The IHC Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The IHC Group Bundle

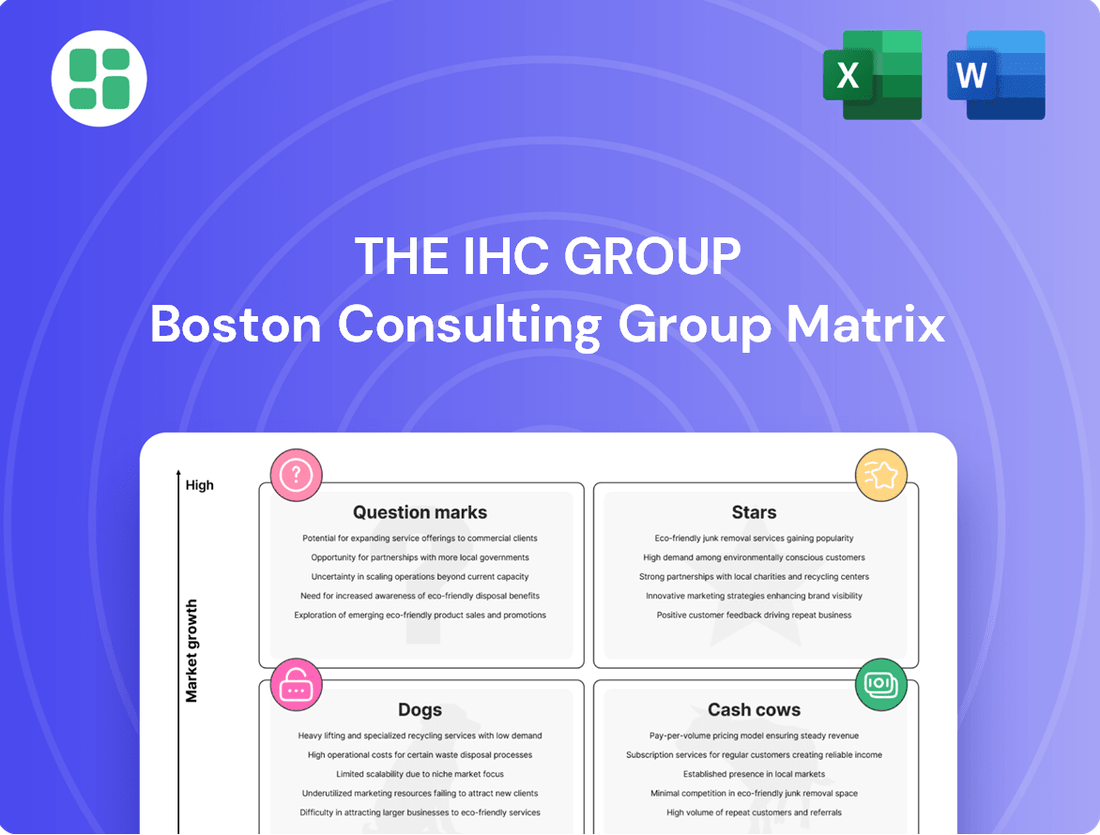

Curious about The IHC Group's strategic product portfolio? This glimpse into their BCG Matrix reveals the potential for growth and stability within their offerings.

Don't just wonder, know. Purchase the full BCG Matrix report for a comprehensive breakdown of The IHC Group's Stars, Cash Cows, Dogs, and Question Marks, empowering you with actionable insights for smart investment and product decisions.

Stars

Medical stop-loss insurance is a critical component for self-funded employers, offering a financial safety net against unpredictable, high-cost medical claims. This market is booming, with projections showing a 15.1% compound annual growth rate between 2025 and 2034, reflecting a clear trend of employers shifting towards self-funding to better control escalating healthcare expenditures.

Independence Holding Company, with its dedicated focus on the medical stop-loss sector, is well-positioned to thrive in this expanding market. Their specialization allows them to effectively capture a significant share of the demand from employers seeking robust protection against catastrophic claims, a key driver in the industry's robust growth trajectory.

The annuity market is booming, and Fixed-Indexed Annuities (FIAs) are leading the charge. Projections show FIAs are set to exceed $120 billion in sales by 2025, a significant jump that highlights their appeal. This strong growth indicates a clear investor preference for products that balance safety with the potential for market-linked gains.

For IHC Group, this surge in FIA demand presents a prime opportunity. By focusing on this high-growth segment, IHC can solidify its position as a market leader, offering investors the security and growth they are actively seeking. Investing in and expanding FIA offerings is therefore crucial for maintaining and enhancing IHC's competitive edge.

Innovative Supplemental Health Plans are positioned as a Stars within The IHC Group's BCG Matrix. The U.S. supplemental health market is projected to grow at a robust 5.60% CAGR between 2025 and 2034, driven by escalating healthcare expenses and greater consumer focus on out-of-pocket costs.

If IHC excels in creating and offering novel supplemental products, like those incorporating wellness initiatives or specific critical illness benefits, these offerings are likely to experience high growth and capture expanding market share. This segment warrants ongoing strategic investment to maintain its leading position and capitalize on market trends.

Reinsurance for Emerging Healthcare Risks

The life and health reinsurance market is projected to grow at a robust 6% compound annual growth rate from 2024 to 2025. This expansion is fueled by an increasing frequency of high-cost claims, particularly those associated with cutting-edge medical treatments such as gene and cell therapies.

If The IHC Group's reinsurance offerings demonstrate particular strength in underwriting and managing these novel, high-value healthcare risks, they are well-positioned to secure a significant portion of this expanding niche market. Success in this specialized field demands substantial expertise and considerable capital, thereby establishing leading participants as key players.

- Market Growth: Life and health reinsurance CAGR of 6% (2024-2025).

- Key Drivers: Rising claims from advanced therapies like gene and cell therapies.

- IHC's Opportunity: Expertise in underwriting and managing high-cost, emerging risks.

- Market Positioning: Potential to become a leader in a capital-intensive, specialized sector.

Digital-First Individual Life Insurance Solutions

Digital-First Individual Life Insurance Solutions represent a strategic push into a market increasingly shaped by technology. The life insurance sector is embracing advanced tools like AI and big data analytics. These technologies are key to making underwriting smoother and tailoring policies to individual needs. Younger consumers are a major driving force behind this growth.

If The IHC Group effectively utilizes digital platforms to connect with new individual life insurance customers, offering adaptable and easy-to-use products, these solutions are well-positioned to capture substantial market share. This is particularly true in a market that is evolving technologically, even if its overall growth rate is moderate. For instance, in 2024, digital channels accounted for an estimated 30% of new individual life insurance sales in the US, a figure projected to rise.

This strategic pivot places these digital offerings in a category with high growth potential.

- Market Trend: Increased adoption of AI and big data in life insurance underwriting and personalization.

- Customer Driver: Younger demographics are increasingly seeking digital-first, user-friendly financial products.

- IHC's Potential: Successful digital platform leverage could lead to significant market share gains.

- Growth Outlook: Positioned as high-growth potential within a technologically evolving, moderately growing market.

Innovative Supplemental Health Plans are positioned as Stars within The IHC Group's BCG Matrix, reflecting their high market growth and high relative market share. The U.S. supplemental health market is projected to grow at a robust 5.60% CAGR between 2025 and 2034, driven by escalating healthcare expenses and greater consumer focus on out-of-pocket costs.

If IHC excels in creating and offering novel supplemental products, these offerings are likely to experience high growth and capture expanding market share. This segment warrants ongoing strategic investment to maintain its leading position and capitalize on market trends.

Digital-First Individual Life Insurance Solutions also represent Stars, with a focus on leveraging technology like AI and big data for underwriting and personalization. Younger consumers are a major driving force behind this growth, with digital channels accounting for an estimated 30% of new individual life insurance sales in the US in 2024.

If IHC effectively utilizes digital platforms to connect with new customers, offering adaptable and easy-to-use products, these solutions are well-positioned to capture substantial market share in this technologically evolving market.

| Business Unit | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| Innovative Supplemental Health Plans | High (5.60% CAGR 2025-2034) | High | Stars |

| Digital-First Individual Life Insurance | Moderate to High (driven by tech adoption) | High | Stars |

What is included in the product

The IHC Group BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, identifying units for growth, maintenance, or divestment within the IHC Group's portfolio.

The IHC Group BCG Matrix provides a clear, actionable visual to identify underperforming units, alleviating the pain of strategic indecision.

Cash Cows

Established Group Term Life Insurance Policies are a classic example of a Cash Cow within The IHC Group's BCG Matrix. The U.S. Group Level Term Insurance Market, a significant segment, was valued at $7.32 billion in 2024 and is anticipated to expand at a 6.50% compound annual growth rate through 2030, indicating a stable, albeit mature, market.

IHC's existing book of group term life policies benefits from this market stability, likely generating consistent and dependable cash flows. This is due to a substantial and loyal customer base, coupled with minimal marketing expenditures typically associated with established products in a mature industry.

Traditional medical stop-loss for large enterprises, a key component of The IHC Group's offerings, represents a mature yet dominant segment within the stop-loss market. In 2024, this segment held the largest market share, underscoring its foundational role.

IHC's established presence and strong relationships within this large enterprise sector translate into significant and consistent cash flow. These policies are not only stable but also contribute substantially to the company's overall financial health, requiring minimal aggressive reinvestment.

Hospital indemnity and accident insurance are key revenue drivers for The IHC Group, operating as strong cash cows within their product portfolio. In 2024, hospital indemnity insurance alone captured over 21.90% of the supplemental health market revenue, demonstrating its substantial and consistent contribution to the overall market.

These established products benefit from high profit margins and a loyal customer base, requiring little incremental investment for marketing or development. This allows them to generate steady, reliable cash flows for the company, supporting other business ventures.

Standard Reinsurance Treaties

Standard reinsurance treaties within the life and health sectors are a cornerstone of financial stability, projecting a healthy compound annual growth rate (CAGR) of 6% between 2024 and 2025.

IHC's engagement in these established reinsurance agreements, especially with enduring partners and predictable risk demographics, generates reliable and significant cash inflows.

These treaty operations are crucial for effective risk mitigation and sustaining the profitability of IHC's entire insurance business.

- Market Growth: Life and health reinsurance is expected to grow at a 6% CAGR from 2024-2025.

- Predictable Cash Flow: Standard treaties with stable partners ensure consistent cash generation.

- Risk Management: These treaties are vital for managing risk across IHC's portfolio.

- Profitability Support: They contribute directly to maintaining overall business profitability.

Direct-to-Consumer Basic Supplemental Health Plans

Direct-to-consumer basic supplemental health plans are a prime example of a Cash Cow for The IHC Group. As more people understand the value of covering gaps in their primary health insurance, these plans, once established, become reliable revenue generators. Their appeal is broad, covering common health needs, and their administration is quite streamlined, which helps keep acquisition costs down.

For IHC, this translates into a consistent income stream. Once these plans gain significant market penetration, they require less new investment to maintain their profitability. This stability allows IHC to focus resources elsewhere while still benefiting from a large base of policyholders.

- Recurring Revenue: These plans generate predictable income, especially as awareness of supplemental benefits increases.

- Low Acquisition Costs: Once established, the cost to acquire new customers for these basic plans tends to decrease.

- Broad Appeal: They address common health insurance gaps, making them attractive to a wide audience.

- Stable Income Stream: They provide a reliable source of income for IHC with minimal ongoing investment needs after initial market penetration.

Cash Cows represent established products with high market share and low growth, generating consistent profits for The IHC Group. These products, like established group term life policies and traditional medical stop-loss, benefit from mature markets and loyal customer bases, requiring minimal reinvestment.

Hospital indemnity and accident insurance, along with direct-to-consumer supplemental health plans, also fall into this category, demonstrating strong revenue generation and profitability. Standard reinsurance treaties further bolster IHC's cash flow by providing predictable income streams and aiding in risk management.

| Product Category | Market Position | Cash Flow Generation | Growth Potential |

| Group Term Life Insurance | High Market Share | Consistent & Dependable | Low (Mature Market) |

| Traditional Medical Stop-Loss | Dominant Market Share | Significant & Consistent | Low |

| Hospital Indemnity & Accident Insurance | Key Revenue Drivers | High Profit Margins | Low to Moderate |

| Direct-to-Consumer Supplemental Health | Broad Appeal | Reliable Revenue Stream | Low (Post-Penetration) |

| Standard Reinsurance Treaties | Financial Stability | Reliable & Significant | Low to Moderate (6% CAGR 2024-2025) |

Preview = Final Product

The IHC Group BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully completed report you will receive immediately after your purchase. This means you are seeing the final, unwatermarked, and professionally formatted analysis, ready for immediate strategic application within The IHC Group.

Dogs

Outdated fixed-rate deferred annuity products are a concern. While the broader annuity market is expanding, sales of fixed-rate deferred annuities are expected to drop by as much as 25% in 2025. This decline is largely attributed to the anticipated decrease in interest rates.

If The IHC Group hasn't adapted its fixed-rate deferred annuity offerings, these products might be facing diminished market share and waning customer interest. Such annuities could lock up capital without delivering competitive returns, making them less attractive in the current financial landscape.

Legacy Short-Term Medical plans within The IHC Group's portfolio likely reside in the "Dogs" quadrant of the BCG Matrix. This is due to the inherent volatility of the short-term medical insurance market, often impacted by shifting regulations and a general perception of limited coverage among consumers.

Older, less flexible STM plans that haven't kept pace with changing consumer needs or the current regulatory landscape would naturally exhibit a low market share. These products offer minimal growth potential for IHC, potentially consuming valuable resources without generating significant returns.

Small, geographically limited individual health plans within The IHC Group's portfolio, particularly those outside their core markets, are likely positioned as Dogs in the BCG Matrix. These niche offerings often face challenges with low market share and limited growth prospects, making them difficult to scale efficiently. For instance, a plan serving a very small, specific region might struggle to compete against larger, more established insurers with broader reach and greater economies of scale.

The operational costs associated with supporting these geographically constrained plans can outweigh their revenue generation, especially if they require dedicated administrative or sales resources. In 2024, many smaller insurers have found it increasingly difficult to compete on price and product breadth in localized markets, leading to declining enrollment and profitability for such offerings. This situation necessitates a strategic review, with divestiture or substantial restructuring being potential outcomes.

Low-Margin, High-Administration Cost Legacy Life Policies

Certain legacy life insurance policies, especially those with intricate administrative demands and slim profit margins, can become a drag on an insurer's performance, fitting the 'dog' category within The IHC Group's BCG Matrix. These policies, while perhaps representing a stable customer base, require disproportionately high servicing costs relative to the revenue they generate. For example, if a significant portion of IHC's portfolio consists of older, commission-heavy whole life policies with low surrender charges, the administrative burden of maintaining these contracts could outweigh their profitability.

The life insurance sector in 2024 is experiencing moderate growth, but for IHC, the key concern would be the resource drain from these legacy 'dogs'. If these policies are costly to manage and do not contribute meaningfully to new business or overall market expansion, they divert capital and attention from more promising growth areas. For instance, if the cost to process claims, manage policyholder inquiries, and handle regulatory compliance for these older policies exceeds 15% of the annual premium income, it signals a significant inefficiency.

- Low Profitability: Policies with very narrow profit margins, often due to outdated pricing structures or guaranteed cash value increases, struggle to generate substantial returns.

- High Administrative Costs: Complex servicing requirements, manual data entry, and legacy IT systems can escalate the cost of managing these older contracts.

- Resource Diversion: Capital and human resources allocated to maintaining these underperforming policies could be better utilized in developing and marketing innovative new products.

- Market Stagnation: While the overall market may grow, these specific legacy products may not be competitive or appealing to current consumer needs, leading to stagnant or declining in-force blocks.

Divested or Non-Core Niche Insurance Lines

Divested or non-core niche insurance lines, if any, would be classified as dogs within The IHC Group's BCG Matrix. These are product lines that have been strategically deprioritized, perhaps due to low growth potential or a lack of synergy with IHC's main business focus. For instance, if IHC had a small offering in a highly specialized insurance sector that saw declining demand or faced intense competition, it might be moved to this category.

Such segments are typically characterized by low market share and low market growth. They often require ongoing investment to maintain, yet offer minimal returns, acting as cash traps. For example, a niche product that saw its addressable market shrink by 15% year-over-year in 2024, while only holding a 2% market share, would fit this description.

- Low Market Share: These lines typically represent a small fraction of IHC's overall business.

- Low Market Growth: The sectors these niche products serve are likely experiencing stagnant or declining growth.

- Cash Traps: They may consume resources without generating significant profits, hindering investment in more promising areas.

- Strategic Divestment: Companies often divest such lines to streamline operations and focus on core competencies.

Products in the Dogs quadrant of The IHC Group's BCG Matrix are those with low market share and low growth potential. These offerings often consume resources without generating significant returns, potentially hindering investment in more promising areas. For instance, legacy insurance products with high administrative costs and slim profit margins, or niche lines that have been strategically deprioritized, fit this description.

In 2024, companies like IHC must carefully manage these "dog" assets. The challenge lies in their tendency to drain capital and attention from growth opportunities. For example, a small, geographically limited health plan might struggle to achieve economies of scale, leading to operational costs that outpace revenue generation.

The strategic approach for these products often involves either divestiture or substantial restructuring to improve efficiency or eliminate the drain on resources. This allows the company to reallocate capital and focus on core competencies and higher-potential market segments.

Consider the case of outdated fixed-rate deferred annuities; their sales were projected to drop by as much as 25% in 2025 due to anticipated interest rate decreases, highlighting their declining market appeal and low growth prospects.

Question Marks

Registered Index-Linked Annuities (RILAs) represent a dynamic and rapidly expanding sector within the annuity landscape. Sales figures from 2024 indicate a robust performance, with projections suggesting these levels will be maintained or even surpassed in 2025, largely fueled by favorable equity market conditions. This strong growth trajectory positions RILAs as a significant opportunity for companies like IHC Group.

If IHC Group is actively pursuing or enhancing its presence in the RILA market, these products would likely be categorized as Question Marks within the BCG Matrix. They possess high growth potential due to market trends, but their current market share may be relatively low as IHC establishes its footing against established competitors. Substantial investment will be crucial to elevate these RILAs to a Star status.

The insurance sector is rapidly integrating AI and big data to refine underwriting and tailor products. IHC's focus on AI-driven underwriting for new, underserved markets signifies a strategic move into areas with significant growth prospects, though current market penetration is low.

This ambitious initiative necessitates considerable investment in research and development to capture market share. For instance, the global AI in insurance market was valued at approximately $1.5 billion in 2023 and is projected to reach over $10 billion by 2028, demonstrating the immense potential IHC is tapping into.

Expanding IHC's established medical stop-loss and supplemental health products into new geographic markets represents a classic question mark scenario. Initially, these products would likely capture a low market share in unfamiliar territories, despite the inherent growth potential of those regions.

Significant upfront investment in marketing, sales infrastructure, and distribution networks is crucial to build brand awareness and secure a foothold against established competitors. For instance, entering a new state might require an initial marketing budget of several million dollars, with a projected break-even period of three to five years.

This strategic move is inherently high-risk, demanding substantial capital and patience, but offers the potential for substantial long-term rewards if successful. The success hinges on accurately assessing market demand and effectively tailoring the product and distribution strategy to local needs.

Telehealth-Integrated Supplemental Benefits

The increasing demand for telehealth services presents a significant opportunity within the health insurance market. The IHC Group's development of supplemental health benefits centered on telehealth utilization positions them to capitalize on this high-growth trend. This strategic focus aligns with a market where consumer adoption of virtual care accelerated rapidly, with a notable surge in telehealth visits during 2024, often exceeding pre-pandemic levels for certain specialties.

While these telehealth-integrated supplemental benefits represent a promising area, they are likely to be in a nascent stage for The IHC Group. Consequently, they would probably exhibit a low current market share. This places them in a position requiring strategic investment and focused market development to gain traction and capture a more substantial segment of the expanding telehealth benefits landscape.

- Growing Telehealth Adoption: Telehealth utilization saw continued strong growth in 2024, with many employers and individuals actively seeking insurance plans that incorporate virtual care options.

- Market Share Potential: Despite the growing trend, new telehealth-focused supplemental benefits typically start with a small market share, necessitating significant marketing and product development efforts.

- Strategic Investment Required: To compete effectively, The IHC Group will need to invest in technology, partnerships, and consumer education to build awareness and drive uptake of these offerings.

Specialized Short-Term Medical Plans for Specific Provider Networks

The IHC Group could strategically develop specialized short-term medical (STM) plans designed for specific, expanding provider networks or employer groups. While the broader STM market exhibits considerable volatility, these niche offerings present a significant opportunity for high growth.

For IHC, these specialized plans would likely start with a low market share. However, if they achieve substantial adoption within their targeted networks, they could ascend to become Stars within the BCG Matrix.

Successfully launching and scaling these products necessitates dedicated marketing strategies and robust partnership development. For instance, in 2024, the employer-sponsored health insurance market saw continued interest in flexible benefit options, with some reports indicating a 5-7% growth in the adoption of supplemental health plans by mid-year.

- Niche Market Potential: Developing STM plans for specific provider networks or employer groups taps into underserved segments.

- BCG Matrix Positioning: These specialized plans would initially be considered Question Marks with potential to become Stars.

- Growth Drivers: Success hinges on focused marketing and strategic partnerships within targeted networks.

- Market Context: The demand for flexible and supplemental health benefits continues to rise, offering a favorable environment for specialized STM products.

Question Marks in The IHC Group's BCG Matrix represent business units or products with low market share but operating in high-growth industries. These ventures require significant investment to increase their market share and potentially become Stars. Without adequate investment, they risk becoming Dogs.

Products like Registered Index-Linked Annuities (RILAs) and telehealth-integrated supplemental health benefits fit this category for IHC. While the markets for these products are expanding rapidly, IHC's current penetration is likely low, demanding substantial capital for development and marketing to capture greater market share.

The strategic challenge is to identify which Question Marks have the highest potential to become Stars and allocate resources accordingly. This involves careful market analysis, product innovation, and effective execution to convert potential into market leadership.

The IHC Group's focus on developing specialized short-term medical (STM) plans for specific, expanding provider networks or employer groups exemplifies a Question Mark. These niche offerings target high-growth segments within the broader, albeit volatile, STM market.

| Product/Initiative | Market Growth Potential | Current Market Share | BCG Category | Investment Need |

|---|---|---|---|---|

| Registered Index-Linked Annuities (RILAs) | High | Low | Question Mark | High |

| AI-Driven Underwriting | High | Low | Question Mark | High |

| Telehealth Supplemental Benefits | High | Low | Question Mark | High |

| Specialized Short-Term Medical (STM) Plans | High (Niche) | Low | Question Mark | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from The IHC Group's financial statements, internal sales figures, and market research reports to accurately assess product performance and market share.