This integration is further bolstered by its investment in advanced processing technologies. For instance, the company has been developing and implementing innovative underground mining techniques, such as those planned for its Balranald deposit, which are designed to improve operational efficiency and access previously uneconomical or difficult-to-reach mineral reserves. This focus on technological advancement not only enhances productivity but also positions Iluka favorably in terms of environmental stewardship by potentially reducing surface disturbance.

Iluka's commitment to technological innovation is demonstrated through its ongoing investment in research and development. This focus allows the company to optimize its processing of mineral sands, aiming for higher yields and purity in its final products. For example, in 2023, Iluka continued to advance its synthetic rutile kiln technology, a key component in its value-adding strategy. This technological edge provides a competitive advantage by enabling the production of higher-value materials, essential for industries like pigment manufacturing and advanced ceramics.

- Vertical Integration: Controls the entire value chain from extraction to finished product, enhancing resilience and value capture.

- Innovative Mining Technology: Development of advanced underground mining solutions, exemplified by plans for Balranald, improves efficiency and resource access.

- Processing Expertise: Ongoing investment in and refinement of processing technologies, such as synthetic rutile kilns, ensures high-quality output and competitive advantage.

Iluka's market leadership in zircon and titanium feedstocks, built over 70 years, provides a significant competitive advantage in supplying essential industrial materials.

The company demonstrated strong financial performance in 2024, achieving a net profit after tax of $231 million and maintaining a healthy mineral sands EBITDA margin of 42%, underscoring operational efficiency and profitability.

Iluka's strategic diversification into rare earth elements, with its Eneabba refinery set to be Australia's first fully integrated rare earth oxide refinery, positions it as a key non-Chinese supplier for high-growth sectors like EVs and renewables.

A robust project pipeline, including the Balranald project slated for H2 2025 commissioning and the Wimmera project, ensures future feedstock supply and long-term growth, particularly supporting its rare earths expansion.

What is included in the product

Delivers a strategic overview of Iluka’s internal and external business factors, highlighting its strengths in mineral sands, weaknesses in production costs, opportunities in emerging markets, and threats from commodity price volatility.

Iluka's SWOT analysis provides a structured framework to identify and address potential threats and weaknesses, thereby alleviating the pain of unforeseen challenges and enabling proactive risk management.

Weaknesses

Iluka's financial performance is closely tied to the unpredictable swings in mineral sands commodity prices, especially for zircon and titanium dioxide feedstocks. For instance, in the first half of 2024, Iluka reported a significant drop in its average selling price for zircon, falling to $1,050 per tonne from $1,398 per tonne in the prior year period, highlighting this vulnerability.

Global economic health and the pace of industrial activity directly influence the demand and pricing of these minerals. This means Iluka's revenue can be quite unstable, requiring careful financial planning and flexible pricing approaches to navigate these market ups and downs.

Zircon represents a significant portion of Iluka's income, making up about 58% of its total revenue in 2024. This heavy reliance means the company is quite vulnerable to changes in the zircon market, including trade policies and demand fluctuations. Such sensitivity can magnify the effects of negative market trends on Iluka's overall financial health.

Iluka's production of key mineral sands products saw a notable decline in 2024. Zircon, rutile, and synthetic rutile output collectively reached 496,000 tonnes, a decrease from the 639,000 tonnes produced in 2023. While the company met its revised production guidance for the year, this trend of lower volumes in core products presents a challenge.

Sustained reductions in output could potentially erode Iluka's market share and negatively impact revenue streams. The company will need to either achieve significant price increases for its remaining production or successfully bring new projects online to compensate for these volume decreases and maintain its financial performance.

High Capital and Operational Intensity

The mining, processing, and refining of critical minerals inherently demand significant capital outlay and sustained operational expenses. Iluka’s strategic projects, such as the Eneabba rare earths refinery and the Balranald mineral sands operation, exemplify this, requiring substantial upfront investment.

While these ventures are financed, their high capital and operational intensity necessitate rigorous cost control and meticulous project management to ensure profitability and efficient resource utilization. For instance, the Eneabba refinery, a cornerstone of Iluka's diversification, represents a multi-year investment with ongoing operational costs tied to energy, labor, and consumables.

- Capital Expenditure: Significant upfront investment required for mine development, processing plants, and infrastructure.

- Operational Costs: Ongoing expenses include energy, labor, maintenance, and consumables, which can be volatile.

- Project Scale: Large-scale operations like Eneabba and Balranald inherently carry higher capital and operational intensity.

- Financial Vigilance: Constant monitoring and management of costs are crucial for maintaining financial health and project viability.

Project Execution Risks

Large-scale development projects, like Iluka's Eneabba rare earths refinery, inherently carry significant execution risks. These complex endeavors, involving intricate technical processes and extensive construction, are prone to delays and cost escalations. For instance, the Eneabba project, a cornerstone of Iluka's strategic growth, faced initial construction challenges that could affect its projected completion and financial performance.

The rare earths industry has a history of commissioning difficulties with similar large-scale projects, posing a direct threat to Iluka's ability to bring the Eneabba refinery online within budget and on schedule. Such setbacks could impact Iluka's financial forecasts for 2024 and 2025, potentially affecting investor confidence and future capital allocation.

- Project Delays: The Eneabba refinery's timeline is susceptible to unforeseen technical or logistical hurdles, potentially pushing back revenue generation.

- Cost Overruns: Escalating material, labor, or equipment costs could inflate the total project expenditure beyond initial estimates.

- Commissioning Challenges: Industry precedents suggest that bringing complex processing plants online can be problematic, leading to extended ramp-up periods and reduced initial output.

Iluka's heavy reliance on zircon, which constituted approximately 58% of its revenue in 2024, makes it highly susceptible to market fluctuations and policy changes impacting this specific mineral. This concentration risk amplifies the impact of any downturns in the zircon sector on the company's overall financial stability.

The company experienced a notable decline in production volumes for its core mineral sands products in 2024, with combined output of zircon, rutile, and synthetic rutile falling to 496,000 tonnes from 639,000 tonnes in 2023. This reduction in output poses a threat to market share and revenue generation, necessitating strategies to either increase prices or bring new projects online to compensate.

Iluka's strategic growth initiatives, such as the Eneabba rare earths refinery and the Balranald mineral sands operation, demand substantial capital investment and incur significant ongoing operational expenses. The financial success of these ventures hinges on rigorous cost management and efficient project execution, as demonstrated by the ongoing investment in the Eneabba refinery.

Large-scale projects like the Eneabba refinery carry inherent execution risks, including potential delays and cost overruns, as seen with initial construction challenges. Historical precedents in the rare earths industry highlight the difficulties in commissioning such complex processing plants, which could impact Iluka's projected timelines and financial performance for 2024-2025.

Preview Before You Purchase

Iluka SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global shift towards clean energy is fueling a massive surge in demand for critical minerals. Think electric vehicles and renewable energy systems; these technologies rely heavily on materials like lithium, cobalt, and rare earth elements. This isn't a fleeting trend, but a fundamental, long-term growth driver.

Iluka's diverse product range, which includes materials like zircon and titanium dioxide, is well-positioned to benefit from this energy transition. For instance, the demand for high-purity titanium dioxide, used in solar panels and wind turbines, is projected to grow significantly. Analysts anticipate the global market for titanium dioxide to reach approximately $25 billion by 2027, with clean energy applications being a key contributor.

Global efforts to de-risk supply chains, driven by geopolitical instability and China's dominance in critical mineral processing, are creating significant opportunities. Iluka's Australian operations, including its new Eneabba rare earths refinery, are well-positioned to benefit from this trend, offering a secure, non-Chinese source of vital materials. This strategic advantage is amplified by the increasing demand for rare earths in sectors like electric vehicles and renewable energy, where supply chain security is paramount.

Shifts in trade policy present a significant opportunity for Iluka. For instance, the imposition of a 30% tariff on South African zircon imports into the United States, as seen in recent policy discussions, directly benefits Australian producers like Iluka by leveling the playing field. This tariff differential can enhance Iluka's competitiveness in a key market.

Furthermore, the exemption of titanium dioxide feedstocks and rare earth oxides from these US tariffs is particularly advantageous for Iluka's diversified business model. This strategic inclusion within favorable trade agreements bolsters the company's ability to operate and compete effectively across its product lines, particularly as global supply chains are re-evaluated.

Innovation in Mining and Processing

Iluka's commitment to innovation, particularly its substantial investments in research and development, presents a significant opportunity. The company is developing proprietary underground mining technology, exemplified by its work at the Balranald deposit. This technological advancement aims to access deeper mineral reserves that were previously uneconomical to extract.

This innovation can lead to reduced environmental footprints, lower operating expenses, and an extended mine life, all contributing to enhanced future profitability. For instance, advancements in selective mining techniques can minimize waste, thereby improving resource utilization. By unlocking these deeper deposits, Iluka can secure a more robust and longer-term supply of critical minerals.

Key opportunities stemming from this innovation include:

- Access to deeper, previously uneconomical mineral deposits.

- Reduced environmental impact through advanced mining techniques.

- Lower operational costs and improved cost efficiency.

- Extended resource longevity and enhanced future profitability.

Value Addition through Downstream Processing

Iluka's Eneabba rare earths refinery represents a significant opportunity to capture greater value by processing monazite feedstock into separated rare earth oxides. This move downstream allows Iluka to directly supply high-demand sectors like electric vehicles and renewable energy, which are projected to see substantial growth. For instance, the global rare earth market was valued at approximately USD 4.5 billion in 2023 and is expected to reach over USD 7.5 billion by 2030, highlighting the immense potential for refined products.

By integrating refining capabilities, Iluka can significantly enhance its profit margins compared to simply selling concentrate. This vertical integration also provides greater control over the product's quality and origin, a crucial factor for customers in high-tech industries seeking reliable and traceable supply chains. The company's strategic investment in Eneabba positions it to capitalize on the increasing global emphasis on secure and ethical sourcing of critical minerals.

This downstream expansion offers several key advantages:

- Enhanced Profitability: Converting monazite into separated oxides typically yields higher margins than selling raw materials.

- Market Access: Directly supplying refined rare earths opens doors to lucrative markets in advanced manufacturing and technology.

- Supply Chain Security: Offering traceable, domestically processed rare earths addresses growing concerns about geopolitical supply risks.

- Product Differentiation: The ability to provide high-purity, separated rare earth oxides sets Iluka apart in a competitive market.

Iluka's strategic positioning to benefit from the global clean energy transition is a significant opportunity, driven by escalating demand for critical minerals essential for technologies like electric vehicles and renewable energy systems. The company's diverse product portfolio, including zircon and titanium dioxide, aligns perfectly with this trend, with titanium dioxide applications in solar panels and wind turbines showing strong projected growth. The global titanium dioxide market is anticipated to reach approximately $25 billion by 2027, with clean energy being a major catalyst.

Iluka's Australian operations, particularly its new Eneabba rare earths refinery, are poised to capitalize on global efforts to de-risk supply chains, offering a secure, non-Chinese source of vital materials. This is further amplified by the increasing demand for rare earths in sectors like electric vehicles, where supply chain security is paramount. Favorable trade policies, such as potential US tariffs on South African zircon, also create a competitive advantage for Australian producers like Iluka.

The company's investment in proprietary underground mining technology, demonstrated at the Balranald deposit, offers the chance to access deeper mineral reserves more efficiently and with a reduced environmental footprint. This innovation can lower operating costs and extend mine life, enhancing future profitability and securing long-term supply. The move downstream with the Eneabba refinery, processing monazite into separated rare earth oxides, presents a substantial opportunity for increased profit margins and direct market access in high-demand sectors.

| Opportunity | Key Driver | Iluka's Position | Market Data/Impact |

| Clean Energy Demand | EVs, Renewables | Zircon, TiO2, Rare Earths | TiO2 market ~ $25B by 2027 |

| Supply Chain De-risking | Geopolitical Instability | Australian Operations, Eneabba Refinery | Non-Chinese source of critical minerals |

| Favorable Trade Policies | Tariffs, Trade Agreements | Australian production advantage | Potential US tariffs on SA zircon |

| Mining Innovation | Underground tech | Balranald deposit | Access deeper, cost-efficient reserves |

| Downstream Processing | Value addition | Eneabba Rare Earths Refinery | Rare Earths market ~ $7.5B by 2030 (est.) |

Threats

Ongoing global trade tensions and the imposition of tariffs present a notable threat to Iluka's operations. For instance, US tariffs have previously impacted Australian zircon exports, potentially affecting Iluka's market access and pricing flexibility. While the company actively seeks alternative markets and maintains disciplined pricing strategies, such trade policies can significantly disrupt established trade routes and increase costs for its international clientele.

While the long-term demand for critical minerals is strong, Iluka faces the immediate threat of price volatility in the short to medium term. This is particularly true for rare earth elements, where significant price swings can directly impact profitability and project economics.

For instance, the spot price for NdPr, a key component in many high-tech applications, experienced a substantial drop in late 2023 and early 2024, falling from over $150/kg to below $50/kg at times. Even with strategic offtake agreements or established floor prices, such sharp declines can erode margins and affect the financial viability of ongoing or planned projects.

Geopolitical tensions significantly impact the critical minerals sector, directly affecting companies like Iluka. For instance, the ongoing trade friction between major global powers in 2024 continues to create uncertainty around export policies for essential resources, potentially leading to supply chain disruptions. Iluka's reliance on stable international trade routes means any escalation in trade disputes or the imposition of new tariffs could increase operational costs and limit market access for its products.

Intensified Competition

Iluka Resources, while a dominant force in the mineral sands market, faces a growing threat from intensified competition. The global surge in demand for critical minerals, essential for the green energy transition, is attracting both established mining giants and opportunistic new players to the sector. This increased interest could significantly alter the competitive landscape.

The expansion of production capacity, particularly from China, presents a notable challenge. Even if the quality of Chinese-produced minerals varies, its sheer volume can exert downward pressure on global prices, especially for key products like zircon. This could impact Iluka's market share and profitability.

- Increased Investment: Global investment in critical minerals exploration and development is projected to rise significantly through 2025, driven by demand from electric vehicles and renewable energy technologies.

- Emerging Producers: Countries like Mozambique and Sierra Leone are increasing their mineral sands output, adding to the supply side and potentially fragmenting market share.

- Price Sensitivity: Zircon prices, a core product for Iluka, have historically shown volatility. Increased supply from new or expanded operations could exacerbate this sensitivity, impacting revenue streams.

Regulatory and Environmental Challenges

Iluka's mining and processing activities face significant regulatory hurdles, with environmental laws constantly adapting and community expectations intensifying. For instance, in 2024, the Australian government continued to emphasize stricter environmental impact assessments for new resource projects, potentially affecting Iluka's expansion plans. These evolving regulations can translate into higher compliance costs and extended project timelines.

The company's social license to operate is also a critical factor. Any perceived failure to meet community standards or address environmental concerns could lead to operational disruptions. For example, ongoing community engagement efforts are crucial for projects like the Balranald mine, where maintaining strong stakeholder relationships is paramount to avoid potential delays or increased scrutiny in 2025.

- Increased Compliance Costs: Evolving environmental standards in 2024 and 2025 necessitate ongoing investment in mitigation technologies and monitoring.

- Operational Delays: New or stricter regulations can impose lengthy approval processes, impacting project schedules.

- Social License Scrutiny: Community expectations regarding environmental performance and benefit sharing remain high, requiring proactive engagement strategies.

Intensified global competition, particularly from China's expanding production capacity, poses a significant threat by potentially driving down prices for key minerals like zircon. Emerging producers in countries such as Mozambique and Sierra Leone are also increasing output, fragmenting market share. This heightened competition, coupled with the inherent price volatility of commodities like zircon, could negatively impact Iluka's revenue streams and profitability through 2025.

| Threat Category | Specific Threat | Impact on Iluka | 2024/2025 Data/Trend |

|---|---|---|---|

| Competition | Increased Production Capacity (China) | Downward pressure on prices, market share erosion | China's mineral sands output has been steadily increasing, impacting global supply dynamics. |

| Competition | Emerging Producers | Market fragmentation, increased supply | Countries like Mozambique and Sierra Leone are growing their mineral sands exports. |

| Market Dynamics | Commodity Price Volatility (Zircon) | Revenue and profitability fluctuations | Zircon prices have historically shown significant swings; increased supply could exacerbate this. |

SWOT Analysis Data Sources

This Iluka SWOT analysis is built upon a foundation of robust data, including the company's official financial reports, comprehensive market research on the mineral sands industry, and expert commentary from industry analysts to provide a well-rounded strategic perspective.