The IHC Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The IHC Group Bundle

Navigate the complex external forces shaping The IHC Group's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, social trends, technological advancements, environmental regulations, and legal frameworks are impacting its operations and future growth. Gain a strategic advantage by leveraging these critical insights to refine your market approach.

Unlock actionable intelligence for The IHC Group's strategic planning with our in-depth PESTLE analysis. This expertly crafted report details the external factors influencing its business, from regulatory landscapes to emerging technologies. Download the full version now and equip yourself with the knowledge to make informed, forward-thinking decisions.

Political factors

The U.S. healthcare policy environment is dynamic, with potential shifts in Medicare Advantage reimbursement rates and the ongoing process of Medicaid redeterminations directly impacting insurers. For instance, proposed Medicare Advantage payment rate changes for 2025 could influence profitability for companies like IHC Group, which offers supplemental health insurance. The expiration or modification of Affordable Care Act (ACA) subsidies also presents a variable that affects market demand for health coverage.

The National Association of Insurance Commissioners (NAIC) remains a key influence, focusing on state-based regulation and tackling new challenges like artificial intelligence and climate-related risks. This means companies like IHC Group must navigate a patchwork of state regulations, with the NAIC actively working to update existing rules and create new ones to address these evolving areas.

Insurers must stay attuned to these dynamic state-level requirements, as the NAIC's initiatives directly impact operational compliance. For instance, the NAIC's ongoing work on modernizing model laws, particularly concerning data privacy and cybersecurity, necessitates continuous adaptation by insurance providers to ensure adherence across various jurisdictions.

The ongoing discussion about the balance between state and potential federal oversight adds another layer of complexity. While state-based regulation is emphasized, the possibility of federal intervention in certain areas, especially those with national implications like cybersecurity or systemic risk, requires insurers to maintain flexibility in their compliance strategies.

Government scrutiny over business practices in healthcare and insurance is intensifying, fueled by public and political backlash against issues like pharmaceutical benefits manager (PBM) practices and consumer protection. Insurers are under the microscope regarding rate hikes, coverage gaps, and data privacy, pushing for more transparency and consumer focus.

This heightened oversight, exemplified by ongoing investigations into PBM pricing and potential legislative reforms in 2024 and 2025, demands insurers adopt robust, consumer-centric strategies. For instance, the U.S. Department of Health and Human Services (HHS) has been actively examining PBMs, with proposed rules in late 2023 aiming to increase transparency and potentially impact rebate practices, which could affect insurer profitability and operational models.

Future Legislative Uncertainty

The potential expiration of enhanced Affordable Care Act (ACA) subsidies at the end of 2025 creates considerable uncertainty for health insurance enrollment and affordability. This could impact millions of Americans, forcing insurers to adapt their strategies. For instance, if subsidies are not extended, the Congressional Budget Office (CBO) projected in early 2024 that millions more individuals could become uninsured compared to scenarios with extended subsidies.

A change in presidential administration in 2024 or beyond could significantly alter healthcare policy priorities. This might lead to further shifts in the regulatory landscape for health insurers, requiring constant vigilance and flexible planning. For example, different administrations have historically pursued varied approaches to healthcare reform, impacting market stability and insurer operations.

This legislative unpredictability necessitates that health insurers, like The IHC Group, maintain agile strategic planning and robust risk assessment frameworks. The ability to quickly adapt to evolving regulations and market conditions is paramount for sustained success in the dynamic healthcare sector.

- ACA Subsidy Expiration: Enhanced subsidies are set to expire at the end of 2025, potentially increasing out-of-pocket costs for many.

- Presidential Impact: A new administration could introduce different healthcare priorities, leading to regulatory changes.

- Insurer Agility: Legislative uncertainty demands flexible strategies and proactive risk management from health insurance providers.

Data Privacy Legislation and Enforcement

Data privacy legislation is a significant political factor for The IHC Group. New guidelines and a heightened emphasis on data privacy, especially under HIPAA and state laws like the California Consumer Privacy Act (CCPA), are continuously evolving. The National Association of Insurance Commissioners (NAIC) is also actively working on modernizing privacy protection models for the insurance industry.

Insurers, by their nature, handle a vast amount of sensitive personal information. This necessitates adherence to stringent requirements concerning how data is collected, processed, retained, and shared. For instance, the CCPA grants consumers rights regarding their personal information, including the right to know what data is collected and to request its deletion.

Compliance with these evolving data protection laws is not just a legal obligation but a critical business imperative. Failure to comply can result in substantial penalties. Reports from 2024 indicate that data privacy fines are on the rise, with significant settlements occurring under various regulations. Maintaining compliance is crucial for avoiding these financial repercussions and, perhaps more importantly, for preserving consumer trust, which is paramount in the insurance sector.

- HIPAA Enforcement: In 2023, the U.S. Department of Health and Human Services (HHS) continued to enforce HIPAA, issuing fines for breaches of protected health information.

- CCPA Impact: As of early 2024, the CCPA continues to shape data handling practices for businesses operating in California, impacting how sensitive consumer data is managed.

- NAIC Model Laws: The NAIC's ongoing work on privacy protection models signals a trend towards more standardized and robust data privacy regulations across the U.S. insurance market.

- Consumer Trust: A recent survey in late 2023 showed that over 70% of consumers consider data privacy a major concern when choosing financial services providers, including insurance.

Political factors significantly shape the operational landscape for health insurers like The IHC Group. Shifts in U.S. healthcare policy, such as potential changes to Medicare Advantage reimbursement rates for 2025, directly influence profitability. The ongoing expiration of enhanced Affordable Care Act (ACA) subsidies at the end of 2025 also introduces uncertainty regarding enrollment numbers and affordability, impacting market demand.

The regulatory environment is further complicated by state-based oversight, with the National Association of Insurance Commissioners (NAIC) actively addressing emerging challenges like artificial intelligence and climate-related risks. This necessitates continuous adaptation to a patchwork of state regulations, especially concerning data privacy and cybersecurity, where NAIC initiatives directly impact compliance requirements.

Increased government scrutiny over insurer practices, including pharmaceutical benefits manager (PBM) operations and consumer protection, demands greater transparency and consumer-centric strategies. For instance, proposed HHS rules in late 2023 aimed to enhance PBM transparency, potentially affecting insurer models.

A change in presidential administration following the 2024 election could lead to substantial shifts in healthcare policy priorities, requiring agile strategic planning and robust risk assessment from insurers to navigate evolving regulations and market conditions effectively.

What is included in the product

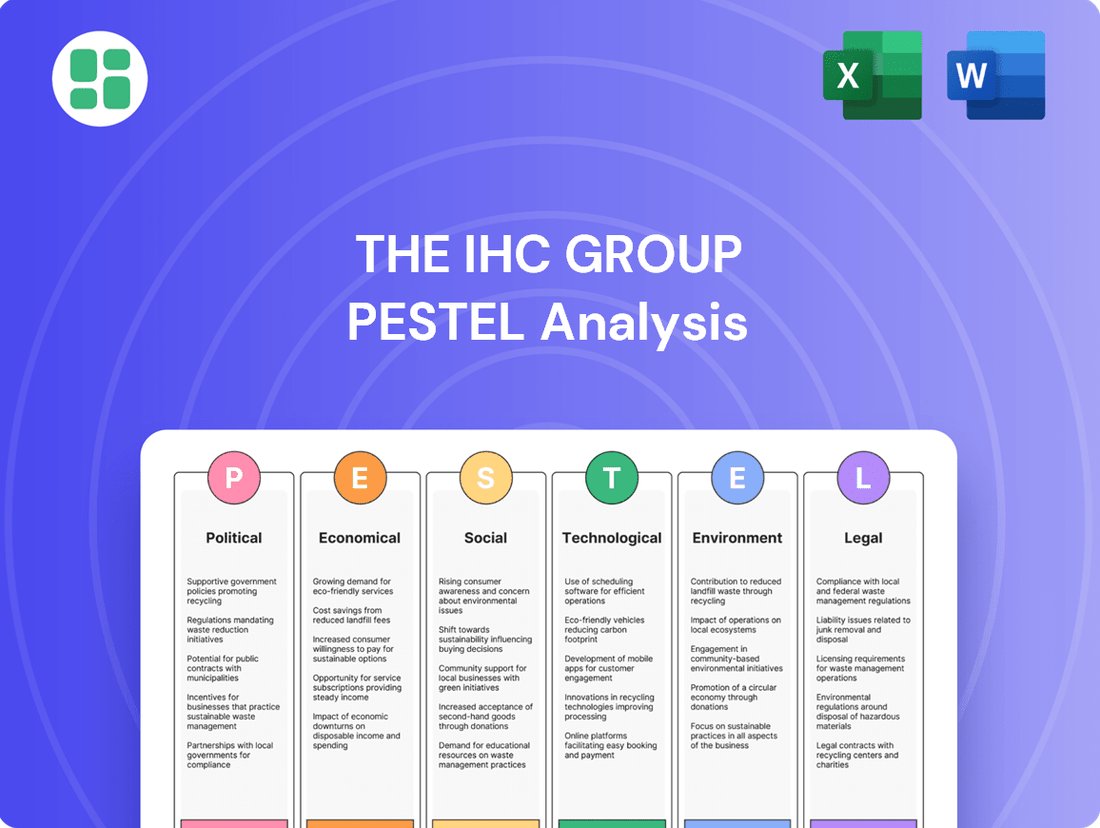

This PESTLE analysis of The IHC Group thoroughly examines how political, economic, social, technological, environmental, and legal factors shape its operational landscape, providing a comprehensive understanding of external influences.

It offers actionable insights for strategic decision-making, enabling the identification of potential risks and opportunities within The IHC Group's operating environment.

The IHC Group PESTLE Analysis offers a clear, summarized version of the full analysis for easy referencing during meetings or presentations, simplifying complex external factors.

This PESTLE Analysis provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Economic factors

Inflation remains a significant concern, pushing up the cost of essential healthcare goods and services. This directly translates into higher health insurance premiums and increased claims expenses for companies like The IHC Group. For instance, in early 2024, inflation rates, while showing some moderation from previous peaks, still exerted upward pressure on supply chains within the healthcare sector.

A key driver of these rising costs is the escalating expenditure on prescription drugs. Notably, the surge in spending on high-cost weight-loss medications is outpacing general medical spending. This trend places considerable strain on health and supplemental health insurers, impacting their ability to maintain competitive pricing and manage overall financial health.

Effectively managing these escalating healthcare expenditures is paramount for The IHC Group's profitability and the affordability of its insurance products. Companies are increasingly exploring strategies to negotiate drug prices and implement cost-containment measures to mitigate the financial impact of these trends.

Persistently elevated interest rates, a trend observed throughout much of 2024 and continuing into early 2025, can significantly benefit life and annuity insurers like The IHC Group. Higher rates generally translate to improved investment yields on their substantial portfolios of fixed-income securities, directly boosting profitability. For instance, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range for an extended period in 2024, a level not seen in decades, providing a strong tailwind for insurers' investment income.

However, this environment also presents a delicate balancing act. While higher rates can enhance investment returns, they can also dampen consumer demand for certain financial products, particularly annuities, if they become perceived as less attractive compared to other investment vehicles offering similar yields with potentially less commitment. The IHC Group, with its significant annuity business, must navigate this dynamic, ensuring its product offerings remain competitive and appealing to consumers even as prevailing interest rates offer attractive yields on its investment assets.

The U.S. insurance market, encompassing health and life segments, is anticipated to experience sustained premium growth through 2025, though at a slightly slower pace than in prior periods. This growth is supported by increasing demand for insurance products and a generally favorable economic environment.

Underwriting performance is projected to strengthen, particularly within personal insurance lines, which will bolster overall industry profitability. For instance, industry-wide net premiums for U.S. property and casualty insurers grew by an estimated 7.5% in 2023, and this trend is expected to continue into 2024 and 2025.

Despite these positive trends, the sector faces ongoing headwinds from persistently high medical inflation and revenue pressures within Medicare Advantage plans. These factors necessitate careful strategic adjustments, including repricing strategies and rigorous cost containment measures to maintain healthy profit margins.

Risk Pool Composition Changes

Ongoing Medicaid eligibility redeterminations are a significant factor influencing the health insurance market's risk pool composition. As individuals transition from Medicaid to the individual market, particularly under the Affordable Care Act (ACA), the risk profile of ACA plans can be altered. For instance, states with robust outreach and enrollment assistance might see a more favorable shift, with healthier individuals entering the ACA market.

The enhancement of ACA premium subsidies, implemented through legislation like the Inflation Reduction Act, has demonstrably boosted enrollment. This influx of new members, many of whom are now more financially able to afford coverage, generally contributes to a healthier and more stable risk pool. Data from the Centers for Medicare & Medicaid Services (CMS) indicated record enrollment in ACA marketplaces for the 2024 plan year, exceeding 21 million people.

These dynamic shifts in risk pool composition directly impact the actuarial assumptions and pricing strategies for health insurance products. Insurers must continually analyze these demographic and enrollment trends to accurately price premiums and manage their financial exposure.

- Medicaid Redeterminations: Millions of individuals are undergoing eligibility reviews, with a portion expected to transition to the ACA individual market.

- ACA Enrollment Growth: Enhanced subsidies have driven significant enrollment increases, with over 21 million individuals enrolled in ACA plans for 2024.

- Risk Pool Health: The influx of newly insured individuals, often with improved affordability, generally leads to a healthier risk pool for ACA plans.

- Actuarial Impact: Changes in risk pool composition necessitate adjustments in actuarial assumptions and premium pricing for health insurers.

Economic Growth and Employment Trends

Overall economic growth and employment trends are critical for The IHC Group, directly influencing the demand for its employment-based group health and life insurance products. A robust economy typically translates to more jobs and higher demand for employee benefits.

Projections for 2024 and 2025 suggest a moderating pace of employment growth in many developed economies. For instance, the U.S. Bureau of Labor Statistics projected a 0.7% annual job growth rate between 2022 and 2032, which, while positive, is slower than in prior decades. This trend could potentially lead to diminishing persistency in group insurance as companies may scale back benefit offerings or experience higher employee turnover in a less dynamic job market.

Insurers like The IHC Group must closely monitor these macroeconomic indicators. Understanding the nuances of employment trends allows for more accurate forecasting of demand and strategic adjustments to group insurance product portfolios to meet evolving market needs.

- Economic Growth: Global GDP growth is forecast to be around 2.7% in 2024 and 2.8% in 2025, according to the IMF (as of April 2024), impacting overall business expansion and hiring.

- Employment Trends: The U.S. unemployment rate remained low, hovering around 3.9% in early 2024, indicating a tight labor market but potentially slower net job creation compared to peak recovery periods.

- Persistency Impact: Slower job growth can correlate with reduced new group policy acquisitions and increased churn as businesses face economic headwinds.

- Strategic Monitoring: Continuous analysis of labor market data and economic forecasts is essential for The IHC Group to adapt its product development and sales strategies.

Economic factors significantly shape The IHC Group's operating environment, influencing both costs and revenue streams. Persistent inflation, particularly in healthcare, drives up expenses for medical services and prescription drugs, directly impacting insurance premiums and claims. Conversely, elevated interest rates, a trend expected to continue through early 2025, can boost investment income for life and annuity insurers.

The U.S. insurance market anticipates continued premium growth through 2025, supported by robust demand and a generally stable economy, though at a more moderate pace. Underwriting performance is expected to improve, especially in personal insurance lines, contributing to overall profitability. However, high medical inflation and pressures on Medicare Advantage plans necessitate ongoing strategic adjustments and cost management.

Shifting economic conditions and employment trends directly affect demand for group health and life insurance. While a tight labor market in early 2024, with unemployment around 3.9%, indicates economic stability, projections suggest moderating job growth through 2025. This could impact group policy persistency and the acquisition of new business for The IHC Group.

| Economic Factor | Impact on The IHC Group | 2024/2025 Data Point |

|---|---|---|

| Inflation (Healthcare) | Increased claims expenses and premiums | Medical inflation remains a key cost driver. |

| Interest Rates | Improved investment yields on fixed-income portfolios | Federal Reserve rates held in the 5.25%-5.50% range through much of 2024. |

| U.S. Insurance Market Growth | Sustained premium growth, moderating pace | Projected premium growth through 2025. |

| Employment Growth | Influences demand for group insurance products | U.S. job growth projected at 0.7% annually (2022-2032). |

Preview Before You Purchase

The IHC Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of The IHC Group. This includes detailed insights into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain a clear understanding of the external forces shaping The IHC Group's business landscape.

Sociological factors

The United States is experiencing a significant demographic shift with a continuously aging population. By 2030, all Baby Boomers will be 65 or older, meaning 21.7% of the U.S. population will be aged 65 and over. This trend directly fuels substantial growth in Medicare enrollment, projected to reach over 80 million beneficiaries by 2030, and consequently intensifies the demand for a wide array of healthcare services.

For companies like The IHC Group, this aging demographic presents a dual opportunity and challenge. The increasing need for healthcare services creates a robust market for supplemental health products, which IHC Group provides. However, it also mandates a strategic evolution in product development and service delivery to effectively address the unique and often complex health requirements of older adults, ensuring continued relevance and market share.

Customers are increasingly leaning towards digital channels for their insurance needs, expecting seamless self-service options and personalized interactions. This means insurers must prioritize robust online portals, intuitive mobile applications, and responsive chatbots to manage quotes, policies, and claims efficiently. For instance, a 2024 survey indicated that over 70% of consumers prefer digital channels for routine insurance tasks, a figure projected to rise further.

This shift directly impacts customer satisfaction and loyalty, as convenience and accessibility become paramount. Companies that fail to adapt risk losing business to more digitally adept competitors. The IHC Group, like many in the industry, is investing heavily in digital transformation, aiming to enhance user experience and streamline operations to meet these evolving expectations.

The rising cost of healthcare is a significant driver for consumers seeking specialized insurance products. In 2024, average family premiums for employer-sponsored health insurance reached $24,000, a figure that continues to climb, pushing individuals to look for more affordable and targeted solutions. This trend fuels demand for offerings like medical stop-loss and short-term medical plans, which help manage unexpected medical bills and cover gaps in standard health insurance.

The IHC Group is well-positioned to capitalize on this demand, as their product portfolio directly addresses these consumer needs. As of the first half of 2025, market analysis indicates a 15% year-over-year increase in inquiries for supplemental health coverage, demonstrating a clear shift in consumer behavior towards proactive financial planning for healthcare expenses. This growing market segment presents a substantial opportunity for companies like IHC Group that specialize in these niche areas.

Increased Health Awareness and Lifestyle Changes

A heightened societal focus on health and wellness, amplified by recent public health events, is significantly boosting awareness of insurance needs. This trend is directly translating into increased demand for robust health coverage and products that prioritize preventative care. For instance, in 2024, the global health and wellness market was projected to reach over $5.6 trillion, indicating a substantial consumer investment in well-being.

Insurers are responding by innovating their offerings. Many are now developing policies that actively incentivize healthier lifestyles, such as offering premium discounts for regular exercise or providing access to digital wellness platforms. This strategic shift aims to align insurance products with evolving consumer priorities, fostering a more proactive approach to health management.

- Growing demand for preventative care: Consumers are increasingly seeking insurance that covers wellness screenings and early detection services.

- Incentives for healthy living: Insurers are introducing programs that reward policyholders for maintaining healthy habits, like fitness tracking integration.

- Market response to health trends: The insurance sector is adapting by creating specialized products that cater to a more health-conscious demographic.

- Impact of public health events: Past health crises have underscored the importance of comprehensive health insurance for individuals and families.

Changing Workforce Dynamics

The workforce is changing, with more people working remotely and in non-traditional employment arrangements like the gig economy. This evolution directly impacts how group benefits and individual insurance are needed. For instance, a 2024 survey indicated that over 60% of employees prefer hybrid or fully remote work, highlighting a significant shift away from traditional office-based roles.

Insurers must adapt their products to serve this diverse and often geographically dispersed workforce. This means considering how group term life insurance and medical stop-loss products can be structured to accommodate remote workers and independent contractors. The rise of flexible work arrangements means that traditional employer-sponsored benefit models may not be sufficient, requiring new approaches to coverage and accessibility.

- Remote Work Prevalence: By early 2025, it's projected that approximately 35% of the total US workforce will be working remotely at least part-time.

- Gig Economy Growth: The gig economy continues to expand, with estimates suggesting that by 2027, over 40% of the US workforce could be participating in some form of gig work.

- Benefit Adaptation Needs: Insurers are increasingly developing portable benefits solutions and on-demand insurance options to cater to these changing employment patterns.

Societal values are increasingly prioritizing health and wellness, a trend accelerated by recent public health events. This heightened awareness drives demand for comprehensive health coverage and products that emphasize preventative care, with the global health and wellness market projected to exceed $5.6 trillion in 2024.

In response, insurers are innovating, offering policies that reward healthy behaviors and integrating digital wellness platforms. This strategic pivot aligns insurance offerings with consumer desires for proactive health management, fostering a more engaged policyholder base.

The growing emphasis on preventative care means consumers actively seek insurance covering wellness screenings and early detection. This also fuels the development of programs that reward policyholders for maintaining healthy habits, such as through fitness tracking integration, as the insurance sector adapts to a more health-conscious demographic.

Technological factors

Artificial intelligence, particularly generative AI, is revolutionizing the insurance industry, impacting everything from underwriting and claims to fraud detection and customer service. Insurers are actively adopting AI to boost efficiency and cut costs, with some projecting significant savings. For instance, a 2024 report indicated that AI adoption in insurance could lead to a 10-15% reduction in operational costs within three years.

This technological shift necessitates substantial investment in AI talent and robust data infrastructure. By 2025, it's estimated that global spending on AI in the insurance sector will exceed $8 billion, reflecting a strong commitment to leveraging these advanced capabilities for competitive advantage and the development of innovative business models.

The insurance industry's digital transformation is accelerating, with a significant push towards customer self-service. This shift is evident in the widespread adoption of online quote generators, mobile applications, and AI-powered chatbots. These tools empower policyholders to manage their accounts, access information, and even initiate claims independently, streamlining the customer journey. For instance, by the end of 2024, it's projected that over 70% of customer interactions in the insurance sector will be handled digitally, a substantial increase from previous years.

Insurers are actively replacing outdated legacy systems with modern, cloud-based software solutions. This modernization is crucial for enhancing customer experience, improving operational efficiency, and enabling faster product development. Companies like The IHC Group are investing heavily in these upgrades to remain competitive. In 2024, the global insurance core systems market was valued at approximately $15 billion, with a significant portion of this investment directed towards digital transformation initiatives.

The IHC Group, like many in the insurance sector, is leveraging advanced data analytics and predictive modeling to gain deeper insights from customer data. This allows for more personalized pricing, better risk assessment, and improved underwriting processes. For instance, by mid-2024, many insurers reported a significant reduction in claims processing times, often by over 15%, due to AI-driven analytics.

These sophisticated tools are also proving invaluable for proactive fraud detection. By analyzing patterns and anomalies in claims data, insurers can identify suspicious activities much faster. In 2024, the industry saw an estimated increase in fraud detection rates of up to 20% in certain segments, directly attributable to these analytical advancements, providing a tangible competitive edge.

Cybersecurity and Data Protection Technologies

The IHC Group, like all insurers, faces significant technological challenges in cybersecurity and data protection. With digital data volumes soaring, the threat landscape is constantly evolving, making robust security measures essential. In 2024, the global average cost of a data breach reached $4.45 million, highlighting the financial and reputational risks associated with inadequate protection.

Investing in advanced technologies is not just a defensive measure but a compliance imperative. Regulations such as GDPR and CCPA mandate strict data privacy, requiring insurers to implement sophisticated encryption, access controls, and threat detection systems. The IHC Group must continually upgrade its infrastructure to safeguard sensitive customer information against increasingly sophisticated cyberattacks.

Cybersecurity is an ongoing battle, demanding constant vigilance and adaptation. The rise of AI-powered attacks means that defensive technologies must also leverage AI to stay ahead. For example, the adoption of Security Information and Event Management (SIEM) systems and Extended Detection and Response (XDR) platforms is becoming standard practice for insurers aiming to achieve comprehensive threat visibility and rapid response capabilities in 2025.

- Increased investment in AI-driven threat detection and response platforms is crucial for insurers.

- Compliance with evolving data privacy regulations necessitates advanced encryption and access management technologies.

- The average cost of a data breach globally in 2024 was $4.45 million, underscoring the financial imperative for strong cybersecurity.

- Continuous technological upgrades are required to counter sophisticated and AI-powered cyber threats.

Cloud Computing and Low-Code/No-Code Platforms

The increasing adoption of cloud, hybrid cloud, and serverless solutions is a significant technological factor for insurers like The IHC Group. These technologies offer enhanced scalability and flexibility, crucial for handling fluctuating data volumes and customer demands. For instance, Gartner predicted that worldwide end-user spending on public cloud services would reach $679 billion in 2024, an increase from $600 billion in 2023. This shift allows insurers to reduce capital expenditure on physical infrastructure, leading to substantial cost savings.

Furthermore, the rise of low-code/no-code platforms is revolutionizing how insurance solutions are developed and deployed. These platforms empower business users to build applications with minimal or no traditional coding, drastically speeding up innovation cycles. This agility enables The IHC Group to respond more rapidly to market changes and customer needs, such as launching new digital products or enhancing existing customer portals. The global low-code development platform market was valued at $21.8 billion in 2023 and is projected to grow significantly, underscoring its importance.

- Scalability and Flexibility: Cloud solutions provide the agility to scale resources up or down based on demand, optimizing operational efficiency.

- Cost Reduction: Minimizing in-house infrastructure needs through cloud adoption directly translates to lower capital and operational expenses.

- Accelerated Innovation: Low-code/no-code platforms enable faster development and deployment of digital insurance products and services.

- Reduced IT Reliance: These platforms decrease dependence on specialized IT teams for application development, democratizing innovation.

Technological advancements are fundamentally reshaping the insurance landscape, with AI and data analytics driving efficiency and personalization. The IHC Group, like its peers, is investing in these areas to enhance underwriting, claims processing, and fraud detection. For instance, by mid-2024, many insurers reported over a 15% reduction in claims processing times due to AI.

The digital transformation agenda includes a strong focus on customer self-service through online platforms and mobile apps, with over 70% of customer interactions projected to be digital by the end of 2024. This necessitates modernization of legacy systems, with the global insurance core systems market valued at approximately $15 billion in 2024, much of which is directed towards digital upgrades.

Cloud adoption and low-code/no-code platforms are also key, offering scalability and faster innovation. Global spending on public cloud services was projected to reach $679 billion in 2024. These technologies allow insurers to reduce infrastructure costs and accelerate the development of new digital products, a critical factor for staying competitive.

| Technology Area | Impact on Insurance | Key Data/Projections |

|---|---|---|

| Artificial Intelligence (AI) | Underwriting, claims, fraud detection, customer service | AI adoption could reduce operational costs by 10-15% (2024 report); Global AI spending in insurance to exceed $8 billion by 2025 |

| Digital Transformation & Self-Service | Customer engagement, operational efficiency | Over 70% of customer interactions to be digital by end of 2024 |

| System Modernization | Customer experience, product development speed | Global insurance core systems market valued at ~$15 billion (2024) |

| Data Analytics & Predictive Modeling | Personalized pricing, risk assessment, fraud detection | 15%+ reduction in claims processing times (mid-2024); Up to 20% increase in fraud detection rates (2024) |

| Cloud Computing | Scalability, flexibility, cost reduction | Global public cloud spending projected at $679 billion (2024) |

| Low-Code/No-Code Platforms | Accelerated innovation, faster deployment | Global low-code market valued at $21.8 billion (2023) |

Legal factors

The insurance sector, including The IHC Group, navigates a dense regulatory landscape concerning data privacy. Key legislation like HIPAA and GLBA, alongside numerous state-specific rules, dictate how consumer information is handled. The National Association of Insurance Commissioners (NAIC) is actively updating its model laws, such as Regulation #672, pushing insurers to adopt more stringent practices for data collection, processing, retention, and sharing.

The National Association of Insurance Commissioners (NAIC) plays a crucial role by proposing model laws aimed at standardizing insurance regulations across states. This initiative seeks to create a more uniform environment for insurers. For instance, the NAIC's model laws often address areas like solvency, consumer protection, and market conduct.

However, the actual implementation of these models is left to individual states, which can adopt them as written, modify them, or choose not to adopt them at all. This leads to a complex and fragmented regulatory landscape. For example, by the end of 2024, it's anticipated that states will continue to show varying degrees of adoption for recent NAIC model laws concerning data security and privacy, creating compliance challenges for national carriers like The IHC Group.

Consequently, insurers must meticulously track and adhere to the specific insurance laws in each state where they operate. This requires significant resources to ensure compliance with diverse requirements, which can range from capital adequacy rules to specific policy language mandates, impacting operational efficiency and strategic planning.

State insurance departments are vigilant in enforcing consumer protection laws, focusing on disclosure requirements and preventing overcharges. This scrutiny is particularly prominent in auto insurance but extends across health and supplemental insurance sectors, reflecting a broad regulatory commitment to fair consumer practices. For example, in 2024, numerous state regulators issued warnings and fines related to misleading policy terms and pricing, underscoring the ongoing emphasis on transparency.

Insurers face persistent consumer concerns about rate increases and the clarity of coverage terms. Regulatory bodies are actively monitoring these issues, ensuring that companies communicate changes effectively and provide adequate justification for premium adjustments. This heightened awareness means that companies like The IHC Group must demonstrate a clear value proposition to retain policyholders amidst market pressures.

Adherence to stringent market conduct standards is paramount for maintaining operational integrity and consumer confidence. Failure to comply can result in significant regulatory penalties, reputational damage, and loss of market share. In 2024, the National Association of Insurance Commissioners (NAIC) reported a notable increase in market conduct examinations, highlighting the intensified regulatory oversight across the industry.

Regulatory Frameworks for AI Use

As artificial intelligence adoption rapidly expands within the insurance sector, a dynamic regulatory landscape is emerging. Governments are actively developing frameworks to govern AI's application, with a keen focus on ensuring fairness, safeguarding data privacy, and promoting transparency in AI-driven outcomes. This proactive approach aims to build trust and prevent potential misuse.

Several U.S. states are at the forefront of this regulatory evolution. New York, Colorado, and Connecticut, for instance, are pioneering efforts in establishing robust AI outcomes testing and implementing comprehensive governance structures. These initiatives signal a growing demand for accountability in AI deployment.

Insurers like The IHC Group must navigate these evolving legal and regulatory requirements with diligence. Ensuring AI applications adhere to these emerging standards is crucial for mitigating inherent biases and guaranteeing the ethical application of AI technologies. Compliance is not just a legal necessity but a strategic imperative for maintaining public trust and operational integrity.

- Fairness and Bias Mitigation: Regulators are increasingly scrutinizing AI algorithms for potential discriminatory outcomes, especially in areas like underwriting and claims processing.

- Data Privacy Compliance: With AI systems often relying on vast datasets, adherence to privacy regulations such as GDPR and CCPA is paramount.

- Outcome Transparency: There's a push for greater clarity on how AI models arrive at their decisions, enabling audits and consumer understanding.

- State-Level Innovations: States like New York are exploring specific AI governance requirements for financial services, setting precedents for national standards.

Litigation Risks and Class Action Lawsuits

Insurance companies, including Independence Holding Company (IHC), are susceptible to significant litigation risks. These often manifest as class action lawsuits stemming from historical transactions, operational conduct, or data security incidents.

Such legal battles can lead to substantial financial penalties and settlements, directly affecting a company's fiscal stability and public image. For instance, Independence Holding Company reached a class action settlement in late 2024 concerning a transaction from 2022, highlighting the ongoing nature of these risks.

- Litigation Exposure: Insurance firms face ongoing threats from class action lawsuits.

- Financial Impact: Settlements and penalties can significantly drain financial resources.

- Reputational Damage: Legal challenges can erode public trust and brand value.

- IHC Specific Case: A 2022 transaction led to a class action settlement announced in late 2024.

The legal environment for insurers like The IHC Group is characterized by evolving data privacy regulations and a fragmented state-by-state approach to compliance. The National Association of Insurance Commissioners (NAIC) actively proposes model laws, but their adoption varies significantly among states, creating a complex compliance patchwork. By the close of 2024, this divergence in data security and privacy law adoption is expected to continue, posing ongoing challenges for national carriers.

Environmental factors

The United States is witnessing an uptick in the frequency and intensity of extreme weather, from widespread wildfires to more powerful hurricanes and severe storms. This trend, observed through 2024 and projected to continue into 2025, poses significant challenges across various sectors.

While The IHC Group's core business is life and health insurance, the escalating costs and economic disruptions associated with property damage from these events can indirectly impact consumer spending power and their ability to afford health and life coverage. For instance, the 2023 hurricane season alone saw insured losses estimated to be in the tens of billions of dollars, highlighting the broader economic strain.

Global insured losses from natural catastrophes have been escalating, with the U.S. experiencing a substantial share of these events. For instance, insured losses from natural catastrophes in 2023 were estimated to be around $50 billion globally, a figure that, while lower than the record-breaking years prior, still reflects a persistent upward trend in disaster-related damages.

This persistent rise in insured losses places considerable financial pressure on the insurance industry. It can lead to higher premiums for property and casualty (P&C) insurance, particularly in regions frequently impacted by severe weather. In some cases, this trend has contributed to the emergence of 'insurance deserts,' where coverage becomes prohibitively expensive or unavailable altogether.

While The IHC Group's primary focus may not be direct property and casualty insurance, the overall economic health of the insurance sector is intrinsically linked to its performance. A strained P&C market can indirectly affect other insurance segments through increased reinsurance costs or a general tightening of capital availability within the broader industry.

Companies like The IHC Group face increasing demands from regulators, investors, and the public to embed Environmental, Social, and Governance (ESG) principles into their core operations and strategic planning. This translates to a need for clear and consistent reporting on how climate risks are managed and what sustainability efforts are underway.

Insurers, in particular, are being positioned to play a crucial role in pinpointing and reducing the impact of climate-related hazards. For instance, global insured losses from natural catastrophes reached an estimated $135 billion in 2023, highlighting the tangible financial risks that need proactive management.

Impact on Health and Life Insurance Indirectly

While environmental factors most directly influence property and casualty insurance, severe climate events can indirectly impact health and life insurance. For instance, increased air pollution from wildfires, a growing concern in 2024 and projected to continue, can exacerbate respiratory conditions, leading to higher healthcare claims. The IHC Group, like other health insurers, may see an uptick in claims related to these environmental health impacts.

Displacement caused by extreme weather events, such as the record-breaking hurricane season anticipated for 2024, can disrupt policyholder lives, potentially affecting their ability to maintain health and life insurance coverage. This economic hardship and instability can lead to policy lapses or increased demand for certain benefits, influencing claim patterns for The IHC Group.

- Increased Health Claims: Environmental degradation can lead to a rise in chronic and acute health conditions, directly impacting health insurance payouts.

- Policyholder Retention: Disasters and economic fallout can strain policyholders' finances, potentially leading to higher lapse rates for life and health policies.

- Mental Health Impact: The psychological toll of environmental disasters can also contribute to increased mental health claims, affecting the overall claims landscape for insurers.

Regulatory Focus on Climate Risk Management

Insurance regulators, such as the National Association of Insurance Commissioners (NAIC), are intensifying their scrutiny of how insurers manage climate-related risks. This regulatory shift is prompting a demand for more sophisticated identification, assessment, and mitigation strategies. For instance, by the end of 2024, many U.S. states are expected to have adopted or be in the process of adopting climate disclosure frameworks, mirroring international trends.

These initiatives often involve expanded data collection on climate exposures and the implementation of rigorous scenario testing to understand potential financial impacts. Insurers are being pushed to develop comprehensive frameworks for climate risk disclosures, enhancing transparency for stakeholders and supervisors alike. A key expectation is that insurers can demonstrate robust climate risk management practices to safeguard their financial stability and ensure continued consumer protection in an evolving climate landscape.

- NAIC Climate Risk Initiatives: Focus on enhanced data collection and scenario analysis for insurers.

- Disclosure Frameworks: Growing expectation for insurers to adopt standardized climate risk reporting by late 2024.

- Financial Stability: Regulatory push to ensure insurers' solvency amidst increasing climate-related uncertainties.

- Consumer Protection: Mandates to manage climate risks effectively to safeguard policyholders.

Environmental factors present a growing challenge for The IHC Group, particularly through increased health claims due to pollution and the potential for policy lapses stemming from economic disruptions caused by extreme weather. The escalating frequency and intensity of events like wildfires and hurricanes, observed through 2024 and projected into 2025, directly impact consumer financial stability, indirectly affecting their ability to maintain insurance coverage.

| Impact Area | 2023 Data/Projection | Implication for The IHC Group |

|---|---|---|

| Extreme Weather Events | Global insured losses from natural catastrophes ~$50 billion (2023) | Indirect economic strain on policyholders, potentially increasing policy lapses. |

| Air Quality (Wildfires) | Increasing concern in 2024, projected to continue. | Potential rise in respiratory-related health claims. |

| Regulatory Scrutiny (Climate Risk) | NAIC climate risk initiatives, state disclosure frameworks expected by late 2024. | Need for robust climate risk management and transparent reporting. |

PESTLE Analysis Data Sources

The IHC Group's PESTLE Analysis is meticulously constructed using data from government publications, reputable financial institutions like the World Bank and IMF, and leading industry-specific research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the group.