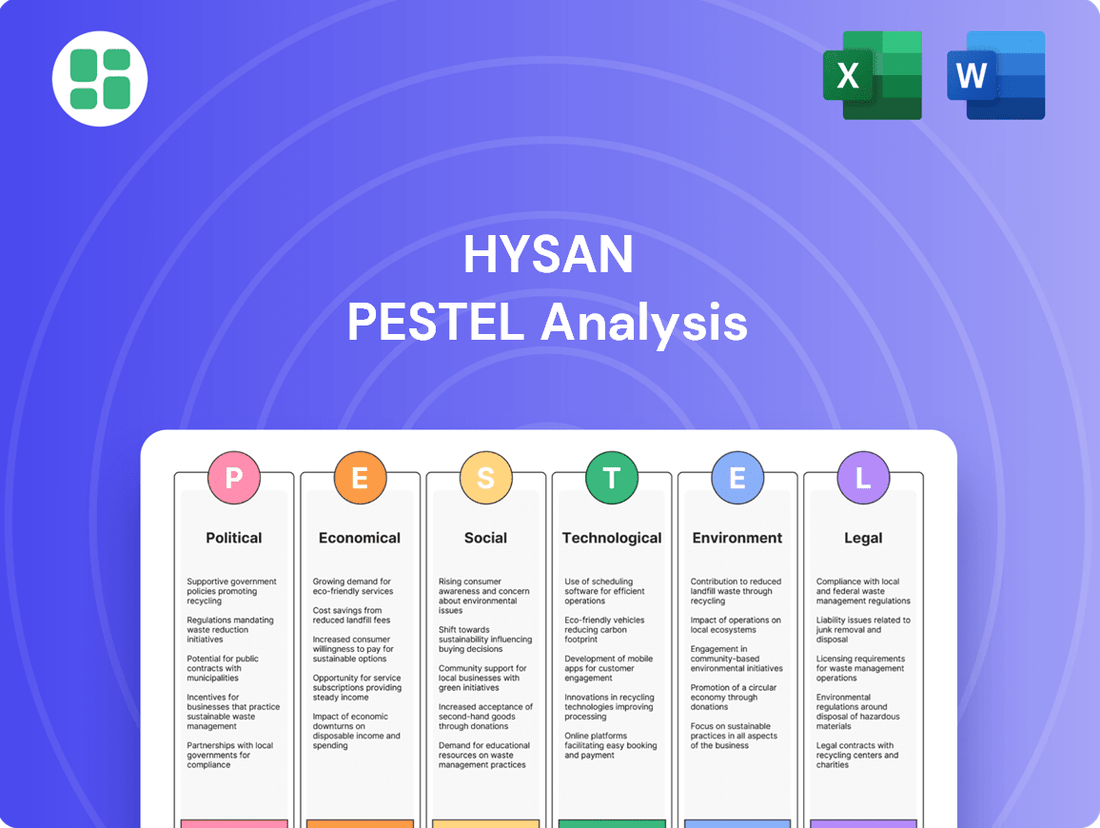

Hysan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hysan Bundle

Uncover the critical political, economic, social, and technological factors shaping Hysan's trajectory. Our meticulously researched PESTLE analysis provides a clear roadmap to navigate these external forces, empowering you to make informed strategic decisions. Don't get left behind – download the full report now for actionable intelligence.

Political factors

Hong Kong's government has been actively shaping the property market. In February 2024, a significant policy shift occurred with the cancellation of all demand-side management measures for residential properties. This included the removal of stamp duties for non-permanent residents and the reduction of mortgage loan-to-value ratios.

These policy adjustments are designed to inject vitality into a market that had been experiencing a slowdown. By lowering the financial barriers for potential buyers, the government aims to boost transaction volumes and stabilize property prices. This proactive approach is expected to foster renewed confidence among investors and purchasers.

For Hysan, this policy change could have a ripple effect across its portfolio. A more active residential market might translate into increased demand for commercial spaces as economic activity picks up. The overall rejuvenation of the property sector could also positively influence leasing demand for Hysan's retail and office properties.

The broader geopolitical landscape, especially Hong Kong's relationship with Mainland China and ongoing international tensions, significantly influences investor confidence and capital movement within the city's property sector. Hysan's 2024 Annual Report, for instance, highlights optimism regarding Hong Kong's economic trajectory as a vital special administrative region of China.

However, any perceived instability or alterations in cross-border policies could dampen demand from mainland Chinese investors and talent, who are crucial for the luxury and rental segments of the market. For example, shifts in visa policies or capital controls could directly impact the influx of these key demographic groups.

Government land sale programs and premium policies are crucial for Hysan's property development. For the 2024-25 period, the government has outlined a land sale program encompassing residential, commercial, and industrial sites, directly influencing the supply and cost of new development opportunities.

Discussions around adjusting land premium payment structures are ongoing, aiming to stimulate development, especially for industrial and re-development projects. These policy adjustments can significantly impact Hysan's future development pipeline and overall profitability by altering acquisition costs and project feasibility.

Regulatory Environment for ESG and Green Buildings

The evolving regulatory landscape for Environmental, Social, and Governance (ESG) criteria and green buildings presents both challenges and opportunities for Hysan. Increased governmental emphasis on ESG reporting and stricter green building mandates can lead to higher compliance expenses.

However, these regulations also foster new avenues for growth and competitive advantage. For example, the anticipated Buildings Energy Efficiency (Amendment) Ordinance 2025 is set to implement more rigorous energy audit stipulations and broaden the scope of buildings subject to these rules. This will likely necessitate increased investment from property developers like Hysan in sustainable operational methods and advanced smart building technologies to meet these upcoming standards.

- Mandatory ESG Reporting: Growing pressure for transparent ESG disclosures could require Hysan to invest in data collection and reporting infrastructure.

- Green Building Standards: Compliance with updated energy efficiency codes, such as those expected in the Buildings Energy Efficiency (Amendment) Ordinance 2025, may necessitate capital expenditure on building retrofits and new sustainable technologies.

- Incentives for Sustainability: Governments may offer tax breaks or subsidies for properties meeting high green building certifications, creating financial benefits for proactive developers.

- Tenant Demand: A rising preference among corporate tenants for ESG-certified or green buildings could drive demand for Hysan's properties that align with these criteria.

Talent Attraction Schemes

Government initiatives aimed at attracting overseas and mainland talent to Hong Kong directly influence the demand for residential leasing and sales, particularly in the premium segment where Hysan has a substantial footprint. These policies are designed to increase population inflows, which in turn stimulates property demand.

For instance, the relaxation of the investment immigration program to permit residential property as an eligible investment, alongside the suspension of stamp duty for incoming talent, are key measures implemented to bolster the property market. These actions are expected to create a more dynamic market environment.

- Talent Inflow Impact: Hong Kong's efforts to attract talent are directly linked to increased demand for residential properties, especially in prime locations favored by Hysan.

- Immigration Program Changes: The inclusion of residential property in the investment immigration program, coupled with stamp duty waivers for new arrivals, are significant policy shifts.

- Market Stimulation: These government measures are intended to stimulate both the leasing and sales markets by encouraging a higher influx of residents.

Hong Kong's government has actively adjusted property market policies, notably canceling demand-side measures in February 2024, including stamp duties for non-residents and loan-to-value ratio adjustments, aiming to invigorate a slowing market and boost transaction volumes.

Geopolitical stability and cross-border policies significantly impact investor confidence; Hysan's 2024 Annual Report notes optimism for Hong Kong's role as a SAR, though policy shifts could deter mainland Chinese investors crucial for premium market segments.

Government land sale programs and premium policies, like the 2024-25 land sale plan for residential, commercial, and industrial sites, directly influence Hysan's development costs and pipeline, with ongoing discussions on land premium payment structures to stimulate development.

Evolving ESG regulations, such as the anticipated Buildings Energy Efficiency (Amendment) Ordinance 2025, will require Hysan to invest in sustainable technologies and retrofits, potentially increasing compliance costs but also offering competitive advantages and attracting ESG-conscious tenants.

What is included in the product

This Hysan PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic positioning.

A concise, actionable summary of Hysan's PESTLE factors, enabling quick identification of external opportunities and threats to inform strategic decisions and mitigate risks.

Economic factors

Fluctuations in interest rates, such as the Hong Kong Interbank Offered Rate (HIBOR) and US Federal Reserve decisions, directly impact mortgage expenses and the ability of property purchasers and developers to secure financing. For instance, HIBOR rates have seen variability, influencing the cost of capital for real estate projects.

Projections for 2025 suggest a potential downtrend in interest rates. This anticipated decline could lower mortgage payments, enhancing housing affordability and likely boosting property transaction volumes, which would be beneficial for Hysan's residential sales and the valuation of its investment properties.

Hong Kong's economic trajectory significantly influences the property market. In 2024, the city experienced a gradual economic recovery. However, the commercial property sector grappled with elevated vacancy rates and subdued retail sales, trends that are anticipated to persist into 2025, potentially affecting Hysan's rental income and occupancy levels.

Hong Kong's property market is inherently cyclical, and recent trends point towards significant supply pressures. For instance, the office sector is projected to see a substantial influx of new supply in 2025, with an estimated 11.5 million square feet of new Grade A office space expected to enter the market across Hong Kong. This surge in availability, coupled with existing high vacancy rates, particularly in core business districts, is likely to intensify competition among landlords.

These dynamics directly affect rental yields and capital values, creating a challenging environment for property owners like Hysan. With an anticipated 1.5 million square feet of new Grade A office supply entering the market in Q4 2024 alone, rental prices are expected to remain under pressure. Consequently, Hysan will likely need to implement more attractive leasing packages and incentives to secure and retain tenants, impacting its revenue streams.

Retail Sales and Tourism Recovery

The rebound in tourism and consumer spending, especially from mainland Chinese visitors, is a significant driver for Hysan's retail properties. This trend is expected to continue, bolstering performance in key shopping areas.

Retail sales value is projected to see growth in 2025, partly due to relaxed visa policies for Shenzhen residents, which should encourage more spending. However, the retail leasing market is showing a clear divide.

- Retail Leasing Polarization: Prime shopping districts are outperforming lower-tier streets, impacting Hysan's strategic decisions for its retail asset management.

- Tourism Impact: The return of tourists, particularly from mainland China, is a critical factor supporting Hysan's retail revenue streams.

- 2025 Forecast: Retail sales are anticipated to grow in 2025, supported by initiatives like multi-entry visas for Shenzhen residents.

Investment Sentiment and Capital Values

Investor sentiment, a key driver of capital values, is currently subdued. Rising financing costs and the expansion of yields are making investors more cautious, directly impacting transaction volumes in commercial property markets. This cautiousness is expected to persist, creating headwinds for property investment and development.

The outlook for commercial property capital values is not optimistic. Projections indicate a decline in 2025, a trend that will likely be exacerbated by ongoing economic uncertainties. This wait-and-see approach by investors presents significant challenges for companies like Hysan, particularly in their property investment and development endeavors.

- Investor Confidence: Influenced by financing costs and yield expansion, investor confidence remains a critical factor affecting commercial property markets.

- Capital Value Projections: Commercial property capital values are forecast to decrease in 2025, reflecting a challenging market environment.

- Transaction Volumes: Higher financing costs and yield expansion are dampening investor appetite, leading to lower transaction volumes.

- Market Uncertainty: Economic uncertainties are prompting a wait-and-see approach from investors, hindering Hysan's investment and development plans.

Interest rate trends, particularly HIBOR and US Federal Reserve actions, directly influence borrowing costs for property transactions and development. With HIBOR rates showing volatility, the cost of capital for real estate projects remains a key consideration.

Projections for 2025 suggest a potential decrease in interest rates, which could lower mortgage payments, improve housing affordability, and likely increase property sales volumes, benefiting Hysan's residential segment and property valuations.

Hong Kong's economic recovery in 2024 faced headwinds in the commercial property sector, with high vacancies and weak retail sales expected to continue into 2025, impacting Hysan's rental income and occupancy.

| Economic Factor | 2024 Trend | 2025 Outlook | Impact on Hysan |

|---|---|---|---|

| Interest Rates (HIBOR) | Variable | Potential Downtrend | Lower financing costs, improved affordability |

| Economic Growth | Gradual Recovery | Continued Recovery | Support for retail, potential office demand |

| Retail Sales | Subdued | Projected Growth | Increased retail revenue, driven by tourism |

| Property Supply (Office) | High Vacancy | New Supply Influx (11.5M sq ft) | Rental price pressure, increased competition |

Preview the Actual Deliverable

Hysan PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hysan PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing actionable insights for strategic planning.

Sociological factors

Demographic shifts, including population inflows from talent schemes and evolving household formation patterns, directly impact the demand for various residential property types. A projected mild recovery in residential prices and increased rental demand, especially for smaller units, is anticipated for 2025. This trend is fueled by returning residents and an influx of professionals, creating a favorable environment for Hysan's varied residential offerings.

The shift towards hybrid and remote work models is fundamentally reshaping demand for commercial real estate. In 2024, office vacancy rates in major global cities remained elevated, prompting a re-evaluation of traditional office footprints. This trend directly impacts developers like Hysan, necessitating adaptable spaces that cater to flexible working arrangements and a greater emphasis on employee well-being.

Consumer preferences are also evolving, with a growing demand for mixed-use developments that offer convenience and a strong sense of community. Hysan's strategy of developing integrated precincts, such as Lee Gardens, which blends office, retail, and residential components, directly addresses this by providing a holistic living and working environment. This approach aims to enhance liveability and foster a better work-life balance, aligning with the desires of a modern workforce.

Hysan's operations are deeply intertwined with Hong Kong's high urbanization rate, a trend that continues to shape demand for quality urban living and commercial spaces. The ongoing influx of people into cities necessitates thoughtful community development, a core focus for Hysan.

The company's Community Business Model, evident in projects like Lee Garden Eight, prioritizes enhancing liveability and social well-being. This approach aims to foster stronger neighborhood connections and a greater sense of belonging within densely populated areas, responding directly to the sociological impacts of urbanization.

Consumer Behavior in Retail

Consumer behavior is rapidly evolving, with a significant shift towards online shopping and a growing appetite for unique, in-person experiences. In 2024, e-commerce sales are projected to continue their upward trajectory, impacting traditional retail models. This trend demands that companies like Hysan actively adapt their strategies to remain relevant and competitive.

Hysan is responding to these changes by focusing on enhancing its physical retail spaces and curating a compelling mix of brands. The renovation of Hysan Place, for instance, aims to create a more engaging environment that appeals to modern shoppers. Furthermore, strengthening loyalty programs, such as the Club Avenue membership, is crucial for retaining customers and fostering a sense of community around its retail offerings.

- E-commerce Growth: Global retail e-commerce sales are expected to reach approximately $7.5 trillion by the end of 2024, highlighting the persistent shift away from brick-and-mortar alone.

- Experiential Retail Demand: A 2024 survey indicated that over 60% of consumers are more likely to visit a store if it offers a unique or memorable experience.

- Loyalty Program Impact: Hysan's Club Avenue program reported a 15% increase in member engagement in the first half of 2024, demonstrating the value of targeted customer retention efforts.

Health and Wellness Consciousness

The increasing societal focus on health and wellness significantly shapes consumer preferences, directly influencing demand for properties that offer superior indoor air quality, ample green spaces, and amenities conducive to well-being. This trend is evident in the growing market for sustainable and healthy living environments.

Hysan Development is actively responding to this shift by integrating green and sustainable features into its portfolio. For instance, their Lee Gardens One development achieved a Gold certification under the Leadership in Energy and Environmental Design (LEED) rating system, underscoring a commitment to environmentally conscious building practices. Furthermore, Hysan is developing smart communities designed to enhance residents' quality of life, aligning with the heightened emphasis on personal health and overall well-being.

The impact of this consciousness is measurable: a 2024 report indicated that over 60% of urban dwellers are willing to pay a premium for housing with access to green spaces and improved air quality. This highlights a tangible market opportunity for developers like Hysan that prioritize these aspects.

- Growing Health Awareness: Consumers increasingly prioritize environments that support physical and mental health.

- Demand for Green Features: Properties offering good indoor air quality and accessible green spaces are in higher demand.

- Hysan's Strategy: Hysan incorporates sustainability and smart community features to meet these evolving needs.

- Market Validation: A significant percentage of urban residents are willing to pay more for healthier living environments.

Societal values are increasingly emphasizing health and wellness, driving demand for properties that offer superior indoor air quality and green spaces. This trend is reflected in consumer willingness to pay a premium for healthier living environments, with over 60% of urban dwellers indicating this preference in a 2024 report. Hysan's commitment to sustainability, demonstrated by LEED Gold certification for Lee Gardens One, directly addresses this growing societal concern.

The shift towards hybrid work models and a greater focus on work-life balance are reshaping urban living preferences. Consumers now seek convenience and community, favoring mixed-use developments that integrate residential, retail, and office spaces. Hysan's Community Business Model, exemplified by projects like Lee Garden Eight, aims to enhance liveability and foster social well-being within urban settings.

Evolving consumer behavior, marked by a strong preference for online shopping alongside a desire for unique in-person experiences, necessitates adaptive retail strategies. Global retail e-commerce sales are projected to reach approximately $7.5 trillion by the end of 2024, underscoring the need for physical retail spaces to offer engaging environments. Hysan's renovations and loyalty programs are designed to meet these dynamic consumer expectations.

| Sociological Factor | Trend | Impact on Hysan | 2024/2025 Data Point |

|---|---|---|---|

| Health & Wellness Focus | Increased demand for healthy living environments | Drives demand for properties with green spaces and good air quality | 60%+ urban dwellers willing to pay premium for healthier housing |

| Work-Life Balance | Preference for mixed-use developments and community integration | Supports Hysan's integrated precinct strategy | Growing demand for convenient, holistic living/working spaces |

| Consumer Behavior Shift | Growth of e-commerce alongside demand for experiential retail | Requires adaptation of retail spaces and customer engagement strategies | Global e-commerce sales projected at $7.5 trillion by end of 2024 |

Technological factors

The increasing adoption of smart building technologies and proptech is a significant technological factor influencing the real estate sector. These innovations are designed to boost operational efficiency, elevate the tenant experience, and improve environmental sustainability.

Hysan's strategic investments in smart solutions underscore this trend. For instance, the company is focusing on enhancing liveability, connectivity, and overall quality of life for its stakeholders. This commitment is exemplified by the integration of Multi-trade Integrated Mechanical, Electrical and Plumbing (MiMEP) systems in new developments, such as Lee Garden Eight, which commenced construction in late 2023 and is expected to be completed in 2027.

Data analytics is becoming a cornerstone of effective property management, offering deep dives into tenant behavior, market dynamics, and operational performance. This allows for smarter decisions, from optimizing rental pricing to improving building services. For instance, by analyzing occupancy rates and lease renewal patterns, property managers can predict future demand and proactively address potential vacancies.

While Hysan Development's specific utilization of advanced data analytics isn't heavily publicized, the property management sector as a whole is increasingly embracing these tools. Industry reports from 2024 indicate a significant rise in PropTech investments, with a substantial portion allocated to data analytics platforms aimed at enhancing portfolio value and informing strategic growth. This trend suggests a growing expectation for companies like Hysan to leverage data for competitive advantage.

Robust digital infrastructure is paramount for Hysan's properties, enabling seamless remote work, advanced smart home features, and engaging digital retail. Hong Kong's average mobile data consumption per user reached approximately 15 GB per month in late 2024, highlighting the demand for high-speed connectivity. Hysan's focus on creating connected communities directly leverages this trend.

Cybersecurity and Data Privacy

As property operations increasingly rely on digital systems and data, cybersecurity and data privacy are paramount. Protecting sensitive tenant and operational information necessitates robust technological defenses. Hysan's 2024 Sustainability Report underscores its commitment to enhancing these critical areas.

The company's proactive approach includes ongoing investments in advanced cybersecurity solutions and stringent data privacy protocols. This focus is crucial for maintaining trust and ensuring compliance with evolving regulations. Hysan's 2024 report indicated a significant increase in cybersecurity training for employees, covering 95% of its workforce to mitigate human-related risks.

- Strengthened Data Encryption: Hysan implemented enhanced encryption for all customer data stored across its digital platforms in 2024, aiming to prevent unauthorized access.

- Regular Security Audits: The company conducted quarterly penetration testing and vulnerability assessments throughout 2024, identifying and rectifying potential security gaps.

- Privacy Policy Updates: Hysan updated its privacy policies in early 2024 to align with the latest global data protection standards, ensuring transparency with stakeholders.

Innovation in Construction Technologies

Advancements in construction technologies are significantly reshaping how buildings are developed. Innovations like modular construction, which involves prefabricating building components off-site, and the increasing use of sustainable building materials are key drivers. These technologies not only boost efficiency and lower construction costs but also substantially improve the environmental footprint of new developments, aligning with growing global sustainability mandates.

Hysan Property Management Company Limited actively embraces these technological shifts. A prime example is its adoption of MiMEP (Modular Integrated Mechanical, Electrical, and Plumbing) systems in its Lee Garden Eight project. This strategic implementation demonstrates Hysan's dedication to pioneering sustainable urban development by integrating cutting-edge construction methods that enhance building performance and reduce waste.

- Modular Construction: Offers faster project completion times and improved quality control by building components in a controlled factory environment.

- Sustainable Materials: Includes recycled content, low-VOC (Volatile Organic Compound) paints, and energy-efficient insulation, contributing to healthier indoor environments and reduced operational energy consumption.

- Digitalization in Construction: Technologies like Building Information Modeling (BIM) are streamlining design, planning, and on-site execution, leading to better coordination and fewer errors.

- MiMEP Systems: As seen in Lee Garden Eight, these integrated systems pre-fabricate MEP components, reducing on-site labor and installation time, while also improving system reliability and maintenance.

Technological advancements are rapidly transforming the real estate landscape, with smart building technologies and proptech at the forefront. These innovations are crucial for enhancing operational efficiency, tenant experience, and environmental sustainability. Hysan's commitment to integrating advanced solutions, such as MiMEP systems in Lee Garden Eight, highlights its proactive approach to leveraging technology for improved building performance and stakeholder value.

Data analytics is becoming indispensable for effective property management, enabling informed decisions regarding rental pricing, service improvements, and demand forecasting. The property sector's increasing PropTech investments in 2024, particularly in data analytics platforms, underscore the expectation for companies like Hysan to utilize data for a competitive edge and portfolio value enhancement.

Robust digital infrastructure is essential for modern properties, supporting remote work, smart features, and digital retail experiences. Hong Kong's high mobile data consumption, averaging around 15 GB per user monthly in late 2024, emphasizes the critical need for high-speed connectivity, which Hysan aims to deliver through its focus on connected communities.

Cybersecurity and data privacy are paramount as digital systems become integral to property operations. Hysan's 2024 Sustainability Report details its dedication to strengthening these areas through advanced solutions and employee training, ensuring data protection and regulatory compliance.

Legal factors

Hong Kong's land lease system is a critical legal factor for Hysan. Almost all land is leased from the government, with typical new leases lasting 50 years and subject to annual government rent. This structure directly shapes Hysan's long-term asset values and future development opportunities.

Modifying these leases, often necessary for redevelopment projects, usually requires paying a premium to the government. In 2024, this premium system continues to be a significant consideration in Hysan's strategic planning for property acquisitions and urban renewal initiatives.

Hong Kong's stringent building codes, including the Buildings Ordinance, mandate rigorous safety standards for all new constructions and renovations. Hysan must adhere to these regulations, which cover everything from structural design and fire safety to ventilation and accessibility. For instance, the Buildings Department actively enforces these codes, with penalties for non-compliance impacting development timelines and costs.

Hysan faces evolving environmental regulations, such as the Buildings Energy Efficiency Ordinance (BEEO) and the push for green building certifications like BEAM Plus. These laws create legal obligations, shaping how Hysan designs and operates its properties. For instance, the upcoming 2025 BEEO amendment, which shortens audit cycles and broadens its scope, will directly affect Hysan's compliance strategies and necessitate further investment in sustainability initiatives.

Tenancy Laws and Rental Regulations

Tenancy laws and rental regulations are fundamental to Hysan's business, directly influencing its leasing operations and revenue streams. These laws dictate everything from the specifics of rental agreements and lease terms to the often complex procedures for eviction. For Hysan, which manages a substantial portfolio encompassing office, retail, and residential spaces, a thorough understanding and strict adherence to these regulations are paramount for maintaining operational stability and predictable revenue.

In Hong Kong, where Hysan primarily operates, the Landlord and Tenant (Consolidation) Ordinance is a key piece of legislation. This ordinance governs many aspects of landlord-tenant relationships, including rent control measures that may apply to certain tenancies, particularly older residential leases. While many commercial leases are less regulated, the ordinance still provides a framework that impacts dispute resolution and property management practices.

Recent data highlights the importance of regulatory compliance. For instance, in 2023, Hong Kong's vacancy rate for Grade A office space was around 9.5%, a figure influenced by economic conditions but also by the attractiveness of rental terms, which are shaped by landlord-tenant dynamics. Similarly, retail rental recovery is closely tied to consumer sentiment and the ability of landlords to offer flexible lease terms, often within the bounds of existing regulations.

- Lease Agreement Compliance: Ensuring all rental agreements adhere to Hong Kong's Landlord and Tenant (Consolidation) Ordinance is critical for Hysan's legal standing.

- Eviction Procedures: Strict adherence to legal eviction processes protects Hysan from litigation and ensures orderly tenant turnover.

- Rental Market Impact: Regulatory frameworks can influence rental pricing and tenant retention, impacting Hysan's revenue stability.

- Portfolio Management: Navigating diverse tenancy laws across different property types (office, retail, residential) requires specialized legal and property management expertise.

Data Privacy Laws

As property management increasingly relies on digital platforms for tenant services and operations, data privacy laws are becoming critically important. Hysan's sustainability reports highlight its focus on bolstering data privacy measures, demonstrating a commitment to responsible personal data handling and compliance with evolving legal frameworks. This includes adherence to regulations like the Personal Data (Privacy) Ordinance in Hong Kong, which governs how organizations collect, use, and store personal information.

Navigating these data privacy requirements is essential for maintaining tenant trust and avoiding potential legal repercussions. Companies like Hysan must ensure their digital infrastructure and data handling practices align with these stringent legal obligations. For instance, the company's efforts in 2024 to enhance cybersecurity protocols are directly linked to its commitment to safeguarding tenant data against breaches, a key aspect of data privacy compliance.

- Compliance with Hong Kong's Personal Data (Privacy) Ordinance

- Implementation of robust data security measures for digital property management

- Tenant data protection initiatives as part of sustainability reporting

- Adherence to evolving global data privacy standards

Hysan's operations are significantly shaped by Hong Kong's legal landscape, particularly its land lease system and building regulations. The government's leasehold system, where most land is leased, necessitates ongoing payments and potential premiums for redevelopment, directly impacting asset valuation and strategic planning. For example, in 2024, the government's rent review policies continue to influence long-term financial projections for Hysan's properties.

Furthermore, stringent building codes, like the Buildings Ordinance, mandate adherence to safety and design standards, impacting construction costs and timelines. Environmental legislation, such as the Buildings Energy Efficiency Ordinance (BEEO), with its 2025 amendment focusing on shorter audit cycles, requires Hysan to invest in sustainable practices and compliance measures. Tenancy laws, including the Landlord and Tenant (Consolidation) Ordinance, govern rental agreements and eviction procedures, crucial for revenue stability and tenant relations.

Data privacy regulations, like Hong Kong's Personal Data (Privacy) Ordinance, are increasingly vital as Hysan adopts digital platforms. The company's 2024 cybersecurity enhancements reflect a commitment to protecting tenant data, aligning with evolving legal obligations and maintaining trust. Compliance with these diverse legal factors is essential for Hysan's operational integrity and long-term success.

Environmental factors

Climate change presents significant physical risks to Hysan's property portfolio in Hong Kong, a coastal city vulnerable to extreme weather. Events like intensified typhoons and potential sea-level rise could directly impact asset value and operational continuity.

Hysan's commitment to climate action is evident in its sustainability reports, which detail efforts to assess and manage climate-related financial disclosures. This proactive approach aims to build resilience against these evolving environmental threats.

The drive to lower energy use and carbon footprints in buildings is a major concern, especially since these structures are significant energy consumers and emission sources in Hong Kong. This directly influences how Hysan operates its properties.

Hysan has committed to ambitious environmental targets, aiming for a 46% cut in absolute carbon emissions by 2031. As of 2024, the company has already made progress, achieving over a 7% reduction in its Scope 1 and 2 emissions.

The growing demand for environmentally friendly spaces and stricter regulations are significantly shaping how buildings are designed, constructed, and updated. This trend is particularly evident with green building certifications such as BEAM Plus, which are increasingly becoming a standard. For instance, Hong Kong's commitment to sustainability is reflected in its building codes and incentives for green developments.

Hysan's Lee Garden Eight project exemplifies this shift, aiming to establish a new benchmark in sustainable urban development. The project integrates advanced green construction technologies and emphasizes public green spaces, directly responding to the drive for higher BEAM Plus ratings. This strategic approach aligns Hysan with evolving market expectations and regulatory frameworks, potentially enhancing its long-term value and appeal.

Waste Management and Resource Consumption

Effective waste management and responsible resource consumption are crucial for large property portfolios like Hysan's. These efforts directly impact environmental footprint and operational costs. While specific waste reduction targets for Hysan weren't detailed, sustainability initiatives typically focus on minimizing waste generation and maximizing recycling rates across their extensive property holdings.

Optimizing water usage is another key environmental consideration. Companies like Hysan often implement strategies to reduce consumption, especially in high-usage areas like commercial properties and public spaces. For instance, implementing water-efficient fixtures and smart irrigation systems can lead to significant savings.

In 2023, Hong Kong's overall recycling rate stood at approximately 37%, with commercial and industrial sectors contributing to this figure. Large property owners are increasingly expected to exceed these averages through dedicated programs.

Key aspects of Hysan's potential environmental strategy in this area could include:

- Waste Reduction Programs: Implementing initiatives to decrease the volume of waste sent to landfills.

- Recycling and Upcycling: Enhancing recycling infrastructure and exploring opportunities to upcycle materials.

- Water Conservation Measures: Adopting technologies and practices to reduce overall water consumption across properties.

- Energy Efficiency in Waste Processing: Exploring sustainable methods for waste treatment and disposal.

Biodiversity and Green Spaces

The increasing emphasis on urban biodiversity and green spaces is a significant environmental factor influencing property development. These elements are recognized for their dual benefits: improving ecological health and enhancing the quality of urban life.

Hysan's commitment to this trend is evident in its Lee Garden Eight development. This project features a substantial 60,000 square-foot green open space, demonstrating a proactive approach to integrating natural environments within a dense urban setting. This initiative aims to boost ecological value and improve the overall liveability of the area.

Key aspects of this environmental consideration include:

- Enhanced Urban Ecosystems: Integrating green spaces supports local wildlife, improves air quality, and helps manage urban heat island effects.

- Improved Resident Well-being: Access to nature in urban environments is linked to reduced stress and improved mental health for occupants.

- Sustainable Development Practices: Projects like Lee Garden Eight set a precedent for incorporating biodiversity as a core component of modern urban planning, aligning with growing environmental consciousness.

- Regulatory Alignment: Increasingly, urban planning regulations are mandating or incentivizing the inclusion of green infrastructure, making such features a strategic necessity for developers.

Environmental factors are increasingly shaping Hysan's operational and strategic landscape. The company is actively addressing climate risks, evidenced by its commitment to reducing carbon emissions, aiming for a 46% cut by 2031 and having already achieved over a 7% reduction in Scope 1 and 2 emissions as of 2024.

This focus extends to sustainable building practices, with projects like Lee Garden Eight setting new benchmarks for green development and higher BEAM Plus ratings, aligning with Hong Kong's growing emphasis on sustainability in its building codes and incentives.

Furthermore, Hysan is integrating urban biodiversity and green spaces into its developments, recognizing their importance for ecological health and resident well-being, as seen in the 60,000 square-foot green open space at Lee Garden Eight.

Waste management and water conservation are also critical, with an expectation for property owners to enhance recycling rates beyond Hong Kong's 2023 overall rate of approximately 37%.

| Environmental Focus Area | Hysan's Action/Commitment | Relevant Data/Context (2023-2024) |

|---|---|---|

| Carbon Emissions Reduction | Targeting 46% absolute cut by 2031 | Achieved >7% reduction in Scope 1 & 2 emissions (as of 2024) |

| Sustainable Building Design | Emphasis on green construction technologies | Lee Garden Eight aiming for high BEAM Plus ratings |

| Urban Biodiversity & Green Spaces | Integration of natural environments in developments | Lee Garden Eight features 60,000 sq ft of green open space |

| Waste Management & Recycling | Enhancing recycling infrastructure and programs | Hong Kong's overall recycling rate was ~37% in 2023 |

| Water Conservation | Implementing water-efficient fixtures and smart systems | Focus on reducing consumption in commercial properties |

PESTLE Analysis Data Sources

Our Hysan PESTLE Analysis draws from a robust blend of official government reports, reputable financial news outlets, and industry-specific market research. We meticulously gather data on Hong Kong's political landscape, economic indicators, technological advancements, and social trends to ensure a comprehensive understanding.