IDEX SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDEX Bundle

IDEX possesses a unique market position with its specialized technologies, but faces challenges in supply chain volatility and intense competition. Understanding these dynamics is crucial for navigating the evolving landscape.

Want the full story behind IDEX's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

IDEX Corporation's strength lies in its leadership within diversified niche markets, particularly in highly engineered fluid and metering technologies. This strategic focus allows for robust competitive advantages and healthy profit margins. For instance, in fiscal year 2023, IDEX reported revenue of $2.4 billion, with its specialty segments consistently demonstrating resilience.

IDEX Corporation consistently showcases robust financial health, evidenced by its impressive gross and EBITDA margins, which indicate a strong ability to convert revenue into profit. For instance, in the first quarter of 2024, IDEX reported a gross margin of 41.5% and an EBITDA margin of 25.9%, highlighting operational efficiency.

This strong profitability translates directly into significant free cash flow generation. In 2023, IDEX generated $769 million in free cash flow, a testament to its effective cash conversion. This consistent cash generation provides the company with ample resources to fund organic growth initiatives, pursue strategic acquisitions, and return capital to shareholders through dividends and share repurchases.

Furthermore, IDEX maintains a prudent approach to its balance sheet, characterized by moderate leverage. As of the end of Q1 2024, the company’s debt-to-equity ratio stood at a manageable 0.45. This conservative financial structure affords IDEX considerable financial flexibility, enabling it to navigate economic uncertainties and capitalize on growth opportunities without undue financial strain.

IDEX's commitment to research and development is a significant advantage, fueling the creation of advanced, proprietary products. This dedication to specialized engineering and unique technologies allows IDEX to provide substantial value to its customers, setting its solutions apart from the competition.

The company's ongoing investment in R&D, evidenced by its consistent allocation of resources towards innovation, underpins its competitive edge. For instance, in the first quarter of 2024, IDEX reported $21.6 million in R&D expenses, a testament to its focus on technological advancement.

Strategic acquisitions, such as the integration of Mott Corporation, further enhance IDEX's technological prowess. Mott Corporation's expertise in filtration and fluidics complements IDEX's existing capabilities, creating synergistic opportunities and expanding its portfolio of high-value offerings.

Strategic Acquisitions and Integration Success

IDEX has demonstrated a strong capability in executing strategic acquisitions, notably integrating Mott Corporation, which significantly broadened its technological expertise and market presence. This strategic move has been instrumental in IDEX’s expansion into lucrative sectors such as semiconductor manufacturing, renewable energy, and advanced water treatment solutions.

The company’s success in integrating acquired businesses has consistently translated into tangible growth, with these acquisitions contributing positively to overall revenue streams. For instance, the acquisition of Mott Corporation in 2014 was a key step in bolstering IDEX’s position in high-performance fluidic solutions.

- Proven Acquisition Track Record: Successful integration of companies like Mott Corporation enhances technological capabilities and market reach.

- Market Expansion: Acquisitions open doors to high-value end markets including semiconductor, energy transition, and water purification.

- Revenue Growth Driver: Strategic M&A is a core component of IDEX's growth strategy, directly contributing to increased revenue and competitive advantage.

Global Presence and Operational Agility

IDEX boasts a significant global footprint with manufacturing facilities spread across more than 20 countries. This extensive network allows the company to tap into diverse growth markets and effectively buffer against localized economic downturns.

The company's operational agility, driven by its '80/20 mindset' and a keen focus on productivity, is a key strength. Initiatives like cost optimization and decentralized manufacturing enable rapid adaptation to shifting market demands and help absorb the impact of global economic challenges and trade policies. For instance, in 2023, IDEX reported that its diversified manufacturing base contributed to its ability to manage supply chain disruptions, a critical factor in maintaining consistent product availability for its international customer base.

- Global Reach: Manufacturing in over 20 countries provides access to diverse growth opportunities and risk diversification.

- Operational Agility: The '80/20 mindset' and focus on productivity allow for quick responses to market changes.

- Cost Mitigation: Localized manufacturing and cost-saving efforts help offset macroeconomic headwinds and tariff impacts.

IDEX's leadership in specialized niche markets, particularly in fluid and metering technologies, provides a strong competitive advantage and supports healthy profit margins. This focus on high-value engineering ensures consistent demand for its sophisticated products.

The company demonstrates robust financial performance, as seen in its strong gross and EBITDA margins. For example, in Q1 2024, IDEX achieved a gross margin of 41.5% and an EBITDA margin of 25.9%, reflecting efficient operations and pricing power.

Significant free cash flow generation, with $769 million reported in 2023, empowers IDEX to invest in growth, pursue acquisitions, and reward shareholders. This financial strength is further bolstered by a conservative balance sheet, with a debt-to-equity ratio of 0.45 as of Q1 2024, providing ample flexibility.

| Metric | Q1 2024 | FY 2023 |

| Gross Margin | 41.5% | N/A |

| EBITDA Margin | 25.9% | N/A |

| Free Cash Flow | N/A | $769 million |

| Debt-to-Equity Ratio | 0.45 | N/A |

What is included in the product

Analyzes IDEX’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Simplifies complex market dynamics by highlighting IDEX's competitive advantages and potential threats.

Weaknesses

IDEX's reliance on cyclical industries such as semiconductors, agriculture, and automotive presents a notable weakness. Downturns in these sectors can directly affect demand for IDEX's products, leading to slower organic growth and impacting overall revenue. For instance, the semiconductor industry experienced a significant slowdown in late 2023 and early 2024, which could have a ripple effect on IDEX's performance in that segment.

While IDEX's overall sales have seen increases, often bolstered by strategic acquisitions, the company has faced a notable challenge with declining organic sales growth in recent periods. This trend suggests that generating growth from its core, existing businesses has become more difficult.

For instance, in the first quarter of 2024, IDEX reported organic sales growth of 1.7%, a slowdown compared to previous periods. This indicates that even with effective pricing strategies and focused initiatives, the company’s volume growth can be dampened by softer market conditions in crucial business segments.

IDEX is grappling with rising operational expenses, notably in employee-related costs and discretionary spending. These pressures, compounded by the dilutive effects of recent acquisitions and divestitures, are a significant hurdle.

While IDEX strives for improved productivity and pricing power, these cost headwinds can still put a strain on gross margins and adjusted EBITDA. For instance, in the first quarter of 2024, the company reported that labor costs had increased, impacting overall profitability.

Return on Equity and Assets Below Industry Averages

IDEX's Return on Equity (ROE) and Return on Assets (ROA) fall below industry benchmarks, indicating potential inefficiencies in how the company uses its shareholder capital and generates profits from its asset base. For instance, in the first quarter of 2024, IDEX reported an ROE of 8.5% and an ROA of 3.2%, while the average for its industry peers stood at 12.1% and 5.5% respectively. This suggests there are opportunities for IDEX to enhance its operational effectiveness and capital deployment strategies to better align with or surpass industry performance.

These lower-than-average profitability ratios, despite generally strong overall profitability, point to specific areas where IDEX could focus on improving its capital efficiency.

- Below Average ROE: IDEX's ROE of 8.5% in Q1 2024 is notably lower than the industry average of 12.1%.

- Below Average ROA: The company's ROA of 3.2% in Q1 2024 also lags behind the industry average of 5.5%.

- Capital Efficiency Concerns: These metrics suggest that IDEX may not be as effective as its competitors in translating its equity and assets into profits.

- Improvement Opportunities: Focusing on optimizing asset utilization and financial leverage could lead to improved returns.

Integration Challenges with Acquisitions

While IDEX's acquisition strategy is a key strength, integrating newly acquired companies, like Mott Corporation, can pose short-term challenges. These integrations can lead to a dilution in adjusted EBITDA margins and demand considerable management focus, potentially diverting resources from other critical areas. For example, the integration process following the Mott acquisition in late 2023 required significant operational alignment, impacting immediate profitability metrics.

Successful integration is paramount for realizing the full value of acquisitions, but it inherently involves risks. These risks can manifest as temporary disruptions to financial performance and a shift in operational priorities. The company's ability to efficiently absorb and synergize acquired entities directly influences the long-term success of its growth-through-acquisition strategy.

- Integration Dilution: Acquisitions, such as Mott Corporation, can temporarily reduce adjusted EBITDA margins during the integration phase.

- Management Bandwidth: Integrating new businesses demands significant management attention, potentially impacting other strategic initiatives.

- Operational Synergies: Achieving successful operational and financial synergies from acquisitions is complex and carries inherent risks.

- Near-Term Financial Impact: The immediate financial metrics may not fully reflect the long-term strategic benefits of an acquisition until integration is complete.

IDEX's dependence on cyclical industries like semiconductors and automotive makes it vulnerable to market downturns, impacting revenue. The company has also seen a slowdown in organic sales growth, with Q1 2024 organic growth at 1.7%, indicating challenges in expanding its core business. Rising operational costs, particularly labor, are pressuring margins, as noted in Q1 2024. Furthermore, IDEX's Return on Equity (ROE) of 8.5% and Return on Assets (ROA) of 3.2% in Q1 2024 lag behind industry averages of 12.1% and 5.5%, suggesting potential inefficiencies in capital utilization.

| Metric | IDEX (Q1 2024) | Industry Average |

|---|---|---|

| Organic Sales Growth | 1.7% | N/A (Varies by segment) |

| ROE | 8.5% | 12.1% |

| ROA | 3.2% | 5.5% |

Preview the Actual Deliverable

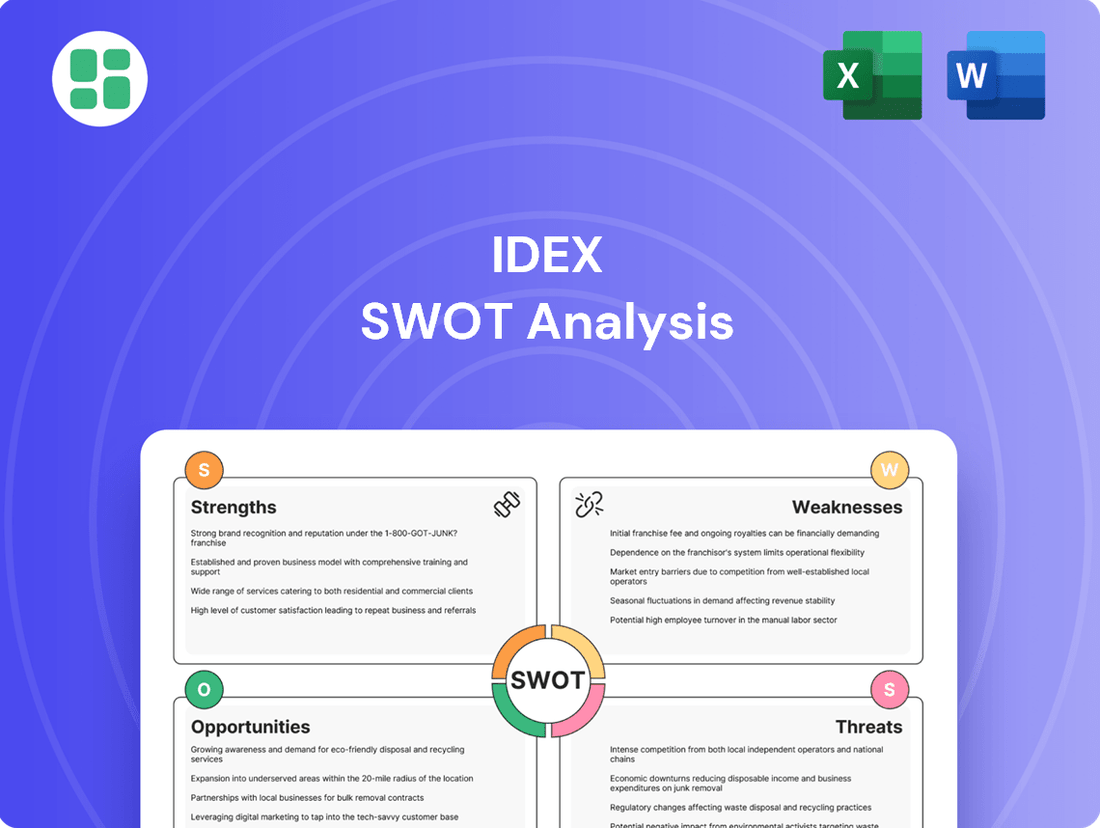

IDEX SWOT Analysis

This is the actual IDEX SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can trust that the preview accurately represents the comprehensive report you'll download.

The preview below is taken directly from the full IDEX SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete understanding of IDEX's strategic position.

Opportunities

IDEX has a prime opportunity to fuel its growth by acquiring businesses that fit well with its existing operations and technology. This inorganic growth strategy is particularly appealing given the company's focus on profitable niches like AI diagnostics, water safety, and healthcare software.

The company's strategic acquisitions have historically been successful, and management has indicated a continued interest in this avenue for expansion. For instance, IDEX's acquisition of Idex Material Science in late 2023, for $100 million, demonstrates a commitment to integrating new capabilities that enhance its market position.

The market for IDEX's target segments, such as advanced water purification and specialized medical devices, is expanding. Reports from 2024 project the global water treatment market to reach over $150 billion by 2028, offering a substantial pool of potential acquisition targets that align with IDEX's high-margin focus.

IDEX is well-positioned to benefit from robust growth in several high-value sectors. The semiconductor industry, a key market for IDEX, is projected to reach $1 trillion in annual revenue by 2030, driven by demand for advanced chips.

The energy transition, encompassing hydrogen fuel cells and carbon capture technologies, presents a significant opportunity. The global hydrogen market alone is expected to grow substantially, with projections indicating a market size of over $200 billion by 2030.

Furthermore, IDEX's precision solutions are highly relevant to medical technologies, space exploration, and defense applications, all experiencing increased investment and innovation. The medical device market, for instance, is anticipated to expand, reaching hundreds of billions in value in the coming years.

IDEX's robust research and development pipeline presents a significant opportunity to create novel products that align with shifting customer preferences and market trends. This ongoing innovation, especially in sophisticated water filtration and precise fluid handling technologies, is poised to unlock new avenues for revenue and solidify its market standing.

For instance, IDEX's investment in R&D, which contributed to its product development efforts in 2023, can be further amplified. The company's focus on advanced materials and miniaturization in its fluidics segment, as highlighted in its recent investor presentations, directly supports the creation of next-generation solutions that can capture emerging market segments.

Increased Focus on Sustainability and Resource Efficiency

The growing global commitment to sustainability offers a significant avenue for IDEX. Many of its products, like those in water treatment and advanced fluid handling systems, directly support resource efficiency and environmental goals. This alignment with Environmental, Social, and Governance (ESG) principles is increasingly attractive to investors and customers.

IDEX's position in markets prioritizing these values is a key opportunity. For instance, the global water and wastewater treatment market was valued at approximately $600 billion in 2023 and is projected to grow, driven by demand for cleaner water and efficient resource management. Companies like IDEX, with solutions that reduce water consumption or improve treatment processes, are well-positioned to capitalize on this trend.

This focus on sustainability can unlock new market segments and strengthen existing customer relationships. By highlighting how its technologies contribute to ESG objectives, IDEX can differentiate itself and potentially secure business with organizations that have stringent sustainability mandates. This strategic alignment can lead to enhanced brand reputation and long-term growth.

- Growing ESG Investment: Global ESG assets are projected to reach $50 trillion by 2025, indicating a strong demand for companies with sustainable practices.

- Water Scarcity Concerns: With over 2 billion people living in countries experiencing high water stress, solutions for efficient water management are critical, a core area for IDEX.

- Regulatory Tailwinds: Stricter environmental regulations worldwide are pushing industries towards more sustainable technologies, creating a favorable market for IDEX's offerings.

Optimizing Operational Efficiencies and Cost Savings

IDEX has a significant opportunity to boost its bottom line by continuing to streamline operations and find ways to cut costs. This focus on efficiency is key to navigating economic headwinds and improving profitability.

The company is already actively working on these fronts. Initiatives like platform optimization and broader productivity programs are in motion, directly addressing the need to counter rising costs and enhance margins.

- Platform Optimization: IDEX's ongoing efforts to refine its technological infrastructure are designed to reduce processing times and resource consumption, leading to direct cost savings.

- Productivity Initiatives: The company's focus on improving employee and system productivity aims to increase output per unit of input, a critical factor in offsetting inflationary pressures.

- Cost Management Programs: IDEX is implementing targeted programs to manage expenses across various departments, ensuring that resources are allocated efficiently.

IDEX is poised to capitalize on growth through strategic acquisitions, particularly in its profitable niches like AI diagnostics and water safety. The company's history of successful acquisitions, such as the $100 million Idex Material Science purchase in late 2023, highlights its capability to integrate new technologies and enhance market position.

The expanding markets for IDEX's offerings, including water treatment (projected over $150 billion by 2028) and semiconductors (aiming for $1 trillion by 2030), present substantial opportunities for both organic and inorganic growth.

Furthermore, IDEX can leverage its robust R&D pipeline to develop innovative products for high-growth sectors like medical technologies, space exploration, and defense, all of which are experiencing increased investment. The company's focus on sustainability, aligning with the growing ESG investment trend (projected $50 trillion by 2025), also positions it favorably to meet increasing environmental regulations and customer demand for resource-efficient solutions.

Threats

IDEX is vulnerable to macroeconomic headwinds like persistent inflation and rising interest rates, which could dampen customer spending. For instance, the Federal Reserve's continued focus on controlling inflation through rate hikes, as seen throughout 2024, directly impacts the cost of capital for IDEX's clients, potentially delaying or reducing capital equipment purchases.

A potential economic slowdown or recession in key industrial markets, particularly in Europe and North America, presents a significant threat. If these economies contract, demand for IDEX's specialized fluidic and sealing solutions in sectors like automotive and industrial manufacturing could decline, directly impacting order volumes and revenue generation throughout 2024 and into 2025.

IDEX operates in specialized industrial equipment markets, facing significant competition from established players. This rivalry often translates into intense pricing pressures, potentially impacting IDEX's profitability and ability to grow market share. For instance, the industrial hydraulics sector, a key area for IDEX, saw global market growth projections tempered by competitive dynamics in early 2024, with analysts noting that price adjustments were a common response to market saturation.

IDEX faces significant threats from supply chain disruptions and fluctuating material costs. For instance, the global semiconductor shortage, which persisted into 2023 and showed signs of easing in early 2024, directly impacted industries reliant on electronic components, a potential area for IDEX's product lines. This volatility in input prices, such as the price of specialized polymers or metals, can directly squeeze profit margins if not effectively passed on to customers.

These supply chain vulnerabilities can lead to extended lead times for critical components, potentially delaying production and impacting IDEX's ability to meet customer demand. Furthermore, unexpected spikes in raw material prices, as seen with certain industrial metals in late 2023 due to geopolitical tensions, can substantially increase operational expenses, directly affecting the company's bottom line and financial performance.

Regulatory Changes and Geopolitical Risks

Evolving regulatory landscapes, such as the increasing focus on data privacy and climate-related disclosures, could significantly impact IDEX's operational costs and complexity. For instance, the European Union's General Data Protection Regulation (GDPR) continues to set a high bar for data handling, and similar regulations are emerging globally, potentially requiring substantial investment in compliance infrastructure.

Geopolitical instability and shifts in trade policies present a tangible threat to IDEX's global operations. Escalating tariffs or trade disputes between major economic blocs can disrupt supply chains, increase the cost of goods, and impact international sales. For example, ongoing trade tensions could lead to higher import duties on components or finished products, directly affecting IDEX's cost of sales and pricing strategies.

- Increased Compliance Costs: New regulations in data privacy and environmental reporting could necessitate significant investments in technology and personnel, raising operational expenses.

- Supply Chain Disruptions: Geopolitical risks, including trade wars and tariffs, can lead to volatility in component sourcing and increased logistics costs for IDEX.

- Market Access Restrictions: Changes in international trade agreements or political instability in key markets could limit IDEX's ability to operate or sell its products globally.

Technological Obsolescence and R&D Failure

A significant ongoing concern for IDEX is the potential for its technology to become outdated if it doesn't consistently develop new products or match the pace of competitor innovation. This risk is amplified if R&D efforts don't translate into successful product launches. For instance, if IDEX's upcoming product pipeline, which is crucial for its growth strategy, faces development hurdles or fails to gain market traction, it could directly hinder sales expansion and negatively affect its financial outlook. In 2023, IDEX reported R&D expenses of $17.2 million, highlighting its investment in innovation, but the success of these investments remains a key factor in mitigating obsolescence.

The company's long-term financial health is directly tied to its ability to innovate and execute its product development roadmap effectively. A failure in this area, perhaps due to unforeseen technical challenges or misjudging market demand for new offerings, could lead to a significant slowdown in revenue growth. For example, if a competitor launches a superior product that captures market share, IDEX could see its sales decline, impacting its profitability. The company's strategic focus on expanding its product portfolio, particularly in areas like advanced sensor technology, means that R&D missteps carry substantial financial consequences.

Furthermore, the rapid pace of technological change across various industries means IDEX must remain agile. A failure to adapt or a significant R&D setback could mean losing out on emerging market opportunities. Consider the market for specialized sensors; if IDEX is unable to introduce next-generation products that meet evolving customer needs, it could cede ground to more innovative rivals. This threat underscores the importance of not just investing in R&D, but ensuring those investments yield commercially viable and competitive technologies.

IDEX faces significant threats from macroeconomic instability, including persistent inflation and rising interest rates, which could curb customer spending on capital equipment throughout 2024 and into 2025. A potential economic slowdown in key industrial markets like Europe and North America could also reduce demand for IDEX's specialized products, impacting order volumes.

Intense competition within its specialized industrial equipment markets poses a threat of pricing pressure, potentially affecting IDEX's profitability and market share growth. Supply chain disruptions and fluctuating material costs, such as those seen with semiconductor shortages or industrial metals in late 2023, directly increase operational expenses and squeeze profit margins.

Evolving regulatory landscapes, particularly in data privacy and environmental reporting, could lead to increased compliance costs, while geopolitical instability and trade policy shifts may disrupt global operations and restrict market access. Furthermore, the risk of technological obsolescence is a constant threat if IDEX fails to innovate at a pace that matches or exceeds competitors, potentially hindering future revenue growth.

| Threat Category | Specific Risk | Potential Impact | Data Point/Example |

|---|---|---|---|

| Macroeconomic Headwinds | Inflation & Interest Rates | Reduced customer spending, delayed capital equipment purchases | Federal Reserve rate hikes throughout 2024 impacting cost of capital. |

| Economic Slowdown | Recession in key markets | Declining demand for industrial solutions, lower revenue | Potential contraction in North American and European industrial manufacturing sectors in 2024-2025. |

| Competitive Landscape | Intense pricing pressure | Impacted profitability, slower market share growth | Industrial hydraulics sector facing market saturation and price adjustments in early 2024. |

| Supply Chain & Costs | Disruptions & material cost volatility | Increased operational expenses, squeezed profit margins | Semiconductor shortages persisting into early 2024; industrial metal price spikes in late 2023. |

| Regulatory Environment | New compliance requirements | Increased operational costs and complexity | Emerging global data privacy regulations mirroring GDPR. |

| Geopolitical Factors | Trade disputes, tariffs | Supply chain disruption, increased costs, market access restrictions | Ongoing trade tensions impacting import duties on components and finished products. |

| Technological Obsolescence | Failure to innovate | Loss of market share, hindered revenue growth | IDEX's 2023 R&D spend of $17.2 million must yield competitive products to avoid this. |

SWOT Analysis Data Sources

This IDEX SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry analysis to ensure a thorough and accurate assessment.