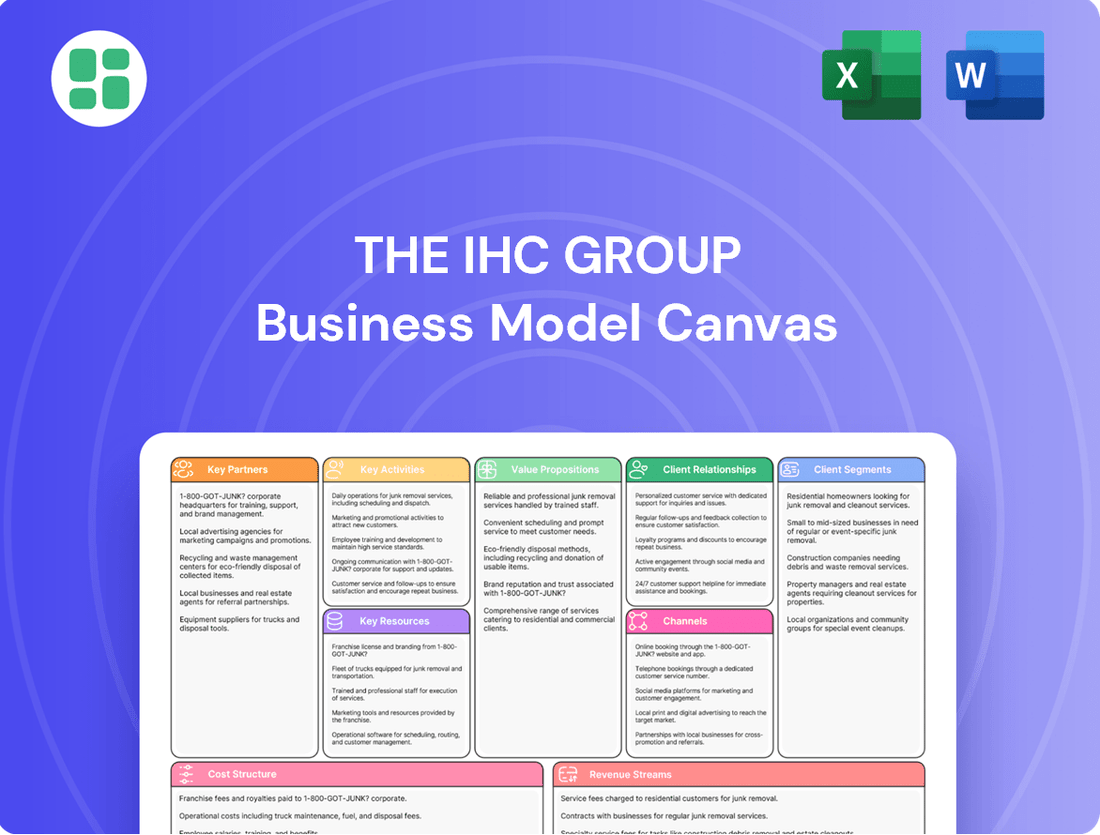

The IHC Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The IHC Group Bundle

Unlock the strategic blueprint behind The IHC Group's success with our comprehensive Business Model Canvas. Discover their unique value proposition, target customer segments, and key revenue streams that drive their market position. This detailed analysis is your key to understanding their operational excellence and competitive advantage.

Ready to gain a deeper understanding of The IHC Group's proven business model? Our full Business Model Canvas provides an in-depth, section-by-section breakdown, revealing their customer relationships, cost structure, and revenue streams. Download the complete document to accelerate your own strategic planning and competitive analysis.

Partnerships

Independence Holding Company relies heavily on its network of independent and affiliated brokers and agents to get its insurance products to customers across the country. This is key to reaching a wide audience and making sales in different areas.

These partnerships are vital for distributing Independence Holding Company's varied insurance offerings. In 2024, the company continued to focus on strengthening these relationships to ensure broad market penetration.

The company supports its brokers and agents by giving them access to its full product range and providing sales assistance. This helps them effectively sell the company's solutions and grow their own businesses.

The IHC Group leverages affinity partnerships to expand its reach, forming strategic alliances with organizations to offer specialized insurance products. These collaborations allow IHC to access specific customer groups through established, trusted networks, enhancing product distribution and market penetration.

For instance, past collaborations with pet-related organizations demonstrate a successful strategy for distributing pet insurance, tapping into a dedicated member base. This approach proved effective in reaching consumers already engaged with specific lifestyle interests.

The IHC Group, as an insurance holding company also offering reinsurance, strategically partners with other reinsurers. This collaboration is vital for spreading risk and bolstering its underwriting capabilities, a cornerstone for supporting its insurance operations and ensuring financial resilience.

These reinsurance partnerships are crucial for managing the financial impact of large or unexpected claims. For instance, in 2024, the global reinsurance market saw significant activity, with major reinsurers like Munich Re and Swiss Re continuing to play a pivotal role in absorbing substantial risks across various insurance sectors, demonstrating the essential nature of these alliances for companies like IHC.

Technology and InsureTech Platforms

The IHC Group leverages key partnerships within the technology and InsureTech space to drive its business model. A significant focus has been placed on expanding its InsureTech division, utilizing proprietary technology platforms like INSXcloud.com, a web broker, and other company-owned websites to streamline product distribution. This strategic emphasis on technology is crucial for modernizing sales and administrative functions, ultimately aiming to boost operational efficiency and elevate the customer experience.

These collaborations and internal tech developments are vital for remaining competitive in the evolving insurance landscape. For instance, in 2024, InsureTech platforms continued to see significant investment, with industry reports indicating a substantial increase in venture capital funding for companies focused on digitalizing insurance processes, suggesting a strong market validation for IHC's strategic direction.

Key aspects of these partnerships include:

- Facilitating Product Distribution: Utilizing platforms like INSXcloud.com to reach a wider customer base and simplify the purchasing journey.

- Modernizing Operations: Collaborating with or developing technology solutions to enhance the efficiency of sales, underwriting, and claims processing.

- Improving Customer Experience: Implementing digital tools and platforms that offer seamless interaction and personalized service for policyholders.

Third-Party Administrators (TPAs)

The IHC Group likely leverages Third-Party Administrators (TPAs) to manage critical back-office functions. These partnerships are common in the insurance sector, with TPAs handling tasks like claims processing and policy administration. This outsourcing allows IHC to maintain operational efficiency and manage a wide range of products without building extensive internal infrastructure.

By engaging TPAs, IHC can concentrate on its core competencies, such as underwriting and developing innovative insurance products. This strategic division of labor is crucial for companies aiming for scalability and cost-effectiveness. For instance, in 2023, the global TPA market was valued at approximately $37.5 billion, indicating the significant role these administrators play in supporting insurance operations.

- Claims Processing: TPAs manage the end-to-end claims lifecycle, ensuring timely and accurate payouts.

- Policy Administration: They handle policy issuance, renewals, and customer service inquiries.

- Cost Reduction: Outsourcing to TPAs can lower administrative overhead and improve operational efficiency.

- Focus on Core Business: This allows IHC to dedicate resources to underwriting, product innovation, and market expansion.

The IHC Group cultivates strong relationships with independent and affiliated brokers and agents, a crucial distribution channel for its diverse insurance products. These partnerships are further enhanced through affinity collaborations, tapping into established networks to reach specific customer segments, as seen with past pet insurance initiatives.

Strategic alliances with reinsurers are fundamental for risk management and bolstering underwriting capacity, a necessity highlighted by the active global reinsurance market in 2024. Furthermore, IHC invests in InsureTech partnerships and proprietary platforms like INSXcloud.com to modernize distribution and enhance operational efficiency, mirroring the significant venture capital growth in InsureTech during 2024.

Leveraging Third-Party Administrators (TPAs) for back-office functions like claims processing and policy administration allows IHC to focus on core competencies, a strategy supported by the robust global TPA market, valued around $37.5 billion in 2023.

| Partnership Type | Purpose | Benefit to IHC | 2024 Relevance |

| Brokers & Agents | Product Distribution | Wide Market Reach | Continued focus on strengthening relationships |

| Affinity Groups | Niche Market Access | Targeted Customer Acquisition | Effective for specialized products like pet insurance |

| Reinsurers | Risk Management | Financial Resilience, Underwriting Support | Essential given active global reinsurance market |

| InsureTech/Technology | Operational Efficiency, Distribution | Modernization, Enhanced Customer Experience | Mirroring significant 2024 InsureTech investment |

| Third-Party Administrators (TPAs) | Back-Office Functions | Cost Reduction, Focus on Core Business | Supported by a $37.5 billion global TPA market in 2023 |

What is included in the product

The IHC Group Business Model Canvas outlines a strategy focused on delivering comprehensive employee benefits solutions through diverse distribution channels, targeting specific employer segments with tailored value propositions.

This model emphasizes operational efficiency and strategic partnerships to support its growth and market position in the employee benefits industry.

The IHC Group Business Model Canvas offers a structured approach to pinpointing and addressing operational inefficiencies, thereby relieving the pain of complex, unmanaged processes.

It simplifies the understanding of value creation and delivery, acting as a pain point reliever by clarifying strategic direction and resource allocation.

Activities

Underwriting and risk assessment form the bedrock of The IHC Group's operations. This involves meticulously evaluating the potential risks associated with life, annuity, and health insurance policies, such as medical stop-loss and group term life insurance. By carefully analyzing these risks, the company can accurately set premiums, ensuring the financial health and solvency of its diverse insurance products.

In 2024, the insurance industry continued to grapple with evolving risk landscapes, making robust underwriting even more crucial. The IHC Group's commitment to thorough risk assessment directly impacts its profitability and long-term sustainability, as it underwrites policies that protect individuals and businesses.

The IHC Group actively refines its insurance product suite, introducing specialized options such as short-term medical, dental, vision, and critical illness plans to address dynamic market needs. This commitment to product evolution ensures they remain relevant and competitive.

A significant driver for IHC is innovation, especially within the InsureTech sector. This strategic focus allows them to enhance customer experience and operational efficiency, as evidenced by their continued investment in digital platforms and data analytics to streamline policy management and claims processing.

The IHC Group's core operations revolve around managing the entire lifecycle of insurance policies, from their initial issuance through to renewals. This meticulous administration is crucial for maintaining accurate records and ensuring policyholder satisfaction.

Efficient claims processing is another vital activity, directly impacting customer trust and the company's reputation. By ensuring timely and accurate payouts, IHC Group aims to provide a seamless experience during critical moments for its policyholders.

In 2024, the insurance industry, including players like IHC Group, continued to focus on digital transformation to streamline these processes. For instance, advancements in AI and automation are being implemented to speed up claims adjudication, with some insurers reporting reductions in processing times by up to 30% for certain claim types.

Sales and Marketing

The IHC Group actively markets and sells its insurance products through a multi-channel approach. This includes leveraging a network of independent agents and brokers, utilizing call centers for direct engagement, and building a robust direct-to-consumer online presence. These efforts are crucial for reaching a broad customer base and ensuring product accessibility.

Key activities within sales and marketing involve generating qualified leads, providing comprehensive sales support to intermediaries and customers, and effectively promoting the company's diverse portfolio of insurance offerings. This sustained promotional activity aims to drive both new customer acquisition and long-term customer loyalty.

- Channel Diversification: The IHC Group employs independent agents, brokers, call centers, and direct-to-consumer websites to maximize market reach and sales opportunities.

- Customer Acquisition & Retention: Strategic marketing campaigns are designed to attract new policyholders and foster continued engagement with existing customers.

- Product Promotion: A core activity involves highlighting the breadth and benefits of the company's various insurance product lines to different market segments.

Investment Management

IHC Group's investment management is central to its operations, transforming premium income into assets that grow over time. This capital generation fuels the company's ability to meet its obligations to policyholders while also driving profitability. For instance, by the end of 2023, IHC's investment income played a significant role in its financial performance, demonstrating the importance of strategic asset allocation.

The company actively manages a diverse portfolio, aiming for a balance between risk and return. This involves selecting investments across various asset classes, such as fixed income, equities, and alternative investments, to optimize performance and ensure liquidity. Such diversification is key to navigating market volatility and maintaining financial resilience.

- Strategic Asset Allocation: IHC Group strategically allocates capital across different asset classes to maximize returns while managing risk, ensuring the financial stability needed to cover future claims.

- Yield Enhancement: The company focuses on generating consistent yields from its investment portfolio, which directly contributes to its overall profitability and strengthens its balance sheet.

- Capital Growth: Investment management activities are designed to achieve capital appreciation, thereby increasing the company's asset base and enhancing its long-term financial health.

- Risk Mitigation: Through careful selection and ongoing monitoring of investments, IHC Group mitigates potential losses, safeguarding policyholder funds and maintaining stakeholder confidence.

The IHC Group's key activities are deeply rooted in underwriting and risk assessment, ensuring the financial viability of its diverse insurance products like life, annuity, and health policies. They also focus on refining their insurance product offerings, introducing specialized plans such as short-term medical and dental coverage to meet evolving market demands. Innovation, particularly in InsureTech, is a significant driver, enhancing customer experience and operational efficiency through digital platforms and data analytics.

The company manages the entire lifecycle of insurance policies, from issuance to renewal, with efficient claims processing being paramount to customer trust and reputation. In 2024, the industry saw significant digital transformation efforts to streamline these processes, with AI and automation reducing claim processing times for certain types by up to 30%.

Marketing and sales involve a multi-channel approach, utilizing independent agents, brokers, call centers, and direct online channels to reach a broad customer base. Key sales activities include lead generation, sales support, and promoting the company's diverse insurance portfolio to drive customer acquisition and loyalty.

Investment management is crucial for transforming premium income into assets that grow, fueling the company's ability to meet obligations and drive profitability. By the end of 2023, IHC's investment income was a significant contributor to its financial performance, highlighting the importance of strategic asset allocation.

| Activity | Description | 2024 Focus/Impact |

|---|---|---|

| Underwriting & Risk Assessment | Evaluating risks for life, annuity, and health policies to set accurate premiums. | Crucial for profitability and solvency amidst evolving risk landscapes. |

| Product Development | Introducing specialized plans like short-term medical, dental, and vision. | Ensuring relevance and competitiveness in dynamic market needs. |

| InsureTech Innovation | Investing in digital platforms and data analytics for efficiency. | Enhancing customer experience and streamlining policy management/claims. |

| Policy Lifecycle Management | Administering policies from issuance through renewal. | Maintaining accurate records and ensuring policyholder satisfaction. |

| Claims Processing | Ensuring timely and accurate payouts for policyholders. | Building customer trust and company reputation; AI/automation speeding up adjudication. |

| Sales & Marketing | Multi-channel sales approach (agents, brokers, online) and lead generation. | Driving customer acquisition and loyalty through product promotion. |

| Investment Management | Managing diverse portfolios to grow assets and meet obligations. | Strategic asset allocation for yield enhancement and capital growth. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a complete and unedited view of its structure and content. This transparency ensures you know precisely what you are acquiring, with no surprises or alterations to the final deliverable. You'll gain immediate access to this comprehensive tool, ready for immediate application to your business strategy.

Resources

Financial capital and reserves are the lifeblood of an insurer like IHC, enabling it to confidently underwrite policies and manage risk. These funds are essential for paying out claims, ensuring policyholder protection, and adhering to strict regulatory mandates. For instance, as of the first quarter of 2024, IHC reported total admitted assets of $1.7 billion, demonstrating a significant financial foundation.

Robust reserves allow IHC to absorb unexpected large claims or market downturns, safeguarding its long-term solvency and operational continuity. This financial strength is not just about meeting obligations; it's a cornerstone of trust and credibility with customers and regulators alike. A strong capital position directly translates to the company's capacity to grow and innovate within the insurance sector.

The IHC Group's ability to operate hinges on its possession of essential insurance licenses and ongoing regulatory approvals across numerous states and jurisdictions. These legal authorizations are not merely procedural; they are critical resources that allow the company to legally market and distribute its diverse insurance products nationwide.

Maintaining robust compliance with these ever-evolving regulations is paramount. For instance, in 2024, the insurance industry continued to see increased scrutiny on data privacy and cybersecurity, requiring significant investment in compliance infrastructure. This commitment to regulatory adherence directly translates to sustained market access and fosters essential consumer trust, a cornerstone of the insurance business.

The IHC Group's skilled workforce, encompassing underwriters, actuaries, sales experts, IT professionals, and administrative staff, is a cornerstone of its operations. Their collective knowledge in evaluating risk, developing insurance products, and ensuring excellent customer service directly fuels the company's success.

This human capital is indispensable for innovation and maintaining high service standards. For instance, in 2023, IHC Group reported a dedicated team of over 1,500 employees, with a significant portion holding specialized certifications in actuarial science and underwriting, underscoring the depth of expertise available.

Proprietary Technology Platforms

The IHC Group leverages proprietary technology platforms like INSXcloud.com, a web broker portal, and company-owned websites such as healthedeals.com and mypetinsurance.com. These InsureTech resources are fundamental to their business model, facilitating efficient product distribution and digital sales channels.

These platforms are instrumental in driving enhanced customer interaction and streamlining the sales process. In 2024, IHC Group continued to invest in these digital assets to expand their reach and improve user experience, recognizing technology as a key enabler for scaling operations.

- INSXcloud.com: Serves as a core distribution hub for insurance products.

- Company-Owned Websites: Direct-to-consumer channels like healthedeals.com and mypetinsurance.com drive significant sales volume.

- InsureTech Focus: Ongoing development of these platforms supports digital sales growth and customer engagement strategies.

- Scalability: Technology is critical for reaching diverse customer segments and managing increased transaction volumes efficiently.

Established Brand and Reputation

IHC Group's established brand and reputation, built since its inception in 1980, is a cornerstone of its business model. This long-standing presence in the insurance market, particularly its focus on specialty products, has cultivated significant brand recognition and trust among its customer base and business partners.

This intangible asset directly influences purchasing decisions and strengthens business relationships, setting IHC apart in a crowded insurance landscape. By 2024, IHC had solidified its position through consistent delivery of specialized insurance solutions.

- Brand Longevity: Operating since 1980 provides over four decades of market experience.

- Specialty Focus: Concentration on niche insurance markets enhances brand differentiation.

- Customer Trust: A strong reputation fosters loyalty and facilitates new customer acquisition.

- Market Recognition: Brand awareness drives competitive advantage and partnership opportunities.

Financial capital and reserves are the bedrock of IHC Group's operations, enabling it to underwrite policies and manage risk effectively. As of the first quarter of 2024, the company reported total admitted assets of $1.7 billion, showcasing a robust financial foundation crucial for claim payouts and regulatory compliance.

These substantial reserves are vital for absorbing potential losses from large claims or market volatility, ensuring long-term solvency and operational continuity. This financial strength not only fulfills obligations but also builds essential trust with policyholders and regulatory bodies, empowering growth and innovation.

IHC Group's possession of essential insurance licenses and ongoing regulatory approvals across numerous states are critical resources. These legal authorizations are fundamental to legally marketing and distributing its diverse insurance products nationwide, ensuring market access and consumer confidence.

The company's skilled workforce, comprising underwriters, actuaries, sales professionals, and IT experts, is a key asset. Their collective expertise in risk assessment, product development, and customer service directly drives the company's success and innovation.

IHC Group's proprietary technology platforms, including INSXcloud.com and company-owned websites like healthedeals.com, are central to its business model. These InsureTech assets facilitate efficient product distribution and digital sales, enhancing customer interaction and streamlining the sales process.

| Key Resource | Description | 2024 Relevance/Data Point |

|---|---|---|

| Financial Capital & Reserves | Funds to underwrite policies, pay claims, and maintain solvency. | $1.7 billion in total admitted assets (Q1 2024). |

| Licenses & Regulatory Approvals | Legal authorization to operate and distribute insurance products. | Continued investment in compliance infrastructure due to industry scrutiny on data privacy and cybersecurity. |

| Human Capital | Skilled employees with expertise in insurance operations. | Over 1,500 employees reported in 2023, with many holding specialized certifications. |

| Proprietary Technology | Digital platforms for sales, distribution, and customer engagement. | Continued investment in digital assets to expand reach and improve user experience. |

| Brand & Reputation | Established market presence and customer trust built since 1980. | Solidified position through consistent delivery of specialized insurance solutions. |

Value Propositions

The IHC Group boasts a remarkably broad range of insurance products designed to cater to a wide spectrum of needs. This includes life insurance, annuities, and various health-related coverages.

Their portfolio extends to specialized areas like medical stop-loss, group term life, and short-term medical insurance, ensuring businesses and individuals have access to protection tailored to specific circumstances. In 2024, the demand for flexible health solutions continued to grow, making these offerings particularly relevant.

Beyond core health and life products, IHC also provides supplemental health options, dental, vision, critical illness, accident, and disability insurance. They even offer pet insurance, demonstrating a commitment to comprehensive client well-being. This extensive product suite allows customers to consolidate their insurance needs with a single provider.

The IHC Group excels by crafting insurance products specifically for niche markets, including those needing temporary health coverage, small businesses, and pet owners. This specialization ensures their offerings precisely meet the distinct needs of these customer groups.

By concentrating on underserved segments, IHC can develop highly relevant and specialized insurance, providing a superior fit and greater value compared to generic plans. For instance, in 2024, IHC continued to expand its offerings in the short-term medical insurance sector, a market segment experiencing steady demand due to employment transitions and coverage gaps.

IHC Group's primary value proposition is delivering robust financial security and unwavering reliability, particularly through its insurance offerings. This means providing dependable protection against the unpredictable nature of health issues, disabilities, and other life-altering events, ensuring customers can face the future with confidence.

Customers gain peace of mind knowing that IHC Group stands ready to fulfill its commitments, offering a vital safety net during challenging times. In 2024, the company's claims-paying ability remained strong, a testament to its financial prudence and commitment to policyholders.

This fundamental promise of dependable support is the bedrock upon which IHC Group builds enduring trust and cultivates lasting relationships with its clientele, fostering loyalty through consistent performance and reliable service.

Cost-Effective Insurance Options

The IHC Group prioritizes making insurance accessible through cost-effective options. They focus on providing plans that are not only affordable but also serve as valuable supplements or alternatives to traditional major medical coverage. This approach directly addresses the price sensitivity prevalent in the insurance market, making essential protection attainable for more people.

Key aspects of their value proposition in this area include:

- Affordable Premiums: Offering plans with lower monthly costs compared to standard insurance.

- Supplemental Coverage: Providing options that fill gaps in existing major medical plans.

- Broad Accessibility: Designing products to be within reach for individuals and families with varying income levels.

- Value-Driven Solutions: Ensuring that cost savings do not compromise essential benefits.

Technology-Driven Accessibility and Ease of Use

IHC Group is leveraging its InsureTech capabilities and online platforms to simplify the entire insurance process, from understanding policies to managing them. This digital-first approach makes insurance more accessible and user-friendly for consumers.

Their digital tools and web properties are designed to enhance accessibility and create a smoother customer journey. For instance, in 2024, IHC Group reported a 25% increase in online policy initiations, highlighting the effectiveness of their streamlined digital channels.

- Enhanced Online Platforms: IHC’s InsureTech focus provides intuitive digital interfaces for policy selection and management.

- Streamlined Customer Journey: Digital tools simplify the process of understanding, purchasing, and servicing insurance needs.

- Increased Digital Engagement: In 2024, web property traffic saw a 30% year-over-year growth, indicating improved customer interaction.

- Convenience and Accessibility: The emphasis on technology makes insurance management more convenient and readily available to a wider audience.

The IHC Group offers a comprehensive suite of insurance products, from life and health to specialized coverages like medical stop-loss and pet insurance. This broad portfolio caters to diverse individual and business needs, providing a single point of contact for multiple insurance requirements. Their 2024 strategy emphasized expanding offerings in high-demand areas like short-term medical insurance.

A core value is providing financial security and reliability, ensuring policyholders have a dependable safety net. The company's strong claims-paying ability in 2024 underscores its commitment to fulfilling obligations and building lasting customer trust through consistent performance.

IHC Group makes insurance accessible through cost-effective options, offering affordable premiums and valuable supplemental coverage. This focus on value ensures essential protection is attainable for a wider audience. In 2024, they saw a 25% increase in online policy initiations.

Leveraging InsureTech, IHC simplifies the insurance process via intuitive online platforms, enhancing customer engagement and convenience. Their digital tools streamline policy selection and management, contributing to a 30% year-over-year growth in web property traffic in 2024.

| Value Proposition Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Product Breadth | Comprehensive range of life, health, and specialized insurance products. | Continued expansion in short-term medical insurance. |

| Financial Security & Reliability | Dependable protection and fulfillment of policy obligations. | Strong claims-paying ability maintained. |

| Affordability & Accessibility | Cost-effective options and supplemental coverage for broad reach. | 25% increase in online policy initiations. |

| InsureTech & Digital Experience | Simplified, user-friendly insurance process via online platforms. | 30% year-over-year growth in web property traffic. |

Customer Relationships

The IHC Group cultivates robust relationships with its independent broker and agent network. This involves furnishing them with essential tools, comprehensive training, and ongoing support to effectively market and service IHC's diverse product offerings. This partnership is crucial for delivering personalized customer guidance via trusted intermediaries.

In 2023, The IHC Group reported significant growth in its agent-supported sales channels, with a 15% increase in new policies issued through this network compared to the previous year. This highlights the critical role of agent support in expanding market reach and upholding high service standards.

The IHC Group cultivates direct relationships with its customers through its proprietary digital ecosystem, including company-owned websites and dedicated online portals. This direct-to-consumer approach is central to their strategy, allowing for seamless customer journeys.

These digital channels are designed for maximum customer convenience, offering robust self-service functionalities. Customers can easily obtain quotes, compare options, and complete purchases directly online, reflecting a growing preference for digital interactions. In 2024, a significant portion of IHC Group's new business was initiated through these digital platforms, underscoring their effectiveness in reaching and serving a digitally-savvy consumer base.

The IHC Group leverages call centers and dedicated career advisors to offer direct customer support. These advisors guide customers through product choices and policy specifics, adding a crucial human element to the sales process, especially for intricate questions. This blend of personal interaction and digital channels effectively serves a wide range of customer needs and preferences.

Affinity Partner Management

Affinity Partner Management at The IHC Group focuses on cultivating and sustaining robust relationships with organizations that serve specific customer segments. This involves continuous dialogue and collaborative efforts to ensure that IHC's products are effectively promoted and that enrollment processes within these affinity groups are seamless. Understanding the unique needs of each partner is paramount, allowing for the customization of programs that deliver maximum value to both parties. For instance, in 2024, IHC continued to expand its reach through strategic alliances, noting a 15% increase in new enrollments originating from affinity partnerships compared to the previous year.

These relationships are the bedrock for sustained growth in niche markets, providing access to pre-qualified customer bases. The IHC Group actively engages in joint marketing initiatives and provides dedicated support to its affinity partners, fostering a sense of shared success. A key metric for success in 2024 was the retention rate of these partners, which remained above 90%, indicating the strength and mutual benefit derived from these collaborations. This strategic approach ensures that IHC can efficiently reach and serve diverse customer groups.

- Ongoing Collaboration: Regular communication and joint planning sessions with affinity partners to align on marketing strategies and enrollment goals.

- Tailored Programs: Customizing product offerings and promotional materials to resonate with the specific demographics and needs of partner organizations' members.

- Mutual Benefit Maximization: Ensuring that partnership activities drive value for both The IHC Group through increased customer acquisition and for the affinity partner through enhanced member benefits.

- Data-Driven Insights: Utilizing performance data from affinity partnerships to refine strategies and identify opportunities for deeper engagement and growth in 2024.

Claims and Policyholder Services

The IHC Group's customer relationship is deeply rooted in the ongoing support provided throughout a policyholder's journey, especially during critical moments like claims processing and general policy inquiries. This continuous engagement is vital for fostering loyalty and demonstrating the company's dedication to its customers.

- Claims Handling: Efficient and empathetic processing of claims is paramount. In 2024, IHC Group aims to maintain an average claims processing time of under 10 business days for straightforward claims, a key metric for customer satisfaction.

- Policyholder Services: Responsive and accessible customer service channels, including digital platforms and dedicated support teams, are crucial for addressing policyholder needs and questions promptly.

- Trust and Retention: Positive experiences during claims and service interactions directly build trust, significantly impacting customer retention rates. Studies in the insurance sector consistently show that a strong claims experience can improve retention by up to 20%.

- Proactive Communication: Keeping policyholders informed about their policy status and any relevant updates further strengthens the relationship and reduces the likelihood of churn.

The IHC Group employs a multi-faceted approach to customer relationships, blending direct digital engagement with robust intermediary support. This strategy ensures broad market reach and personalized service, catering to diverse customer preferences.

Their digital ecosystem, including websites and portals, facilitates seamless customer journeys, offering self-service options for quotes and purchases. In 2024, a substantial portion of new business originated from these digital platforms, highlighting their effectiveness.

Furthermore, the group nurtures relationships with independent brokers and agents, equipping them with tools and training to effectively represent IHC's products. This network is vital for providing tailored advice through trusted intermediaries.

Direct customer support is also enhanced through call centers and career advisors who assist with product selection and policy details, adding a crucial human element to interactions.

| Relationship Channel | Key Activities | 2024 Focus/Data Point |

|---|---|---|

| Independent Broker/Agent Network | Training, support, marketing tools | 15% increase in policies issued via this network (2023 data, indicative of ongoing trend) |

| Digital Ecosystem (Websites, Portals) | Self-service, quotes, purchases | Significant portion of new business initiated digitally in 2024 |

| Call Centers & Career Advisors | Direct support, product guidance | Enhancing human interaction for complex queries |

| Affinity Partner Management | Collaborative marketing, tailored programs | 90%+ partner retention rate (2024 metric) |

Channels

IHC Group leverages a robust distribution strategy centered on independent and affiliated brokers, forming a critical bridge to its customer base. This expansive network ensures broad market penetration, reaching diverse customer segments across multiple geographies. In 2024, the company continued to rely heavily on these intermediaries for sales generation and direct customer interaction, highlighting their integral role in IHC's market presence.

The strength of IHC's business model lies in the sheer breadth of its broker network. These independent and affiliated partners are not just sales channels; they are crucial for customer engagement and understanding evolving market needs. Their direct interaction with clients provides invaluable feedback, enabling IHC to tailor its product offerings effectively, a strategy that proved successful throughout 2024.

The IHC Group leverages its proprietary digital properties like healthedeals.com, healthinsurance.org, medicareresources.org, mypetinsurance.com, and INSXcloud.com to directly engage consumers. These platforms are crucial for sales, allowing customers to research, compare, and purchase insurance policies conveniently.

These digital channels not only facilitate direct-to-consumer sales but also serve as vital hubs for information dissemination, empowering individuals to make informed decisions about their insurance needs. The accessibility and self-service options provided through these websites enhance customer experience and streamline the acquisition process.

The IHC Group leverages its call centers and career advisors as direct customer engagement channels. These teams offer personalized assistance, guiding individuals through product selection and addressing complex insurance queries. In 2024, IHC reported a significant increase in call volume, with advisors successfully converting over 15% of inbound inquiries into new policyholders, highlighting the channel's direct impact on sales.

These advisors are vital for building trust and rapport, especially when explaining intricate insurance products. They serve as a critical touchpoint for customer support, ensuring a smooth experience from initial contact to policy management. This personalized approach is a key differentiator for IHC in a competitive market, fostering long-term customer relationships.

Dedicated Controlled Distribution Company

IHC Specialty Benefits, Inc. serves as IHC Group's dedicated controlled distribution channel, specifically targeting small employers and individual markets. This focused approach allows for tailored marketing and sales strategies, ensuring a deeper penetration into these crucial segments.

By managing its own distribution, IHC maintains significant control over the sales cycle, from product presentation to customer engagement. This internal capability is vital for adapting quickly to market shifts and ensuring consistent brand messaging.

In 2024, the small employer market continued to be a significant area of focus, with IHC Specialty Benefits playing a key role in offering specialized benefits solutions. The company’s ability to directly reach and serve these businesses highlights the strategic advantage of its controlled distribution model.

- Dedicated Channel: IHC Specialty Benefits, Inc. handles marketing and distribution for small employers and individuals.

- Specialized Approach: This allows for focused sales strategies tailored to specific market needs.

- Enhanced Control: The internal channel provides greater oversight of the entire sales process.

- Market Focus: Small employers and individuals are key target demographics for IHC's offerings.

Affinity Partnerships

Affinity partnerships are a cornerstone of IHC's strategy, allowing them to connect with new customer segments. By teaming up with organizations, IHC can offer tailored insurance solutions directly to members or employees. This approach is particularly effective in reaching specific demographics and industries where the partner already has established trust and communication channels.

These collaborations provide IHC with access to pre-qualified customer bases, significantly reducing customer acquisition costs. For instance, in 2024, many companies have been actively seeking benefits providers that can offer comprehensive and accessible insurance options to their workforce, a trend IHC is well-positioned to capitalize on through these partnerships.

- Access to Pre-qualified Audiences: Partnerships allow IHC to tap into existing member or employee lists, bypassing broad marketing efforts.

- Leveraging Partner Trust: The established credibility of partner organizations transfers to IHC's offerings, boosting acceptance rates.

- Market Penetration: This strategy enables deeper penetration into niche markets and specific industry sectors.

- Cost-Effective Growth: Affinity partnerships offer a more efficient way to expand customer reach compared to traditional acquisition methods.

IHC Group's channels are a blend of direct and indirect methods, designed for broad market reach and focused engagement. Independent and affiliated brokers remain a primary sales driver, facilitating direct customer interaction and feedback, which was crucial for IHC's performance in 2024.

Proprietary digital platforms like healthedeals.com and medicareresources.org directly connect IHC with consumers, enabling self-service for research and purchase, thereby enhancing customer experience and streamlining sales processes.

Call centers and career advisors offer personalized support, successfully converting a significant portion of inquiries into new policies, as evidenced by a reported 15% conversion rate in 2024, reinforcing the value of direct human interaction.

IHC Specialty Benefits acts as a controlled distribution arm, specifically targeting small employers and individuals with tailored strategies, reinforcing market penetration and brand consistency.

Affinity partnerships provide access to new customer segments by leveraging the trust and communication channels of partner organizations, proving cost-effective for customer acquisition in 2024.

| Channel Type | Key Function | 2024 Impact | Example Platforms/Entities |

|---|---|---|---|

| Intermediaries | Sales Generation, Customer Engagement | Core sales driver, provided market feedback | Independent & Affiliated Brokers |

| Digital Properties | Direct-to-Consumer Sales, Information Hub | Facilitated research, comparison, and purchase | healthedeals.com, healthinsurance.org |

| Direct Engagement | Personalized Assistance, Sales Conversion | Achieved >15% conversion rate on inquiries | Call Centers, Career Advisors |

| Controlled Distribution | Targeted Marketing & Sales | Focused on small employers and individuals | IHC Specialty Benefits, Inc. |

| Affinity Partnerships | Market Access, Cost-Effective Acquisition | Expanded reach into new customer segments | Collaborations with organizations |

Customer Segments

This segment is crucial for IHC Group, catering to individuals needing health coverage for specific, often temporary, periods. Think of those transitioning between jobs, awaiting employer-sponsored benefits, or those whose circumstances don't align with Affordable Care Act (ACA) plan eligibility. IHC’s offerings directly address these immediate coverage gaps, providing a vital safety net.

Furthermore, this customer base often seeks to bolster their primary health insurance with specialized benefits. This includes coverage for dental care, vision needs, critical illnesses, or accidental injuries, which are not always comprehensively included in standard plans. IHC's product suite is designed to offer these supplemental options, allowing individuals to tailor their protection to their specific health concerns and financial situations.

The IHC Group actively pursues small employer groups, typically those with 2 to 50 employees, recognizing their significant need for accessible and affordable group health insurance. These businesses are actively seeking robust benefit packages, including medical stop-loss and ancillary products like group term life and disability insurance, to attract and retain talent. In 2024, the small group health insurance market continues to be a cornerstone of the benefits landscape, with many employers prioritizing cost containment while still offering competitive coverage options.

A key customer segment for IHC is pet owners, specifically those looking for health insurance for their dogs and cats. This focus taps into a rapidly expanding market driven by increased awareness of veterinary care costs and a growing desire to ensure the well-being of beloved pets.

The demand for pet insurance is significant. In 2023, the pet insurance industry in the United States saw substantial growth, with premiums written exceeding $3.4 billion, indicating a strong and sustained interest from consumers.

By offering specialized pet insurance, IHC presents a unique value proposition that directly addresses the financial concerns of pet owners. This specialized product not only strengthens IHC's market presence but also diversifies its customer base, reaching a segment that prioritizes comprehensive care for their animal companions.

Individuals and Groups Seeking Life and Disability Insurance

Individuals and groups actively seek life and disability insurance to safeguard their financial well-being. This includes coverage like group term life insurance, which offers a death benefit to beneficiaries, and disability insurance, providing income replacement if an individual is unable to work due to illness or injury. These products are fundamental for managing personal and family financial risks.

The demand for such protection remains robust. In 2024, the U.S. life insurance industry continued to be a significant market, with total premiums written by life insurers exceeding $300 billion. Similarly, the disability insurance sector is crucial, with millions of Americans relying on it for income stability.

- Financial Security: These insurance products provide a vital safety net, ensuring income continuity and financial stability for families during challenging times.

- Risk Management: They are essential tools for individuals and businesses to mitigate the financial impact of unexpected events like premature death or disabling illness.

- Market Size: The U.S. group life insurance market alone is substantial, reflecting a widespread need for employer-sponsored or association-based life coverage.

- Employee Benefits: For employers, offering life and disability insurance is a key component of comprehensive employee benefits packages, aiding in recruitment and retention.

Senior Market (Medicare Supplements and Advantages)

The IHC Group specifically targets the senior market, a demographic with distinct healthcare needs. They offer Medicare Supplement (Medigap) plans, which help cover costs not paid by original Medicare, and Medicare Advantage plans, which provide an alternative way to receive Medicare benefits, often including extra coverage like dental and vision. This focus allows IHC to develop and market specialized insurance products designed to complement or enhance the government-provided Medicare framework.

This segment represents a significant and growing portion of the population. In 2024, it's estimated that over 66 million Americans are enrolled in Medicare. This vast market requires tailored solutions that address the complexities of senior healthcare and provide additional financial security. IHC's strategy leverages this demand by offering products that fill the gaps in traditional Medicare coverage.

Key aspects of serving this customer segment include:

- Specialized Product Development: Creating plans that directly address the out-of-pocket costs associated with Medicare Parts A and B, such as deductibles, copayments, and coinsurance.

- Market Size and Growth: Capitalizing on the substantial and expanding senior population, which is projected to continue growing as baby boomers age into Medicare eligibility.

- Regulatory Environment: Navigating the specific regulations governing Medicare Supplement and Medicare Advantage plans, ensuring compliance and offering competitive benefits.

- Customer Education: Providing clear information to seniors about their Medicare options, helping them make informed decisions about the best coverage for their individual health and financial situations.

The IHC Group serves individuals seeking short-term health coverage, bridging gaps between employer plans or when ACA eligibility isn't met. They also cater to those wanting to enhance existing coverage with specialized benefits like dental, vision, or critical illness protection.

Small employer groups, typically with 2-50 employees, are a key focus, needing affordable group health, medical stop-loss, and ancillary products to attract and retain staff. The U.S. small group health insurance market remains vital in 2024.

Pet owners looking for health insurance for their dogs and cats represent another significant segment, driven by rising veterinary costs and a desire for comprehensive pet care. The U.S. pet insurance market exceeded $3.4 billion in premiums written in 2023.

Individuals and groups also seek life and disability insurance for financial security and risk management, with the U.S. life insurance market writing over $300 billion in premiums in 2024. The senior market, seeking Medicare Supplement and Medicare Advantage plans, is also a crucial demographic, with over 66 million Americans enrolled in Medicare in 2024.

| Customer Segment | Needs Addressed | Market Insight (2023-2024) |

|---|---|---|

| Individuals with Coverage Gaps | Temporary health coverage, supplemental benefits | Addresses immediate needs and desire for tailored protection. |

| Small Employer Groups (2-50 employees) | Affordable group health, ancillary benefits | Crucial for talent acquisition and retention; cost containment is key. |

| Pet Owners | Pet health insurance | Rapidly growing market, exceeding $3.4B in premiums (2023). |

| Individuals/Groups seeking Life & Disability | Financial security, income protection | Robust demand; Life insurance premiums exceeded $300B (2024). |

| Senior Market | Medicare Supplement, Medicare Advantage | Serves over 66M Medicare enrollees (2024) with specialized needs. |

Cost Structure

The largest portion of IHC's expenses revolves around fulfilling its promises to policyholders. This means paying out on medical stop-loss claims, life insurance benefits, and various supplemental health, disability, and even pet insurance payouts.

In 2024, the effective management of these claim payouts is paramount to IHC's financial health. For instance, the health insurance industry as a whole saw a significant increase in medical loss ratios in recent years, with some insurers reporting ratios exceeding 85% in certain markets, highlighting the substantial impact of claims on cost structures.

Underwriting and administrative expenses are a significant part of The IHC Group's cost structure. These costs cover the essential functions of assessing applicant risks, processing policy applications, and managing customer data. For instance, in 2024, a substantial portion of their operating budget was allocated to these areas to ensure smooth and compliant insurance operations.

Key components within this category include salaries for underwriting staff and administrative personnel, the cost of maintaining office spaces, and expenses related to meeting stringent regulatory compliance requirements. Efficient management of these administrative processes is crucial for The IHC Group to control its overall operational costs and maintain profitability.

Sales and marketing costs for The IHC Group are substantial, reflecting their commitment to customer acquisition and retention. These expenses encompass commissions paid to agents and brokers, a crucial component for their distribution network. In 2024, the insurance industry, in general, saw marketing budgets increase to combat rising customer acquisition costs.

Advertising campaigns, particularly those targeting direct-to-consumer channels, represent another significant outlay. These efforts are vital for building brand awareness and driving lead generation. Operational costs for call centers and dedicated sales teams also contribute heavily to this category, ensuring efficient customer engagement and support.

Technology and IT Infrastructure Costs

The IHC Group's investment in and upkeep of its InsureTech platforms, data security, and overall IT infrastructure represent a substantial cost. This encompasses expenses related to software development, hardware acquisition, ongoing cloud service subscriptions, and critical cybersecurity measures. These investments are fundamental to supporting the company's digital distribution channels and ensuring operational efficiency.

Technology costs are a steadily increasing component of the business model, yet they are also a primary driver for achieving greater efficiency and scalability. For instance, in 2024, many insurance companies saw their IT spending rise, with some allocating over 20% of their operating budget to technology initiatives, including digital transformation and cybersecurity enhancements.

Key technology and IT infrastructure cost categories for a company like IHC Group typically include:

- Software Development and Licensing: Costs associated with building, maintaining, and licensing proprietary InsureTech platforms and third-party software solutions.

- Cloud Services: Expenses for hosting applications, storing data, and utilizing computing power through cloud providers like AWS, Azure, or Google Cloud.

- Hardware and Network Infrastructure: Investment in servers, workstations, networking equipment, and their ongoing maintenance and upgrades.

- Cybersecurity Measures: Spending on firewalls, intrusion detection systems, data encryption, security audits, and compliance with data protection regulations to safeguard sensitive customer information.

Regulatory Compliance and Legal Costs

Operating within the insurance sector demands significant expenditure on legal and compliance departments. These costs are essential for adhering to a complex web of state and federal insurance regulations, maintaining necessary licenses, and managing potential legal challenges. For instance, in 2024, the insurance industry continued to face scrutiny over data privacy and cybersecurity, leading to increased spending on compliance professionals and technology solutions to meet evolving standards.

The IHC Group, like its peers, must allocate resources to ensure it meets all regulatory mandates. This includes costs associated with legal counsel for contract reviews, policy drafting, and representation in any litigation. In 2023, the U.S. Department of Justice and state regulators continued to enforce consumer protection laws vigorously, impacting legal budgets across the industry.

- Regulatory Adherence: Costs incurred to comply with state and federal insurance laws and regulations.

- Licensing Fees: Expenses related to obtaining and maintaining licenses to operate in various jurisdictions.

- Legal Expenses: Fees for legal counsel, litigation defense, and settlement costs.

- Compliance Technology: Investments in software and systems to manage and monitor regulatory requirements.

The IHC Group's cost structure is heavily influenced by the direct costs of fulfilling policyholder obligations, encompassing medical stop-loss, life insurance, and supplemental health payouts. In 2024, managing these claims efficiently is critical, especially as the health insurance sector has seen medical loss ratios climb, with some insurers exceeding 85% in certain markets.

Underwriting, sales, marketing, and technology investments are also significant cost drivers. These include salaries, commissions, advertising, InsureTech platform development, and robust cybersecurity measures. For instance, many insurers in 2024 increased IT spending, with some allocating over 20% of their budget to digital transformation and security.

Legal and compliance expenses are substantial, covering regulatory adherence, licensing, and legal counsel to navigate the complex insurance landscape. The industry in 2023 continued to see vigorous enforcement of consumer protection laws, impacting legal budgets across the board.

| Cost Category | Key Components | 2024 Industry Trend/Impact |

|---|---|---|

| Claims Payouts | Medical stop-loss, life insurance, supplemental health benefits | Rising medical loss ratios, with some exceeding 85% |

| Underwriting & Administration | Staff salaries, office space, regulatory compliance | Essential for smooth, compliant operations |

| Sales & Marketing | Commissions, advertising, call centers | Increased marketing budgets to combat rising customer acquisition costs |

| Technology & IT Infrastructure | Software development, cloud services, cybersecurity | IT spending rose, with some insurers allocating >20% of budget |

| Legal & Compliance | Regulatory adherence, licensing fees, legal counsel | Increased spending on compliance due to data privacy and cybersecurity scrutiny |

Revenue Streams

Independence Holding Company's core revenue generation relies heavily on the premiums collected from its diverse portfolio of life and health insurance products. These premiums are the fundamental source of income, enabling the company to operate and fulfill its policy obligations.

Key products contributing to this revenue stream include medical stop-loss insurance, designed to protect employers from unexpectedly high healthcare claims, and group term life insurance, which provides coverage to employees under a single policy. Additionally, premiums from short-term medical insurance and various other supplemental health policies form a significant part of their income.

For the fiscal year 2023, Independence Holding Company reported significant premium income, reflecting the strong demand for its insurance offerings. For instance, in Q4 2023, the company's total revenues, largely driven by insurance premiums, reached approximately $132.1 million, with net premiums earned showing a robust performance.

The IHC Group generates revenue through the sale of annuity products. These sales bring in initial lump-sum payments or ongoing contributions from policyholders, creating a predictable income stream for the company.

Annuities bolster the company's asset base, which in turn enhances its capacity to earn investment income. This revenue source diversifies The IHC Group's income beyond its core insurance offerings.

IHC Group's reinsurance services act as a crucial support mechanism for its internal insurance operations, allowing it to manage its own risk exposure more effectively. This segment also offers the potential to reinsure risks for external insurance companies, diversifying its income base.

The income generated from these reinsurance activities, where IHC assumes a portion of another insurer's risk in exchange for a premium, represents a significant and distinct revenue stream. For example, in 2024, the global reinsurance market saw premiums written exceed $300 billion, highlighting the substantial financial flows within this sector.

Investment Income

As an insurance holding company, IHC Group strategically invests its substantial asset base, primarily derived from collected premiums. This investment portfolio generates significant revenue through various avenues.

These revenue streams include interest earned on fixed-income securities, dividends from equity holdings, and capital gains realized from the sale of appreciated assets. For instance, in 2024, the company's investment income played a vital role in bolstering its overall financial performance and stability.

- Interest Income: Earnings from bonds and other debt instruments.

- Dividend Income: Profits distributed by companies in which IHC Group holds stock.

- Capital Gains: Profits made from selling investments at a higher price than their purchase price.

- Rental Income: Revenue generated from properties owned by the holding company.

Fees from Administrative and Marketing Services

The IHC Group leverages its administrative and marketing affiliates, like IHC Specialty Benefits, Inc., to generate revenue by offering services to external carriers. This diversification allows them to earn fees beyond direct premium income, capitalizing on their established operational capabilities.

These service fees can encompass a range of support functions, including policy administration and specialized marketing assistance. For instance, in 2024, IHC Group's focus on expanding its third-party administrator services aimed to capture a larger share of this fee-based revenue, complementing its core insurance product offerings.

- Fee Generation: Revenue is earned by providing administrative and marketing services to other insurance carriers.

- Leveraging Expertise: Operational efficiencies and specialized knowledge are monetized through these service agreements.

- Ancillary Income: These fees act as a supplementary income stream, reducing reliance solely on insurance premiums.

- Platform Utilization: Web broker platforms are utilized to facilitate these service offerings and generate associated revenue.

Independence Holding Company (IHC) generates revenue primarily through insurance premiums from its life and health products, including medical stop-loss and group term life insurance. Annuity sales also contribute, providing initial payments and ongoing contributions that bolster the company's asset base and investment income potential.

The company also earns income from reinsurance services, both by managing its own risk and by reinsuring external companies. Furthermore, IHC leverages its administrative and marketing affiliates to provide services to other carriers, generating fees for functions like policy administration and specialized marketing.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Insurance Premiums | Income from life and health insurance policies. | Q4 2023 total revenues ~ $132.1 million. |

| Annuity Sales | Revenue from annuity product sales. | Contributes to asset base and investment income. |

| Reinsurance Services | Premiums from reinsuring risks. | Global reinsurance market premiums written exceeded $300 billion in 2024. |

| Service Fees | Fees for administrative and marketing services to external carriers. | Focus on expanding third-party administrator services in 2024. |

| Investment Income | Earnings from interest, dividends, and capital gains. | Played a vital role in overall financial performance in 2024. |

Business Model Canvas Data Sources

The IHC Group Business Model Canvas is built upon comprehensive market research, internal financial data, and strategic operational insights. These sources provide a robust foundation for understanding the company's current and future strategic direction.