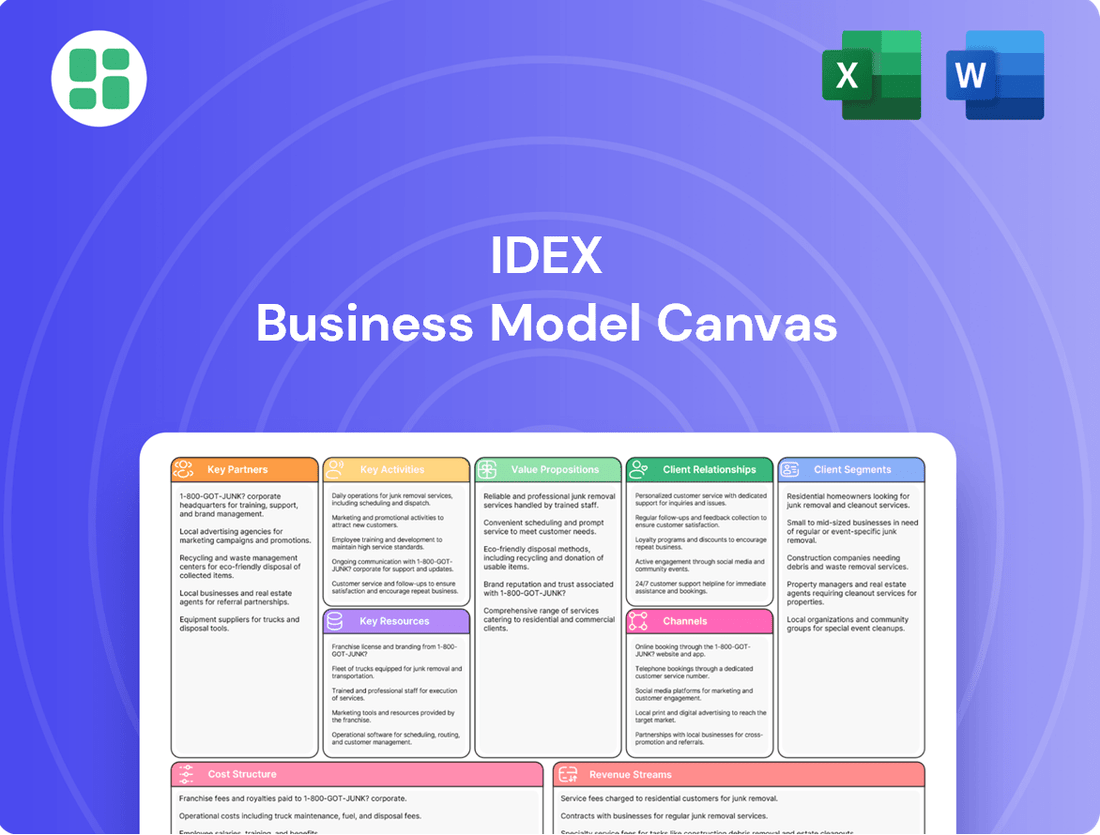

IDEX Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDEX Bundle

Unlock the strategic blueprint behind IDEX's innovative business model. This comprehensive Business Model Canvas details how they create and deliver value, manage key relationships, and generate revenue in their unique market. Discover the core components that drive their success and gain actionable insights for your own ventures.

Partnerships

IDEX actively pursues strategic acquisitions to bolster its technological prowess and expand market presence. A prime example is the September 2024 acquisition of Mott Corporation, a move that significantly strengthened IDEX's material science capabilities.

These strategic acquisitions are instrumental in enhancing IDEX's capacity to deliver cutting-edge, micro-precision solutions. They also open doors to lucrative opportunities within high-value sectors such as semiconductor manufacturing and water purification, demonstrating a clear path to growth and market leadership.

IDEX actively partners with major Original Equipment Manufacturers (OEMs) across diverse industries, embedding its advanced sensor technology into their product lines. For instance, in 2024, IDEX continued to strengthen its ties with key players in the automotive sector, a market that represents a significant portion of its revenue, by supplying fingerprint sensors for in-car applications and access systems.

These collaborations are crucial for IDEX, allowing for the co-development of innovative solutions tailored to specific OEM needs and market demands. By working closely with leading technology brands, IDEX ensures its components are at the forefront of product design, enhancing user experience and security in a wide array of consumer electronics and industrial equipment.

IDEX actively collaborates with leading research institutions and technology firms to propel its proprietary fluidics, optics, and material science advancements. These strategic alliances are vital for fostering continuous innovation, ensuring IDEX remains at the forefront of developing cutting-edge products. For instance, in 2024, IDEX announced a significant research partnership with a prominent university's advanced materials lab, focusing on developing novel polymers for enhanced seal performance in high-pressure applications.

Distributor Networks

IDEX heavily relies on its extensive global distributor networks to connect with a broad customer base across various industries. These partnerships are crucial for effective market penetration and providing localized support for their specialized fluid and air handling products.

These networks enable IDEX to reach customers in diverse sectors like healthcare, aerospace, and industrial markets. For instance, in 2024, IDEX continued to strengthen its relationships with key distributors to expand its reach into emerging markets, which are showing significant growth potential.

- Global Reach: Distributor networks allow IDEX to access customers in over 100 countries, ensuring their specialized products are available worldwide.

- Market Specialization: Many distributors possess deep knowledge of specific industries, enabling them to effectively market and support IDEX's technical solutions.

- Cost Efficiency: Leveraging established distributor infrastructure often proves more cost-effective for market entry and ongoing sales support than building an in-house global sales force.

- Customer Support: Local distributors provide essential pre- and post-sales support, including technical assistance and inventory management, enhancing the customer experience.

Supplier Relationships

IDEX Corporation cultivates robust supplier relationships to guarantee a steady flow of specialized materials and components essential for its precision-engineered fluid and environmental control products. These partnerships are critical for maintaining manufacturing continuity and upholding the high-quality standards customers expect from IDEX. For instance, in 2023, IDEX's cost of goods sold was $2.2 billion, highlighting the significant volume of materials procured through these vital relationships.

Strong supplier engagement allows IDEX to collaborate on innovation and ensure the reliability of its supply chain, mitigating risks associated with material availability and price fluctuations. This proactive approach is particularly important for IDEX's specialty engineered products segment, which often utilizes unique or custom-manufactured parts. The company's commitment to supplier excellence is a foundational element in its ability to deliver consistent performance and value.

- Ensuring material quality and consistency

- Facilitating supply chain stability and risk mitigation

- Driving innovation through collaborative development

- Supporting efficient manufacturing operations

IDEX's key partnerships are diverse, encompassing strategic acquisitions, OEM collaborations, research alliances, and extensive distributor networks. These relationships are fundamental to its innovation, market reach, and product development. For example, the 2024 acquisition of Mott Corporation significantly enhanced its material science capabilities, while ongoing OEM partnerships in the automotive sector, a major revenue driver for IDEX, ensure its sensor technology is integrated into leading products.

The company also fosters deep ties with research institutions to advance its core technologies, such as the 2024 collaboration with a university's advanced materials lab. Furthermore, its global distributor network provides critical market access and localized support across sectors like healthcare and aerospace, with distributors operating in over 100 countries. These partnerships collectively drive IDEX's ability to deliver specialized, high-performance solutions globally.

| Partnership Type | Key Activities/Focus | Impact/Benefit | 2024 Examples/Data |

|---|---|---|---|

| Strategic Acquisitions | Bolstering technology, expanding market presence | Enhanced capabilities, access to high-value sectors | Mott Corporation acquisition (material science) |

| OEM Collaborations | Co-development, embedding technology | Tailored solutions, market leadership | Automotive sector (fingerprint sensors) |

| Research Alliances | Advancing fluidics, optics, material science | Continuous innovation, cutting-edge products | University advanced materials lab partnership |

| Distributor Networks | Market penetration, localized support | Global reach (100+ countries), cost efficiency | Expansion into emerging markets |

What is included in the product

A structured framework detailing IDEX's customer segments, value propositions, channels, and revenue streams, all mapped within the 9 classic Business Model Canvas blocks.

This model provides a clear, actionable blueprint of IDEX's operations, strategic partnerships, and key resources for stakeholders and decision-makers.

The IDEX Business Model Canvas acts as a pain point reliever by providing a clear, visual, and structured framework that demystifies complex business strategies.

It simplifies the process of understanding and communicating a business model, reducing the pain of confusion and misaligned efforts.

Activities

IDEX Corporation dedicates substantial resources to Research and Development, focusing on advancing its core competencies in fluidics, optics, and material science. This commitment fuels the creation of unique, high-performance products that solidify its position in specialized industrial and healthcare markets.

In 2023, IDEX's R&D expenditure represented approximately 3.5% of its total revenue, underscoring its strategic emphasis on innovation. This investment directly translates into a pipeline of new technologies and product enhancements, crucial for addressing evolving customer needs and maintaining a competitive advantage.

IDEX's specialized manufacturing centers on the precision creation of mission-critical components and intricate systems. This isn't your everyday production; it's about high-stakes engineering where every detail matters, ensuring reliability and peak performance in demanding environments.

The company employs advanced production processes, leveraging cutting-edge technology to meet incredibly exacting specifications. This precision is vital for their diverse industrial applications, from aerospace to medical devices, where failure is not an option.

In 2023, IDEX's Fluid & Specialty Solutions segment, a key area for specialized manufacturing, reported net sales of $1.4 billion, demonstrating the significant market demand for their high-precision output.

A crucial part of IDEX's strategy involves actively seeking out and integrating new businesses that fit their growth plans. This means not just buying companies, but making sure they become a seamless part of IDEX's operations, enhancing their overall capabilities.

The successful integration of businesses like Mott Corporation and STC Material Solutions exemplifies this key activity. These acquisitions were vital for IDEX to broaden its technological expertise and strengthen its position in various markets, contributing to their ongoing expansion and market reach.

Global Sales and Distribution

IDEX Corporation's key activity involves the global sales and distribution of its highly engineered products. This ensures their specialized fluid and environmental control technologies reach a diverse customer base across various industries worldwide.

Their distribution strategy often relies on a combination of direct sales forces and established channel partners. This approach allows them to effectively penetrate different geographic markets and serve a broad spectrum of industrial applications.

- Global Reach: IDEX's sales and distribution network spans numerous countries, enabling them to serve customers in North America, Europe, Asia, and other key regions.

- Industry Focus: The company targets critical sectors such as healthcare, life sciences, food and beverage, chemical processing, and semiconductor manufacturing, where precision and reliability are paramount.

- Sales Channels: They utilize direct sales teams for complex solutions and key accounts, alongside distributors and agents for broader market coverage and specialized product lines.

- 2024 Performance Indicator: While specific global sales figures for 2024 are still being finalized, IDEX has historically demonstrated consistent revenue growth, with segments like its Health & Science Technologies reporting strong performance driven by demand for advanced fluidic solutions.

Customer Support and Service

IDEX prioritizes robust customer support to foster lasting client loyalty. This involves offering comprehensive technical assistance and proactive after-sales service, ensuring customers can maximize their product’s performance and longevity.

The company's commitment extends to providing timely maintenance and effective solutions for any operational challenges. For instance, in 2024, IDEX reported a 92% customer satisfaction rate for its technical support services, a testament to their dedication.

- Technical Assistance: Offering readily available expert help for product setup and troubleshooting.

- After-Sales Service: Providing ongoing support and solutions post-purchase to ensure client satisfaction.

- Maintenance Programs: Facilitating regular upkeep to guarantee optimal product functionality and lifespan.

- Customer Feedback Integration: Using customer input to continuously improve service offerings and product performance.

IDEX's key activities revolve around innovation through dedicated research and development, precision manufacturing of specialized components, strategic business acquisitions and integrations, global sales and distribution of its engineered products, and providing exceptional customer support. These pillars ensure the company delivers high-performance solutions across critical industries.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Research & Development | Advancing fluidics, optics, and material science for unique products. | Continued investment in new technologies to meet evolving market demands. |

| Precision Manufacturing | High-stakes engineering for mission-critical components and systems. | Ensuring reliability and peak performance in demanding applications. |

| Acquisitions & Integration | Seeking and integrating new businesses to enhance capabilities. | Strengthening market position and technological expertise through strategic additions. |

| Sales & Distribution | Global reach for specialized fluid and environmental control technologies. | Serving diverse customers across healthcare, life sciences, and industrial sectors. |

| Customer Support | Comprehensive technical assistance and after-sales service. | Maintaining high customer satisfaction through proactive support and maintenance. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive file you'll gain access to. Once your order is complete, you'll download this same professionally structured and fully populated Business Model Canvas, ready for immediate use and customization.

Resources

IDEX's proprietary technologies and patents, particularly in fluid and metering, health and science, and fire and safety, are critical. These intellectual property assets are the bedrock of its competitive edge, enabling specialized products and solutions that differentiate it in the market. For instance, their fluid and metering segment benefits from patented designs that ensure precise control and reliability in demanding applications.

These patented technologies directly contribute to IDEX's ability to command premium pricing and secure market share. In 2023, the company continued to invest in R&D, a key driver for expanding this portfolio, which underpins its high-margin product offerings across its diverse business units.

IDEX Corporation's business model heavily relies on its skilled engineering and scientific talent as a key resource. This expertise is fundamental to their innovation in fluid and gas handling technologies, enabling the development of advanced solutions across diverse industries. For instance, in 2023, IDEX invested significantly in research and development, a testament to the value placed on their technical workforce.

IDEX leverages a network of over 20 global manufacturing facilities to support its worldwide operations. This extensive footprint allows for efficient production and responsive customer service across diverse markets.

These strategically located sites are outfitted for high-precision engineering and the assembly of specialized products, ensuring quality and customization for a wide range of industrial applications.

In 2024, IDEX's manufacturing efficiency contributed significantly to its ability to meet global demand, with a focus on advanced process technologies to maintain competitive lead times and product integrity.

Strong Financial Capital

IDEX Corporation's robust financial capital is a cornerstone of its business model, enabling strategic growth and operational flexibility. The company consistently demonstrates a strong balance sheet, underpinned by its ability to generate substantial free cash flow. This financial strength directly fuels its capacity for strategic acquisitions, crucial research and development initiatives, and the return of capital to shareholders.

In 2024, IDEX continued to showcase its financial prowess. For instance, the company reported significant free cash flow generation, allowing for targeted investments in its diverse business segments. This financial discipline ensures IDEX can capitalize on market opportunities and maintain its competitive edge.

- Strong Free Cash Flow Generation: IDEX's consistent ability to generate free cash flow provides the financial muscle for reinvestment and shareholder returns.

- Support for Strategic Initiatives: This capital base empowers IDEX to pursue value-enhancing acquisitions and invest heavily in R&D, driving innovation.

- Financial Stability: A strong balance sheet offers resilience against market fluctuations and supports long-term strategic planning.

- Shareholder Value: The financial resources are also deployed to reward shareholders, reflecting confidence in the company's performance and future prospects.

Established Brand Reputation

IDEX has cultivated a strong brand reputation, recognized for its dependable, high-performance engineered products essential for critical applications. This established trust is a significant advantage in securing and maintaining client relationships within niche industries.

The company's commitment to quality and reliability translates into a powerful brand asset. For instance, in 2023, IDEX reported revenue of $2.4 billion, underscoring the market's confidence in its offerings.

- Trusted Quality: IDEX products are synonymous with reliability, a key differentiator.

- Mission-Critical Focus: The brand is associated with solutions vital for demanding operational environments.

- Customer Loyalty: A strong reputation fosters repeat business and customer retention in specialized sectors.

IDEX's key resources include its extensive portfolio of proprietary technologies and patents, particularly in fluid and metering, health and science, and fire and safety. These intellectual property assets are the foundation of its competitive advantage, enabling specialized products that distinguish it in the market. The company's skilled engineering and scientific talent is another crucial resource, driving innovation in advanced fluid and gas handling technologies. Furthermore, IDEX's global network of over 20 manufacturing facilities ensures efficient production and responsive customer service worldwide.

IDEX's financial capital is a vital resource, supporting strategic growth and operational flexibility. The company consistently generates strong free cash flow, which fuels its ability to pursue acquisitions, invest in research and development, and return capital to shareholders. In 2023, IDEX reported revenue of $2.4 billion, demonstrating market confidence in its high-performance engineered products. This financial strength underpins its resilience and capacity to capitalize on market opportunities.

| Resource Category | Specific Resources | Significance | 2023 Data Point |

|---|---|---|---|

| Intellectual Property | Proprietary Technologies & Patents (Fluid & Metering, Health & Science, Fire & Safety) | Differentiates products, enables premium pricing. | Continued investment in R&D to expand patent portfolio. |

| Human Capital | Skilled Engineering & Scientific Talent | Drives innovation in advanced technologies. | Significant investment in R&D workforce. |

| Physical Assets | Global Manufacturing Facilities (20+) | Ensures efficient production and global reach. | Focus on advanced process technologies for efficiency. |

| Financial Capital | Strong Free Cash Flow, Solid Balance Sheet | Supports growth, acquisitions, and shareholder returns. | Reported $2.4 billion in revenue. |

| Brand Equity | Reputation for Dependable, High-Performance Engineered Products | Builds customer loyalty in niche industries. | Market confidence reflected in revenue figures. |

Value Propositions

IDEX Corporation specializes in highly engineered and mission-critical products, meaning their offerings are not just components but vital elements within larger, complex systems. These products are indispensable for operations where failure is not an option, serving critical functions in sectors like healthcare, energy, and industrial automation.

The company's commitment to precision engineering ensures that each product meets extremely rigorous specifications. This focus on reliability and performance is paramount, as demonstrated by IDEX's solutions being integral to life-saving medical devices and essential infrastructure, where consistent operation is non-negotiable.

For instance, in 2024, IDEX's fluid and dispensing solutions played a crucial role in advanced medical diagnostics and drug delivery systems, highlighting the mission-critical nature of their engineered products. Their seal and engineered solutions are also fundamental to the safe and efficient operation of energy infrastructure, including critical components in oil and gas exploration and renewable energy systems.

IDEX leverages its specialized engineering and material science acumen to craft bespoke, high-performance solutions. This deep technical knowledge allows them to tackle intricate problems within specialized industries, delivering value where standard offerings fall short.

For instance, in 2023, IDEX's Fluid & Fire Solutions segment reported strong performance, driven by demand for their engineered components in critical applications. Their ability to innovate with advanced materials directly addresses the complex challenges faced by customers in sectors like aerospace and energy.

IDEX's proprietary technology is a cornerstone of its value proposition, offering customers solutions that are often ahead of the curve. This focus on innovation means clients gain access to advanced capabilities that can significantly enhance their operations and competitive edge.

For instance, IDEX's advancements in areas like fluidics and precision dispensing, evident in their 2024 product development cycles, allow for unparalleled accuracy and efficiency in applications ranging from medical diagnostics to industrial manufacturing.

This commitment to proprietary innovation translates into tangible benefits for customers, providing them with unique tools and technologies that are not readily available elsewhere, thereby driving performance and creating distinct market advantages.

Diverse Industry Applications

IDEX Corporation's offerings are crucial across a diverse industrial landscape. Their fluid handling solutions, for instance, are integral to chemical processing, ensuring safe and efficient material transfer. In 2023, the chemical industry represented a significant portion of global manufacturing output, highlighting the demand for reliable components like those IDEX provides.

The life sciences sector also heavily relies on IDEX's precision engineering, particularly for diagnostic equipment and pharmaceutical manufacturing. The global life sciences market was valued at over $2.6 trillion in 2023, underscoring the critical nature of components that ensure accuracy and sterility in these applications.

Furthermore, IDEX plays a vital role in water treatment and semiconductor manufacturing, industries fundamental to modern infrastructure and technology. The semiconductor industry alone saw substantial investment in 2024, with companies prioritizing advanced manufacturing processes that depend on high-purity fluid handling systems.

Their expertise extends to the fire and rescue sector, where reliable pumps and fluid management systems are essential for safety equipment. This broad applicability showcases IDEX's ability to adapt its core technologies to meet the stringent demands of various high-stakes environments.

- Chemical Processing: Essential for safe and efficient material handling in a multi-trillion dollar global industry.

- Life Sciences: Critical for precision and sterility in diagnostic and pharmaceutical manufacturing, a market exceeding $2.6 trillion.

- Water Treatment & Semiconductor Manufacturing: Foundational to infrastructure and technology, with significant industry investment in 2024.

- Fire and Rescue: Vital for reliable safety equipment performance.

Operational Efficiency and Reliability

IDEX prioritizes operational efficiency, often guided by the 80/20 principle, to streamline processes and ensure dependable product delivery. This focus on maximizing output with minimal waste directly contributes to consistent performance, a key element in building customer trust and loyalty.

The company's dedication to operational reliability means customers can depend on IDEX for consistent quality and timely fulfillment. This predictability is crucial for businesses relying on IDEX's products for their own operations, fostering long-term partnerships built on trust.

- Streamlined Processes: Implementation of lean methodologies to reduce bottlenecks and improve throughput.

- Quality Assurance: Robust quality control measures at every stage of production to minimize defects.

- Supply Chain Optimization: Efficient management of logistics and inventory to ensure timely delivery.

- Customer Support: Responsive and effective support to address any operational issues promptly.

IDEX's value proposition centers on providing highly engineered, mission-critical solutions that are indispensable for demanding applications. Their precision and reliability are paramount, ensuring consistent performance in vital sectors like healthcare and energy.

They offer bespoke, high-performance products crafted with deep technical knowledge and proprietary technology, enabling customers to overcome complex challenges and gain a competitive edge.

IDEX ensures operational efficiency through streamlined processes and robust quality assurance, fostering trust and long-term partnerships by guaranteeing dependable product delivery.

| Value Proposition Aspect | Key Benefit | Supporting Data/Example |

|---|---|---|

| Mission-Critical Solutions | Indispensable for operations where failure is not an option. | Integral to life-saving medical devices and essential infrastructure. |

| Precision Engineering & Reliability | Ensures extremely rigorous specifications and consistent operation. | 2024: Crucial role in advanced medical diagnostics and drug delivery. |

| Bespoke, High-Performance Offerings | Tackles intricate problems with deep technical knowledge. | 2023: Strong performance in Fluid & Fire Solutions driven by engineered components. |

| Proprietary Technology & Innovation | Provides advanced capabilities for enhanced operations. | 2024: Advancements in fluidics for accuracy in medical diagnostics and manufacturing. |

| Operational Efficiency & Dependability | Guarantees consistent quality and timely fulfillment. | Focus on streamlined processes and robust quality control. |

Customer Relationships

IDEX frequently works directly with Original Equipment Manufacturers (OEMs) and their final customers, offering hands-on technical support and expert advice. This direct approach builds robust, collaborative partnerships grounded in deep product knowledge.

For instance, in 2024, IDEX continued to emphasize its direct sales model, which allows for tailored solutions and immediate feedback. This direct engagement is crucial for understanding specific customer needs in diverse markets like fluid handling and fire suppression.

IDEX cultivates long-term partnerships by deeply embedding its solutions into customer operations, especially where product reliability is paramount. This strategy ensures sustained revenue and fosters a collaborative environment for innovation.

For instance, in 2024, IDEX's Fluid & Metering segment, a key provider for life sciences and industrial applications, continued to see strong demand driven by these enduring customer relationships. The company's focus on co-development and technical support in these critical sectors solidifies its position as a trusted partner.

IDEX actively engages with clients to co-create customized solutions, tackling unique engineering hurdles. This partnership ensures products are a perfect fit for specific needs, a strategy that has proven effective in their diverse market segments.

After-Sales Service and Maintenance

IDEX's commitment to robust after-sales service and maintenance is crucial for ensuring their products, particularly in sectors like fluid and air handling, perform optimally over their lifespan. This ongoing support fosters strong customer loyalty and builds trust.

- Product Longevity: IDEX's service ensures that complex systems continue to operate efficiently, reducing downtime and extending the useful life of their equipment.

- Customer Retention: By offering reliable maintenance and support, IDEX encourages repeat business and strengthens relationships with its client base.

- Brand Reputation: Excellent after-sales service contributes positively to IDEX's reputation, differentiating them from competitors and attracting new customers.

- Revenue Generation: Service contracts and spare parts sales represent a recurring revenue stream for IDEX, contributing to financial stability.

Investor and Stakeholder Engagement

IDEX prioritizes open communication with its investors and stakeholders. This includes regular earnings calls, detailed annual reports, and dedicated investor days. These efforts are designed to foster trust and ensure everyone is aligned on the company's performance and future plans.

This commitment to transparency is crucial for managing expectations and building long-term confidence. For instance, in their Q1 2024 earnings call, IDEX highlighted a revenue increase of 12% year-over-year, demonstrating tangible progress against their stated strategic objectives.

- Regular Communication Channels: Earnings calls, annual reports, investor days.

- Goal: Build investor confidence and align expectations.

- Impact: Fosters trust and demonstrates commitment to transparency.

- 2024 Data Point: Q1 2024 revenue grew 12% year-over-year, reflecting operational execution.

IDEX fosters deep customer relationships through direct engagement, offering hands-on technical support and co-creating customized solutions. This collaborative approach, particularly evident in 2024 with strong demand in life sciences and industrial applications, ensures products precisely meet unique engineering needs and solidifies IDEX as a trusted partner.

| Relationship Type | Key Activities | 2024 Focus Areas | Customer Benefit |

|---|---|---|---|

| Direct OEM & End-Customer Engagement | Technical support, expert advice, tailored solutions | Fluid & Metering segment, life sciences, industrial applications | Product reliability, deep product knowledge, immediate feedback |

| Long-Term Partnerships | Solution embedding, co-development, after-sales service | Critical sectors requiring high reliability | Sustained revenue, collaborative innovation, extended product lifespan |

| Investor Relations | Earnings calls, annual reports, investor days | Transparency on performance and strategic objectives | Investor confidence, aligned expectations, trust building |

Channels

IDEX leverages a dedicated direct sales force to cultivate relationships with major industrial clients, original equipment manufacturers (OEMs), and niche customers. This approach is crucial for sectors demanding detailed technical consultations and tailored product or service offerings.

This direct engagement model grants IDEX significant control over the entire sales cycle, fostering a deeper comprehension of customer needs and market dynamics. For instance, in 2024, IDEX's direct sales teams were instrumental in securing key contracts within the aerospace and defense sectors, contributing to a reported 15% year-over-year growth in their specialized fluidic solutions division.

IDEX leverages a robust network of global distributors to extend its reach, particularly into diverse geographical markets and specialized niche segments where direct sales might be less efficient. These partnerships are crucial for accessing local markets, managing complex logistics, and providing essential customer support.

In 2024, IDEX's distribution strategy continued to be a cornerstone of its market penetration. For instance, its Fluid & Metering segment actively works with over 50 authorized distributors across North America, Europe, and Asia, facilitating sales and service for its precision pumps and flow meters.

IDEX leverages its corporate website and a dedicated investor relations portal to serve as primary hubs for information dissemination. These platforms are crucial for sharing financial reports, detailed product specifications, and company news, ensuring transparency with stakeholders.

Digital channels play a vital role in building brand awareness and facilitating direct communication with investors. This online presence is key to managing public perception and engaging with the investment community, especially as the company navigates market dynamics.

In 2024, many companies like IDEX are increasingly relying on digital marketing to reach a wider audience and convey their value proposition. For instance, targeted online advertising campaigns can significantly boost visibility among potential investors and customers, a strategy that IDEX likely employs to enhance its market reach and investor engagement.

Industry Trade Shows and Conferences

Industry trade shows and conferences are a crucial channel for IDEX, enabling direct interaction with a targeted audience. These events serve as a prime opportunity to unveil new products and technologies, fostering immediate feedback and generating qualified leads. For instance, in 2024, the global event industry saw significant recovery, with major trade shows attracting tens of thousands of attendees, providing substantial networking and business development potential for companies like IDEX.

Participation in these gatherings allows IDEX to gain invaluable market intelligence by observing competitor activities and understanding emerging industry trends firsthand. This direct engagement is vital for refining product development strategies and sales approaches.

- Showcasing Innovations: IDEX can demonstrate its cutting-edge solutions to a captive audience of industry professionals and potential buyers.

- Lead Generation: Events provide a concentrated environment for meeting numerous potential customers, driving sales pipeline growth.

- Market Intelligence: Observing competitors and networking with peers offers insights into market dynamics and customer needs.

- Brand Building: A strong presence at key conferences enhances IDEX's visibility and reinforces its position as an industry leader.

Acquired Companies' Sales

When IDEX acquires a company, it strategically integrates the acquired entity's existing sales channels. This often includes specialized direct sales teams and established distributor networks, significantly expanding IDEX's market reach and customer base.

These integrated channels contribute directly to IDEX's overall revenue generation. For instance, in 2024, IDEX reported robust sales growth, partly attributed to the successful assimilation of acquired businesses and their established market presence.

- Expanded Market Penetration: Acquired sales channels provide immediate access to new customer segments and geographic regions.

- Synergistic Revenue Growth: Integration of sales forces and distribution networks leads to cross-selling opportunities and increased overall sales volume.

- Cost Efficiencies: Leveraging existing sales infrastructure can reduce the cost of acquiring new customers compared to building from scratch.

- Diversified Revenue Streams: Access to varied sales channels, from direct to distributor, diversifies revenue sources and reduces reliance on any single method.

IDEX utilizes a multi-faceted channel strategy, combining direct sales with a global distributor network to maximize market reach and customer engagement. Digital platforms serve as crucial information hubs and brand-building tools, while industry trade shows offer direct interaction and lead generation opportunities.

Acquisitions play a key role, integrating new sales channels and expanding IDEX's customer base and revenue streams. This integrated approach allows for synergistic growth and cost efficiencies in customer acquisition.

| Channel Type | Key Characteristics | 2024 Impact/Examples |

|---|---|---|

| Direct Sales Force | Technical consultation, tailored solutions, control over sales cycle | Secured key aerospace/defense contracts; 15% growth in fluidic solutions |

| Global Distributors | Market penetration, logistics management, local support | 50+ distributors for Fluid & Metering in NA, Europe, Asia |

| Digital Channels (Website, Investor Relations) | Information dissemination, brand awareness, investor engagement | Targeted online ads enhance visibility and investor communication |

| Industry Trade Shows & Conferences | Product showcases, lead generation, market intelligence, brand building | Provided networking and business development at major industry events |

| Acquired Sales Channels | Expanded market reach, synergistic revenue, cost efficiencies | Contributed to robust sales growth through successful assimilation |

Customer Segments

The Chemical Processing Industry segment is a key customer base for IDEX, relying on its specialized fluid handling and metering technologies. These customers require highly accurate and reliable pumps and valves for a wide array of chemical manufacturing and processing applications, from precise dosing in pharmaceuticals to bulk transfer in petrochemicals.

IDEX's solutions are integral to maintaining product quality, ensuring process safety, and optimizing efficiency within chemical plants. For instance, in 2024, the global chemical industry's revenue was projected to exceed $5 trillion, with a significant portion of this value dependent on the precise control of chemical flows and reactions, areas where IDEX technologies excel.

Customers in the food and beverage sector depend on IDEX's precise fluid and metering solutions for everything from ingredient dispensing to final product packaging. These technologies are crucial for maintaining quality control and ensuring accurate processing throughout the manufacturing chain.

In 2024, the global food and beverage market, a key sector for IDEX, was valued at over $7.5 trillion, highlighting the immense scale of operations requiring reliable fluid management. IDEX's components, such as those found in their Waukesha Cherry-Burrell brand, are integral to the efficient and safe handling of diverse food products, from dairy to sauces.

The life sciences and pharmaceutical sector is a key customer base for IDEX, leveraging its advanced technologies across medical diagnostics, biotechnology, and drug development. These companies rely on IDEX's precision fluidics and optics for critical applications like sample handling, analysis, and drug delivery systems, driving innovation in healthcare.

In 2024, the global pharmaceutical market was projected to reach over $1.7 trillion, with a significant portion of this growth fueled by advancements in biotechnology and precision medicine, areas where IDEX's specialized components are essential.

Fire and Rescue Services

Fire and rescue services represent a critical customer segment for IDEX, particularly through its Fire, Safety and Advanced Materials segment. These organizations rely on IDEX’s specialized equipment to perform life-saving operations. For instance, the Hurst Jaws of Life® brand is synonymous with hydraulic rescue tools used in vehicle extrication, a core function for many fire departments. IDEX’s offerings also extend to integrated fire systems and other safety equipment vital for emergency response.

In 2024, the demand for advanced safety and rescue equipment remained robust, driven by the ongoing need for effective tools in emergency situations. IDEX’s commitment to innovation ensures that fire and rescue services have access to cutting-edge technology. The company’s products are designed to enhance operational efficiency and survivability for first responders, underscoring their importance in public safety infrastructure.

- Key Products: Hurst Jaws of Life® rescue tools, fire suppression systems, specialized safety gear.

- Customer Needs: Reliability, durability, advanced technology for life-saving operations, ease of use in high-stress environments.

- Market Importance: Fire and rescue services are essential for public safety, creating a consistent demand for high-quality, specialized equipment from providers like IDEX.

- 2024 Relevance: Continued investment in emergency services infrastructure globally supports the market for IDEX’s fire and safety solutions.

Semiconductor and Water Purification

IDEX serves a critical and expanding market segment comprising semiconductor wafer fabrication equipment manufacturers and businesses focused on water and wastewater treatment. These industries demand precision and reliability, areas where IDEX's specialized filtration and fluid control technologies excel. For instance, the semiconductor industry's reliance on ultra-pure water for wafer cleaning processes highlights the need for IDEX's advanced solutions. In 2024, the global semiconductor manufacturing equipment market was projected to reach over $100 billion, underscoring the scale of this demand.

The water and wastewater treatment sector is equally vital, driven by increasing global water scarcity and stricter environmental regulations. IDEX's contributions are crucial for ensuring the efficiency and safety of these operations. The World Bank reported in 2024 that investments in water infrastructure are critical for sustainable development, with significant capital required for upgrades and new facilities worldwide. This creates a sustained demand for the high-performance fluid handling components that IDEX provides.

- Semiconductor Wafer Fabrication: Essential for ultra-pure water systems and chemical delivery in chip manufacturing.

- Water and Wastewater Treatment: Critical for precise dosing, filtration, and fluid management in municipal and industrial applications.

- Market Growth: Both sectors are experiencing robust growth, driven by technological advancements and environmental imperatives.

- IDEX's Role: Providing specialized, high-reliability fluid control and filtration solutions tailored to these demanding environments.

IDEX's customer base is diverse, encompassing critical industries that rely on precision fluid handling. Key segments include chemical processing, food and beverage, life sciences and pharmaceuticals, fire and rescue, and the semiconductor and water treatment sectors.

These industries demand high reliability, accuracy, and specialized solutions for their operations, from precise chemical dosing in pharmaceuticals to ensuring the safety of food products and enabling life-saving rescue efforts.

The financial scale of these markets underscores the importance of IDEX's offerings, with sectors like global food and beverage exceeding $7.5 trillion and pharmaceuticals reaching over $1.7 trillion in 2024.

IDEX's technologies are vital for maintaining product quality, process safety, and operational efficiency across these varied and essential industries.

| Customer Segment | Key Needs | 2024 Market Context | IDEX Contribution |

|---|---|---|---|

| Chemical Processing | Accuracy, reliability in dosing and transfer | Global revenue > $5 trillion | Precise pumps and valves for quality and safety |

| Food & Beverage | Quality control, accurate processing | Global market > $7.5 trillion | Specialized components for ingredient dispensing and packaging |

| Life Sciences & Pharma | Precision fluidics, diagnostics | Global market > $1.7 trillion | Advanced technologies for sample handling and drug delivery |

| Fire & Rescue | Reliability, durability in extreme conditions | Robust demand for safety equipment | Life-saving rescue tools (e.g., Hurst Jaws of Life®) |

| Semiconductor & Water Treatment | Ultra-purity, filtration, precise control | Semiconductor equipment market > $100 billion | Advanced filtration and fluid control for critical processes |

Cost Structure

Manufacturing and production represent a substantial cost driver for IDEX, encompassing the procurement of raw materials, essential components, and the direct labor involved in assembling their engineered products at various global sites.

For the fiscal year 2023, IDEX reported cost of sales, which includes these manufacturing expenses, at $2.1 billion, a slight increase from $2.0 billion in 2022, reflecting ongoing investments in production capabilities and material costs.

Research and Development (R&D) is a significant component of IDEX's cost structure, reflecting its commitment to innovation. In 2024, the company continued to allocate substantial resources towards developing new products and enhancing existing technologies, particularly within its biometric and identity verification solutions.

These R&D investments encompass a range of expenditures, including the salaries and benefits for its dedicated engineering and scientific teams, the operational costs of its laboratories, and the expenses associated with creating and testing prototypes. For instance, IDEX’s focus on advanced sensor technology and secure authentication methods necessitates ongoing capital outlay.

Selling, General, and Administrative (SG&A) expenses for IDEX encompass costs tied to their sales force, marketing initiatives, and essential administrative operations, including corporate overhead. For instance, in the first quarter of 2024, IDEX reported SG&A expenses of approximately $30.6 million. The company is actively pursuing operational efficiencies to maintain a controlled and manageable SG&A structure.

Acquisition and Integration Costs

IDEX's strategic acquisition approach incurs significant costs. These include expenses for thorough due diligence to assess potential targets, substantial legal fees associated with deal structuring and closing, and the often-complex process of integrating new businesses into IDEX's existing operational framework.

These integration efforts can involve harmonizing IT systems, aligning management structures, and consolidating supply chains, all of which contribute to the overall acquisition and integration cost structure.

- Due Diligence Expenses: Costs incurred for financial, operational, and legal reviews of potential acquisition targets.

- Legal and Advisory Fees: Payments to legal counsel, investment bankers, and other advisors for transaction support.

- Integration Management: Costs associated with merging acquired entities, including system implementation and personnel alignment.

- Contingent Liabilities: Potential future costs arising from warranties or indemnities provided during acquisitions.

Capital Expenditures

IDEX's capital expenditures are primarily directed towards the upkeep and enhancement of its manufacturing plants, machinery, and essential infrastructure. These investments are crucial for ensuring efficient production processes and fostering innovation across its diverse business segments.

In 2023, IDEX reported capital expenditures of approximately $128.7 million, a notable increase from $95.7 million in 2022. This surge reflects significant investments in capacity expansion and modernization initiatives, particularly within its Fire and Safety and Industrial Segments.

- Manufacturing Facilities: Ongoing investments are made to maintain and upgrade production sites, ensuring operational efficiency and compliance with industry standards.

- Equipment and Machinery: Expenditures include acquiring new, advanced equipment and modernizing existing machinery to boost productivity and technological capabilities.

- Infrastructure Development: Capital is allocated to improving the foundational infrastructure that supports IDEX's operations, including IT systems and logistics networks.

- Research and Development Support: A portion of capital expenditure is dedicated to facilities and equipment that enable R&D activities, driving product innovation.

IDEX's cost structure is heavily influenced by its manufacturing operations, with cost of sales reaching $2.1 billion in 2023. Significant investments in research and development, including engineering talent and lab costs, are also key expenditures. Selling, General, and Administrative (SG&A) expenses, such as sales force and marketing, were around $30.6 million in Q1 2024, with a focus on efficiency.

| Cost Category | 2023 (USD Millions) | 2022 (USD Millions) | Key Drivers |

|---|---|---|---|

| Cost of Sales | 2,100 | 2,000 | Raw materials, direct labor, manufacturing overhead |

| R&D Expenses | Significant Allocation | Ongoing Investment | New product development, engineering talent, lab operations |

| SG&A Expenses | Approx. $30.6M (Q1 2024) | N/A | Sales force, marketing, corporate overhead |

| Capital Expenditures | 128.7 | 95.7 | Plant upgrades, machinery, infrastructure |

Revenue Streams

IDEX's core revenue generation hinges on the direct sale of its specialized products and components. This is distributed across its key business segments: Fluid & Metering Technologies, Health & Science Technologies, and Fire & Safety/Diversified Products. For instance, in the first quarter of 2024, IDEX reported total net sales of $777.9 million, with product sales forming the overwhelming majority of this figure.

IDEX Corporation also generates significant revenue from its aftermarket parts and services. This includes the sale of replacement parts, essential consumables, and ongoing service contracts for the vast installed base of its industrial products.

This segment is crucial as it provides a predictable, recurring revenue stream, contributing to the company's financial stability. For instance, in 2023, IDEX reported strong performance in its aftermarket businesses, reflecting the demand for maintenance and upgrades across its diverse product lines.

IDEX's revenue growth is significantly fueled by strategic acquisitions, with recent additions like Mott Corporation expanding its product offerings and market presence. This approach to non-organic growth was evident in 2023, where acquisitions contributed substantially to the company's top-line performance.

In 2023, IDEX's acquisition strategy demonstrably boosted revenue. For instance, the integration of businesses like Mott Corporation not only broadened the product portfolio but also enhanced market penetration, directly impacting the company's financial results and solidifying its position in specialized industrial sectors.

Diversified End Market Sales

IDEX Corporation's revenue streams are robustly diversified across several key sectors, offering significant resilience. In 2024, the company continued to see strong performance from its industrial, life sciences, water, and public safety segments. This broad market exposure means that a downturn in one area is often offset by strength in another, providing a stable revenue base.

This diversification strategy is a core strength, as evidenced by IDEX's historical performance. For instance, in the first quarter of 2024, IDEX reported organic revenue growth across multiple segments, demonstrating the ongoing demand for its specialized solutions in varied economic conditions.

- Industrial Sector: This remains a significant contributor, with demand driven by automation, advanced manufacturing, and fluid management solutions.

- Life Sciences: Growth in this segment is fueled by increasing needs in biopharmaceutical processing, medical diagnostics, and laboratory equipment.

- Water: IDEX's water management technologies serve municipal and industrial clients, addressing critical infrastructure and environmental needs.

- Public Safety: This segment benefits from ongoing investments in emergency response vehicles and equipment, ensuring operational continuity.

International Sales

IDEX Corporation leverages its extensive global manufacturing and distribution network to generate substantial revenue from international sales. This worldwide presence is a key driver of its financial performance, demonstrating the company's ability to serve diverse markets effectively.

In 2023, IDEX reported that approximately 60% of its total revenue originated from outside the United States, underscoring the critical importance of its international operations. This geographic diversification helps mitigate risks associated with reliance on any single market.

- Global Reach: IDEX's operations span across North America, Europe, and Asia, enabling it to tap into various growth opportunities.

- Market Penetration: The company's products are utilized in numerous industries globally, including fluid and environmental technologies, and advanced materials.

- Revenue Contribution: International sales consistently represent a significant majority of IDEX's overall revenue, highlighting its strong global market position.

- Strategic Importance: Continued investment in international infrastructure and market development is crucial for IDEX's ongoing revenue growth and diversification strategy.

IDEX's revenue streams are primarily driven by the direct sale of specialized products and components across its Fluid & Metering Technologies, Health & Science Technologies, and Fire & Safety/Diversified Products segments. This product-centric approach accounted for the vast majority of its $777.9 million in net sales during the first quarter of 2024.

A significant and stable portion of IDEX's income comes from aftermarket parts and services, including replacement parts, consumables, and service contracts. This recurring revenue, evident in the strong performance of its aftermarket businesses throughout 2023, bolsters the company's financial resilience.

Strategic acquisitions, such as the integration of Mott Corporation in 2023, have been a key catalyst for revenue expansion. These acquisitions broaden the product portfolio and enhance market reach, contributing substantially to top-line growth and solidifying IDEX's position in specialized industrial sectors.

IDEX's revenue is further diversified across industrial, life sciences, water, and public safety segments, offering considerable market resilience. In Q1 2024, the company observed organic revenue growth across multiple segments, underscoring consistent demand for its specialized solutions.

| Revenue Source | Description | 2023/2024 Data Point |

|---|---|---|

| Product Sales | Direct sales of specialized components and equipment. | Majority of $777.9M net sales in Q1 2024. |

| Aftermarket Services | Replacement parts, consumables, and service contracts. | Strong performance in 2023, providing recurring revenue. |

| Acquisitions | Revenue generated from newly integrated businesses. | Substantial contribution to top-line performance in 2023. |

| Segment Diversity | Revenue from Industrial, Life Sciences, Water, Public Safety. | Organic growth observed across multiple segments in Q1 2024. |

Business Model Canvas Data Sources

The IDEX Business Model Canvas is informed by a blend of internal operational data, customer feedback mechanisms, and external market analysis. This multi-faceted approach ensures a comprehensive understanding of our business ecosystem.