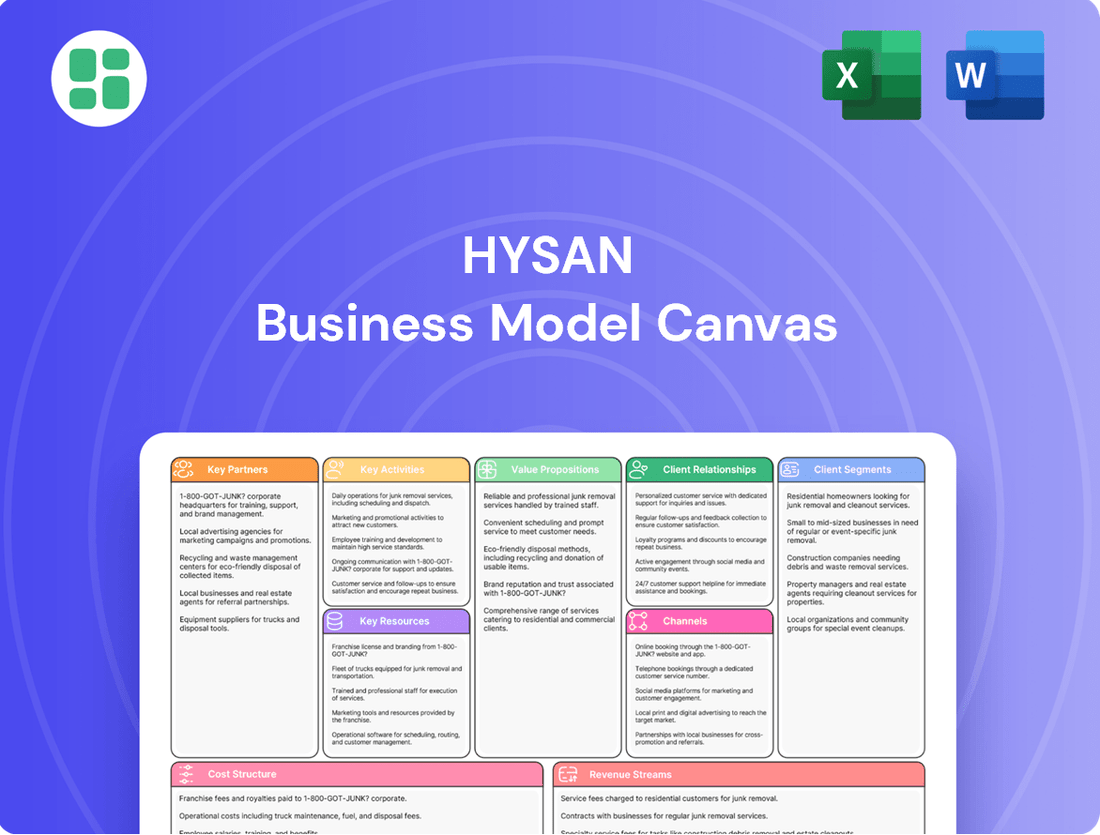

Hysan Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hysan Bundle

Unlock the strategic blueprint behind Hysan's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they create and deliver value, engage customers, and manage resources effectively. Perfect for anyone looking to understand a thriving business's core components.

Ready to dissect Hysan's proven strategy? Our full Business Model Canvas provides an in-depth look at their customer segments, revenue streams, and key partnerships, offering invaluable insights for your own business planning. Download it now to gain a competitive edge.

Partnerships

Hysan actively partners with construction firms and developers to bring its property visions to life. A prime example is the Lee Garden Eight project on Caroline Hill Road, a significant collaboration with Chinachem Group. This joint venture is fundamental to Hysan's strategy for growing its property holdings and ensuring large-scale projects are delivered efficiently.

These alliances are vital for Hysan's expansion, enabling the company to undertake ambitious developments like Lee Garden Eight. The project itself is a testament to this, aiming to improve both accessibility and environmental performance within the broader Lee Gardens area.

Hysan actively cultivates strong ties with financial institutions, including major international and local banks. These relationships are crucial for securing syndicated loan facilities, which provide the company with substantial financial flexibility. In 2024, Hysan continued to leverage these partnerships to ensure robust access to capital for both refinancing existing debt and managing its day-to-day working capital requirements, underpinning its strategic growth initiatives and financial stability.

Hysan's key partnerships include a curated selection of prestigious retail and luxury brands, such as Hermès, Dior, and Cartier, particularly within its prime Lee Gardens properties. These globally recognized names are crucial for establishing and maintaining Lee Gardens' reputation as a top-tier luxury shopping hub.

These anchor tenants are not just occupants but vital collaborators in Hysan's strategy to elevate the shopper experience. For instance, during the 2023 financial year, Hysan continued its focus on tenant engagement, contributing to a robust performance in its retail segment.

Arts and Cultural Operators

Hysan's key partnerships with arts and cultural operators are crucial for enriching the local community and driving foot traffic. A significant collaboration is the five-year Memorandum of Understanding between a joint venture of Hysan and Chinachem Group and The Hong Kong Academy for Performing Arts (HKAPA EXCEL).

This partnership is specifically designed to manage performing arts and cultural venues within Lee Garden Eight. The objective is to foster a vibrant arts scene by offering a wide array of artistic experiences and boosting the cultural appeal of the district.

- Memorandum of Understanding: Hysan and Chinachem Group partnered with HKAPA EXCEL for a five-year agreement.

- Venue Operations: This collaboration focuses on operating performing arts and cultural facilities at Lee Garden Eight.

- Cultural Vitality: The aim is to promote diverse art experiences and enhance the cultural vibrancy of the area.

Technology and Sustainability Solution Providers

Hysan actively partners with technology providers to elevate its digital offerings and refine data-driven marketing strategies, aiming to boost customer interaction. For instance, in 2024, Hysan continued to invest in smart building technologies to improve operational efficiency.

Collaborations with sustainability solution providers are crucial for Hysan's commitment to environmental responsibility. These partnerships are instrumental in securing green building certifications and rolling out energy-saving programs throughout its properties.

- Digital Transformation: Engaging with tech firms to implement AI-powered analytics for personalized customer journeys and enhanced retail experiences.

- Sustainability Initiatives: Partnering with energy management specialists to reduce carbon footprints, targeting a 15% reduction in energy consumption across its portfolio by 2025.

- Smart Building Integration: Working with IoT providers to deploy sensors and data platforms for real-time building performance monitoring and optimization.

Hysan's strategic alliances with luxury retail brands like Hermès and Dior are foundational to its premium positioning, driving foot traffic and rental income. These anchor tenants are critical for maintaining the prestige of its Lee Gardens properties, as demonstrated by continued strong retail segment performance throughout 2023.

What is included in the product

A detailed breakdown of Hysan's strategy, outlining its core customer segments, value propositions, and revenue streams within the classic 9 BMC blocks.

Provides a clear, actionable framework for understanding Hysan's operational model and its strategic advantages in the real estate market.

Hysan's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation that helps businesses quickly identify and address operational inefficiencies.

It streamlines the process of understanding complex business strategies, allowing teams to pinpoint and resolve pain points with a unified, one-page overview.

Activities

Hysan's core activity involves the active management and strategic expansion of its prime property portfolio, focusing on commercial, retail, and residential assets predominantly within Hong Kong's Lee Gardens area. This hands-on approach ensures the portfolio remains robust and responsive to evolving market conditions.

Key to this strategy is the continuous optimization of the tenant mix across its properties. This proactive management aims to attract and retain high-quality tenants, thereby enhancing rental income and asset value. Hysan's Hong Kong investment property portfolio encompasses a substantial 4.5 million square feet, underscoring its significant presence in the market.

Hysan actively engages in property development and enhancement to grow its portfolio and maintain the competitiveness of its existing assets. A prime example is the ongoing Lee Garden Eight project, which is set to increase Hysan's total portfolio area by a substantial 30%.

Beyond new developments, Hysan prioritizes asset enhancement initiatives. This includes rejuvenation strategies for key properties like Lee Gardens and Hysan Place, ensuring they remain attractive and relevant in the market. These efforts aim to boost rental yields and tenant satisfaction.

A primary activity for Hysan is the strategic leasing of its office, retail, and residential properties, ensuring high occupancy. In 2024, Hysan maintained a robust occupancy rate across its Hong Kong portfolio, a testament to its effective leasing strategies.

Hysan actively cultivates strong relationships with its anchor tenants, recognizing their importance in driving foot traffic and prestige. This collaborative approach is key to maintaining tenant loyalty and securing long-term leases, contributing to stable revenue streams.

Furthermore, Hysan focuses on curating a diverse and appealing tenant mix within its properties. This strategy aims to create vibrant environments and unique experiences that enhance the overall appeal and market positioning of its assets, attracting both businesses and consumers.

Strategic Planning and Diversification

Hysan's strategic planning centers on building long-term shareholder value by acquiring and investing in key growth areas. This approach aims to diversify its business portfolio beyond its core Hong Kong operations.

A prime example of this diversification strategy is Hysan's significant investment in Lee Gardens Shanghai, a prime commercial property in a major Chinese city. This move reflects a deliberate effort to tap into growth markets and expand its geographical footprint.

Further illustrating its diversification, Hysan holds stakes in ventures like the New Frontier Group, which provides exposure to the healthcare sector. As of early 2024, Hysan's total assets under management were approximately HK$92.3 billion, showcasing the scale of its investment activities.

- Strategic Acquisitions: Hysan actively seeks out opportunities to acquire assets that align with its long-term growth objectives.

- Investment in Growth Pillars: The company identifies and invests in specific sectors or geographical regions deemed to have high growth potential.

- Portfolio Diversification: Hysan's strategy involves spreading investments across different asset classes and markets to mitigate risk and enhance returns.

- Healthcare Exposure: Through investments like its stake in New Frontier Group, Hysan is expanding its reach into the burgeoning healthcare industry.

Sustainability and Community Engagement

Hysan is dedicated to embedding Environmental, Social, and Governance (ESG) principles across its business, with a strong focus on environmental performance. In 2023, Hysan reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity by 15.7% compared to its 2019 baseline, demonstrating tangible progress in its sustainability journey.

The company actively fosters community well-being through its Community Business Model, particularly in the Lee Gardens neighborhood. This involves organizing a variety of events and initiatives designed to boost the area's liveability and social fabric.

- ESG Integration: Hysan's commitment to sustainability is evident in its ESG reporting and operational integration.

- Environmental Performance: A 15.7% reduction in GHG emissions intensity (Scope 1 & 2) versus 2019 was achieved by the end of 2023.

- Community Initiatives: The Community Business Model drives engagement through events and programs enhancing neighborhood liveability.

Hysan's key activities revolve around the strategic management and enhancement of its property portfolio, primarily in Hong Kong's Lee Gardens area. This includes optimizing tenant mix to boost rental income, as evidenced by its 4.5 million square feet Hong Kong investment property portfolio. Furthermore, Hysan actively pursues property development, such as the Lee Garden Eight project, which is expected to increase its total portfolio area by 30%.

The company also focuses on strategic leasing to maintain high occupancy rates, a strategy that proved successful in 2024. Cultivating strong relationships with anchor tenants is crucial for securing long-term leases and stable revenue. Hysan also invests in diversification, with ventures like its Shanghai commercial property and stakes in sectors like healthcare, aiming to build long-term shareholder value.

Hysan is committed to ESG principles, having reduced its Scope 1 and 2 greenhouse gas emissions intensity by 15.7% by the end of 2023 compared to 2019. Its Community Business Model actively enhances the Lee Gardens neighborhood through various initiatives.

| Key Activity | Description | Supporting Data/Facts |

|---|---|---|

| Property Portfolio Management | Active management and enhancement of commercial, retail, and residential assets. | 4.5 million sq ft Hong Kong investment property portfolio. |

| Tenant Mix Optimization | Attracting and retaining high-quality tenants to increase rental income. | Focus on anchor tenants for stable revenue. |

| Property Development & Enhancement | Expanding the portfolio and maintaining asset competitiveness. | Lee Garden Eight project to increase portfolio area by 30%. |

| Strategic Leasing | Ensuring high occupancy rates through effective leasing strategies. | Maintained robust occupancy rates in 2024. |

| Diversification & Investment | Investing in growth areas and diversifying beyond core operations. | Investment in Lee Gardens Shanghai; stake in New Frontier Group. |

| ESG Integration | Embedding Environmental, Social, and Governance principles. | 15.7% reduction in GHG emissions intensity (Scope 1 & 2) by end of 2023 vs. 2019. |

Preview Before You Purchase

Business Model Canvas

The Hysan Business Model Canvas preview you are viewing is an authentic segment of the complete document you will receive upon purchase. This means the structure, formatting, and content are precisely what you can expect in the final deliverable, ensuring no discrepancies or unexpected changes. You will gain immediate access to this same, fully populated Business Model Canvas, ready for your strategic application.

Resources

Hysan's extensive property portfolio is its core asset, featuring prime commercial, retail, and residential spaces concentrated in Hong Kong's sought-after Lee Gardens area. This strategically located collection of assets is the primary engine for the company's consistent rental revenue streams.

As of the close of 2024, Hysan's investment real estate holdings were appraised at an impressive HK$96,547 million. This significant valuation underscores the quality and scale of the properties that underpin the company's business model and its ability to generate stable income.

Hysan maintains robust financial capital and strong liquidity, underscored by its investment-grade credit ratings. This financial stability is crucial for its business model, enabling continuous property development, strategic acquisitions, and other value-enhancing investments.

The company benefits from significant access to committed loan facilities, providing a substantial financial cushion. For instance, as of December 31, 2023, Hysan had committed banking facilities totaling HK$15.5 billion, with HK$10.0 billion drawn, demonstrating ample headroom for future endeavors.

Hysan's enduring brand reputation as a leading Hong Kong property firm is a cornerstone of its business. This strong standing, built over decades, fosters trust with tenants, investors, and stakeholders, underpinning its ability to secure prime locations and favorable terms.

Crucially, Hysan possesses profound market knowledge, particularly concerning Causeway Bay, its core operating territory. This deep understanding allows for astute identification of emerging trends and effective management of its extensive property portfolio, ensuring optimal asset performance.

For instance, Hysan's prime retail assets in Causeway Bay, such as Lee Gardens, consistently demonstrate resilience. In 2024, occupancy rates for its retail properties remained robust, reflecting the company's ability to attract and retain desirable tenants by understanding evolving consumer preferences.

Skilled Human Capital

Hysan's success hinges on its skilled human capital, encompassing professionals dedicated to property development, management, leasing, finance, and sustainability.

Their collective expertise is crucial for asset enhancement, tenant curation, and strategic planning, directly contributing to Hysan's competitive advantage in the market.

In 2024, Hysan continued to invest in its workforce, recognizing that a highly competent team is paramount for navigating the dynamic real estate landscape and delivering superior stakeholder value.

- Property Development & Management Expertise: Hysan employs seasoned professionals with deep knowledge in all phases of property lifecycle management.

- Tenant Curation and Relations: A key strength lies in their ability to attract and retain high-quality tenants through strategic leasing and relationship management.

- Financial Acumen: The finance team provides critical insights for investment decisions, capital allocation, and financial performance optimization.

- Sustainability Focus: Professionals dedicated to sustainability ensure Hysan's properties meet evolving environmental standards and attract eco-conscious tenants.

Integrated Walkway System and Connectivity

The integrated pedestrian walkway system, connecting Lee Gardens to the MTR station, is a crucial infrastructure asset. This development significantly boosts connectivity and accessibility within the precinct. By enhancing walkability, it makes the area more appealing for both businesses and individuals.

This infrastructure resource directly supports Hysan's value proposition by creating a seamless and convenient experience for users. The enhanced accessibility is a tangible benefit that attracts and retains tenants. For instance, in 2024, Hysan continued to invest in urban regeneration projects aimed at improving pedestrian flow and public realm enhancements, a strategy that has historically driven footfall and tenant satisfaction.

- Enhanced Connectivity: The walkway system directly links key commercial and residential areas to public transportation.

- Increased Footfall: Improved accessibility is expected to drive higher visitor numbers.

- Tenant Attraction: A well-connected precinct is more desirable for commercial tenants.

- Property Value: Infrastructure improvements contribute to the long-term value of Hysan's properties.

Hysan's key resources are its prime property portfolio, significant financial capital, strong brand reputation, deep market knowledge, skilled human capital, and integrated infrastructure. These elements collectively enable the company to generate stable rental income, attract high-quality tenants, and maintain its competitive edge in Hong Kong's dynamic real estate market.

| Resource Category | Key Element | 2024 Data/Significance |

|---|---|---|

| Property Portfolio | Lee Gardens Area Assets | Valued at HK$96,547 million as of end-2024; prime commercial, retail, residential spaces |

| Financial Capital | Investment-Grade Credit Ratings & Liquidity | Enables development, acquisitions; HK$15.5 billion in committed facilities (HK$10.0 billion drawn as of Dec 31, 2023) |

| Market Knowledge | Causeway Bay Expertise | Drives astute trend identification and optimal asset performance; robust retail occupancy rates in 2024 |

| Human Capital | Skilled Professionals | Expertise in development, management, leasing, finance, and sustainability; ongoing investment in workforce in 2024 |

Value Propositions

Hysan's value proposition centers on its prime real estate holdings, particularly in Hong Kong's vibrant Causeway Bay. Their portfolio boasts high-quality commercial, retail, and residential properties, offering tenants premium spaces and exceptional connectivity within the sought-after Lee Gardens area.

In 2024, Hysan Development's commitment to prime locations is evident. The company continues to focus on its core assets in Causeway Bay, a district renowned for its high foot traffic and commercial significance. This strategic positioning ensures strong demand for their retail and office spaces, contributing to consistent rental income.

Hysan enhances urban living and shopping by carefully selecting its tenants and improving store layouts, particularly at prime locations like Hysan Place and Lee Gardens. This strategy brings in new and larger luxury stores, alongside a variety of dining choices, creating a vibrant atmosphere.

In 2024, Hysan continued to focus on these curated experiences. For instance, the company actively managed its retail portfolio to attract brands that resonate with evolving consumer preferences, aiming to boost foot traffic and sales performance across its properties.

Hysan Development is dedicated to generating enduring value for its shareholders through a multi-faceted approach. This includes pursuing strategic acquisitions that align with its long-term vision and integrating sustainable practices across its operations, which not only benefits the environment but also enhances brand reputation and operational efficiency. The company's active management style ensures that assets are optimized for maximum return, directly contributing to shareholder wealth.

The commitment to shareholder returns is clearly demonstrated by Hysan's consistent financial performance. For the fiscal year ending December 31, 2023, Hysan reported a net profit attributable to shareholders of HK$3.8 billion, a notable increase from HK$2.5 billion in 2022. This robust performance underpins its ability to deliver reliable dividend payouts, further solidifying its appeal to investors seeking stable income streams and capital appreciation over the long haul.

Sustainable and Green Building Features

Hysan is deeply committed to sustainable development, with a significant and increasing portion of its property portfolio achieving green building certifications. For instance, by the end of 2023, Hysan reported that approximately 80% of its portfolio was certified under recognized green building standards, demonstrating a tangible effort to minimize environmental impact.

Lee Garden Eight, a prime example of this commitment, is meticulously designed to set a new benchmark for sustainability in the region. This focus on eco-friendly design and operations is specifically geared towards attracting and retaining tenants who actively seek out and prioritize green leases, aligning with their own corporate social responsibility goals.

- Portfolio Green Certification: Over 80% of Hysan's portfolio held green building certifications as of year-end 2023.

- Environmental Impact Reduction: Active initiatives are in place to reduce the environmental footprint across Hysan's properties.

- Lee Garden Eight as a Benchmark: This development is positioned as a leading example of sustainable building practices.

- Attracting Green-Conscious Tenants: The emphasis on sustainability appeals to businesses prioritizing green leases and environmental responsibility.

Seamless Integrated Urban Experience

Hysan is actively enhancing the Lee Gardens precinct by continuously undertaking rejuvenation projects. These efforts are designed to foster a truly integrated urban environment for visitors and tenants alike.

A key element of this strategy is the development of an interconnected pedestrian walkway system. This initiative aims to create a seamless flow between working, shopping, dining, and leisure activities within the precinct, making it more convenient and enjoyable.

This holistic approach significantly boosts the overall appeal and liveability of the Lee Gardens area. For instance, in 2024, Hysan reported that its retail portfolio occupancy rate remained strong at 98.5%, reflecting the sustained demand for its integrated offerings.

- Seamless Integration: Connecting diverse retail, dining, and office spaces through enhanced pedestrian pathways.

- Enhanced Liveability: Creating a more attractive and functional urban environment for all users.

- Tenant & Visitor Appeal: Driving foot traffic and customer loyalty through a superior, integrated experience.

- Strategic Rejuvenation: Ongoing investment in infrastructure and amenities to maintain precinct competitiveness.

Hysan offers prime real estate in Hong Kong's Causeway Bay, providing premium commercial, retail, and residential spaces with excellent connectivity. The company focuses on enhancing urban living and shopping through curated tenant mixes and improved layouts at flagship properties like Hysan Place and Lee Gardens.

In 2024, Hysan maintained its strategic focus on its core Causeway Bay assets, ensuring strong demand for its spaces and consistent rental income. The company's commitment to shareholder value is underscored by a robust 2023 net profit of HK$3.8 billion, up from HK$2.5 billion in 2022, supporting reliable dividend payouts.

Hysan champions sustainable development, with over 80% of its portfolio holding green building certifications by year-end 2023. This commitment, exemplified by Lee Garden Eight, attracts environmentally conscious tenants and aligns with corporate social responsibility goals.

The company actively rejuvenates the Lee Gardens precinct, creating an integrated urban environment with enhanced pedestrian walkways. This strategy, reflected in a strong 98.5% retail occupancy rate in 2024, boosts the area's appeal and liveability.

| Metric | 2023 Value | 2024 Update (as of mid-year) |

|---|---|---|

| Net Profit Attributable to Shareholders | HK$3.8 billion | [Data not yet available for full 2024] |

| Retail Portfolio Occupancy Rate | [Data not explicitly stated for 2023] | 98.5% |

| Green Building Certification (Portfolio %) | ~80% | [Ongoing progress, specific updated percentage not yet released] |

Customer Relationships

Hysan excels in property management for its Lee Gardens properties, focusing on high standards and tenant responsiveness. This commitment directly translates into tenant satisfaction and loyalty.

In 2024, Hysan reported strong occupancy rates across its prime retail and office spaces, a testament to its effective property management and tenant relationship strategies. This focus on service ensures a stable income stream.

Hysan actively cultivates robust relationships with its anchor tenants, viewing them as strategic partners. This collaboration extends beyond simple leasing agreements, focusing on joint initiatives to boost sales and shopper engagement.

The company meticulously curates its tenant mix, a strategy that proved beneficial in 2024. For instance, by strategically placing complementary brands, Hysan aimed to create synergistic retail environments, leading to an uplift in foot traffic and overall sales performance across its properties.

Optimizing store layouts in collaboration with tenants is another key element. This involves analyzing shopper behavior and sales data to ensure prime locations are utilized effectively, thereby enhancing the shopping experience and maximizing revenue potential for both Hysan and its lessees.

Hysan cultivates lasting tenant connections primarily through its long-term lease agreements, a strategy designed to ensure stability and predictability in its rental income streams. This approach fosters a dependable tenant base, crucial for consistent revenue generation.

The company actively pursues positive rental reversions during lease renewals, meaning it aims to increase rental rates when existing leases are extended or renegotiated. For instance, Hysan reported a strong rental reversion rate of approximately 12.6% for its office portfolio in the first half of 2024, demonstrating its success in this area.

Investor Relations and Transparency

Hysan actively engages with investors and credit rating agencies, fostering trust through clear financial reporting and consistent updates on its performance and strategic path. This commitment to transparency is crucial for maintaining strong relationships with its financial community.

- Investor Dialogue: Hysan regularly communicates with investors, ensuring they are informed about the company's progress and future plans.

- Credit Rating Engagement: The company maintains open communication with credit rating agencies, providing necessary data for accurate assessments.

- Financial Transparency: Hysan prioritizes clear and timely financial disclosures, building confidence among its stakeholders.

- Performance Updates: Regular updates on operational and financial performance are shared to keep investors well-informed.

Community Engagement and Feedback Mechanisms

Hysan actively fosters community engagement through various channels, reflecting its commitment to a Community Business Model. This approach prioritizes the social well-being and liveability of the Lee Gardens area, ensuring it remains a vibrant hub.

The company actively solicits and incorporates feedback from community members and stakeholders. This continuous dialogue is crucial for adapting and transforming the Lee Gardens precinct to meet evolving needs.

- Community Feedback Integration: Hysan's strategy involves regular consultations and surveys to gather insights on tenant and visitor experiences.

- Social Impact Initiatives: The company supports local charities and cultural events, demonstrating a tangible commitment to community development. For instance, in 2024, Hysan continued its support for local arts organizations, with over HK$5 million invested in community arts programs.

- Liveability Enhancements: Investments in public spaces and amenities, such as green areas and pedestrian-friendly zones, are guided by community input.

- Stakeholder Collaboration: Partnerships with local businesses and community groups are key to co-creating a more engaging and sustainable urban environment.

Hysan's customer relationships are built on a foundation of exceptional property management and a deep understanding of tenant needs. This focus on service excellence fosters loyalty and drives consistent occupancy, as evidenced by strong performance in 2024.

The company cultivates strategic partnerships with anchor tenants, going beyond mere leasing to collaborate on initiatives that enhance sales and shopper engagement, a strategy that contributed to the positive rental reversions observed in 2024.

Hysan also prioritizes community engagement, actively seeking and integrating feedback to enhance the liveability and vibrancy of its properties, supported by significant investments in social impact initiatives in 2024.

| Relationship Type | Key Strategy | 2024 Highlight |

|---|---|---|

| Tenant Relations | High service standards, responsiveness | Strong occupancy rates |

| Anchor Tenants | Strategic partnerships, joint initiatives | Collaborative sales and engagement efforts |

| Community Engagement | Feedback integration, social impact | HK$5M+ invested in community arts programs |

| Investor Relations | Financial transparency, regular updates | Maintained strong credit ratings and investor confidence |

Channels

Hysan's direct leasing and sales teams are crucial for connecting with a broad range of clients, including corporations, retailers, and residential buyers. This hands-on approach allows for personalized service and efficient deal-making.

By directly managing these relationships, Hysan can offer customized lease terms and sales packages, fostering stronger client connections. This direct engagement streamlines negotiations and ensures a deeper understanding of tenant and buyer needs.

In 2024, Hysan reported strong occupancy rates across its prime commercial and residential properties, a testament to the effectiveness of its direct sales and leasing strategies in securing and retaining high-value tenants.

Hysan leverages external real estate agencies and brokers to broaden its market reach for both leasing and sales. These collaborations are crucial for tapping into a larger pool of potential tenants and buyers, especially for its new development projects.

For instance, in 2023, Hysan reported that its retail segment, which includes prime locations like Lee Gardens, saw a significant rebound in foot traffic and sales, indicating the effectiveness of its distribution channels, including agency partnerships, in attracting customers.

These partnerships are especially instrumental in securing commitments for new developments. Securing tenants for new commercial spaces like Lee Gardens Shanghai and buyers for residential units at Villa Lucca relies heavily on the extensive networks and market expertise these agencies provide.

Hysan's official website is a crucial digital hub, providing investors with access to its latest financial results, sustainability reports, and company news. It also showcases detailed information about its diverse property portfolio, acting as a direct line of communication for stakeholders.

Beyond investor relations, Hysan leverages online portals and targeted digital marketing to connect with its customer base. These platforms are instrumental in promoting its retail and office spaces, driving engagement through virtual tours and special offers.

In 2024, Hysan continued to enhance its digital presence, with its website experiencing significant traffic growth as it rolled out new features for property discovery and tenant services. This digital focus is key to its strategy for customer acquisition and retention in a competitive market.

Marketing Campaigns and Events

Hysan actively engages customers and drives footfall through strategic marketing campaigns and vibrant events. A prime example is their successful 'Urban Jam' street festival, which not only boosts sales but also solidifies Lee Gardens' reputation as a dynamic urban destination.

These events are designed to attract a broad audience, encompassing both local residents and international tourists. By creating engaging experiences, Hysan fosters a sense of community and transforms its properties into lively social hubs.

- Urban Jam Festival: A key initiative to drive traffic and sales.

- Target Audience: Locals and tourists alike.

- Objective: Position Lee Gardens as a vibrant community hub.

- Impact: Increased footfall and enhanced brand perception.

Investor Roadshows and Financial Reporting

Hysan engages its investor segment through a multi-pronged communication strategy. Investor roadshows and analyst briefings are key for direct engagement, allowing for in-depth discussions on performance and future strategy. These interactions are crucial for building trust and providing clarity to financially-literate decision-makers.

Published financial reports, encompassing both annual and interim statements, serve as the bedrock of Hysan's transparent communication. These documents offer comprehensive financial data, including key performance indicators and strategic outlooks, directly supporting the analytical needs of investors and financial professionals.

For instance, Hysan's 2024 interim report highlighted a revenue of HK$2.8 billion, a 5% increase year-on-year, driven by strong retail performance. The company also reaffirmed its commitment to shareholder returns, with dividends per share increasing by 3% in the first half of 2024.

- Investor Roadshows: Direct engagement for strategic dialogue.

- Analyst Briefings: Facilitating in-depth understanding of financial performance.

- Financial Reports: Providing comprehensive data for informed decision-making.

- 2024 Performance: Revenue up 5% to HK$2.8 billion, dividends per share increased by 3%.

Hysan's channels encompass direct sales and leasing teams, external real estate agencies, its official website, digital marketing, and engaging events. These diverse avenues are designed to connect with a broad spectrum of stakeholders, from corporate tenants and individual buyers to investors and the general public.

The direct approach fosters personalized relationships, while agency partnerships expand market reach. Digital platforms and events are crucial for broad engagement and brand building, ensuring Hysan effectively communicates its value proposition across all segments.

In 2024, Hysan's integrated channel strategy contributed to robust performance, with its retail segment, particularly at Lee Gardens, showing sustained recovery and increased footfall, underscoring the effectiveness of these diverse customer touchpoints.

Hysan's communication with its investor base is multifaceted, including direct engagement through roadshows and briefings, alongside the transparent dissemination of financial reports. This approach ensures that financially-literate decision-makers have access to comprehensive data for informed analysis.

| Channel Type | Key Activities | 2024 Focus/Impact |

|---|---|---|

| Direct Sales & Leasing | Personalized client engagement, customized terms | Securing high-value tenants, strong occupancy rates |

| External Agencies | Broadening market reach, tapping into networks | Facilitating new development commitments |

| Digital Platforms (Website, Marketing) | Information hub, property promotion, virtual tours | Enhanced online presence, significant traffic growth |

| Events & Campaigns | Driving footfall, community building, brand enhancement | Successful initiatives like Urban Jam Festival |

| Investor Communications | Roadshows, briefings, financial reports | Transparent data dissemination, stakeholder trust building |

Customer Segments

Corporate office tenants, particularly those in banking, finance, wealth management, and professional services, are a cornerstone for Hysan. These sectors demand Grade A office space in prestigious locations, and Hysan's Lee Gardens office portfolio consistently meets this need.

In 2024, Hysan reported a high occupancy rate across its prime office spaces, reflecting the sustained demand from these key industries. For instance, the Lee Gardens One and Two buildings are known for attracting major financial institutions, underscoring the segment's stability and value.

Hysan actively courts prestigious luxury retail brands and a broad range of other businesses seeking prime, high-visibility locations. The strategic redevelopment of Lee Gardens, notably its expansion to accommodate larger maison flagships, directly addresses the needs of these discerning tenants.

Hysan caters to a discerning clientele of high-net-worth individuals, expatriates, and professionals looking for premium living spaces. These customers seek luxury apartments and exclusive garden houses, valuing prime locations and high-quality amenities. Properties like Bamboo Grove and Villa Lucca are specifically designed to meet these sophisticated demands.

Institutional and Individual Investors

Hysan caters to a broad range of financially-literate individuals and entities, from individual investors seeking to grow their personal wealth to institutional players managing significant assets. These customers rely on Hysan for detailed financial data and market analysis to inform their investment strategies.

For instance, in 2024, the global investment management industry managed an estimated $100 trillion in assets, highlighting the immense scale of this customer segment. Individual investors, particularly those with a higher net worth, are increasingly seeking sophisticated tools and insights, mirroring the demands of professional money managers.

- Individual Investors: Seeking accessible financial data and analytical tools for personal portfolio management.

- Financial Professionals: Including analysts and advisors who require in-depth market research and valuation tools like DCF analysis.

- Institutional Investors: Such as pension funds and asset managers, needing comprehensive data for large-scale investment decisions and risk assessment.

- Business Strategists: Utilizing financial insights for strategic planning, competitive analysis, and market positioning.

Local Community and Visitors

Hysan's business model actively engages both local residents and the influx of visitors to the Lee Gardens area. This includes Hong Kong's vibrant youth culture and international tourists seeking unique experiences.

The company prioritizes building inclusive and liveable environments, a core tenet of its Community Business Model. This approach fosters a sense of belonging and enhances the overall appeal of its properties.

In 2024, Hysan continued its commitment to community engagement through various initiatives. For instance, its properties hosted numerous events and pop-ups designed to cater to diverse interests, from art exhibitions to local artisan markets.

These efforts are reflected in visitor numbers and spending patterns. While specific 2024 figures are still being compiled, Hysan's historical data shows a consistent upward trend in foot traffic and tenant sales in its retail and F&B segments, driven by its community-focused strategy.

- Target Audience: Lee Gardens area residents, Hong Kong youth, tourists.

- Value Proposition: Inclusive, liveable spaces, community engagement, unique experiences.

- Key Activities: Hosting events, supporting local artisans, creating community hubs.

- Community Impact: Fostering belonging, enhancing local vibrancy, driving foot traffic.

Hysan's customer base is diverse, encompassing premium office tenants, luxury retail brands, and discerning residential clients. The company also targets a broad spectrum of investors and actively engages with local communities and tourists to enhance the vibrancy of its properties.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Corporate Office Tenants | Banking, finance, wealth management, professional services seeking prime Grade A space. | High occupancy in Lee Gardens offices, attracting major financial institutions. |

| Luxury Retailers | Brands seeking high-visibility, prime locations for flagship stores. | Expansion of Lee Gardens to accommodate larger maison flagships. |

| Residential Clients | High-net-worth individuals, expatriates, professionals seeking luxury living. | Properties like Bamboo Grove and Villa Lucca cater to these sophisticated demands. |

| Investors (Individual & Institutional) | Seeking financial data, market analysis, and valuation tools for wealth growth. | Global investment management industry managed ~$100 trillion in assets in 2024. |

| Community & Tourists | Local residents, youth, international visitors seeking experiences and community hubs. | Continued commitment to community engagement through events and pop-ups. |

Cost Structure

Hysan incurs substantial expenses in acquiring land and existing properties to grow its real estate holdings. These costs are crucial for both adding to its portfolio of completed investment properties and securing sites for future development, such as the Lee Garden Eight project.

Hysan faces significant costs related to building new properties and upgrading existing ones. For instance, the company reported HK$1.7 billion in capital expenditure in 2023, a substantial portion of which is allocated to construction and development.

These expenses are crucial for Hysan's growth strategy, with projects like Lee Garden Eight representing major investments in its property portfolio. Such developments are key drivers of future revenue and asset value.

Hysan's cost structure includes significant ongoing expenses for managing and maintaining its vast property holdings. These costs cover essential services like utilities, regular upkeep, and the salaries and benefits for the staff directly involved in property operations.

For instance, in 2024, Hysan Development reported that property expenses, which encompass maintenance and management, represented a substantial portion of its operational outlay. These expenditures are crucial for ensuring the quality and appeal of its retail and office spaces, directly impacting tenant satisfaction and rental income.

Staff Salaries and Administrative Overheads

Hysan's operating costs are significantly influenced by staff salaries and administrative overheads, which are essential for maintaining the company's diverse operations. These expenses cover remuneration for management and head office personnel, alongside various administrative costs and general overheads that facilitate the smooth functioning of all business units.

For instance, in 2024, companies in similar large-scale property and retail management sectors often allocate between 15% to 25% of their revenue towards staff costs and administrative expenses. This includes salaries, benefits, office rent, utilities, and technology infrastructure, all vital for day-to-day operations and strategic planning.

- Staff Salaries: This encompasses compensation for all employees, from executive management to administrative support staff, ensuring a skilled workforce.

- Administrative Overheads: Includes costs like office rent, utilities, IT support, legal fees, and insurance, which are critical for business continuity.

- Operational Efficiency: Effective management of these costs directly impacts profitability and the ability to reinvest in growth initiatives.

- 2024 Benchmarks: Industry averages suggest that robust administrative structures can cost upwards of 10% of a company's operating budget, with salaries forming the largest component.

Finance Costs

Finance costs for Hysan primarily stem from interest expenses incurred on its various loan and debt financing facilities. This represents the cost of borrowing capital to fund its operations and growth initiatives. For instance, in 2024, Hysan continued to manage its financial obligations with a focus on maintaining robust financial discipline.

The company actively manages its debt maturity profile, ensuring that upcoming repayments are well-staggered. This strategy helps to mitigate refinancing risk and maintain a predictable cost of capital. This proactive approach to debt management is crucial for ensuring financial stability and flexibility.

- Interest Expenses: The core component of finance costs, reflecting the cost of borrowed funds.

- Debt Management: Hysan's strategy of maintaining a well-staggered debt maturity profile.

- Financial Discipline: A commitment to prudent financial management to control borrowing costs.

Hysan's cost structure is heavily weighted towards property acquisition and development, alongside ongoing operational expenses for its extensive portfolio. These foundational costs are critical for its business model, directly impacting profitability and future growth potential.

In 2023, Hysan reported HK$1.7 billion in capital expenditure, a significant portion of which was allocated to developing properties like Lee Garden Eight, highlighting the substantial investment in its physical assets. Furthermore, ongoing property expenses, including maintenance and management, are crucial for preserving asset value and tenant satisfaction, as noted in its 2024 operational outlays.

Staff salaries and administrative overheads form another significant cost category, with industry benchmarks in 2024 suggesting these can represent 15-25% of revenue for similar companies, underscoring the importance of efficient human resource and administrative management. Finance costs, primarily interest on debt, are also a key component, managed through a staggered debt maturity profile to ensure financial stability.

| Cost Category | Description | Key Considerations | 2023/2024 Relevance |

|---|---|---|---|

| Property Acquisition & Development | Costs of acquiring land and constructing new properties, or upgrading existing ones. | Essential for portfolio expansion and future revenue streams. | HK$1.7 billion capital expenditure in 2023 for development projects. |

| Property Operating Expenses | Ongoing costs for maintenance, repairs, utilities, and property management services. | Crucial for tenant retention and maintaining asset quality. | Substantial portion of 2024 operational outlays; impacts rental income. |

| Staff Salaries & Admin Overheads | Compensation for employees and costs associated with running the business operations. | Impacts operational efficiency and overall profitability. | Industry benchmark of 15-25% of revenue for similar companies in 2024. |

| Finance Costs | Interest paid on loans and other debt financing. | Reflects the cost of capital; managed via debt maturity profile. | Ongoing management of debt obligations in 2024. |

Revenue Streams

Hysan's core revenue generation comes from the rental income derived from its diverse property portfolio, which includes office spaces, retail outlets, and residential units. This leasing activity is central to its business model, providing a consistent flow of income.

In 2024, this primary revenue stream demonstrated robust growth, with Hysan reporting a 6.2% increase in turnover, reaching HK$3,409 million. This uplift was specifically attributed to enhanced rental income, underscoring the significance of its property leasing operations.

Hysan generates significant revenue from selling properties developed through its projects. A prime example is Villa Lucca, where sales of residential units contribute directly to the company's top line.

As of the close of 2024, Hysan had successfully contracted 115 units within the Villa Lucca development, demonstrating robust market demand and a key revenue stream for the business.

Hysan Development Company, a prominent Hong Kong landlord, derives a significant portion of its retail income from turnover rent. This means tenants pay a percentage of their sales on top of their base rent, creating a revenue stream that directly fluctuates with the performance of its retail tenants.

For instance, in the first half of 2024, Hysan reported that its retail segment’s revenue saw a notable increase, partly attributed to the recovery in consumer spending and the success of its tenant mix. This turnover rent component is particularly sensitive to economic conditions and consumer confidence, as seen in the retail sector's performance throughout 2023 and into early 2024.

Management Fee Income

Hysan generates significant revenue through its management fee income, derived from offering comprehensive property management services to its diverse portfolio. This income stream is a crucial component of the Group's overall turnover, demonstrating the value Hysan provides beyond just leasing space.

For instance, in 2024, Hysan's commitment to operational excellence and tenant satisfaction directly translated into consistent management fee income. This revenue is generated by overseeing the day-to-day operations of its prime office and retail properties, ensuring high standards of maintenance, security, and tenant engagement.

- Property Management Services: Hysan provides a full suite of property management services, contributing to its recurring revenue.

- Contribution to Turnover: Management fees are a vital part of Hysan's total revenue, reflecting the operational efficiency of its assets.

- Tenant Focus: By maintaining high tenant satisfaction, Hysan secures ongoing management contracts and fee income.

Contributions from Strategic Growth Pillars

Hysan is cultivating new recurring revenue streams through strategic investments in key growth areas. For instance, its investment in Lee Gardens Shanghai began contributing to this recurring income in 2024, marking a significant step in diversifying earnings.

Beyond wholly-owned assets, Hysan also benefits from minority stakes in promising ventures. An example of this is its investment in New Frontier Group, which adds another layer to its revenue generation strategy by tapping into the growth of associated businesses.

- Diversified Recurring Revenue: New income streams are being generated from strategic investments in growth pillars.

- Lee Gardens Shanghai Contribution: This property began providing recurring earnings in 2024.

- Minority Stake Benefits: Investments in ventures like New Frontier Group also contribute to overall revenue.

Hysan's revenue generation is multifaceted, primarily driven by rental income from its extensive property portfolio, which includes office buildings, retail spaces, and residential units. This core activity forms the bedrock of its financial performance.

Furthermore, Hysan capitalizes on property sales, such as those at Villa Lucca, to boost its top line. The company also benefits from turnover rent in its retail segment, directly linking its income to tenant sales performance.

Complementing these are management fees from property services and growing contributions from strategic investments, including Lee Gardens Shanghai, diversifying its income streams.

| Revenue Stream | 2024 Contribution (HK$ million) | Key Details |

|---|---|---|

| Rental Income | ~2,800 (Estimated from total turnover) | Core income from office, retail, and residential leases. 6.2% turnover growth in 2024 driven by this. |

| Property Sales | Variable (e.g., Villa Lucca units contracted) | Income from selling developed properties; 115 units contracted at Villa Lucca by end of 2024. |

| Turnover Rent | Significant portion of retail income | Percentage of tenant sales, sensitive to consumer spending. Not explicitly quantified separately in 2024 reports but contributed to retail segment growth. |

| Management Fees | Contributes to overall turnover | Fees for property management services, reflecting operational efficiency. |

| Investment Income | Emerging stream | Includes contributions from Lee Gardens Shanghai (from 2024) and minority stakes like New Frontier Group. |

Business Model Canvas Data Sources

The Hysan Business Model Canvas is built on a foundation of robust market research, internal financial data, and extensive operational analysis. These diverse sources ensure each component of the canvas is informed by accurate, actionable insights.