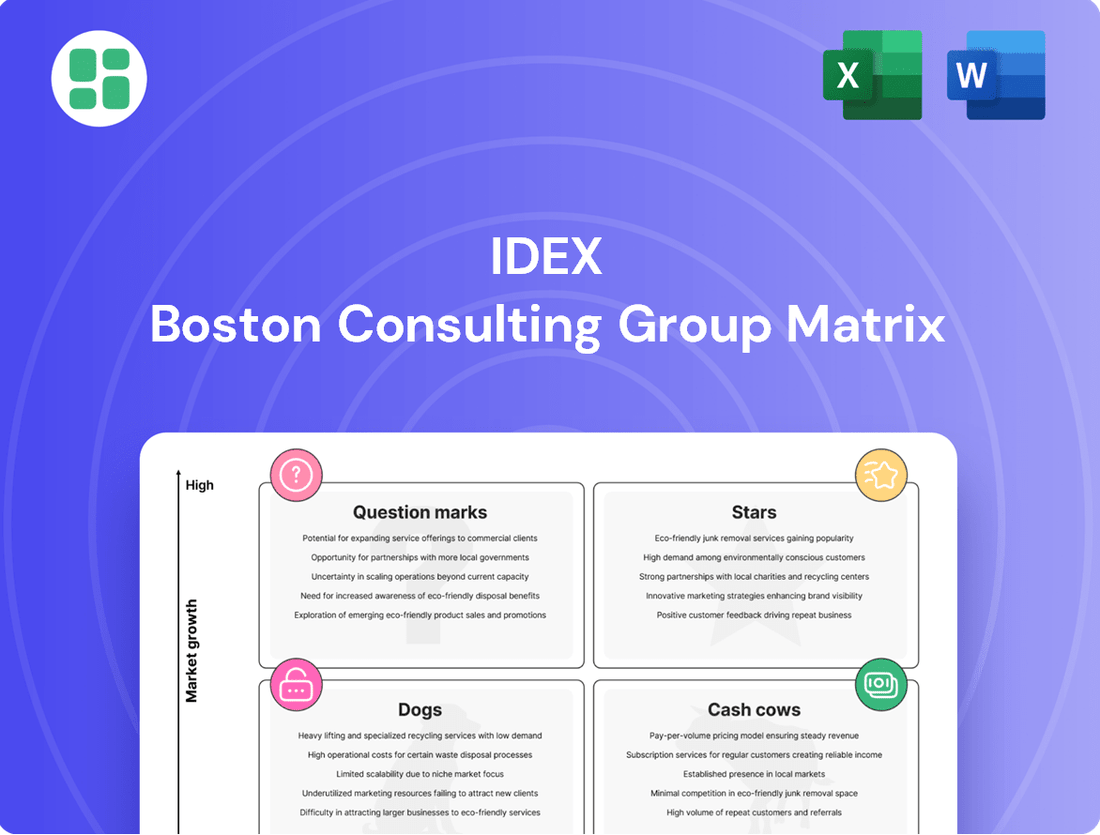

IDEX Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDEX Bundle

Uncover the strategic potential of this company's product portfolio with a clear understanding of its position within the IDEX BCG Matrix. See how its offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and gain a foundational view of its market dynamics.

Ready to transform this insight into decisive action? Purchase the full BCG Matrix report for a comprehensive breakdown of each product's quadrant placement, data-driven strategic recommendations, and a clear roadmap for optimizing your investments and product development.

Stars

The September 2024 integration of Mott Corporation into IDEX's portfolio significantly bolsters its standing in advanced filtration and micro-precision solutions. This strategic move enhances IDEX's capabilities in high-growth sectors like semiconductor manufacturing, renewable energy, and advanced medical devices.

Mott's expertise in applied materials science and micro-precision engineering complements IDEX's existing strengths, opening doors to new, high-value market segments. The acquisition is expected to drive substantial revenue growth and market share expansion for IDEX in these critical industries.

Early indicators of Mott's performance post-acquisition are highly positive. A notable multi-year agreement for wastewater filtration solutions underscores Mott's robust demand and its potential to capture significant market share in essential environmental applications.

The life sciences sector, a significant part of IDEX's Health & Science Technologies (HST) segment, is showing strong organic order growth. This area, encompassing vital tools like diagnostic machines and DNA sequencers, is a primary focus for IDEX's future expansion efforts.

Demand within life sciences has been resilient, even with some industrial project delays. This steady demand is expected to contribute to high single-digit growth for the HST segment in 2025. IDEX is actively investing in new solutions for emerging disease therapies, positioning itself for continued penetration in this high-growth market.

IDEX's precision optical components are vital for the burgeoning broadband satellite communications market, a sector experiencing substantial growth due to the escalating need for global connectivity. This specialized segment within Health & Science Technologies is propelled by ongoing technological innovation and strategic capital allocation.

The company's dedication to these essential components positions it to secure an increasing market share in a high-growth, high-value industry. For instance, the global satellite communication market was valued at approximately USD 30.5 billion in 2023 and is projected to reach USD 77.4 billion by 2030, growing at a CAGR of 14.3% during the forecast period, according to Statista.

Intelligent Water Platform Solutions

Within IDEX's Fluid & Metering Technologies (FMT) segment, the intelligent water platform is a significant growth driver, projected to propel water business expansion through 2025.

This segment benefits from increasing global demand for advanced water management solutions, fueled by tightening water quality regulations.

IDEX's specialized offerings are well-positioned in this high-growth market, enabling the company to capture greater market share.

- Market Growth: The global smart water market was valued at approximately $10.1 billion in 2023 and is projected to reach $25.9 billion by 2030, growing at a CAGR of 14.5%.

- IDEX's Position: IDEX's intelligent water platform addresses critical needs in water treatment, distribution, and conservation, aligning with these market trends.

- Revenue Contribution: While specific segment revenue for the intelligent water platform isn't always broken out, IDEX's overall Fluid & Metering Technologies segment reported strong performance, contributing significantly to the company's financial results in 2023 and early 2024.

- Strategic Focus: IDEX's investment in smart water technologies reflects a strategic commitment to capitalize on the increasing importance of water efficiency and regulatory compliance worldwide.

Aerospace and Defense Fluidic Systems

The aerospace and defense sector, a key driver within IDEX's Fire & Safety/Diversified Products (FSDP) segment, is showing robust growth. This is fueled by the increasing demand for IDEX's specialized fluidic systems and components essential for critical applications in this industry.

IDEX's fluidic solutions are vital for modernizing and expanding defense capabilities globally. The company's proprietary technologies position it strongly in this high-growth market.

- Market Growth: The aerospace and defense market is experiencing sustained expansion.

- Demand for Fluidics: IDEX's specialized fluidic systems are seeing heightened demand due to their critical role.

- Technological Edge: Proprietary technologies give IDEX a competitive advantage in this sector.

- Strategic Importance: The sector's growth aligns with IDEX's strategy to leverage specialized engineering for high-value applications.

Stars represent business units with high market share in high-growth markets. IDEX's precision optical components for broadband satellite communications fit this category. Similarly, its intelligent water platform within Fluid & Metering Technologies operates in a rapidly expanding smart water market.

The company's strong position in life sciences, particularly in diagnostic machines and DNA sequencers, also aligns with the Star quadrant due to the sector's robust organic growth and IDEX's strategic investments. The aerospace and defense sector, where IDEX provides specialized fluidic systems, is another area characterized by sustained expansion and demand for IDEX's advanced solutions.

| Business Unit/Product Area | Market Growth Trajectory | IDEX's Market Share Position | Rationale |

|---|---|---|---|

| Precision Optical Components (Satellite Comms) | High (CAGR 14.3% projected to 2030) | Strong and growing | Vital for expanding global connectivity needs. |

| Intelligent Water Platform | High (CAGR 14.5% projected to 2030) | Well-positioned | Addresses increasing global demand for advanced water management. |

| Life Sciences (Diagnostic Machines, DNA Sequencers) | High (Resilient organic growth) | Significant | Focus of strategic expansion and investment in new therapies. |

| Fluidic Systems (Aerospace & Defense) | High (Sustained expansion) | Strong | Essential for modernizing defense capabilities. |

What is included in the product

This matrix categorizes products by market share and growth, guiding investment decisions.

IDEX BCG Matrix provides clarity on resource allocation, relieving the pain of uncertain investment decisions.

Cash Cows

IDEX's core industrial pumps and fluid handling products, primarily within its Fluid & Metering Technologies segment, are classic cash cows. These established offerings, like those from Viking Pump and Warren Rupp, operate in mature markets where IDEX enjoys a strong, long-standing market position.

Their mission-critical nature ensures consistent demand across various industrial applications, generating reliable and predictable cash flow for the company. For instance, in 2023, the FMT segment reported net sales of $720.5 million, a testament to the enduring strength of these product lines.

Capital allocation for these cash cows focuses on optimizing operational efficiency and defending market share rather than pursuing aggressive expansion. This strategy allows IDEX to harvest the substantial profits generated by these mature, yet vital, business units.

Municipal water infrastructure solutions represent a classic Cash Cow for IDEX within the broader Fluid & Metering Technology (FMT) segment. This market, critical for public health and environmental safety, offers a stable and predictable demand for essential fluid management products. IDEX's established position and significant market share in this mature sector translate into a reliable and consistent revenue stream.

The inherent stability of municipal water infrastructure means that IDEX's investments in marketing and promotion are relatively low, yet the profit margins generated are substantial. For instance, in 2024, the global municipal water treatment market was valued at approximately $25 billion, with steady growth projected, underscoring the enduring demand for these vital services.

Firefighting pumps and controls represent a classic Cash Cow for IDEX within its Fire & Safety/Diversified Products segment. This mature product line enjoys a leading market position, consistently delivering stable, high-margin revenue due to the critical nature of emergency response equipment and predictable demand.

The segment's continued record sales in 2024 underscore IDEX's strong market share in a space characterized by low, yet consistent, growth. This stability allows for significant cash generation, which can be reinvested in other business areas or returned to shareholders.

BAND-IT Stainless Steel Banding and Clamps

BAND-IT, a key player within IDEX Corporation's Fire and Specialty Products Distribution (FSDP) segment, specializes in stainless steel banding and clamping systems. These products are crucial for securing components in demanding environments, including industrial infrastructure and aerospace applications. The business benefits from a stable, mature market where its established presence and unique technology ensure consistent demand and strong profitability.

As a Cash Cow in the BCG Matrix, BAND-IT generates substantial, reliable cash flow. This is largely due to its entrenched market position and the essential nature of its offerings, which require limited reinvestment for growth. For instance, IDEX's FSDP segment, which includes BAND-IT, reported robust performance in recent periods, contributing significantly to the corporation's overall financial health. In 2024, IDEX Corporation's revenue growth was supported by the steady performance of its established businesses like BAND-IT, underscoring its role as a consistent cash generator.

- Established Market Position: BAND-IT holds a strong foothold in the industrial and aerospace sectors, ensuring predictable revenue streams.

- High Profitability: Proprietary technology and a mature market allow for premium pricing and healthy profit margins.

- Consistent Cash Flow: The business reliably generates cash with minimal need for substantial capital expenditure, supporting other ventures within IDEX.

- Low Growth, High Share: While not a high-growth area, BAND-IT's significant market share makes it a prime example of a Cash Cow.

Dispensing Equipment for Architectural Coatings

IDEX's dispensing equipment for architectural coatings is a classic Cash Cow. This segment operates within a mature market, meaning demand is stable and predictable, not experiencing rapid expansion. IDEX holds a significant position here, leveraging its specialized technology to maintain a strong market share.

The reliability of this business is a key characteristic. It generates consistent revenue and contributes positively to IDEX's overall profitability. Crucially, these operations typically require minimal additional investment to maintain their performance, allowing IDEX to allocate capital to higher-growth areas.

- Market Position: Dominant in a mature, stable architectural coatings market.

- Revenue Generation: Provides a consistent and dependable income stream.

- Investment Needs: Requires low capital expenditure for ongoing operations.

- Profitability Contribution: Supports overall company earnings without high growth expectations.

IDEX's industrial pumps, particularly those from Viking Pump and Warren Rupp, exemplify Cash Cows. Operating in mature markets with high market share, these products generate consistent, reliable cash flow. For instance, the Fluid & Metering Technologies segment, housing many of these pumps, achieved net sales of $720.5 million in 2023, demonstrating their enduring market strength.

These critical components for industrial applications require limited reinvestment, allowing IDEX to leverage their profitability. The focus for these units is on maintaining efficiency and market position rather than aggressive growth, effectively harvesting mature market demand.

Municipal water infrastructure solutions are another key Cash Cow for IDEX. This sector, vital for public services, ensures stable and predictable demand for IDEX's essential fluid management products. The global municipal water treatment market, valued around $25 billion in 2024, highlights the consistent need for these solutions, which IDEX serves with a strong market presence.

Firefighting pumps and controls also represent a significant Cash Cow. As a mature product line with a leading market position, it delivers stable, high-margin revenue due to the critical nature of emergency equipment. This segment's continued record sales in 2024 underscore IDEX's strong market share in a low-growth but highly profitable niche.

| Business Unit/Product Line | BCG Category | 2023 Net Sales (Segment) | Key Characteristics |

| Industrial Pumps (Viking Pump, Warren Rupp) | Cash Cow | $720.5 million (FMT Segment) | Mature market, high market share, critical applications, stable demand, low reinvestment. |

| Municipal Water Infrastructure Solutions | Cash Cow | Included in FMT Segment | Essential service, predictable demand, strong market position, high profitability, low marketing spend. |

| Firefighting Pumps and Controls | Cash Cow | Included in Fire & Safety/Diversified Products Segment | Mature market, leading position, stable high margins, critical equipment, consistent revenue. |

Delivered as Shown

IDEX BCG Matrix

The preview you see is the identical IDEX BCG Matrix document you will receive upon purchase. This means you're getting the fully formatted, analysis-ready report without any watermarks or demo content, ensuring immediate professional usability.

Rest assured, the IDEX BCG Matrix file you are currently viewing is the exact same comprehensive document that will be delivered to you after completing your purchase. It's designed for strategic insight and is ready for immediate application in your business planning.

What you are previewing is the actual, complete IDEX BCG Matrix report that you will download immediately after your purchase. This ensures you receive a professionally crafted and analysis-ready document, perfect for strategic decision-making.

This preview showcases the exact IDEX BCG Matrix document you will acquire upon purchase. You can be confident that the final file will be fully formatted and ready for immediate use in your strategic analysis and presentations.

Dogs

Agricultural Fluid Handling Solutions, within IDEX's Fluid & Metering Technologies (FMT) segment, are currently experiencing a downturn. This sector, which includes products like electric valves and severe-duty pumps for agricultural liquid handling, has been hit by a cyclical softness and a broader down agriculture cycle.

The demand for these specialized agricultural products has decreased, reflecting a challenging market environment. This situation suggests that these offerings may have a relatively low market share and limited growth prospects in the immediate future.

Given these market conditions, Agricultural Fluid Handling Solutions are candidates for a strategic review. Companies in this space need to assess their competitive positioning and future growth potential in light of the current agricultural economic climate.

Certain legacy energy market solutions, particularly within IDEX's Fluid & Metering Technology (FMT) segment, are likely classified as dogs in the BCG matrix. These older product lines are tied to traditional energy markets, which are currently experiencing softness and low growth. This trend is driven by the global shift towards energy transition and the inherent volatility of commodity prices.

These legacy products may be seeing a declining market share as the energy landscape evolves. For instance, in 2024, the International Energy Agency reported that investments in fossil fuels, while still significant, are facing increasing pressure from renewable energy sources, impacting demand for traditional infrastructure components.

Consequently, these areas might generate minimal cash flow and could tie up valuable resources that could be better allocated to growth areas. This lack of growth potential and low market share firmly places them in the 'dog' category of the BCG matrix.

Within IDEX's broad industrial offerings, certain highly specialized, niche applications might fall into the 'dog' category of the BCG matrix. These could be products serving smaller markets that haven't seen significant growth or have encountered intense competition, leading to low market share and minimal returns on investment. For instance, a specific type of pump designed for a declining industrial process might fit this description.

These underperforming segments often demand considerable management attention and resources without yielding proportional benefits. IDEX's strategic focus on efficiency, often referred to as their 80/20 approach, means these 'dog' products are prime candidates for a thorough review. The company would likely explore options such as optimizing their production, finding new niche markets, or potentially divesting these assets to reallocate capital to more promising areas.

Discontinued or Divested Product Lines

Discontinued or divested product lines within IDEX Corporation are typically categorized as 'dogs' in the BCG Matrix. These are business units or products that have low market share and low growth potential, often representing areas where the company no longer sees a strategic advantage or sufficient return on investment. IDEX has historically divested non-core assets to streamline operations and focus on higher-growth segments.

While specific details on every divested product line are not always public, the act of divestiture itself signifies that these assets were assessed as dogs. For instance, in 2021, IDEX completed the sale of its Health & Science Technologies business for $360 million, a move that allowed the company to concentrate on its core industrial segments.

The divestiture of such product lines is a strategic decision to reallocate capital and management attention to areas with stronger growth prospects. These 'dog' units, prior to their sale, likely exhibited declining revenues or profitability, making them candidates for exit rather than continued investment.

- Divestiture Strategy: IDEX periodically reviews its portfolio, divesting businesses that no longer align with its strategic objectives or growth ambitions.

- Low Growth, Low Share: Divested product lines typically fall into the 'dog' quadrant of the BCG Matrix, characterized by limited market growth and a small competitive share.

- Capital Reallocation: Selling off 'dog' assets frees up capital and resources that can be reinvested in more promising 'stars' or 'cash cows'.

- Focus on Core Strengths: Divestitures allow IDEX to concentrate on its core competencies and markets where it holds a stronger competitive position.

Older Generations of Semiconductor Equipment Components (Pre-Mott Acquisition)

Before IDEX's acquisition of Mott Corporation, some of its legacy semiconductor equipment components may have been categorized as dogs. This is because the semiconductor industry experiences rapid technological advancements, potentially leaving older, less innovative components in slower-growth markets with declining market share.

These older components, not benefiting from Mott's enhanced capabilities or newer technologies, could struggle to compete. If IDEX is not actively phasing out or upgrading these specific offerings, they represent a potential drag on overall performance.

For instance, consider the market for certain legacy filtration or fluidic components that were prevalent in older semiconductor manufacturing processes. As newer, more efficient technologies emerge, demand for these older parts naturally wanes.

- Legacy Components: Older semiconductor fluidic and filtration components not upgraded post-Mott acquisition.

- Market Dynamics: Facing declining market share due to rapid technological evolution in semiconductor manufacturing.

- Strategic Challenge: Potential underperformance if not actively phased out or integrated with new capabilities.

Products classified as 'dogs' within IDEX's portfolio are those with low market share and low growth potential. These are often legacy offerings or those serving niche, declining markets that no longer align with the company's strategic growth objectives.

Such products typically generate minimal cash flow and can consume resources that would be better invested elsewhere. IDEX's focus on operational efficiency and portfolio optimization means these 'dog' segments are prime candidates for strategic review, which could include improvement, repositioning, or divestiture.

For example, certain older energy market components or discontinued product lines fit this 'dog' profile, reflecting the company's active management of its business units to enhance overall performance and focus on core strengths.

Question Marks

Following the Mott acquisition, IDEX is positioned as a significant player in the semiconductor wafer fabrication equipment market. This sector is experiencing robust growth, and IDEX is strategically investing to expand its market share and integrate new technologies. The company's commitment to this high-growth area involves substantial cash outlays as it builds out its operational footprint and capabilities.

IDEX's Health & Science Technologies (HST) segment is strategically positioned to capitalize on the burgeoning demand for new disease therapies. This focus area represents a significant growth opportunity, as advancements in medical science create a continuous need for specialized fluidic solutions. For instance, the global market for biopharmaceutical fluidics, crucial for drug discovery and delivery, was projected to reach over $11 billion by 2024, highlighting the immense potential.

While these fluidic applications for new disease therapies offer high-growth prospects, IDEX may still be in the nascent stages of establishing substantial market penetration. Gaining significant market share in such a specialized and rapidly evolving field requires time, robust product development, and strong customer relationships. The company's efforts are geared towards building a strong foundation for future dominance in this critical healthcare niche.

These ambitious initiatives necessitate considerable investment in research and development (R&D) and extensive market development activities. Consequently, the immediate financial returns from these ventures can be uncertain, as is typical for pioneering technologies. IDEX's commitment to innovation in this space underscores its long-term vision, anticipating substantial rewards as these therapies mature and gain wider adoption.

Mott Corporation's recent $40 million, multi-year agreement for a custom wastewater filtration system with a major U.S. dairy farm exemplifies a significant advancement in specialized water treatment. This project targets a high-growth segment within the water industry, showcasing Mott's capability in developing tailored solutions for demanding agricultural applications. The scale of this deal underscores the potential for such niche markets to drive substantial revenue.

This large-scale, custom project represents a new frontier for Mott, demanding considerable investment in resources and expertise to ensure successful execution and market leadership. While this initiative is still in its early stages, its successful implementation could propel it into a 'star' category within the BCG matrix. The company's ability to deliver on such complex projects will be crucial for future growth and market positioning in advanced filtration.

Specialized Materials Science Innovations (STC Material Solutions Integration)

The acquisition of STC Material Solutions in late 2023 significantly bolstered IDEX's capabilities in specialized materials science. This segment, while holding considerable high-growth potential across diverse applications, is currently in an integration phase for IDEX as the company explores emerging market opportunities.

IDEX will need to strategically invest in these advanced material science capabilities to foster innovation and secure a leading market position. For instance, the aerospace and defense sectors, key markets for advanced materials, saw a global market size of approximately $370 billion in 2023, with significant projected growth driven by technological advancements.

- High-Growth Potential: Advanced materials are crucial for sectors like aerospace, automotive, and electronics, which are experiencing rapid innovation.

- Integration Phase: IDEX is actively working to integrate STC Material Solutions' expertise, a process that typically requires focused investment and strategic planning.

- Market Expansion: The company is exploring new applications and markets where its specialized materials can offer a competitive advantage.

- Investment Needs: Capital allocation is essential to scale production, enhance R&D, and build market share in these specialized, often high-margin, segments.

Platform Optimization Initiatives for Efficiency

IDEX is actively engaged in platform optimization and delayering initiatives, representing strategic internal investments designed to enhance operational efficiency and foster integration across its diverse business units. These efforts, while not directly product-based, are crucial for driving future growth and profitability by streamlining operations and reducing costs. For instance, in 2024, IDEX projected significant savings from these optimization programs, with a target of $15 million in delayering and operational efficiency gains by the end of the year, which will be reinvested into growth areas.

These initiatives are categorized as 'question marks' within the IDEX BCG Matrix because their ultimate impact on market share and competitive advantage, while intended to be positive, is not yet fully realized or guaranteed. They require substantial resource allocation and ongoing management to ensure they deliver the projected benefits and contribute to IDEX's overall strategic objectives.

- Platform Optimization: Focuses on improving internal processes and technology integration.

- Delayering Savings: Aims to reduce operational costs through organizational streamlining.

- Resource Allocation: Significant investment in 2024 to support these internal strategic projects.

- Future Growth Driver: Intended to unlock future market share gains and competitive positioning.

Platform optimization and delayering initiatives represent internal strategic investments for IDEX, aimed at boosting efficiency and integration. These efforts, while not tied to specific products, are vital for future growth and profitability by streamlining operations and cutting costs. For example, IDEX targeted $15 million in savings from these programs in 2024, with funds earmarked for reinvestment in growth areas.

These strategic internal projects are classified as 'question marks' because their ultimate effect on market share and competitive advantage is still uncertain, despite their intended positive outcomes. They require significant resource allocation and continuous oversight to ensure they deliver the anticipated benefits and align with IDEX's broader strategic goals.

These initiatives focus on improving internal processes and integrating technologies, aiming to reduce operational costs through organizational streamlining. Significant investment was allocated in 2024 to support these internal strategic projects, which are intended to unlock future market share gains and enhance competitive positioning.

IDEX's strategic focus on platform optimization and delayering in 2024, targeting $15 million in efficiency gains, positions these as question marks. While crucial for future growth, their direct impact on market share is yet to be fully realized, necessitating ongoing investment and strategic management.

| Initiative | Objective | 2024 Target Savings | BCG Category | Strategic Importance |

|---|---|---|---|---|

| Platform Optimization | Enhance operational efficiency and integration | Part of overall delayering savings | Question Mark | Streamlining operations, cost reduction |

| Delayering Initiatives | Reduce organizational costs and streamline operations | $15 million | Question Mark | Unlock future growth and profitability |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive landscape analysis, to accurately position business units.