The IHC Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The IHC Group Bundle

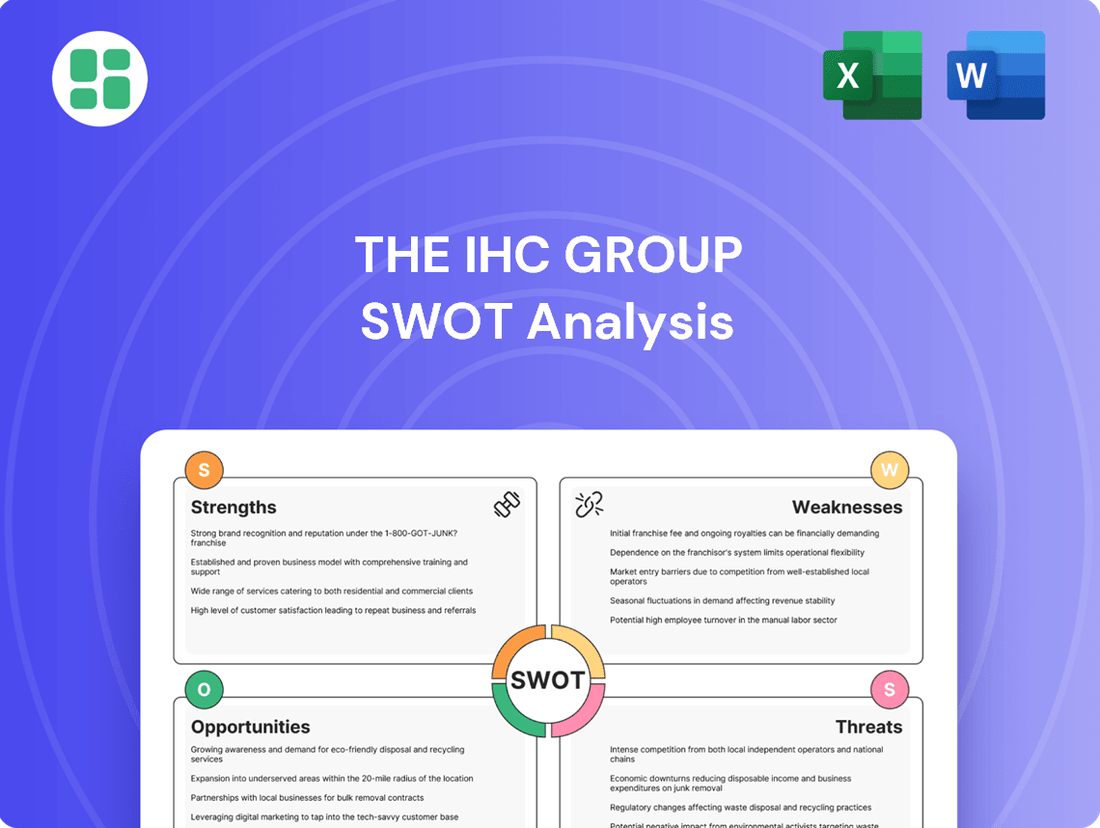

The IHC Group's market position is shaped by a blend of robust operational strengths and emerging opportunities, but also faces potential challenges from competitive pressures and evolving industry landscapes.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Independence Holding Company boasts a robust and varied product lineup, encompassing life, annuity, and multiple health insurance offerings. This breadth, featuring products like medical stop-loss, group term life, and short-term medical, enables the company to serve a wide array of customers.

This diversification significantly reduces the inherent risks of depending too heavily on a single product category, providing a more stable revenue stream. For instance, in 2023, the company reported a substantial increase in its group life and disability segment, demonstrating the strength of its diversified approach.

The IHC Group's specialization in niche markets, such as medical stop-loss and supplemental health insurance, offers a distinct competitive advantage. These focused areas allow for the development of deep expertise and highly tailored solutions, catering to unique customer demands with less broad market competition.

The medical stop-loss insurance market, a key area for IHC, was valued at an estimated $26.9 billion in 2024. This segment is expected to experience robust growth, underscoring the strategic benefit of IHC's concentration in this specialized and expanding sector.

The IHC Group's reinsurance capabilities are a significant strength, bolstering its primary insurance offerings and fortifying its financial stability. This strategic approach to risk management allows IHC to cede a portion of its liabilities, thereby enhancing its capacity to underwrite larger risks and absorb potential unforeseen losses. As of early 2024, the global reinsurance market experienced a notable hardening, with reinsurers demanding higher premiums due to increased catastrophic event frequency, a trend that IHC can leverage to its advantage by securing favorable terms for its risk transfer needs.

Broad Market Reach (Individuals and Groups)

The IHC Group's ability to serve both individual and group clients significantly broadens its market reach, allowing it to capture a larger share of the insurance and financial services landscape. This dual approach diversifies revenue streams, as individual clients often have different needs and purchasing behaviors than group clients, such as employers or associations. For instance, in 2024, the group insurance segment continued to show robust growth, contributing to a substantial portion of their overall premium income, while their individual product lines also saw steady uptake. This strategy helps mitigate risks associated with over-reliance on any single market segment.

This broad market appeal translates into greater financial stability and growth potential. By catering to diverse customer needs, IHC can adapt more effectively to changing market dynamics and economic conditions. Their strategy in 2025 is focused on further leveraging this broad base by offering tailored solutions that appeal to both segments, aiming to increase customer lifetime value across the board. This dual focus is a key differentiator, enabling them to tap into distinct customer segments with unique needs, thereby fostering deeper market penetration.

- Diversified Revenue: Serving both individuals and groups creates multiple income sources, reducing reliance on any single market.

- Market Penetration: Tapping into distinct customer segments allows for deeper market penetration and broader brand recognition.

- Customer Segmentation: The ability to cater to varied needs within both individual and group markets allows for highly targeted product development and marketing.

- Resilience: A broad client base enhances financial resilience, making the company less vulnerable to downturns in specific sectors.

Established Market Presence

Independence Holding Company, established in 1980, boasts a significant and enduring presence within the insurance industry. This extensive history translates into deep-seated industry expertise and strong brand recognition, crucial advantages in a dynamic market.

The company has cultivated a robust network of general agents, independent brokers, and producers over its decades of operation. This established distribution channel is a powerful asset, facilitating market penetration and sales growth.

As of the first quarter of 2024, IHC Group reported total assets of approximately $8.5 billion, underscoring its substantial market standing and operational scale. This financial strength further solidifies its established market presence.

Key strengths stemming from its established market presence include:

- Longevity and Experience: Over 40 years in the insurance sector.

- Brand Recognition: A trusted name within the industry.

- Extensive Distribution Network: Access to a wide array of sales channels.

- Accumulated Industry Knowledge: Deep understanding of market dynamics and customer needs.

Independence Holding Company's diversified product portfolio, spanning life, annuity, and various health insurance lines, is a core strength. This breadth, including niche offerings like medical stop-loss and short-term medical, allows IHC to cater to a broad customer base and reduces reliance on any single product category, fostering revenue stability. For example, in 2023, the company saw significant growth in its group life and disability segment, highlighting the benefits of this diversified approach.

The company's strategic focus on specialized markets, particularly medical stop-loss insurance, provides a distinct competitive edge. This specialization allows for deep expertise and tailored solutions, meeting unique customer demands in a less crowded competitive space. The medical stop-loss market was valued at approximately $26.9 billion in 2024 and is projected for strong growth, underscoring the strategic advantage of IHC's concentration in this expanding sector.

IHC's robust reinsurance capabilities are a significant strength, enhancing its primary insurance offerings and financial resilience. This allows them to manage risk effectively, cede liabilities, and underwrite larger risks. The global reinsurance market, experiencing a hardening in early 2024 with increased premiums, presents an opportunity for IHC to secure favorable terms for risk transfer.

The company's ability to serve both individual and group clients expands its market reach and diversifies revenue streams. This dual focus mitigates risks associated with over-reliance on one segment, as seen in the continued robust growth of their group insurance segment in 2024, which contributed significantly to overall premium income alongside steady uptake in individual product lines. Their 2025 strategy aims to leverage this broad base with tailored solutions for both segments.

| Strength Category | Key Aspect | Supporting Data/Example |

|---|---|---|

| Product Diversification | Broad product lineup (life, annuity, health) | Growth in group life and disability segment (2023) |

| Market Specialization | Niche markets (e.g., medical stop-loss) | Medical stop-loss market valued at $26.9 billion (2024) |

| Risk Management | Reinsurance capabilities | Leveraging hardening global reinsurance market (early 2024) |

| Market Reach | Serving individual and group clients | Robust growth in group insurance segment (2024) |

What is included in the product

Delivers a strategic overview of The IHC Group’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis for the IHC Group, simplifying complex strategic challenges into manageable insights.

Weaknesses

While IHC Group's focus on specific health segments like medical stop-loss is a strength, it also presents a potential weakness. A significant concentration in these areas could leave the company vulnerable to shifts in regulations or market dynamics unique to those segments. For instance, changes in employer self-funding trends or unexpected escalations in healthcare costs could disproportionately affect IHC's profitability within its specialized niches.

The IHC Group, like many health insurers, faces significant vulnerability to shifts in healthcare policy. For instance, potential changes to the Affordable Care Act (ACA) or new federal mandates could directly affect the profitability and marketability of its products. This regulatory uncertainty necessitates constant vigilance and strategic agility to navigate evolving compliance landscapes and maintain competitive positioning.

The insurance landscape is intensely competitive, with established national and international players boasting significant financial muscle and widespread brand loyalty. This presents a formidable challenge for IHC Group, as these larger entities can leverage greater resources for marketing campaigns and offer a more extensive range of products, potentially overshadowing IHC's market presence.

Capital Intensity of Insurance Operations

The insurance industry, particularly in life, annuity, and health sectors, demands significant capital reserves. These reserves are crucial for meeting stringent regulatory mandates and ensuring the ability to pay out future claims. For instance, U.S. life insurers, as of the end of 2023, held approximately $1.4 trillion in statutory reserves, highlighting the sheer scale of capital required.

This inherent capital intensity can constrain operational flexibility. Companies like The IHC Group may find their ability to pursue rapid expansion or invest in entirely new business lines restricted unless they can secure substantial external financing or demonstrate robust internal capital generation. This can slow down innovation and market share growth compared to less capital-intensive industries.

- Substantial Capital Reserves: Life, annuity, and health insurance operations necessitate large capital reserves to satisfy regulatory requirements and manage potential claims payouts.

- Limited Expansion Flexibility: The high capital requirements can hinder rapid expansion or investment in new ventures without external funding or strong internal capital generation.

- Regulatory Capital Demands: Meeting solvency and capital adequacy ratios, such as the Risk-Based Capital (RBC) framework in the U.S., requires insurers to maintain significant capital buffers, impacting strategic agility.

Impact of Past Divestitures

Independence Holding Company's divestiture of its traditional insurance operations, completed by early 2022, significantly reshaped its business model. The sale of these entities, with only a residual minority stake retained in pet insurance, means the company no longer benefits from the revenue streams and market presence of wholly-owned insurance businesses.

This strategic pivot away from core insurance underwriting could limit its ability to leverage established distribution networks and brand recognition in those traditional markets. Consequently, the company's future growth trajectory in previously core segments may be constrained by this structural change, requiring a focus on new avenues for expansion.

- Divestiture Completion: Sale of former insurance companies concluded between late 2021 and early 2022.

- Remaining Interest: Only a minority stake in a pet insurance operation remains.

- Business Profile Shift: No longer holds wholly or majority-owned traditional insurance operations.

- Growth Impact: Altered business profile may affect future growth in formerly core insurance segments.

The IHC Group's strategic shift away from traditional insurance underwriting, marked by the divestiture of its core operations by early 2022, presents a notable weakness. This move means the company no longer benefits from the consistent revenue streams and established market presence these businesses provided.

Consequently, the company's ability to leverage existing distribution networks and brand recognition in those formerly core insurance markets is diminished. This structural change could constrain future growth opportunities in segments where it previously held a strong footing, necessitating a reliance on newer, potentially less proven, growth avenues.

The intense competition within the insurance sector is a significant hurdle. Larger, well-established national and international players possess greater financial resources for marketing and can offer a broader product portfolio, potentially overshadowing IHC's market visibility and customer acquisition efforts.

Preview the Actual Deliverable

The IHC Group SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for The IHC Group. This means the comprehensive report, detailing strengths, weaknesses, opportunities, and threats, is exactly what you'll receive. Purchase unlocks the entire in-depth version, providing you with actionable insights.

Opportunities

The increasing burden of healthcare costs, with out-of-pocket expenses rising for many, is fueling a significant demand for supplemental health products. This trend is expected to continue as individuals seek to manage unexpected medical bills and enhance their coverage. For instance, in 2023, average deductibles for employer-sponsored health plans reached $1,731 for individuals, a figure that often necessitates additional insurance solutions.

IHC's established expertise in the supplemental health insurance sector provides a strong foundation to capitalize on this market expansion. By focusing on developing innovative and affordable products, the company is well-positioned to attract a larger customer base navigating these financial pressures.

The shift towards self-funded health plans by employers, driven by a desire for cost control, is a significant tailwind for medical stop-loss insurance providers. This trend is creating a burgeoning demand for the very products IHC Group offers. The market for stop-loss insurance is experiencing robust growth, with projections indicating continued expansion through 2025 and beyond, making it a prime area for IHC to focus its strategic efforts.

IHC Group is well-positioned to benefit from this market dynamic by broadening its client base and innovating its stop-loss offerings. Developing more adaptable and all-encompassing stop-loss solutions tailored to the varied needs of employers, from small businesses to larger enterprises, will be key. The increasing adoption of self-funding, particularly among mid-sized employers, presents a substantial opportunity for IHC to capture market share.

The IHC Group can significantly boost its operations by embracing cutting-edge technologies. Implementing AI and advanced data analytics can streamline claims processing, a critical area for efficiency. For instance, in 2024, the insurance industry saw a 15% increase in straight-through processing rates for simple claims due to AI adoption, a benchmark IHC could aim for.

Investing in InsurTech is another avenue for competitive advantage. Digital platforms and AI-powered customer service tools can enhance customer engagement and provide a more personalized experience. By adopting these solutions, IHC can expect to reduce administrative costs, potentially by 10-20% in areas like underwriting and claims handling, as observed in early adopters within the sector during 2024-2025.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions present a significant opportunity for The IHC Group to accelerate growth and market penetration. By collaborating with leading healthcare providers, IHC can integrate its insurance solutions more seamlessly into patient care pathways, enhancing value for both providers and members. For instance, a partnership with a major hospital network could grant IHC access to a substantial new member base, potentially increasing its customer reach by millions.

Teaming up with innovative technology firms could bolster IHC's digital capabilities, improving member experience through advanced telehealth platforms or AI-driven health management tools. Acquiring smaller, specialized insurers or InsurTech startups is another avenue to quickly expand product portfolios, such as adding niche health insurance plans or innovative wellness programs. This strategy was evident in the broader insurance market in 2024, with several mid-sized insurers being acquired to gain technological advantages and market share, a trend expected to continue into 2025.

These strategic moves can unlock several benefits:

- Expanded Product Offerings: Access to new insurance lines or specialized health services.

- New Customer Segments: Entry into previously untapped markets or demographic groups.

- Enhanced Distribution: Leveraging partners' existing networks to reach more potential customers.

- Geographic Expansion: Entering new regions or countries through acquisition or alliance.

Increasing Pet Insurance Market Penetration

The IHC Group can capitalize on the burgeoning pet insurance sector through its minority stake in Independence Pet Holdings, Inc. This market is seeing significant expansion, driven by a surge in pet ownership and a growing owner desire to mitigate escalating veterinary expenses. This presents a clear path for IHC to diversify its revenue streams beyond its core human health insurance offerings.

The pet insurance market is projected for robust growth. For instance, the U.S. pet insurance market was valued at approximately $2.8 billion in 2023 and is anticipated to reach around $11.2 billion by 2030, exhibiting a compound annual growth rate (CAGR) of over 21%. This upward trend underscores a substantial opportunity for IHC to leverage its existing infrastructure and market presence.

- Growing Pet Ownership: Millions of households are welcoming pets, creating a larger addressable market for insurance products.

- Rising Veterinary Costs: Advanced treatments and specialized care contribute to increasing vet bills, making insurance a more attractive proposition for pet owners.

- Market Penetration Potential: Despite growth, pet insurance penetration in the U.S. remains relatively low compared to other developed nations, indicating ample room for expansion.

- Diversification Strategy: Expanding into pet insurance aligns with IHC's strategy to broaden its insurance portfolio and tap into new, high-growth segments.

The rising demand for supplemental health insurance, driven by increasing healthcare costs and deductibles, presents a significant growth avenue for IHC. For example, the average deductible for employer-sponsored health plans in 2023 was $1,731 for individuals, highlighting the need for supplementary coverage.

The increasing trend of employers self-funding health plans creates a strong market for medical stop-loss insurance, a core offering for IHC. This market is projected for continued expansion through 2025, offering substantial opportunities for IHC to broaden its client base.

Embracing InsurTech and AI for streamlined claims processing and enhanced customer engagement can significantly improve operational efficiency and competitive positioning. Early adopters in the insurance sector saw administrative cost reductions of 10-20% in 2024-2025 through such technologies.

Strategic partnerships and acquisitions offer a pathway for IHC to expand its product lines, reach new customer segments, and enhance its distribution networks. The pet insurance market, where IHC has a stake, is a prime example of a high-growth area, with U.S. market value projected to reach $11.2 billion by 2030, growing at over 21% CAGR.

Threats

The insurance sector, especially health and life insurance, is under constant and evolving regulatory oversight. This intensified scrutiny, as seen with ongoing discussions around solvency requirements and consumer protection measures in various markets, can directly translate into higher operational costs for companies like IHC Group.

Meeting new compliance mandates often requires substantial investments in legal, IT, and administrative resources. For instance, data privacy regulations like GDPR or similar frameworks being adopted globally necessitate robust systems and ongoing training, directly impacting a company's bottom line and potentially affecting profitability.

Economic volatility presents a significant threat to The IHC Group. Downturns can lead to reduced spending on insurance premiums by both consumers and employers, directly impacting revenue streams. For instance, a projected slowdown in global GDP growth for 2024-2025 could translate to tighter household budgets and cautious corporate spending, affecting demand for IHC's offerings.

Interest rate fluctuations pose another substantial risk. As an insurer, IHC relies heavily on investment income to bolster its financial performance. Changes in interest rates can directly affect the returns generated from its investment portfolio. For example, a sudden increase in rates might devalue existing bond holdings, while prolonged low rates could compress yields on new investments, impacting overall profitability.

Persistent increases in healthcare costs and the growing severity of medical claims are significant threats to The IHC Group's profitability in their health and medical stop-loss insurance lines. These trends directly inflate loss ratios, squeezing underwriting margins. For instance, the Centers for Medicare & Medicaid Services (CMS) projected that national health expenditures would grow by 5.4% in 2024, reaching $5.1 trillion. This upward pressure necessitates frequent premium adjustments or substantial product redesigns to maintain financial viability.

Cybersecurity Risks and Data Breaches

As a company entrusted with sensitive personal and health data, IHC is inherently exposed to significant cybersecurity threats. The increasing sophistication of cyberattacks means a data breach could have severe repercussions.

The financial fallout from a breach can be immense, encompassing costs for incident response, system recovery, and potential legal liabilities. Moreover, regulatory bodies are imposing stricter penalties; for instance, the average cost of a data breach in the healthcare sector reached $10.10 million in 2023, according to IBM's Cost of a Data Breach Report.

- Reputational Damage: A data breach can severely damage customer trust, impacting IHC's market position and ability to attract new clients.

- Financial Penalties: Regulatory fines, such as those under HIPAA or GDPR, can be substantial, adding to the direct costs of a breach.

- Operational Disruption: Remediation efforts can lead to significant downtime, affecting service delivery and revenue generation.

- Loss of Competitive Advantage: Stolen proprietary information or customer lists can be exploited by competitors.

Competitive Pressure and Pricing Wars

The insurance industry is intensely competitive, and IHC Group faces significant pressure from rivals. This can translate into pricing wars, where companies aggressively lower premiums to attract customers, potentially squeezing profit margins for everyone involved. For instance, in 2024, the U.S. health insurance market saw continued consolidation and aggressive pricing tactics from major players, impacting smaller or niche insurers.

Larger, established insurance companies often have economies of scale that allow them to absorb lower premiums more effectively than IHC. Furthermore, new market entrants, particularly those leveraging technology and innovative distribution models, can disrupt the traditional pricing landscape. This dynamic could force IHC to re-evaluate its own pricing strategies, potentially leading to reduced profitability if it needs to match competitor offers to remain competitive.

- Intensifying Competition: The insurance sector is characterized by a high number of players, leading to constant competition for market share.

- Pricing Pressures: Competitors' aggressive pricing can force IHC to lower its own premiums, impacting revenue and profitability.

- Impact of Larger Players: Established insurers with greater financial resources can engage in price wars more sustainably, creating a disadvantage for IHC.

- New Entrants and Innovation: Disruptive technologies and business models from new market entrants can further intensify pricing challenges.

The IHC Group operates within a highly regulated environment, facing evolving compliance requirements that can increase operational costs. For example, data privacy regulations and solvency standards demand significant investment in IT and administrative resources, directly impacting profitability.

Economic downturns and interest rate fluctuations present considerable threats, potentially reducing premium revenue and investment income. A projected global GDP slowdown for 2024-2025 could curb consumer and employer spending on insurance, while interest rate volatility impacts the yield on IHC's investment portfolio.

Rising healthcare costs and claim severity directly challenge IHC's health and medical stop-loss lines, inflating loss ratios. With national health expenditures projected to grow by 5.4% in 2024, IHC must navigate these pressures through premium adjustments or product redesigns.

Cybersecurity threats are a constant danger, with the average cost of a data breach in healthcare reaching $10.10 million in 2023. A breach could lead to substantial financial penalties, reputational damage, and operational disruptions for IHC.

Intense competition, particularly from larger players and innovative new entrants, exerts downward pressure on premiums. This can force IHC into pricing wars, potentially squeezing profit margins and requiring strategic adjustments to remain competitive in the 2024-2025 market.

SWOT Analysis Data Sources

This IHC Group SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary to provide a robust and actionable strategic overview.