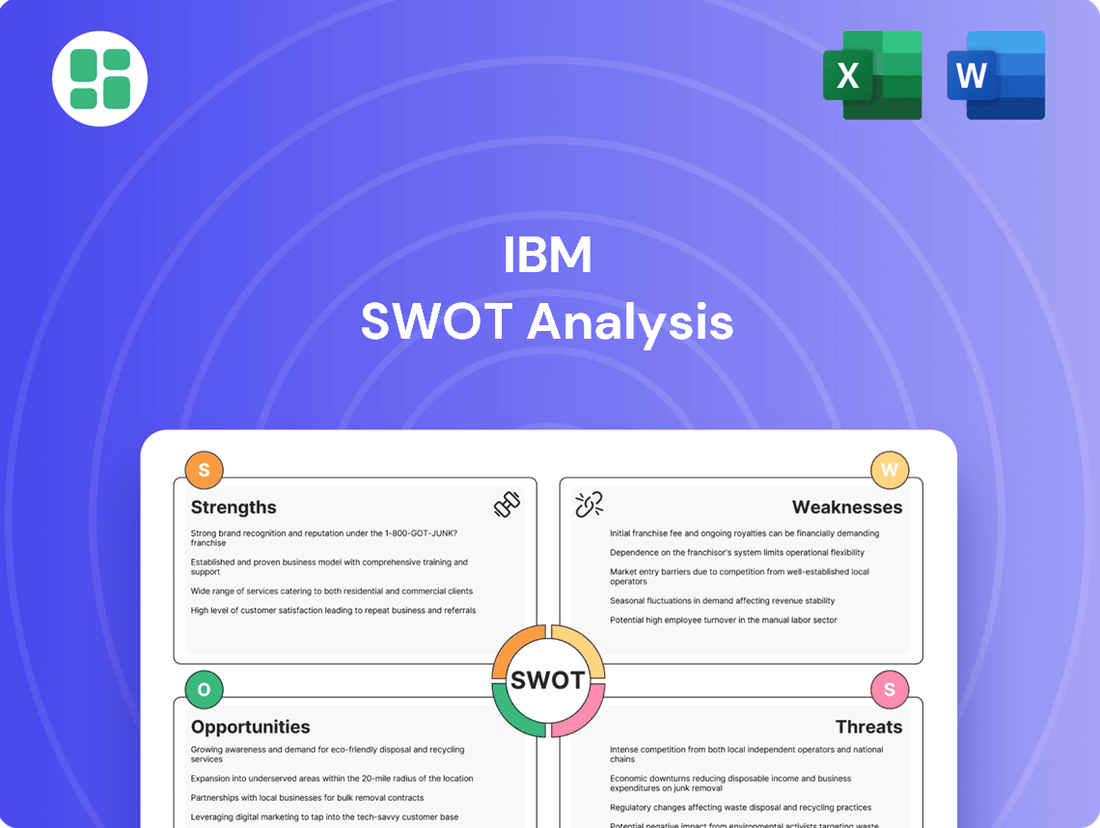

IBM SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IBM Bundle

IBM's robust brand recognition and extensive client base are significant strengths, but its challenges in adapting to cloud computing trends present a notable weakness. Discover the complete picture behind IBM's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

IBM boasts a formidable brand reputation, a testament to over a century of technological leadership and innovation. This enduring legacy translates into significant brand equity, fostering deep trust and loyalty among its extensive enterprise customer base.

This powerful brand recognition allows IBM to command premium pricing and maintain strong customer relationships across its diverse portfolio of hybrid cloud, AI, and consulting services. In 2024, IBM's brand value was estimated to be in the tens of billions of dollars, underscoring its significant competitive advantage.

IBM's strength lies in its extensive intellectual property portfolio, a direct result of sustained and substantial investments in research and development. This commitment ensures a steady stream of innovative solutions.

The company's R&D focus is particularly strong in high-growth areas such as artificial intelligence, quantum computing, and hybrid cloud solutions. These investments position IBM as a leader in shaping future technological landscapes.

In 2023, IBM reported $2.7 billion in R&D spending, underscoring its dedication to innovation and maintaining a competitive edge in rapidly evolving markets.

IBM has solidified its position as a leader in hybrid cloud and artificial intelligence, a strategic shift that underpins its current market offering. Its integrated solutions are designed to accelerate digital transformation for a global clientele.

The company's commitment to AI is exemplified by its watsonx platform, a comprehensive suite for building, deploying, and managing AI models. This is complemented by Red Hat OpenShift, a powerful Kubernetes platform that simplifies the management of complex, multi-cloud environments, making IBM's hybrid cloud strategy particularly compelling for enterprises.

Global Presence and Vast Enterprise Client Base

IBM's global presence is a cornerstone of its strength, with operations reaching over 170 countries. This expansive reach allows IBM to serve a diverse and extensive client base, encompassing major enterprises, government bodies, and various institutions worldwide.

This broad operational footprint translates into a deep understanding of diverse markets and a robust foundation for its integrated solutions and services. In 2023, IBM reported revenue from its global operations, highlighting its significant international market penetration.

- Global Reach: Operations in over 170 countries.

- Client Diversity: Serves large enterprises, governments, and institutions.

- Market Insight: Extensive footprint fosters deep market understanding.

- Customer Base: Broad customer acquisition potential for integrated offerings.

Diversified Business Model and Integrated Solutions

IBM's strength lies in its deeply diversified business model, spanning software, consulting, and infrastructure. This breadth allows the company to offer integrated solutions that harness the synergy between its hardware, software, and services. For instance, in Q1 2024, IBM reported revenue growth driven by its hybrid cloud and AI capabilities, demonstrating the power of these integrated offerings.

This comprehensive approach enables IBM to tackle intricate client challenges effectively and capitalize on cross-selling opportunities across its various segments. Such integration not only strengthens client relationships but also fortifies IBM's market position against more specialized competitors.

- Diverse Revenue Streams: IBM generates income from software licensing and subscriptions, IT consulting services, and infrastructure solutions, reducing reliance on any single market.

- Synergistic Offerings: The company's ability to bundle hardware, software, and services provides clients with end-to-end solutions, enhancing value and customer stickiness.

- Resilience in Market Fluctuations: Diversification helps IBM weather economic downturns or shifts in specific technology sectors, as strength in one area can offset weakness in another.

IBM's robust brand reputation, built over a century of technological leadership, fosters deep trust and allows for premium pricing. Its extensive intellectual property portfolio, fueled by consistent R&D investment, ensures a pipeline of innovative solutions, particularly in AI and quantum computing. The company's strategic focus on hybrid cloud and AI, exemplified by platforms like watsonx and Red Hat OpenShift, positions it strongly for enterprise digital transformation.

IBM's global reach, spanning over 170 countries, provides deep market insights and a broad client base. This extensive footprint supports its diversified business model, which integrates software, consulting, and infrastructure, enabling synergistic offerings and resilience against market fluctuations. In Q1 2024, IBM reported revenue growth driven by these integrated hybrid cloud and AI capabilities.

| Metric | 2023 Value | Significance |

|---|---|---|

| R&D Spending | $2.7 billion | Underpins innovation and competitive edge in key tech areas. |

| Brand Value Estimate | Tens of billions of dollars | Represents significant competitive advantage and customer loyalty. |

| Global Operations | Over 170 countries | Enables diverse market understanding and broad client service. |

What is included in the product

Delivers a strategic overview of IBM’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats.

Helps identify and address IBM's competitive weaknesses and external threats by providing a structured framework for strategic analysis.

Weaknesses

IBM's strategic focus on large, customized enterprise solutions, while lucrative, inherently restricts its addressable market compared to more standardized product offerings. This specialization means IBM captures a smaller percentage of the overall IT spending pie, as many smaller businesses opt for less bespoke and more readily available software. For instance, in Q1 2024, IBM's revenue from its largest clients, while significant, highlights this concentration.

This reliance on large enterprise contracts makes IBM particularly sensitive to shifts in major corporations' IT budgets and investment cycles. A slowdown in enterprise spending, which occurred in certain sectors during late 2023 and early 2024 due to economic uncertainty, directly impacts IBM's revenue streams more acutely than it might affect companies with a broader, more diversified customer base.

IBM's legacy hardware and traditional IT services segments continue to present a notable weakness, with revenues in these areas experiencing a decline. For instance, in the fourth quarter of 2023, IBM reported a 2.4% decrease in revenue for its Infrastructure segment, which largely encompasses these legacy offerings, to $3.8 billion. This persistent challenge necessitates ongoing strategic management, including potential divestitures or significant modernization efforts, to mitigate their impact on the company's overall growth trajectory.

IBM faces significant headwinds in its core growth areas due to intense competition. In the cloud computing sector, giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud continue to dominate, putting IBM's hybrid cloud strategy under constant pressure. For instance, AWS reported over $65 billion in revenue for 2023, showcasing the scale of its operations compared to IBM's cloud segment.

Furthermore, the rapidly evolving artificial intelligence (AI) landscape is populated by numerous agile startups and established tech players, all vying for market share. This dynamic environment necessitates continuous, substantial investment in R&D to remain competitive, impacting IBM's profitability and market positioning.

Perception as a Traditional Tech Company

Despite substantial investments in AI and hybrid cloud, IBM often struggles with a perception as a legacy technology firm. This image can hinder its appeal to top talent in fast-moving tech sectors and create a disadvantage when competing against the more dynamic branding of cloud-native rivals.

This perception can manifest in how the market values the company, potentially leading to a valuation discount compared to peers perceived as more innovative. For instance, while IBM's revenue from hybrid cloud, a key growth area, reached $21.2 billion in 2023, the overall market perception might not fully reflect this shift.

This can impact IBM's competitive positioning:

- Talent Acquisition: Difficulty attracting engineers and data scientists who may gravitate towards companies with a more contemporary tech image.

- Market Perception: Investors might overlook the company's transformation, focusing instead on its historical identity.

- Competitive Landscape: Challenges in directly competing with the agile, 'born-in-the-cloud' narrative of some competitors, even as IBM builds out its own cloud capabilities.

High Cost of Solutions for Broader Markets

IBM's emphasis on intricate, tailored enterprise solutions often translates to premium pricing. This can create a barrier for small and medium-sized businesses (SMBs) or those prioritizing budget-friendly, off-the-shelf options, thereby restricting IBM's reach into wider market segments.

For instance, while IBM's hybrid cloud solutions are robust, their implementation and ongoing management can be substantial investments. A report from IDC in late 2024 indicated that the average total cost of ownership for enterprise-grade hybrid cloud deployments can range from hundreds of thousands to millions of dollars annually, depending on scale and complexity. This high cost inherently limits the addressable market for such comprehensive solutions, making them less appealing to businesses with tighter budgets or simpler IT needs.

- High Implementation Costs: IBM's specialized software and consulting services for complex projects can involve significant upfront investment, potentially exceeding the budgets of many SMBs.

- Limited Appeal to Cost-Conscious Markets: Businesses focused on cost optimization may find IBM's premium pricing prohibitive compared to more accessible competitors offering standardized solutions.

- Reduced Market Penetration: The elevated cost structure can hinder IBM's ability to capture market share in segments where price sensitivity is a primary purchasing driver.

IBM's focus on large, customized enterprise solutions, while lucrative, limits its addressable market compared to standardized offerings, capturing a smaller percentage of overall IT spending. This specialization means IBM is more sensitive to shifts in major corporations' IT budgets, as seen in Q1 2024 revenue concentrations, making it vulnerable to economic uncertainties impacting enterprise spending.

The company's legacy hardware and traditional IT services continue to decline, as evidenced by a 2.4% revenue decrease in its Infrastructure segment in Q4 2023, necessitating ongoing modernization efforts.

IBM faces intense competition in cloud computing from giants like AWS, which reported over $65 billion in revenue for 2023, and in AI from numerous agile startups, requiring substantial R&D investment to remain competitive.

Despite significant investments, IBM struggles with a perception as a legacy technology firm, potentially hindering talent acquisition and market valuation compared to more dynamic rivals, even as its hybrid cloud revenue reached $21.2 billion in 2023.

IBM's premium pricing for tailored solutions can create a barrier for SMBs and cost-conscious businesses, limiting market penetration. For example, the average total cost of ownership for enterprise-grade hybrid cloud deployments can range from hundreds of thousands to millions of dollars annually, according to late 2024 IDC reports.

| Weakness | Description | Impact | Supporting Data/Example |

| Limited Addressable Market | Specialization in large, customized enterprise solutions | Restricts market share compared to standardized offerings | Q1 2024 revenue concentration on large clients |

| Legacy Segments Decline | Revenue decrease in hardware and traditional IT services | Requires ongoing modernization or divestiture | Infrastructure segment revenue down 2.4% in Q4 2023 |

| Intense Competition | Dominance of rivals in cloud and AI markets | Necessitates high R&D investment, impacts profitability | AWS 2023 revenue > $65 billion |

| Legacy Perception | Image as an older technology firm | Hinders talent acquisition and market valuation | Hybrid cloud revenue $21.2 billion in 2023, but perception lag |

| High Cost Structure | Premium pricing for tailored solutions | Limits appeal to SMBs and cost-conscious markets | Annual TCO for hybrid cloud can be millions of dollars (late 2024 IDC report) |

Preview Before You Purchase

IBM SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive insights that will be yours after completing your transaction.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete strategic overview of IBM.

Opportunities

The global hybrid cloud market is experiencing robust growth, projected to reach over $1.5 trillion by 2027, driven by businesses seeking flexibility and scalability. IBM's significant investments in Red Hat OpenShift and its watsonx AI platform position it to capture a substantial share of this expanding market.

Enterprises are increasingly adopting AI, with a significant portion prioritizing hybrid cloud for secure and compliant data management. IBM's established presence in enterprise IT and its comprehensive hybrid cloud and AI offerings provide a strong competitive advantage.

IBM's history is marked by successful strategic acquisitions, notably Red Hat, which significantly boosted its hybrid cloud and AI offerings. More recently, in 2024, IBM announced its intent to acquire HashiCorp for $6.4 billion, further bolstering its cloud infrastructure automation capabilities. These moves demonstrate a clear strategy to enhance its competitive position in key growth areas and expand market access.

Continuing this approach by identifying and executing targeted acquisitions and forming strategic alliances will be crucial. For instance, partnerships with leading cloud providers or specialized AI firms could accelerate IBM's innovation cycle and broaden its ecosystem. This ongoing pursuit of synergistic collaborations allows IBM to quickly integrate new technologies and talent, staying ahead in the rapidly evolving tech landscape.

IBM has a significant opportunity to deepen its penetration in emerging markets, where the adoption of advanced technologies like AI and cloud computing is accelerating. For instance, in Southeast Asia, cloud adoption is projected to grow substantially, with a significant portion of businesses still in the early stages of digital transformation, presenting a fertile ground for IBM's hybrid cloud and AI solutions.

Furthermore, IBM can capitalize on the growing demand for specialized, industry-specific AI and cloud solutions. This includes tailoring offerings for sectors such as healthcare, finance, and manufacturing, where unique regulatory environments and operational needs require bespoke technological approaches.

By focusing on these niche verticals, IBM can differentiate itself from broader competitors and capture market share. For example, IBM's recent collaborations in the life sciences sector highlight its strategy to provide targeted AI-driven insights, a trend that is expected to see continued investment and expansion through 2025.

Leveraging AI for Internal Productivity and New Business Models

IBM has a significant opportunity to boost its internal operations by deploying its own AI technologies. For instance, automating routine tasks within its consulting and IT services divisions could unlock substantial efficiency gains. This internal focus not only reduces operational costs but also frees up human capital for more strategic, high-value work.

The company can also explore new revenue streams by productizing its internal AI solutions. Think about offering specialized AI-driven platforms or tools that were initially developed for IBM's own use but have broader market applicability. This strategy leverages existing R&D investments and capitalizes on the growing demand for AI-powered business solutions.

Consider these specific areas:

- Streamlining IT Operations: IBM's AI can automate infrastructure management, predictive maintenance, and cybersecurity threat detection, potentially reducing IT operational expenses by 15-25% by 2025, as projected by industry analysts.

- Enhancing Customer Service: Implementing AI-powered chatbots and virtual assistants for internal support can improve response times and employee satisfaction.

- Developing New AI-as-a-Service Models: IBM can package its internal AI expertise into new service offerings, tapping into the projected global AI market growth, which is expected to reach over $500 billion by 2025.

Growth in Consulting Services for Digital Transformation

The ongoing digital transformation across industries presents a significant opportunity for IBM Consulting. Businesses are actively seeking specialized assistance to modernize their operations and embrace new technologies. IBM's established reputation and comprehensive offerings in areas like AI and cloud are perfectly aligned with this market need.

IBM Consulting is poised to capitalize on this trend, projecting strong revenue growth from its digital transformation services. For instance, the company reported a 20% increase in consulting revenue in the first quarter of 2024, largely driven by these strategic initiatives. This growth highlights the robust demand for IBM's expertise in helping clients navigate complex technological shifts.

- Increased Demand: Businesses worldwide are investing heavily in digital transformation, creating a vast market for consulting services.

- IBM's Strengths: IBM's deep industry knowledge and focus on AI and hybrid cloud solutions position it as a preferred partner.

- Revenue Growth: IBM Consulting's revenue saw a significant jump in early 2024, underscoring the market's responsiveness to its offerings.

- Strategic Focus: The company's ability to assist clients with cloud modernization and AI deployment directly addresses key market pain points.

IBM can leverage the expanding hybrid cloud market, projected to exceed $1.5 trillion by 2027, by continuing to invest in Red Hat OpenShift and watsonx AI. The increasing enterprise adoption of AI, coupled with a preference for hybrid cloud for data security, presents a significant opportunity for IBM's established IT presence and comprehensive offerings.

Targeted acquisitions, like the planned $6.4 billion purchase of HashiCorp in 2024, strengthen IBM's cloud automation capabilities. Further strategic alliances with cloud providers and AI specialists can accelerate innovation and market access.

Emerging markets, particularly in Southeast Asia, offer substantial growth potential for IBM's hybrid cloud and AI solutions due to accelerating digital transformation. IBM can also capitalize on the demand for industry-specific AI and cloud solutions, as demonstrated by its life sciences collaborations, to differentiate itself and capture niche market share.

IBM has a prime opportunity to enhance internal operations through AI deployment, potentially reducing IT operational costs by 15-25% by 2025. Furthermore, productizing internal AI solutions can create new revenue streams, tapping into the global AI market expected to surpass $500 billion by 2025.

The robust demand for digital transformation services presents a major opportunity for IBM Consulting, which saw a 20% revenue increase in Q1 2024 from these initiatives. IBM's deep industry knowledge and focus on AI and hybrid cloud position it as a key partner for businesses navigating technological shifts.

Threats

IBM operates in intensely competitive cloud and AI landscapes, facing formidable rivals like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, which hold significant market share. These hyperscalers offer vast resources and extensive service portfolios, creating a constant challenge for IBM to keep pace.

Simultaneously, agile niche players are emerging, developing specialized AI solutions that can quickly capture specific market segments. For instance, in the AI healthcare sector, startups are rapidly innovating, forcing established companies like IBM to demonstrate unique value propositions and accelerated innovation cycles to avoid losing ground.

In 2024, the global cloud computing market was valued at over $600 billion, with hyperscalers dominating a substantial portion. IBM's ability to differentiate its hybrid cloud and AI offerings, particularly its Red Hat integration, is crucial for carving out and defending its market position against this dual threat.

The relentless speed of technological change, especially in areas like artificial intelligence and cloud computing, presents a significant threat to IBM. There's a constant risk that IBM's current offerings could quickly become outdated if they don't innovate at a pace that matches or surpasses market expectations and competitor progress. This rapid obsolescence could erode their competitive edge.

For instance, while IBM has invested heavily in AI, the emergence of highly disruptive AI models from competitors in 2024 and early 2025 means IBM must continuously adapt its own AI strategies and product roadmaps. Failure to do so could see its AI solutions lagging behind, impacting its market share in this critical growth sector.

Economic downturns, heightened geopolitical instability, and persistent inflation present significant threats to IBM. These factors can trigger a contraction in enterprise IT spending, directly impacting IBM's consulting and infrastructure business units. For instance, a global recession could lead businesses to delay or scale back major technology investments, a core revenue driver for IBM.

IBM's substantial reliance on large, multi-year enterprise projects exposes it to the risks associated with macroeconomic volatility. A slowdown in client budgets or a shift in investment priorities due to economic uncertainty could lead to project deferrals or cancellations, negatively affecting IBM's revenue streams and project pipeline visibility. This vulnerability was highlighted in late 2023 and early 2024, where global economic headwinds led some analysts to project a more cautious IT spending environment for large enterprises.

Escalating Cybersecurity and Data Breaches

IBM, as a custodian of extensive client data and a provider of critical technology services, faces significant risks from escalating cybersecurity threats. Sophisticated attacks like ransomware and credential harvesting pose a constant danger, potentially leading to substantial financial penalties and severe reputational damage.

The financial implications of a major data breach are considerable. For instance, IBM's 2023 Q4 earnings report highlighted ongoing investments in security, reflecting the industry-wide trend where data breaches can cost millions. In 2024, the average cost of a data breach globally reached $4.73 million, according to IBM's own Cost of a Data Breach Report, underscoring the immense financial exposure.

- Target for Sophisticated Attacks: IBM's role as a major technology and consulting firm makes it a high-value target for cybercriminals seeking sensitive client information.

- Financial Penalties and Reputational Damage: A significant breach can result in hefty fines under regulations like GDPR and CCPA, alongside a critical erosion of client trust and brand image.

- Impact on Client Trust: Loss of client confidence following a security incident can lead to contract terminations and a decline in new business opportunities, directly impacting revenue streams.

Regulatory Changes and Compliance Burdens

The evolving landscape of data privacy regulations, such as GDPR and CCPA, presents a significant hurdle. IBM must constantly update its offerings and internal operations to adhere to these increasingly stringent legal and ethical mandates across diverse markets.

Non-compliance with these regulations can lead to substantial financial penalties and reputational damage. For instance, fines under GDPR can reach up to 4% of global annual revenue, a considerable risk for a company of IBM's scale.

- Increased Compliance Costs: Adapting to new regulations requires ongoing investment in technology, legal counsel, and employee training, impacting operational budgets.

- Geopolitical Regulatory Divergence: Navigating differing data handling and privacy laws in various countries adds complexity and increases the potential for missteps.

- Reputational Risk: Data breaches or non-compliance incidents can severely damage customer trust and brand image, affecting future business prospects.

IBM faces intense competition from hyperscalers like AWS, Microsoft Azure, and Google Cloud, which dominate the cloud market, and from agile niche players developing specialized AI solutions. The rapid pace of technological change, particularly in AI and cloud, means IBM's offerings risk obsolescence if innovation doesn't keep pace, as seen with disruptive AI models emerging in 2024 and early 2025.

Macroeconomic instability, geopolitical tensions, and inflation can curb enterprise IT spending, impacting IBM's consulting and infrastructure revenue, a vulnerability noted in late 2023 and early 2024. Furthermore, IBM is a prime target for sophisticated cyberattacks, with the average cost of a data breach reaching $4.73 million globally in 2024, as per IBM's own report, posing significant financial and reputational risks.

Evolving data privacy regulations like GDPR and CCPA necessitate constant adaptation, with non-compliance carrying potential fines up to 4% of global annual revenue. Navigating these diverse and stringent legal mandates across different markets adds complexity and increases the risk of costly missteps.

SWOT Analysis Data Sources

This IBM SWOT analysis is built upon a foundation of credible data, drawing from IBM's official financial filings, comprehensive market research reports, and expert industry analysis to provide a robust and accurate strategic overview.