IBM PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IBM Bundle

Unlock IBM's strategic landscape with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping its future. Equip yourself with actionable intelligence to navigate the complexities of the global market. Purchase the full version now for an immediate competitive advantage.

Political factors

IBM navigates a complex web of global regulations, from data privacy mandates like the EU's GDPR to evolving AI governance frameworks. In 2024, the company continues to invest heavily in compliance to ensure its operations and product development, particularly in areas like hybrid cloud and AI, meet diverse national standards.

Compliance is not just a legal necessity but a strategic imperative, impacting IBM's market access and reputation. Failure to adhere to these often-changing rules can lead to significant fines and operational disruptions. For instance, ongoing discussions around AI ethics and data usage in 2024 highlight the need for proactive regulatory engagement.

Furthermore, geopolitical shifts and trade policies present ongoing challenges. IBM's global supply chain and market strategies are directly influenced by international relations, requiring constant adaptation to trade agreements and potential sanctions, particularly as technology becomes a focal point in global competition.

IBM holds a substantial position within government and public sector markets, offering a range of technology and consulting solutions. This area is directly shaped by government spending priorities, budget allocations, and evolving procurement policies, all of which can shift with political cycles and economic climates.

For instance, in the United States, federal IT spending was projected to reach $141 billion in 2024, a figure that directly impacts companies like IBM that serve this sector. Securing and retaining these lucrative government contracts necessitates a deep understanding of intricate bidding procedures and strict adherence to regulatory standards.

Global geopolitical tensions and evolving trade policies present significant challenges for IBM. The ongoing trade disputes, particularly between major economic blocs, can disrupt IBM's intricate international supply chains and limit its access to key markets. For example, the U.S.-China trade friction has impacted technology sectors, potentially affecting IBM's hardware and software sales in those regions.

IBM must remain agile in adapting to shifting trade agreements and potential new restrictions. These changes can directly influence the cost of doing business, from sourcing components to delivering services. Fluctuating tariff policies, like those seen in recent years impacting various goods, can also influence client spending behavior and their willingness to commit to large technology investments, creating uncertainty in demand.

Cybersecurity and National Security Priorities

Governments worldwide are escalating cybersecurity to a paramount national security concern, driving a surge in stringent regulations and a heightened demand for advanced security solutions. This trend directly shapes IBM's strategic imperatives, requiring its cybersecurity offerings to be meticulously aligned with national defense blueprints and critical infrastructure safeguarding efforts. For instance, the U.S. Department of Defense's Cybersecurity Strategy continues to emphasize zero-trust architectures, a domain where IBM actively invests and develops solutions.

IBM, as a significant player in the cybersecurity landscape, must navigate this evolving political terrain by ensuring its products and services not only meet but anticipate these national security requirements. The company's commitment to securing critical national infrastructure, such as power grids and financial systems, positions it as a key partner for governments. IBM's 2024 cybersecurity investments, for example, are heavily focused on AI-driven threat detection and response, directly addressing government mandates for more proactive defense mechanisms.

- Increased Government Spending: Global government spending on cybersecurity is projected to reach over $150 billion in 2024, a significant portion of which will target critical infrastructure protection.

- Regulatory Compliance: IBM must adhere to evolving data protection and cybersecurity mandates, such as the EU's NIS2 Directive, which imposes stricter security obligations on critical entities.

- National Security Partnerships: IBM actively collaborates with national governments on initiatives like the Cybersecurity and Infrastructure Security Agency's (CISA) programs to enhance the resilience of U.S. critical infrastructure.

Political Will for Sustainability and Digital Transformation

Governments worldwide are increasingly prioritizing sustainability and digital transformation, directly benefiting IBM. This political will translates into significant opportunities for IBM's core offerings, including hybrid cloud, AI, and consulting services, as public sector entities seek to modernize and achieve ambitious environmental goals. For instance, the European Union's Green Deal, aiming for climate neutrality by 2050, and the United States' Bipartisan Infrastructure Law, which allocates substantial funds for digital modernization and climate resilience, underscore this trend.

These governmental initiatives create a strong demand for IBM's solutions. Governments are actively investing in areas like sustainable high-performance computing to manage vast datasets for climate modeling and AI-powered automation to optimize resource usage and reduce emissions in public services. IBM's expertise in these domains positions it to secure contracts supporting national digital infrastructure upgrades and environmental targets.

- Increased government spending on digital infrastructure: Many nations are earmarking significant budgets for digital transformation projects, with the global government spending on IT expected to reach over $600 billion in 2024.

- Focus on ESG (Environmental, Social, and Governance) initiatives: Political pressure and regulatory frameworks are pushing public sector organizations to adopt more sustainable practices, driving demand for IBM's green IT solutions and consulting.

- AI adoption in public services: Governments are exploring AI for efficiency gains, from managing smart cities to improving healthcare delivery, creating a market for IBM's AI and automation platforms.

Political factors significantly influence IBM's operations through government spending, regulatory landscapes, and international relations. The company's substantial engagement with public sector clients means its revenue is directly tied to government budget allocations and procurement policies, which can fluctuate with political cycles. For instance, the projected $141 billion in U.S. federal IT spending for 2024 highlights the importance of these contracts.

Navigating diverse global regulations, from data privacy to AI governance, remains a key political challenge, requiring continuous investment in compliance. Geopolitical tensions and trade policies also impact IBM's supply chains and market access, demanding constant adaptation to international agreements and potential sanctions, as seen in U.S.-China trade friction.

Governments' increasing focus on cybersecurity as a national security imperative drives demand for IBM's solutions, aligning with initiatives like zero-trust architectures. Similarly, political will for sustainability and digital transformation creates opportunities for IBM's hybrid cloud and AI offerings, supported by initiatives like the EU's Green Deal and the U.S. Bipartisan Infrastructure Law.

| Area | 2024/2025 Trend | Impact on IBM |

|---|---|---|

| Government IT Spending | Projected $141B (US Federal IT, 2024) | Direct revenue driver for IBM's public sector business. |

| Cybersecurity Regulations | Increasingly stringent (e.g., NIS2 Directive) | Drives demand for IBM's security solutions; requires compliance investment. |

| Digital Transformation Initiatives | Global focus (e.g., EU Green Deal, US Infrastructure Law) | Creates opportunities for IBM's cloud, AI, and consulting services. |

| Geopolitical Tensions | Ongoing, impacting trade and supply chains | Requires strategic adaptation for market access and operational efficiency. |

What is included in the product

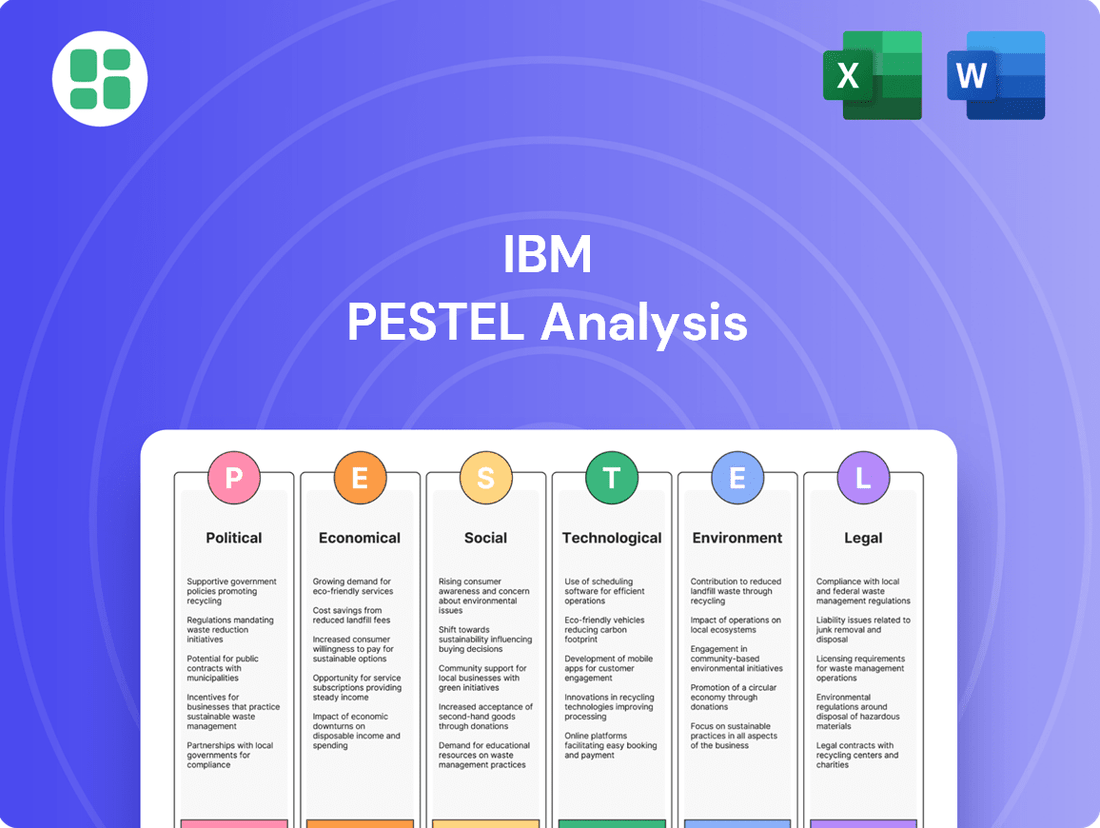

This IBM PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting IBM across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

IBM's revenue is closely tied to the health of the global economy. In 2024, projections for global GDP growth are around 2.7%, according to the World Bank, a slight slowdown from previous years. This environment can influence client spending on IT infrastructure and digital transformation initiatives, directly impacting IBM's software, consulting, and hardware businesses.

A robust economic climate typically spurs greater investment in technology, which benefits IBM's core offerings. However, a potential economic slowdown or recession in 2024-2025 could lead to reduced discretionary IT budgets. This would likely translate to slower growth or even declines in IBM's consulting revenues as clients postpone or scale back projects.

Rising inflation in 2024 and projected into 2025 can directly increase IBM's operational expenses. For instance, the cost of essential components and skilled labor can climb, squeezing profit margins if not effectively passed on to customers. This necessitates agile pricing models.

Interest rate shifts significantly impact IBM's financial landscape. Higher rates in 2024 and potentially continuing into 2025 increase borrowing costs for IBM's capital expenditures and can deter clients from financing large technology investments, affecting demand for IBM's solutions.

Currency exchange rate volatility significantly impacts IBM's global financial results. As a multinational, IBM's reported revenues from international markets can be affected when converted back to U.S. dollars. For instance, a stronger dollar in 2024 could reduce the reported dollar value of sales made in euros or other foreign currencies.

This currency fluctuation presents a challenge for IBM's revenue and profit forecasting. The company actively manages these risks through financial hedging instruments and by adjusting pricing strategies in different regions to offset adverse currency movements, aiming to maintain stable financial performance despite global economic shifts.

Investment Trends in AI and Hybrid Cloud

Businesses are significantly increasing their investments in artificial intelligence (AI) and hybrid cloud, directly boosting demand for IBM's core products and services. This trend is a major tailwind for IBM, as its strategic focus on these areas positions it to capitalize on this growing market. For instance, IDC projected worldwide spending on AI systems to reach $500 billion in 2024, a substantial increase from previous years.

IBM's strategy is intricately linked to these investment trends, utilizing its deep expertise in AI and hybrid cloud to drive expansion within its software and consulting divisions. The company anticipates that these AI investments will translate into tangible financial benefits within the next one to two years. This forward-looking approach is supported by market data, with Gartner forecasting that AI will contribute $1.8 trillion to global GDP in 2024.

- AI and Hybrid Cloud Investment Surge: Businesses globally are channeling substantial capital into AI and hybrid cloud infrastructure, creating a robust demand environment for companies like IBM.

- IBM's Strategic Alignment: IBM's business model and growth strategy are directly aligned with these burgeoning technology trends, leveraging its strengths in AI and hybrid cloud solutions.

- Projected Financial Impact: IBM executives anticipate that their strategic investments in AI will generate material financial returns within the next 12 to 24 months.

- Market Growth Indicators: Industry forecasts, such as IDC's prediction of $500 billion in worldwide AI spending for 2024, underscore the significant market opportunities.

Competition and Market Pricing Pressures

The technology sector, especially in cloud computing and artificial intelligence, is intensely competitive, directly impacting IBM's pricing strategies and its standing in the market. Companies like Microsoft Azure, Amazon Web Services, and Google Cloud are formidable rivals, driving down prices and demanding constant innovation. IBM's ability to maintain its market share hinges on its capacity to consistently introduce new and distinct products and services.

To navigate these pressures and sustain its competitive advantage, IBM is actively pursuing a strategy of continuous innovation and differentiation. This involves not only developing proprietary technologies but also making strategic acquisitions to bolster its portfolio and expand its reach. For instance, IBM's acquisition of Red Hat in 2019 for $34 billion was a significant move aimed at strengthening its hybrid cloud capabilities, a key battleground in the current tech landscape.

IBM's focus is increasingly shifting towards high-value, high-margin solutions, particularly in areas like hybrid cloud, AI, and consulting services. This strategic pivot aims to move away from commoditized offerings and concentrate on areas where it can command premium pricing and deliver greater value to its clients. In the first quarter of 2024, IBM reported revenue growth driven by its software segment, which includes its hybrid cloud platform, indicating the success of this strategy.

- Intense Competition: IBM faces significant competition from major cloud providers like AWS, Azure, and Google Cloud, pressuring its pricing and market share in cloud and AI services.

- Innovation Imperative: Continuous innovation and differentiation are crucial for IBM to maintain its edge against tech giants and specialized vendors in rapidly evolving markets.

- Strategic Acquisitions: IBM has utilized strategic acquisitions, such as Red Hat for $34 billion in 2019, to enhance its hybrid cloud offerings and competitive positioning.

- Focus on High-Value Solutions: The company is prioritizing high-margin offerings in hybrid cloud, AI, and consulting to improve profitability and market standing amidst pricing pressures.

Economic factors significantly shape IBM's performance, with global GDP growth projections around 2.7% for 2024, a slight slowdown impacting client IT spending. Inflation in 2024 and 2025 can increase IBM's operational costs, necessitating agile pricing. Higher interest rates in 2024-2025 also raise borrowing costs and can deter client financing for technology investments.

Currency volatility affects IBM's reported international revenues; for instance, a stronger dollar in 2024 reduces the value of sales made in foreign currencies. Businesses are heavily investing in AI and hybrid cloud, areas where IBM strategically focuses, with IDC projecting worldwide AI spending to reach $500 billion in 2024.

| Economic Factor | 2024/2025 Impact on IBM | Supporting Data/Trend |

|---|---|---|

| Global GDP Growth | Slight slowdown may reduce IT spending. | World Bank projects 2.7% global GDP growth for 2024. |

| Inflation | Increases operational costs, potentially squeezing margins. | Persistent inflation in 2024-2025 drives up component and labor costs. |

| Interest Rates | Higher borrowing costs and can deter client investment. | Interest rates remained elevated in 2024, impacting capital expenditure financing. |

| Currency Exchange Rates | Fluctuations impact reported international revenues. | A strong US dollar in 2024 reduced the dollar value of foreign sales. |

| Technology Investment (AI/Hybrid Cloud) | Drives demand for IBM's core offerings. | IDC forecasts $500 billion in worldwide AI spending for 2024. |

Full Version Awaits

IBM PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This IBM PESTLE Analysis provides a comprehensive overview of the external factors influencing the company's operations.

The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying.

Sociological factors

IBM faces evolving workforce demographics, with the retirement of seasoned professionals creating knowledge transfer challenges while new generations enter with different expectations. This shift necessitates adapting management styles and career development paths.

A significant skills gap persists in areas like artificial intelligence and cloud computing, critical for IBM's future growth. For instance, a 2024 LinkedIn report highlighted that demand for AI skills outpaced supply by a substantial margin globally.

IBM's SkillsBuild initiative directly tackles this by providing free digital skills training, aiming to reskill and upskill individuals for in-demand tech roles. By mid-2024, SkillsBuild had already reached millions of learners worldwide, demonstrating IBM's commitment to bridging this gap.

The widespread adoption of hybrid and remote work, a trend significantly amplified by the COVID-19 pandemic, directly influences IBM's internal operations and its client-facing technology solutions. This shift necessitates new approaches to team management, digital collaboration tools, and cybersecurity.

Employee expectations have dramatically evolved, with a strong emphasis now placed on work-life balance, flexible scheduling, and a positive, inclusive workplace culture. For instance, a 2024 survey indicated that over 70% of employees would consider leaving a job that didn't offer flexibility. IBM's ability to attract and retain top talent hinges on its responsiveness to these demands.

IBM's strategic response includes investing in its own hybrid cloud infrastructure and developing advanced collaboration platforms like IBM watsonx. These offerings are designed to support clients navigating similar workforce transformations, enabling seamless remote operations and enhanced employee engagement. The company's own internal policies are also being recalibrated to foster a culture that supports these new work paradigms.

Public concern over data privacy and the ethical implications of artificial intelligence significantly shapes how consumers and businesses engage with technology. Surveys in 2024 indicate a growing demand for transparency in data handling, with a majority of consumers expressing willingness to switch providers if their privacy is compromised. This trend directly impacts technology adoption rates and the perceived value of tech services.

IBM's strategic focus on building trust through transparency and ethical AI development is crucial for client confidence. By embedding ethical considerations into every stage of AI creation, including explainability and bias reduction in its AI solutions, IBM aims to address these societal concerns. This proactive approach is vital for maintaining market leadership in an era of heightened scrutiny.

Digital Literacy and Adoption Rates

The increasing digital literacy globally directly impacts IBM's market. As more people and businesses become comfortable with technology, they are more likely to adopt IBM's advanced software and cloud solutions. For instance, in 2024, a significant portion of the workforce across developed nations demonstrated a foundational understanding of digital tools, paving the way for more sophisticated enterprise solutions.

The speed at which businesses integrate new digital technologies is crucial. Companies with higher digital adoption rates are prime candidates for IBM's AI, hybrid cloud, and consulting services. Reports from late 2024 indicated a surge in cloud migration projects, with many enterprises actively seeking partners like IBM to manage this transition effectively.

- Digital Literacy Growth: In 2024, over 75% of the global workforce reported using digital tools daily, a figure expected to climb as digital education initiatives expand.

- Cloud Adoption Surge: By the end of 2024, an estimated 60% of businesses had adopted some form of cloud computing, with a strong trend towards hybrid cloud environments.

- AI Integration: The adoption of AI tools in business operations saw a 20% year-over-year increase in 2024, creating a larger market for IBM's AI-powered solutions.

Societal Impact of AI and Automation

The rapid integration of AI and automation into various sectors presents significant societal shifts, primarily concerning job displacement and the evolving nature of work. As these technologies advance, there's a growing emphasis on the necessity for workforce reskilling and upskilling to adapt to new economic landscapes. For instance, reports in late 2024 and early 2025 indicate a growing demand for roles focused on AI ethics, data science, and human-AI collaboration, while traditional roles in manufacturing and data entry face potential decline.

IBM is proactively addressing these societal impacts by championing a 'people-powered AI' philosophy. This approach prioritizes developing AI solutions that augment human abilities and enhance productivity, rather than aiming for outright job replacement. The company's commitment is reflected in its significant investments in training programs and partnerships designed to equip individuals with the skills needed for the AI-driven economy. By 2025, IBM aims to have trained millions globally in AI and data science competencies.

Key initiatives IBM is undertaking include:

- Workforce Reskilling Programs: Offering accessible training modules and certifications in AI, cloud computing, and cybersecurity, with a focus on practical application and career readiness.

- Promoting Human-AI Collaboration: Developing AI tools that assist professionals in fields like healthcare, finance, and customer service, enabling them to perform their jobs more effectively.

- Ethical AI Development: Engaging in public discourse and research to ensure AI technologies are developed and deployed responsibly, considering their broader societal implications.

- Partnerships for Skill Development: Collaborating with educational institutions and governments to create curricula and pathways for future-proof careers.

Sociological factors significantly influence IBM's operating environment, particularly concerning the evolving workforce and public perception of technology. The increasing demand for flexible work arrangements, with over 70% of employees in 2024 considering leaving jobs without flexibility, directly impacts IBM's talent acquisition and retention strategies. Furthermore, growing public concern over data privacy and AI ethics, with a majority of consumers in 2024 willing to switch providers over privacy issues, necessitates IBM's commitment to transparency and responsible AI development.

Technological factors

IBM's strategic direction is deeply intertwined with advancements in Artificial Intelligence, particularly generative AI. This technology is a key enabler for automating complex data analysis and boosting operational efficiency across various sectors. IBM's commitment is evident in its substantial investments in AI R&D, highlighted by its watsonx platform and specialized AI accelerators designed for mainframe environments.

The company's emphasis on AI is geared towards delivering measurable financial benefits to its clientele and fueling IBM's own expansion. For instance, IBM reported that its AI business revenue grew significantly in 2023, with generative AI solutions playing a crucial role in this growth, demonstrating the tangible impact of these technological factors on IBM's financial performance.

Hybrid cloud computing continues to be a cornerstone for IBM, allowing clients to seamlessly blend public, private, and on-premises IT resources. This integration is vital for businesses seeking agility and control over their digital infrastructure.

IBM's strategic acquisition of Red Hat for $34 billion in 2019 significantly bolstered its hybrid cloud capabilities, with ongoing investments in open hybrid cloud solutions like Red Hat OpenShift. This focus is critical for maintaining IBM's edge in a competitive market where flexibility and scalability are paramount.

The market's persistent demand for adaptable, secure, and scalable cloud platforms directly fuels growth in IBM's software and infrastructure divisions. For instance, IBM's software revenue saw a notable increase in recent quarters, driven by its hybrid cloud portfolio, reflecting strong client adoption.

IBM is a leader in quantum computing, consistently pushing the boundaries with new quantum processors and developing algorithms aimed at unlocking business value. Their commitment is evident in their ongoing research and development efforts, positioning them to capitalize on future market opportunities.

While quantum computing is still in its nascent stages, its potential to transform industries like finance, materials science, and AI is immense. IBM's early investment and strategic focus on commercialization place them in a strong position to benefit from this technological revolution.

As of early 2024, IBM continues to expand its quantum ecosystem, offering cloud access to its quantum systems and fostering partnerships to accelerate adoption. The company’s roadmap includes increasing qubit counts and improving error correction, crucial steps towards practical quantum advantage.

Cybersecurity Threat Landscape and Solutions

The cybersecurity threat landscape is evolving rapidly, with increasingly sophisticated attacks like ransomware and identity-based threats demanding constant innovation in defense. IBM's X-Force research actively tracks these trends, informing the development of its security solutions designed to protect client data and systems. For instance, IBM reported a 13% increase in the average cost of a data breach globally in 2024, reaching $4.73 million, highlighting the critical need for robust security measures.

IBM is leveraging artificial intelligence and automation as core components of its strategy to fortify identity security and enhance resilience against cyber breaches. These technologies enable faster detection of anomalies and more proactive defense mechanisms. In 2024, IBM's security services helped organizations manage over 1.5 trillion security events, demonstrating the scale of their protective efforts.

- Escalating Sophistication: Cyber threats, particularly ransomware and identity-based attacks, are becoming more advanced, necessitating continuous security innovation.

- IBM's X-Force: IBM's dedicated research arm provides crucial intelligence on emerging threats, underpinning its security product development.

- AI and Automation: The company utilizes AI and automation to strengthen identity security and improve overall resilience against potential breaches.

- Impact of Breaches: The global average cost of a data breach reached $4.73 million in 2024, a 13% increase, underscoring the financial imperative for effective cybersecurity.

Emergence of Agentic AI and Automation

The rise of agentic AI, systems that can make independent decisions and handle intricate tasks, is a significant technological shift IBM is actively adopting. This advancement is driving greater automation throughout IBM's operations, impacting areas like human resources, IT support, and the efficiency of its supply chain. For instance, IBM's continued investment in AI research and development, with a projected spend of $25 billion on AI and cloud initiatives through 2026, underscores its commitment to leveraging this technology.

IBM is embedding AI into its core business processes to boost productivity and realize substantial cost reductions. This integration is evident in its AI-powered software solutions, which aim to streamline workflows and enhance decision-making capabilities for clients. By automating repetitive tasks and providing intelligent insights, IBM anticipates significant operational efficiencies, contributing to its overall financial performance and competitive edge in the market.

- Agentic AI Development: IBM is investing heavily in AI that can autonomously manage complex tasks and make decisions, enhancing operational capabilities.

- Automation Across Operations: This technology enables increased automation in HR, IT support, and supply chain management, improving efficiency.

- Productivity and Cost Savings: IBM's strategic integration of AI across its workflows is designed to drive productivity gains and achieve notable cost reductions.

- AI Integration in Software: The company is embedding AI into its software offerings to provide clients with smarter tools for workflow optimization and better decision-making.

IBM's technological trajectory is heavily influenced by the rapid advancements in artificial intelligence, particularly generative AI, which is central to automating complex data analysis and enhancing operational efficiency across industries. The company's significant R&D investments in AI, exemplified by its watsonx platform and specialized AI accelerators, underscore this focus.

IBM's AI business revenue saw substantial growth in 2023, with generative AI solutions being a key driver, demonstrating the direct financial impact of these technological factors.

The company's strategic emphasis on hybrid cloud computing, bolstered by its $34 billion acquisition of Red Hat in 2019, continues to be a critical differentiator, enabling clients to manage diverse IT resources seamlessly. This focus on open hybrid cloud solutions, like Red Hat OpenShift, is vital for IBM's competitive positioning in a market that prioritizes agility and scalability.

IBM's software and infrastructure divisions are experiencing growth fueled by the market's demand for flexible, secure, and scalable cloud platforms, with its hybrid cloud portfolio showing strong client adoption and contributing to notable revenue increases in recent quarters.

IBM is a recognized leader in quantum computing, actively developing new processors and algorithms to unlock business value, positioning itself to benefit from the transformative potential of this nascent technology across sectors like finance and materials science.

As of early 2024, IBM is expanding its quantum ecosystem through cloud access and partnerships, with ongoing development focused on increasing qubit counts and improving error correction to achieve practical quantum advantage.

The evolving cybersecurity landscape, marked by increasingly sophisticated threats like ransomware and identity-based attacks, necessitates continuous innovation in defense, a trend actively tracked by IBM's X-Force research to inform its security solutions.

The global average cost of a data breach rose by 13% in 2024 to $4.73 million, highlighting the critical importance of robust cybersecurity measures, which IBM addresses through AI and automation for enhanced identity security and breach resilience.

IBM is integrating agentic AI, systems capable of independent decision-making, into its operations to drive greater automation in areas such as HR, IT support, and supply chain management, aiming for significant productivity gains and cost reductions.

The company's projected spend of $25 billion on AI and cloud initiatives through 2026 signals a deep commitment to leveraging AI for operational efficiency and competitive advantage, embedding these capabilities into its software solutions to optimize client workflows.

| Technological Factor | IBM's Strategy/Investment | Market Impact/Data Point |

|---|---|---|

| Generative AI | watsonx platform, AI accelerators, R&D investment | AI business revenue grew significantly in 2023 |

| Hybrid Cloud | Red Hat acquisition ($34B in 2019), Red Hat OpenShift | Software revenue increase driven by hybrid cloud portfolio |

| Quantum Computing | Processor development, algorithm research, cloud access | Potential to transform finance, materials science, AI |

| Cybersecurity | X-Force research, AI/automation for identity security | Global average data breach cost $4.73M in 2024 (+13%) |

| Agentic AI | Integration into HR, IT support, supply chain | Projected AI/cloud spend of $25B through 2026 |

Legal factors

IBM navigates a complex web of global data protection laws like the EU's GDPR and California's CCPA. These regulations mandate strict data handling, consent, and security measures. Failure to comply can result in substantial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

As a significant technology company, IBM operates under stringent antitrust and competition laws across the globe. These regulations aim to prevent monopolistic practices and ensure a level playing field for all market participants. For instance, in 2023, the global regulatory landscape saw increased scrutiny on large tech mergers, with many jurisdictions actively reviewing deals for potential anti-competitive effects.

IBM's strategic moves, including acquisitions like the proposed $6.4 billion purchase of HashiCorp announced in April 2024, are subject to thorough review by antitrust authorities. Regulators in the US, Europe, and other key markets will assess whether this consolidation could harm competition in cloud computing and software infrastructure, potentially impacting pricing and innovation.

Navigating this complex legal environment is crucial for IBM's growth strategy. The company must demonstrate to regulators that its business practices and any proposed acquisitions will not stifle competition or disadvantage consumers. This often involves providing detailed information and potentially agreeing to certain conditions to gain regulatory approval, a process that can significantly influence the timeline and structure of IBM's expansion efforts.

IBM's extensive portfolio of patents, trademarks, and copyrights is crucial for its competitive edge. As a leader in patent generation, especially in emerging fields like AI, cloud, and quantum computing, IBM actively seeks robust protection. For instance, in 2023, IBM continued its strong patent filing activity, reflecting its ongoing innovation in these key areas.

The company faces significant legal risks from intellectual property infringement litigation, necessitating constant vigilance and enforcement. Such disputes can lead to substantial financial penalties and reputational damage, making proactive management of its IP assets a top priority for IBM's legal and business strategies.

Cybersecurity Laws and Incident Reporting

Governments worldwide are strengthening cybersecurity regulations, imposing mandatory incident reporting for data breaches. This trend directly affects IBM and its clientele, necessitating robust compliance measures. IBM's offerings must facilitate client adherence to these evolving legal frameworks, while IBM's own operations must also meet these stringent standards.

The financial repercussions of security lapses are substantial. For instance, IBM's 2024 Cost of a Data Breach Report indicated that the average global cost of a data breach reached $4.45 million in 2023, a figure that underscores the critical need for effective cybersecurity. Proper access controls, particularly for artificial intelligence systems, are paramount in mitigating these risks.

- Increased Regulatory Scrutiny: Expect more stringent data protection laws and mandatory breach notifications across major markets.

- Compliance as a Service: IBM's cybersecurity solutions are increasingly positioned to help clients navigate complex legal landscapes and reporting obligations.

- Operational Impact: IBM's internal cybersecurity posture is under constant review to align with global regulatory expectations and protect its own vast data assets.

- AI Governance: The report highlights the growing importance of secure AI implementation, with breaches involving AI costing an average of $5.58 million.

Ethical AI Guidelines and Regulations

Governments worldwide are increasingly focused on establishing ethical AI guidelines. For instance, the European Union's AI Act, expected to be fully implemented by 2025, categorizes AI systems by risk level, imposing stricter requirements on high-risk applications. IBM is a prominent advocate for responsible AI, emphasizing principles such as fairness, explainability, and privacy in its AI development. This proactive stance is vital for IBM, as compliance with these emerging regulations, like those being debated in the US Congress throughout 2024, directly impacts the market acceptance and deployment of its AI technologies.

IBM's commitment to ethical AI is demonstrated through initiatives like its Trustworthy AI framework. This framework guides the development of AI systems that are:

- Fair: Ensuring AI systems do not exhibit bias.

- Reliable and Safe: Guaranteeing AI systems perform as intended and do not pose undue risks.

- Transparent: Making AI systems understandable in their decision-making processes.

- Accountable: Establishing clear lines of responsibility for AI system outcomes.

IBM operates within a dynamic legal framework, facing evolving data privacy laws like GDPR and CCPA, which mandate stringent data handling and security. Antitrust regulations are also a significant factor, with global scrutiny on tech mergers, such as IBM's proposed acquisition of HashiCorp in April 2024, impacting competitive landscapes.

Intellectual property law is paramount, with IBM's extensive patent portfolio, particularly in AI and quantum computing, requiring robust protection against infringement. Furthermore, increasing cybersecurity regulations worldwide impose mandatory breach reporting, directly influencing IBM's offerings and internal practices, with data breaches costing an average of $4.45 million in 2023.

The rise of ethical AI guidelines, exemplified by the EU's AI Act and ongoing US legislative discussions in 2024, necessitates responsible AI development. IBM's commitment to trustworthy AI, focusing on fairness, reliability, transparency, and accountability, is crucial for market acceptance of its AI technologies.

| Legal Area | Key Regulations/Trends | IBM Impact/Action | Relevant Data/Examples |

|---|---|---|---|

| Data Privacy | GDPR, CCPA | Mandatory data handling & security compliance | GDPR fines up to 4% global revenue |

| Antitrust & Competition | Global merger reviews | Scrutiny on acquisitions (e.g., HashiCorp deal, April 2024) | Increased review of tech mergers in 2023 |

| Intellectual Property | Patent, trademark, copyright law | Protecting AI, cloud, quantum patents | Strong patent filing activity in 2023 |

| Cybersecurity | Mandatory breach reporting | Ensuring client compliance & internal security | 2023 data breach cost: $4.45 million (IBM report) |

| AI Governance | Ethical AI guidelines (EU AI Act, US discussions) | Developing trustworthy AI (fair, reliable, transparent, accountable) | EU AI Act implementation by 2025; AI breaches cost $5.58 million |

Environmental factors

IBM is making significant strides in climate action, targeting a 65% reduction in greenhouse gas emissions from 2010 levels by 2025 and aiming for net-zero operations by 2030. This commitment drives investments in energy efficiency, particularly in data centers, and a substantial increase in renewable energy procurement.

The escalating demand for cloud computing and artificial intelligence processing directly translates into substantial energy consumption by data centers. IBM recognizes this environmental challenge, actively pursuing enhanced energy efficiency within its data center operations.

IBM is leveraging AI-driven automation and sophisticated resource management tools to optimize power usage and minimize its environmental footprint. The company openly acknowledges the significant energy and water requirements inherent in training and operating advanced AI models.

IBM faces the significant environmental challenge of managing e-waste generated by its hardware products and client equipment. This includes everything from old servers to discarded laptops, all requiring responsible disposal and recycling.

The company actively pursues a circular economy model, aiming to keep materials in use for as long as possible. This commitment is reflected in their design processes, which increasingly prioritize sustainability and the potential for product reuse or component recovery.

IBM is also investing in innovative recycling technologies, such as textile-to-textile recycling, to further reduce waste and extract value from end-of-life products. In 2023, the global e-waste generation reached an estimated 62 million metric tons, highlighting the scale of this environmental issue and the importance of corporate responsibility in managing it.

Resource Scarcity and Sustainable Sourcing

Concerns over the availability of critical resources, especially rare earth minerals essential for electronics and increasing water scarcity in many regions, directly impact IBM's supply chain and operational planning. These factors necessitate a strategic focus on securing reliable and ethically sourced materials.

IBM is actively implementing sustainable sourcing policies and setting ambitious targets to minimize its environmental footprint, including significant reductions in water consumption across its global operations. For instance, by the end of 2023, IBM reported a 13% reduction in water withdrawal intensity compared to its 2019 baseline, demonstrating tangible progress.

- Resource Dependency: IBM's reliance on rare earth minerals for its advanced technology products makes it vulnerable to supply disruptions and price volatility.

- Water Management: As of its 2023 Environmental, Social, and Governance (ESG) report, IBM's water conservation efforts have led to a 13% decrease in water withdrawal intensity.

- Sustainable Practices: The company's commitment to sustainable sourcing extends to its procurement processes, aiming for greater transparency and environmental responsibility throughout its value chain.

- Ecosystem Protection: Initiatives like the Jefferson Project at Lake George highlight IBM's dedication to leveraging technology for environmental stewardship and freshwater ecosystem preservation.

Corporate Social Responsibility and Environmental Reporting

Environmental factors are increasingly shaping corporate strategy, with a significant emphasis on Corporate Social Responsibility (CSR) and environmental reporting. Investors, consumers, and regulatory bodies are demanding greater transparency and demonstrable commitment to sustainability from companies like IBM. This trend is driving a proactive approach to environmental stewardship and disclosure.

IBM actively addresses these pressures by publishing detailed sustainability reports, outlining its progress and commitments. The company sets ambitious voluntary environmental goals, encompassing crucial areas such as biodiversity preservation and product recycling initiatives. For instance, in its 2023 sustainability report, IBM highlighted achieving a 95% waste diversion rate for its facilities and a 100% renewable electricity procurement for its global operations. These efforts are vital for maintaining IBM's reputation and meeting the evolving expectations of its diverse stakeholders.

- Investor Scrutiny: ESG (Environmental, Social, and Governance) investing continues to grow, with a significant portion of assets under management now considering these factors. In 2024, ESG funds are projected to reach $30 trillion globally, influencing corporate behavior.

- Consumer Demand: Consumers are increasingly making purchasing decisions based on a company's environmental impact. A 2024 survey indicated that over 60% of consumers are willing to pay more for sustainable products.

- Regulatory Landscape: Governments worldwide are implementing stricter environmental regulations. For example, the EU's Corporate Sustainability Reporting Directive (CSRD) mandates detailed reporting for many companies, setting a precedent for global standards.

- IBM's Commitment: IBM's consistent reporting and goal-setting, such as its 2030 net-zero greenhouse gas emissions target, demonstrate a strategic response to these environmental pressures.

IBM's environmental strategy is deeply intertwined with its operational demands, particularly the energy consumption of its data centers supporting cloud and AI services. The company is actively pursuing energy efficiency and aims for net-zero operations by 2030, with a target of a 65% greenhouse gas reduction from 2010 levels by 2025.

Managing e-waste and resource scarcity, especially rare earth minerals, are critical environmental considerations for IBM. The company is investing in circular economy models and innovative recycling technologies to mitigate these challenges, aligning with a global e-waste generation that reached an estimated 62 million metric tons in 2023.

Growing investor and consumer focus on ESG factors, coupled with stricter environmental regulations like the EU's CSRD, necessitates robust environmental reporting and proactive sustainability initiatives. IBM's commitment to these areas, including achieving a 13% reduction in water withdrawal intensity by the end of 2023, demonstrates a strategic response to these evolving pressures.

| Environmental Factor | IBM's Action/Commitment | Relevant Data/Target |

|---|---|---|

| Greenhouse Gas Emissions | Reducing emissions from operations | 65% reduction from 2010 levels by 2025; Net-zero by 2030 |

| Data Center Energy Consumption | Improving energy efficiency | Ongoing investments in AI-driven optimization |

| E-waste Management | Circular economy principles, recycling | Investing in textile-to-textile recycling technologies |

| Resource Scarcity (Rare Earth Minerals) | Sustainable sourcing policies | Focus on ethical and reliable material procurement |

| Water Scarcity | Water consumption reduction | 13% reduction in water withdrawal intensity (vs. 2019 baseline) by end of 2023 |

| Stakeholder Expectations (ESG) | Transparency and reporting | Published sustainability reports, 95% waste diversion rate (2023) |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws from a comprehensive blend of official government statistics, reputable market research firms, and international economic reports. This ensures that each factor, from political stability to technological advancements, is grounded in verifiable and current information.