IDEX PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDEX Bundle

Navigate the complex external forces shaping IDEX's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements present both challenges and opportunities for the company. Gain a strategic advantage by leveraging these expert insights. Download the full PESTLE analysis now to unlock actionable intelligence and refine your market approach.

Political factors

Government policies, particularly those concerning manufacturing and trade, directly shape IDEX Corporation's operational landscape. For instance, shifts in tariffs or import/export regulations for sectors like life sciences or chemical processing, where IDEX has significant interests, can alter supply chain costs and market access. In 2024, ongoing trade negotiations between major economic blocs continue to present potential adjustments to these frameworks.

Global trade agreements and geopolitical tensions significantly influence IDEX, a worldwide manufacturer. For instance, the ongoing trade friction between the US and China, which saw tariffs imposed on billions of dollars of goods in 2023-2024, directly impacts the cost of components and the accessibility of markets for IDEX's specialized products.

New international agreements, such as potential revisions to trade pacts or the formation of new economic blocs, can reshape IDEX's competitive environment. These shifts can affect raw material sourcing costs and the demand for their engineered solutions across different regions, making adaptability a key strategic imperative.

Maintaining robust diplomatic relationships between the countries where IDEX has a significant operational footprint is paramount. Geopolitical stability ensures smoother supply chains and predictable market access, crucial for a company reliant on global commerce, as evidenced by the 2024 ongoing discussions around supply chain resilience.

Government initiatives like the CHIPS and Science Act of 2022, which aims to boost domestic semiconductor manufacturing, could indirectly benefit IDEX through increased demand for its precision fluidics in advanced manufacturing processes. Similarly, policies supporting renewable energy infrastructure might drive sales of IDEX's flow control technologies used in hydrogen or other clean energy systems.

However, a shift in government priorities, such as reduced R&D funding for emerging technologies or increased regulatory burdens on certain industrial applications, could pose headwinds. For instance, if government incentives for electric vehicle adoption were to decrease, it might impact IDEX's potential growth in related fluid management solutions.

Political Stability and Risk

The political stability of nations where IDEX sources materials, manufactures goods, or markets its products is a significant factor. For instance, geopolitical tensions in regions crucial for semiconductor supply chains, a key area for many tech-reliant industries IDEX might serve, could impact production costs and availability. A 2024 report by the World Economic Forum highlighted increased geopolitical fragmentation as a major global risk, potentially affecting international trade and investment flows.

Political instability, such as unexpected regime changes or escalating security threats in a country where IDEX has manufacturing operations or a significant customer base, can directly disrupt its supply chains, damage physical assets, or dampen market demand. For example, a sudden imposition of trade sanctions or export controls by a government could halt the movement of essential components or finished products. In 2023, several countries experienced significant political upheaval, leading to temporary disruptions in global commerce.

IDEX needs to proactively assess and develop strategies to mitigate these geopolitical risks. This involves diversifying sourcing locations, building resilient supply chain networks, and maintaining contingency plans for operational disruptions. Understanding the political landscape and potential flashpoints is crucial for ensuring business continuity and financial stability.

- Geopolitical Risk Assessment: IDEX must continuously monitor political stability in key operating and sourcing regions.

- Supply Chain Resilience: Diversifying suppliers and manufacturing locations mitigates risks from localized political instability.

- Market Demand Impact: Political unrest can directly reduce consumer and business spending in affected markets.

- Regulatory Changes: Shifts in government policy, including trade agreements or sanctions, can significantly alter operational costs and market access.

Regulatory Environment for Niche Markets

The regulatory landscape for the specialized sectors IDEX serves presents a dynamic challenge. For instance, evolving safety standards in the fire and rescue industry, like those mandated by NFPA 1981 for self-contained breathing apparatus, directly influence IDEX's product design and testing protocols. Similarly, the life sciences sector faces stringent regulations from bodies such as the FDA, impacting the development and approval timelines for components used in medical devices, with compliance costs often representing a significant portion of R&D expenditure.

These varying regulatory frameworks necessitate continuous adaptation and investment in compliance for IDEX. For example, in 2024, the global medical device market saw increased scrutiny on cybersecurity, requiring manufacturers like IDEX to integrate robust security measures into their components, potentially adding to production costs. Changes in environmental regulations, such as stricter emissions standards for industrial equipment, can also affect the materials and manufacturing processes IDEX employs.

- Fire and Rescue: Compliance with NFPA standards impacts equipment safety and performance requirements.

- Life Sciences: FDA regulations govern product approvals, purity, and manufacturing practices for medical and pharmaceutical applications.

- Industrial Markets: Environmental regulations, like those concerning emissions, can influence material sourcing and production.

- Semiconductor Industry: Ultra-high purity standards for gases and chemicals used in chip manufacturing demand rigorous quality control from suppliers like IDEX.

Government policies, trade agreements, and geopolitical stability are crucial for IDEX's global operations. For instance, 2024 trade negotiations and ongoing US-China trade friction directly impact supply chain costs and market access for IDEX's specialized products. Government initiatives supporting advanced manufacturing, like the CHIPS Act, could boost demand for IDEX's fluidics, while regulatory changes in sectors such as life sciences and environmental standards require continuous adaptation and compliance investment.

What is included in the product

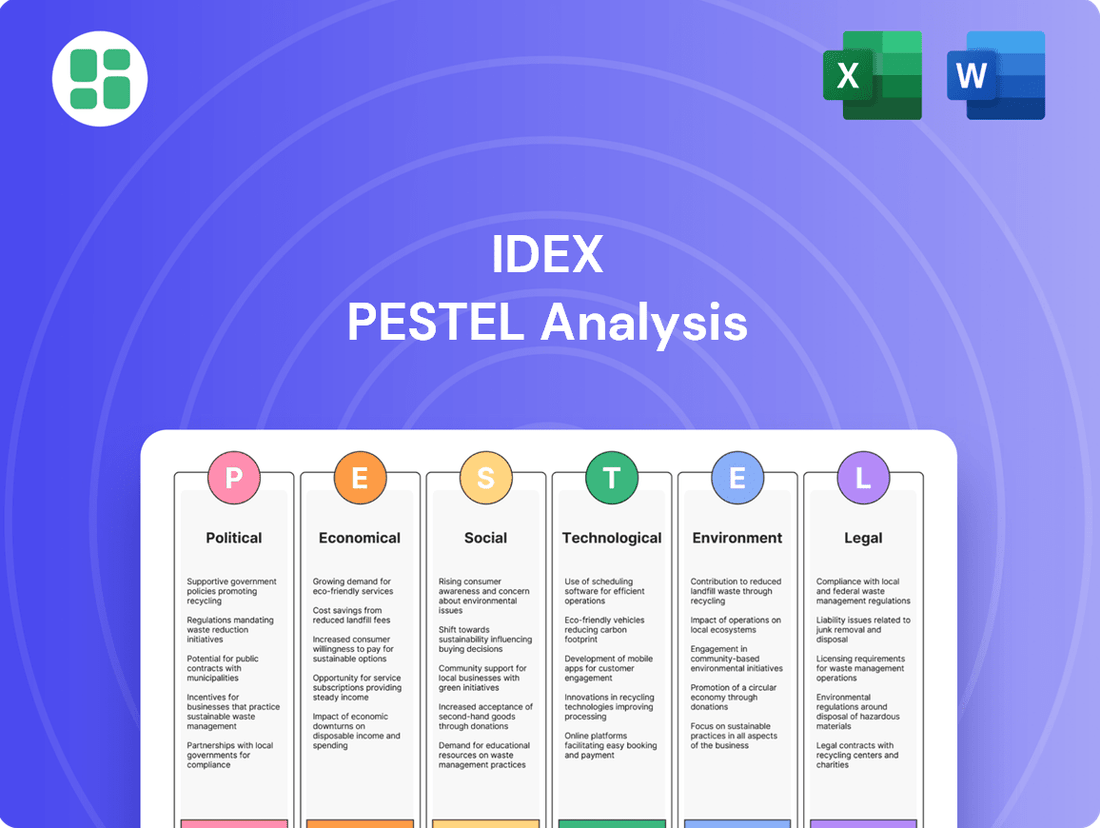

This IDEX PESTLE analysis provides a comprehensive examination of how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, impact the organization's strategic landscape.

The IDEX PESTLE Analysis offers a structured framework to identify and understand external factors impacting a business, thereby alleviating the pain of navigating complex market dynamics and uncertainty.

Economic factors

Global economic growth significantly impacts IDEX's capital expenditure. In 2024, the IMF projected global growth at 3.2%, a slight slowdown from 3.1% in 2023, but still indicating resilience. Stronger growth encourages IDEX's customers to invest in new equipment, driving demand for its specialized fluidic and optical solutions.

However, recession risks remain a concern. Persistent inflation and geopolitical tensions could dampen global economic activity in 2025, potentially leading to delayed customer investments. For instance, a significant contraction in manufacturing output, a key sector for IDEX, would directly translate to reduced sales opportunities.

Interest rates significantly impact IDEX's financial strategy. For instance, the Federal Reserve's benchmark interest rate, which influences borrowing costs across the economy, saw increases throughout 2022 and 2023, reaching a range of 5.25% to 5.50% by July 2023. This rise directly affects IDEX's expenses for any debt-financed expansion or research and development projects.

A higher cost of capital can make strategic acquisitions or significant R&D investments less attractive, potentially moderating the pace of IDEX's growth. Companies like IDEX, which often rely on external funding for innovation and market expansion, are particularly sensitive to these shifts. For example, if IDEX were to issue new debt in a higher interest rate environment, its interest payments would increase, impacting profitability.

Access to affordable capital remains a critical enabler for IDEX's business model, which frequently involves acquiring complementary businesses and investing in new technologies. As of early 2024, while some forecasts suggest potential rate stabilization or even slight decreases later in the year, the overall cost of borrowing remains elevated compared to previous years, presenting a continued consideration for IDEX's capital allocation decisions.

As a global manufacturer, IDEX faces significant exposure to currency exchange rate volatility. These fluctuations directly impact its reported revenues, costs, and overall profitability when foreign earnings are converted back to its primary reporting currency. For instance, a stronger US dollar against other currencies could reduce the reported value of sales made in those foreign markets.

Significant shifts in exchange rates can alter the competitive landscape for IDEX's exports and imports. A stronger dollar makes US-made products more expensive for foreign buyers, potentially dampening international sales volumes. Conversely, a weaker dollar can make imported components cheaper, which might benefit IDEX's cost structure but could also lead to increased competition from foreign suppliers in domestic markets.

For example, in 2024, the US dollar experienced moderate strength against several major currencies, including the Euro and Japanese Yen. This trend could have presented challenges for IDEX's export competitiveness in those regions, potentially impacting sales volume and pricing strategies. Conversely, if IDEX sources significant materials from countries with weaker currencies, it might see a cost advantage.

Inflationary Pressures and Supply Chain Costs

Persistent inflationary pressures are a significant concern for IDEX, directly impacting its manufacturing costs. For instance, the U.S. Producer Price Index (PPI) for manufactured goods saw a notable increase in early 2024, reflecting higher input costs for raw materials and components. This rise translates to increased expenses for IDEX in acquiring necessary supplies.

The company faces the challenge of absorbing these rising costs or passing them on to customers. Managing supply chain disruptions and associated transportation expenses is paramount. In 2024, global shipping costs, while moderating from pandemic peaks, remained elevated due to geopolitical factors and port congestion, adding to IDEX's operational expenditures.

To navigate these headwinds, IDEX must implement robust pricing strategies and enhance supply chain resilience. This includes diversifying suppliers and exploring alternative sourcing options to reduce reliance on single points of failure. Maintaining healthy profit margins while remaining competitive in the market requires a delicate balance in these inflationary times.

- Rising inflation directly increases IDEX's raw material, labor, and transportation expenses.

- The U.S. PPI for manufactured goods indicated ongoing cost pressures in early 2024.

- Global shipping costs remained a factor in 2024, impacting IDEX's logistics expenses.

- Effective supply chain management and strategic pricing are crucial for IDEX to mitigate these pressures.

Industry-Specific Capital Expenditure Trends

IDEX's financial health is significantly influenced by the capital expenditure (CapEx) patterns within its key served industries. For instance, the chemical processing sector, a major market for IDEX's fluid handling solutions, saw its global CapEx projected to reach approximately $1.2 trillion in 2024, according to industry analysis firms. This indicates robust investment in new plants and upgrades, directly benefiting demand for IDEX's specialized equipment.

Similarly, the food and beverage industry, another critical segment for IDEX, is experiencing steady investment, with global CapEx in food processing expected to grow at a compound annual growth rate (CAGR) of over 4% through 2028. This sustained investment fuels the need for IDEX's precision metering and dispensing technologies used in production and packaging.

The life sciences sector, where IDEX offers health and science products, also presents a strong CapEx outlook. Driven by advancements in biotechnology and pharmaceuticals, this sector's CapEx is anticipated to expand, creating further opportunities for IDEX's high-precision fluidic components essential for research and manufacturing.

- Chemical Processing CapEx: Global spending projected around $1.2 trillion for 2024, supporting demand for IDEX's fluid handling systems.

- Food & Beverage Investment: Expected CAGR of over 4% in food processing CapEx through 2028, driving need for IDEX's metering technologies.

- Life Sciences Growth: Continued expansion in CapEx within biotech and pharma, benefiting IDEX's health and science product lines.

Global economic growth influences IDEX's demand, with the IMF projecting 3.2% growth in 2024, indicating resilience. However, recession risks and geopolitical tensions could dampen investment in 2025, impacting sales for key sectors like manufacturing. Interest rate hikes, such as the Federal Reserve's 5.25%-5.50% range in mid-2023, increase IDEX's borrowing costs, potentially slowing expansion and R&D.

Currency fluctuations affect IDEX's international revenue and costs; for instance, a stronger USD in 2024 made US exports pricier. Inflation drives up IDEX's raw material, labor, and transportation expenses, with the U.S. PPI for manufactured goods showing cost pressures in early 2024. Elevated global shipping costs in 2024 also added to operational expenditures.

Capital expenditure in IDEX's served industries is a key driver. The chemical processing sector's projected $1.2 trillion CapEx in 2024 supports demand for IDEX's fluid handling solutions. Steady investment in food processing, with a projected 4% CAGR through 2028, boosts demand for IDEX's metering technologies, while growth in life sciences CapEx benefits its health and science products.

| Economic Factor | 2024/2025 Impact on IDEX | Key Data Point/Trend |

| Global Economic Growth | Drives demand for specialized equipment; recession risks could dampen investment. | IMF projected 3.2% global growth in 2024. |

| Interest Rates | Increases borrowing costs for CapEx and R&D; impacts financial strategy. | Federal Reserve rate range 5.25%-5.50% as of mid-2023. |

| Currency Exchange Rates | Affects reported revenue and export competitiveness; a stronger USD can reduce foreign sales value. | Moderate USD strength against EUR and JPY observed in 2024. |

| Inflation | Raises raw material, labor, and transportation costs; requires strategic pricing. | U.S. PPI for manufactured goods showed cost pressures in early 2024; elevated shipping costs persisted. |

Preview the Actual Deliverable

IDEX PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive IDEX PESTLE analysis covers all key external factors influencing the company's strategic landscape.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental influences on IDEX.

What you’re previewing here is the actual file—fully formatted and professionally structured. This IDEX PESTLE analysis provides actionable insights for strategic planning and decision-making.

Sociological factors

Shifting workforce demographics, such as an aging population in developed nations and a growing youth population in others, present both challenges and opportunities for IDEX. For instance, the U.S. Bureau of Labor Statistics projected that the median age of the U.S. workforce would continue to rise, potentially leading to a shortage of younger, skilled workers in critical fields by 2024-2025.

The demand for specialized engineering and technical skills remains high, directly impacting IDEX's ability to staff its advanced manufacturing and product development operations. In 2024, reports indicated a persistent gap in the supply of qualified mechanical and electrical engineers, a core requirement for IDEX's highly engineered product segments.

Effective talent management and robust development programs are therefore crucial for IDEX to maintain its innovative edge and operational efficiency. Companies like IDEX must invest in training and upskilling to bridge these skill gaps and ensure a pipeline of talent capable of driving future technological advancements.

Societal awareness regarding health and safety is escalating, driving demand for advanced solutions. This trend directly bolsters IDEX's fire, safety, and health technologies, as organizations increasingly prioritize compliance and worker well-being. For instance, the global industrial safety market was valued at approximately $60 billion in 2023 and is projected to grow, reflecting this heightened societal focus.

Societal expectations for corporate social responsibility are significantly shaping how companies like IDEX operate. Consumers and investors are increasingly demanding ethical sourcing, sustainable manufacturing practices, and genuine community engagement. This trend directly impacts IDEX's brand reputation and the loyalty it garners from its customer base.

For IDEX, meeting these heightened CSR standards is becoming a competitive advantage. Companies that demonstrate strong environmental stewardship and social responsibility, such as those investing in renewable energy or fair labor practices, often attract a growing segment of environmentally conscious consumers and socially responsible investors. For instance, in 2024, global ESG (Environmental, Social, and Governance) investment assets were projected to exceed $30 trillion, highlighting the financial significance of these factors.

Conversely, a failure to uphold high CSR standards can lead to substantial reputational damage and potential loss of market share. In today's transparent environment, where information spreads rapidly, companies are under scrutiny for their operational practices. Transparency in supply chains and business dealings is no longer optional but a critical component of maintaining trust and ensuring long-term viability for IDEX.

Public Perception of Industrial Technologies

Public perception of industrial technologies significantly shapes regulatory landscapes and market acceptance for companies like IDEX. Growing awareness of environmental impacts, for instance, can lead to increased scrutiny of manufacturing processes and product lifecycles. A 2024 survey indicated that 65% of consumers consider a company's environmental record when making purchasing decisions.

Positive public sentiment towards innovations in critical sectors can directly translate into market opportunities. For IDEX, advancements in water purification technologies, for example, are often met with public approval, fostering demand. Conversely, negative perceptions, perhaps concerning the safety of certain chemical processes or materials used in industrial applications, can trigger stricter regulations and dampen market interest, potentially impacting IDEX's product adoption rates.

- Environmental Concerns: Public apprehension regarding the environmental footprint of industrial processes can lead to stricter regulations, affecting IDEX's operational costs and product development.

- Safety Perceptions: Consumer and public trust in the safety of industrial technologies, particularly in sensitive areas like healthcare or food processing, is crucial for market penetration.

- Technological Acceptance: Positive public reception of advanced technologies, such as those used in IDEX's fluid management solutions, can drive demand and open new market segments.

- Regulatory Influence: Public opinion often acts as a catalyst for government policy changes, directly influencing the regulatory environment in which IDEX operates.

Customer Preferences for Advanced Solutions

Customer preferences are shifting towards advanced, integrated technological solutions, pushing companies like IDEX to concentrate on specialized engineering and niche markets. This trend is evident in the growing demand for products that not only offer superior performance but also incorporate higher levels of automation and provide deeper data analytics. For instance, in the industrial automation sector, the global market size was estimated to reach approximately $223.4 billion in 2023 and is projected to grow significantly, indicating a strong customer appetite for sophisticated systems.

This evolving demand necessitates continuous innovation and product upgrades from IDEX to cater to these increasingly complex customer requirements. The push for greater efficiency and precision is a key driver, with businesses actively seeking solutions that can streamline operations and deliver measurable improvements. In 2024, many sectors are seeing increased investment in smart manufacturing technologies, with adoption rates for IoT and AI in industrial settings showing a steady upward trajectory.

- Growing demand for automation: Customers seek to reduce manual labor and improve operational consistency.

- Preference for data-driven insights: Businesses want products that provide real-time performance data for better decision-making.

- Emphasis on integration: Customers prefer solutions that seamlessly connect with existing systems for enhanced efficiency.

- Focus on specialized applications: Niche markets are increasingly valued for their specific, high-performance needs.

Societal expectations for corporate social responsibility are increasingly influencing IDEX's operations and brand perception. Consumers and investors are prioritizing ethical sourcing and sustainable practices, making strong CSR a competitive advantage. In 2024, global ESG investment assets were projected to exceed $30 trillion, underscoring the financial impact of these societal demands.

Public perception of industrial technologies, particularly environmental impacts, can lead to stricter regulations and affect market acceptance for IDEX. A 2024 survey found that 65% of consumers consider a company's environmental record in purchasing decisions, highlighting the importance of managing public sentiment.

Customer preferences are shifting towards advanced, integrated technological solutions, driving IDEX to focus on specialized engineering and niche markets. The industrial automation sector, for example, was valued at approximately $223.4 billion in 2023, indicating a strong demand for sophisticated systems that offer efficiency and data analytics.

Technological factors

IDEX's reliance on fluidics and materials science means continuous innovation is key. For instance, advancements in high-performance polymers and ceramics can lead to more robust and chemically resistant pump components, opening doors in demanding sectors like pharmaceuticals and advanced chemical processing. The company's commitment to R&D in these areas directly impacts its ability to offer solutions for evolving industry needs.

IDEX is poised to benefit from the accelerating digital transformation within industrial sectors. The increasing integration of the Internet of Things (IoT) and advanced data analytics into manufacturing processes and equipment offers substantial growth avenues for the company.

By embedding smart sensors and connectivity into their fluid and pneumatic control solutions, IDEX can provide customers with predictive maintenance capabilities, remote monitoring, and deeper operational insights. For instance, in 2024, the global IoT market was projected to reach over $1.5 trillion, with industrial IoT (IIoT) being a significant driver, indicating a strong demand for connected industrial solutions.

This technological shift allows IDEX to move beyond traditional product sales, creating new value propositions and recurring revenue streams through enhanced service models. These digital integrations can lead to improved efficiency and reduced downtime for their clients, solidifying IDEX's position as a key technology partner.

IDEX Corporation is significantly influenced by technological advancements in automation and manufacturing. Innovations like collaborative robots and AI-powered quality control are enhancing production efficiency. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow substantially, presenting opportunities for IDEX to integrate these technologies into its operations, thereby reducing costs and improving output quality.

The adoption of additive manufacturing, or 3D printing, offers IDEX the potential for greater design freedom and faster prototyping, which can lead to reduced lead times. Furthermore, IDEX's ability to offer automated solutions, such as advanced dispensing systems for electronics manufacturing, taps into a growing market demand. The global market for dispensing equipment, a key area for IDEX, was estimated to be around $7 billion in 2024, indicating strong customer interest in automated process solutions.

Research and Development (R&D) Investment

IDEX's commitment to research and development is crucial for its position in engineered products. Continued investment fuels innovation, allowing the company to create new solutions and stay ahead in competitive markets. This focus on R&D is a core element in addressing evolving customer demands and technological advancements across IDEX's various business units.

For 2023, IDEX reported R&D expenses of $211.9 million, representing approximately 3.4% of its total revenue. This sustained investment highlights the company's strategy to maintain technological leadership and develop proprietary solutions. A robust R&D pipeline is a significant competitive advantage for IDEX.

Key areas of IDEX's R&D focus include:

- Development of advanced fluidic solutions for life sciences and industrial applications.

- Enhancement of precision dispensing technologies for improved efficiency and accuracy.

- Exploration of new materials and manufacturing processes to support next-generation product design.

- Investment in digital technologies to integrate smart features and connectivity into existing product lines.

Emerging Technologies in Health and Science

Rapid advancements in health and science technologies, including new diagnostic tools, laboratory automation, and bioprocessing equipment, are directly impacting IDEX's health and science segment. For instance, the global laboratory automation market was valued at approximately $5.5 billion in 2023 and is projected to grow significantly, presenting opportunities for IDEX to supply critical components. Staying at the forefront of these technological shifts and developing enabling solutions is crucial for IDEX to maintain its position as a key supplier in these dynamic, high-growth markets.

IDEX's ability to integrate its fluidic solutions with emerging technologies like AI-driven diagnostics or advanced gene sequencing platforms will be a key differentiator. The biopharmaceutical market, a major driver of bioprocessing equipment demand, saw significant investment in 2024, with global R&D spending expected to exceed $250 billion. Collaborating with leading research institutions and universities can provide IDEX with early insights into these trends and foster the development of next-generation products.

- Diagnostic Innovation: The market for in-vitro diagnostics (IVD) is expanding, with projections indicating it could reach over $100 billion by 2027, driven by demand for point-of-care testing and molecular diagnostics. IDEX's precision fluidics are essential for the accuracy and efficiency of many of these advanced diagnostic systems.

- Laboratory Automation Growth: The increasing adoption of automation in clinical and research laboratories, aiming to improve throughput and reduce errors, is a significant trend. IDEX's components are vital for the robotic systems and automated workflows that define modern laboratories.

- Bioprocessing Advancements: The biopharmaceutical industry's focus on novel therapies, including cell and gene therapies, requires sophisticated bioprocessing equipment. IDEX's expertise in high-precision fluid handling supports the development and manufacturing of these complex biological products.

- Research Partnerships: Strategic alliances with academic and research bodies can accelerate innovation, allowing IDEX to co-develop solutions tailored to the evolving needs of scientific discovery and medical advancement.

Technological factors are paramount for IDEX, particularly in its fluidics and engineered products segments. The company's substantial R&D investment, which was $211.9 million in 2023, underscores its commitment to innovation in areas like advanced materials and precision dispensing. This focus is critical for developing solutions that meet the evolving demands of sectors such as life sciences and industrial automation.

The digital transformation trend, including the growth of Industrial IoT (IIoT), presents significant opportunities for IDEX. By integrating smart technologies into its fluid and pneumatic control systems, IDEX can offer enhanced predictive maintenance and remote monitoring capabilities to its clients. The global IoT market's projected growth to over $1.5 trillion in 2024 highlights the demand for such connected industrial solutions.

Furthermore, advancements in automation and manufacturing technologies, such as industrial robotics and additive manufacturing, directly benefit IDEX. The industrial robotics market's valuation of around $50 billion in 2023 indicates a strong trend towards automation that IDEX can leverage. Similarly, the dispensing equipment market, estimated at $7 billion in 2024, shows a clear demand for IDEX's automated process solutions.

IDEX's health and science segment is also heavily influenced by technological progress. The expanding market for laboratory automation, valued at approximately $5.5 billion in 2023, and the growth in bioprocessing equipment, driven by advancements in therapies, create substantial opportunities for IDEX to supply critical components and solutions.

| Technology Area | 2023/2024 Market Data | IDEX Relevance |

|---|---|---|

| Industrial IoT (IIoT) | Global IoT market projected over $1.5 trillion (2024) | Enables smart features in fluidic control systems. |

| Industrial Robotics | Market valued at ~$50 billion (2023) | Opportunities for integration into IDEX operations and solutions. |

| Dispensing Equipment | Market estimated at ~$7 billion (2024) | Direct market for IDEX's automated process solutions. |

| Laboratory Automation | Market valued at ~$5.5 billion (2023) | Demand for IDEX components in advanced diagnostic and research systems. |

| R&D Investment | $211.9 million (2023) | Fuels innovation in materials science and precision technologies. |

Legal factors

IDEX Corporation operates in sectors like fire and safety, where product integrity is non-negotiable. Stringent product liability laws mean that any failure can lead to significant legal and financial repercussions. For instance, in 2023, the U.S. Consumer Product Safety Commission (CPSC) reported over \$1.3 billion in recalls, highlighting the substantial financial risk associated with product defects.

The company must maintain robust quality control and rigorous testing protocols to ensure compliance with evolving safety regulations. Failure to meet these standards, such as those set by the National Fire Protection Association (NFPA) for fire suppression systems, can result in costly recalls and damage to brand reputation. Adherence to international standards, like ISO certifications, is also vital for IDEX's global market penetration, ensuring their products are accepted and trusted worldwide.

For IDEX, a company built on proprietary technology and specialized engineering, robust intellectual property (IP) protection is paramount. Laws covering patents, trademarks, and trade secrets are crucial for preventing the theft of its innovations and preserving its market advantage. This legal framework is foundational to IDEX's ability to maintain its competitive edge in the industry.

The enforcement of these IP rights requires ongoing vigilance. IDEX must actively monitor for potential infringements and be prepared to take legal action to defend its innovations. This proactive approach ensures that the company's investments in research and development translate into sustained commercial value.

IDEX's manufacturing facilities and product applications are heavily regulated by environmental, health, and safety (EHS) laws. These regulations cover critical areas such as air and water emissions, waste management, the safe handling of hazardous substances, and maintaining secure working conditions. For instance, in 2024, companies in the industrial manufacturing sector faced increased scrutiny on Scope 1 and Scope 2 emissions reporting, with potential penalties for non-compliance impacting operational continuity.

Strict adherence to these EHS mandates is crucial for IDEX's ongoing operations. Failure to comply can lead to substantial financial penalties, temporary or permanent closure of facilities, and severe damage to the company's public image and brand trust. For example, a significant environmental violation in 2023 resulted in a multi-million dollar fine for a competitor, highlighting the financial risks involved.

Consequently, a proactive approach to EHS management is not merely a legal obligation but a strategic imperative for IDEX. This involves continuous investment in safety protocols, pollution control technologies, and employee training to mitigate risks and ensure sustainable business practices. By prioritizing EHS, IDEX can safeguard its operations, protect its workforce, and maintain its social license to operate.

International Trade Laws and Sanctions

IDEX, operating globally, must meticulously comply with a web of international trade laws, encompassing export controls and import regulations. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Export Administration Regulations (EAR), impacting the flow of technology and goods. Failure to adhere can result in severe penalties, as seen in past cases where companies faced multi-million dollar fines for violating sanctions or export restrictions.

Economic sanctions, often imposed by bodies like the United Nations or individual nations, present a significant challenge. IDEX must ensure its operations do not inadvertently breach sanctions against countries or entities, a complex task given the dynamic nature of global politics. For example, sanctions against Russia, intensified in 2022 and continuing through 2024, require rigorous due diligence to avoid prohibited transactions.

- Export Controls: IDEX must track changes in regulations like the EAR, which govern the export of dual-use items and technologies.

- Import Regulations: Compliance with customs duties, tariffs, and product-specific import standards in each operating country is essential.

- Economic Sanctions: Navigating sanctions regimes, such as those affecting Iran, North Korea, or Russia, demands constant vigilance and robust compliance programs.

- Geopolitical Trade Policies: Adapting to evolving trade agreements and potential protectionist measures, like tariffs on goods from specific regions, is a continuous strategic imperative.

Data Privacy and Cybersecurity Regulations

IDEX operates in an environment increasingly shaped by stringent data privacy and cybersecurity regulations. Laws like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) directly impact how IDEX handles customer and internal data. Failure to comply can lead to significant financial penalties, with GDPR fines potentially reaching up to 4% of global annual revenue or €20 million, whichever is higher. For instance, in 2023, the global cost of data breaches averaged $4.45 million, highlighting the financial risk associated with inadequate security.

Maintaining robust cybersecurity is therefore not just good practice but a legal imperative for IDEX. Protecting sensitive information is crucial for preserving customer trust and avoiding costly legal battles and reputational damage. As of early 2024, cybersecurity spending by companies worldwide is projected to exceed $200 billion, reflecting the critical nature of these investments.

- GDPR Fines: Up to 4% of global annual revenue or €20 million.

- CCPA Impact: Grants consumers rights regarding their personal information.

- Average Data Breach Cost: $4.45 million globally in 2023.

- Global Cybersecurity Spending: Projected to exceed $200 billion in 2024.

IDEX must navigate a complex landscape of product liability laws, where failures can result in substantial financial and legal consequences. For example, in 2023, U.S. product recalls exceeded $1.3 billion, underscoring the financial risks associated with defects. Adherence to evolving safety standards, such as those from the NFPA, is critical for compliance and maintaining market access.

Intellectual property laws are fundamental to IDEX's competitive advantage, protecting its innovations from infringement. The company must actively defend its patents and trade secrets, as these legal frameworks are essential for realizing the commercial value of its research and development investments.

Environmental, health, and safety (EHS) regulations significantly impact IDEX's operations, covering emissions, waste, and workplace safety. Non-compliance can lead to severe penalties, as demonstrated by a competitor facing multi-million dollar fines in 2023 for environmental violations. Proactive EHS management is thus a strategic necessity.

Global operations necessitate strict adherence to international trade laws, including export controls and sanctions. The U.S. BIS's EAR updates, for instance, directly affect technology and goods flow, with violations carrying significant penalties. Navigating sanctions, such as those impacting Russia through 2024, requires constant diligence.

Data privacy and cybersecurity laws, like GDPR and CCPA, are critical for IDEX. Non-compliance can incur hefty fines, with GDPR penalties potentially reaching 4% of global annual revenue. The average cost of a data breach in 2023 was $4.45 million, highlighting the importance of robust data protection.

Environmental factors

Growing global concerns about climate change are significantly influencing market demand, pushing for energy-efficient and low-carbon solutions. This trend creates both hurdles and avenues for IDEX. For instance, in 2023, the U.S. saw a 6% increase in renewable energy generation, highlighting the shift towards cleaner alternatives that IDEX's technologies can support.

IDEX faces increasing pressure to minimize its own operational carbon footprint. Concurrently, the company has an opportunity to innovate by developing products that assist customers in meeting their sustainability targets. This includes creating more efficient pumps and metering systems designed to lower overall resource consumption, aligning with the global push for reduced environmental impact.

The escalating scarcity and unpredictable costs of essential raw materials are compelling IDEX to adopt robust sustainable sourcing strategies. For instance, the global demand for rare earth elements, crucial for many advanced technologies, has seen price surges, with some materials experiencing over 50% volatility in 2024.

Businesses are increasingly scrutinized for their supply chain's environmental footprint, from mining impacts to processing energy consumption. This pressure means IDEX needs to actively manage its sourcing to ensure responsible practices, aligning with growing consumer and regulatory expectations.

To navigate these challenges, IDEX should investigate alternative materials with lower environmental impact, embrace circular economy models to reuse and recycle components, and optimize resource efficiency across its operations. This proactive approach is vital for mitigating supply chain risks and building long-term resilience.

IDEX's operations and product offerings are significantly shaped by water management and pollution control regulations. Stricter governmental policies globally, like the EU's Water Framework Directive and the US EPA's Clean Water Act, are driving demand for advanced water treatment and conservation technologies. For instance, in 2024, global spending on water and wastewater treatment is projected to reach over $600 billion, highlighting the market's growth potential for companies like IDEX.

Societal expectations for environmental stewardship also play a crucial role. Consumers and investors increasingly favor businesses that demonstrate responsible water usage and minimize pollution. IDEX's expertise in fluid handling and metering technologies positions it to offer solutions that help various industries, from agriculture to manufacturing, improve their water efficiency and reduce effluent discharge, thereby meeting these elevated environmental standards.

Waste Management and Circular Economy Trends

The global shift towards a circular economy, prioritizing waste reduction and resource efficiency, directly impacts IDEX's operations. This trend mandates a focus on designing products for longevity, ease of repair, and recyclability, thereby minimizing waste across the entire product lifecycle.

This environmental imperative drives innovation in how IDEX approaches product development and material sourcing. Companies are increasingly pressured to adopt sustainable practices, influencing everything from initial design concepts to end-of-life product management.

For instance, the European Union's Circular Economy Action Plan, updated in 2020, sets ambitious targets for waste reduction and resource reuse. By 2030, the EU aims to significantly increase recycling rates for municipal waste, with specific targets for packaging waste. This regulatory environment encourages businesses like IDEX to invest in circular design principles and explore new materials that support these goals.

- Circular Economy Growth: The global circular economy market was valued at approximately $2.4 trillion in 2023 and is projected to reach over $4.5 trillion by 2030, indicating a substantial market shift.

- Waste Reduction Targets: Many countries are implementing stricter waste management regulations, with some aiming for zero waste to landfill by 2050.

- Product Lifespan Extension: Initiatives promoting product repairability and durability are gaining traction, influencing consumer purchasing decisions and manufacturer responsibilities.

- Material Innovation: There's a growing demand for recycled and bio-based materials, pushing R&D efforts in sustainable material science.

Customer Demand for Eco-Friendly Solutions

A significant and growing portion of IDEX's customer base, spanning multiple sectors, is increasingly prioritizing products and technologies that bolster their own sustainability efforts. This trend presents a clear market opportunity for IDEX to gain a competitive edge by providing solutions designed to lower energy usage, reduce waste generation, or incorporate eco-conscious materials.

For instance, in 2024, a survey by Deloitte found that 73% of consumers are willing to change their purchasing habits to reduce environmental impact. This directly translates to a demand for IDEX's offerings that align with these evolving customer values and increasingly stringent environmental regulations.

- Growing Consumer Preference: Over 70% of consumers are actively seeking sustainable products.

- Regulatory Alignment: IDEX's eco-friendly solutions help customers meet environmental compliance.

- Market Differentiation: Offering sustainable options provides a competitive advantage in the marketplace.

- Brand Reputation: Demonstrating commitment to sustainability enhances IDEX's brand image.

Environmental factors are increasingly shaping IDEX's operational landscape and market opportunities. Growing global awareness of climate change is driving demand for energy-efficient solutions, with renewable energy generation seeing a 6% increase in the U.S. in 2023, a trend IDEX can capitalize on. Simultaneously, IDEX faces pressure to reduce its own carbon footprint and innovate products that aid customers in achieving their sustainability goals, such as more efficient pumps. This necessitates a focus on sustainable sourcing, especially given the volatility in raw material prices, with some rare earth elements experiencing over 50% price fluctuations in 2024. Furthermore, stricter water management and pollution control regulations, like the EU's Water Framework Directive, are boosting the market for advanced water treatment technologies, a sector where IDEX's fluid handling expertise is valuable, with global spending projected to exceed $600 billion in 2024. Societal expectations for environmental stewardship also push for responsible water usage and pollution minimization, aligning with IDEX's potential to offer efficiency-enhancing solutions.

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from official government publications, international organizations, and leading market research firms. We ensure comprehensive coverage by incorporating economic indicators, technological advancements, and regulatory changes from reputable sources.