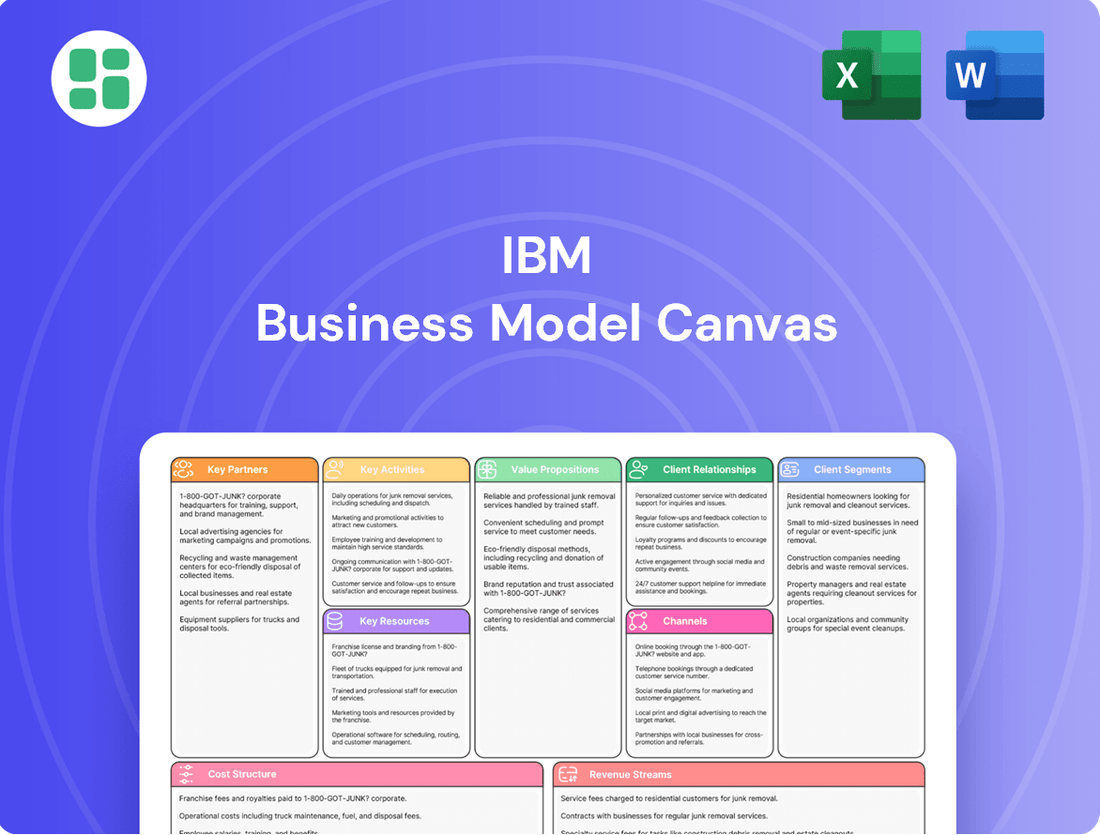

IBM Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IBM Bundle

Curious about the strategic engine driving IBM's global success? This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. Discover the actionable insights that fuel their innovation and market dominance.

Partnerships

IBM's strategic alliances with major cloud providers like Amazon Web Services (AWS) and Microsoft are crucial. These collaborations allow IBM to deliver its robust software portfolio as Software-as-a-Service (SaaS) directly through the hyperscalers' expansive cloud infrastructures, significantly broadening its market access.

By leveraging AWS and Microsoft Azure, IBM provides clients with enhanced flexibility in deploying its solutions, catering to diverse IT environments. This approach is central to accelerating clients' adoption of hybrid cloud strategies and advanced artificial intelligence capabilities, as evidenced by IBM's continued investment in these ecosystems.

IBM collaborates with major system integrators and consulting firms worldwide to offer comprehensive solutions, guiding clients through digital transformation and technology deployment. These partnerships are crucial for integrating IBM's advanced capabilities in AI, cloud, automation, and security with the partners' strategic, technological, and operational expertise.

For instance, IBM's extensive network includes partners like Accenture, Deloitte, and Capgemini, who play a vital role in bringing IBM's hybrid cloud and AI solutions to market. In 2023, these strategic alliances were instrumental in IBM's revenue growth, particularly in its hybrid cloud segment, which saw significant client adoption driven by partner-led implementations.

IBM collaborates with industry-specific solution providers to create tailored offerings. For instance, partnerships in healthcare, like with Moderna for drug development, leverage IBM's AI and hybrid cloud to accelerate innovation. These collaborations aim to co-develop and co-sell solutions addressing unique sector challenges.

Hardware and Software Vendors

IBM strategically collaborates with hardware and software vendors to broaden its market reach and product capabilities. For instance, its alliance with Lenovo aims to integrate IBM's AI solutions, like Watsonx, into Lenovo's hardware, creating more powerful offerings for businesses. Similarly, partnerships with enterprise software giants like SAP facilitate the seamless integration of IBM's advanced technologies into critical business processes.

These alliances are crucial for developing comprehensive solutions that address complex client needs. By combining IBM's expertise in AI and cloud computing with partners' specialized software and hardware, IBM can deliver end-to-end solutions that drive digital transformation. For example, integrating Watsonx with SAP's ERP systems allows for enhanced data analytics and AI-driven insights within core business operations.

- Lenovo Partnership: Focuses on embedding IBM's AI capabilities into Lenovo's hardware for enhanced enterprise solutions.

- SAP Collaboration: Enables integration of IBM's Watsonx AI platform with SAP's enterprise resource planning software for improved business intelligence.

- Portfolio Enhancement: These partnerships allow IBM to offer more robust and integrated solutions, increasing its value proposition to clients.

- Market Penetration: Strategic alliances help IBM access new customer segments and strengthen its position in various market verticals.

Research and Academic Institutions

IBM actively collaborates with leading research institutions and universities worldwide. These partnerships are crucial for driving advanced research and development, particularly in cutting-edge fields such as quantum computing and artificial intelligence. For instance, IBM's collaboration with institutions like MIT and the University of Waterloo has been instrumental in advancing quantum algorithms and hardware development.

These academic alliances are designed to foster a continuous cycle of innovation, ensuring IBM remains a leader in emerging technological landscapes. Such collaborations often result in the creation of new intellectual property, patent filings, and the foundational research that underpins future product and service offerings. In 2024, IBM announced a significant expansion of its university partnerships, aiming to accelerate research in areas like hybrid cloud and AI ethics.

Key benefits derived from these partnerships include:

- Access to world-class talent and specialized expertise

- Early exploration of disruptive technologies

- Co-development of novel solutions and research papers

- Building a pipeline for future recruitment and knowledge transfer

IBM's key partnerships are vital for extending its reach and enhancing its offerings. Collaborations with hyperscalers like AWS and Microsoft allow IBM to deliver its software as a service, significantly broadening market access and enabling hybrid cloud adoption. Strategic alliances with system integrators such as Accenture and Deloitte are crucial for implementing IBM's AI and cloud solutions, driving client digital transformation.

Further strengthening its ecosystem, IBM partners with hardware and software vendors like Lenovo and SAP to integrate its AI capabilities, such as Watsonx, into broader enterprise solutions. These collaborations are essential for creating comprehensive, end-to-end offerings that address complex client needs and drive business value.

IBM also fosters deep relationships with academic institutions globally, driving innovation in areas like quantum computing and AI. These partnerships ensure IBM remains at the forefront of emerging technologies, contributing to new intellectual property and a strong talent pipeline. For example, IBM's 2024 expansion of university partnerships aims to accelerate research in hybrid cloud and AI ethics.

| Partner Type | Key Partners | Strategic Focus | Impact |

|---|---|---|---|

| Cloud Providers | AWS, Microsoft Azure | SaaS delivery, Hybrid Cloud Enablement | Expanded market access, accelerated client adoption |

| System Integrators | Accenture, Deloitte, Capgemini | Digital Transformation, AI/Cloud Implementation | Comprehensive solution delivery, client success |

| Hardware/Software Vendors | Lenovo, SAP | Technology Integration (e.g., Watsonx) | Enhanced product offerings, seamless business process integration |

| Academic Institutions | MIT, University of Waterloo | R&D in AI, Quantum Computing | Innovation leadership, talent pipeline development |

What is included in the product

A structured framework outlining IBM's strategic approach to business, detailing its customer segments, value propositions, channels, and revenue streams.

The IBM Business Model Canvas simplifies complex strategies, offering a structured approach to identify and address customer pain points effectively.

Activities

IBM's core activity involves the development and sale of a diverse software portfolio. This includes foundational operating systems, essential middleware, and robust enterprise applications designed to meet complex business needs.

A key focus is on their hybrid cloud and AI offerings, notably Red Hat and Watsonx. These platforms are instrumental in enabling businesses to navigate digital transformations and leverage artificial intelligence effectively.

Software revenue is a vital engine for IBM's growth. In the first quarter of 2024, IBM reported software revenue of $5.8 billion, demonstrating its significant contribution to the company's financial performance.

IBM's IT consulting and business services are a cornerstone of its business model, focusing on guiding clients through complex digital transformations. These services span areas like cloud adoption, AI integration, and business process re-engineering, aiming to enhance operational efficiency and innovation.

In 2023, IBM's Consulting segment reported revenue of $19.1 billion, demonstrating the significant financial contribution of these activities. This segment is crucial for helping businesses leverage cutting-edge technologies to achieve strategic objectives and maintain a competitive edge in rapidly evolving markets.

IBM's key activities include the design and manufacturing of mission-critical hardware. This encompasses their renowned mainframe systems, such as the IBM Z series, with the z17 model launching in 2024, and their Power Systems. These offerings are vital for enterprises requiring robust, secure, and high-performance computing environments.

Despite a strategic shift towards hybrid cloud and AI, IBM continues to invest in and produce advanced hardware. Their storage solutions are also a significant part of this activity, ensuring data integrity and accessibility for demanding workloads. This hardware foundation remains essential for maintaining secure and reliable enterprise operations.

Research and Development (R&D)

IBM’s key activities heavily revolve around continuous investment in Research and Development (R&D). This is especially true in rapidly evolving fields such as artificial intelligence (AI), quantum computing, and blockchain technology. These innovation efforts are crucial for creating new products and services.

This dedication to R&D directly fuels IBM's competitive edge and strengthens its intellectual property portfolio. For instance, in 2023, IBM reported $2.5 billion in R&D spending, a testament to its commitment to future technologies. This investment underpins their ability to offer advanced solutions in areas like hybrid cloud and AI.

- Focus on AI and Quantum Computing: IBM consistently allocates significant resources to advance AI capabilities and explore the potential of quantum computing.

- Intellectual Property Generation: R&D activities lead to the creation of patents and proprietary technologies, a vital asset for IBM.

- Product and Service Innovation: The outcomes of R&D directly translate into new offerings, keeping IBM at the forefront of technological solutions.

- Competitive Advantage: Sustained investment in cutting-edge research ensures IBM maintains a strong position against competitors in the technology sector.

Managing a Global Partner Ecosystem

IBM actively cultivates a vast global partner ecosystem, a cornerstone of its strategy to deliver comprehensive client solutions. This involves deep collaboration with technology providers, system integrators, and specialized industry firms. These partnerships are crucial for co-development, co-marketing, and co-selling initiatives that extend IBM's market reach and enhance its offerings.

In 2024, IBM continued to strengthen these relationships, recognizing that a robust partner network is essential for innovation and client success. This focus allows IBM to leverage specialized expertise, bringing together diverse capabilities to address complex business challenges. For instance, IBM's focus on hybrid cloud and AI necessitates a broad base of partners who can integrate IBM's core technologies with their own specialized solutions.

- Co-Development: IBM collaborates with partners on developing new solutions and enhancing existing ones, particularly in areas like hybrid cloud and AI.

- Co-Marketing: Joint marketing efforts amplify reach and awareness for integrated solutions, leveraging the strengths of both IBM and its partners.

- Co-Selling: Partners work alongside IBM sales teams to bring tailored solutions to market, ensuring clients receive comprehensive support and expertise.

- Ecosystem Growth: In 2024, IBM reported a significant increase in partner-led revenue, underscoring the economic impact of its managed partner ecosystem.

IBM's key activities center on developing and delivering advanced software solutions, particularly in hybrid cloud and AI, exemplified by Red Hat and Watsonx. These software offerings are crucial for digital transformation initiatives.

The company also excels in providing IT consulting and business services, guiding clients through complex technology integrations and process improvements. This segment is vital for helping businesses leverage new technologies effectively.

Furthermore, IBM designs and manufactures mission-critical hardware, including its robust mainframe and Power Systems, which are essential for secure, high-performance computing environments. Continued R&D investment fuels innovation across all these areas.

Full Version Awaits

Business Model Canvas

The IBM Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete, ready-to-use file. You'll gain full access to this same professionally structured and formatted Business Model Canvas, enabling you to immediately apply its insights to your business strategy.

Resources

IBM's intellectual property, including its vast patent portfolio and trademarks, is a cornerstone of its business model. This IP acts as a shield for its innovations and a powerful revenue generator through licensing, reinforcing its competitive edge in the technology sector.

As of early 2024, IBM continues to be a prolific patent filer, consistently ranking among the top companies globally. For instance, in 2023, IBM secured over 3,000 patents, a testament to its ongoing commitment to research and development. This robust IP strengthens its market position and provides a significant barrier to entry for competitors.

IBM's global workforce, a cornerstone of its business model, comprises over 280,000 employees as of early 2024. This diverse talent pool includes highly skilled researchers, engineers, consultants, and sales professionals.

Their profound expertise in cutting-edge technologies like artificial intelligence, quantum computing, and hybrid cloud solutions is paramount. This deep knowledge allows IBM to tackle complex client challenges and maintain its competitive edge in specialized, high-value markets.

In 2023, IBM reported significant investments in workforce development and reskilling programs, aiming to enhance capabilities in areas such as AI and data science, ensuring the workforce remains at the forefront of technological innovation.

IBM's hybrid cloud infrastructure, underpinned by a vast global network of data centers, serves as a critical resource. This infrastructure enables IBM to offer scalable, secure, and dependable cloud services, adeptly managing client data, applications, and demanding AI workloads across both private on-premises setups and public cloud environments.

In 2024, IBM continued to invest heavily in its data center footprint, a key enabler for its hybrid cloud strategy. This physical and virtual infrastructure is essential for delivering the performance and reliability that clients expect for their mission-critical operations.

Brand Reputation and Client Relationships

IBM's brand reputation, a cornerstone of its business model, represents decades of built trust in reliability and innovation. This long-standing image is a critical intangible asset, attracting and retaining clients who value stability and forward-thinking solutions.

The company's deep-rooted relationships with major enterprise clients and governments globally are invaluable resources. These established connections ensure a consistent revenue stream and facilitate opportunities for upselling and cross-selling new technologies and services.

- Brand Equity: IBM consistently ranks among the top global brands for technology and business services, reflecting its enduring reputation for quality and expertise.

- Client Retention: A significant portion of IBM's revenue in 2023 came from existing clients, underscoring the strength of these relationships. For instance, in Q4 2023, IBM reported strong performance in its hybrid cloud segment, largely driven by its established client base.

- Trust and Security: In an era of increasing cybersecurity concerns, IBM's reputation for secure and robust solutions is a key differentiator, particularly for government and regulated industries.

Financial Capital and Investments

IBM's financial capital is a cornerstone of its business model, enabling substantial investments in research and development, strategic acquisitions, and the cultivation of top-tier talent. This robust financial footing provides the flexibility needed to continually reshape its business portfolio and undertake ambitious, large-scale initiatives, including significant market expansion efforts.

In 2023, IBM reported revenue of $61.9 billion, underscoring its significant financial capacity. This financial strength directly supports its ability to fund innovation and strategic growth, as demonstrated by its consistent investment in cloud and AI technologies.

- Access to Capital: IBM's strong credit rating and established market presence facilitate access to diverse sources of funding, crucial for large-scale investments.

- Investment in R&D: Significant capital allocation to research and development fuels IBM's innovation pipeline, particularly in areas like hybrid cloud and artificial intelligence.

- Strategic Acquisitions: Financial flexibility allows IBM to pursue and integrate companies that enhance its technological capabilities and market reach, such as the acquisition of Hashi, which bolstered its hybrid cloud portfolio.

- Portfolio Management: Capital resources are strategically deployed to divest non-core assets and invest in high-growth segments, optimizing the company's overall business model.

IBM's key resources are multifaceted, encompassing its extensive intellectual property, its highly skilled global workforce, its robust hybrid cloud infrastructure, its strong brand reputation and client relationships, and its substantial financial capital.

These resources collectively enable IBM to innovate, deliver complex solutions, and maintain a competitive advantage in the technology market. The company's ongoing investment in these areas, particularly in its workforce and infrastructure, reinforces its strategic direction towards hybrid cloud and artificial intelligence.

IBM's commitment to research and development, evidenced by its consistent patent filings and investments in employee reskilling, ensures its technological leadership. Furthermore, its financial strength allows for strategic growth through acquisitions and sustained innovation.

| Resource Category | Key Components | 2023/Early 2024 Data Point | Strategic Importance |

| Intellectual Property | Patents, Trademarks | Over 3,000 patents secured in 2023 | Defends innovation, generates licensing revenue |

| Human Capital | Global Workforce | Over 280,000 employees | Drives innovation and client solutions |

| Physical & Digital Infrastructure | Data Centers, Hybrid Cloud | Continued investment in data center footprint | Enables scalable, secure cloud services |

| Brand & Relationships | Brand Reputation, Client Base | Strong client retention, deep enterprise relationships | Builds trust, ensures revenue streams |

| Financial Capital | Revenue, Investment Capacity | $61.9 billion revenue in 2023 | Funds R&D, acquisitions, and growth |

Value Propositions

IBM's hybrid cloud strategy empowers businesses to bridge their existing on-premises infrastructure with public cloud services, fostering digital transformation. This integration is crucial for modernizing legacy applications and streamlining data management, leading to enhanced operational agility. For instance, in 2024, hybrid cloud adoption continued to be a dominant trend, with many enterprises leveraging it to manage sensitive data while capitalizing on cloud scalability.

IBM's Watsonx platform is a cornerstone for accelerating AI adoption, offering clients robust generative AI capabilities. These tools are designed to unlock data insights, streamline automation, and improve decision-making across various business functions, fostering transformation and innovation.

In 2024, IBM reported significant growth in its hybrid cloud and AI segments, with Watsonx playing a key role in driving these advancements. Clients are increasingly leveraging Watsonx to build, deploy, and govern AI models, leading to tangible improvements in operational efficiency and market competitiveness.

IBM's commitment to enterprise-grade security and resilience is a cornerstone of its value proposition, particularly for clients relying on its mission-critical infrastructure like the IBM Z mainframe. This robust offering safeguards sensitive client data and core systems against an ever-evolving landscape of cyber threats.

The IBM Z platform, for instance, provides unparalleled levels of reliability and data protection, essential for sectors with demanding regulatory compliance. In 2024, IBM Z continued to be a leader in mainframe security, with features designed to prevent unauthorized access and ensure business continuity, a critical factor for financial institutions and government agencies.

Providing Deep Industry and Business Process Expertise

IBM's consulting services leverage deep industry and business process expertise to address complex client challenges. This specialized knowledge allows IBM to craft technology solutions that are precisely aligned with the unique needs and strategic goals of various sectors. For instance, in 2024, IBM's focus on hybrid cloud and AI continues to drive significant value for clients across finance, healthcare, and manufacturing, enabling them to optimize operations and foster innovation.

Through this approach, IBM empowers businesses to enhance their operational efficiency and achieve competitive advantages. Their consultants bring practical, hands-on experience, translating industry best practices into actionable strategies. This results in improved workflows and the successful implementation of transformative technologies tailored to specific business environments.

IBM's commitment to industry-specific solutions is evident in their continued investment in research and development. By understanding the nuances of each sector, they can offer more effective and impactful solutions. This deep dive into business processes ensures that clients receive not just technology, but also strategic guidance that drives tangible results.

- Industry Specialization: IBM offers tailored consulting for sectors like finance, healthcare, and manufacturing, addressing unique operational demands.

- Process Optimization: Expertise in business processes allows IBM to help clients streamline workflows and improve efficiency through technology.

- Technology Alignment: Solutions are designed to integrate seamlessly with client objectives, focusing on areas like hybrid cloud and AI in 2024.

- Problem Solving: IBM's consulting arm tackles complex business challenges, providing strategic guidance for innovation and growth.

Optimizing IT Costs and Operational Efficiencies

IBM's integrated offerings, spanning software, hardware, and expert consulting, streamline operations for clients, cutting down on complexity and boosting overall efficiency. This holistic approach ensures that businesses can effectively manage their IT landscape.

By embracing automation, adopting hybrid cloud strategies, and fine-tuning infrastructure, companies can unlock substantial cost reductions and achieve more effective allocation of their resources. For instance, IBM's hybrid cloud solutions have been instrumental in helping clients achieve up to a 25% reduction in IT operational costs.

- Streamlined IT Operations: IBM's integrated solutions reduce complexity, leading to smoother IT management.

- Cost Savings: Automation and hybrid cloud adoption can result in significant IT expenditure reductions, with clients reporting savings of up to 25%.

- Enhanced Resource Utilization: Optimized infrastructure ensures better use of existing IT assets and investments.

- Operational Efficiency Gains: Businesses experience improved productivity and faster delivery of IT services.

IBM's value proposition centers on delivering integrated solutions that simplify complex IT environments and drive efficiency. By combining software, hardware, and expert consulting, IBM helps businesses optimize their operations and achieve significant cost savings. For example, IBM's hybrid cloud adoption has been shown to reduce IT operational costs by as much as 25%.

| Value Proposition Component | Description | Key Benefit | 2024 Data/Example |

|---|---|---|---|

| Integrated Solutions | Combining software, hardware, and consulting services. | Streamlined IT operations and reduced complexity. | Clients leverage IBM's unified approach for seamless IT management. |

| Cost Optimization | Leveraging automation and hybrid cloud for efficiency. | Significant reductions in IT operational expenditures. | Up to 25% IT operational cost reduction reported by clients. |

| Enhanced Resource Utilization | Optimizing infrastructure for better asset management. | Improved productivity and faster IT service delivery. | Clients achieve more effective allocation of IT investments. |

Customer Relationships

IBM cultivates enduring client partnerships via its dedicated consulting and professional services. These teams delve into unique client challenges, crafting customized digital transformation solutions and providing essential implementation and ongoing support.

In 2024, IBM's consulting segment continued to be a cornerstone of its client engagement strategy, driving significant revenue through complex project delivery and strategic advisory services.

This approach fosters trust and ensures IBM's solutions are deeply integrated, leading to sustained engagement and repeat business as clients navigate evolving technological landscapes.

IBM's approach to customer relationships centers on dedicated account management teams for key clients, ensuring ongoing engagement and alignment with their strategic objectives. This personalized service model is crucial for fostering long-term loyalty and understanding evolving client needs.

The company cultivates strong, collaborative partnerships with major enterprises and government entities, positioning itself as a trusted advisor for their technology strategies. This deep integration allows IBM to proactively contribute to clients' digital transformation journeys.

In 2024, IBM continued to emphasize these relationships, with a significant portion of its revenue derived from its largest clients, underscoring the success of its strategic partnership model. For instance, its consulting segment, heavily reliant on these deep client engagements, saw robust growth.

IBM's self-service and online support platforms are a cornerstone of their customer relationship strategy, offering clients immediate access to a vast repository of information. These platforms empower users to find answers, resolve common issues, and manage their IBM solutions independently, significantly reducing reliance on direct human interaction for routine queries.

In 2024, IBM continued to invest heavily in these digital resources. For instance, the IBM Support site saw millions of unique visitors monthly, with a substantial portion of technical inquiries resolved through automated tools and knowledge base articles. This digital-first approach not only enhances customer satisfaction by providing instant support but also optimizes IBM's operational efficiency.

Community Engagement and Developer Programs

IBM actively cultivates vibrant communities around its core technologies, such as Red Hat OpenShift and Watsonx. These platforms are crucial for fostering collaboration among developers and users, facilitating knowledge exchange and joint contributions. This approach not only builds strong client loyalty but also ensures that customers can effectively tap into a shared pool of expertise.

These engagement initiatives are vital for IBM's ecosystem. For instance, the Red Hat Developer program offers resources and support, driving innovation and adoption. In 2023, Red Hat reported significant growth, with its open-source software and services underpinning many of IBM's cloud offerings. This community-driven development model is a cornerstone of IBM's strategy to ensure its platforms remain cutting-edge and widely adopted.

- Community Focus: IBM nurtures developer communities around key platforms like Red Hat OpenShift and Watsonx.

- Knowledge Sharing: These communities enable users and developers to share expertise and collaborate on solutions.

- Loyalty and Leverage: Fostering these groups builds client loyalty and allows them to benefit from collective intelligence.

- Developer Programs: Initiatives like the Red Hat Developer program provide essential resources, driving innovation and adoption.

Hyper-Personalized Interactions and Proactive Engagement

IBM leverages AI and data analytics to foster hyper-personalized interactions, aiming to anticipate customer needs before they even arise. This proactive approach is central to building strong customer relationships.

- AI-Driven Insights: IBM's AI platforms analyze vast datasets to understand individual customer preferences and behaviors, enabling tailored recommendations and solutions.

- Proactive Support: By predicting potential issues, IBM can offer timely support and solutions, minimizing disruption and enhancing the customer experience. For instance, IBM's AI-powered support tools can identify system anomalies and alert clients to potential problems, often before they impact operations.

- Targeted Experiences: This data-informed strategy allows IBM to create highly relevant and personalized experiences, from product offerings to communication, significantly boosting customer satisfaction and fostering long-term loyalty. In 2024, companies that adopted hyper-personalization strategies reported an average increase of 10-15% in customer retention rates.

IBM's customer relationships are built on a foundation of dedicated account management and deeply integrated consulting services, ensuring alignment with client strategic objectives. This personalized approach fosters trust and long-term loyalty, with a significant portion of revenue in 2024 stemming from these key enterprise and government partnerships.

The company also invests in robust self-service and online support platforms, empowering clients with immediate access to information and issue resolution. In 2024, millions of monthly visitors utilized these digital resources, with a substantial percentage of inquiries resolved through automated tools, enhancing efficiency and customer satisfaction.

Furthermore, IBM cultivates vibrant developer communities around platforms like Red Hat OpenShift and Watsonx, promoting collaboration and knowledge sharing. Initiatives such as the Red Hat Developer program drive innovation and adoption, underscoring the value of this community-driven strategy.

IBM leverages AI and data analytics for hyper-personalized customer interactions, anticipating needs and offering proactive support. This data-informed strategy enhances customer experience and loyalty, with personalized approaches generally leading to increased customer retention rates.

| Customer Relationship Type | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Dedicated Account Management | Strategic alignment, ongoing engagement | Drives significant revenue from key clients; fosters long-term loyalty |

| Consulting & Professional Services | Customized solutions, implementation, support | Cornerstone of client engagement; robust growth in consulting segment |

| Self-Service & Online Support | Knowledge base, issue resolution, information access | Millions of monthly visitors; high resolution rates via digital tools |

| Community Engagement | Developer forums, knowledge sharing, collaboration | Drives innovation and adoption for platforms like Red Hat OpenShift |

| AI-Driven Personalization | Predictive analytics, tailored recommendations | Enhances customer experience; aims to increase retention rates |

Channels

IBM's direct sales force and account managers are crucial for engaging high-value enterprise and government clients. These teams focus on building deep relationships, understanding intricate needs, and securing substantial contracts for IBM's comprehensive technology solutions. In 2024, IBM continued to emphasize its hybrid cloud and AI capabilities, with direct sales playing a pivotal role in demonstrating these complex offerings to key decision-makers.

IBM's global partner ecosystem is a cornerstone of its go-to-market strategy, encompassing a vast network of solution providers, system integrators, and resellers. This extensive channel is crucial for extending IBM's reach across diverse industries and geographies, ensuring its software, hardware, and services are accessible to a broad customer base.

These partners are not merely distributors; they actively enhance IBM's offerings by integrating their own specialized value-added services and deep industry expertise. For instance, in 2024, IBM reported that its partner ecosystem contributed significantly to its hybrid cloud and AI revenue streams, with many partners developing unique solutions on IBM's platforms.

The reseller channel, in particular, plays a vital role in reaching small and medium-sized businesses that might not engage directly with IBM. In the first half of 2024, IBM saw a notable increase in partner-led sales, indicating the growing importance of these relationships in driving overall business growth and market penetration.

IBM utilizes its primary digital storefront, IBM.com, alongside prominent third-party cloud marketplaces such as AWS Marketplace, Google Cloud Marketplace, and Microsoft Azure Marketplace. This multi-channel approach ensures broad reach and accessibility for its software and cloud solutions.

These digital platforms facilitate rapid deployment and streamlined procurement, allowing customers to access IBM's extensive portfolio with ease. In 2024, cloud marketplaces continued to be a significant growth driver for enterprise software sales, with IBM actively participating to expand its customer base and revenue streams.

Consulting Engagements

Consulting engagements represent a vital channel for IBM, not just for service delivery but also for uncovering new avenues for technology adoption. IBM's consultants collaborate closely with clients, embedding IBM solutions and driving their implementation.

This direct client interaction frequently paves the way for additional sales of IBM's extensive software and hardware portfolio. In fiscal year 2023, IBM reported consulting revenue of $19.4 billion, underscoring its significance as a revenue driver and a key touchpoint for customer relationships.

- Client-Centric Solutions: Consultants tailor IBM's offerings to specific client needs.

- Opportunity Identification: Engagements reveal further technology integration possibilities.

- Sales Catalyst: Successful implementations often lead to expanded IBM product adoption.

- Revenue Contribution: Consulting is a substantial part of IBM's overall financial performance.

Marketing and Events

IBM leverages extensive global marketing campaigns and a robust presence at major industry events and conferences, such as its flagship Think event and the National Retail Federation (NRF) show, to highlight its technological advancements and strategic insights. These platforms are crucial for demonstrating thought leadership and detailing its comprehensive product portfolio. For instance, in 2024, IBM continued its focus on AI and hybrid cloud solutions, with events serving as key touchpoints for potential clients to understand the tangible benefits and applications of these technologies.

These marketing and event channels are instrumental in building brand recognition and fostering a deeper understanding of IBM's value propositions among its target audience. They serve as powerful lead generation tools, directly connecting IBM with prospective customers and partners. Furthermore, IBM's webinars and digital content initiatives provide accessible educational resources, enabling a broad spectrum of stakeholders, from individual investors to enterprise executives, to grasp the intricacies of IBM's offerings and their strategic implications.

The effectiveness of these channels is reflected in their ability to directly impact IBM's sales pipeline and market positioning. By consistently engaging with the market through these diverse touchpoints, IBM reinforces its image as an innovator and a reliable partner in digital transformation. In 2024, the company actively promoted its AI-driven solutions, underscoring how these events and campaigns translate into concrete business opportunities and client engagement.

- Global Marketing Campaigns: Broad-reaching initiatives to build brand awareness and communicate core value propositions.

- Industry Events & Conferences: Platforms like Think and NRF showcase innovation, thought leadership, and product demonstrations.

- Webinars & Digital Content: Educate potential clients and raise awareness of IBM's technological advancements and strategic solutions.

- Lead Generation & Client Education: Channels designed to attract new business and inform the market about IBM's capabilities.

IBM's channels are diverse, encompassing direct sales for high-value clients, a vast partner ecosystem for broad market reach, and digital storefronts like IBM.com and cloud marketplaces for accessible software and cloud solutions. Consulting engagements also serve as a crucial channel for driving technology adoption and uncovering new sales opportunities.

In 2024, IBM continued to leverage these channels to promote its hybrid cloud and AI advancements. The partner network, in particular, demonstrated significant growth, contributing substantially to revenue streams. Digital marketplaces also saw increased activity, facilitating easier customer access to IBM's offerings.

IBM's marketing campaigns and industry events, such as Think, are vital for thought leadership and lead generation, directly impacting sales pipelines. These efforts ensure IBM's innovations are communicated effectively to a wide audience, from individual investors to enterprise executives.

Customer Segments

IBM's primary customer segment consists of large enterprises and multinational corporations. These organizations, spanning sectors like financial services, telecommunications, retail, and manufacturing, are actively pursuing digital transformation initiatives. For instance, in 2024, a significant portion of Fortune 500 companies continued their investments in hybrid cloud infrastructure, a key area where IBM offers extensive solutions.

These large clients typically require sophisticated and integrated IT solutions. Their needs often revolve around modernizing legacy systems, adopting hybrid cloud strategies to leverage both on-premises and public cloud resources, and implementing artificial intelligence (AI) at scale to drive business outcomes. IBM's focus on these complex needs positions it to address the core challenges faced by global enterprises in the current technological landscape.

Government agencies and public sector entities represent a crucial customer segment for IBM, driven by their mandate to deliver secure, reliable, and efficient services to citizens. These organizations often require robust infrastructure solutions for critical national systems, including defense, transportation, and healthcare. In 2024, governments worldwide continue to invest heavily in digital transformation initiatives to modernize operations and enhance public service delivery, a trend IBM is well-positioned to support.

IBM's offerings are tailored to meet the unique demands of the public sector, focusing on areas like advanced data management for policy analysis, cybersecurity to protect sensitive information, and cloud solutions for scalable public services. For instance, many governments are prioritizing the secure management of vast datasets to improve decision-making and resource allocation. IBM's commitment to hybrid cloud and AI capabilities directly addresses these needs, enabling public sector clients to leverage their data more effectively and securely.

IBM recognizes the significant potential within the mid-market sector, often reaching these businesses through its robust partner network. These companies are actively looking for solutions that offer a strong balance of scalability and affordability, particularly in areas like cloud migration, advanced data analytics, and process automation. For instance, in 2024, the mid-market segment represented a substantial portion of IT spending, with many businesses investing in digital transformation initiatives to stay competitive.

Developers and IT Professionals

IBM deeply values its segment of developers and IT professionals who are instrumental in building and managing applications across its robust platforms. This group is particularly engaged with solutions like Red Hat OpenShift, the AI capabilities of Watsonx, and a suite of other IBM software tools, driving innovation and digital transformation.

To foster this crucial segment, IBM prioritizes providing comprehensive resources, extensive documentation, and active community support. This ensures developers have the tools and assistance they need to succeed. For instance, IBM's developer portal offers access to millions of code samples and tutorials, and its developer advocacy programs actively engage with communities worldwide.

Key aspects of IBM's engagement with developers and IT professionals include:

- Platform Enablement: Providing robust SDKs, APIs, and tools for building on IBM Cloud, Red Hat OpenShift, and AI platforms.

- Community Engagement: Fostering vibrant developer communities through forums, events, and online collaboration spaces.

- Learning Resources: Offering extensive documentation, tutorials, certifications, and training programs to upskill professionals.

- Innovation Support: Empowering developers to leverage cutting-edge technologies like AI, hybrid cloud, and data analytics through IBM's offerings.

Research and Academic Institutions

IBM actively partners with universities and research bodies, granting them access to advanced platforms like its quantum computing systems and AI tools. This collaboration fuels groundbreaking research and enhances educational curricula, with IBM's quantum computing resources being utilized by over 100 academic institutions globally as of early 2024.

These academic engagements are vital for nurturing the next generation of tech talent, with IBM's academic programs directly contributing to a pipeline of skilled professionals. For instance, IBM's SkillsBuild initiative, launched in 2019, had provided digital skills training to over 1 million individuals worldwide by the end of 2023, many of whom are students or recent graduates.

- Access to Advanced Technologies: IBM provides universities with cutting-edge AI and quantum computing resources for research and teaching.

- Talent Development: Academic partnerships serve as a crucial channel for IBM to identify and recruit future employees.

- Innovation Ecosystem: Collaborations foster a symbiotic relationship, driving innovation from both IBM and academic research.

- Educational Enhancement: IBM's technologies are integrated into academic programs, offering students hands-on experience with emerging tech.

IBM serves a diverse customer base, with large enterprises and multinational corporations forming its core. These clients, across various industries, are heavily invested in digital transformation, particularly in hybrid cloud and AI solutions. In 2024, IBM's focus on modernizing legacy systems and integrating complex IT needs continues to resonate with these global businesses.

Cost Structure

IBM's commitment to innovation fuels significant Research and Development (R&D) expenses, a core cost driver. In 2023, IBM reported R&D expenses of $7.5 billion, underscoring its dedication to advancing technologies like artificial intelligence, quantum computing, and hybrid cloud solutions. This substantial investment is crucial for maintaining its competitive edge and developing future revenue streams through new products and services.

Sales, General, and Administrative (SG&A) expenses are a significant component of IBM's cost structure, encompassing operating costs beyond direct product creation. These include the substantial investments in its global sales and marketing teams, crucial for reaching and supporting a diverse client base across various industries.

In 2023, IBM's SG&A expenses amounted to approximately $10.7 billion. This figure reflects the ongoing costs of maintaining a worldwide sales force, executing extensive marketing campaigns to promote its hybrid cloud and AI solutions, and managing corporate overhead, all vital for its business operations and market presence.

IBM's Cost of Goods Sold (COGS) for hardware and software is significantly influenced by the expenses associated with manufacturing its diverse hardware components, such as servers and mainframe systems. In 2023, IBM continued to invest in its advanced manufacturing capabilities to ensure product quality and innovation, a key driver of its COGS.

Furthermore, the development and licensing of its extensive software portfolio, including Red Hat, represent a substantial portion of COGS. This encompasses the ongoing research and development costs to maintain competitive software solutions and the licensing fees for third-party intellectual property integrated into its offerings.

The provision of cloud infrastructure, a growing segment for IBM, also contributes to COGS. This involves the costs of data center operations, energy consumption, and the maintenance of its global network, all crucial for delivering its hybrid cloud services reliably.

Workforce and Talent-Related Costs

IBM's workforce and talent-related costs are a substantial component of its overall expenses. These costs encompass employee salaries, comprehensive benefits packages, ongoing training and development programs, and the crucial expenses associated with acquiring new talent. For instance, in 2023, IBM reported that its total compensation and benefits expenses were approximately $27.5 billion, reflecting the significant investment in its human capital.

The company strategically invests in reskilling its existing workforce and actively seeks to attract top-tier talent, particularly in high-growth areas such as artificial intelligence (AI) and hybrid cloud solutions. This focus is directly tied to IBM's strategic pivot towards these advanced technologies. As of the first quarter of 2024, IBM has continued to emphasize hiring in these critical skill areas, though specific figures for talent acquisition costs are not publicly itemized separately from overall compensation.

- Employee Compensation: Salaries and wages form the largest part of workforce costs.

- Benefits: Health insurance, retirement plans, and other employee benefits add significantly to expenses.

- Training and Development: IBM invests in reskilling programs, especially in AI and hybrid cloud, to maintain a competitive edge.

- Talent Acquisition: Costs associated with recruiting, interviewing, and onboarding new employees, particularly those with specialized skills.

Acquisition and Integration Costs

IBM's cost structure includes significant expenses related to strategic acquisitions and their subsequent integration. For instance, in 2024, IBM acquired companies like Neural Magic, StreamSets, and webMethods. These moves are designed to enhance IBM's offerings in critical growth sectors.

The financial outlay for these acquisitions, coupled with the resources needed to integrate new technologies, talent, and operations, forms a substantial part of IBM's cost base. These integration efforts are crucial for realizing the full strategic value of the acquired businesses and ensuring they contribute effectively to IBM's overall capabilities.

- Acquisition Expenses: Costs incurred for purchasing companies such as Neural Magic, StreamSets, and webMethods in 2024.

- Integration Costs: Investments in merging acquired entities' operations, technologies, and personnel into IBM's existing framework.

- Strategic Alignment: These costs are directly tied to IBM's strategy of bolstering its portfolio in high-growth areas like hybrid cloud and artificial intelligence.

- Long-Term Value Creation: While significant upfront, these expenditures are aimed at driving future revenue and market share growth.

IBM's cost structure is heavily influenced by its substantial investments in Research and Development (R&D), aiming to stay at the forefront of technological advancements. Complementing this, Sales, General, and Administrative (SG&A) expenses are significant, covering global operations and market outreach. The Cost of Goods Sold (COGS) reflects the expenses tied to hardware manufacturing, software development, and cloud infrastructure provision.

Workforce costs, including compensation and benefits, represent a major expenditure, with IBM prioritizing talent in AI and hybrid cloud. Strategic acquisitions, such as those made in 2024, also contribute to the cost base, reflecting investments in expanding its service and product portfolio.

| Cost Category | 2023 Expenses (Approx.) | Key Drivers |

|---|---|---|

| Research & Development (R&D) | $7.5 billion | Innovation in AI, quantum computing, hybrid cloud |

| Sales, General & Administrative (SG&A) | $10.7 billion | Global sales force, marketing, corporate overhead |

| Workforce Costs (Compensation & Benefits) | $27.5 billion | Salaries, benefits, training, talent acquisition |

| Cost of Goods Sold (COGS) | Varies (Hardware, Software, Cloud) | Manufacturing, software development, data center operations |

| Strategic Acquisitions | Not specified (e.g., Neural Magic, StreamSets in 2024) | Integration of new technologies and talent |

Revenue Streams

Software sales and subscriptions represent a cornerstone of IBM's revenue, encompassing everything from traditional enterprise software licenses to the increasingly vital Software as a Service (SaaS) model. This segment is a consistent engine for the company's growth.

IBM's recurring revenue from platforms like Red Hat and its AI offerings, Watsonx, are particularly significant drivers. For instance, in the first quarter of 2024, IBM reported revenue of $14.0 billion, with software contributing a substantial portion, showcasing the enduring strength of this business model.

IBM's consulting and professional services represent a core revenue engine, encompassing IT strategy, digital transformation initiatives, and comprehensive managed services. This segment leverages IBM's deep expertise to guide clients through complex technological shifts and operational improvements.

In 2023, IBM's Consulting segment generated $15.5 billion in revenue, highlighting the significant financial contribution from these advisory and implementation services. This demonstrates a strong demand for IBM's ability to deliver tangible business outcomes through technology.

IBM's infrastructure (hardware) sales are a foundational revenue stream, primarily driven by its high-performance systems like IBM Z mainframes and Power Systems. These robust platforms are critical for organizations handling massive transaction volumes and mission-critical enterprise workloads. For instance, in the first quarter of 2024, IBM reported revenue from its Infrastructure segment was $4.2 billion, a notable increase driven by strong demand for its latest mainframe offerings.

Beyond mainframes, IBM's storage solutions also contribute significantly to this segment. These offerings are designed to manage vast amounts of data efficiently and securely, supporting the evolving needs of cloud and hybrid cloud environments. While hardware sales can be cyclical, they remain a vital component of IBM's business, often paving the way for lucrative software and services revenue as clients leverage these powerful systems.

Financing Services

IBM Global Financing is a key revenue stream, offering financing for IBM hardware, software, and services. This service directly supports client acquisitions, making it easier for them to invest in IBM solutions and thereby boosting IBM's overall sales. In 2023, IBM Global Financing reported total financing receivables of $29.4 billion, demonstrating its significant contribution to the company's financial performance.

This financing arm not only generates interest income but also acts as a strategic enabler, removing financial barriers for customers. It fosters stronger client relationships by providing flexible payment options and predictable costs. For example, the availability of financing can be a deciding factor for large enterprises looking to deploy new technologies.

- Financing Solutions: IBM Global Financing provides credit and leasing options for IBM products and services.

- Revenue Generation: This stream contributes revenue through interest income and fees on financing agreements.

- Customer Acquisition: It facilitates customer purchases by offering accessible and flexible payment plans.

- 2023 Performance: IBM Global Financing managed $29.4 billion in financing receivables in 2023.

Intellectual Property Licensing

IBM generates significant revenue by licensing its vast intellectual property, particularly its extensive patent portfolio. This strategy allows the company to monetize its substantial investments in research and development, turning its innovations into a direct income stream.

In 2023, IBM reported that it had been granted over 100,000 patents, a testament to its ongoing commitment to innovation. This intellectual property is then licensed to various companies across different industries, enabling IBM to earn royalties and fees.

- Monetization of R&D: IBM leverages its significant investment in research and development by licensing its patented technologies.

- Diverse Licensing Agreements: The company engages in licensing agreements with a broad range of companies, extending the reach and impact of its innovations.

- Revenue Generation: Licensing intellectual property provides a consistent and profitable revenue stream, supplementing other business segments.

IBM's revenue streams are diverse, reflecting its broad technological and service offerings. The company generates income from software sales and subscriptions, consulting services, infrastructure hardware, financing solutions, and intellectual property licensing. These segments collectively contribute to IBM's robust financial performance.

In the first quarter of 2024, IBM reported total revenue of $14.0 billion. Software was a significant contributor, with its recurring revenue from platforms like Red Hat and Watsonx demonstrating sustained demand. The Infrastructure segment also saw a notable increase, driven by strong sales of its mainframe systems.

| Revenue Segment | 2023 Revenue (USD billions) | Q1 2024 Revenue (USD billions) |

|---|---|---|

| Software | [Data not explicitly provided for 2023 total software, but Q1 2024 software revenue was a substantial part of the $14.0B total] | [Implied significant portion of $14.0B] |

| Consulting | 15.5 | [Data not explicitly provided for Q1 2024] |

| Infrastructure | [Data not explicitly provided for 2023 total infrastructure] | 4.2 |

| Global Financing | [Managed $29.4B in financing receivables in 2023] | [Data not explicitly provided for Q1 2024] |

| Intellectual Property Licensing | [Monetized over 100,000 patents in 2023] | [Data not explicitly provided for Q1 2024] |

Business Model Canvas Data Sources

The IBM Business Model Canvas is meticulously constructed using a blend of internal financial data, comprehensive market research, and expert strategic insights. This multi-faceted approach guarantees that every block within the canvas is populated with accurate, relevant, and actionable information.