Hysan SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hysan Bundle

Hysan's strong retail portfolio and prime Hong Kong locations present significant opportunities, but it also faces intense competition and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Hysan's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hysan's strategic focus on prime locations, particularly its concentrated portfolio in Hong Kong's Lee Gardens area, is a significant strength. This precinct is a dynamic hub, currently undergoing substantial rejuvenation and expansion, which solidifies its status as a premier integrated shopping and commercial district. This prime positioning naturally attracts high foot traffic and ensures strong tenant demand.

Hysan boasts a robustly diversified property portfolio spanning approximately 4.5 million square feet across Hong Kong's office, retail, and residential sectors. This strategic balance across different property types acts as a crucial buffer against sector-specific downturns, enhancing overall stability.

The company's ability to weather market fluctuations is evident in its performance. For example, during the first half of 2024, Hysan experienced a decline in office turnover but simultaneously saw an increase in retail turnover, underscoring the resilience inherent in its diversified holdings.

Hysan's dedication to sustainability is clearly outlined in its 2024 Sustainability Report, highlighting a strategic focus on green building principles. This commitment is further exemplified by the integration of advanced sustainable design in upcoming projects such as Lee Garden Eight, aiming to set new benchmarks in eco-friendly development.

This proactive approach to environmental, social, and governance (ESG) factors positions Hysan favorably within a market increasingly prioritizing sustainability. Such initiatives not only resonate with environmentally aware tenants, potentially boosting occupancy rates, but also contribute to long-term operational cost savings through enhanced energy and resource efficiency.

Proactive Portfolio Rejuvenation and Expansion

Hysan is actively rejuvenating its existing Lee Gardens portfolio while simultaneously pursuing significant new developments. A prime example is the Caroline Hill Road Project, now known as Lee Garden Eight, which is anticipated to be completed in 2026. This strategic expansion is designed to modernize Hysan's assets.

These proactive measures will not only modernize existing properties but also significantly expand the company's gross floor area by nearly 30%. The development includes the creation of an integrated pedestrian walkway system, a crucial element in future-proofing the portfolio against evolving urban and commercial demands.

- Portfolio Enhancement: Hysan is investing in modernizing its Lee Gardens properties.

- Expansion Strategy: The Caroline Hill Road Project (Lee Garden Eight) is a key development targeting a 2026 completion.

- Growth Projection: These initiatives are expected to increase gross floor area by almost 30%.

- Future-Proofing: An integrated pedestrian walkway system is being developed to enhance connectivity and asset value.

Strong Financial Discipline and Liquidity

Hysan demonstrates strong financial discipline, maintaining a robust balance sheet and healthy liquidity. This is further evidenced by its substantial syndicated loan facilities, secured from prominent banking institutions. These facilities provide ample resources for refinancing existing debt and covering working capital requirements, bolstering the company's ability to pursue its long-term growth strategies even amidst economic headwinds.

Key financial strengths include:

- Ample Liquidity: Hysan's commitment to maintaining strong liquidity ensures it can meet its short-term obligations and capitalize on opportunities.

- Robust Balance Sheet: A solid balance sheet provides a stable foundation for operations and future investments.

- Syndicated Loan Facilities: Access to significant loan facilities from leading banks offers financial flexibility and security for ongoing operations and strategic initiatives.

- Financial Resilience: These strengths collectively position Hysan to navigate challenging market conditions effectively and support its long-term development objectives.

Hysan's prime real estate holdings, particularly its concentration in Hong Kong's vibrant Lee Gardens precinct, represent a significant strength. This area is a premier commercial and retail hub, benefiting from high foot traffic and sustained tenant demand, further enhanced by ongoing rejuvenation efforts.

The company maintains a diversified property portfolio across office, retail, and residential sectors, spanning approximately 4.5 million square feet. This diversification provides a buffer against sector-specific downturns, contributing to overall financial stability.

Hysan's financial health is robust, characterized by strong liquidity and a solid balance sheet, supported by substantial syndicated loan facilities. This financial prudence ensures the company can manage its obligations and fund strategic growth initiatives, even during economic uncertainty.

| Metric | Value (as of H1 2024/Latest Available) | Significance |

|---|---|---|

| Gross Floor Area (sq ft) | ~4.5 million | Diversified portfolio across key Hong Kong sectors. |

| Lee Garden Eight Completion | Target 2026 | Significant expansion, increasing GFA by ~30%. |

| Sustainability Focus | Integrated into new developments (e.g., Lee Garden Eight) | Appeals to ESG-conscious tenants and offers long-term operational benefits. |

| Financial Position | Strong liquidity, robust balance sheet, ample syndicated loans | Enables strategic investments and resilience against market volatility. |

What is included in the product

Delivers a strategic overview of Hysan’s internal and external business factors, highlighting its prime real estate portfolio and the competitive landscape.

Offers a clear, actionable framework to identify and address Hysan's strategic challenges and opportunities.

Weaknesses

Hysan's heavy reliance on the Lee Gardens area in Causeway Bay, Hong Kong, presents a substantial geographic concentration risk. This singular focus, while capitalizing on a prime location, leaves the company highly vulnerable to any localized economic slowdowns, political disruptions, or changes in urban development plans that specifically target this district. For instance, while specific 2024/2025 figures are still emerging, historical data shows Hong Kong's retail sales can fluctuate significantly based on these localized factors.

The Hong Kong Grade A office market is grappling with ongoing softness, characterized by ample supply and muted demand, which is exerting considerable pressure on rental rates. This challenging environment has directly impacted Hysan's Lee Gardens office properties.

Hysan's Lee Gardens office portfolio has recorded negative rental reversion rates. This means that rents achieved on lease renewals or new lettings are lower than previous rates, directly affecting the company's overall office revenue and profitability.

The Hong Kong retail sector, despite revitalization efforts, is experiencing ongoing headwinds. Changing consumer habits among both visitors and locals, coupled with a stronger Hong Kong dollar, are impacting performance. This environment can lead to temporary vacancies, particularly when tenant mixes are being updated.

Residential Rental Reversion Negative

Hysan's residential leasing segment experienced a notable challenge in the first half of 2024. Despite an increase in occupancy rates, the average rental reversion for renewals, rent reviews, and new lettings remained negative. This suggests that while demand is present, the market conditions are not allowing for rental price increases, impacting the revenue potential for this segment.

This negative rental reversion is occurring even with a positive inflow of new talent, which typically fuels residential demand. The data indicates a disconnect between rising occupancy and the ability to achieve favorable rental rate adjustments.

- Occupancy Growth: Hysan's residential portfolio saw improved occupancy in H1 2024.

- Negative Rental Reversion: Average rental reversions for renewals, reviews, and new lettings were negative.

- Challenging Market: This points to a difficult environment for residential rental growth.

- Talent Inflows: The trend persists despite increased demand from new talent entering the market.

Fair Value Losses on Investment Properties

Hysan has experienced fair value losses on its investment properties, a direct consequence of a more challenging valuation landscape within the property sector. For instance, in the first half of 2024, the company reported a significant valuation decrease in its investment properties, impacting its overall financial performance.

While these fair value adjustments are non-cash items, they do affect the reported profit and can serve as an indicator of prevailing market sentiment concerning property valuations. This downturn in valuation can influence investor perception and potentially affect the company's book value.

- Fair Value Losses: Hysan recorded notable fair value losses on its investment properties, reflecting a difficult property market.

- Impact on Profit: Although non-cash, these losses directly reduce reported profits.

- Market Sentiment: The losses can signal a broader negative sentiment regarding property asset values.

- Valuation Environment: A challenging valuation environment is a key factor contributing to these reported losses.

Hysan's significant exposure to Causeway Bay creates a considerable geographic concentration risk, making it susceptible to localized economic downturns or changes in urban planning affecting this specific district. The company's office portfolio is facing headwinds from a soft Hong Kong Grade A office market, characterized by oversupply and weak demand, leading to negative rental reversions. This trend is also evident in its residential segment, where despite increased occupancy in H1 2024, average rental reversions remained negative, indicating an inability to raise rents even with growing demand from new talent inflows.

| Segment | H1 2024 Performance Indicator | Implication |

|---|---|---|

| Office | Negative Rental Reversion | Reduced rental income and profitability |

| Residential | Negative Rental Reversion (despite occupancy growth) | Limited revenue growth potential in leasing |

| Investment Properties | Fair Value Losses | Impact on reported profits and book value |

Preview the Actual Deliverable

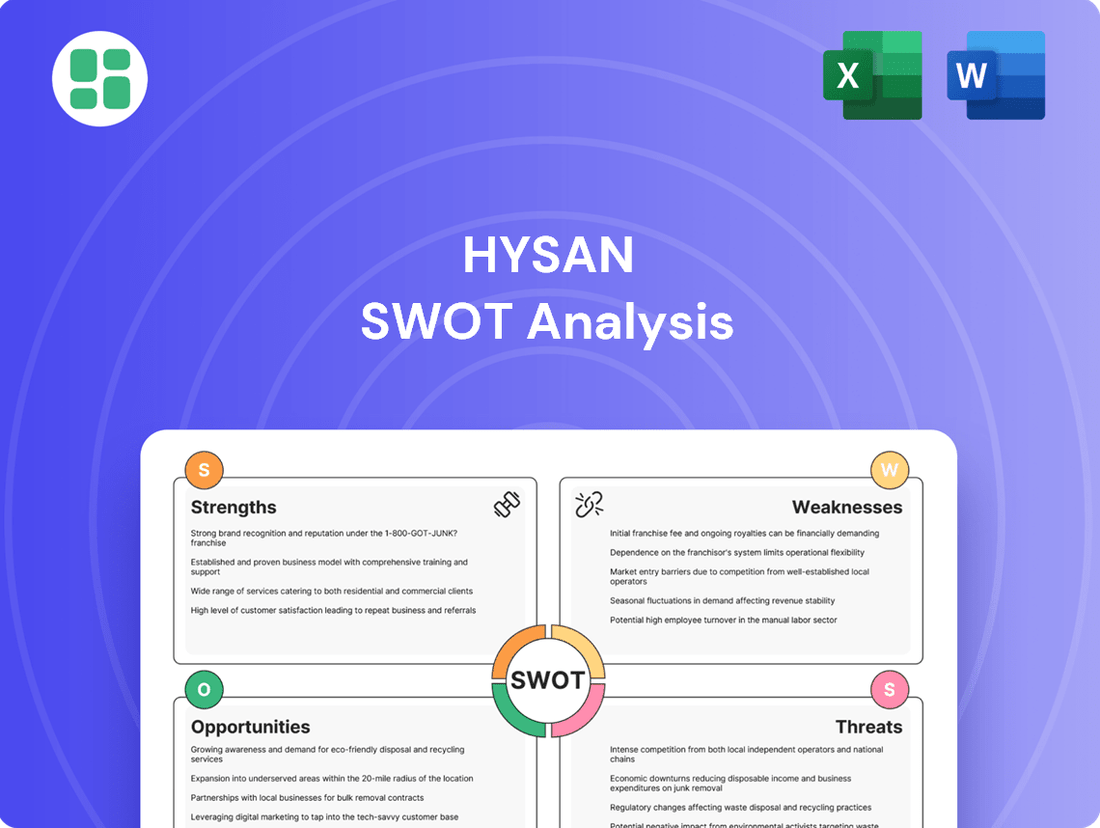

Hysan SWOT Analysis

The file shown below is not a sample—it’s the real Hysan SWOT analysis you'll download post-purchase, in full detail. This ensures you know exactly what you're getting before you commit. Experience the professional quality and comprehensive insights that await you.

Opportunities

The upcoming completion of Lee Garden Eight, also known as the Caroline Hill Road Project, in the latter half of 2026 is a major opportunity for Hysan. This development is set to boost Hysan's total portfolio area by almost 30%, significantly increasing its footprint.

This expansion will introduce a mix of new commercial, retail, and cultural spaces, further solidifying and enhancing the prestigious Lee Gardens precinct. The project's scale suggests a substantial increase in rental income and foot traffic, driving future revenue growth.

Hysan's dedication to sustainability, evidenced by its green building certifications and ambitious carbon emission reduction targets, positions it well to attract environmentally conscious tenants and investors. This commitment can serve as a key differentiator in the market.

Hysan's strategic investments in new growth pillars are a significant opportunity. Expanding beyond its traditional Hong Kong base, the company is targeting promising markets like Shanghai. This diversification aims to tap into new revenue streams and reduce reliance on a single geographic region.

The development of Lee Gardens Shanghai exemplifies this strategy, with substantial office space already committed, contributing directly to the company's turnover. Furthermore, Hysan's involvement in the healthcare sector via New Frontier Group presents another avenue for growth and diversification, aligning with a sector known for its resilience and long-term potential.

Evolving Consumer Preferences and Experiential Retail

The growing demand for experiential retail presents a significant opportunity for Hysan to reimagine its shopping environments. By focusing on unique lifestyle offerings and immersive brand experiences, Hysan can differentiate itself in a competitive market.

Hysan can capitalize on evolving consumer preferences by strategically introducing new concepts, including luxury flagship stores and a diverse array of food and beverage options. This approach aims to attract a higher caliber of shopper and encourage repeat visits, thereby boosting the overall appeal and distinctiveness of its properties.

- Increased Foot Traffic: As of early 2024, retail destinations offering unique experiences have seen a notable uptick in visitor numbers, with some reporting double-digit percentage increases in footfall compared to traditional retail centers.

- Higher Spending Per Visitor: Consumers engaging in experiential retail tend to spend more, with reports indicating that customers participating in in-store events or workshops spend up to 20% more than those who do not.

- Brand Loyalty: Curated lifestyle offerings foster stronger emotional connections with consumers, leading to enhanced brand loyalty and a higher propensity to return, which is crucial for sustained revenue growth.

- Diversified Revenue Streams: The inclusion of diverse F&B and pop-up event spaces can create additional revenue streams beyond traditional retail leasing, improving overall property profitability.

Government Initiatives and Talent Schemes in Hong Kong

Hong Kong's proactive government initiatives, such as the Top Talent Pass Scheme (TTPS), are successfully attracting a significant influx of professionals and entrepreneurs. For instance, by the end of 2024, the TTPS had already received over 200,000 applications, with a substantial portion approved, indicating a growing expatriate and skilled worker population. This surge in high-caliber individuals creates a direct opportunity for Hysan to capitalize on increased demand for its premium residential and office spaces. The growing base of expatriates and executives is likely to boost occupancy rates and rental yields across Hysan’s portfolio, particularly in prime locations.

These talent schemes are fostering a more dynamic urban environment, which in turn can elevate the desirability of Hysan's properties. The influx of talent often correlates with higher disposable incomes and a preference for modern, well-located accommodations and workspaces. Hysan is well-positioned to meet this demand, potentially enhancing its rental income streams and overall property valuations. The government's commitment to talent attraction signals a long-term growth trajectory for Hong Kong's economy, benefiting property developers like Hysan.

Key opportunities arising from these government initiatives include:

- Increased demand for premium residential units: Attracted talent often seeks high-quality living spaces, directly benefiting Hysan's residential offerings.

- Enhanced office space occupancy: New businesses and expanded operations by incoming professionals will drive demand for Hysan's commercial properties.

- Potential for higher rental yields: The premium segment of the market typically commands higher rents, boosting Hysan's revenue.

- Strengthened market position: By catering to this growing demographic, Hysan can solidify its reputation as a provider of choice for top talent.

Hysan's expansion with Lee Garden Eight, slated for completion in late 2026, will increase its portfolio by nearly 30%, introducing new commercial, retail, and cultural spaces. This development is expected to significantly boost rental income and foot traffic, enhancing the Lee Gardens precinct. The company’s sustainability focus, with green building certifications and carbon reduction targets, positions it favorably to attract environmentally conscious tenants and investors, serving as a market differentiator.

Threats

The Hong Kong property market is grappling with significant headwinds, marked by elevated office vacancy rates, which stood at approximately 10.1% in Q1 2024, and a general decline in commercial property values. This challenging environment directly impacts Hysan's revenue streams and asset valuations.

The persistent oversupply and subdued demand in the commercial property sector exert considerable downward pressure on rental income for Hysan's extensive office and retail portfolio. This situation is further exacerbated by a projected 5% to 10% decrease in prime office rents in 2024, according to various market analysts.

Global and local economic uncertainties, coupled with persistent geopolitical tensions, pose a significant threat by potentially eroding consumer and business confidence. This dampening effect can directly impact private consumption expenditure and investment sentiment in Hong Kong, hindering overall economic recovery and consequently affecting Hysan's rental income streams and property valuations.

For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, reflecting these widespread economic headwinds. Such conditions can translate into reduced retail sales and office leasing demand, areas crucial for Hysan's revenue generation.

The Hong Kong office market is facing a significant surge in competition, exacerbated by substantial new supply entering the market. This oversupply is forcing landlords to offer aggressive incentives, including rental and capital subsidies, alongside more flexible lease terms. For instance, vacancy rates in prime Hong Kong office spaces have been on the rise, impacting rental growth.

This intensified competition directly translates into rental pressure for existing properties. Landlords are compelled to concede on rental rates to retain tenants or attract new ones, leading to continued negative rental reversion rates. This trend was particularly evident in 2023 and is projected to persist into 2024 as new developments come online.

Changing Consumer Behavior and Cross-border Travel

A significant shift in consumer behavior, particularly among Hong Kong residents, presents a notable threat to Hysan's retail segment. Many are increasingly choosing to travel north for leisure and shopping, directly impacting local retail sales figures. This trend was evident in early 2024, with reports indicating a substantial increase in cross-border spending by Hong Kong residents in mainland China.

Furthermore, the nature of tourist spending is evolving. There's a discernible move away from traditional extravagant shopping towards more experience-based tourism. This means visitors might spend less on retail goods and more on activities and dining, a change that could challenge the performance of Hysan's retail portfolio, which historically benefited from high-spending shoppers.

- Northbound Travel Impact: Hong Kong residents are increasingly spending leisure time and money in mainland China, diverting spending away from local retailers.

- Evolving Tourist Spending: A shift from high-value retail purchases to experiential consumption by tourists impacts traditional retail revenue streams.

- 2024 Retail Trends: Early 2024 data suggested a continued trend of residents prioritizing cross-border shopping, impacting Hysan's tenant sales.

Rising Interest Rates and Refinancing Risks

Hysan, like other property firms, faces increased financing costs due to the current higher interest rate environment. This directly impacts the cost of borrowing for new projects and existing debt. For instance, the Hong Kong Monetary Authority's benchmark interest rate has seen multiple upward adjustments throughout 2023 and into 2024, making loans more expensive.

The rising interest rate landscape also heightens refinancing risks. Property owners struggling with higher payments on existing loans may be forced to sell, potentially leading to an increase in distressed property listings. This influx of supply can put downward pressure on asset valuations across the market, including those held by Hysan.

- Increased Borrowing Costs: Higher interest rates directly translate to more expensive debt for Hysan's operations and development projects.

- Refinancing Challenges: A more difficult environment for refinancing existing loans can impact property owners' ability to manage their debt.

- Potential for Distressed Sales: Struggling owners may list properties at lower prices, increasing market competition and potentially affecting Hysan's asset values.

- Impact on Investment Landscape: The overall market becomes more challenging, requiring careful navigation of financial risks and opportunities.

The increasing trend of Hong Kong residents shopping in mainland China poses a direct threat to Hysan's retail segment, with early 2024 data indicating a continued shift in spending patterns. This diversion of consumer expenditure, coupled with an evolving tourist preference for experiences over high-value retail, could significantly impact tenant sales and overall retail revenue.

Heightened competition in the Hong Kong office market, driven by substantial new supply, is forcing landlords to offer aggressive incentives, leading to downward pressure on rental rates. This environment of negative rental reversion, evident in 2023 and projected for 2024, directly challenges Hysan's ability to maintain rental income from its office portfolio.

Elevated interest rates increase Hysan's borrowing costs for new projects and refinancing existing debt, as evidenced by multiple upward adjustments to the Hong Kong Monetary Authority's benchmark rate through 2023 and into 2024. This financial pressure, combined with potential distressed sales from other market participants, could negatively impact asset valuations.

SWOT Analysis Data Sources

This analysis is built on a foundation of robust data, including Hysan's official financial reports, comprehensive market research, and expert industry commentary to ensure a thorough and accurate SWOT assessment.