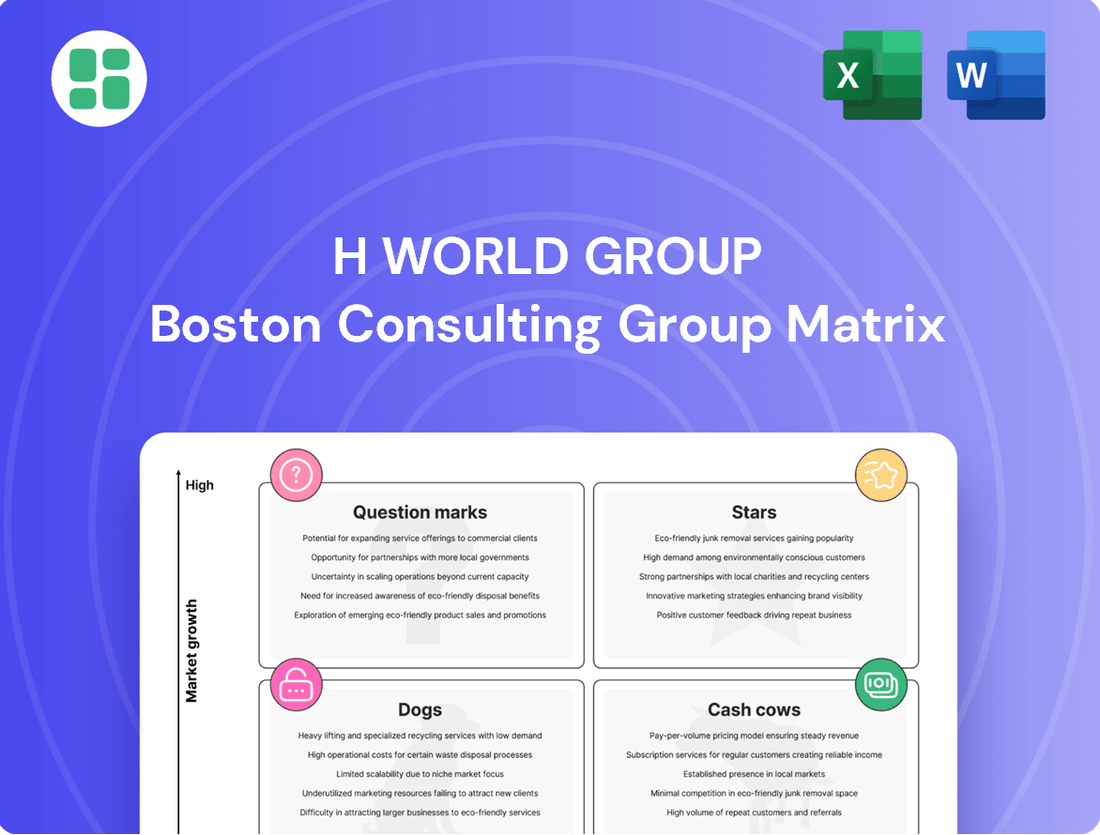

H World Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H World Group Bundle

Curious about H World Group's strategic product positioning? This glimpse into their BCG Matrix reveals potential Stars, Cash Cows, Dogs, and Question Marks, offering a strategic overview of their portfolio's health.

To truly unlock the power of this analysis and make informed decisions, dive into the full BCG Matrix. It provides a comprehensive breakdown of each product's market share and growth rate, equipping you with the actionable insights needed to optimize resource allocation and drive future success.

Don't miss out on the complete picture. Purchase the full H World Group BCG Matrix today for a clear roadmap to strategic growth and competitive advantage.

Stars

H World Group is aggressively growing its upper-midscale hotel brands, such as Crystal Orange Hotel and Intercity Hotel. This strategic focus is evident in the substantial number of new hotel openings and pipeline developments throughout 2024 and into Q1 2025.

The company's expansion in this segment reflects a response to increasing consumer demand for higher-quality lodging options beyond basic economy hotels. Brands like Maxx by Steigenberger and Manxin Hotel are key players in this push, aiming to capture a larger share of this growing market.

H World Group's strategic shift towards an asset-light, manachised, and franchised model is a significant factor in its expansion. By March 2025, an impressive 92% of its hotel rooms operated under this framework.

This approach allows for swift network growth while minimizing capital outlay, directly fueling substantial revenue increases through management and franchise fees. The company sees this as its primary path forward, given its inherent scalability and superior profit margins.

H World Group has been aggressively expanding its network, particularly within China. In 2024 alone, the company celebrated a record 2,442 new hotel openings. This rapid growth is set to continue, with plans for around 2,300 gross hotel openings in 2025, predominantly in the Chinese market.

This expansion strategy is heavily focused on penetrating less competitive, lower-tier cities across China. The company's ambition is to significantly increase its presence, aiming to operate in 2,000 cities, a substantial leap from the 1,394 cities it covered previously.

JI Hotel Performance

JI Hotel is a cornerstone of H World Group's portfolio, strategically positioned as a strong contender in the hotel industry. Its robust market presence is evidenced by its ranking as the fourth largest globally in terms of room count, boasting 325,999 rooms. This impressive scale is a testament to its effective business model and broad appeal.

The brand's success is largely driven by its adaptive segmentation strategy, which successfully addresses the diverse and changing preferences of modern travelers. By understanding and catering to these evolving needs, JI Hotel has cemented its place as a preferred choice for many.

JI Hotel continues to exhibit significant growth potential and a commanding market share, particularly within the mid-to-upscale hotel segments in China. This strong performance highlights its strategic advantage in a key growth market.

- Global Room Count: 325,999 rooms (as of recent reports, placing it 4th globally).

- Market Position: Strong presence in the mid-to-upscale segments.

- Key Market: China, demonstrating high market share and growth potential.

- Strategic Advantage: Successful segmentation model catering to evolving traveler needs.

H Rewards Loyalty Program

The H Rewards loyalty program is a significant asset for H World Group, demonstrating robust growth and customer engagement. As of Q1 2025, the program boasts an impressive 277 million members. This substantial membership base directly fuels over 65% of all reservations, highlighting the program's effectiveness in driving direct bookings and reducing reliance on costly third-party channels.

This high conversion rate from loyalty members to direct bookings significantly enhances profitability. It signifies a strong market position and a considerable increase in customer lifetime value, as members are more likely to make repeat purchases and spend more over time. The program’s success is a testament to H World Group's strategy of fostering direct customer relationships.

- 277 million members by Q1 2025.

- Over 65% of total reservations driven by direct bookings.

- Enhanced profitability through reduced third-party channel reliance.

- Strong market position and high customer lifetime value.

JI Hotel, with its substantial global room count and strong market position in China's mid-to-upscale segment, clearly falls into the Stars category within H World Group's BCG Matrix. Its successful adaptive segmentation strategy and significant growth potential in a key market underscore its status as a high-growth, high-market-share business.

| Brand | Market Share | Growth Rate | BCG Category |

|---|---|---|---|

| JI Hotel | High | High | Star |

What is included in the product

H World Group's BCG Matrix offers a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which units to grow, maintain, or divest for optimal portfolio performance.

The H World Group BCG Matrix provides a clear visual of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

HanTing Hotel, H World's flagship economy brand, stands as an undisputed champion with 359,475 rooms globally as of early 2024. This brand holds a mature and dominant market share within the stable Chinese economy lodging sector.

Its deeply entrenched presence and competitive pricing strategy allow HanTing to consistently generate substantial cash flow. Consequently, the need for significant new investment to drive growth is minimal, positioning it firmly as a Cash Cow for H World Group.

The Legacy-Huazhu segment, representing H World's core Chinese hotel operations, is a clear cash cow. In 2024, it achieved a strong occupancy rate of 81.2%, demonstrating its enduring market presence and operational efficiency. This segment consistently generates significant hotel turnover, underpinning the group's financial stability.

While Revenue Per Available Room (RevPAR) can experience minor shifts, the sheer scale of Legacy-Huazhu's network and its optimized operational processes guarantee a reliable and substantial cash flow. This mature business is the bedrock that funds H World's expansion and investment in newer ventures.

H World's central reservation systems (CRS) are a prime example of a cash cow, generating significant, high-margin revenue through fees charged across its vast hotel network. This robust digital infrastructure is critical for the smooth operation of its extensive portfolio, ensuring a consistent and dependable cash flow.

These systems represent a mature business segment where ongoing investment for maintenance is minimal relative to the substantial returns they yield. For instance, in 2024, H World reported that its hotel operations, heavily reliant on these reservation systems, continued to be a stable profit driver, underscoring the efficiency and profitability of this segment.

High Occupancy in Key Cities

H World Group's hotels in major Chinese metropolises such as Guangzhou, Shenzhen, and Xi'an are consistently demonstrating robust occupancy levels. For instance, Guangzhou saw an impressive occupancy rate of 88% during the May Day holiday in 2025. These established urban hubs, while perhaps not experiencing explosive growth, are crucial for generating stable, high revenue per available room.

These mature markets are the bedrock of H World Group's reliable cash flow, acting as significant cash cows within the company's portfolio. Their consistent performance ensures a steady stream of income, underpinning the group's financial stability.

- High Occupancy Rates: Cities like Guangzhou, Shenzhen, and Xi'an consistently report strong occupancy, e.g., 88% in Guangzhou during May Day 2025.

- Stable Revenue Generation: Mature urban markets provide reliable revenue per available room, contributing significantly to cash flow.

- Cash Cow Status: These well-established hotels represent a substantial portion of the company's dependable cash generation.

- Financial Stability: The consistent performance of these properties is key to H World Group's overall financial health.

Dividend and Share Repurchase Program

H World Group's robust shareholder return program underscores its position as a cash cow. In 2024, the company returned approximately US$767 million to shareholders via dividends and share repurchases. This substantial capital distribution is a direct result of strong free cash flow generated from its established and profitable business segments.

The announcement of a new 3-year shareholder return plan, targeting up to $2 billion starting July 2024, further solidifies this assessment. Such a commitment highlights the consistent and predictable earnings power of its mature operations, a hallmark of a healthy cash cow.

- Shareholder Returns (2024): Approximately US$767 million

- New Shareholder Return Plan: Up to US$2 billion over 3 years (announced July 2024)

- Indicator of Strength: Demonstrates significant free cash flow generation

- Business Segment Status: Reflects mature and profitable operations

H World Group's established brands and mature markets function as its primary cash cows. These segments, characterized by high occupancy and stable revenue, require minimal new investment while generating substantial profits. For instance, HanTing Hotel, with 359,475 rooms globally in early 2024, exemplifies this, consistently producing significant cash flow.

The Legacy-Huazhu segment, H World's core Chinese operations, also acts as a cash cow, evidenced by an 81.2% occupancy rate in 2024. This segment's efficiency and scale ensure a reliable income stream that supports the group's overall financial health and investments in growth areas.

| Segment/Brand | Key Characteristic | Cash Flow Contribution |

| HanTing Hotel | Mature, dominant market share, stable Chinese economy lodging | Substantial, consistent |

| Legacy-Huazhu | Core Chinese operations, high occupancy (81.2% in 2024) | Reliable and significant |

| Central Reservation Systems (CRS) | High-margin revenue generation, critical digital infrastructure | Consistent and dependable |

| Major Chinese Metropolises (e.g., Guangzhou) | Robust occupancy (88% in Guangzhou during May Day 2025), stable RevPAR | Steady and high |

What You See Is What You Get

H World Group BCG Matrix

The H World Group BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive upon purchase. This means you can confidently assess the comprehensive analysis and strategic insights without any alterations or missing sections. Rest assured, this is the complete, ready-to-use report, designed for immediate application in your business planning and decision-making processes.

Dogs

H World Group is strategically addressing its underperforming leased and owned properties, a key component of its BCG Matrix analysis. The company has announced plans to close approximately 600 hotels in 2025, a significant move to streamline its portfolio.

These closures primarily target older, leased or owned properties that no longer align with H World Group's asset-light strategy or are consistently struggling with profitability. Such assets often become cash traps, draining resources due to high operating expenses and yielding minimal returns, thus making their divestiture a critical strategic priority for the group.

Certain legacy operations within H World Group, particularly those not fitting its current asset-light, manachised strategy, could be classified as Dogs. These might include older, less efficient hotel structures or properties burdened with unfavorable lease agreements.

The group's stated emphasis on cost reduction and efficiency enhancements for 2025 directly targets these underperforming areas. For instance, if a legacy property requires significant capital expenditure without a clear path to profitability under the new model, it would be a prime candidate for divestment or restructuring.

Within H World's extensive brand lineup, there are likely smaller, less distinct brands positioned in mature or slow-growing market segments. These brands often face intense competition and possess minimal unique selling propositions, making it difficult to capture substantial market share.

These brands typically operate at the break-even point or even generate losses, demanding significant management attention and resources without yielding proportionate returns. For instance, if a specific hotel segment saw only a 1.5% growth in 2024, brands within it that haven't differentiated themselves would fall into this category.

Specific Restructuring-Impacted Units

Within H World Group's Legacy-DH segment, certain individual units or sub-brands are showing characteristics of dogs in the BCG matrix. These are typically assets that have undergone significant restructuring but continue to face challenges, resulting in ongoing losses or substantial one-off costs without a clear path to recovery. While the broader Legacy-DH segment holds potential, these specific underperforming units are resource drains.

- Underperforming DH Hotels: Specific hotels within the Legacy-DH portfolio that have not shown improvement post-restructuring, potentially impacting overall segment profitability.

- High One-Off Costs: Units incurring persistent high costs related to renovations or operational adjustments that are not yielding expected returns.

- Persistent Losses: Assets consistently reporting net losses, indicating a failure to achieve profitability despite prior interventions.

Operations in Highly Competitive or Saturated Micro-Markets

Hotels situated in intensely competitive or saturated micro-markets within China, where the supply of rooms far exceeds the actual demand, can unfortunately be classified as dogs in the BCG matrix.

Even if the broader Chinese hospitality market is experiencing growth, specific geographical pockets might contend with aggressive price wars and consequently, a diminished Revenue Per Available Room (RevPAR). For example, in 2024, certain Tier 3 cities in China saw hotel occupancy rates hover around 50-60% while simultaneously experiencing a decline in average daily rates (ADR) by as much as 10% year-over-year due to oversupply.

These underperforming units often find it an uphill battle to remain profitable and retain their significance within the market landscape. Their ability to generate substantial returns is severely hampered, making them a drain on resources rather than a contributor to overall company growth.

- Intense Competition: Micro-markets with a high density of hotel offerings lead to aggressive pricing strategies.

- Demand-Supply Imbalance: When hotel room supply significantly outstrips customer demand, profitability suffers.

- Low RevPAR: High competition and pricing pressure directly impact a hotel's ability to generate revenue per available room.

- Profitability Challenges: These hotels often struggle to cover operational costs and achieve positive net income.

H World Group's "Dogs" in the BCG Matrix likely represent older, leased or owned properties that are underperforming and don't fit the asset-light strategy. These could include hotels in saturated markets with low RevPAR or brands with minimal differentiation. The company's 2025 plan to close around 600 hotels directly targets these less profitable assets, aiming to improve efficiency and reduce resource drains.

These underperforming units, often characterized by persistent losses or high one-off costs without clear recovery paths, are a strategic focus for divestment or restructuring. For example, hotels in Tier 3 cities experiencing a 10% year-over-year decline in average daily rates in 2024 due to oversupply would fall into this category.

| Category | Characteristics | Example Scenario (2024 Data) |

| Dogs | Low market share, low growth, low profitability | Older leased hotels in saturated markets |

| High operating costs, minimal returns | Brands with weak competitive advantages | |

| Require significant resources without proportionate returns | Hotels in Tier 3 cities with declining ADR |

Question Marks

H World Group's expansion into markets like Laos with brands such as Intercity Hotel, JI Hotel, and Orange Hotel positions these ventures as potential stars. Laos, with its growing tourism sector, offers a high-growth environment, as evidenced by a projected 12.5% annual growth rate in tourist arrivals between 2023 and 2028, according to the World Travel & Tourism Council (WTTC) in their 2024 outlook.

These new international entries, while promising due to market potential, currently operate with a low market share in Laos. Significant capital investment is necessary to establish brand awareness, build operational infrastructure, and achieve network density, characteristic of a question mark in the BCG matrix.

The Legacy-DH segment, encompassing brands such as Steigenberger, experienced a net loss in 2024 and continued this trend into Q1 2025. Revenue also declined in Q1 2025, a contrast to the RevPAR growth observed in 2024.

Despite operating in a market with potential for international growth, the segment's current low profitability and ongoing restructuring place it in a question mark position within the BCG matrix. It is a cash consumer, with its future success hinging on improved operational efficiency and the effectiveness of asset-light strategies.

H World Group is strategically expanding into the upper-upscale and niche segments with brands like Steigenberger Icon and Song Hotels. These initiatives target growing market areas, reflecting a deliberate effort to diversify beyond its established core offerings.

While these newer brands represent potential high-growth opportunities, they likely hold a smaller market share within H World's overall portfolio compared to its dominant brands. Significant investment will be required to build brand awareness and secure a competitive position in these upscale markets.

Deep Penetration into Lower-Tier Chinese Cities

H World's strategy to expand into lower-tier Chinese cities, specifically third- and fourth-tier urban areas, presents a significant opportunity for future growth. These markets, while developing, are currently less saturated, offering H World a chance to establish a strong foothold.

The company's approach involves substantial investment in building out its network and increasing brand recognition within these emerging regions. This focus is crucial for converting these developing markets into high-performing 'stars' within the BCG matrix.

- Growth Potential: Lower-tier cities in China are experiencing considerable economic development, leading to increased consumer spending and demand for hospitality services.

- Market Share: While the overall market is growing, H World is still in the early stages of capturing significant market share in many of these specific third- and fourth-tier locations.

- Investment Needs: To solidify its position and drive growth, H World is allocating resources towards expanding its hotel footprint and enhancing brand visibility in these less competitive urban centers.

- Strategic Focus: The long-term objective is to leverage this deep penetration strategy to transform these emerging markets into key revenue drivers for the group.

Technology-Driven Service Innovations

H World Group's focus on technology-driven service innovations, including investments in new mobile features, dynamic pricing, and personalized booking, positions it for future growth. These advancements aim to boost guest engagement and streamline operations, though their full impact is still developing. For instance, in 2023, H World Group reported a significant increase in its digital presence, with mobile bookings accounting for a substantial portion of its reservations, indicating the early success of these tech investments.

These initiatives are currently in their growth phase, requiring continued research and development to fully realize their market potential and achieve leadership. The company's commitment to green initiatives also falls under this category, aligning with evolving consumer preferences and regulatory landscapes. By prioritizing these areas, H World Group is building a foundation for enhanced guest experiences and operational efficiencies, anticipating a stronger competitive edge.

- Mobile Feature Enhancement: Continued investment in user-friendly mobile applications to improve booking, check-in, and loyalty program engagement.

- Dynamic Pricing: Implementation of sophisticated algorithms to optimize room rates based on real-time demand and market conditions.

- Personalized Booking: Leveraging data analytics to offer tailored recommendations and customized packages to individual guests.

- Green Initiatives: Integration of sustainable practices and technologies to reduce environmental impact and appeal to eco-conscious travelers.

H World Group's expansion into new international markets, such as Laos with brands like Intercity Hotel, positions these ventures as potential question marks. While these markets offer growth opportunities, the brands currently hold a low market share, necessitating substantial investment for brand building and operational setup.

Similarly, the Legacy-DH segment, despite operating in a market with international growth potential, faces challenges with low profitability and ongoing restructuring. This segment consumes cash and its future success hinges on operational improvements and the effectiveness of its asset-light strategies, characteristic of a question mark.

The company's strategic entry into upper-upscale and niche segments with brands like Steigenberger Icon and Song Hotels also places them in the question mark category. These initiatives target growing market areas but require significant investment to build brand awareness and gain a competitive edge in these upscale markets.

H World's expansion into lower-tier Chinese cities, while promising for future growth, also represents question marks. The company is investing heavily to build its network and brand recognition in these less saturated areas, aiming to transform them into future stars.

Investments in technology-driven service innovations, such as enhanced mobile features, dynamic pricing, and personalized booking, are also question marks. These initiatives require continued R&D to fully realize their market potential and achieve leadership, though early indicators like a significant increase in mobile bookings in 2023 show promise.

| BCG Category | H World Group Brands/Initiatives | Rationale | Investment Need | Market Share |

|---|---|---|---|---|

| Question Marks | Intercity Hotel, JI Hotel, Orange Hotel in Laos | New international markets with growth potential but low current penetration. | High | Low |

| Question Marks | Legacy-DH Segment (e.g., Steigenberger) | Low profitability, ongoing restructuring, cash consumer. | High (for turnaround) | Varies |

| Question Marks | Steigenberger Icon, Song Hotels | Entry into upscale/niche segments, requires brand building. | High | Low (initially) |

| Question Marks | Expansion into Lower-Tier Chinese Cities | Developing markets requiring significant network and brand investment. | High | Low (initially) |

| Question Marks | Technology Innovations (Mobile, Dynamic Pricing, Personalization) | Growth phase, requiring continued R&D for full potential. | High | Developing |

BCG Matrix Data Sources

Our H World Group BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.