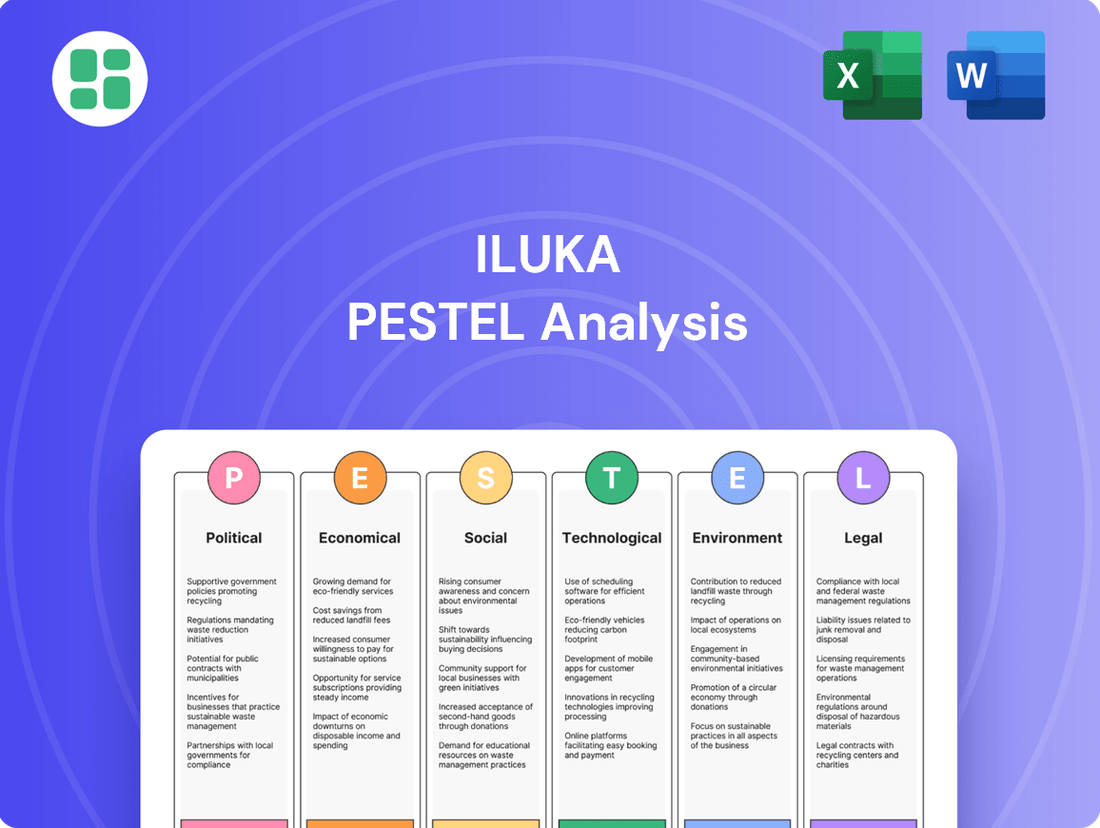

Iluka PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iluka Bundle

Unlock the critical external factors shaping Iluka's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and threats to the company. Equip yourself with the strategic intelligence needed to navigate this dynamic landscape. Download the full analysis now and gain a decisive advantage.

Political factors

Iluka's operations are entirely based in Australia, making government mining policies and regulations a critical factor. Changes in these rules, from permitting processes to operational standards, can directly influence project schedules and expenses. For instance, evolving environmental regulations might necessitate additional investment in compliance measures.

The Australian political landscape shows a clear commitment to critical minerals, which is beneficial for Iluka. A prime example is the A$120 million non-recourse loan provided by the Australian Government for Iluka's Eneabba Rare Earths Refinery. This financial backing underscores a supportive stance towards strategic resource development.

Global trade dynamics significantly shape Iluka's operational environment. The shifting landscape, marked by both expansive trade agreements and the resurgence of protectionist policies, directly impacts Iluka's access to key export markets and its position within the competitive arena. For example, while specific titanium dioxide feedstocks and rare earths have seen exemptions from recent US tariff impositions, zircon, a crucial product for Iluka, faces a 10% tariff. This tariff could potentially dampen sales volumes into the United States, necessitating strategic adjustments in marketing and market diversification efforts.

Geopolitical stability in Australia, where Iluka Resources primarily operates, remains a key strength. As of early 2024, Australia's stable political environment supports consistent operations and access to global markets for mineral sands. This contrasts with regions experiencing higher geopolitical volatility, which could disrupt supply chains for competitors.

However, shifts in global trade policies and international relations can still impact Iluka's market access and the reliability of demand forecasts. For instance, changes in tariffs or trade agreements involving key export markets could necessitate adjustments to Iluka's sales strategies and customer diversification efforts. The company's robust Australian base provides a degree of insulation from these broader international risks.

Resource Nationalism

Governments increasingly asserting control over natural resources, known as resource nationalism, poses a risk to Iluka's long-term access to mineral reserves and its operational freedom. This can manifest as altered royalty payments, new ownership mandates, or tighter regulations on export quantities. For instance, in 2024, several African nations continued to review and revise their mining codes to secure a larger share of resource revenues, a trend that, while not directly impacting Iluka's Australian operations, signals a broader global shift.

Iluka's primary operations are in Australia, a jurisdiction generally characterized by a stable regulatory environment. However, the company must remain vigilant to global trends in resource nationalism. For example, in late 2023, some South American countries implemented higher export taxes on critical minerals, demonstrating how quickly the landscape can change. Iluka's strategic planning must account for potential shifts in fiscal regimes or ownership requirements that could impact profitability and operational flexibility.

- Global Resource Nationalism Trends: Monitoring policy shifts in key resource-rich regions globally.

- Australian Regulatory Environment: Assessing the stability and potential changes in Australian mining laws and taxation.

- Impact on Reserve Access: Evaluating how potential government interventions might affect Iluka's ability to access and develop its mineral deposits.

- Operational Autonomy: Considering how changes in ownership requirements or export controls could limit strategic decision-making.

Government Support for Critical Minerals

Government initiatives to secure critical mineral supply chains are a significant tailwind for companies like Iluka. Australia's Critical Minerals Facility, for instance, has provided crucial funding for Iluka's Eneabba Rare Earths Refinery project. This facility is designed to de-risk and accelerate the development of strategic mineral projects, directly benefiting Iluka's expansion into the rare earths sector.

These policies offer tangible strategic advantages by potentially providing direct financial support, helping to secure off-take agreements with downstream users, and streamlining the often lengthy approval processes. Such governmental backing bolsters Iluka's competitive standing in the global rare earths market, a sector vital for advanced manufacturing and clean energy technologies.

- Government Funding: Australia's Critical Minerals Facility has committed significant capital to projects like Iluka's Eneabba refinery, underscoring direct financial support.

- Supply Chain Security: Policies aim to onshore and diversify supply chains for critical minerals, reducing reliance on single sources and enhancing national economic security.

- Expedited Approvals: Governments are increasingly looking to fast-track permitting and regulatory processes for critical mineral projects to meet demand.

- Strategic Partnerships: Government support often facilitates collaboration and off-take agreements, creating stable demand for Iluka's products.

Australia's stable political environment is a key asset for Iluka, fostering consistent operations and market access. Government backing for critical minerals, such as the A$120 million loan for Iluka's Eneabba Rare Earths Refinery, highlights a supportive stance. However, global resource nationalism trends, like increased export taxes seen in some South American nations in late 2023, present a risk that Iluka must monitor. Shifts in trade policies, including tariffs on products like zircon, can also impact sales volumes into key markets, necessitating strategic adaptation.

| Political Factor | Description | Impact on Iluka | Example/Data |

| Government Mining Policies & Regulations | Rules governing exploration, extraction, environmental standards, and permitting. | Affects project timelines, operational costs, and compliance requirements. | Evolving environmental regulations may require additional investment. |

| Critical Minerals Support | Government initiatives to boost domestic production and supply chains for strategic minerals. | Provides financial backing, de-risks projects, and potentially streamlines approvals. | A$120 million loan from Australian Government for Eneabba Rare Earths Refinery. |

| Global Trade Dynamics & Tariffs | International trade agreements, protectionist policies, and import/export duties. | Influences market access, competitiveness, and sales volumes in export markets. | 10% US tariff on zircon could dampen sales volumes into the United States. |

| Resource Nationalism | Governments asserting greater control over natural resources, often through higher royalties or ownership mandates. | Risks long-term reserve access, operational freedom, and profitability. | Increased export taxes on critical minerals in some South American countries (late 2023). |

What is included in the product

This Iluka PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, offering a comprehensive understanding of its operating landscape.

It provides actionable insights for strategic decision-making by identifying key external drivers and their potential influence on Iluka's future performance and market position.

Iluka's PESTLE analysis provides a clear, summarized version of external factors, simplifying complex market dynamics for easier referencing during strategic planning and reducing the pain of information overload.

Economic factors

Global commodity prices for zircon, rutile, and rare earth elements are critical to Iluka's financial performance. Fluctuations in these prices directly affect Iluka's revenue streams and overall profitability, as these are key products for the company.

In fiscal year 2024, Iluka experienced a downturn in mineral sands revenue, largely attributed to subdued demand in significant markets and seasonal factors impacting sales volumes. This highlights the sensitivity of Iluka's earnings to broader economic conditions and cyclical buying patterns.

The rare earth market presents its own set of challenges. While an established floor price exists for these commodities, the inherent volatility in their pricing introduces a notable risk factor for Iluka, potentially impacting forward-looking revenue projections and strategic planning.

The global economic outlook significantly influences Iluka's performance, particularly through its impact on industrial demand for its core products. A robust global economy generally translates to increased construction and manufacturing activity, directly boosting the need for mineral sands like titanium dioxide pigment, a key component in paints, plastics, and paper. For instance, in 2024, projections from the IMF anticipate global growth around 3.2%, a moderate but steady pace that should support demand for these industrial materials.

Conversely, any deceleration in global economic growth, or specific downturns in major manufacturing hubs, can lead to reduced industrial output and, consequently, lower demand for Iluka's mineral sands. A slowdown in sectors like automotive or construction, which are significant consumers of titanium dioxide, would directly impact Iluka's sales volumes and pricing power. The ongoing geopolitical uncertainties and inflationary pressures observed through early 2025 continue to pose risks to sustained global industrial expansion.

Iluka's strategic focus on critical minerals positions it to benefit from a strong global economy that drives demand across a wider array of industrial applications. As industries increasingly rely on advanced materials for technological innovation and infrastructure development, the demand for Iluka’s resources, including those used in welding applications and advanced ceramics, is expected to remain a key growth driver. The push towards electrification and renewable energy infrastructure, for example, often requires specialized mineral inputs that Iluka may supply.

As an Australian company with significant international sales, Iluka's financial performance is sensitive to fluctuations in the AUD/USD exchange rate. For instance, during the first half of 2024, a generally stronger Australian dollar against the US dollar would have a dampening effect on the reported Australian dollar value of Iluka's US dollar-denominated export revenues.

Conversely, a weaker Australian dollar, as seen in some periods of 2023 where the AUD dipped below 0.65 USD, would have the opposite effect, boosting the local currency value of those same international sales and potentially improving profit margins on exported goods.

Inflationary Pressures on Operating Costs

Rising inflation significantly impacts Iluka's operating expenses. Increased costs for essential inputs like energy, skilled labor, and machinery directly affect profitability in the mining and processing sectors.

Iluka itself acknowledged this trend, reporting a 3% increase in its total cash cost of production for fiscal year 2024. This figure highlights the tangible effect of these inflationary pressures on the company’s bottom line.

- Energy Costs: Global energy prices have seen upward volatility, directly increasing fuel and electricity expenses for mining operations.

- Labor Expenses: A tight labor market and wage inflation contribute to higher personnel costs for skilled workers.

- Equipment and Materials: The cost of acquiring and maintaining mining equipment and essential raw materials has also risen.

Effectively managing these escalating operating costs is paramount for Iluka to sustain its profit margins and maintain a competitive edge in the market.

Interest Rate Environment & Capital Costs

Changes in the interest rate environment directly impact Iluka's cost of capital. For instance, if central banks like the Reserve Bank of Australia or the US Federal Reserve continue their tightening cycles through 2024 and into 2025, borrowing costs for new projects or refinancing existing debt will likely increase. This could make the economics of developing new mineral sands projects or expanding existing operations less attractive.

Iluka's ability to manage these rising capital costs is partly supported by its financial health. As of its latest reports, the company has maintained a robust net cash position, which can provide a buffer against higher borrowing expenses and allow for more flexible financing of capital expenditures. This financial resilience is crucial in an environment where debt servicing becomes more expensive.

The impact of interest rates on Iluka's investment decisions is significant. For example, a project requiring substantial upfront capital investment might be re-evaluated if the projected return on investment falls below the increased hurdle rate dictated by higher interest rates. This could lead to a slowdown in the pace of new mine development or capacity expansions.

- Interest Rate Hikes: Global central banks, including the RBA and Federal Reserve, have signaled a cautious approach to rate cuts in 2024, with potential for continued stability or even further increases if inflation proves persistent, impacting Iluka's borrowing costs.

- Cost of Capital: Higher interest rates translate directly to increased costs for any new debt financing Iluka might seek for expansion projects or acquisitions, potentially raising the minimum acceptable return for new investments.

- Project Viability: The economic feasibility of Iluka's long-term projects, such as the development of new mines or processing facilities, becomes more sensitive to interest rate fluctuations, potentially delaying or altering investment plans.

- Net Cash Position: Iluka's reported net cash balance provides a degree of insulation, allowing it to self-fund certain initiatives or reduce reliance on external borrowing in a rising rate environment.

Iluka's financial performance is closely tied to global economic growth, which influences demand for its mineral sands. Projections for 2024 suggested moderate global growth, generally supporting industrial activity. However, economic slowdowns in key markets or manufacturing hubs pose a direct risk to Iluka's sales volumes and pricing power.

The company's strategic focus on critical minerals is a positive factor, aligning with industries driving technological innovation and infrastructure development. Continued investment in electrification and renewable energy is expected to sustain demand for Iluka's specialized resources.

Iluka's profitability is also impacted by currency fluctuations. A stronger Australian dollar in early 2024 reduced the reported value of its US dollar export revenues. Conversely, a weaker Australian dollar, as seen in periods of 2023, would enhance the local currency value of these sales.

Rising inflation significantly affects Iluka's operational costs, with the company reporting a 3% increase in its total cash cost of production for fiscal year 2024. Key cost drivers include energy, labor, and equipment expenses, necessitating effective cost management to maintain profit margins.

Full Version Awaits

Iluka PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Iluka PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to this detailed report to inform your strategic decisions.

Sociological factors

Iluka Resources places significant emphasis on community relations to maintain its social license to operate, a critical factor for its mining and mineral sands operations. The company actively engages with local stakeholders, ensuring transparent communication and addressing concerns promptly. This commitment is demonstrated through initiatives like the 'Iluka Lends a Hand' program, which supports community development projects.

In 2023, Iluka continued its investment in community programs, with specific figures detailing contributions to local infrastructure, education, and environmental stewardship across its operational regions in Western Australia and Victoria. For instance, their support for local employment and procurement directly benefits regional economies, fostering goodwill and mitigating potential operational disruptions. This proactive approach is essential for long-term operational continuity and social acceptance.

Iluka Resources, like many in the mining sector, faces the critical sociological challenge of securing and retaining a skilled workforce. In 2024, Australia's mining industry grappled with a shortage of specialized roles, impacting project timelines and operational costs. For Iluka, ensuring robust health, safety, and wellbeing programs is paramount to fostering a productive and engaged workforce, directly influencing operational efficiency and project execution.

Iluka's commitment to robust health and safety standards is crucial, influencing its public image and operational smoothness. The company actively cultivates a culture of safety through comprehensive systems and regular audits, aiming to safeguard its employees.

A key metric for Iluka is its Lost Time Injury Frequency Rate (LTIFR). For the year ended December 31, 2023, Iluka reported an LTIFR of 0.9, a significant improvement from 1.7 in 2022, demonstrating progress in their safety initiatives.

Consumer and Investor Demand for Sustainable Products

Consumers and investors are increasingly prioritizing sustainability, driving demand for ethically sourced and responsibly produced goods. This shift significantly impacts market dynamics and capital allocation, favoring companies with demonstrable environmental and social commitments.

Iluka's proactive stance on sustainability, including its ambitious decarbonisation targets and extensive land rehabilitation programs, directly addresses these growing expectations. For instance, Iluka has committed to reducing its Scope 1 and 2 greenhouse gas emissions by 30% by 2030 against a 2021 baseline.

This alignment with societal values translates into tangible business benefits, influencing purchasing decisions and investor confidence. Companies that effectively integrate sustainability into their operations often experience enhanced brand reputation and greater access to financing, particularly from ESG-focused funds.

- Growing Market Share: Sustainable product markets are expanding rapidly, with global ESG assets projected to reach $53 trillion by 2025, according to Bloomberg Intelligence.

- Investor Preference: A 2024 survey by PwC found that 70% of investors consider ESG factors material to their investment decisions.

- Iluka's Commitment: Iluka's investment in rehabilitation projects, such as its Western Australian operations, demonstrates a long-term commitment to environmental stewardship.

- Decarbonisation Goals: Iluka aims to achieve net-zero emissions by 2050, aligning with global climate action efforts.

Indigenous Rights and Cultural Heritage Protection

Iluka Resources acknowledges the profound importance of respecting Indigenous rights and safeguarding cultural heritage within its operational territories. This commitment is not merely a compliance issue but a cornerstone of responsible resource development. The company actively engages with diverse community stakeholders, with a particular emphasis on building strong relationships with Indigenous groups. This proactive approach is crucial for ensuring that exploration and development activities proceed with the utmost cultural sensitivity and awareness.

Iluka's engagement strategy involves thorough consultation and collaborative planning from the earliest stages of project lifecycles. This ensures that potential impacts on cultural heritage sites are identified and mitigated effectively. For instance, in 2024, Iluka continued its ongoing partnerships with Traditional Owner groups across its Western Australian operations, with specific heritage management plans being reviewed and updated in consultation with these communities.

- Community Engagement: Iluka invested significantly in community programs in 2024, focusing on Indigenous employment and training initiatives.

- Heritage Protection: The company's heritage management protocols are regularly reviewed and updated based on feedback from Indigenous stakeholders.

- Cultural Sensitivity Training: All personnel working in proximity to sensitive areas undergo mandatory cultural awareness and heritage protection training.

- Partnership Development: Iluka aims to foster long-term, mutually beneficial partnerships with Indigenous communities, recognizing their intrinsic connection to the land.

Sociological factors significantly influence Iluka Resources' operations, primarily through community relations and workforce management. The company's commitment to social license involves proactive engagement with local communities, as evidenced by their support for development projects and local employment, fostering goodwill and operational stability.

Iluka's focus on workforce health, safety, and wellbeing is paramount, especially given industry-wide challenges in securing skilled labor. Their improved Lost Time Injury Frequency Rate (LTIFR) of 0.9 in 2023, down from 1.7 in 2022, highlights their dedication to employee safety and operational efficiency.

The increasing societal demand for ethical and sustainable practices impacts Iluka's market position and investor appeal. By investing in rehabilitation and setting ambitious decarbonisation targets, such as a 30% reduction in Scope 1 and 2 emissions by 2030, Iluka aligns with these values, enhancing its brand reputation and access to capital.

Respecting Indigenous rights and cultural heritage is a core tenet of Iluka's operations. Through ongoing consultation and partnerships with Traditional Owner groups, the company ensures sensitive project development and heritage protection, reinforcing its commitment to responsible resource management.

| Factor | Iluka's Approach | 2023/2024 Data/Trend |

|---|---|---|

| Community Relations | Proactive engagement, support for local development | Continued investment in community programs |

| Workforce Safety | Emphasis on health, safety, and wellbeing programs | LTIFR improved to 0.9 in 2023 (from 1.7 in 2022) |

| Sustainability & Ethics | Addressing consumer and investor demand for responsible practices | Commitment to 30% Scope 1 & 2 emission reduction by 2030 |

| Indigenous Heritage | Respect for rights, cultural sensitivity, and collaboration | Ongoing partnerships and heritage management plan updates |

Technological factors

Continuous advancements in mining and processing technologies are significantly reshaping the industry. For instance, Iluka's innovative underground mining method at its Balranald project demonstrates how new techniques can boost efficiency and lower operational costs, potentially unlocking deposits that were previously unviable.

Iluka's commitment to research and development is crucial for capitalizing on these technological leaps. By investing in R&D, the company aims to stay at the forefront of innovation, ensuring it can effectively leverage new methods to improve its competitive edge and access a wider range of resources.

Digitalization and automation are revolutionizing mining, with companies like Iluka investing in technologies to boost efficiency and safety. This includes advanced remote monitoring systems and the integration of autonomous haul trucks, which can significantly reduce operational costs and human exposure to hazardous environments. For instance, the mining sector globally saw a significant increase in automation adoption, with an estimated 25% of mining companies planning to deploy autonomous systems by 2025, a trend Iluka is actively participating in.

These advancements enable more precise resource extraction and processing, leading to better yields and reduced waste. By leveraging data analytics, operations can be optimized in real-time, allowing for quicker responses to changing conditions and improved decision-making. This data-driven approach is crucial for maximizing profitability in a competitive market.

Iluka Resources is actively leveraging new technologies to enhance its exploration and resource definition capabilities. These advancements are crucial for identifying new mineral deposits and extending the productive life of existing mines, directly impacting the company's long-term viability and profitability.

Advanced geophysical and geological techniques, such as high-resolution seismic imaging and sophisticated geochemical analysis, are improving the accuracy and efficiency of resource discovery. For instance, in 2024, Iluka reported progress in its exploration programs, utilizing these cutting-edge methods to better understand subsurface geology and potential resource concentrations.

Iluka's exploration efforts are geographically diverse, spanning both Australia and international locations. This global reach allows the company to tap into a wider range of geological settings, increasing the probability of discovering significant new resources and mitigating risks associated with single-region dependency.

Development of New Applications for Mineral Sands

Innovation in how mineral sands are used is a significant technological driver, opening up new markets and boosting demand for these materials. Iluka, as a key player in this sector, stands to gain from the increasing integration of zircon, rutile, and rare earths into advanced technologies, defense systems, and the crucial sustainable energy sector.

The demand for rare earths, in particular, is intrinsically linked to the growth of electric vehicles and renewable energy infrastructure, highlighting a direct technological dependency. For instance, the global market for rare earth elements was projected to reach approximately $5.0 billion in 2024, with significant growth anticipated due to their critical role in magnets for wind turbines and electric car motors.

- Zircon's use in advanced ceramics and refractories continues to expand, driven by demand in electronics and aerospace.

- Rutile finds increasing application in high-performance welding and pigment production for advanced coatings.

- Rare earths are indispensable for permanent magnets in electric vehicle powertrains and wind turbine generators, with the global market for these magnets expected to grow substantially by 2030.

Research & Development in Sustainable Production

Iluka Resources is actively investing in research and development to foster more sustainable production methods. This focus includes exploring lower-emission energy sources and refining rehabilitation techniques to improve its environmental footprint. A key initiative is the commissioning of a solar farm at its Cataby site, a significant step towards reducing reliance on traditional energy sources and lowering its carbon emissions.

These R&D efforts are crucial for Iluka's long-term strategy, aiming to align its operations with increasing environmental regulations and stakeholder expectations. By enhancing its environmental performance, the company seeks to build resilience and maintain its social license to operate.

- Investment in R&D for sustainable production methods.

- Focus on lower-emission energy sources and improved rehabilitation techniques.

- Commissioning of a solar farm at the Cataby site.

- Enhancing environmental performance and reducing carbon footprint.

Technological advancements are a significant driver for Iluka, particularly in how its core products are utilized. Zircon's role in advanced ceramics for electronics and aerospace, and rutile's use in high-performance welding and coatings, are expanding markets. The critical demand for rare earths in electric vehicle powertrains and wind turbines, with the global rare earth magnet market projected for substantial growth by 2030, directly links Iluka's future to these technological shifts.

| Product | Key Technological Application | Market Driver | 2024/2025 Outlook |

|---|---|---|---|

| Zircon | Advanced ceramics, refractories | Electronics, aerospace | Expanding demand |

| Rutile | High-performance welding, pigments | Advanced coatings | Increasing application |

| Rare Earths | Permanent magnets (EVs, wind turbines) | Renewable energy, electric mobility | Strong growth projected, market valued around $5.0 billion in 2024 |

Legal factors

Iluka's operations are heavily influenced by stringent environmental laws and intricate permitting processes, particularly concerning its mining and processing activities. Compliance with regulations covering biodiversity protection, water resource management, and emission controls is paramount for securing and retaining operational licenses. For instance, in 2023, Iluka reported on its comprehensive environmental management initiatives, underscoring the significant legal and operational weight of these requirements.

The legal landscape surrounding mining tenures and land access significantly shapes Iluka Resources' operational capacity. Securing the rights to explore and extract minerals, often through complex tenure systems, is fundamental. For instance, in Western Australia, where Iluka operates, the Mining Act 1978 (WA) dictates the process for obtaining and maintaining mining leases, directly influencing project timelines and costs.

Navigating land access laws is equally critical, requiring Iluka to engage with various stakeholders, including private landowners and Indigenous communities. Agreements for land use, often negotiated under frameworks like the Native Title Act 1993 (Cth), are essential for operational continuity. These agreements can involve significant financial considerations and community benefit sharing, impacting project economics.

Iluka Resources operates under stringent corporate governance and reporting mandates, primarily dictated by the Australian Securities Exchange (ASX). This necessitates transparent disclosures regarding financial performance, environmental, social, and governance (ESG) initiatives, and robust risk management frameworks. For instance, Iluka's 2024 Annual Report demonstrates a commitment to the Global Reporting Initiative (GRI) Framework, a widely recognized standard for sustainability reporting, ensuring stakeholders receive comprehensive and comparable information.

International Trade & Sanctions Compliance

Iluka's global operations necessitate strict adherence to international trade regulations, encompassing tariffs and sanctions, which directly impact its sales and distribution channels. Navigating these complex legal frameworks is paramount for maintaining market access and ensuring smooth global commerce.

The evolving geopolitical landscape presents significant challenges, particularly concerning export controls. For instance, China's dominance in rare earth supply chains means that any imposition of export restrictions, such as those seen in 2023 impacting critical minerals, could drastically alter supply chain dynamics for companies like Iluka, affecting both raw material sourcing and finished product availability.

Iluka must therefore maintain robust compliance programs to mitigate risks associated with sanctions and trade disputes. This includes staying abreast of evolving trade policies from major economic blocs and proactively managing its supply chain to reduce reliance on single-source or politically sensitive regions.

- International Trade Laws: Iluka's ability to export its products globally is contingent on compliance with a patchwork of national and international trade laws, including those related to import duties and export licensing.

- Sanctions Compliance: Operating in diverse markets requires Iluka to meticulously screen its customers and partners against various international sanctions lists to avoid penalties and reputational damage.

- Export Controls: Potential restrictions on the export of critical minerals, as demonstrated by China's actions in late 2023, pose a direct threat to Iluka's supply chain stability and market reach for its mineral products.

- Supply Chain Resilience: Iluka's strategy must incorporate building resilience against trade disruptions by diversifying its supplier base and exploring alternative sourcing or production locations.

Taxation Policies & Royalties

Changes in government taxation policies and mining royalties significantly impact Iluka's financial health. These adjustments can include shifts in corporate tax rates, the introduction of specific mining levies, and royalty payments calculated on production volume or revenue streams. For instance, the Australian Federal Budget 2024 introduced a Critical Minerals Production Tax Credit, a measure that could potentially provide a financial uplift for Iluka's operations.

Iluka's tax obligations are multifaceted, encompassing standard corporate income tax and specific mining-related charges. The company's effective tax rate is a key performance indicator, directly influencing its net profit after tax. Fluctuations in these rates, whether at the federal or state level, require careful financial forecasting and strategic planning to mitigate adverse effects.

- Corporate Tax Rate: Iluka is subject to Australia's general corporate tax rate, which stood at 30% for larger companies in the 2023-24 financial year.

- Mining Royalties: Royalty rates vary by Australian state and mineral commodity, directly impacting the cost of production for Iluka's operations.

- Critical Minerals Tax Credit: The 2024 Australian Federal Budget's introduction of a production tax credit for critical minerals offers a potential avenue for cost reduction and improved profitability on eligible products.

- International Tax Exposure: While primarily Australian-based, any international operations or sales would expose Iluka to foreign taxation regulations, adding another layer of complexity.

Iluka's legal framework is complex, requiring adherence to environmental regulations, mining tenures, and land access agreements, particularly in Western Australia under the Mining Act 1978. Furthermore, the company must comply with stringent corporate governance and reporting standards, as exemplified by its 2024 commitment to the Global Reporting Initiative (GRI) Framework. International trade laws and potential export controls, especially concerning critical minerals as seen in late 2023, also significantly shape its global operations and supply chain strategies.

Environmental factors

Global efforts to curb climate change are intensifying, with governments worldwide implementing stricter regulations on carbon emissions. This directly affects companies like Iluka, influencing their operational costs and strategic direction. For instance, the Australian government's commitment to net-zero emissions by 2050, alongside state-level initiatives, necessitates a proactive approach to environmental management.

Iluka is actively assessing its exposure to climate-related risks, which include potential disruptions from extreme weather events and the financial implications of carbon pricing mechanisms. The company is also closely monitoring evolving federal and state environmental policies, such as changes to the Safeguard Mechanism, to ensure compliance and identify potential impacts on its mining and mineral processing activities.

In response, Iluka is exploring opportunities to transition to lower emission energy sources for its operations. This could involve investing in renewable energy projects or adopting more energy-efficient technologies. For example, the increasing availability and decreasing cost of solar and wind power in Australia present viable alternatives to traditional fossil fuels, potentially reducing Iluka's carbon footprint and operational expenses.

Iluka Resources demonstrates a strong commitment to biodiversity protection and land rehabilitation across its operational sites. The company actively rehabilitates hundreds of hectares each year, focusing on establishing sustainable land uses post-mining operations, a practice underpinned by its robust Health, Safety, Environment and Community (HSEC) Management System.

In 2023, Iluka reported significant progress in its rehabilitation efforts, with over 400 hectares undergoing rehabilitation, continuing a trend of substantial land restoration. This ongoing work aims to not only meet regulatory requirements but also to create positive environmental legacies, enhancing local ecosystems and supporting future land productivity.

Iluka Resources, a significant player in mineral sands, relies heavily on water for its mining and processing activities. In 2023, the company continued to emphasize sustainable water management across its global operations, particularly in regions facing water scarcity. This commitment is crucial for maintaining social license to operate and ensuring environmental stewardship.

Each of Iluka's sites conducts thorough water risk assessments, developing site-specific management plans. These plans are designed to ensure responsible water usage, minimizing impact on shared water resources and local ecosystems. This proactive approach is especially critical for operations in arid or semi-arid environments where water is a more constrained resource.

For instance, Iluka's operations in Western Australia, a region prone to drought, necessitate advanced water management techniques. By investing in technologies and processes that optimize water use and recycling, the company aims to reduce its overall water footprint and mitigate risks associated with water scarcity, a factor that could influence operational costs and expansion plans in the coming years.

Waste Management & Tailings Disposal

Effective waste management and safe tailings disposal are paramount for mining operations, including those of Iluka. The company's commitment to environmental stewardship is reflected in its comprehensive tailings management strategy, which adheres to stringent environmental standards to minimize ecological impact and ensure regulatory compliance.

Iluka's approach to tailings management is designed to mitigate environmental risks, such as potential water contamination and land disturbance. In 2023, Iluka reported investing $13.5 million in environmental rehabilitation and closure activities, a testament to their ongoing commitment to managing the legacy of mining operations and ensuring responsible waste disposal.

- Tailings Management: Iluka employs robust systems for the safe storage and containment of mine tailings, adhering to industry best practices and regulatory requirements.

- Environmental Standards: The company's environmental policies guide its waste management protocols, aiming to prevent pollution and protect biodiversity.

- Risk Mitigation: Proper tailings disposal is critical for preventing environmental incidents and maintaining social license to operate.

- Rehabilitation Investment: Iluka's ongoing investment in rehabilitation, as seen in their 2023 environmental expenditure, underscores their dedication to long-term environmental responsibility.

Energy Transition & Renewable Energy Adoption

Iluka Resources plays a vital role in the global energy transition by supplying critical minerals like rare earths, which are fundamental components in electric vehicles and renewable energy infrastructure. For instance, the demand for rare earths is projected to surge, with some estimates suggesting a near doubling by 2030 driven by EV and wind turbine manufacturing.

The company is actively integrating renewable energy into its own operational framework. A prime example is the 9MW solar farm at its Cataby mineral sands operation in Western Australia, which commenced operations in 2022 and is designed to significantly reduce its reliance on fossil fuels for power generation.

- Critical Mineral Supply: Iluka provides essential rare earth elements crucial for the manufacturing of permanent magnets used in EV motors and wind turbines, directly supporting decarbonization efforts.

- Operational Renewables: The 9MW solar farm at Cataby demonstrates Iluka's commitment to reducing its carbon footprint by generating clean energy for its processing facilities.

- Market Growth: The accelerating adoption of electric vehicles and renewable energy projects globally is creating substantial demand for the minerals Iluka supplies.

Iluka's environmental strategy is shaped by global decarbonization efforts and evolving regulations. The company is actively managing its carbon footprint, with a focus on reducing emissions and exploring cleaner energy sources, as seen in its 2023 investment of $13.5 million in environmental rehabilitation and closure activities.

The company's commitment to biodiversity and land rehabilitation remains strong, with over 400 hectares undergoing restoration in 2023. This aligns with stringent environmental standards and a proactive approach to managing the long-term impact of mining operations.

Sustainable water management is a key focus, particularly in water-scarce regions like Western Australia. Iluka implements site-specific plans to ensure responsible water usage and minimize ecological impact, crucial for maintaining its social license to operate.

Iluka plays a critical role in the energy transition by supplying rare earth elements, essential for EVs and renewable energy infrastructure. The company is also integrating renewables into its operations, such as the 9MW solar farm at its Cataby site, which began operations in 2022.

PESTLE Analysis Data Sources

Our Iluka PESTLE Analysis draws from a comprehensive range of data, including government reports on resource management and environmental regulations, international trade agreements, and economic forecasts from reputable financial institutions. We also incorporate industry-specific market research and technological advancement updates to ensure a holistic view.