H World Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H World Group Bundle

H World Group demonstrates significant strengths in its established brand and extensive network, but faces potential threats from evolving market dynamics and competitive pressures. Understanding these internal capabilities and external forces is crucial for strategic decision-making.

Want the full story behind H World Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

H World Group's extensive hotel network is a significant strength, evidenced by its operation of 11,147 hotels with over 1 million rooms across 19 countries as of December 31, 2024. This vast footprint allows for broad market reach and economies of scale.

The company's rapid expansion strategy is a key differentiator, as demonstrated by achieving the 10,000-hotel milestone in 2024 and opening over 2,400 new hotels that year, surpassing its targets. This aggressive growth highlights strong execution and market demand.

This expansion is particularly focused on China's lower-tier cities and the upper-midscale segment, indicating strategic market penetration and an ability to adapt to evolving consumer preferences and underserved markets.

H World Group boasts a diverse multi-brand portfolio, a significant strength that allows it to capture a wide spectrum of the hospitality market. This includes economy brands like HanTing and mid-scale options such as JI Hotel and Crystal Orange Hotel, alongside upscale international brands like Steigenberger Hotels & Resorts and IntercityHotel.

This strategic brand diversification is crucial for resilience, enabling H World Group to adapt to varying economic conditions and traveler preferences. For instance, in 2023, the company reported a significant recovery in occupancy rates across its brands, with its mid-scale and upscale segments showing particularly strong performance, reflecting the broad appeal of its offerings.

H World Group's commitment to an asset-light strategy is a significant strength, with its franchised and manachised hotels making up an increasing share of its revenue. This approach is crucial for margin expansion and robust cash flow generation. For instance, by the end of 2023, H World Group operated 2,900 hotels, with over 90% of them franchised or manachised, a testament to this successful strategy.

This focus on franchising significantly bolsters the company's resilience against economic downturns by minimizing capital expenditure requirements. The model allows for rapid scaling and adaptability, as demonstrated by their continued expansion despite varying market conditions. This strategic choice directly translates into a more flexible and financially robust business structure.

Robust Financial Performance and Shareholder Returns

H World Group demonstrated strong financial performance in 2024, achieving a significant year-over-year revenue increase of 9.2%, reaching RMB 23.9 billion (US$3.3 billion). This growth underscores the company's operational effectiveness and market position.

The company’s commitment to shareholder value was evident through its substantial returns, distributing approximately US$767 million to shareholders via dividends and share repurchases. This action signals robust confidence in H World Group's future earnings potential and strategic direction.

- Revenue Growth: 9.2% increase in 2024, reaching RMB 23.9 billion (US$3.3 billion).

- Shareholder Returns: Approximately US$767 million distributed through dividends and buybacks.

- Confidence Indicator: Shareholder returns reflect strong belief in long-term growth prospects.

Advanced Central Reservation Systems and Loyalty Program

H World Group's advanced central reservation systems streamline operations and guest management across its extensive network of properties. This technological backbone is crucial for maintaining efficiency and a consistent guest experience.

The H Rewards program is a significant strength, boasting 267 million members as of early 2024. This vast membership base directly supports enhanced sales capabilities and cultivates strong customer loyalty, establishing a vital direct booking channel for the company.

- 267 million members in the H Rewards program as of early 2024, driving customer loyalty and direct bookings.

- Advanced central reservation systems enhance operational efficiency and guest management across all H World properties.

- Direct booking channel strengthened by the loyalty program, reducing reliance on third-party platforms and improving margins.

H World Group’s substantial hotel network, encompassing 11,147 hotels and over 1 million rooms by the end of 2024, provides significant market penetration and operational efficiencies. This extensive reach is further amplified by a strategic focus on rapid expansion, evidenced by the opening of over 2,400 new hotels in 2024, demonstrating robust execution and market demand, particularly in China's lower-tier cities and the upper-midscale segment.

The company's multi-brand strategy, featuring economy to upscale offerings like HanTing, JI Hotel, and Steigenberger, ensures broad market appeal and resilience against economic fluctuations. This diversification is supported by a commitment to an asset-light model, with over 90% of its 2,900 hotels franchised or manachised by the end of 2023, which enhances margin expansion and cash flow generation.

H World Group's strong financial performance, including a 9.2% revenue increase to RMB 23.9 billion (US$3.3 billion) in 2024 and substantial shareholder returns of approximately US$767 million, underscores its operational effectiveness and market confidence. The loyalty program, H Rewards, with 267 million members by early 2024, significantly boosts direct bookings and customer loyalty, further supported by advanced central reservation systems for streamlined operations.

| Key Strength | Metric/Data Point | Impact |

| Hotel Network Size | 11,147 hotels, 1M+ rooms (Dec 2024) | Broad market reach, economies of scale |

| Expansion Pace | 2,400+ new hotels opened in 2024 | Market share growth, adaptability |

| Brand Portfolio | Economy to Upscale brands (HanTing, JI, Steigenberger) | Diverse customer appeal, market resilience |

| Asset-Light Model | 90%+ franchised/manachised hotels (End 2023) | Margin expansion, robust cash flow, reduced capex |

| H Rewards Program | 267M members (Early 2024) | Customer loyalty, direct bookings, sales enhancement |

What is included in the product

Delivers a strategic overview of H World Group’s internal and external business factors, highlighting its market strengths and potential growth opportunities alongside operational weaknesses and competitive threats.

Offers a clear, actionable framework to identify and address H World Group's strategic challenges.

Weaknesses

H World Group faced profitability headwinds in late 2024, reporting a decline in net income for both the fourth quarter and the full year. This downturn was largely attributed to significant foreign exchange losses and an uptick in withholding taxes, impacting the bottom line despite robust revenue expansion.

While the company demonstrated strong revenue growth, its profitability metrics lagged behind some competitors. This suggests that translating top-line gains into bottom-line success remains a critical challenge for H World Group, requiring a closer examination of cost management and operational efficiencies.

The Legacy-DH segment, encompassing Deutsche Hospitality, saw an 11.3% revenue decrease in the first quarter of 2025. This downturn contrasts sharply with the robust growth observed in the Legacy-Huazhu segment, highlighting potential headwinds in H World Group's international markets.

This revenue decline suggests that the recovery or growth trajectory for Deutsche Hospitality is lagging behind the company's domestic Chinese operations. Factors such as geopolitical influences, varying economic conditions, or specific market challenges within Europe could be contributing to this underperformance.

China's hotel market is incredibly crowded. New hotels, both local and international, are popping up everywhere. This means H World Group, like its rivals, often has to lower prices to attract guests, which can really hurt how much money they make.

This fierce competition puts a strain on keeping room prices high and ensuring hotels are full. For instance, in 2023, while the overall travel market rebounded, the sheer volume of new supply in key Chinese cities meant that average daily rates (ADR) for many brands, including those managed by H World Group, faced upward pressure to remain competitive, impacting RevPAR growth.

Risk of Over-expansion and Quality Control

H World Group's aggressive expansion strategy, while a key strength, presents a significant risk of over-expansion. Analysts are concerned that managing the quality of a rapidly increasing number of franchised hotels could become a major challenge. This focus on volume over quality could lead to unsustainable growth in the long run.

For instance, as of the first quarter of 2024, H World Group reported a net increase of 106 hotels. While this demonstrates impressive growth, maintaining consistent service standards across such a rapidly expanding network, particularly with franchised locations, requires robust oversight. A potential dilution of brand quality could impact customer loyalty and future revenue streams.

The company's ability to effectively monitor and enforce quality control measures across its franchised properties is paramount. Failure to do so could lead to a decline in guest satisfaction scores, which are crucial for repeat business and positive word-of-mouth referrals. This is particularly relevant given the competitive landscape of the hotel industry, where brand reputation is a key differentiator.

- Over-expansion Risk: Rapid growth can strain resources and management capacity.

- Quality Control Challenges: Maintaining consistent hotel quality across a large franchised network is difficult.

- Unsustainable Growth: A purely volume-driven approach without quality assurance may not be sustainable long-term.

- Brand Dilution: Compromised quality can negatively impact brand reputation and customer loyalty.

Vulnerability to Macroeconomic Uncertainties

H World Group, like many in the hospitality sector, is navigating a landscape fraught with macroeconomic uncertainties. A significant concern is the ongoing downturn in China's property market, which can dampen consumer confidence and discretionary spending, directly impacting travel and leisure budgets. This cautious outlook is further shaped by a weak job market, which can reduce disposable income available for hotel stays and related services.

Persistent deflationary pressures in China also present a challenge, potentially affecting pricing power and overall revenue generation for H World Group. These combined economic headwinds could lead to reduced demand for hotel services and a dampening effect on Revenue Per Available Room (RevPAR) figures throughout 2024 and into 2025.

- Property Market Downturn: Continued weakness in China's real estate sector can negatively impact consumer wealth and spending propensity.

- Job Market Weakness: A subdued employment environment may lead to lower consumer confidence and reduced travel expenditure.

- Deflationary Pressures: Persistent low inflation or deflation can constrain pricing strategies and impact RevPAR growth.

- Consumer Spending Impact: These macroeconomic factors collectively pose a risk to consumer spending on travel and lodging, H World Group's core business.

H World Group's rapid expansion, while a driver of growth, introduces significant quality control challenges across its vast franchised network. Maintaining consistent service standards and brand integrity amidst this scale is a considerable hurdle, potentially impacting customer satisfaction and loyalty. This focus on volume over meticulous quality assurance could lead to unsustainable long-term growth and brand dilution.

Preview Before You Purchase

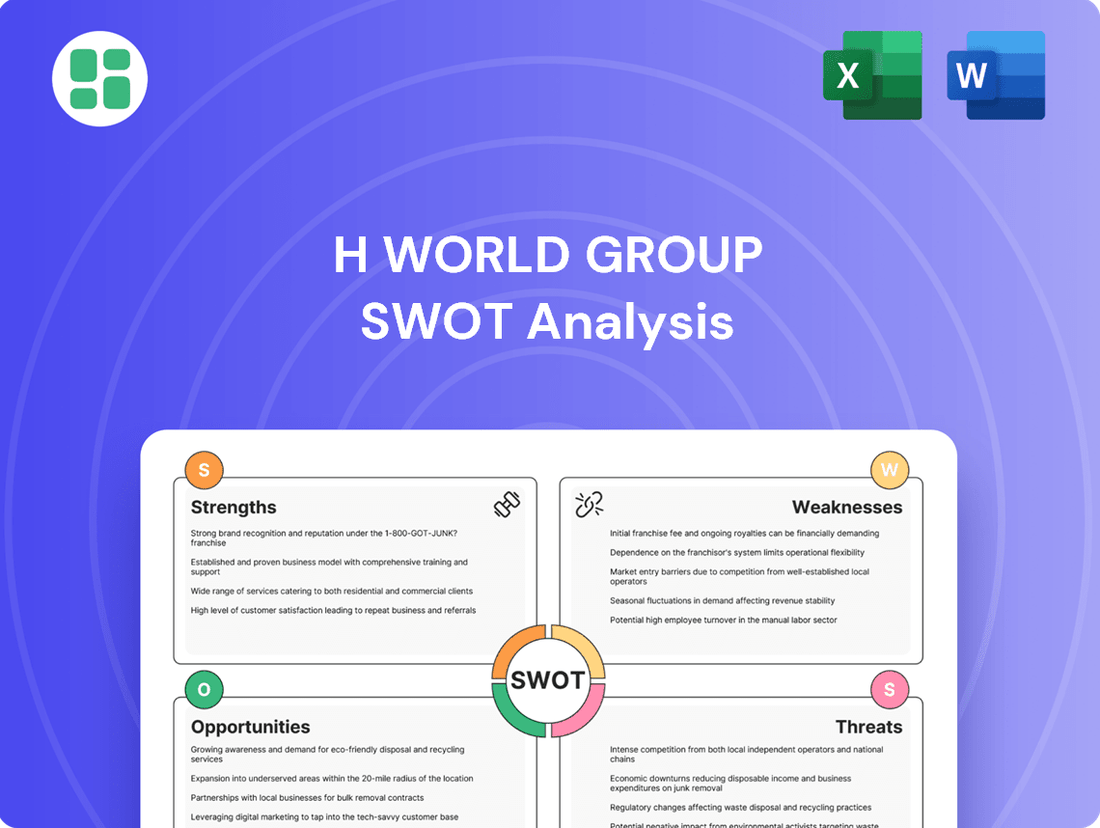

H World Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a concise overview of H World Group's Strengths, Weaknesses, Opportunities, and Threats. You'll gain valuable insights into the company's strategic positioning and potential challenges.

Opportunities

China's domestic travel market is showing robust recovery, with significant growth projected for 2024 and 2025. This surge is fueled by rising disposable incomes and continued urbanization, creating a strong demand for quality accommodation. H World Group is well-positioned to benefit from this trend.

The company can leverage this opportunity by strategically expanding its presence, especially in China's lower-tier cities. These markets have historically seen a shortage of well-managed, mid-scale hotels, presenting a clear gap for H World Group to fill and capture market share. For instance, by the end of 2023, H World Group had already opened 1,300 new hotels, with a significant portion targeting these developing urban centers.

H World Group is capitalizing on a clear trend: consumers are increasingly seeking better hotel experiences, particularly in the mid-to-high-end market. This aligns perfectly with their strategy to grow their presence in the upper-midscale segment.

The company's commitment to this area is evident in its 2024 performance, where it successfully added 231 new upper-midscale hotels. This rapid expansion, coupled with a robust pipeline of future developments in this category, signals a significant opportunity for sustained growth and market share capture.

H World Group's asset-light strategy, heavily reliant on manachised and franchised hotels, offers a powerful engine for scalable and capital-efficient expansion. This model allows the company to grow its network at a significantly faster pace compared to owning properties outright.

This focus on fee-based revenue streams, generated from managing and franchising hotels, directly translates to improved profitability and stronger cash flow for H World Group. For instance, as of the first quarter of 2024, the company reported a robust increase in its franchise revenue, underscoring the success of this approach.

International Expansion Beyond China

H World Group's strategic push for international expansion, particularly through its H World International division (formerly Deutsche Hospitality), signals a significant growth avenue. This rebranding is designed to accelerate its global presence, moving beyond its core Chinese market and tapping into new customer bases.

The group is actively pursuing new hotel signings in diverse regions, demonstrating tangible progress in its international strategy. For instance, recent developments in the Asia-Pacific and Middle East & Africa (MEIA) regions highlight this momentum. The company's entry into new markets, such as Laos, is a key indicator of this expansion, aiming to establish a broader and more diversified revenue base.

- Global Footprint Expansion: H World International's rebranding supports a focused strategy for growth outside China.

- New Market Entry: Recent hotel signings in Asia-Pacific and MEIA, including Laos, showcase active market penetration.

- Diversified Revenue Streams: International expansion aims to reduce reliance on any single market and capture global demand.

Technological Advancements and Digital Transformation

H World Group has a significant opportunity to capitalize on the hotel industry's widespread digital transformation. This includes the integration of AI for guest services and the adoption of smart hotel technologies. For instance, by mid-2024, many leading hotel chains were reporting increased guest satisfaction scores linked to personalized digital experiences and streamlined check-in processes.

Leveraging technology can bolster H World Group's operational efficiencies and fortify its central reservation systems. This digital push is crucial for enhancing the guest journey, particularly through its H Rewards loyalty program. By Q1 2025, hotels that invested in integrated digital platforms saw an average 15% increase in direct bookings compared to those relying on third-party channels.

The group can further enhance guest satisfaction and loyalty by implementing advanced technological solutions.

- AI-driven personalization: Offering tailored recommendations and services to H World Group's loyalty members.

- Smart room technology: Enabling guests to control lighting, temperature, and entertainment via mobile devices.

- Enhanced mobile app functionality: Streamlining booking, check-in/out, and in-room service requests.

- Data analytics for operational improvement: Utilizing guest data to optimize staffing, inventory, and service delivery.

China's domestic travel market is poised for continued strong growth through 2024 and 2025, driven by rising consumer spending power and ongoing urbanization. H World Group is strategically positioned to benefit from this expansion, particularly by targeting underserved lower-tier cities where demand for quality mid-scale hotels is high. The company's aggressive hotel openings, with 1,300 new locations by the end of 2023, underscore its commitment to capturing this domestic demand.

The company's focus on the upper-midscale segment aligns with evolving consumer preferences for enhanced hotel experiences. H World Group's addition of 231 new upper-midscale hotels in 2024, coupled with a substantial development pipeline, highlights its ability to capitalize on this trend and secure market share.

H World Group's asset-light, manachised and franchised model facilitates rapid, capital-efficient expansion, generating scalable and profitable fee-based revenue. This strategy is proving successful, as evidenced by the first quarter of 2024's strong growth in franchise revenue.

International expansion via H World International presents a significant growth opportunity, aiming to diversify revenue streams and tap into global markets. Recent hotel signings in the Asia-Pacific and MEIA regions, including entry into Laos, demonstrate active progress in this global push.

The ongoing digital transformation in the hospitality sector offers H World Group a chance to boost efficiency and guest satisfaction. Integrating AI and smart technologies, especially within its H Rewards loyalty program, can enhance the guest journey and drive direct bookings, with hotels adopting these technologies seeing an average 15% increase in direct bookings by Q1 2025.

Threats

The Chinese hotel market is seeing a significant increase in available rooms, with the total number of hotels exceeding pre-COVID levels. This surge in supply, driven by aggressive expansion from major players like Jin Jiang International, is intensifying competition.

This heightened competition can lead to market saturation, putting downward pressure on room rates and potentially affecting key performance indicators like Revenue Per Available Room (RevPAR) for H World Group.

Ongoing macroeconomic challenges in China, including a struggling property sector and a subdued job market, are dampening consumer confidence and spending on discretionary items like travel. This directly affects the hospitality industry, with potential for lower hotel demand and pricing power.

Deflationary pressures in China, observed in early 2025, further exacerbate the situation by potentially reducing the perceived value of spending and encouraging consumers to postpone purchases. This can translate into lower occupancy rates and declining average daily rates for hotels, impacting revenue per available room (RevPAR).

Geopolitical tensions and evolving regulatory landscapes present significant threats to H World Group. For example, the ongoing trade disputes and potential for new tariffs could disrupt supply chains and increase operational costs. Furthermore, shifts in international relations might affect the company's ability to expand into new markets or maintain existing international operations.

Regulatory changes, both at home and abroad, pose a direct challenge. Government policies, such as potential alcohol bans or stricter regulations on foreign investment, could directly impact H World Group's revenue streams, particularly in areas like business travel and food and beverage services. For instance, a hypothetical 10% increase in operating costs due to new compliance measures could significantly impact profitability.

Operational Cost Increases and Foreign Exchange Fluctuations

H World Group faces the threat of rising operational costs, which can squeeze profitability. Expenses like labor and utilities are on an upward trend, making it harder to maintain healthy profit margins. For example, in 2023, the company reported that increases in employee compensation and other operating expenses contributed to higher costs.

Furthermore, foreign exchange rate volatility presents a significant risk. Fluctuations in currency values can lead to losses, directly impacting H World Group's net income. This is particularly concerning as the company continues to expand its international footprint, making it more susceptible to these currency movements.

- Rising Labor and Utility Expenses: Increased costs for staff and energy can directly reduce profit margins.

- Foreign Exchange Losses: Unfavorable currency movements negatively affect the company's reported earnings.

- Impact on International Expansion: Growing global operations amplify the risks associated with currency fluctuations and varying operational costs.

Health Crises and Travel Restrictions

Future health crises and ensuing travel restrictions represent a significant threat to H World Group. The lingering impact of the COVID-19 pandemic, which saw global travel plummet, underscores the sector's susceptibility. For instance, in 2020, the United Nations World Tourism Organization reported a 73% drop in international tourist arrivals globally, a stark reminder of how quickly demand can evaporate.

These disruptions directly impact H World Group's core business: hospitality and tourism.

- Operational Disruption: Lockdowns and social distancing measures can force temporary closures or limit service capacity.

- Reduced Demand: Fear of contagion and government-imposed travel bans drastically cut into both leisure and business travel.

- Economic Downturn: Health crises often trigger broader economic recessions, further dampening consumer spending on travel and accommodation.

Intensifying competition in China's hotel market, with supply exceeding pre-COVID levels, threatens to depress room rates and negatively impact H World Group's RevPAR. Macroeconomic headwinds, including a weak property sector and subdued consumer confidence in China as of early 2025, further dampen travel demand and pricing power.

Rising operational costs, particularly for labor and utilities, continue to pressure H World Group's profit margins, as evidenced by increased compensation expenses reported in 2023. Geopolitical instability and evolving regulatory frameworks introduce risks of supply chain disruptions, increased operational costs, and potential limitations on international expansion, with hypothetical compliance measures potentially increasing costs by 10%.

The threat of future health crises and associated travel restrictions remains significant, recalling the 73% global drop in international tourist arrivals reported by the UNWTO in 2020, which could lead to operational disruptions, reduced demand, and economic downturns impacting H World Group's core business.

SWOT Analysis Data Sources

This SWOT analysis for H World Group is built upon a foundation of comprehensive data, including publicly available financial statements, detailed market research reports, and insights from industry experts. These sources provide a robust understanding of the company's performance and its operating environment.