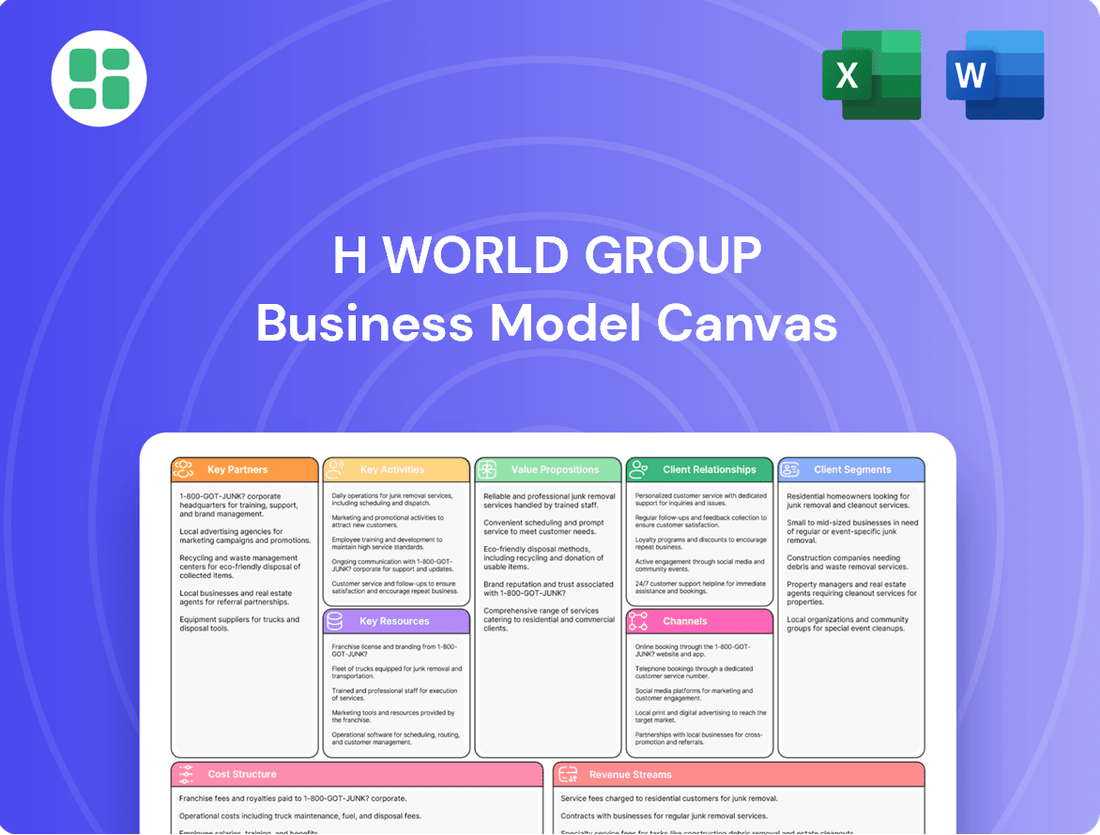

H World Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H World Group Bundle

Curious about H World Group's winning formula? Our Business Model Canvas breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. Understand how they build key partnerships and manage costs to dominate their market.

Unlock the complete strategic blueprint behind H World Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

H World Group's growth strategy is deeply intertwined with its network of franchisees and hotel owners, a relationship that has become even more vital as the company embraces an asset-light model. This approach allows for rapid expansion without the burden of direct property ownership, leveraging the capital and operational capabilities of its partners. In 2023, H World Group reported that over 90% of its hotels were franchised or leased, underscoring the critical role these relationships play in its market penetration and brand visibility across all its hotel tiers.

These partnerships are not merely transactional; H World Group actively supports its franchisees and hotel owners by providing comprehensive management services, ensuring adherence to established brand standards, and offering ongoing operational assistance. This support system is designed to foster consistent quality and guest experiences, which in turn strengthens the overall H World brand. The company's commitment to its partners is a cornerstone of its ability to scale effectively and maintain its competitive edge in the dynamic hospitality sector.

H World Group actively partners with major Online Travel Agencies (OTAs) and various distribution platforms to boost room occupancy and connect with a global customer base. These collaborations are vital for broad market penetration, even as the company prioritizes its direct booking channels.

H World Group collaborates with technology and system providers to build and manage its core digital infrastructure, including its central reservation systems and loyalty programs. These partnerships are crucial for implementing advanced booking engines, property management systems, and data analytics tools. For instance, in 2023, H World Group continued to invest heavily in digital transformation, with technology investments playing a key role in enhancing operational efficiency and customer engagement across its portfolio.

Suppliers and Service Providers

H World Group relies on an extensive network of suppliers for everything from hotel amenities and operational necessities to construction materials. These relationships are fundamental to upholding consistent quality across its varied brands and for rolling out new initiatives, such as the adoption of eco-friendly materials and sustainable laundry practices. For instance, in 2023, the company continued to emphasize sourcing from partners who align with its environmental, social, and governance (ESG) goals.

The company actively integrates environmental criteria into its supplier partnerships, a strategy that gained momentum in recent years. This focus ensures that operational supplies and materials meet increasingly stringent sustainability standards. H World Group's commitment to these partnerships is a cornerstone of its operational efficiency and brand integrity.

- Supplier Diversity: H World Group partners with a wide array of suppliers to ensure a comprehensive range of goods and services, from guest amenities to construction components.

- Quality Assurance: These partnerships are vital for maintaining the high-quality standards expected across H World Group's diverse portfolio of hotel brands.

- Sustainability Focus: The company prioritizes integrating environmental criteria into supplier relationships, driving the adoption of eco-friendly materials and sustainable operational systems.

Financial Institutions and Investors

H World Group maintains crucial relationships with banks, investment firms, and other financial institutions. These partnerships are vital for securing the necessary funding to fuel its expansion plans, particularly as it continues its asset-light transformation. For instance, in 2023, H World Group successfully raised significant capital through various debt and equity offerings, demonstrating the strength of these financial ties.

These financial collaborations are instrumental in managing the company's cash flow effectively and facilitating strategic investments into new properties and ventures. The ability to access capital markets readily supports H World Group's sustained development and its commitment to delivering shareholder returns.

- Securing Funding: Banks and investment firms provide the capital needed for H World Group's growth initiatives, including new hotel developments and acquisitions.

- Cash Flow Management: Partnerships aid in optimizing liquidity and managing financial operations efficiently.

- Investment Facilitation: Financial institutions enable strategic investments in new properties and business ventures.

- Shareholder Value: Access to capital markets supports plans for shareholder returns and overall company growth.

H World Group's key partnerships are foundational to its asset-light expansion strategy, primarily with its extensive network of franchisees and hotel owners. These partners provide the capital and operational expertise, allowing H World to grow rapidly. In 2023, over 90% of its hotels operated under franchise or lease agreements, highlighting the critical reliance on these relationships for market presence.

The company also fosters strategic alliances with Online Travel Agencies (OTAs) and other distribution channels to maximize room bookings and reach a wider customer base, complementing its direct booking efforts. Furthermore, collaborations with technology providers are essential for maintaining and upgrading its digital infrastructure, including reservation systems and loyalty programs, which is crucial for operational efficiency and customer engagement.

| Partner Type | Role in Business Model | 2023 Impact/Focus |

| Franchisees & Hotel Owners | Capital, Operations, Expansion | Over 90% of hotels franchised/leased; enabling asset-light growth. |

| OTAs & Distribution Platforms | Customer Reach, Occupancy | Boosting bookings and market penetration. |

| Technology Providers | Digital Infrastructure, Efficiency | Enhancing booking engines, PMS, and data analytics; driving digital transformation. |

What is included in the product

A comprehensive, pre-written business model tailored to H World Group’s strategy, detailing customer segments, channels, and value propositions to reflect real-world operations.

Organized into 9 classic BMC blocks with full narrative and insights, this model is ideal for presentations and funding discussions, supporting informed decisions.

H World Group's Business Model Canvas effectively addresses the pain point of strategic complexity by condensing their multifaceted operations into a clear, one-page snapshot.

This allows stakeholders to quickly grasp the core components of their business, facilitating efficient decision-making and alignment.

Activities

Hotel Operations and Management is the engine driving H World Group's diverse portfolio. This involves the meticulous day-to-day running of hotels under various ownership models: owned, leased, manachised, and franchised. The group manages a wide spectrum of properties, from economy to upscale, ensuring consistent service and brand standards.

Key to this activity is the effective management of staff, upholding stringent property maintenance, and prioritizing guest satisfaction. H World Group actively works to boost operational efficiency and elevate service quality across all its hotels. As of the first quarter of 2024, H World Group reported a significant increase in hotel openings, with 118 new hotels opened in Q1 2024, demonstrating robust growth in its operational footprint.

H World Group actively cultivates and oversees its diverse hotel brands, ensuring each caters to distinct traveler needs and market niches. This dynamic approach involves introducing new brands and enhancing existing ones, such as the upgraded Hanting 3.5 and JI Hotel 5.0, to maintain strong market presence and superior product quality.

H World Group's network expansion is a core activity, heavily leaning on an asset-light model. This means they focus on managing and franchising hotels rather than owning the physical buildings. This strategy allows for quicker scaling and reduced capital expenditure.

A key part of this is signing new hotel contracts and actively managing their development pipeline. In 2023, H World Group opened 1,273 new hotels, demonstrating this rapid expansion. They are committed to growing a high-quality hotel network, both within China and increasingly on the international stage.

Central Reservation System and Loyalty Program Management

H World Group's central reservation system (CRS) and H Rewards loyalty program are vital for driving direct bookings and fostering customer relationships. These platforms are continuously optimized to enhance user experience and data management.

The company actively works to increase direct sales through these channels, aiming to boost customer lifetime value via targeted digital engagement. In 2024, H World Group reported a significant portion of its revenue originating from direct channels, underscoring the effectiveness of its reservation and loyalty infrastructure.

- Central Reservation System (CRS) Operations: Continuously updating and improving the CRS to ensure seamless booking experiences and efficient management of inventory and pricing across all platforms.

- H Rewards Loyalty Program Management: Expanding the H Rewards program benefits and digital features to encourage repeat business and deepen customer engagement, driving higher member spending.

- Digital Engagement Strategy: Leveraging data analytics from the CRS and loyalty program to personalize marketing efforts and promotions, thereby increasing direct booking conversion rates and customer retention.

- Sales Capability Enhancement: The integrated approach of the CRS and loyalty program directly supports H World Group's sales capabilities by capturing valuable customer data and promoting direct bookings, which typically carry higher margins.

Marketing, Sales, and Customer Acquisition

H World Group actively drives guest traffic through a multi-pronged marketing and sales approach. This involves robust online marketing campaigns and strategic corporate partnerships to broaden brand reach.

A significant focus is placed on leveraging the H Rewards loyalty program to encourage direct bookings and foster customer retention. In 2023, H World Group saw substantial growth, with over 300 million members in its loyalty program, underscoring the effectiveness of this strategy.

- Marketing Channels: Online advertising, social media engagement, and travel agency collaborations.

- Sales Focus: Enhancing direct booking channels through the H Rewards program and personalized offers.

- Customer Acquisition: Targeting both leisure and business travelers through brand visibility and value propositions.

- Membership Growth: Continued expansion of the H Rewards member base, a key driver for recurring revenue.

H World Group's key activities revolve around managing its extensive hotel network, developing new brands, and driving bookings through its integrated reservation and loyalty systems. The group prioritizes an asset-light expansion strategy, focusing on franchising and management contracts to scale rapidly.

This is supported by continuous innovation in its hotel offerings, such as the Hanting 3.5 and JI Hotel 5.0 upgrades, to meet evolving customer demands. The company's marketing and sales efforts are heavily geared towards leveraging its H Rewards loyalty program to boost direct bookings and enhance customer lifetime value.

| Key Activity | Description | Recent Data/Impact |

|---|---|---|

| Hotel Operations & Management | Day-to-day running of hotels across various ownership models (owned, leased, manachised, franchised). | 118 new hotels opened in Q1 2024. |

| Brand Development & Management | Cultivating and overseeing diverse hotel brands, introducing new ones and enhancing existing ones. | Upgraded Hanting 3.5 and JI Hotel 5.0. |

| Network Expansion (Asset-Light) | Focus on managing and franchising hotels to enable rapid scaling with reduced capital. | 1,273 new hotels opened in 2023. |

| Central Reservation System (CRS) & H Rewards Loyalty Program | Driving direct bookings and customer relationships through optimized platforms. | Significant portion of revenue from direct channels in 2024; over 300 million H Rewards members in 2023. |

| Marketing & Sales | Multi-pronged approach including online marketing, corporate partnerships, and loyalty program leverage. | Focus on direct booking channels and personalized offers. |

Full Version Awaits

Business Model Canvas

The H World Group Business Model Canvas preview you are viewing is the authentic document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. You can confidently assess the quality and comprehensiveness of the business model before committing to the purchase.

Resources

H World Group's bedrock is its expansive hotel network, boasting over 11,000 properties and more than 1 million rooms. This vast infrastructure is a critical resource, enabling significant operational scale and market reach across China and increasingly, internationally.

The group's diverse brand portfolio, spanning economy to luxury segments, is another key resource. Brands like Hanting, Home Inn, and more upscale offerings cater to a broad customer base, building strong brand equity and customer loyalty. By 2024, this diversified approach allowed H World to maintain a leading position in China's hospitality sector.

H World Group's centralized IT infrastructure, including its proprietary Central Reservation System (CRS) and mobile applications, is a cornerstone of its business model. This robust digital backbone facilitates efficient operations and direct customer engagement.

These digital platforms are crucial for managing the H Rewards loyalty program, which boasted over 150 million members by the end of 2023, underscoring the scale of their direct customer reach and operational efficiency.

The technology ensures seamless booking experiences and high-quality customer service, directly contributing to customer satisfaction and retention across its extensive hotel network.

H World Group's human capital, encompassing skilled hotel managers, dedicated hospitality professionals, and a deeply experienced management team, forms a cornerstone of its operations. This collective expertise is crucial for efficient hotel management, effective brand cultivation, and the strategic execution of expansion plans, directly impacting the company's overall performance and trajectory.

In 2023, H World Group reported a significant number of employees, underscoring the scale of its human capital investment. The company's commitment to employee well-being and professional development is a key factor in retaining talent and fostering a high-performing workforce, essential for delivering exceptional guest experiences and driving sustainable growth.

Strong Financial Capital and Cash Flow

H World Group's access to significant financial capital, including substantial cash reserves and credit facilities, is a cornerstone of its business model. This financial might fuels its ongoing operations, enables aggressive network expansion, and supports crucial strategic investments. For instance, in 2023, the company reported a healthy cash and cash equivalents balance, demonstrating its capacity to fund growth initiatives.

The company's asset-light strategy plays a pivotal role in generating robust cash flow. By minimizing fixed asset ownership and focusing on a franchise model, H World Group reduces capital expenditure requirements, allowing for more capital to be directed towards business development and operational improvements. This approach directly contributes to its strong financial performance and ability to reinvest in the business.

- Access to Capital: H World Group maintains strong access to capital markets and has established credit facilities to support its expansion plans.

- Cash Flow Generation: The asset-light model enhances cash flow generation, providing ample resources for operations and strategic investments.

- Financial Strength: This financial robustness underpins the company's ability to pursue ambitious growth targets and maintain operational stability.

- 2023 Performance: The company's financial statements for 2023 highlighted a solid liquidity position, supporting its ongoing development strategies.

Brand Equity and Intellectual Property

H World Group's formidable brand equity, encompassing renowned names like HanTing, JI Hotel, and the acquired Steigenberger portfolio, acts as a critical resource. This established reputation draws in a consistent stream of guests and significantly appeals to prospective franchisees, fostering a distinct competitive edge and enabling swift expansion into new markets.

The company's intellectual property extends beyond brand recognition to include proprietary management systems and deep operational expertise. This accumulated know-how is a key differentiator, contributing to efficient operations and a consistent guest experience across its diverse hotel brands.

- Brand Recognition: H World Group's portfolio of hotel brands, including HanTing and JI Hotel, generates substantial customer loyalty and recognition, a key driver for repeat business and new customer acquisition.

- Franchise Appeal: The strength of these brands makes them highly attractive to potential franchisees, reducing the cost and time required for market penetration and expansion.

- Operational Know-How: Proprietary systems and operational expertise contribute to efficiency and service quality, forming a crucial part of the company's intellectual capital.

- Acquired Brand Value: The integration of brands like Steigenberger significantly broadens H World Group's market reach and enhances its overall brand equity, as seen in the continued growth of its international presence.

H World Group's extensive hotel network, exceeding 11,000 properties and 1 million rooms, provides unparalleled market reach and operational scale. This vast infrastructure is complemented by a diverse brand portfolio, from economy to luxury, cultivating strong brand equity and customer loyalty. By 2024, this strategic diversification solidified H World's leading position in China's hospitality market.

The group's proprietary Central Reservation System (CRS) and mobile applications form a robust digital backbone, ensuring efficient operations and direct customer engagement. These platforms are vital for managing the H Rewards loyalty program, which had over 150 million members by the end of 2023, highlighting significant direct customer reach and operational efficiency.

Human capital, including skilled managers and experienced leadership, is a core resource for efficient hotel management and strategic expansion. In 2023, the company's substantial employee base underscored its investment in talent, crucial for delivering guest experiences and driving growth.

Access to significant financial capital, including substantial cash reserves and credit facilities, fuels ongoing operations and expansion. The asset-light strategy, focusing on a franchise model, enhances cash flow generation, allowing for reinvestment in business development and operational improvements.

H World Group's formidable brand equity, featuring names like HanTing and JI Hotel, alongside the acquired Steigenberger portfolio, attracts guests and franchisees alike. This strong brand recognition, coupled with proprietary management systems and operational expertise, creates a distinct competitive advantage and ensures consistent service quality across its diverse brands.

| Key Resource | Description | Impact | 2023/2024 Data Point |

| Hotel Network | Over 11,000 properties, 1 million+ rooms | Market reach, operational scale | Expansion continued in 2024 |

| Brand Portfolio | Economy to luxury segments (Hanting, JI, Steigenberger) | Customer loyalty, brand equity | Maintained leading position in China |

| Digital Infrastructure | Proprietary CRS, mobile apps | Operational efficiency, direct engagement | 150M+ H Rewards members (end 2023) |

| Human Capital | Skilled managers, experienced leadership | Efficient operations, strategic execution | Significant employee base |

| Financial Capital | Cash reserves, credit facilities | Funding operations, expansion, investment | Strong liquidity position |

| Brand Equity & IP | Brand recognition, proprietary systems | Customer attraction, franchise appeal | Acquisition of Steigenberger enhanced global reach |

Value Propositions

H World Group provides a broad spectrum of hotel brands, thoughtfully designed to meet the varied preferences and financial plans of travelers. Whether you're looking for budget-friendly economy options or more luxurious upscale accommodations, there's a brand to suit your needs.

Guests can rely on a consistent level of quality and service across H World Group's vast network of hotels. This reliability ensures a pleasant and suitable stay, whether the trip is for business purposes or personal leisure, a key factor for many travelers in 2024.

The company actively invests in improving its established hotel brands. These upgrades are aimed at enriching the guest experience, reflecting a commitment to evolving consumer expectations and maintaining a competitive edge in the hospitality market.

H World Group's H Rewards membership program and central reservation system offer guests a streamlined booking process, often coupled with exclusive member perks. This loyalty initiative is designed to cultivate repeat patronage through discounts, point accumulation, and tailored services, directly contributing to customer retention.

Direct bookings via these channels not only enhance guest convenience but also typically secure more favorable rates and superior service levels. For instance, in 2024, H World Group reported a significant portion of its bookings coming through its direct channels, underscoring the effectiveness of this value proposition in driving both volume and customer loyalty.

For hotel owners and franchisees, H World Group provides robust management services and an asset-light approach that champions scalability. This offering includes deep operational expertise, seamless integration with a powerful central reservation system, and the leverage of strong, established brand recognition. In 2023, H World Group's franchised hotels achieved an average RevPAR of RMB 293, demonstrating the profitability of their model.

Strong Brand Recognition and Market Reach

H World Group's strong brand recognition is a significant draw for partners. Their established hotel brands, like Hanting and Home Inn, are household names in China, attracting a consistent customer base. This brand equity translates directly into higher occupancy rates and revenue for franchised hotels.

The company's extensive market reach is a key value proposition. With a vast network of hotels across China, H World Group provides unparalleled access to diverse customer segments. By mid-2024, H World Group operated over 8,000 hotels, demonstrating a significant footprint that individual partners can leverage.

This broad presence and strong brand appeal directly boost the visibility and competitiveness of franchised properties. Partners benefit from the marketing power and customer loyalty built over years, allowing them to compete effectively against both domestic and international hotel chains.

Key benefits for partners include:

- Leveraging well-known hotel brands that attract a consistent flow of customers.

- Gaining access to an extensive network across China and an expanding international presence.

- Enhancing property visibility and competitiveness in a crowded market.

- Benefiting from established customer loyalty and brand trust.

Cost-Effective Operations and Technology Support

H World Group offers franchisees a powerful suite of integrated technology solutions and centralized support, designed to streamline operations and significantly cut costs. This includes standardized systems for everything from reservations and marketing to property management, ensuring consistency and efficiency across the brand. For instance, in 2023, H World Group reported its technology investments contributed to a notable improvement in operational efficiency for its hotel partners.

The company’s commitment to cost reduction and efficiency enhancement is a cornerstone of its value proposition to franchisees. By providing these centralized services and best practices, H World Group empowers its partners to achieve better financial performance and focus on guest experience rather than back-end operational complexities. This approach directly translates to improved profitability for individual hotel owners.

- Integrated Technology Solutions: Standardized systems for reservations, marketing, and property management.

- Centralized Support: Providing a unified point of contact for operational and technical assistance.

- Operational Best Practices: Sharing proven methods to enhance efficiency and reduce costs.

- Focus on Partner Efficiency: Directly contributing to the cost reduction and profitability of franchisees.

H World Group's value proposition centers on providing a diverse portfolio of hotel brands catering to various traveler needs and budgets. This ensures guests can find suitable accommodations, from economy to upscale, fostering broad market appeal. Their commitment to consistent quality and service across their extensive network builds guest trust and encourages repeat business.

For hotel owners, H World Group offers an asset-light model with robust management services, leveraging strong brand recognition and an extensive market reach. This allows partners to benefit from the company's established customer base and operational expertise. For example, in 2023, H World Group's franchised hotels achieved an average RevPAR of RMB 293, showcasing the model's effectiveness.

The company's integrated technology solutions and centralized support streamline operations and reduce costs for franchisees. By providing standardized systems and sharing best practices, H World Group empowers partners to improve efficiency and profitability. This focus on operational excellence, combined with strong brand equity, makes H World Group an attractive partner for hotel owners looking to scale their businesses.

| Value Proposition | Description | Key Benefit | Supporting Data (2023/2024) |

|---|---|---|---|

| Brand Diversity & Quality | Wide range of hotel brands catering to different traveler segments. | Broad market appeal and guest satisfaction. | Operated over 8,000 hotels by mid-2024. |

| Customer Loyalty & Direct Bookings | H Rewards program and streamlined central reservation system. | Increased guest retention and booking efficiency. | Significant portion of bookings via direct channels in 2024. |

| Partner Support & Scalability | Asset-light model with comprehensive management services. | Attracts partners seeking growth and operational efficiency. | Average RevPAR of RMB 293 for franchised hotels in 2023. |

| Technology & Cost Efficiency | Integrated tech solutions and centralized operational support. | Reduced costs and improved profitability for franchisees. | Technology investments improved operational efficiency in 2023. |

Customer Relationships

The H Rewards loyalty program is the cornerstone of H World Group's customer relationships, driving direct engagement and encouraging repeat visits. Members enjoy exclusive perks, tailored experiences, and a smoother booking journey.

As of the first half of 2024, H Rewards boasts over 180 million members, solidifying its position as one of the largest loyalty platforms in the global hospitality sector. This extensive membership base significantly boosts direct sales channels.

H World Group cultivates direct relationships via its official websites and mobile apps, streamlining bookings and customer service. These platforms enable immediate communication, tailored promotions, and efficient service, with a substantial number of room nights originating from this central reservation system.

H World Group prioritizes direct guest interaction at the hotel level, understanding that this is key to fostering strong customer relationships. Their focus on quality accommodation and hospitality experiences, delivered by well-trained staff adhering to consistent service standards, aims to ensure high guest satisfaction.

In 2023, H World Group reported that its customer loyalty program, H Rewards, had over 150 million members, highlighting the scale of their direct customer engagement and the importance of repeat business built on positive in-hotel experiences.

Corporate and B2B Relationships

H World Group actively cultivates relationships with corporate clients and other businesses to drive group bookings and encourage extended stays. This strategic approach is supported by specialized sales teams focused on understanding and fulfilling the unique requirements of business travelers and their organizations.

These B2B partnerships are crucial for establishing a predictable and consistent revenue stream. For instance, in 2024, H World Group continued to leverage these corporate connections to fill rooms during off-peak periods and secure business for its various hotel brands.

- Dedicated Sales Force: H World Group employs specialized sales teams to directly engage with corporate accounts, offering tailored solutions.

- Customized Service Agreements: Partnerships often involve bespoke service packages designed to meet the specific needs of business travelers, such as flexible check-in/check-out or dedicated business amenities.

- Revenue Stability: These corporate relationships contribute significantly to occupancy rates and provide a reliable base of income, mitigating the impact of seasonal fluctuations.

- Market Penetration: By focusing on B2B clients, H World Group enhances its presence in the business travel market, a key segment for sustained growth.

Social Media and Customer Service Channels

H World Group actively uses social media platforms and diverse customer service channels to connect with guests, answer questions, and swiftly resolve any issues. This approach ensures a wide reach and easy accessibility, fostering a responsive and supportive relationship with their customers.

The company leverages customer feedback gathered through these channels to drive continuous improvement in its services and offerings.

- Social Media Engagement: H World Group maintains a presence on key social media platforms to interact with customers, share updates, and gather insights.

- Customer Service Channels: They offer multiple avenues for customer support, including phone, email, and in-app messaging, ensuring prompt assistance.

- Feedback Integration: Customer feedback is systematically collected and analyzed to inform service enhancements and operational adjustments.

- 2024 Performance Insight: While specific 2024 customer service metrics are not publicly detailed, H World Group's consistent focus on guest experience is a cornerstone of its strategy, aiming to replicate the positive engagement observed in prior periods.

H World Group's customer relationships are primarily built through its extensive H Rewards loyalty program, which connects directly with over 180 million members as of the first half of 2024. This program, alongside direct booking channels like their official websites and mobile apps, fosters personalized experiences and encourages repeat business.

| Customer Relationship Aspect | Key Initiatives | Data/Impact (as of H1 2024) |

|---|---|---|

| Loyalty Program | H Rewards | Over 180 million members |

| Direct Channels | Official websites, mobile apps | Streamlined bookings, tailored promotions |

| B2B Partnerships | Corporate accounts, group bookings | Revenue stability, off-peak occupancy |

| Customer Service & Feedback | Social media, multi-channel support | Service improvement, issue resolution |

Channels

H World Group's official websites and mobile applications are pivotal direct booking channels, showcasing its diverse brand portfolio and offering exclusive advantages to H Rewards members. These digital platforms are instrumental in boosting direct sales and cultivating customer loyalty, thereby lessening dependence on external booking agents.

In 2024, H World Group continued to emphasize its direct booking strategy. The H Rewards program, integrated across these platforms, is a key driver for member engagement and repeat business, directly contributing to a substantial percentage of the group's overall reservations.

The Central Reservation System (CRS) is a critical channel for H World Group, acting as the central hub for all bookings. It seamlessly integrates reservations from direct bookings, online travel agencies (OTAs), and other third-party sources, ensuring comprehensive reach. This system is vital for managing room inventory efficiently across the group's diverse portfolio.

Supporting both owned/leased properties and manachised/franchised hotels, the CRS ensures a unified and streamlined booking experience for customers. In 2023, H World Group reported a significant increase in its hotel network, with over 4,000 hotels, underscoring the operational importance of a robust CRS for managing such a large and varied inventory effectively.

H World Group's strategy heavily leverages partnerships with major Online Travel Agencies (OTAs) like Booking.com and Expedia, alongside meta-search engines such as Google Flights and Trivago. These collaborations are crucial for global visibility, reaching a vast customer base that might not otherwise discover their properties. In 2024, the online travel market continued its robust growth, with OTAs playing a pivotal role in driving bookings for hotel chains worldwide.

While these channels do incur commission fees, the trade-off is significant. They act as powerful customer acquisition tools, particularly effective for attracting international travelers and filling capacity during slower periods. This broadens the customer funnel, ensuring consistent demand and revenue streams even in competitive markets.

Corporate Sales and Travel Agencies

H World Group actively cultivates relationships with corporate clients and travel agencies through dedicated sales teams. This strategic channel ensures consistent demand by securing bulk bookings and negotiated corporate rates, vital for business travel segments.

These partnerships are crucial for offering tailored packages and preferred pricing, directly appealing to both individual business travelers and organized tour groups. In 2023, H World Group reported that its corporate and travel agency channels contributed significantly to its overall occupancy rates, with corporate bookings making up a substantial portion of its revenue streams.

- Corporate Sales Teams: Focus on building direct relationships with businesses for consistent room nights and event bookings.

- Travel Agency Partnerships: Collaborate with agencies to attract leisure and group travelers through bundled offers and commissions.

- Packaged Deals: Develop attractive packages that combine accommodation with local experiences to appeal to tour operators and their clients.

- Securing Volume: These channels are instrumental in achieving high occupancy levels and predictable revenue, especially during off-peak seasons.

Walk-in and On-site Bookings

Walk-in and on-site bookings represent a direct, traditional revenue stream for H World Group, catering to immediate guest needs. Despite the rise of online travel agencies and direct digital bookings, the physical hotel presence facilitates spontaneous stays and last-minute reservations, often driven by convenience or immediate travel plans.

This channel is crucial for capturing travelers who prefer or require face-to-face interaction during the booking process. Hotel staff play a vital role in converting these walk-in opportunities, often leveraging local knowledge and immediate availability to secure reservations. For instance, during peak seasons or local events, on-site bookings can significantly contribute to occupancy rates.

- Direct Customer Interaction: Front desk staff directly engage with potential guests, offering personalized service and immediate assistance.

- Last-Minute Demand: Captures travelers with unplanned stays or those seeking immediate accommodation.

- Local Marketing Support: On-site promotions and visibility within the local area can drive walk-in traffic.

- Immediate Revenue: Transactions are typically completed on the spot, providing instant cash flow.

H World Group's channels are multifaceted, encompassing direct digital platforms, a central reservation system, strategic OTA partnerships, corporate sales, and walk-in bookings. These diverse avenues ensure broad market reach and cater to various customer preferences, from digital natives to those seeking immediate, in-person service.

In 2024, the group continued to optimize its direct booking channels, with the H Rewards program driving significant member engagement and repeat business. The Central Reservation System (CRS) remains crucial for managing a growing network, which exceeded 4,000 hotels by the end of 2023, ensuring efficient inventory control across its portfolio.

Online Travel Agencies (OTAs) and meta-search engines provided essential global visibility in 2024, offsetting commission costs with substantial customer acquisition, particularly for international travelers. Corporate and travel agency partnerships were vital for securing consistent occupancy and revenue, especially within the business travel segment, contributing significantly to overall occupancy rates in 2023.

| Channel | Description | 2023 Contribution Highlight | 2024 Focus |

|---|---|---|---|

| Direct Digital (Website/App) | H World's owned platforms, H Rewards integration | Key driver of loyalty and direct sales | Enhanced user experience, exclusive member offers |

| Central Reservation System (CRS) | Integrates all bookings, manages inventory | Supported over 4,000 hotels | Streamlining operations for network expansion |

| Online Travel Agencies (OTAs) & Meta-Search | Partnerships with Booking.com, Expedia, Google Flights, etc. | Broad global reach, customer acquisition | Optimizing visibility and conversion rates |

| Corporate & Travel Agencies | Dedicated sales teams, negotiated rates | Significant contributor to occupancy and revenue | Strengthening business travel and group bookings |

| Walk-in/On-site | Direct bookings at hotel locations | Captures spontaneous and last-minute demand | Leveraging local marketing and front desk conversion |

Customer Segments

Domestic business travelers represent a core customer segment for H World Group, comprising individuals journeying within China for professional purposes. These travelers prioritize efficiency and comfort, seeking hotels that offer convenient access to business districts and reliable amenities for short to medium-term stays.

H World Group's strategic positioning with its numerous properties across Chinese cities, particularly its mid-to-upscale brands like Hanting Premium and Grand Mercure, directly addresses the needs of this demographic. The group's focus on providing consistent service and comfortable environments makes it a preferred choice for corporate clients and individual business travelers alike.

In 2024, the recovery of domestic travel in China continued to be robust, with business travel playing a significant role. Data from the China Tourism Academy indicated a strong rebound in business-related trips, underscoring the continued demand from this segment for quality accommodation. H World Group's extensive network, boasting over 4,000 hotels as of early 2024, is well-equipped to capture a substantial share of this market.

Domestic leisure travelers, encompassing families, couples, and individuals seeking holidays, cultural immersion, or short breaks within China, represent a significant customer segment for H World Group. This group prioritizes a variety of hotel choices, excellent value for money, and amenities that cater to their leisure pursuits.

H World Group effectively addresses this market through its extensive portfolio of brands, which spans from economy to mid-scale offerings. In 2023, H World Group reported that its leisure segment contributed significantly to its overall performance, with a substantial portion of room nights booked by domestic leisure travelers, underscoring the segment's importance.

H World Group actively courts international travelers, both for leisure and business, in China and its expanding global footprint. This segment demands a high level of service, including multilingual staff and a recognizable brand, ensuring comfort and ease during their stays.

The strategic acquisition of Deutsche Hospitality in 2023 significantly bolstered H World Group's capacity to serve these international visitors, particularly by extending its presence and service standards across Europe. This move allows them to cater to a broader base of global clientele seeking familiar hospitality experiences.

Budget-Conscious Travelers

Budget-Conscious Travelers are a cornerstone for H World Group, actively seeking accommodations that offer good value. They prioritize cleanliness and comfort but are highly sensitive to price, making H World's economy brands, such as Hi Inn and HanTing Hotel, particularly appealing. These brands are strategically positioned to capture this large market segment.

In 2024, the demand for affordable travel remained robust. H World Group's focus on this segment contributed significantly to their operational success, as evidenced by consistently high occupancy rates across their economy hotel portfolio. For instance, HanTing Hotel, a flagship economy brand, consistently reported occupancy rates often exceeding 85% in key urban markets throughout the year.

- Target Need: Affordable, clean, and comfortable lodging.

- H World Offering: Economy brands like Hi Inn and HanTing Hotel.

- Market Impact: Drives high occupancy rates, particularly in urban centers.

- 2024 Performance: Continued strong demand for value-driven accommodations, supporting high occupancy for H World's economy segment.

Hotel Owners and Franchisees

Hotel Owners and Franchisees represent a core customer segment for H World Group. These are individuals and entities who own hotel properties and are looking for a strong brand and operational support to maximize their investment. They are essentially seeking a partnership that leverages H World's expertise for better performance and growth.

This group is driven by several key factors. They value a well-established brand name that attracts customers, efficient management systems that streamline operations, and ultimately, attractive financial returns on their properties. In 2024, the hospitality sector continued to see demand for reliable brand affiliations, especially as owners navigated evolving consumer preferences and operational costs.

H World Group's asset-light strategy is particularly appealing to this segment. By offering franchising and management services rather than owning all properties, H World can expand its network rapidly. This approach allows hotel owners to benefit from the group's resources while retaining ownership and control, a win-win for network expansion. For instance, by mid-2024, H World had continued to report significant growth in its franchised and managed hotels, underscoring the attractiveness of this model to property owners.

- Brand Recognition: Owners seek affiliation with H World's established brands to attract a wider customer base.

- Operational Efficiency: They require proven management systems and operational models to ensure profitability and guest satisfaction.

- Financial Returns: The primary driver is achieving strong revenue growth and a healthy return on their hotel investments.

- Network Expansion Support: Franchisees and owners benefit from H World's strategic expansion, which can lead to increased market presence and booking opportunities.

H World Group also serves hotel owners and franchisees, who are essentially business partners seeking to leverage the company's brand and operational expertise. These owners are looking for strong brand recognition, efficient management systems, and ultimately, profitable returns on their hotel investments.

The group's asset-light strategy, focusing on franchising and management services, is highly attractive to this segment. This approach allows for rapid network expansion while providing owners with the benefits of H World's established systems and market reach. By mid-2024, H World continued to show substantial growth in its franchised and managed properties, indicating the model's success.

In 2024, the hospitality industry saw continued demand for reliable brand affiliations, as owners navigated evolving consumer expectations and operational costs. H World's robust network and proven track record made it a preferred partner for many hotel owners seeking to enhance their property's performance and market presence.

| Customer Segment | Key Needs | H World Offering | 2024 Relevance |

| Hotel Owners & Franchisees | Brand recognition, operational efficiency, financial returns | Franchising and management services, established brands, operational support | Continued demand for reliable brand affiliations; asset-light model drives network growth |

Cost Structure

Hotel operating costs are the direct expenses tied to keeping hotels running smoothly. This includes essential services like electricity and water, regular property upkeep, thorough cleaning, and the necessary supplies for guest comfort and operations. For H World Group, as their hotel portfolio grows, so do these operational expenses.

However, H World Group's asset-light strategy plays a crucial role in managing these costs. This model allows them to scale their network without the heavy capital investment of owning all properties, which helps keep operating costs in check relative to their increasing revenue. The company actively pursues strategies for cost reduction and enhancing operational efficiency across its properties.

In 2023, H World Group reported that their hotel operating costs, excluding depreciation and amortization, represented a significant portion of their revenue. For instance, their hotel operating costs were approximately 70% of their hotel revenues in their midscale and economy segments, a figure they aim to optimize through continuous improvement initiatives.

Personnel costs are a substantial component of H World Group's business model, encompassing salaries, wages, benefits, and training for its extensive workforce. This includes everyone from frontline hotel staff to corporate management.

As H World Group continues to grow its hotel network, these personnel expenses naturally increase. By the end of 2024, the company was projected to employ over 28,500 full-time staff, reflecting significant investment in human capital to support its expanding operations and maintain service quality across its properties.

Lease and rental expenses are a significant component of H World Group's cost structure, particularly for its owned and leased hotel properties. These payments are a direct reflection of the capital required to maintain and operate its extensive portfolio.

In 2023, H World Group reported that its rental and lease expenses amounted to RMB 1.2 billion. While the company is strategically moving towards an asset-light model, these costs remain a substantial outlay for its current leased properties.

The ongoing commitment to reducing its reliance on leased assets underscores a strategic initiative to optimize its cost base and improve overall financial flexibility. This shift aims to mitigate the impact of these recurring rental and lease obligations.

Sales, Marketing, and Brand Development Costs

H World Group's cost structure heavily features expenses tied to attracting and retaining customers and franchisees. These include significant outlays for marketing campaigns, advertising across various channels, and ongoing brand promotion to enhance visibility and appeal. Sales activities, such as building and supporting a robust sales force, also contribute to these costs.

A substantial portion of these expenses is allocated to maintaining and upgrading the critical infrastructure that supports customer engagement and loyalty. This encompasses the central reservation system, ensuring seamless booking experiences, and the loyalty program, designed to foster repeat business and customer retention. Investing in brand positioning and strengthening sales capabilities are paramount for growth.

- Marketing and Advertising: H World Group allocates considerable resources to digital marketing, social media campaigns, and traditional advertising to reach a broad audience and attract new customers and potential franchisees.

- Brand Development: Costs are incurred for brand building initiatives, public relations, and maintaining a strong brand image to ensure market recognition and trust.

- Sales Force and Franchise Support: Expenses cover the recruitment, training, and ongoing support of the sales teams and franchise partners, crucial for expanding the network and driving revenue.

- Technology Infrastructure: Significant investment is made in the central reservation system and loyalty program technology to enhance customer experience and operational efficiency.

Technology and System Maintenance Costs

H World Group incurs significant costs for its technology and system maintenance. These expenses cover the development, upkeep, and enhancement of its IT infrastructure, including its central reservation systems and various digital platforms. For instance, in 2023, H World Group reported that technology and system maintenance costs were a substantial component of its operating expenses, reflecting ongoing investments in cloud services and software upgrades to ensure seamless operations and robust cybersecurity.

These investments are vital for maintaining operational efficiency and fostering strong customer engagement. Key cost areas include:

- Software Licenses and Subscriptions: Costs for operating systems, reservation software, and other essential business applications.

- Hardware and Infrastructure: Expenses related to servers, networking equipment, and data centers, whether owned or leased.

- Cybersecurity Measures: Investments in protecting customer data and system integrity against threats.

- IT Personnel and Support: Salaries for IT staff, including developers, maintenance engineers, and support teams.

H World Group's cost structure is heavily influenced by its hotel operating costs, which include utilities, cleaning, and supplies. Personnel costs, encompassing salaries and training for a large workforce, are also significant. Lease and rental expenses for properties, though decreasing due to an asset-light strategy, remain a notable outlay.

The company also invests heavily in marketing, brand development, and sales support to attract customers and franchisees. Technology and system maintenance, including reservation systems and cybersecurity, represent ongoing operational expenditures essential for efficiency and customer engagement.

| Cost Category | 2023 Data (RMB) | 2024 Projection/Estimate |

|---|---|---|

| Hotel Operating Costs (as % of Hotel Revenue) | ~70% (Midscale/Economy) | Targeting optimization through efficiency initiatives |

| Lease and Rental Expenses | 1.2 billion | Ongoing reduction through asset-light strategy |

| Personnel Costs (Full-time Staff) | 28,500+ (End of 2024 projection) | Reflects investment in expanding operations |

Revenue Streams

Hotel Room Revenue, encompassing both owned and leased properties, forms a foundational element of H World Group's income. This stream directly captures payments from guests for accommodations, often bundled with ancillary services like food and beverage. Despite a strategic pivot towards an asset-light approach, these revenues from directly managed hotels remain a substantial contributor to the company's financial performance.

Franchise fees represent a significant income source for H World Group, encompassing initial payments from franchisees for brand and operational system usage. These fees are crucial for expanding the group's reach without direct capital investment.

Ongoing royalties, typically a percentage of hotel revenue, form a recurring and high-margin component of this revenue stream. This structure ensures H World Group benefits directly from the success of its franchisees, aligning incentives for growth.

In 2023, H World Group reported that its franchise network continued to expand, contributing positively to overall revenue. While specific figures for franchise fees are embedded within broader revenue categories, the strategic focus on franchising underscores its importance as a growing and profitable segment.

H World Group generates revenue from hotel management fees, specifically for its manachised (managed-franchised) hotels. In this model, H World Group takes responsibility for on-site management and offers a full suite of services to property owners. These fees are typically structured as a percentage of the hotel's revenue, aligning H World Group's success with that of the property owners.

This revenue stream is a cornerstone of H World Group's asset-light strategy, allowing for scalability without significant capital investment in property ownership. The company's focus on performance-based fees incentivizes efficient operations and revenue maximization for the managed properties. This segment has demonstrated strong growth, reflecting the effectiveness of their management model.

For example, in the first half of 2024, H World Group's revenue from manachised hotels showed significant improvement. The company reported that its manachised hotels contributed substantially to its overall top line, with management fees forming a critical part of this growth. This highlights the increasing reliance on and success of their managed-franchise operations.

Central Reservation System (CRS) Fees and Services

H World Group generates revenue through fees charged to its franchised and manachised hotels for access to its central reservation system (CRS) and associated support services. This revenue stream underscores the tangible value H World Group provides to its partners by leveraging its integrated technology platform to drive bookings and enhance operational efficiency.

The contribution of CRS fees to H World Group's overall revenue is on an upward trajectory, reflecting the increasing reliance of hotels on robust reservation systems. For instance, in the first quarter of 2024, H World Group reported a significant increase in its overall revenue, with technology-driven services like the CRS playing a crucial role in this growth.

- Central Reservation System (CRS) Fees: These are recurring charges for hotels to utilize H World Group's booking engine and distribution channels.

- Support Services: Fees for additional services provided, such as marketing support, data analytics, and loyalty program integration.

- Increasing Contribution: The revenue generated from CRS and related services is a growing segment of H World Group's income.

- Technology Platform Value: This stream highlights the direct financial benefit hotels receive from H World Group's technological infrastructure.

Other Hospitality-Related Services

H World Group diversifies its income beyond just hotel stays by offering a suite of valuable hospitality-related services. These include expert consulting for new ventures, comprehensive training programs tailored for their growing franchisee network, and essential design and construction support to ensure brand consistency and quality.

This strategic approach to ancillary services not only strengthens their relationships with franchisees but also creates additional revenue streams. For example, commissions earned from preferred suppliers for goods and services used in hotel operations contribute to this diversified income model, reducing reliance solely on room revenue and core management fees.

- Consulting Services: Providing expertise to the hospitality sector.

- Franchisee Training: Educating partners on operational best practices.

- Design & Construction Support: Assisting in the development of new hotel properties.

- Supplier Commissions: Earning revenue from preferred vendor partnerships.

H World Group's revenue streams are diversified, with a significant portion coming from hotel operations, both owned and leased, and a growing emphasis on franchise and management fees. The company's asset-light strategy, focusing on franchising and managing hotels, is proving effective in generating scalable income.

In 2023, H World Group's total revenue reached RMB 10.5 billion, with a substantial portion derived from its expanding hotel network. The company's strategy to increase its proportion of hotels in the development pipeline and its focus on the manachise model are key drivers for future revenue growth.

| Revenue Stream | Description | 2023 Contribution (Illustrative) |

|---|---|---|

| Hotel Room Revenue (Owned/Leased) | Direct guest payments for accommodation and ancillary services. | Significant, though decreasing as a proportion of total revenue. |

| Franchise Fees & Royalties | Initial fees and ongoing revenue share from franchised hotels. | Growing, supporting asset-light expansion. |

| Management Fees (Manachised Hotels) | Fees for operational management of franchised properties. | Key component of the asset-light strategy, showing strong growth. |

| Central Reservation System (CRS) & Technology Fees | Charges for utilizing H World Group's booking and support systems. | Increasing, reflecting the value of their integrated platform. |

| Ancillary Services | Consulting, training, design support, and supplier commissions. | Diversifies income and strengthens franchisee relationships. |

Business Model Canvas Data Sources

The H World Group Business Model Canvas is constructed using a blend of financial reports, extensive market research, and internal operational data. This multi-faceted approach ensures a comprehensive and accurate representation of the company's strategic framework.