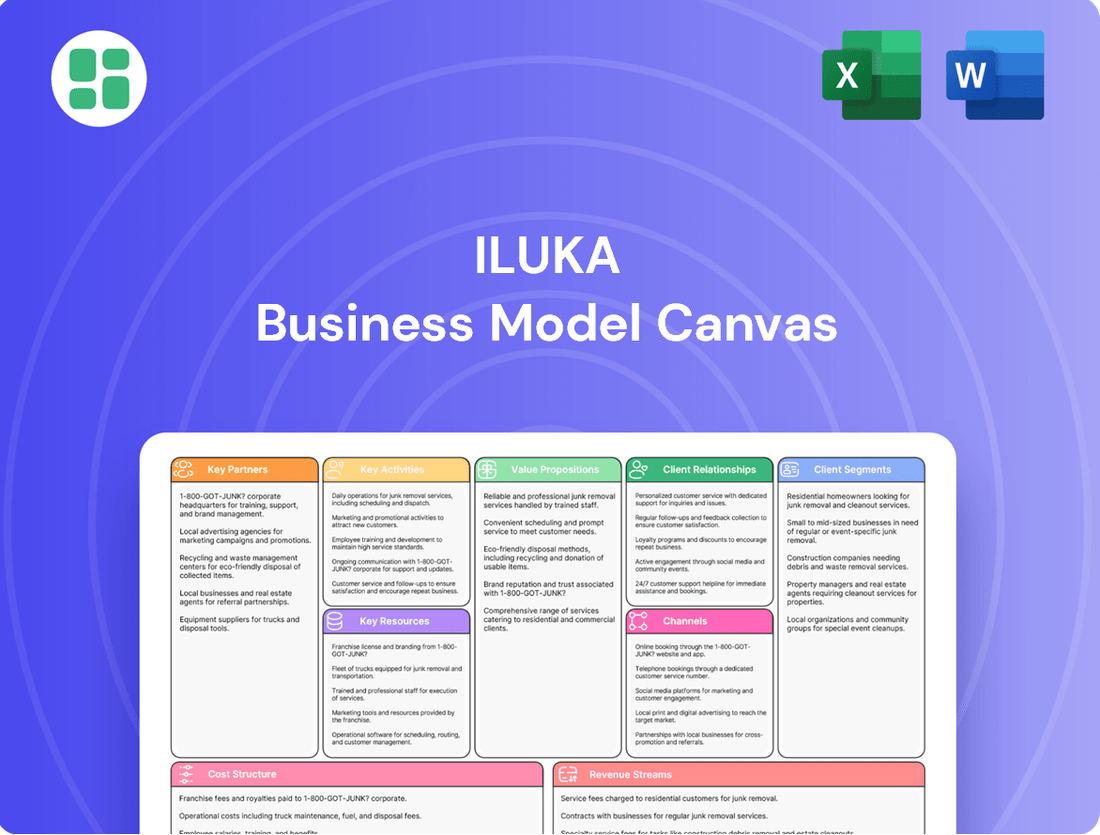

Iluka Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iluka Bundle

Discover the strategic core of Iluka's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Perfect for anyone aiming to understand or replicate market-leading strategies.

Partnerships

Iluka Resources actively collaborates with government entities, notably the Australian Government, for crucial strategic ventures. A prime example is the Eneabba rare earths refinery project, which has benefited from substantial non-recourse loans, underscoring government support for critical mineral development.

Iluka collaborates with other mining entities through joint ventures, such as the Balranald project, to share investment burdens and leverage diverse expertise. This strategic approach allows for more efficient development of new resource opportunities, spreading the financial risk and enhancing operational capabilities. For instance, in the 2024 financial year, Iluka's significant investment in the Balranald project highlights the importance of these partnerships in accessing and developing valuable mineral deposits.

Iluka Resources actively collaborates with technology and research partners to drive innovation in mineral exploration and processing. These partnerships are vital for enhancing exploration techniques and boosting processing efficiencies, ultimately supporting the development of new applications for critical minerals.

A prime example of this commitment is Iluka's significant investment in research and development for advanced underground mining technology specifically for its Balranald project. This focus on R&D underscores the company's dedication to staying at the forefront of technological advancements in the mining sector.

Logistics and Shipping Providers

Iluka's success hinges on robust relationships with logistics and shipping providers. These partners are critical for the global reach of its mineral sands, ensuring products like zircon and titanium dioxide reach customers efficiently. For instance, in 2023, Iluka's total revenue was AUD 1.1 billion, underscoring the sheer volume of goods requiring reliable transport.

These partnerships facilitate the movement of bulk commodities across vast distances, often involving complex international freight arrangements. The ability to maintain consistent delivery schedules is paramount for customer satisfaction and securing repeat business in the competitive global market.

- Global Reach: Essential for delivering mineral sands to diverse international markets.

- Efficiency and Reliability: Ensures timely and cost-effective transportation, crucial for maintaining competitive pricing.

- Cost Management: Negotiating favorable shipping rates directly impacts Iluka's profitability.

- Risk Mitigation: Partnering with reputable providers minimizes risks associated with transit damage or delays.

Contractors and Service Suppliers

Iluka relies on a network of contractors for critical mining operations, construction of new facilities, and ongoing maintenance. These partnerships are essential for accessing specialized skills and equipment, enabling efficient project execution and maintaining operational uptime. For instance, in 2024, Iluka continued to leverage external expertise for its Jacinth-Ambrosia operations and the development of its synthetic rutile kiln upgrade project.

These key partnerships ensure Iluka can scale its workforce and capabilities as needed, without the overhead of maintaining a large in-house specialized workforce. This flexibility is crucial for managing the cyclical nature of the mining industry and the capital-intensive demands of major projects.

- Mining Contractors: Providing specialized earthmoving and extraction services.

- Construction Firms: Undertaking the building and expansion of processing plants and infrastructure.

- Maintenance and Engineering Suppliers: Offering technical support, equipment repair, and specialized engineering solutions.

- Logistics and Transport Providers: Facilitating the movement of raw materials and finished products.

Iluka’s key partnerships extend to technology developers and research institutions, fostering innovation in mineral processing and exploration. These collaborations are vital for enhancing operational efficiencies and developing new applications for critical minerals, as seen in their investment in advanced underground mining R&D for the Balranald project.

Government bodies, particularly the Australian Government, are crucial partners, providing support through non-recourse loans for projects like the Eneabba rare earths refinery, signaling strong backing for critical mineral development.

Iluka also engages in joint ventures with other mining companies, such as at Balranald, to share investment risks and leverage combined expertise, thereby enabling more efficient development of new resource opportunities.

Furthermore, reliable logistics and shipping providers are indispensable for Iluka's global distribution of products like zircon and titanium dioxide, ensuring timely delivery and cost-effectiveness, which directly impacts its profitability, evidenced by their AUD 1.1 billion revenue in 2023.

| Partner Type | Purpose | Example/Impact |

|---|---|---|

| Government Entities | Strategic Ventures, Funding Support | Australian Government non-recourse loans for Eneabba rare earths refinery. |

| Other Mining Entities | Joint Ventures, Risk Sharing | Balranald project collaboration to share investment and expertise. |

| Technology & Research Partners | Innovation, Efficiency Improvement | R&D investment in advanced underground mining technology for Balranald. |

| Logistics & Shipping Providers | Global Distribution, Cost Management | Ensuring efficient delivery of mineral sands, impacting AUD 1.1 billion 2023 revenue. |

| Contractors (Mining, Construction, Maintenance) | Operational Execution, Specialized Skills | Leveraging external expertise for Jacinth-Ambrosia operations and synthetic rutile kiln upgrades in 2024. |

What is included in the product

A structured overview of Iluka's operations, detailing its key customer segments, value propositions, and revenue streams within the mineral sands industry.

The Iluka Business Model Canvas acts as a pain point reliever by providing a clear, visual map of the business, making it easier to identify and address inefficiencies.

It alleviates the pain of complex strategy by distilling all key business elements onto a single, accessible page for rapid understanding and problem-solving.

Activities

Iluka's core activities revolve around identifying and delineating new mineral sands and rare earth deposits, crucial for securing its future supply chain. This includes ongoing work at promising sites like the Wimmera and Balranald projects.

In 2024, Iluka continued to advance its exploration efforts, with a significant focus on expanding its rare earth resource base. For instance, the Balranald project in New South Wales is a key strategic asset, demonstrating the company's commitment to developing new revenue streams beyond traditional mineral sands.

Iluka's core mining and extraction operations involve the physical removal of heavy mineral concentrate from various deposits. This is a crucial activity, directly feeding into the creation of their valuable products.

At key sites like Jacinth-Ambrosia in South Australia and Cataby in Western Australia, Iluka employs diverse mining techniques. These operations are the engine of their business, transforming raw earth into valuable mineral sands.

Notably, Iluka is pioneering innovative underground mining methods at its Balranald project in New South Wales. This forward-thinking approach aims to access deeper resources efficiently and sustainably. In 2023, Iluka reported production of 330,000 tonnes of synthetic rutile and 136,000 tonnes of ilmenite from its Western Australian operations, showcasing the scale of its extraction activities.

Iluka processes raw heavy mineral concentrate, transforming it into sought-after products such as zircon, rutile, and synthetic rutile. This core activity is crucial for extracting maximum value from its mineral sands operations.

The company is actively expanding its capabilities, notably through the development of its Eneabba refinery, which will produce separated rare earth oxides. This strategic move diversifies Iluka's product portfolio and taps into a high-growth market.

In 2023, Iluka's mineral sands operations generated revenue of $1,007 million, with zircon and rutile being key contributors. The expansion into rare earths represents a significant future revenue stream, with the Eneabba project targeting initial rare earth oxide production in 2025.

Product Marketing and Global Sales

Iluka actively markets and sells its critical minerals, such as zircon and rare earths, to a broad international customer base. This involves engaging with diverse industrial sectors, including ceramics, construction, and advanced manufacturing, to meet their specific material needs.

Managing sales volumes and pricing strategies is paramount to Iluka's success in the global market. The company focuses on optimizing these aspects to ensure profitability and maintain a competitive edge. For instance, in 2023, Iluka reported a significant portion of its revenue derived from its mineral sands operations, highlighting the importance of these sales activities.

- Global Reach: Iluka's sales network spans multiple continents, serving key markets in Europe, Asia, and North America.

- Customer Focus: Tailoring product offerings and service levels to meet the unique requirements of industrial customers is a core strategy.

- Market Dynamics: Sales activities are closely aligned with global commodity price fluctuations and demand trends for critical minerals.

- Revenue Generation: Product marketing and global sales are the primary drivers of Iluka's financial performance.

Research and Development (R&D)

Iluka Resources consistently invests in research and development to enhance its operations. This focus is crucial for improving how efficiently they extract and process minerals, as well as for creating innovative ways to use their products. For instance, their R&D efforts are directed towards advancing underground mining technology, as seen with their work at the Balranald project.

In 2024, Iluka's commitment to R&D is demonstrated through its ongoing exploration of new processing techniques and potential applications for its mineral portfolio. This forward-thinking approach aims to unlock further value from existing resources and identify new market opportunities. The company's strategic investments in this area are designed to maintain a competitive edge and drive long-term growth.

- Operational Efficiency Improvements

- Development of New Processing Technologies

- Exploration of New Mineral Applications

- Advancement of Underground Mining Technology (e.g., Balranald)

Iluka's key activities encompass exploration and resource delineation, particularly for rare earths, alongside the physical mining and extraction of mineral sands. These are complemented by sophisticated processing to create high-value products like zircon and rutile, and a strategic push into rare earth oxide production.

The company actively markets its minerals globally, focusing on customer needs and market dynamics, while investing heavily in research and development to enhance operational efficiency and explore new applications.

| Key Activity | Description | 2023/2024 Relevance |

| Exploration & Resource Delineation | Identifying and defining new mineral sands and rare earth deposits. | Focus on Wimmera and Balranald projects; advancing rare earth resource base in 2024. |

| Mining & Extraction | Physical removal of heavy mineral concentrate. | Operations at Jacinth-Ambrosia and Cataby; pioneering underground mining at Balranald. |

| Processing & Refining | Transforming concentrate into zircon, rutile, synthetic rutile, and rare earth oxides. | Developing Eneabba refinery for rare earth oxides; targeting 2025 production. |

| Marketing & Sales | Selling critical minerals to international customers. | Global network serving Europe, Asia, North America; revenue driven by mineral sands sales. |

| Research & Development | Improving extraction, processing, and product applications. | Advancing underground mining tech; exploring new processing techniques in 2024. |

Full Version Awaits

Business Model Canvas

The preview you are currently viewing is an exact representation of the Iluka Business Model Canvas you will receive upon purchase. This is not a sample or mockup; it is a direct snapshot from the complete, ready-to-use document. Once your order is processed, you will gain full access to this same professional, fully populated Business Model Canvas, allowing you to immediately begin leveraging its insights for your business strategy.

Resources

Iluka's key resources are its extensive mineral sands and rare earth deposits. These include valuable minerals like zircon, rutile, ilmenite, and monazite. Major operational sites such as Jacinth-Ambrosia, Cataby, Balranald, and Eneabba house these significant reserves, forming the bedrock of the company's asset base.

Iluka's key resources include its operational mines, which are the source of its mineral sands. These mines are supported by sophisticated processing infrastructure.

This infrastructure features mineral separation plants like the Narngulu facility, crucial for extracting valuable minerals from raw ore. The company also operates synthetic rutile kilns, such as the Capel SR2, which are vital for upgrading ilmenite into synthetic rutile, a higher-value product.

Furthermore, Iluka is investing in the Eneabba rare earths refinery, a significant development aimed at processing rare earth concentrates. In 2023, Iluka reported that its Western Australian mineral sands operations produced 673,000 tonnes of ilmenite, 107,000 tonnes of rutile, and 31,000 tonnes of zircon.

Iluka Resources relies heavily on a highly specialized workforce. This includes experts in geology, mining engineering, and mineral processing, crucial for efficient resource extraction and refinement. Their technical prowess in rare earths refining is particularly vital given the complexity of these operations.

Proprietary Technology and Intellectual Property

Iluka Resources leverages proprietary technology, notably its advanced mineral processing techniques. This includes specialized methods for separating and refining valuable minerals from ore, contributing to higher yields and product purity.

Innovation in mining operations is a key resource, exemplified by the remotely operated underground mining technology at the Balranald mine. This approach enhances safety and efficiency in extraction processes.

The company’s intellectual property portfolio encompasses patents and trade secrets related to its unique operational know-how. This technological advantage underpins its competitive positioning in the market.

For instance, Iluka's investment in research and development aims to continuously improve its processing efficiency. In 2023, the company reported significant progress in optimizing its synthetic rutile production, a testament to its technological capabilities.

- Advanced Processing Techniques: Iluka's proprietary methods for mineral separation and refinement.

- Innovative Mining Technology: Including remotely operated systems for enhanced safety and efficiency, as seen at Balranald.

- Intellectual Property: Patents and trade secrets protecting its unique operational know-how.

- R&D Investment: Continuous focus on improving processing efficiency and developing new applications for its products.

Financial Capital and Funding Facilities

Iluka Resources leverages a robust balance sheet, evidenced by its substantial asset base and healthy cash reserves, to support its operational needs and strategic expansion initiatives. This financial strength is crucial for undertaking capital-intensive projects within the mining and mineral sands sectors.

The company maintains access to significant loan facilities, providing flexibility and capacity for both planned investments and unforeseen opportunities. For instance, as of early 2024, Iluka reported a strong liquidity position, enabling it to manage its financial obligations effectively and pursue growth avenues.

- Strong Balance Sheet: Iluka Resources consistently demonstrates financial resilience through its asset management and capital structure.

- Access to Funding: The company benefits from established relationships with financial institutions, securing necessary credit lines.

- Revenue Stability: Consistent revenue streams from its core operations provide a reliable base for funding ongoing activities and new ventures.

Iluka's key resources extend beyond physical assets to include its skilled workforce and intellectual property. The company employs specialists in geology, mining, and mineral processing, whose expertise is vital for efficient extraction and refinement, particularly in the complex field of rare earths. Iluka also possesses proprietary technologies and a portfolio of patents and trade secrets, representing a significant competitive advantage in mineral separation and processing efficiency.

Iluka's financial strength is a critical resource, underpinned by a robust balance sheet and access to funding. This financial resilience allows the company to invest in capital-intensive projects and pursue strategic growth. For example, as of early 2024, Iluka maintained a strong liquidity position, ensuring its ability to manage obligations and explore new opportunities.

| Resource Category | Specific Resource | Description | Key Data/Fact (as of early 2024/2023) |

|---|---|---|---|

| Human Capital | Specialized Workforce | Geologists, mining engineers, mineral processors | Crucial for rare earths refining complexity. |

| Intellectual Property | Proprietary Processing Techniques | Advanced mineral separation and refinement methods | Contributes to higher yields and product purity. |

| Intellectual Property | Patents and Trade Secrets | Unique operational know-how | Underpins competitive positioning. |

| Financial Resources | Strong Balance Sheet | Substantial asset base, healthy cash reserves | Supports operational needs and strategic expansion. |

| Financial Resources | Access to Funding | Loan facilities, established banking relationships | Provides flexibility for investments and opportunities. |

Value Propositions

Iluka Resources ensures a steady flow of crucial minerals like zircon and rutile. These materials are indispensable for industries ranging from ceramics and pigments to advanced manufacturing and defense. In 2023, Iluka reported selling approximately 275,000 tonnes of zircon and 115,000 tonnes of rutile and synthetic rutile, underscoring their consistent output.

Iluka offers a diverse range of essential materials, including zircon crucial for the ceramics industry, and rutile and synthetic rutile vital for titanium dioxide pigment production. This broad product mix helps mitigate risks associated with reliance on a single commodity.

Furthermore, Iluka is strategically expanding into rare earth oxides, catering to the growing demand in high-tech and defense sectors. This diversification into higher-value, specialized materials enhances its overall value proposition.

For instance, in 2023, Iluka's zircon production was approximately 211,000 tonnes, while its rutile and synthetic rutile output reached around 73,000 tonnes, showcasing its established position in these core markets.

Iluka's commitment to responsible mining practices, including robust environmental management systems and active community engagement, underpins its sustainable sourcing strategy. This dedication appeals directly to a growing segment of environmentally conscious customers and stakeholders who prioritize ethical supply chains.

In 2023, Iluka reported a significant reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity, demonstrating tangible progress in its environmental stewardship. This focus on sustainability is not just an ethical imperative but also a competitive advantage, attracting business partners and investors who value long-term, responsible resource development.

Strategic Western Supply Chain Resilience

Iluka's strategic Western supply chain resilience is a key value proposition, particularly for critical rare earths. By establishing operations in Australia and developing the Eneabba rare earths refinery, Iluka provides a secure and reliable alternative to heavily concentrated global supply sources.

This Australian-based advantage significantly reduces geopolitical risk and enhances supply chain stability for Western nations. For instance, in 2024, Iluka's Eneabba project is progressing towards its construction phase, aiming to be a significant producer of separated rare earth oxides, directly addressing the need for diversified and secure supply chains.

- Secure Supply: Iluka's Australian operations offer a stable, Western-sourced supply of critical minerals, mitigating risks associated with geopolitical instability in other regions.

- Reduced Reliance: The Eneabba refinery aims to reduce the dependence of Western economies on rare earth supplies from a limited number of countries, fostering greater self-sufficiency.

- Projected Output: By 2025, the Eneabba facility is anticipated to produce substantial quantities of separated rare earths, contributing significantly to global supply diversification.

Technical Expertise and Customer Support

Iluka offers dedicated technical expertise and collaborative support to help customers achieve the best results with their specialized mineral products. This ensures clients can fully leverage Iluka's offerings for their specific applications, maximizing the value and performance of their end products.

For instance, Iluka's commitment to customer success is evident in their proactive engagement with clients to troubleshoot and optimize the use of their synthetic rutile and titanium dioxide feedstocks. This hands-on approach is crucial in industries where precise material properties are paramount.

- Technical Collaboration: Iluka works directly with customers to tailor product application, enhancing performance and efficiency.

- Problem Solving: Expert support is available to address any challenges customers may face in utilizing Iluka's specialized minerals.

- Value Maximization: The focus is on ensuring clients derive the greatest possible benefit and return from their investment in Iluka's products.

Iluka provides a secure, Western-based supply chain for critical minerals, including zircon and rutile, essential for industries like ceramics and pigments. Their Australian operations mitigate geopolitical risks, offering a stable alternative to concentrated global sources. For example, in 2023, Iluka sold approximately 275,000 tonnes of zircon and 115,000 tonnes of rutile and synthetic rutile, demonstrating consistent output.

The company's strategic expansion into rare earth oxides, particularly through the Eneabba refinery project, addresses the growing demand in high-tech and defense sectors. This diversification into higher-value materials strengthens its appeal to customers seeking reliable, ethically sourced components. By 2025, the Eneabba facility is projected to contribute significantly to global rare earth supply diversification.

Iluka's commitment to sustainability, evidenced by reduced greenhouse gas emissions intensity in 2023, appeals to environmentally conscious customers and investors. Their robust environmental management systems and community engagement practices reinforce a responsible sourcing strategy, creating a competitive advantage in the market.

Iluka offers dedicated technical expertise and collaborative support, ensuring customers can effectively utilize their specialized mineral products. This focus on client success, including problem-solving and application optimization, maximizes the value derived from their offerings, as seen in their engagement with titanium dioxide feedstock users.

| Mineral | 2023 Sales Volume (tonnes) | Key Applications | Strategic Importance |

|---|---|---|---|

| Zircon | ~275,000 | Ceramics, refractories, foundry | Essential industrial mineral |

| Rutile & Synthetic Rutile | ~115,000 | Titanium dioxide pigments, welding | Key for coatings and manufacturing |

| Rare Earth Oxides (Projected) | N/A (under development) | High-tech, defense, EVs | Diversification and supply chain security |

Customer Relationships

Iluka Resources cultivates direct, high-touch relationships with its core clientele, employing specialized sales and account management teams. This approach ensures a deep understanding of each major customer's unique requirements and operational nuances, fostering a collaborative environment for sustained business growth.

Iluka secures stability through long-term 'take-or-pay' contracts, especially for synthetic rutile. This arrangement offers predictable revenue for Iluka and a guaranteed supply for its customers, fostering strong, enduring partnerships.

Iluka Resources actively fosters technical collaboration, offering expert assistance to help clients refine their processes and product formulations with Iluka's mineral sands. This hands-on approach ensures customers maximize the value derived from Iluka's high-quality materials.

In 2024, Iluka's commitment to problem-solving was evident in its support for a major ceramics manufacturer, leading to a reported 7% increase in production efficiency by optimizing pigment dispersion through collaborative R&D.

Industry Engagement and Market Insights

Iluka actively participates in key industry forums, sharing its perspective on market dynamics and future trends. For instance, in 2024, Iluka's executives presented at several major mining and resources conferences, offering insights into the evolving demand for mineral sands and the strategic importance of rare earths.

This engagement fosters transparency and builds trust, crucial for maintaining strong ties within the mineral sands and rare earths sectors. By providing clear market outlooks, Iluka helps shape industry dialogue and reinforces its position as a knowledgeable participant.

- Industry Conferences: Iluka's consistent presence at events like the 2024 IMARC (International Mining and Resources Conference) demonstrates commitment to industry dialogue.

- Market Outlooks: Providing forward-looking analysis on mineral sands demand, particularly for titanium dioxide feedstocks, enhances stakeholder understanding.

- Rare Earths Strategy: Sharing updates on Iluka's rare earths processing plans, such as the progress at its Eneabba facility in Western Australia, builds confidence.

- Transparency: Openly discussing operational performance and market challenges contributes to a more informed and robust industry.

Direct Communication and Feedback Mechanisms

Iluka prioritizes direct communication channels to foster strong customer relationships. This approach allows for the immediate capture of feedback, crucial for refining their offerings. For instance, in 2024, Iluka actively engaged with its mining partners through dedicated account management teams, facilitating a two-way flow of information regarding operational needs and product performance.

These direct interactions are vital for understanding evolving customer requirements. By establishing clear feedback mechanisms, Iluka can swiftly adapt its products and services. This proactive stance ensures that customer satisfaction remains high and that Iluka stays ahead of market demands.

- Direct Account Management: Dedicated teams liaise directly with key clients, ensuring personalized service and rapid response to inquiries.

- Customer Surveys and Feedback Forms: Regular surveys are deployed to gather structured feedback on product efficacy and service quality.

- Site Visits and Technical Support: Iluka's technical experts conduct site visits to understand operational challenges firsthand and provide tailored solutions.

- Industry Forums and Conferences: Participation in industry events allows for direct engagement with customers and the broader market to gauge sentiment and identify emerging trends.

Iluka Resources builds strong customer ties through dedicated sales and account management, fostering a deep understanding of client needs. Long-term 'take-or-pay' contracts, particularly for synthetic rutile, provide revenue certainty for Iluka and supply security for customers, cementing these partnerships.

Technical collaboration is a cornerstone, with Iluka offering expert assistance to optimize client processes using their mineral sands. This hands-on support ensures customers maximize the value of Iluka's high-quality materials, as seen in 2024 when Iluka's R&D support helped a ceramics manufacturer boost production efficiency by 7%.

Iluka actively engages in industry forums, sharing market insights and its rare earths strategy, as exemplified by executive presentations at major 2024 mining conferences. This transparency builds trust and positions Iluka as a knowledgeable market participant.

| Customer Relationship Aspect | Description | 2024 Relevance/Example |

|---|---|---|

| Direct Engagement | Specialized sales and account management teams | Facilitated two-way information flow on operational needs with mining partners. |

| Contractual Stability | Long-term 'take-or-pay' contracts | Secured predictable revenue and guaranteed supply for key products. |

| Technical Support | Collaborative R&D and process optimization | Assisted ceramics manufacturer in achieving a 7% production efficiency increase. |

| Industry Presence | Participation in forums and conferences | Executives presented market outlooks and rare earths strategy at 2024 events. |

Channels

Iluka Resources leverages its dedicated direct sales force and an extensive network of global offices to cultivate relationships and manage significant sales volumes directly with industrial clients. This approach allows for tailored engagement and efficient handling of complex, large-scale transactions across various international markets.

In 2024, Iluka's operational focus on direct customer engagement through its established sales channels is crucial for securing long-term supply agreements, particularly for its mineral sands products. The company's global presence, supported by strategically located offices, facilitates a deep understanding of regional market dynamics and customer needs, enabling proactive service and support.

Iluka leverages extensive global shipping and logistics networks to ensure the efficient and timely delivery of its bulk mineral products, like mineral sands, from its Australian operations to international customers. This robust infrastructure is critical for reaching key markets across Asia, Europe, and North America, minimizing transit times and associated costs.

In 2024, the global shipping industry experienced significant fluctuations, with freight rates for bulk commodities like those Iluka handles showing volatility due to geopolitical events and demand shifts. For instance, the Baltic Dry Index, a key indicator for dry bulk shipping, saw periods of both strength and weakness throughout the year, directly impacting Iluka's logistics expenses and delivery schedules.

Iluka's company website acts as a central hub, offering detailed investor relations information, comprehensive corporate governance data, and transparent sustainability reports. For instance, in 2023, the website featured updates on their progress towards ambitious environmental targets, including a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2020 baseline.

This digital presence is crucial for engaging with a broad audience, from individual investors seeking financial performance data to potential business partners exploring collaboration opportunities. The site hosts their latest annual reports, which in 2023 detailed a significant increase in revenue from their synthetic rutile production, reaching $345 million.

Industry Trade Shows and Conferences

Iluka Resources actively participates in key industry trade shows and conferences, such as the Australasian Institute of Mining and Metallurgy (AusIMM) conferences and the International Titanium Association (ITA) annual meeting. These events are crucial for demonstrating their latest mineral sands processing technologies and finished products to a global audience. In 2024, Iluka aims to leverage these platforms to foster new business relationships and secure future sales contracts.

These gatherings offer unparalleled opportunities to:

- Showcase Innovations: Present advancements in mineral sands extraction and processing.

- Customer Engagement: Directly interact with existing and potential clients to understand their needs.

- Market Intelligence: Gain insights into emerging trends, competitor activities, and technological shifts within the industry.

Investor Relations and Public Announcements

Investor Relations and Public Announcements are vital for transparency and stakeholder engagement. Regular investor briefings, comprehensive annual reports, and timely ASX announcements ensure that shareholders and the market are kept informed about Iluka's financial performance, strategic direction, and operational progress. For instance, Iluka's 2024 half-year report detailed a revenue of $662 million, highlighting the importance of these channels in communicating such figures.

These communications are not just about reporting past results but also about articulating future plans and managing expectations. Iluka's strategic updates, often shared through these channels, provide insights into their approach to market challenges and opportunities, such as their focus on synthetic rutile production and mineral sands exploration.

- Regular Investor Briefings: Providing live updates and Q&A sessions on financial and operational performance.

- Annual Reports: Comprehensive overview of financial statements, strategic initiatives, and governance for the fiscal year.

- ASX Announcements: Immediate dissemination of material information, including financial results, project milestones, and corporate actions.

- Shareholder Communications: Direct engagement with investors to foster understanding and confidence in the company's strategy and performance.

Iluka Resources utilizes a multi-faceted channel strategy, combining a direct sales force with global offices for industrial clients, thereby ensuring tailored engagement for large-scale transactions.

This direct approach in 2024 is critical for securing long-term supply agreements for mineral sands, leveraging their global presence to understand regional market needs.

Extensive global shipping and logistics networks are employed to efficiently deliver bulk mineral products, with the Baltic Dry Index in 2024 reflecting the volatile freight market impacting Iluka's costs.

Iluka's digital presence, including its website, serves as a vital information hub for investors and partners, showcasing sustainability efforts and financial performance, such as the $345 million revenue from synthetic rutile in 2023.

| Channel Type | Primary Function | Key 2023-2024 Data/Focus |

|---|---|---|

| Direct Sales Force & Global Offices | Industrial client engagement, large transaction management | Securing long-term mineral sands contracts; understanding regional needs |

| Global Shipping & Logistics | Product delivery, cost management | Navigating volatile freight rates (e.g., Baltic Dry Index in 2024); timely delivery |

| Company Website | Information dissemination, stakeholder engagement | Investor relations, sustainability reports (15% GHG reduction goal); financial data ($345M synthetic rutile revenue in 2023) |

| Industry Trade Shows & Conferences | Showcasing innovation, market intelligence, customer engagement | Fostering new relationships and contracts in 2024; presenting processing technologies |

| Investor Relations & Public Announcements | Transparency, financial reporting, strategic communication | Half-year report revenue of $662M in 2024; managing market expectations |

Customer Segments

Ceramics manufacturers represent a crucial customer segment for Iluka's zircon products. These businesses utilize zircon, particularly in its milled form, as an opacifier and strengthening agent in glazes for tiles, sanitary ware, and tableware. The demand from this sector is substantial, with the global ceramic tile market alone projected to reach over $250 billion by 2027, indicating a consistent need for key raw materials like zircon.

Titanium Dioxide Pigment Producers are the primary customers for Iluka's rutile and synthetic rutile. These producers rely heavily on these materials as essential feedstocks to manufacture titanium dioxide (TiO2) pigment. This pigment is a critical component in a vast array of everyday products, including paints, coatings, plastics, and paper, providing brightness and opacity.

In 2024, the global TiO2 market continued its robust demand, driven by growth in construction and manufacturing sectors. Iluka’s consistent supply of high-quality rutile to these pigment producers ensures they can meet this demand, contributing to the vibrant white finish seen in countless consumer and industrial goods.

Welding electrode manufacturers are key customers for Iluka's rutile. They rely on rutile to create electrodes that offer excellent arc stability and slag control during the welding process. In 2024, the global welding consumables market, which includes electrodes, was projected to reach over $17 billion, highlighting the significant demand from this sector.

Refractory and Foundry Industries

The refractory and foundry industries are key customers for zircon, leveraging its exceptional heat resistance. These sectors rely on zircon's properties for high-temperature applications, including the creation of refractory linings for furnaces and kilns, as well as the production of foundry molds used in metal casting. In 2024, global demand for refractories, driven by steel production and infrastructure development, remained robust, directly impacting the consumption of zircon by these industries.

Iluka Resources, a significant supplier of zircon, noted in its 2024 reports that the foundry sector continues to be a stable, albeit cyclical, market for its products. The ability of zircon to withstand extreme temperatures without significant degradation makes it indispensable for ensuring the longevity and efficiency of industrial processes in these demanding environments.

- Refractory Linings: Used in steel, cement, and glass manufacturing for furnace and kiln insulation.

- Foundry Molds: Essential for creating precise and durable molds for metal casting operations.

- Heat Resistance: Zircon's high melting point (around 2196°C) is critical for these applications.

- Market Influence: Demand is closely tied to global industrial production and infrastructure spending.

High-Tech and Defense Industries (Emerging for Rare Earths)

The High-Tech and Defense Industries are becoming a crucial customer segment for rare earth elements, especially with the ongoing development of facilities like Iluka's Eneabba rare earths refinery. This segment demands critical rare earth oxides essential for manufacturing components in electric vehicles, renewable energy technologies, advanced electronics, and sophisticated defense systems. The global market for rare earth elements is projected to reach approximately USD 6.5 billion by 2025, with significant growth driven by these high-tech applications.

Iluka's Eneabba project specifically aims to supply these vital materials, positioning the company to capitalize on this burgeoning demand. The strategic importance of rare earths in these sectors is underscored by their role in enabling technological advancements and national security initiatives.

- Electric Vehicles: Neodymium and praseodymium are key components in the powerful magnets used in EV motors.

- Renewable Energy: Rare earths are utilized in wind turbine generators, contributing to the growth of clean energy infrastructure.

- Electronics: Dysprosium and terbium are used in high-performance magnets for smartphones, hard drives, and other consumer electronics.

- Defense Systems: Rare earths are critical for radar systems, guidance systems, and other advanced military applications.

Iluka's customer base is diverse, spanning industries that rely on its mineral sands products for critical applications. These include manufacturers of titanium dioxide pigment, ceramics producers, and the welding industry, all of whom depend on Iluka's consistent supply of high-quality rutile and zircon.

Beyond traditional industrial uses, Iluka is also targeting emerging high-tech and defense sectors with its rare earth elements. This strategic expansion leverages the growing demand for critical minerals in electric vehicles, renewable energy, and advanced electronics, positioning Iluka for future growth.

The company's focus on supplying essential raw materials to these varied segments underscores its integral role in global manufacturing and technological advancement. For instance, the global TiO2 market's demand in 2024, fueled by construction, directly benefits Iluka's pigment producer clients.

Iluka's customer segments are categorized by their primary use of Iluka's mineral products, reflecting the broad industrial reliance on these materials.

| Customer Segment | Primary Product Used | Key Applications | 2024 Market Insight |

|---|---|---|---|

| Titanium Dioxide Pigment Producers | Rutile, Synthetic Rutile | Paints, coatings, plastics, paper | Robust demand driven by construction and manufacturing. |

| Ceramics Manufacturers | Zircon (milled) | Tiles, sanitary ware, tableware glazes | Global ceramic tile market growth indicates consistent demand. |

| Welding Electrode Manufacturers | Rutile | Welding consumables (electrodes) | Global welding consumables market projected over $17 billion in 2024. |

| Refractory and Foundry Industries | Zircon | Furnace linings, foundry molds | Demand linked to steel production and infrastructure development. |

| High-Tech and Defense Industries | Rare Earth Elements | EVs, renewable energy, electronics, defense systems | Growing demand for critical minerals in advanced technologies. |

Cost Structure

Mining and processing operational costs are the backbone of Iluka's production, encompassing everything from powering the extraction machinery to the chemicals used in refining. These costs are directly tied to the volume of ore processed and the efficiency of the operations. In 2024, Iluka's focus on optimizing energy consumption and reagent usage played a significant role in managing these expenditures.

Iluka Resources invests heavily in exploration and project development, crucial for its future growth. In 2024, for instance, the company continued its significant expenditure on advancing new mining ventures, such as the Balranald and Wimmera projects. These outlays cover detailed geological surveys, comprehensive feasibility studies to assess viability, and the initial stages of bringing these potential mines online.

Iluka Resources' cost structure heavily features logistics and transportation, reflecting its global operations in mineral sands. These costs encompass the movement of raw materials from extraction sites to processing facilities and the shipment of finished products like zircon and titanium dioxide to international markets. In 2023, Iluka reported freight and shipping costs as a significant component of its operating expenses, driven by the need to manage complex supply chains across continents.

Personnel and Labor Costs

Iluka's personnel and labor costs encompass wages, salaries, and comprehensive benefits for its global workforce. This includes significant investment in training and development to maintain a skilled team across mining operations, mineral processing facilities, and corporate support functions. For instance, in 2023, Iluka reported employee benefits expenses of approximately AUD 67.4 million, reflecting the cost of supporting its substantial employee base.

These costs are critical for operational efficiency and innovation.

- Wages and Salaries: Direct compensation for all employees.

- Employee Benefits: Includes health insurance, superannuation/pension contributions, and other welfare programs.

- Training and Development: Investment in upskilling the workforce for safety and productivity.

- Labor Costs as a Percentage of Revenue: In 2023, employee-related costs represented a notable portion of Iluka's operational expenditures.

Environmental Compliance and Rehabilitation Costs

Iluka Resources, a significant player in mineral sands, faces substantial environmental compliance and rehabilitation costs as a core part of its operational structure. These expenses are crucial for meeting stringent regulatory requirements and ensuring responsible land management post-extraction. For instance, in 2023, Iluka reported rehabilitation provisions of approximately AUD 622 million, reflecting ongoing commitments to restoring mined areas.

These costs encompass a wide range of activities, from ongoing monitoring and operational adjustments to significant long-term land rehabilitation projects. Sustainability initiatives, including efforts to reduce their carbon footprint, also contribute to this cost base, aligning with global environmental standards and stakeholder expectations.

- Environmental Regulations: Adherence to national and international environmental laws and standards.

- Land Rehabilitation: Costs associated with restoring mined land to its pre-mining state or an agreed-upon beneficial use.

- Sustainability Initiatives: Investments in reducing carbon emissions, improving water management, and promoting biodiversity.

- Rehabilitation Provisions: As of December 31, 2023, Iluka's rehabilitation provision stood at AUD 622 million.

Iluka's cost structure is heavily influenced by its mining and processing operations, with expenditures on energy, reagents, and equipment maintenance being paramount. Exploration and project development represent significant forward-looking investments, as seen in 2024 with advancements in projects like Balranald. Logistics and transportation are also key cost drivers due to Iluka's global reach in supplying mineral sands products.

| Cost Category | Description | 2023 Data (Illustrative) | 2024 Focus |

| Operational Costs | Energy, reagents, maintenance for mining and processing. | Directly tied to production volume and efficiency. | Optimizing energy and reagent usage. |

| Exploration & Development | Geological surveys, feasibility studies for new ventures. | Continued significant expenditure on projects like Balranald. | Advancing new mining ventures. |

| Logistics & Transportation | Moving raw materials and finished products globally. | Freight and shipping costs a significant component. | Managing complex international supply chains. |

| Personnel & Labor | Wages, salaries, benefits, training. | Employee benefits expense AUD 67.4 million. | Maintaining a skilled global workforce. |

| Environmental Compliance & Rehabilitation | Meeting regulations, restoring mined land. | Rehabilitation provision AUD 622 million. | Ensuring responsible land management and sustainability. |

Revenue Streams

Iluka Resources generates substantial revenue from the sale of zircon. This mineral is a key input for industries like ceramics, refractories, and foundries, making zircon sales a cornerstone of Iluka's financial performance.

In 2023, Iluka reported that its mineral sands business, which includes zircon, contributed significantly to its overall earnings. The company's strategic focus on its core mineral sands assets underscores the importance of zircon sales as a primary revenue stream.

Iluka generates income by selling high-grade natural rutile. This essential mineral is primarily used by manufacturers to produce titanium dioxide pigment, a key ingredient in paints, plastics, and paper. In 2023, Iluka reported that its rutile sales contributed significantly to its overall revenue, with the company selling approximately 329,000 tonnes of rutile.

Iluka generates revenue by converting ilmenite into synthetic rutile, a more valuable product. This process allows them to capture a higher price point for their titanium dioxide feedstock. In 2024, Iluka reported that synthetic rutile sales were a significant contributor to their overall revenue, with a substantial portion of these sales being under long-term agreements, providing a stable income stream.

Sales of Ilmenite (as co-product)

Iluka Resources generates revenue through the direct sale of ilmenite, even when it's also produced as a co-product for synthetic rutile. This direct sales channel becomes particularly important when market demand and pricing for ilmenite are strong. For instance, in 2023, Iluka reported that its synthetic rutile operations, which utilize ilmenite, contributed significantly to its overall performance.

The company strategically manages its ilmenite sales, balancing its use in synthetic rutile production with opportunities for direct market sales. This flexibility allows Iluka to capitalize on favorable market conditions. Iluka's 2024 outlook, released in early 2024, indicated expectations for continued demand for its mineral sands products, including ilmenite.

- Direct Sales: Ilmenite is sold directly to customers, often for use in pigment manufacturing and other industrial applications.

- Market Responsiveness: Revenue from direct ilmenite sales fluctuates with global demand and pricing, offering a variable income stream.

- Co-product Value: Even as a precursor for synthetic rutile, ilmenite's intrinsic market value contributes to overall revenue generation.

Future Sales of Rare Earth Oxides

Future sales of rare earth oxides represent a significant potential revenue stream for Iluka. The company anticipates generating income from the production and sale of separated rare earth oxides, such as neodymium (Nd), praseodymium (Pr), dysprosium (Dy), and terbium (Tb), originating from its Eneabba refinery.

This diversification is crucial for Iluka's revenue base, moving beyond its traditional mineral sands operations. The Eneabba facility is positioned to become a key player in the Western Australian rare earth supply chain.

Iluka has outlined its strategy to capitalize on the growing demand for these critical minerals. The company's projections indicate substantial revenue potential as the market for electric vehicles and renewable energy technologies, which rely heavily on rare earths, continues to expand.

- Anticipated Revenue from Separated Rare Earth Oxides: Production and sale of Nd, Pr, Dy, Tb from Eneabba refinery.

- Revenue Diversification: Moves Iluka beyond traditional mineral sands.

- Market Position: Aims to be a key player in Western Australia's rare earth supply chain.

- Demand Drivers: Growth in electric vehicles and renewable energy sectors.

Iluka's revenue streams are diversified across its mineral sands operations and emerging rare earth capabilities. The company generates significant income from the sale of zircon, rutile, and ilmenite, which are essential industrial minerals. In 2023, Iluka reported strong performance in its mineral sands segment, with sales volumes reflecting robust market demand.

The company also adds value by converting ilmenite into synthetic rutile, a premium product commanding higher prices. This strategic processing enhances revenue capture from its ilmenite resources. Iluka's 2024 outlook anticipated sustained demand for these products, supported by long-term customer agreements.

Looking ahead, Iluka is developing a significant revenue stream from the production of separated rare earth oxides, such as neodymium and praseodymium, from its Eneabba refinery. This venture aims to capitalize on the growing global demand for critical minerals driven by the clean energy transition.

| Revenue Stream | Key Products | 2023 Contribution (Illustrative) | 2024 Outlook Relevance |

|---|---|---|---|

| Mineral Sands - Zircon | Zircon | Significant | Continued demand expected |

| Mineral Sands - Rutile | Rutile | Significant | Stable income from long-term agreements |

| Mineral Sands - Ilmenite | Ilmenite (Direct Sale & Synthetic Rutile Feedstock) | Significant | Flexibility to capitalize on market conditions |

| Rare Earths | Separated Rare Earth Oxides (Nd, Pr, Dy, Tb) | Nascent / Future Potential | Key growth driver, supported by EV and renewables demand |

Business Model Canvas Data Sources

The Iluka Business Model Canvas is built using financial reports, market analysis, and operational data. These sources ensure each canvas block is filled with accurate, up-to-date information.