Hysan Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hysan Bundle

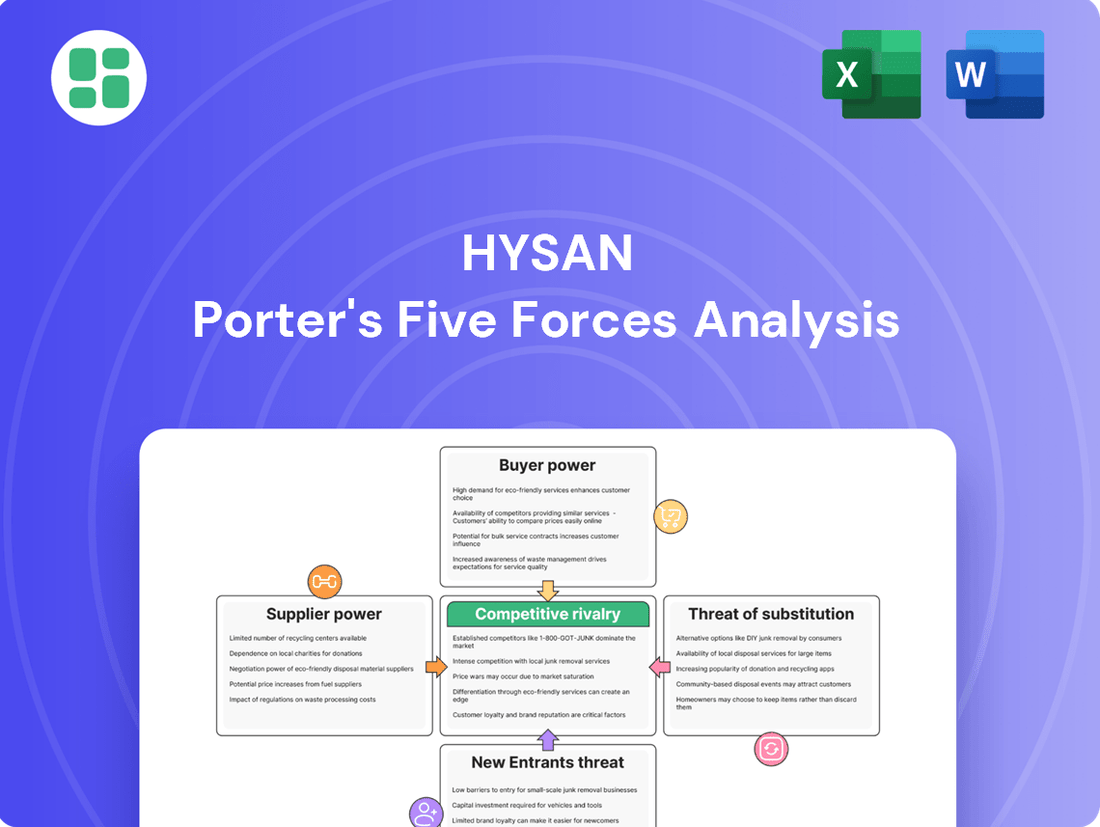

Hysan's competitive landscape is shaped by the interplay of buyer power, supplier leverage, and the threat of new entrants. Understanding these forces is crucial for navigating its market effectively.

The complete report reveals the real forces shaping Hysan’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The scarcity of land in Hong Kong is a major factor that significantly boosts the bargaining power of land suppliers, which are predominantly the government and a handful of large developers holding extensive land reserves. This limited availability forces developers like Hysan to contend with escalating acquisition costs and directly impacts the viability of their development projects.

With land ownership concentrated among a few established entities, this creates a formidable barrier for new entrants and consequently shrinks the pool of potential development sites available for acquisition.

Suppliers of construction materials and skilled labor wield significant influence, especially in environments experiencing inflation or a scarcity of qualified workers. While specific data for Hysan isn't provided, the broader Hong Kong market in 2024 has seen inflationary pressures on construction materials, with some reports indicating a 5-10% increase in costs for key inputs like steel and cement compared to the previous year.

A competitive labor market for skilled trades in Hong Kong further amplifies supplier power. This dynamic can directly affect property developers' project budgets and schedules, leading to increased operational expenses. Maintaining robust supplier relationships and implementing efficient procurement practices are therefore crucial for Hysan to manage these cost pressures effectively.

The bargaining power of financial institutions as capital suppliers for Hysan is generally moderate. This is supported by Hysan's robust financial health, evidenced by its investment-grade credit ratings, such as Baa2 from Moody's and BBB from Fitch. The company’s strategic approach to debt management, including a well-staggered maturity profile and the utilization of existing undrawn facilities for refinancing, further reduces its immediate dependence on potentially more demanding terms from lenders.

Technology and Service Providers

As property management and development increasingly lean on cutting-edge technologies, specialized providers of these solutions can gain significant bargaining power. This is particularly true for smart building systems, advanced property management software, and consultants focused on sustainable development. For instance, the global smart building market was valued at approximately $80 billion in 2023 and is projected to grow substantially, indicating a strong demand for these specialized services.

Hysan Development's strategic focus on enhancing its assets and embracing sustainable practices means it may actively seek out premium technology and service providers. This pursuit of high-quality, specialized solutions can inadvertently grant these suppliers greater leverage in negotiations. The increasing complexity and integration of these technologies within property operations further solidify the position of key providers.

- Growing reliance on smart building tech: The global smart building market is expanding rapidly, with projections suggesting continued robust growth through 2030, increasing the importance of specialized tech providers.

- Hysan's sustainability focus: Hysan's commitment to ESG principles and asset enhancement necessitates partnerships with providers offering advanced, sustainable solutions, potentially increasing supplier leverage.

- Demand for integrated solutions: The need for seamless integration of various property technologies empowers providers who can offer comprehensive, end-to-end service packages.

- Limited number of high-quality providers: The market for highly specialized and reliable property technology and sustainability consultants may have fewer players, concentrating bargaining power among them.

Infrastructure and Utility Providers

Infrastructure and utility providers, like electricity and telecommunications companies, often hold significant bargaining power. This is because their services are essential for property operations, and there are typically few readily available substitutes. For Hysan, these costs are a substantial, often fixed, component of operating expenses, influencing both profitability and the ability to offer competitive services to tenants.

In 2024, the cost of electricity for commercial properties in Hong Kong, where Hysan primarily operates, saw fluctuations. For instance, the average price per kilowatt-hour (kWh) for commercial users hovered around HK$1.40 to HK$1.60, depending on consumption and tariff structures. These costs are largely non-negotiable and directly impact Hysan's bottom line.

- Essential Services: Electricity, water, and telecommunications are critical for Hysan's properties, making these providers indispensable.

- Limited Alternatives: The scarcity of alternative utility providers in established urban areas grants existing suppliers considerable leverage.

- Cost Impact: These utility costs represent a significant, often unyielding, portion of property operating expenses, directly affecting Hysan's financial performance.

- Tenant Serviceability: The reliability and cost of these utilities can influence Hysan's ability to attract and retain tenants by impacting the overall cost of occupancy and the quality of services provided.

The bargaining power of suppliers for Hysan is influenced by several factors, including the scarcity of land, concentration of ownership, and the demand for specialized services. In 2024, construction material costs saw an estimated 5-10% increase, impacting project budgets. Additionally, the growing global smart building market, valued around $80 billion in 2023, highlights the increasing leverage of technology providers.

| Supplier Type | Key Factors Influencing Power | 2024 Data/Context |

|---|---|---|

| Land Suppliers | Scarcity, concentrated ownership | Limited availability in Hong Kong drives up acquisition costs. |

| Construction Materials & Labor | Inflation, skilled labor scarcity | 5-10% increase in material costs (e.g., steel, cement) in 2024; competitive labor market. |

| Technology Providers (Smart Building) | Market growth, specialization | Global market ~ $80 billion (2023); increasing demand for integrated, sustainable solutions. |

| Infrastructure & Utilities | Essential services, limited alternatives | Commercial electricity prices ~ HK$1.40-HK$1.60/kWh in 2024; costs are largely fixed. |

What is included in the product

Uncovers the competitive intensity within Hong Kong's retail and office property market, detailing Hysan's strategic positioning against rivals, buyer and supplier power, and the threat of new entrants and substitutes.

Quickly assess competitive intensity and identify potential threats with a visually intuitive breakdown of all five forces.

Customers Bargaining Power

Customers, especially those looking for office and retail spaces in Hong Kong, hold considerable sway. This is largely because there's a surplus of commercial properties, leading to high vacancy rates. For instance, the Grade A office vacancy rate hit 13.1% in 2024 and is expected to climb to 22% by the end of 2025.

This oversupply naturally pushes rents down, giving tenants more room to negotiate favorable lease terms. The retail sector is seeing a similar trend, with anticipated declines in rents, further strengthening the bargaining position of potential tenants.

Shifting customer preferences significantly impact bargaining power. In office leasing, a notable trend is the 'flight-to-quality', where tenants increasingly demand premium buildings with superior amenities and flexible lease terms, thereby strengthening their negotiating position with landlords like Hysan.

For the retail sector, the continued rise of e-commerce and evolving consumer habits mean landlords must actively adapt their offerings. This adaptation is crucial as tenants can more easily switch to online platforms or demand more favorable terms if physical retail spaces fail to meet new expectations, directly affecting landlord revenue and tenant retention.

In Hong Kong's residential property market, buyers now wield more influence. The lifting of cooling measures and a substantial amount of unsold housing stock have significantly boosted buyer power. This situation has compelled developers to adopt more aggressive pricing tactics.

Reflecting this shift, Hong Kong housing prices saw a notable decrease of 6.8% in 2024. Projections indicate a further decline of around 5% for 2025, giving buyers greater leverage to negotiate improved terms and more favorable pricing.

Availability of Alternatives and Price Sensitivity

Customers in Hong Kong have a wide array of choices for properties, especially with new developments consistently entering the market. This abundance of alternatives significantly strengthens their bargaining power.

Economic headwinds, including ongoing uncertainties and elevated interest rates, are making consumers more attuned to pricing. As a result, Hysan faces pressure to maintain competitive rents and sales figures to attract and retain tenants and buyers.

- Abundant Alternatives: Hong Kong's property market offers numerous competing properties, increasing customer choice.

- Price Sensitivity: Economic conditions and high interest rates heighten customer focus on price, driving comparisons.

- Negotiating Leverage: The combination of choice and price sensitivity grants customers considerable power to negotiate terms.

- Competitive Pressure: Hysan must offer attractive pricing to remain competitive in this environment.

Landlord Concessions and Incentives

Landlords, recognizing the significant bargaining power of their tenants, are actively providing concessions. This includes offering rent-free periods, contributing to tenant fit-outs, and adjusting lease terms to secure and keep occupants.

The office sector, in particular, is seeing a tenant-favorable market. This is driven by intense competition among landlords vying for new leases and lease renewals, leading to more attractive deals for businesses.

- Tenant Incentives: Landlords are increasingly offering incentives like rent-free periods and fit-out allowances.

- Market Dynamics: The office sector is experiencing a tenant-favorable environment due to high competition.

- Lease Negotiations: Hysan, like other landlords, must negotiate favorable terms to retain existing tenants and attract new ones.

Customers in Hong Kong's property market, especially for office and retail spaces, possess significant bargaining power. This is amplified by a substantial supply of commercial properties, leading to high vacancy rates, such as the 13.1% for Grade A offices in 2024, projected to reach 22% by the end of 2025. This oversupply naturally pressures rents downwards, allowing tenants to negotiate more favorable lease terms and concessions like rent-free periods.

| Factor | Impact on Bargaining Power | Supporting Data/Trend |

|---|---|---|

| Property Oversupply | Increases customer choice and leverage | Grade A office vacancy rate at 13.1% in 2024, projected to reach 22% by end of 2025. |

| Price Sensitivity | Drives demand for lower rents and better terms | Economic headwinds and elevated interest rates make consumers more price-conscious. |

| Flight-to-Quality (Office) | Empowers tenants demanding premium amenities | Tenants increasingly prioritize superior buildings and flexible leases. |

| E-commerce Growth (Retail) | Forces landlords to adapt or risk tenant loss | Consumers can switch to online platforms if physical retail doesn't meet evolving expectations. |

Same Document Delivered

Hysan Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at a comprehensive Porter's Five Forces analysis of Hysan, detailing the competitive landscape and strategic implications for the company. This includes an in-depth examination of buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry within Hysan's operating environment.

Rivalry Among Competitors

The Hong Kong property market exhibits significant concentration, with a handful of developers dominating new supply. For instance, Sun Hung Kai Properties, CK Asset Holdings, and Henderson Land are projected to deliver a substantial 60% of all new residential units between 2025 and 2026.

This concentration means these major players already hold considerable market share and extensive land banks, directly intensifying competition among them. Their sheer size and control over future inventory create a highly competitive environment where strategic moves by one can significantly impact the others.

The market environment in 2024 presented a significant challenge. A slow economic recovery, coupled with the anticipation of new office supply entering the market, created an atmosphere of caution. High interest rates further constrained spending and investment, while weak retail sales indicated a broader consumer hesitancy.

These combined factors significantly limited overall market growth. Consequently, competitors found themselves compelled to compete more aggressively for the existing, albeit smaller, pool of demand. This intensified rivalry means companies must work harder to capture market share and maintain profitability.

Hysan Development operates in highly competitive office and retail markets, especially where new supply is entering and rental rates are softening. This intense rivalry forces landlords, including Hysan, to offer attractive incentives and adjust their rental pricing downwards. For instance, in 2023, the Hong Kong office market saw a significant increase in vacancy rates, particularly in Central, reaching approximately 6.1% by year-end, which directly pressures rental income and necessitates competitive strategies.

High Unsold Inventory in Residential Market

The residential property market is currently grappling with a significant overhang of unsold inventory, a situation that directly fuels intense competitive rivalry among developers. This excess stock forces them to adopt aggressive pricing tactics to move units, leading to a price-driven competitive landscape where sales velocity is paramount. As of early 2024, data indicates a substantial number of unabsorbed new homes in many key urban centers, putting considerable pressure on profit margins.

This environment creates a scenario where developers are constantly vying for market share by offering incentives and discounts. The cautious sentiment from buyers, often stemming from economic uncertainties or higher interest rates, further exacerbates the situation, compelling developers to compete fiercely on price to attract demand and manage their existing portfolios effectively.

- High unsold inventory directly translates to price wars among developers.

- Developers are forced into aggressive pricing strategies to ensure sales velocity.

- Cautious buyer sentiment amplifies the pressure to compete on price.

Differentiation and Asset Enhancement

Competitive rivalry within the Hong Kong retail and office space market is intensified by differentiation efforts, particularly through asset enhancement and strategic location. Hysan Development, for instance, actively pursues strategies to distinguish its properties. This includes significant investments in rejuvenating its core assets, such as the Lee Gardens area.

By focusing on premium property offerings, incorporating green building features, and enhancing the overall tenant experience, Hysan aims to attract and retain a diversified tenant base. This approach is crucial in a market where physical space is at a premium and tenants seek more than just a location; they desire a desirable environment. For example, Hysan's commitment to sustainability is reflected in its properties achieving high green building certifications, which is increasingly a factor for corporate tenants in 2024.

- Asset Enhancement: Hysan's strategy involves continuous upgrading and modernization of its properties to maintain a premium appeal.

- Green Features: Integration of sustainable building practices and certifications to attract environmentally conscious tenants.

- Strategic Location: Leveraging prime locations like Causeway Bay to offer unparalleled accessibility and prestige.

- Tenant Diversification: Attracting a mix of retail, office, and potentially residential tenants to create a vibrant ecosystem and mitigate sector-specific risks.

The competitive rivalry in Hong Kong's property market remains fierce, particularly in the office and retail sectors. Developers like Hysan are compelled to offer incentives and adjust rental pricing due to factors like economic slowdowns and increased office supply. For instance, the Hong Kong office market saw vacancy rates climb to approximately 6.1% by the end of 2023, especially in prime areas, putting downward pressure on rents and intensifying competition among landlords.

Developers are also contending with substantial unsold residential inventory, forcing aggressive pricing strategies and sales promotions. This price-driven competition is exacerbated by cautious buyer sentiment, often linked to economic uncertainties and higher interest rates, pushing developers to compete harder for market share and manage their portfolios effectively.

Hysan counters this rivalry through asset enhancement and strategic differentiation, investing in property upgrades and sustainable features. For example, its commitment to green building certifications in 2024 appeals to environmentally conscious tenants, a key factor in attracting and retaining them in a competitive landscape.

| Sector | Competitive Factor | Hysan's Strategy | Market Data/Impact |

|---|---|---|---|

| Office | Intensified rivalry due to new supply and economic caution | Asset enhancement, tenant experience | 2023 year-end vacancy rate ~6.1% in Central |

| Retail | Pressure on rental rates and demand | Premium offerings, green features | Weak retail sales in 2024 |

| Residential | High unsold inventory leading to price wars | Aggressive pricing tactics, incentives | Significant unabsorbed new homes in early 2024 |

SSubstitutes Threaten

The increasing prevalence of remote and hybrid work models significantly threatens the traditional office space market, directly reducing demand for physical office properties. This shift means fewer companies need large, centralized office locations.

While many Hong Kong companies have been encouraging a return to the office, employee preference for flexible work arrangements remains strong. This persistent demand for flexibility directly impacts office occupancy rates and can dampen rental growth prospects for landlords.

In 2024, office vacancy rates in Hong Kong's core business districts, such as Central and Admiralty, saw an uptick, with some reports indicating rates exceeding 10% in certain prime areas. This reflects the ongoing challenge of adapting to evolving workplace preferences and the reduced need for traditional office footprints.

The burgeoning growth of e-commerce presents a significant threat of substitutes for traditional brick-and-mortar retail. Online platforms offer consumers convenience and a wider selection, directly impacting the demand for physical retail spaces. In 2024, global e-commerce sales were projected to reach over $6.3 trillion, a testament to its increasing dominance.

This shift online is further amplified by declining domestic consumption and per capita tourist spending, which were notable trends in many markets throughout 2023 and into 2024. Retailers are consequently compelled to re-evaluate their physical footprint, with many downsizing operations or prioritizing an omnichannel strategy that includes a robust online presence.

The growing popularity of co-working and flexible office spaces presents a significant threat of substitutes for traditional office leasing models. These alternatives cater to businesses, especially smaller ones, that require agility and cost-effectiveness over long-term commitments. For instance, in 2024, the global flexible office market was valued at over $20 billion, demonstrating its substantial appeal.

Hysan’s own portfolio has experienced direct impact from this trend, with a notable increase in demand from co-working providers within its office spaces. This expansion by co-working operators within Hysan’s properties underscores the attractiveness of these flexible arrangements for both providers and their end-users, directly challenging the demand for conventional, longer-term office leases.

Government Housing and Affordable Alternatives

Government initiatives and an increasing supply of more compact, budget-friendly housing options present a significant threat of substitution to Hysan's premium residential properties. These alternatives cater to a broader segment of the market, particularly first-time buyers or those seeking more economical living solutions.

Government policies, such as potential adjustments to property taxes or subsidies for affordable housing projects, can further tilt the market towards these substitutes. For instance, in 2024, Hong Kong's government continued to explore measures to increase housing supply and affordability, which could indirectly impact demand for higher-priced segments.

- Government Housing Programs: Direct provision of housing by the government or incentives for developers to build affordable units can siphon demand away from private, higher-priced developments.

- Smaller Unit Supply: Developers are increasingly offering smaller, more efficiently designed apartments, which are inherently more affordable and appeal to a wider buyer pool.

- Policy Incentives: Measures like reduced stamp duties for properties below certain price thresholds directly encourage consumers to opt for more affordable alternatives.

- Market Segmentation: The availability of diverse housing types across different price points allows buyers to find suitable substitutes that meet their financial capabilities, even if they compromise on certain luxury features.

Alternative Investment Avenues

For investors, alternative investment avenues present a significant threat of substitution to direct property investment. Vehicles like Real Estate Investment Trusts (REITs), which offer liquidity and diversification, or other alternative asset classes such as private equity or infrastructure funds, can attract capital away from physical real estate. This is particularly relevant when the direct property market faces headwinds.

In 2024, the real estate market has experienced varied performance globally. For instance, while some commercial property sectors have seen increased vacancy rates, leading to potential capital value declines, other asset classes have shown robust growth. Investors are actively re-evaluating their portfolios, seeking opportunities that offer more attractive risk-adjusted returns or greater stability. For example, as of Q1 2024, global REITs, despite some sector-specific challenges, collectively offered dividend yields that were competitive with, or in some cases exceeded, the rental yields from direct property investments in many major cities.

- REITs offer diversification and liquidity, making them attractive alternatives to direct property ownership.

- Alternative asset classes like private equity and infrastructure can draw capital away from real estate, especially during market downturns.

- In 2024, competitive dividend yields from REITs, sometimes surpassing direct property rental yields, highlight the substitution threat.

The threat of substitutes for Hysan's core businesses, particularly office and retail spaces, is substantial. The rise of remote work and co-working spaces directly challenges the demand for traditional office leases, while e-commerce continues to erode the necessity of physical retail footprints.

Alternative investment vehicles like REITs and other asset classes also pose a substitution threat to direct property investment, especially when they offer competitive yields or greater liquidity. The increasing availability of more affordable housing options, often supported by government initiatives, further diversifies choices away from Hysan's premium residential offerings.

In 2024, these trends are underscored by persistent employee preferences for flexible work, rising e-commerce sales projected to exceed $6.3 trillion globally, and a flexible office market valued at over $20 billion. Additionally, global REITs offered competitive dividend yields, sometimes surpassing direct property rental yields in major cities.

| Substitute Category | Nature of Threat | 2024 Data/Trend Highlight |

|---|---|---|

| Remote/Hybrid Work | Reduced demand for physical office space | Continued strong employee preference for flexibility impacting occupancy. |

| E-commerce | Decline in demand for physical retail | Global e-commerce sales projected over $6.3 trillion. |

| Co-working Spaces | Alternative to traditional office leases | Global flexible office market valued over $20 billion. |

| Alternative Investments (REITs, etc.) | Capital diversion from direct property | Competitive REIT dividend yields potentially exceeding direct property rental yields. |

| Affordable Housing | Substitution for premium residential properties | Government focus on increasing housing supply and affordability. |

Entrants Threaten

The property development and investment landscape in Hong Kong, where Hysan operates, presents a significant hurdle for newcomers due to substantial capital requirements. For instance, land auctions in prime Hong Kong locations frequently see bids reaching billions of Hong Kong dollars, as evidenced by government land sales. This immense financial outlay for land acquisition, coupled with the escalating costs of construction materials and labor, effectively locks out smaller, less capitalized entities from entering the market.

The threat of new entrants in Hong Kong's property market is significantly dampened by severe land scarcity. Established developers, like Sun Hung Kai Properties and Henderson Land, possess substantial land banks, creating a formidable barrier for newcomers seeking prime development locations. This existing concentration of land ownership means that acquiring new sites is not only costly but also exceptionally challenging, effectively limiting the influx of fresh competition.

Navigating Hong Kong's intricate planning, zoning, and environmental regulations poses a substantial barrier for potential new entrants. These complex legal frameworks and lengthy approval processes demand significant local expertise and considerable time investment, thereby escalating the initial costs and inherent risks associated with market entry.

Brand Recognition and Tenant Relationships

Hysan benefits from significant brand recognition and deep-rooted tenant relationships, especially within its prime Hong Kong properties like Lee Gardens. This established trust makes it difficult for new entrants to replicate the same level of appeal and secure high-quality tenants without a comparable history.

Newcomers face the daunting task of building brand loyalty and demonstrating a reliable track record, which can take years. For instance, in 2024, the retail occupancy rate for prime Hong Kong Grade-A retail spaces remained robust, indicating a preference for established landlords with proven tenant retention strategies.

- Brand Equity: Hysan’s long-standing presence fosters significant brand equity, a key barrier for new competitors.

- Tenant Loyalty: Existing strong relationships with anchor tenants and a diverse mix of retailers provide stability and reduce churn risk.

- Reputation: A proven history of successful property management and tenant support builds a reputation that new entrants must painstakingly earn.

- Market Access: Established players often have preferential access to desirable locations and leasing opportunities, further hindering new market entrants.

Challenging Market Conditions

The current market landscape presents a significant deterrent to new entrants. High vacancy rates, a common feature in many commercial real estate sectors as of early 2024, coupled with downward pressure on rents in specific segments, signal a challenging environment. For instance, office vacancy rates in major global cities have remained elevated, with some reports indicating figures exceeding 15% in key business districts.

This challenging environment directly impacts the attractiveness of entering the market. The prospect of achieving robust returns is diminished when faced with declining rental income and the need to offer incentives to secure tenants. Consequently, the risk-reward profile for new players becomes less appealing, especially in a market that may be undergoing consolidation, making it harder for newcomers to establish a foothold and achieve profitability.

The threat of new entrants is therefore mitigated by these prevailing market conditions:

- Deterrent Market Conditions: High vacancy rates and declining rents in certain sectors discourage new businesses from entering.

- Reduced Profitability Prospects: The likelihood of lower returns makes the market less attractive for potential investors.

- Increased Risk Profile: A consolidating market often presents higher risks for newcomers trying to gain market share.

- Capital Intensity: Significant upfront capital is required to enter, which is a greater hurdle in an uncertain economic climate.

The threat of new entrants into Hong Kong's property sector, where Hysan operates, is considerably low. The immense capital required for land acquisition, as seen in government land sales where bids can reach billions of Hong Kong dollars, along with high construction costs, effectively bars less capitalized firms. Furthermore, established developers' substantial land banks create a significant barrier to entry, limiting new players' access to prime locations.

The regulatory environment in Hong Kong also presents a formidable challenge. Navigating complex planning, zoning, and environmental regulations demands extensive local expertise and significant time investment, increasing initial costs and risks for newcomers. Hysan also benefits from strong brand equity and established tenant relationships, making it difficult for new entrants to attract and retain high-quality tenants without a comparable track record.

Market conditions as of early 2024, characterized by high vacancy rates and downward pressure on rents in certain segments, further deter new entrants. For instance, office vacancy rates in some major global cities have exceeded 15% in key business districts. This challenging environment reduces profitability prospects and increases the risk profile for potential investors, making the market less attractive for new players.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of land acquisition and construction in Hong Kong. | Significant financial barrier, limiting entry to well-funded entities. |

| Land Scarcity & Existing Land Banks | Concentration of land ownership among established developers. | Difficulties in acquiring prime development sites for newcomers. |

| Regulatory Complexity | Intricate planning, zoning, and environmental regulations. | Requires local expertise and time, escalating entry costs and risks. |

| Brand Equity & Tenant Relationships | Hysan's established reputation and strong tenant loyalty. | New entrants struggle to replicate appeal and secure quality tenants. |

| Market Conditions (Early 2024) | High vacancy rates and potential rent declines in certain sectors. | Reduced profitability prospects and increased market risk. |

Porter's Five Forces Analysis Data Sources

Our Hysan Porter's Five Forces analysis leverages a comprehensive dataset including Hysan's annual reports, publicly available financial statements, and industry-specific market research reports. We also incorporate data from reputable real estate analytics firms and government economic indicators to provide a robust understanding of the competitive landscape.