IBM Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IBM Bundle

IBM operates within a complex technological landscape, facing intense competition from rivals and the constant threat of disruptive innovations. Understanding the dynamics of buyer power and the availability of substitutes is crucial for navigating this market.

The complete report reveals the real forces shaping IBM’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

IBM's reliance on a limited number of suppliers for high-end technology components, like advanced semiconductors and specialized hardware, grants these suppliers a degree of bargaining power. This is particularly true for proprietary or hard-to-replicate parts, where IBM has fewer alternatives.

The switching costs for IBM to change suppliers for these critical components are significant, potentially reaching tens of millions of dollars. This figure accounts for the complex processes involved in redesigning semiconductors or reconfiguring hardware to accommodate new suppliers, reinforcing the suppliers' leverage.

IBM's reliance on highly specialized hardware and software components, such as advanced semiconductors or proprietary operating systems, significantly elevates the bargaining power of its suppliers. The intricate integration required for these inputs means that switching to a different vendor would involve substantial costs, including retooling, extensive testing, and potential compatibility issues.

For instance, the development and integration of custom AI chips or specialized cloud infrastructure software can take years and millions in R&D. In 2024, the semiconductor industry, a critical supplier for IBM's hardware, continued to experience supply chain complexities and price volatility, further solidifying the position of established, specialized chip manufacturers.

IBM's bargaining power with suppliers is bolstered by its sheer size and global operational footprint. While some IBM components are highly specialized, the company actively cultivates relationships with multiple suppliers for many of its needs. This diversification strategy is crucial; for instance, in 2024, IBM's extensive procurement network allows it to shift orders for standard server components or cloud infrastructure services if a particular supplier attempts to exert undue price pressure.

Supplier's Ability for Forward Integration

The threat of suppliers integrating forward to become competitors for IBM is generally low, especially given the immense complexity and capital requirements of the IT solutions sector. However, certain suppliers of specialized software components might explore developing more comprehensive, integrated solutions that could overlap with IBM's offerings.

IBM's vast customer relationships and its broad spectrum of services present substantial barriers, discouraging suppliers from attempting such a strategic shift. For instance, IBM's 2024 revenue of $61.9 billion reflects its significant market presence, making it a challenging target for a supplier's forward integration.

- Low Direct Threat: The high barriers to entry in advanced IT solutions limit most suppliers’ ability to replicate IBM’s integrated offerings.

- Potential for Niche Integration: Some software component suppliers might develop more bundled or platform-based solutions.

- IBM's Deterrents: IBM's extensive client base and diversified service portfolio serve as significant deterrents to potential supplier forward integration.

- Market Share Protection: IBM's established market position, which saw its hybrid cloud revenue grow significantly in recent years, further solidifies its competitive advantage against potential supplier encroachment.

Importance of IBM to Suppliers

For numerous specialized technology component providers, IBM stands as a significant and essential client. This interdependence helps to level the playing field, as these suppliers are keen to foster strong relationships and offer competitive pricing to ensure ongoing business with a prominent industry leader like IBM.

IBM's vast procurement needs mean that for many of its suppliers, the company represents a substantial portion of their revenue. For instance, in 2023, IBM's total revenue was approximately $61.9 billion, indicating the scale of its purchasing power and the importance of its relationships with its supply chain partners.

- Significant Customer Base: IBM's large operational scale makes it a critical customer for many technology component suppliers.

- Revenue Dependence: For specialized suppliers, IBM can represent a considerable percentage of their annual income, fostering a desire for continued partnership.

- Mutual Dependency: This reliance on each other creates a balance, encouraging suppliers to remain competitive and maintain quality to retain IBM's business.

Suppliers of highly specialized components, such as advanced semiconductors and proprietary software, hold considerable bargaining power over IBM due to high switching costs and the limited number of alternative providers. For instance, the complex integration and R&D required for custom AI chips can take years and millions of dollars, making it difficult for IBM to change vendors quickly.

The semiconductor industry, a key supplier for IBM's hardware, faced ongoing supply chain challenges and price fluctuations in 2024, further strengthening the position of established manufacturers. While IBM's scale and diversification efforts provide some leverage, the specialized nature of critical inputs means suppliers retain significant influence.

| Supplier Characteristic | Impact on IBM's Bargaining Power | Example/Data Point (2023-2024) |

|---|---|---|

| Specialization of Components | Increases Supplier Power | High reliance on advanced semiconductors and proprietary software. |

| Switching Costs | Increases Supplier Power | Tens of millions of dollars for redesigning hardware or integrating new software. |

| Number of Alternative Suppliers | Decreases Supplier Power (if many) / Increases Supplier Power (if few) | Limited alternatives for highly proprietary or hard-to-replicate parts. |

| Supplier Dependence on IBM | Decreases Supplier Power | IBM's 2023 revenue of $61.9 billion makes it a crucial client for many suppliers. |

What is included in the product

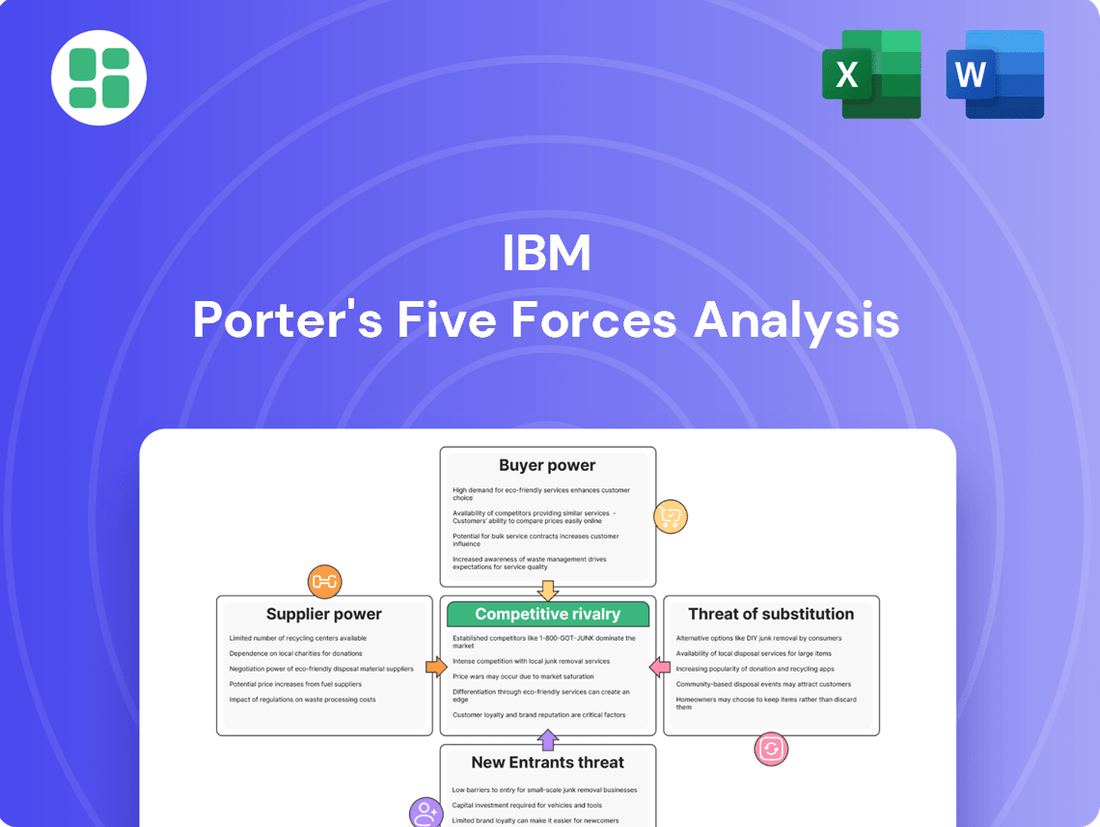

IBM's Porter's Five Forces Analysis examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its operating industries.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, enabling proactive strategy adjustments.

Customers Bargaining Power

IBM's diverse client base, spanning sectors like financial services, healthcare, and government, significantly dilutes customer bargaining power. This broad distribution means that IBM's revenue is not overly reliant on any single customer or industry segment, preventing any one client from exerting undue influence over pricing or terms. For instance, in 2023, IBM reported that its largest customer accounted for less than 5% of its total revenue, underscoring this diversification.

Customers deeply embedded with IBM's integrated solutions, particularly in hybrid cloud and AI, encounter substantial switching costs. This is due to the intricate integration with their existing IT infrastructure and critical business operations.

The migration process from established IBM systems to alternative providers is not only time-consuming but also resource-intensive, carrying inherent risks related to data integrity and operational continuity. For instance, a significant portion of enterprises rely on IBM's legacy systems, making a complete overhaul a complex undertaking.

This high barrier to exit significantly strengthens IBM's bargaining power with its customer base, as the cost and disruption associated with switching often outweigh the perceived benefits of moving to a competitor.

IBM operates in a dynamic technology landscape where customers frequently encounter numerous alternative providers for hardware, software, and cloud services. This abundance of choice significantly influences customer bargaining power. For instance, in 2024, the global cloud computing market alone was projected to reach over $600 billion, showcasing the sheer volume of players offering competing solutions.

When customers can easily switch to a competitor offering similar functionality or price points, their ability to negotiate favorable terms with IBM increases. This is particularly true for standardized components or services where differentiation is less pronounced. The availability of open-source alternatives for certain software functionalities also contributes to this pressure.

Customer Price Sensitivity

IBM's large enterprise clients, a core segment, exhibit significant price sensitivity. These customers, particularly when procuring substantial hardware or undertaking extensive projects, engage in thorough negotiations. This can directly impact IBM's profitability.

The bargaining power of these customers is amplified by their ability to request tailored solutions and seek the most competitive pricing. This dynamic can exert considerable downward pressure on IBM's profit margins.

- Customer Price Sensitivity: Large enterprise clients often prioritize cost, especially for significant investments.

- Negotiation Leverage: Their scale allows for robust negotiation on pricing and terms.

- Customization Demands: The need for bespoke solutions can increase costs for IBM while customers seek value.

- Margin Impact: Intense price competition can compress IBM's profit margins on key deals.

Threat of Backward Integration by Customers

The threat of customers backward integrating by developing their own IT solutions is generally low for IBM. The significant investment in capital, specialized skills, and considerable time needed to create complex enterprise-level systems makes this impractical for most businesses.

This high barrier to entry protects IBM's market position. For instance, developing a cloud infrastructure comparable to IBM Cloud requires billions of dollars in upfront investment and a vast pool of highly skilled engineers, a commitment few potential customers can afford or manage.

- High Capital Investment: Building proprietary IT infrastructure often necessitates billions in capital expenditure, far exceeding typical IT budgets for many firms.

- Expertise Gap: Replicating IBM's deep technical expertise in areas like AI, quantum computing, and hybrid cloud management requires specialized talent that is scarce and expensive.

- Time-to-Market Disadvantage: Developing in-house solutions would significantly delay a business's ability to adopt new technologies compared to leveraging IBM's ready-made offerings.

IBM's customer bargaining power is generally moderate, influenced by several factors. While IBM's broad client base and the high switching costs associated with its integrated solutions limit customer leverage, the competitive technology landscape and customer price sensitivity can increase it.

| Factor | Impact on IBM | Supporting Data/Example (2023-2024) |

|---|---|---|

| Customer Diversification | Lowers bargaining power | Largest customer < 5% of revenue (2023) |

| Switching Costs | Lowers bargaining power | High integration with hybrid cloud/AI solutions |

| Availability of Alternatives | Increases bargaining power | Global cloud market > $600 billion (2024 projection) |

| Customer Price Sensitivity | Increases bargaining power | Large enterprises negotiate heavily on substantial deals |

| Backward Integration Threat | Lowers bargaining power | Billions in investment needed for comparable infrastructure |

Preview the Actual Deliverable

IBM Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive IBM Porter's Five Forces Analysis details the competitive landscape, including threats of new entrants, bargaining power of buyers and suppliers, and the intensity of rivalry within the technology sector. You’ll gain actionable insights into IBM's strategic positioning and potential challenges.

Rivalry Among Competitors

IBM operates in a highly competitive landscape, facing intense rivalry from major technology giants such as Microsoft, Amazon Web Services (AWS), and Google Cloud. These competitors are not only strong in cloud computing but also aggressively pursue market share in artificial intelligence, software solutions, and comprehensive IT services, directly challenging IBM's core offerings.

The competition extends to specialized areas as well, with companies like Oracle and SAP posing significant threats in enterprise software and database solutions. Furthermore, numerous hardware manufacturers and global consulting firms actively compete for IT infrastructure projects and strategic business transformation engagements, creating a multifaceted competitive environment for IBM.

In 2024, the cloud computing market, a key battleground for IBM, continued its rapid expansion. AWS, for instance, maintained its leadership position, reporting substantial revenue growth. Similarly, Microsoft Azure and Google Cloud have consistently invested heavily in expanding their global infrastructure and AI capabilities, intensifying the pressure on IBM's hybrid cloud and AI strategies.

The technology sector, a core battleground for IBM, is defined by relentless innovation, especially in artificial intelligence and hybrid cloud. This constant churn means companies are always pushing out new products and services to stay ahead.

For instance, in 2024, the global AI market was projected to reach hundreds of billions of dollars, showcasing the intense investment and competition. IBM’s significant R&D spending, which historically accounts for a substantial portion of its revenue, is a direct response to this dynamic, as falling behind technologically can quickly erode market position.

The IT solutions market, where IBM operates, presents significant hurdles for companies looking to leave. Think about the massive amounts of money poured into building data centers, developing cutting-edge software, and nurturing long-term customer trust. These aren't small investments; they represent sunk costs that are incredibly difficult to recoup.

Because exiting is so costly, even companies that aren't performing exceptionally well tend to stick around. This persistence means the competitive landscape remains crowded. Instead of seeing less successful players fade away, IBM faces ongoing pressure from a full field of rivals, all vying for market share.

Product and Service Differentiation

IBM emphasizes its hybrid cloud and AI capabilities, alongside tailored industry solutions and extensive enterprise experience, as key differentiators. However, rivals like Microsoft Azure and Amazon Web Services are also aggressively pursuing their own unique selling propositions, often through specialized cloud services and extensive partner ecosystems.

This intense focus on differentiation means that competitive rivalry is often moderate to strong. Companies compete fiercely on product features, system performance, and the seamless integration of their offerings. For instance, in 2024, the cloud computing market saw continued innovation, with providers emphasizing specialized AI hardware and software stacks to attract specific enterprise workloads.

- IBM's Hybrid Cloud and AI: IBM continues to invest heavily in its hybrid cloud strategy, aiming to provide flexibility for enterprises managing both on-premises and public cloud data. This includes advancements in AI-driven automation and data analytics.

- Competitor Differentiation Strategies: Major competitors differentiate through various means, such as offering specialized industry clouds (e.g., Microsoft's cloud for financial services), robust AI development platforms, or extensive global network infrastructures.

- Impact on Rivalry: The drive for unique value propositions intensifies competition, pushing all players to innovate rapidly and offer compelling, integrated solutions that address complex business needs, often leading to price competition on commodity services.

- Market Dynamics: In 2024, the demand for integrated solutions that combine cloud infrastructure, AI services, and industry-specific applications remained a key battleground, with providers showcasing their ability to deliver end-to-end digital transformation capabilities.

Price Competition in Certain Segments

Price competition is a significant factor for IBM, especially within its cloud services and certain software solution segments. Companies in these areas often engage in aggressive pricing strategies, sometimes referred to as price wars, to capture or maintain market share. IBM's strategy involves offering value-driven solutions, but staying competitive on pricing remains crucial for attracting and retaining customers in these intensely contested markets.

For instance, in the competitive cloud infrastructure market, pricing models can significantly influence customer choice. While IBM's hybrid cloud approach offers distinct advantages, it must contend with competitors who may offer lower entry-level pricing. This dynamic means that even with superior technology, IBM's pricing must be carefully calibrated to remain attractive.

- Cloud Services Pricing Pressure: IBM faces intense pricing pressure in its public and hybrid cloud offerings, a sector where hyperscalers often leverage economies of scale for aggressive pricing.

- Software Licensing Models: In software, IBM must balance its value-based licensing with the pricing structures of SaaS providers and open-source alternatives, particularly in areas like data analytics and AI platforms.

- Impact on Margins: While IBM aims for higher-margin consulting and software sales, price competition in infrastructure and certain commoditized software solutions can impact overall profitability if not managed strategically.

Competitive rivalry is a dominant force for IBM, with intense competition from tech giants like Microsoft, AWS, and Google Cloud. These rivals vie for market share across cloud computing, AI, and IT services, directly challenging IBM's core business segments.

The landscape is further complicated by specialized competitors and global consulting firms, creating a broad and multifaceted competitive environment. In 2024, the cloud market, a key battleground, saw continued expansion and heavy investment in AI capabilities by major players, intensifying pressure on IBM's strategies.

IBM's differentiation efforts, focusing on hybrid cloud and AI, are met by competitors' own unique selling propositions, often leveraging specialized clouds and extensive partner ecosystems. This drives rapid innovation and competition on product features, performance, and integration.

| Competitor | Key Focus Areas | 2024 Market Share (Cloud - Est.) |

|---|---|---|

| Amazon Web Services (AWS) | Comprehensive Cloud Services, AI/ML | ~31% |

| Microsoft Azure | Hybrid Cloud, AI Integration, Enterprise Solutions | ~25% |

| Google Cloud | Data Analytics, AI/ML, Open Source | ~11% |

SSubstitutes Threaten

Public cloud services from hyperscalers like Amazon Web Services (AWS) and Microsoft Azure present a compelling substitute for traditional on-premise server solutions, directly impacting IBM's hardware revenue streams. These cloud platforms offer scalability and flexibility that can be more attractive than upfront capital expenditure on physical infrastructure.

For instance, in 2024, the global cloud computing market was projected to reach over $1.3 trillion, demonstrating the significant shift in IT spending away from on-premise solutions. This trend directly challenges IBM's legacy hardware business, as many enterprises opt for these readily available cloud alternatives.

IBM's strategic response involves a strong push into hybrid cloud, offering its own cloud services and integration capabilities to capture value in this evolving landscape. This pivot aims to leverage its existing enterprise relationships and expertise to provide a middle ground for clients hesitant to go fully public cloud.

The increasing maturity and availability of open-source software, particularly in areas like AI frameworks, presents a moderate threat of substitution for IBM's offerings. Companies may choose these free alternatives to cut down on licensing fees and gain greater adaptability, even if it means investing more in internal technical skills.

Large enterprises with robust IT departments, like Microsoft or Google, might develop their own cloud infrastructure or specialized software, bypassing IBM's broader solutions. This in-house capability can be a significant substitute, especially when specific performance or security needs are paramount. For instance, a major financial institution might build its own proprietary trading platform rather than relying on a third-party vendor.

Highly specialized niche providers offer another layer of substitution. These firms focus on delivering very specific IT services or products, often with greater depth or tailored features than a generalist like IBM can provide across its entire portfolio. Think of companies exclusively offering advanced cybersecurity analytics or highly specialized data warehousing solutions.

The trend towards open-source software and customizable platforms further strengthens the threat of substitutes. Companies can leverage open-source components to build bespoke solutions, reducing reliance on proprietary IBM software. This is a growing trend, with many businesses actively seeking to avoid vendor lock-in by adopting more flexible, adaptable technology stacks.

Generic Software and Off-the-Shelf Solutions

The availability of generic software and off-the-shelf solutions presents a significant threat of substitutes for IBM. While IBM excels in delivering highly customized enterprise solutions, a segment of the market can be adequately served by simpler, pre-packaged products. These alternatives often come at a lower cost and with quicker implementation times, making them attractive to clients who do not require IBM's extensive integration capabilities or specialized consulting services.

Competitors offering these more accessible solutions can siphon off customers who might otherwise consider IBM. For instance, many small to medium-sized businesses might opt for cloud-based CRM or project management tools that are readily available and require minimal customization, rather than investing in a comprehensive IBM suite. This trend is amplified by the increasing maturity of the software market, where specialized functionalities are becoming more commoditized.

- Market Share of SaaS: The global Software as a Service (SaaS) market was projected to reach over $200 billion in 2024, indicating a substantial portion of IT spending is directed towards readily available solutions.

- SMB Adoption: Small and medium-sized businesses (SMBs), a key market segment, often prioritize cost-effectiveness and ease of use, making off-the-shelf software a more viable option than complex, bespoke systems.

- Cloud-Native Solutions: The rise of cloud-native applications and platforms allows for rapid deployment of generic functionalities, directly competing with the need for custom enterprise software.

- Open-Source Alternatives: The increasing sophistication and support for open-source software also provide viable substitutes for proprietary, customized solutions in various business functions.

Evolving Technologies and Disruptive Innovations

The threat of substitutes for IBM is amplified by the relentless pace of technological evolution. Emerging disruptive technologies and novel business models can quickly redefine what constitutes a viable alternative to IBM's current offerings, particularly in areas like cloud computing and software services. For instance, the rise of specialized SaaS providers or open-source alternatives can offer comparable functionalities at lower costs, directly impacting IBM's market share.

IBM's strategic response hinges on its substantial commitment to research and development. In 2023, IBM reported investing $2.7 billion in R&D, a significant portion of which is directed towards pioneering fields such as artificial intelligence, quantum computing, and blockchain. This proactive approach aims to not only mitigate the threat of existing substitutes but also to create new, superior solutions that preemptively address future market needs and potential disruptions.

- AI and Automation: Advancements in AI can substitute for human expertise in areas like data analysis and customer service, potentially reducing demand for certain IBM consulting services.

- Cloud-Native Solutions: The growing prevalence of cloud-native architectures and containerization technologies offers alternatives to traditional on-premises or hybrid cloud solutions that IBM offers.

- Open-Source Software: The increasing maturity and adoption of open-source alternatives in areas like databases, operating systems, and middleware can present a cost-effective substitute for proprietary IBM software.

- Blockchain and Distributed Ledgers: For specific transaction and data management needs, blockchain technology can offer a decentralized and potentially more efficient substitute for traditional centralized systems.

The threat of substitutes for IBM is multifaceted, encompassing public cloud services, open-source software, in-house solutions by large enterprises, niche providers, and generic off-the-shelf products. These alternatives challenge IBM's revenue streams by offering scalability, cost-effectiveness, and tailored functionalities that can be more appealing to certain market segments.

Public cloud providers like AWS and Azure are significant substitutes for IBM's on-premise hardware, with the global cloud market projected to exceed $1.3 trillion in 2024. Similarly, the growing maturity of open-source software, especially in AI, allows companies to reduce licensing fees and gain flexibility.

Large enterprises increasingly develop in-house capabilities, bypassing third-party vendors, while niche providers offer specialized solutions that can outperform IBM's broader offerings. The trend towards open-source and customizable platforms further empowers businesses to avoid vendor lock-in.

Generic software and off-the-shelf solutions, particularly appealing to SMBs, offer lower costs and quicker implementation. The SaaS market's projected growth beyond $200 billion in 2024 highlights this shift towards readily available solutions.

| Substitute Category | Impact on IBM | Key Drivers | Illustrative Data Point (2024 Projection) |

|---|---|---|---|

| Public Cloud Services | Hardware and software revenue | Scalability, flexibility, pay-as-you-go | Global Cloud Market: >$1.3 trillion |

| Open-Source Software | Software licensing and support revenue | Cost savings, customization, community support | Increasing adoption in AI frameworks |

| In-House Enterprise Solutions | Consulting and managed services revenue | Specific control, unique requirements | Major financial institutions building proprietary platforms |

| Niche/Specialized Providers | Market share in specific segments | Deep expertise, tailored features | Advanced cybersecurity analytics firms |

| Generic Off-the-Shelf Software | Revenue from complex enterprise solutions | Lower cost, faster deployment, ease of use | SaaS Market: >$200 billion |

Entrants Threaten

The technology and consulting sector, particularly for enterprise-level solutions, demands significant upfront capital. Companies need to invest heavily in research and development to stay competitive, build robust infrastructure such as data centers, and establish a global presence to serve diverse clients. For instance, major cloud providers like Amazon Web Services (AWS) and Microsoft Azure have invested billions of dollars in their infrastructure, creating a high barrier to entry for new players. In 2024, the global IT services market was valued at over $1.3 trillion, underscoring the scale of investment required to even enter this space.

IBM benefits from a deeply ingrained brand reputation built over decades, fostering significant customer loyalty, particularly among large enterprises and government clients. This long-standing trust makes it incredibly difficult for new entrants to gain traction. For instance, IBM's revenue in 2024 was reported at $62.0 billion, a testament to its sustained market presence and client commitment, which new competitors would struggle to replicate.

Incumbent tech giants like IBM leverage significant economies of scale across their operations, from chip manufacturing to cloud infrastructure. This scale allows for lower per-unit costs in production and service delivery, a hurdle new entrants must overcome. For example, in 2024, IBM's substantial investments in advanced semiconductor fabrication facilities provide a cost advantage that smaller competitors cannot easily replicate.

Furthermore, IBM benefits from an established experience curve, meaning they've refined their processes and product development over decades. This accumulated knowledge translates into greater efficiency and potentially lower pricing strategies, making it challenging for newcomers to compete on cost and quality without significant upfront investment and time.

Intellectual Property and Proprietary Technologies

IBM's extensive intellectual property, including thousands of patents and proprietary technologies, acts as a significant deterrent to new entrants. For instance, its advancements in AI, exemplified by the Watsonx platform, require substantial R&D investment for any competitor to replicate.

This deep well of innovation creates formidable barriers. New companies would face the daunting task of either developing comparable technologies from scratch, a costly and time-consuming endeavor, or negotiating licensing agreements, which often come with significant financial obligations.

- IBM's R&D spending in 2023 reached $7.5 billion, highlighting the continuous investment in proprietary technology.

- The company holds over 150,000 patents globally, underscoring the breadth of its protected innovations.

- Licensing IBM's advanced AI or hybrid cloud solutions would necessitate substantial upfront and ongoing fees, increasing the cost of market entry.

Access to Distribution Channels and Global Reach

Newcomers face significant hurdles in establishing robust distribution channels and achieving the global reach that incumbent players like IBM already possess. IBM's established sales force, deep consulting capabilities, and vast partner ecosystem create a formidable barrier, making it exceptionally difficult for new entrants to effectively access and serve the broad enterprise market. For instance, IBM's global services segment, which leverages its extensive channel network, generated approximately $15.8 billion in revenue in 2023, highlighting the scale and reach that new competitors must overcome.

Consider the following points regarding this threat:

- Established Partnerships: IBM's long-standing relationships with technology providers and resellers offer preferential access and terms, which are hard for new entrants to replicate.

- Brand Loyalty and Trust: Enterprises often rely on established vendors like IBM for critical infrastructure and software due to a history of trust and proven performance, making it challenging for new entrants to gain initial traction.

- Economies of Scale in Distribution: IBM's sheer volume of sales and service delivery allows for greater efficiency and lower per-unit costs in its distribution efforts, a significant advantage over smaller, newer companies.

The threat of new entrants for IBM is relatively low due to substantial capital requirements for R&D, infrastructure, and global reach, as seen in the over $1.3 trillion global IT services market in 2024. Decades of brand building and customer loyalty, evidenced by IBM's $62.0 billion revenue in 2024, create significant hurdles for newcomers. Furthermore, IBM's extensive patent portfolio, with over 150,000 global patents, and substantial R&D spending, like the $7.5 billion in 2023, act as formidable barriers to entry.

| Barrier Type | IBM's Position | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Billions invested in R&D and infrastructure | High initial investment needed |

| Brand Loyalty & Reputation | Decades of trust, $62.0B revenue (2024) | Difficult to gain initial traction |

| Intellectual Property | 150,000+ patents, $7.5B R&D (2023) | Costly to replicate or license |

| Economies of Scale | Lower per-unit costs in production/delivery | Challenging to compete on price |

| Distribution Channels | Vast global sales and partner ecosystem | Limited market access for newcomers |

Porter's Five Forces Analysis Data Sources

Our IBM Porter's Five Forces analysis leverages a comprehensive suite of data, including IBM's own financial reports and investor presentations, alongside industry-specific market research from firms like Gartner and IDC, to provide a robust understanding of the competitive landscape.