IBM Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IBM Bundle

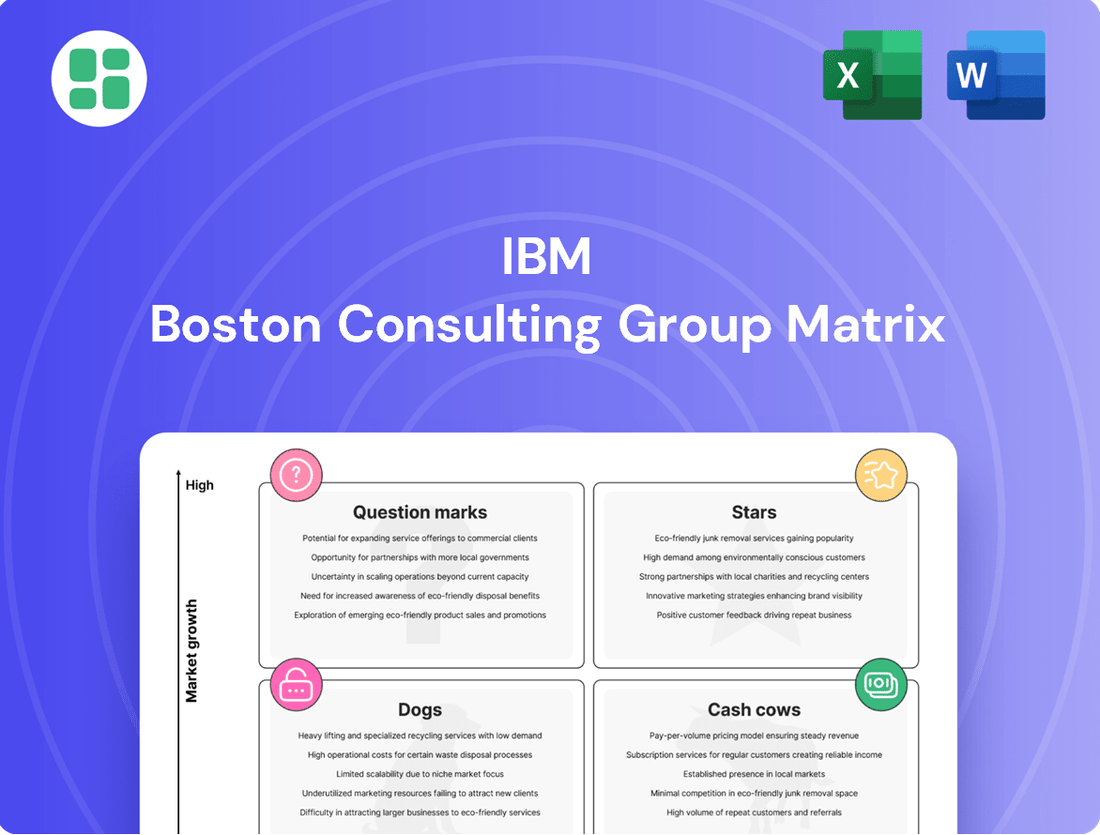

The IBM BCG Matrix is a powerful tool for understanding your product portfolio's performance. It categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual representation of their market share and growth potential. This strategic framework helps businesses make informed decisions about resource allocation and future investments.

Ready to transform your product strategy? Purchase the full BCG Matrix report to unlock detailed analysis, actionable insights, and a clear roadmap for optimizing your business's success.

Stars

IBM's generative AI offerings, under the watsonx umbrella, represent a significant growth area. By Q4 2024, this book of business had already reached $5 billion, projecting a strong trajectory with over $7.5 billion inception-to-date by Q2 2025. This surge highlights substantial market demand and client adoption for IBM's AI solutions.

IBM is positioning itself as a leader in generative AI consulting, actively assisting clients in the practical implementation of these advanced AI technologies. This strategic focus on client enablement is crucial for scaling its market presence and fostering innovation in this rapidly evolving field.

The investment in watsonx is a core element of IBM's future growth strategy. The company is actively consuming cash to expand its market reach and drive continuous innovation, underscoring the strategic importance of generative AI to its long-term vision.

Red Hat, a cornerstone of IBM's hybrid cloud strategy, continues its impressive trajectory. In 2024, it's projected to achieve revenue growth in the range of 14-17%, a testament to its strong market position in hybrid cloud and automation. This growth fuels IBM's leadership in open-source enterprise solutions.

Since its acquisition, Red Hat has more than doubled in size, a remarkable feat underscoring the success of its OpenShift and Ansible platforms. Its consistent double-digit revenue growth, expected to continue through 2025, solidifies its status as a star performer within IBM's portfolio.

IBM's automation software, a key component of its Hybrid Platform & Solutions, is performing exceptionally well. Sales saw a significant 15% jump year-over-year in Q2 2024, and continued this strong momentum with a 14% increase in Q2 2025.

The strategic acquisition of Apptio and the integration of HashiCorp are significantly enhancing IBM's offerings in this dynamic market. These moves are designed to bolster IBM's position in a high-growth sector.

This segment is vital for assisting clients in optimizing their IT expenditures and simplifying operational complexities. Consequently, it's positioned as a strong Star within the IBM BCG Matrix, indicating high potential for future cash generation.

Hybrid Platform & Solutions (Software Segment)

The Hybrid Platform & Solutions segment within IBM's software offerings is a significant driver of the company's growth. In 2024, this segment experienced robust revenue increases, generally in the range of 10-12%.

This performance underscores its importance as a cornerstone of IBM's broader software business, which itself is a high-growth sector for the company. The segment's success is directly tied to its critical role in executing IBM's hybrid cloud and artificial intelligence strategies.

Key offerings within this segment demonstrate both a strong market position in their respective niches and a promising outlook for continued expansion. This indicates a healthy market share and significant future growth potential.

- Strong Revenue Growth: IBM's Hybrid Platform & Solutions segment saw revenue increases of 10-12% in 2024.

- Foundational to Software Performance: This segment is a key contributor to IBM's overall high-growth software business.

- Strategic Importance: It is central to IBM's hybrid cloud and AI strategy.

- Market Position and Potential: The segment holds a strong market share in its focus areas and exhibits continued growth potential.

AI-Driven Consulting Services

AI-driven consulting services represent a significant growth area for IBM Consulting, even as overall consulting revenue experiences some softness due to cautious client spending. This segment is a prime example of a Star within the IBM BCG Matrix framework.

IBM's generative AI book of business demonstrates substantial growth, with a significant portion stemming directly from consulting engagements. This indicates IBM's strong position in guiding clients through AI adoption and digital transformation initiatives.

The market for generative AI consulting is experiencing rapid expansion, and IBM is actively building its market share within this high-growth sector. For instance, in 2024, IBM announced significant investments and partnerships aimed at accelerating AI adoption for its clients, underscoring its commitment to this Star segment.

- Generative AI Consulting Growth: IBM Consulting's book of business for generative AI projects is a key growth driver.

- Market Position: The firm is positioned as a leader in advising clients on AI adoption and transformation strategies.

- Star Classification: This segment is classified as a Star due to its operation within a high-growth market and IBM's expanding market share.

- Client Engagement: A substantial portion of IBM's generative AI revenue comes from consulting engagements, highlighting client trust and demand for AI expertise.

Stars in the IBM BCG Matrix represent business units or products with high market share in high-growth industries. These entities typically require significant investment to maintain their growth but are expected to generate substantial future profits. IBM's generative AI offerings, Red Hat, and automation software are prime examples of these Star performers.

Stars are crucial for a company's long-term success, acting as future cash cows once their growth markets mature. IBM's strategic focus on these areas, particularly in AI and hybrid cloud, positions it for sustained leadership and profitability.

The classification of these segments as Stars underscores IBM's successful pivot towards high-demand, future-oriented technologies. This strategic allocation of resources is designed to capture market share and drive innovation.

IBM's strategic focus on generative AI, Red Hat, and automation software places them firmly in the Star category of the BCG Matrix. These segments exhibit high growth rates and strong market positions, demanding continued investment to capitalize on their potential.

| Segment | Market Growth | Market Share | IBM's Position | Outlook |

|---|---|---|---|---|

| Generative AI (watsonx) | High | Growing | Leading consultant, significant book of business | Strong future growth, high investment |

| Red Hat | High (Hybrid Cloud) | High | Cornerstone of hybrid cloud strategy, doubled in size | Continued double-digit growth |

| Automation Software | High | Strong | Key driver of Hybrid Platform & Solutions | Continued strong momentum, acquisitions |

What is included in the product

The IBM BCG Matrix analyzes product portfolio performance based on market share and growth.

The IBM BCG Matrix provides a clear, visual overview of your portfolio, simplifying complex strategic decisions and alleviating the pain of uncertainty.

Cash Cows

IBM Z mainframes are a prime example of a Cash Cow within IBM's portfolio, boasting a dominant market share in a mature sector. These systems are indispensable for mission-critical operations across sectors like finance, where reliability is paramount.

Despite potential cyclicality tied to new hardware releases, such as the anticipated z17, IBM Z consistently delivers robust and stable cash flows. This is largely due to a deeply entrenched installed base and the systems' renowned high availability and performance, making them enduring revenue generators.

In 2023, IBM reported that its mainframe segment, which includes IBM Z, continued to be a significant contributor to its overall revenue, demonstrating the enduring strength of these systems. The ongoing demand for secure and scalable transaction processing ensures their continued role as a vital cash engine for the company.

Transaction processing software, a cornerstone of IBM's offerings, particularly on its Z systems, generates a reliable and consistent revenue stream. This segment, while not experiencing explosive growth, holds a dominant market share within IBM's software business, acting as a consistent cash generator.

For many major corporations, this software is indispensable for their fundamental operations. It consistently delivers healthy profit margins and substantial cash flow, requiring minimal new capital investment to maintain its position.

In 2023, IBM reported its software segment revenue reached $27.0 billion, with transaction processing playing a significant role in this figure, underscoring its importance as a cash cow.

IBM's infrastructure support services are a classic cash cow, generating predictable, recurring revenue from its vast installed base of hardware and software. This segment thrives on its established client relationships and long-term service contracts, ensuring a stable cash inflow even in a mature market. For instance, in 2024, IBM reported significant revenue from its Global Technology Services segment, which includes infrastructure support, demonstrating its continued role as a reliable cash generator.

Established Enterprise IT Consulting Services

IBM's established enterprise IT consulting services are a classic example of a Cash Cow in the BCG matrix. While not experiencing the explosive growth of AI, these services operate in a large, stable market where IBM has a dominant presence. Their strength lies in deep industry knowledge and enduring client partnerships, which translate into reliable revenue streams and healthy profit margins.

These mature offerings demand a more measured investment strategy. Instead of aggressive expansion, IBM focuses on nurturing existing client relationships and optimizing operational efficiency. This approach ensures continued profitability without the need for the substantial capital typically allocated to high-growth "Stars."

- Market Maturity: These services cater to a well-established demand within large enterprises for ongoing IT support, modernization, and integration.

- Strong Market Share: IBM's long history and extensive client base give it a significant advantage in this segment, allowing for consistent revenue generation.

- Profitability: Due to lower R&D and market penetration costs compared to emerging technologies, these services typically boast strong profit margins, contributing significantly to IBM's overall financial health.

- Investment Focus: Capital is primarily directed towards maintaining service quality, client retention, and incremental efficiency improvements rather than disruptive innovation.

Power Systems Hardware and OS

IBM's Power Systems, featuring the robust Power10 and the anticipated Power11 processors, cater to a specialized segment of enterprise clients, especially those running demanding data workloads like SAP Hana. This hardware and its accompanying operating systems are a reliable source of steady income from a committed customer base.

While not experiencing explosive growth, the Power Systems division holds a significant position in its niche market. It consistently generates substantial cash flow, which is crucial for funding IBM's overarching hybrid cloud initiatives.

- Revenue Contribution: In 2023, IBM reported that its Hybrid Cloud segment, which includes Power Systems, generated $22.4 billion in revenue, demonstrating the ongoing importance of these solutions.

- Customer Loyalty: Power Systems benefits from a high degree of customer retention due to the specialized nature of the hardware and the significant investment required to migrate away from it.

- Strategic Importance: The platform's ability to handle intensive data processing makes it a key component in IBM's strategy to support mission-critical enterprise applications within a hybrid cloud environment.

IBM's software for transaction processing, particularly on its Z systems, acts as a significant cash cow. While not a high-growth area, it holds a dominant market share and generates consistent, profitable revenue with minimal new investment needed. In 2023, IBM's software segment, which heavily features this, brought in $27.0 billion, highlighting its enduring financial contribution.

| Product/Service | BCG Category | Key Characteristics | 2023 Revenue Contribution (Approx.) |

| IBM Z Mainframes | Cash Cow | Dominant market share, mission-critical operations, stable cash flow. | Significant contributor to IBM's overall revenue. |

| Transaction Processing Software | Cash Cow | Indispensable for core operations, healthy profit margins, consistent revenue. | Key component within the $27.0 billion software segment. |

| Infrastructure Support Services | Cash Cow | Predictable recurring revenue, established client base, long-term contracts. | Reliable revenue generator within Global Technology Services. |

| Enterprise IT Consulting | Cash Cow | Large, stable market, dominant presence, deep industry knowledge. | Consistent revenue generation from existing client partnerships. |

| Power Systems | Cash Cow | Niche market, specialized hardware, substantial cash flow for hybrid cloud. | Part of the $22.4 billion Hybrid Cloud segment. |

Preview = Final Product

IBM BCG Matrix

The IBM BCG Matrix document you are currently previewing is the identical, fully functional report you will receive immediately after completing your purchase. This means no altered content or watermarks, ensuring you get a complete and professional strategic analysis tool ready for immediate application in your business planning.

Dogs

IBM has strategically pruned its hardware offerings, divesting non-core assets to sharpen its focus on hybrid cloud and AI. Any remaining legacy hardware, outside of mainframes and Power systems, typically resides in mature or declining markets. These segments often struggle with low market share and minimal new revenue generation.

These older hardware lines can become costly liabilities, requiring maintenance and support without offering substantial strategic growth potential. For instance, in 2023, IBM's Infrastructure segment, which includes these types of products, saw revenue shifts as the company continued its portfolio optimization efforts, with a clear emphasis on newer, more profitable technologies.

Certain legacy software products, particularly those not designed for hybrid cloud or AI integration, often find themselves in a challenging market position. These offerings, while perhaps having a loyal user base, typically experience diminishing demand and a shrinking market share. For instance, older versions of mainframe software or specialized business applications that haven't evolved with current technology trends might fit this description.

These products, while not central to IBM's forward-looking strategy in hybrid cloud, AI, and automation, can still require resources for maintenance and support. This can create a drag on profitability, as the investment needed to keep them running may not be justified by the revenue they generate. In 2023, IBM's software segment revenue was $26.4 billion, with a significant portion driven by newer, integrated solutions.

Consequently, such products are often candidates for strategic review. This might involve a decision to phase them out gradually, transfer them to a different support model, or invest minimally to maintain their existing functionality for their niche customer base. The focus shifts to optimizing resource allocation towards areas with higher growth potential, such as Red Hat or IBM's AI and data platforms.

Divested business units like Kyndryl and parts of Watson Health exemplify past 'dogs' for IBM within the BCG Matrix framework. These segments struggled with low growth and significant capital requirements, hindering their ability to secure a dominant market share within IBM's broader offerings.

The strategic decision to divest these operations was aimed at enhancing IBM's overall growth trajectory and sharpening its focus on high-margin, software-centric ventures. For instance, Kyndryl's spin-off in November 2021 allowed IBM to shed a capital-intensive infrastructure services business, while the sale of Watson Health in 2022 addressed a unit that faced market challenges and intense competition.

Non-Core Financing Segment

IBM's financing segment, often categorized as a Dog in a BCG-like analysis, has demonstrated a consistent pattern of revenue decline. This segment experienced a notable 8.3% revenue decrease in the second quarter of 2024, followed by further contractions of 2.5% in both the third and fourth quarters of 2024.

This sustained downward trend signals a market characterized by low growth, and potentially contraction, for IBM's financial services offerings. While the financing arm does provide a supportive function for the sale of other IBM products, its standalone financial performance and limited growth prospects position it as a Dog. This classification implies that the segment may be tying up capital without offering substantial strategic advantages or significant upside potential for the company.

- Declining Revenues: Q2 2024 saw an 8.3% drop, with Q3 and Q4 2024 showing 2.5% decreases.

- Low Growth Market: The segment operates in a market with limited expansion opportunities.

- Capital Tie-up: The financing business may be consuming resources without generating commensurate returns.

- Strategic Re-evaluation: Its Dog status suggests a need to assess its contribution versus its resource demands.

Traditional, Declining IT Outsourcing Services

Within the IBM BCG Matrix, traditional IT outsourcing services that have become commoditized, particularly those not aligned with cloud-native strategies or advanced automation, would likely fall into the 'Dog' quadrant. These offerings often operate in highly competitive markets with slim profit margins, potentially leading to minimal profitability or even losses.

Such services might represent a legacy business for IBM Consulting, where investment in differentiation or market share gains is unlikely to yield significant returns. For instance, basic infrastructure management or routine application maintenance, if not significantly enhanced by automation or specialized expertise, could be candidates for this classification.

In 2024, the IT outsourcing market continues to see a strong shift towards specialized, outcome-based services, with commoditized offerings facing pressure. Companies are increasingly prioritizing cloud migration, cybersecurity, and data analytics, leaving traditional, lower-value IT services with reduced demand and profitability.

- Low Market Share: Services lacking unique value propositions struggle to capture significant market share in a crowded field.

- Low Growth Rate: Demand for basic, undifferentiated IT outsourcing is often stagnant or declining as clients adopt newer technologies.

- Low Profitability: Intense competition drives down prices, making it difficult to achieve substantial profit margins in these segments.

- Resource Drain: These services can consume management attention and capital without contributing meaningfully to IBM's strategic objectives or future growth.

IBM's financing segment, showing consistent revenue declines with an 8.3% drop in Q2 2024 and 2.5% decreases in Q3 and Q4 2024, exemplifies a 'Dog' in the BCG Matrix. This indicates a low-growth market for these offerings, potentially tying up capital without significant strategic upside.

Similarly, commoditized IT outsourcing services, especially those not aligned with cloud or automation, also fit the 'Dog' profile. These services face intense competition and declining demand as clients shift to newer technologies, leading to low profitability and minimal strategic contribution.

These 'Dog' segments, like the financing arm and un-differentiated IT services, highlight areas where IBM may need to re-evaluate resource allocation. The focus remains on optimizing capital for higher-growth, software-centric ventures.

| Segment | BCG Classification | 2024 Performance Indicators | Strategic Implication |

|---|---|---|---|

| IBM Financing | Dog | Q2 2024: -8.3% revenue; Q3 & Q4 2024: -2.5% revenue | Low growth, potential capital tie-up |

| Commoditized IT Outsourcing | Dog | Declining demand, low profit margins | Resource drain, minimal strategic contribution |

Question Marks

Quantum computing represents a high-growth, emerging market with the potential to revolutionize industries, and IBM is a significant player in its research and development. IBM's substantial investments in quantum hardware, such as the IBM Quantum System One and the upcoming Starling system, alongside its software platform Qiskit, underscore its dedication to leading this transformative technology.

Despite these advancements, widespread commercial adoption and significant market share are still in their nascent stages. This positions quantum computing as a Question Mark within strategic frameworks, demanding continuous and considerable investment to unlock its future potential.

IBM's blockchain solutions are currently positioned as a Question Mark within the BCG framework. While IBM was an early pioneer in enterprise blockchain, and the technology shows significant promise for areas like supply chain management and digital identity, the overall market adoption has been slower than expected. This means IBM's market share, while present, isn't yet a dominant force across the full spectrum of potential blockchain applications.

The enterprise blockchain market is still maturing, and widespread enterprise adoption is not yet a certainty. For instance, while some reports in 2024 indicated continued investment in blockchain pilots and proofs-of-concept across various industries, the transition to large-scale, production-ready deployments remains a hurdle. This evolving landscape necessitates ongoing investment from IBM to solidify its position and capture market share in a sector with high, but not fully realized, growth potential.

The market for AI-driven sustainability solutions is experiencing rapid expansion, with a significant 88% of business leaders intending to boost their IT spending in this sector. IBM's research underscores this promising growth trajectory, and the company is actively investing in developing relevant solutions.

Despite this potential, a substantial hurdle exists: over half of all organizations are not yet leveraging AI for sustainability initiatives. This suggests IBM's current market share in this nascent AI application remains low, necessitating considerable market cultivation and strategic investment for widespread adoption and scaling.

Emerging Hybrid Cloud Niche Solutions

Beyond its strong Red Hat foundation, IBM is actively developing specialized hybrid cloud solutions targeting emerging niche markets. These could include AI-driven analytics platforms for healthcare or quantum computing readiness for specific scientific research sectors.

While the broader hybrid cloud market is established, these nascent segments represent significant growth potential for IBM. For instance, the global hybrid cloud market was valued at approximately $130 billion in 2023 and is projected to grow, but these emerging niches are expected to expand at an even faster rate.

In these highly specific, developing areas, IBM's initial market share would likely be small. This positions them as potential Question Marks within the IBM BCG Matrix, requiring strategic investment to cultivate these specialized offerings into future market leaders.

- AI-powered hybrid cloud for drug discovery: Targeting pharmaceutical research with tailored data management and processing capabilities.

- Edge computing solutions for smart manufacturing: Offering specialized hybrid cloud services for real-time data analysis and control in industrial settings.

- Quantum-ready hybrid cloud infrastructure: Preparing for the advent of quantum computing by offering compatible hybrid cloud environments for advanced simulation and modeling.

Specialized AI Models (e.g., Granite) for Enterprise Use

IBM is actively developing specialized AI models, such as Granite, to cater to specific enterprise needs and allow for fine-tuning. This positions them in a burgeoning AI market, which saw global spending on AI solutions projected to reach $200 billion in 2024, according to IDC. While this represents a significant growth avenue for IBM, these particular models are new entrants in a crowded field, meaning their current market share is minimal.

These specialized models are considered a high-potential area for IBM to distinguish its AI portfolio. However, achieving widespread adoption requires substantial investment in marketing and ongoing development to demonstrate their unique value proposition. The enterprise AI market is highly competitive, with numerous players offering a range of solutions, making it crucial for IBM to effectively communicate the benefits of Granite.

- High Growth Potential: Specialized AI models like Granite offer IBM a distinct opportunity to capture market share in niche enterprise applications.

- Early Stage Adoption: Despite the overall AI market's rapid expansion, the specific market penetration of these newer, specialized models is currently low.

- Investment Required: Significant resources are needed for development and marketing to establish these models as leaders in their respective enterprise segments.

- Competitive Landscape: IBM faces intense competition, necessitating clear differentiation and demonstrable ROI for its specialized AI offerings.

IBM's quantum computing initiatives represent a significant investment in a high-growth, albeit nascent, market. While IBM is a leading player in developing quantum hardware and software, widespread commercial adoption remains a future prospect. This positions quantum computing as a Question Mark, requiring sustained financial commitment to capitalize on its transformative potential.

Enterprise blockchain, another area for IBM, also falls into the Question Mark category. Despite IBM's early involvement and the technology's promise, market adoption has been slower than anticipated. This means IBM's market share is not yet dominant, and the sector's maturity is still developing, necessitating ongoing investment to secure a stronger foothold.

IBM's specialized AI models, like Granite, are also classified as Question Marks. While the overall AI market is booming, with projected spending of $200 billion in 2024, these specific models are new entrants facing fierce competition. Their current market share is minimal, requiring substantial investment in development and marketing to prove their unique value and achieve broader adoption.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, market research reports, and industry growth forecasts to provide a clear strategic overview.