Hysan Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hysan Bundle

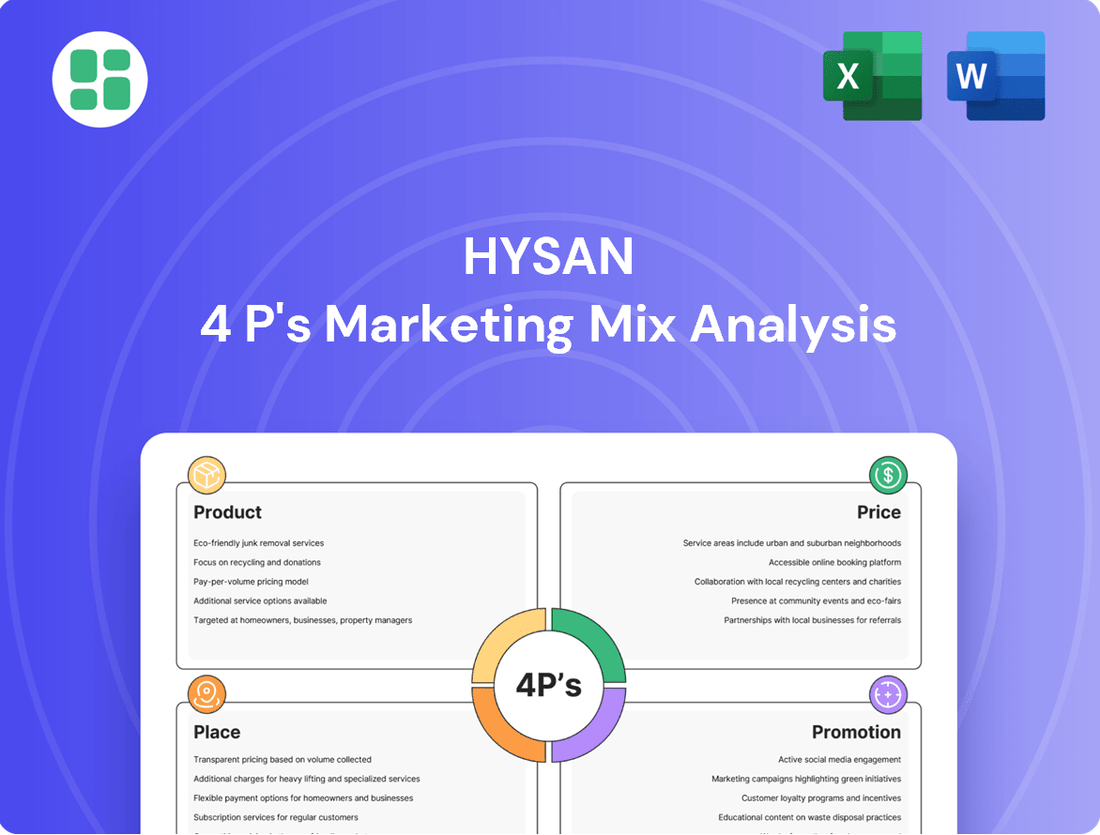

Hysan's marketing success is built on a robust 4Ps strategy, expertly balancing its product offerings, pricing structures, distribution channels, and promotional activities. This comprehensive analysis delves into how these elements synergize to create a powerful market presence.

Discover the intricate details of Hysan's product innovation, its strategic pricing models, its effective place in the market, and its impactful promotion campaigns. Gain actionable insights that can inform your own marketing endeavors.

Ready to unlock the full potential of Hysan's marketing approach? Access our complete, editable 4Ps Marketing Mix Analysis and gain a competitive edge.

Product

Hysan Development's diverse property portfolio is anchored in its prime Causeway Bay holdings, notably the Lee Gardens precinct. This strategic concentration allows for a synergistic mix of premium office spaces, sought-after retail environments, and exclusive residential offerings like Bamboo Grove, catering to a broad spectrum of clientele.

The company actively curates this diverse mix to serve multinational corporations seeking prime office locations and affluent individuals desiring luxury living. This approach ensures a robust and resilient revenue stream, drawing from multiple market segments within Hong Kong's dynamic commercial landscape.

Hysan's product strategy centers on ongoing portfolio rejuvenation, ensuring its properties remain appealing and competitive. This involves continuous enhancement of existing assets to align with changing market needs and consumer tastes.

Significant renovations at Hysan Place and Lee Garden One concluded in December 2024. These upgrades introduced fresh concepts and brands, including expanded luxury flagship stores for Hermès, Dior, and Cartier, bolstering the properties' allure.

Hysan is strategically investing in property development to bolster its core offerings and solidify its market standing. These initiatives are crucial for long-term growth and competitive advantage.

A prime example is the Caroline Hill Road development, branded as Lee Garden Eight, with an anticipated completion in H2 2026. This project represents a significant expansion of Hysan's commercial footprint.

Lee Garden Eight will introduce considerable commercial space and public green areas, enhancing the overall appeal and utility of the Lee Gardens precinct. This development is expected to attract higher footfall and rental yields.

Integrated Property Management Services

Hysan's integrated property management services extend beyond just bricks and mortar, focusing on delivering a premium, hassle-free experience for all its tenants. This commitment ensures that every aspect of facility management, tenant support, and space maintenance meets a high standard, directly contributing to tenant satisfaction and loyalty.

These comprehensive services are a cornerstone of Hysan's strategy to boost tenant retention and elevate the overall value of its property portfolio. For instance, in 2023, Hysan reported a high occupancy rate across its key assets, underscoring the effectiveness of its tenant-centric management approach.

- Tenant Retention: High-quality management directly impacts lease renewals.

- Value Enhancement: Well-maintained properties command premium rents and attract quality tenants.

- Operational Efficiency: Streamlined facility management reduces costs and improves tenant experience.

- Brand Reputation: Consistent service delivery builds trust and strengthens Hysan's brand image in the competitive Hong Kong market.

Commitment to Sustainability and Innovation

Hysan places a strong emphasis on sustainability and innovation within its property portfolio. This commitment is evident in their pursuit of green building certifications and the implementation of energy-saving measures across their developments, such as the 2023 completion of Lee Garden Six which achieved LEED Platinum certification. This focus not only reduces environmental impact but also appeals to a growing segment of environmentally conscious tenants and investors.

Future projects, like the upcoming Lee Garden Eight, are designed with pioneering sustainability features. These include advanced energy-efficient systems and the integration of cultural facilities and expansive green open spaces. This forward-thinking approach aims to create properties that offer enhanced long-term value and a superior user experience, reflecting a dedication to modern environmental and social governance principles.

Hysan's strategic integration of sustainability and innovation contributes significantly to the perceived value of their properties. For instance, their ongoing efforts in energy efficiency have contributed to a reduction in operational costs, with a target to decrease carbon intensity by 30% by 2030 compared to 2019 levels. This proactive stance aligns with global trends and strengthens their market position.

- Green Building Certifications: Hysan actively seeks certifications like LEED for its properties, demonstrating a commitment to environmentally responsible design and construction.

- Energy-Saving Initiatives: Implementation of technologies and practices to reduce energy consumption across their building portfolio.

- Innovative Design: New developments incorporate cutting-edge features for sustainability and tenant well-being.

- Long-Term Value: The focus on sustainability enhances the appeal and enduring value of Hysan's properties in the market.

Hysan's product strategy focuses on a curated mix of premium retail, office, and residential spaces, primarily in Causeway Bay. Recent upgrades at Hysan Place and Lee Garden One, completed in December 2024, introduced flagship stores for luxury brands like Hermès and Dior, enhancing their appeal. The upcoming Lee Garden Eight, expected in H2 2026, will add substantial commercial space and public green areas, further solidifying the Lee Gardens precinct's desirability.

| Property | Completion/Upgrade | Key Features | Tenant Profile |

|---|---|---|---|

| Hysan Place | Dec 2024 (Upgrade) | Expanded luxury flagship stores (Hermès, Dior, Cartier) | Premium retail, office |

| Lee Garden One | Dec 2024 (Upgrade) | Enhanced retail offerings | Premium retail |

| Lee Garden Six | 2023 | LEED Platinum certified | Office, retail |

| Lee Garden Eight (Caroline Hill Road) | H2 2026 (Anticipated) | New commercial space, public green areas | Commercial, public amenity |

What is included in the product

This analysis provides a comprehensive breakdown of Hysan's marketing mix, detailing its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It offers a professional, data-driven overview ideal for benchmarking, strategy development, and stakeholder reporting.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for better decision-making.

Provides a clear, concise framework for understanding and optimizing Hysan's marketing efforts, removing the frustration of scattered information.

Place

Hysan's 'Place' strategy is anchored in its prime real estate holdings in Causeway Bay, Hong Kong Island, specifically the Lee Gardens area. This concentration fosters a unique 'city within a city' environment, integrating office, retail, and residential spaces. This prime location is a substantial competitive edge.

Hysan is enhancing its Place strategy by developing an integrated pedestrian walkway system within the Lee Gardens precinct, slated for full connectivity by 2026. This initiative aims to create a seamless flow between Hysan's properties and the Causeway Bay MTR station, significantly boosting accessibility and convenience for visitors and tenants alike.

Hysan's strategic move into Mainland China, exemplified by the Lee Gardens Shanghai project, represents a significant diversification of its property portfolio. This Grade A commercial complex is designed to capture new market opportunities and bolster the company's overall revenue streams.

The successful leasing performance at Lee Gardens Shanghai, with occupancy rates showing positive trends as of early 2024, underscores the viability of this expansion. This venture taps into the robust demand for high-quality commercial spaces in key Chinese economic hubs, contributing directly to Hysan's growth trajectory.

Direct Leasing and Agency Partnerships

Hysan Development employs a strategic distribution model that combines direct leasing with property agency partnerships to maximize market penetration across its diverse portfolio. This dual approach ensures comprehensive coverage for its office, retail, and residential properties.

Direct leasing allows Hysan to cultivate direct relationships with tenants, offering customized solutions and fostering long-term partnerships. This hands-on approach is crucial for securing high-quality anchor tenants and maintaining strong occupancy rates.

Collaborating with established property agencies extends Hysan's reach, tapping into wider networks and accelerating the leasing process for its available spaces. For instance, in 2024, Hysan continued to leverage these partnerships to fill vacancies efficiently, contributing to its overall rental income.

- Direct Leasing: Enables tailored tenant solutions and direct relationship management.

- Agency Partnerships: Broadens market reach and enhances network penetration.

- Portfolio Coverage: Ensures efficient leasing across office, retail, and residential segments.

- Market Penetration: Aims to maximize occupancy and rental income through a multi-channel strategy.

Optimized Tenant Mix and Flow

Hysan Development actively cultivates a dynamic tenant mix across its prime retail and office spaces, ensuring a robust and appealing portfolio. This strategy involves attracting a diverse array of high-caliber tenants, encompassing prestigious luxury brands, established financial institutions, and modern co-working providers. This deliberate diversification is key to maintaining consistently high occupancy rates and building resilience against potential market downturns.

The strategic arrangement of these diverse offerings within Hysan’s precincts is meticulously designed to optimize foot traffic and elevate the overall vibrancy of its properties. For instance, Hysan Place, a flagship property, reported a strong average occupancy rate of 98.8% for its retail segment as of the first half of 2024, demonstrating the success of its tenant curation. This thoughtful placement creates a synergistic environment, enhancing the customer experience and driving sustained commercial activity.

- Tenant Diversification: Hysan's portfolio includes a blend of luxury retail, essential services, and premium office spaces, reducing reliance on any single sector.

- Occupancy Rates: Hysan's properties, such as Lee Gardens One, maintained an office occupancy rate of 97.5% in the first half of 2024, highlighting tenant stability.

- Foot Traffic Enhancement: Strategic tenant placement, like integrating popular dining options with retail and office spaces, boosts overall visitor numbers and dwell time.

- Market Resilience: The varied tenant base provides a buffer against sector-specific economic shocks, contributing to stable rental income streams.

Hysan's 'Place' strategy is deeply rooted in its premium Hong Kong Island portfolio, particularly the Lee Gardens area, creating an integrated urban environment. This strategic positioning is further amplified by ongoing infrastructure enhancements, such as the pedestrian walkway system connecting properties to the MTR, expected to be fully operational by 2026. The expansion into Mainland China with Lee Gardens Shanghai also diversifies its geographical 'place,' aiming to capture new market demand.

The company's distribution approach leverages both direct leasing, fostering tenant relationships, and agency partnerships to maximize market reach. This dual strategy is crucial for maintaining high occupancy across its diverse property types. Hysan's tenant mix strategy, evident in properties like Hysan Place, which reported a 98.8% retail occupancy in H1 2024, emphasizes diversification to ensure market resilience and vibrancy.

| Property/Area | Key Location Aspect | Recent Occupancy (H1 2024) | Strategic Initiative |

|---|---|---|---|

| Lee Gardens, Causeway Bay | Prime Hong Kong Island | Office: 97.5% (Lee Gardens One) | Integrated pedestrian walkway (by 2026) |

| Hysan Place | Causeway Bay Hub | Retail: 98.8% | Dynamic tenant mix |

| Lee Gardens Shanghai | Mainland China Expansion | Positive trends (early 2024) | Grade A commercial complex development |

Same Document Delivered

Hysan 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Hysan 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You'll gain immediate access to this ready-to-use analysis to inform your strategic decisions.

Promotion

Hysan's promotional efforts are deeply intertwined with its Lee Gardens rejuvenation strategy, prominently featuring the unveiling of upgraded flagship stores and innovative retail concepts. These announcements, frequently communicated through press releases and investor updates, underscore the enhanced customer experience and solidify Lee Gardens' standing as a top-tier luxury and lifestyle hub.

Hysan's 'Community Business Model' is central to its engagement strategy, focusing on urban culture-centric events within the Lee Gardens precinct. This approach aims to create a vibrant community hub, drawing in both local residents and tourists.

Initiatives like 'Urban Jam' and #URBANHOOD are specifically curated to boost foot traffic and foster a sense of belonging. For example, in 2023, Hysan Development reported that its retail properties, including Lee Gardens, saw a significant uplift in visitor numbers during key event periods, contributing to a 15% year-on-year increase in turnover for its retail segment.

These events position the Lee Gardens precinct not just as a shopping destination, but as a dynamic lifestyle hub, enhancing brand loyalty and encouraging repeat visits by offering unique cultural experiences.

Hysan actively cultivates customer loyalty through its digital and loyalty programs, notably Club Avenue and Lee Gardens Club. These initiatives are designed to deepen customer engagement and encourage repeat business by offering exclusive perks and targeted promotions. For instance, during the first half of 2024, Hysan's focus on enhancing these digital platforms contributed to a steady flow of members, underscoring their importance in driving sustained retail traffic and sales.

Corporate Communications and Investor Relations

Hysan Development places significant emphasis on its corporate communications and investor relations, ensuring transparency and consistent engagement with its stakeholders. This proactive approach aims to clearly articulate the company's financial health, strategic direction, and dedication to sustainable development, fostering trust and understanding within the investment community.

Key promotional activities include the dissemination of detailed annual reports, timely interim results announcements, and comprehensive investor presentations. These materials serve as crucial channels to showcase Hysan's unique value proposition, reinforcing its appeal to investors and financial professionals alike.

For the fiscal year ending December 31, 2023, Hysan reported a net profit attributable to shareholders of HK$3,706 million, a significant increase from the previous year. The company's commitment to clear communication is reflected in its proactive engagement with analysts and investors, with numerous meetings and presentations held throughout 2024 to discuss its portfolio performance and future outlook.

- Financial Transparency: Hysan's commitment to providing detailed financial reports, including its 2023 Annual Report which exceeded 200 pages, ensures stakeholders have access to comprehensive performance data.

- Investor Engagement: The company actively participates in investor conferences and hosts dedicated briefing sessions, exemplified by its investor day in March 2024, to foster direct dialogue.

- Strategic Communication: Investor relations efforts consistently highlight strategic initiatives, such as ongoing asset enhancement projects in its retail portfolio, which are crucial for demonstrating future growth potential.

- Sustainability Focus: Communications increasingly integrate Hysan's Environmental, Social, and Governance (ESG) performance, a key factor for many investors in 2024 and beyond, as evidenced by its inclusion in the Hang Seng Corporate Sustainability Index.

Brand Positioning through Tenant Partnerships

Hysan elevates its brand positioning by forging strategic alliances with prominent international and local businesses. This includes collaborations with luxury fashion houses and acclaimed Michelin-starred dining establishments, all aimed at refining its brand image and drawing in discerning tenants and patrons. For instance, in 2023, Hysan Development reported a significant increase in retail sales across its portfolio, with flagship properties like Lee Gardens One to Six seeing robust performance driven by the appeal of its curated tenant mix.

These prestigious brand affiliations serve as a powerful endorsement, clearly distinguishing Hysan's properties in a crowded commercial real estate landscape. The presence of such reputable names acts as a silent yet effective promotional tool, reinforcing Hysan's commitment to quality and exclusivity. This strategy is crucial for maintaining a competitive edge, particularly as the retail sector continues to evolve, demanding unique experiences and high-caliber offerings.

- Tenant Mix Enhancement: Hysan actively curates its tenant roster to include globally recognized luxury brands and award-winning culinary experiences.

- Brand Image Amplification: Partnerships with premium brands directly contribute to a sophisticated and aspirational brand image for Hysan's properties.

- Competitive Differentiation: The exclusive tenant mix provides a unique selling proposition, setting Hysan apart from competitors.

- Customer Attraction: High-value tenants and customers are drawn to Hysan's properties due to the quality and prestige of its partnered brands.

Hysan's promotional strategy leverages community engagement and digital loyalty programs to drive foot traffic and cultivate brand loyalty. Initiatives like 'Urban Jam' and #URBANHOOD create vibrant lifestyle hubs, while programs such as Club Avenue and Lee Gardens Club offer exclusive perks, encouraging repeat business. These efforts are crucial for maintaining sustained retail traffic and sales, as seen in the steady flow of members to its digital platforms during the first half of 2024.

Hysan also emphasizes financial transparency and strategic communication through detailed annual reports and investor presentations, fostering trust with stakeholders. Its proactive investor relations, including participation in investor days and analyst briefings, highlight strategic initiatives and ESG performance, crucial for attracting investment. For the fiscal year ending December 31, 2023, Hysan reported a net profit of HK$3,706 million, underscoring its financial stability and clear communication strategy.

Strategic alliances with luxury fashion houses and acclaimed dining establishments enhance Hysan's brand positioning and attract discerning tenants. This curated tenant mix, exemplified by the robust performance of Lee Gardens One to Six in 2023, serves as a powerful endorsement, reinforcing Hysan's commitment to quality and exclusivity in a competitive market.

| Promotional Area | Key Initiatives | Impact/Data Point |

|---|---|---|

| Community Engagement | Urban Jam, #URBANHOOD | 15% year-on-year increase in turnover for retail segment during key event periods (2023) |

| Digital Loyalty Programs | Club Avenue, Lee Gardens Club | Steady flow of members in H1 2024, driving sustained retail traffic |

| Corporate Communications | Annual Reports, Investor Presentations | Net profit attributable to shareholders of HK$3,706 million (FY 2023) |

| Strategic Alliances | Luxury Brands, Michelin-Starred Dining | Robust performance in flagship properties like Lee Gardens One to Six (2023) |

Price

Hysan's rental pricing is deeply intertwined with Hong Kong and Mainland China's market dynamics. The company actively tracks rental trends, occupancy levels, and competitor pricing to ensure its offerings are both competitive and aligned with the premium value of its prime assets.

For instance, as of Q1 2024, Hong Kong's Grade A office market saw rents averaging around HKD 100-120 per square foot, with prime districts like Causeway Bay, Hysan's core area, often commanding the higher end of this spectrum. Hysan's strategy involves adjusting its rates within this range, balancing market pressures with the intrinsic value of its properties.

This dynamic approach allows Hysan to effectively respond to market fluctuations, maintaining strong occupancy and rental income even amidst economic shifts. Their ability to adapt pricing based on real-time data is crucial for navigating the competitive landscape.

Hysan employs value-based premium pricing for its high-end residential and luxury retail offerings. This strategy directly correlates with the superior design, prime locations, and exclusive amenities provided, which are highly valued by its discerning clientele.

For instance, Hysan's Lee Gardens One property, a prime example of its luxury retail segment, commands top rental rates in Causeway Bay, reflecting its prestigious address and curated tenant mix. This premium positioning, despite higher costs, consistently achieves high occupancy, underscoring customer willingness to pay for quality and prestige.

Hysan may leverage flexible leasing terms and tailored incentives to attract and retain quality tenants, especially in a fluctuating market. This approach is crucial for maintaining stable occupancy, even when the office sector experiences headwinds like negative rental reversion rates, a trend observed in many urban centers throughout 2024.

Diversified Revenue Streams

Hysan's income is built on a foundation of gross rental income from its diverse property holdings, which include office spaces, retail outlets, and residential units. This broad base helps cushion the company against downturns in any one sector.

Beyond rentals, Hysan also generates revenue through property development projects and fees earned from managing properties, adding further layers to its income generation strategy. This multi-pronged approach enhances financial stability.

The company's revenue is further bolstered by turnover rent agreements with its retail tenants. For instance, in 2023, Hysan reported a significant portion of its retail rental income derived from these performance-based arrangements, demonstrating their importance.

- Gross Rental Income: From office, retail, and residential properties.

- Property Development: Income from new and ongoing development projects.

- Management Fees: Earnings from providing property management services.

- Turnover Rent: A variable component tied to retail sales performance.

Long-Term Value Creation Focus

Hysan's pricing strategy emphasizes long-term value creation, moving beyond immediate profits. This approach is evident in their strategic investments and focus on sustainable operations, which aim to bolster asset value and future revenue streams.

The company's financial discipline underpins this long-term perspective. For instance, Hysan's commitment to prudent financial management allows for strategic capital allocation that enhances shareholder returns over time, rather than chasing short-term market fluctuations.

- Strategic Acquisitions: Hysan has historically pursued acquisitions that align with its long-term vision, such as its 2023 investment in a prime retail property, which is expected to yield consistent rental income and capital appreciation.

- Sustainable Practices: The company's investment in green building certifications and energy-efficient upgrades across its portfolio, a trend continuing into 2024, not only reduces operational costs but also enhances property appeal and long-term rental potential.

- Active Asset Management: Hysan actively manages its properties, undertaking renovations and re-leasing strategies to optimize rental yields and tenant mix, thereby securing robust revenue growth, as seen in their consistent rental reversion rates exceeding 5% in recent years.

- Financial Discipline: Maintaining a healthy balance sheet and a strong credit rating, as reflected in their low gearing ratios, provides Hysan with the flexibility to pursue value-enhancing opportunities and weather market downturns, ensuring sustained shareholder value.

Hysan's pricing strategy is a nuanced blend of market responsiveness and premium value assertion. For its prime office and retail spaces in Hong Kong's Causeway Bay, pricing is benchmarked against Grade A market averages, typically HKD 100-120 per square foot as of Q1 2024, with Hysan often capturing the upper end due to its prestigious locations.

The company employs value-based premium pricing for its luxury residential and high-end retail segments. This reflects superior design, prime locations, and exclusive amenities, justifying higher rental rates for discerning clientele, as seen with Lee Gardens One.

Flexible leasing terms and tailored incentives are utilized to secure and retain quality tenants, a crucial tactic during market fluctuations and potential headwinds like negative rental reversion rates observed in urban markets during 2024.

| Property Segment | Pricing Strategy | Key Rationale | Example | Market Context (Q1 2024) |

| Prime Office/Retail (Causeway Bay) | Market-aligned Premium | Prime location, high demand | Lee Gardens One | Avg. HKD 100-120/sq ft (Grade A) |

| Luxury Residential/High-End Retail | Value-Based Premium | Superior amenities, prestige | Lee Gardens One (Retail) | Top rental rates in Causeway Bay |

| General Portfolio | Flexible & Tailored | Tenant retention, market adaptation | Incentives for quality tenants | Navigating potential headwinds |

4P's Marketing Mix Analysis Data Sources

Our Hysan 4P's Marketing Mix Analysis leverages a robust blend of official company disclosures, including annual reports and investor presentations, alongside real-time market intelligence from industry databases and e-commerce platforms. We meticulously gather data on product portfolios, pricing strategies, distribution networks, and promotional activities to ensure an accurate reflection of Hysan's market presence and competitive approach.