H World Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H World Group Bundle

H World Group operates in a dynamic hospitality landscape, facing moderate rivalry from established players and emerging brands. The bargaining power of buyers, primarily travelers, is significant due to the availability of numerous accommodation options and online review platforms.

Threats from substitute products, such as vacation rentals and alternative travel experiences, also exert pressure on H World Group's market share. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping H World Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for H World Group's essential inputs, like real estate, construction materials, and technology, directly influences their bargaining power. When a small number of major suppliers control a crucial input market, they can more easily dictate prices and contract terms, potentially increasing costs for H World.

For instance, in 2024, the global construction materials market saw significant price volatility due to supply chain disruptions and increased demand, particularly impacting companies with large development pipelines like H World. This concentration means that if these key suppliers face issues or decide to increase prices, H World has fewer alternatives, weakening its negotiating position.

While H World's vast scale and extensive network offer some leverage in procuring supplies, the specialized nature of certain services or the exclusivity of prime real estate locations can still grant suppliers a considerable advantage. This means that even with their size, H World must carefully manage relationships with these concentrated suppliers to mitigate potential cost increases and ensure continuity of operations.

The costs H World incurs to switch from one supplier to another significantly impact supplier bargaining power. For instance, integrating new property management software or retraining staff on unfamiliar systems represents a considerable expense. In 2023, H World Group reported total operating costs of RMB 12.8 billion, indicating the scale at which such switching costs could manifest.

For a company of H World's size, these substantial switching costs can create inertia, making it economically challenging to alter existing supplier relationships. This can lead to suppliers having greater leverage in negotiations, as H World may be hesitant to incur the upfront investment and disruption associated with finding and onboarding new providers.

The uniqueness of supplier offerings significantly impacts H World Group's bargaining power. If suppliers provide highly differentiated products, like proprietary hotel management software or exclusive luxury brand amenities, H World faces limited alternatives and potentially higher costs. For instance, in 2024, the global hospitality software market saw continued innovation, with some providers offering unique AI-driven guest experience platforms that are difficult to substitute.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into hotel operations is a factor H World must consider. If a key supplier, particularly in technology or property development, decided to launch its own hotel brand, it could directly compete with H World’s existing businesses. This scenario, while not a daily concern for most traditional suppliers, represents a potential strategic shift that could impact market dynamics.

For instance, a major property developer with extensive hotel real estate holdings might leverage its existing assets and expertise to create and manage its own hotel chain. Similarly, a leading hospitality technology provider could potentially pivot to offering its services through its own branded hotels, thereby bypassing the need for third-party operators like H World. This possibility underscores the importance of fostering strong, mutually beneficial relationships with suppliers and continuously negotiating favorable terms to mitigate such risks.

- Forward Integration Risk: Suppliers with capabilities in technology or real estate development could potentially launch their own hotel brands, directly competing with H World.

- Strategic Importance: This threat highlights the need for H World to maintain robust supplier partnerships and secure competitive agreements.

- Mitigation Strategy: Proactive relationship management and contract negotiation are key to minimizing the impact of potential supplier forward integration.

Importance of H World to Suppliers

H World Group's substantial purchasing volume makes it a significant customer for many of its suppliers. For smaller or niche suppliers, this reliance can translate into reduced bargaining power for them, as H World's business is critical to their own revenue streams. For instance, if a specialized food ingredient supplier derives over 30% of its annual revenue from H World, they are less likely to push for significantly higher prices or less favorable terms.

Conversely, larger and more diversified suppliers may find H World to be just one of many clients. In such cases, H World's importance to these suppliers is diminished, thereby increasing the suppliers' bargaining power. A major beverage distributor, for example, that serves hundreds of hotel chains and restaurant groups globally might only see H World as a small fraction of its overall sales, giving them more leverage in price negotiations.

- Supplier Dependence: Smaller suppliers heavily reliant on H World's orders have less leverage.

- Market Share: For suppliers with a large market share and diverse clientele, H World's importance is diluted.

- Negotiating Position: H World's purchasing power is strongest with suppliers where it represents a significant portion of their business.

- Industry Dynamics: The bargaining power of suppliers is also influenced by the overall supply and demand for the goods or services they provide to the hospitality sector.

The bargaining power of suppliers to H World Group is influenced by several factors, including supplier concentration, switching costs, and the uniqueness of their offerings. In 2024, the hospitality sector continued to face challenges with the availability and cost of key resources like construction materials and specialized technology, a trend that directly impacts H World's operating expenses and negotiation leverage.

High switching costs, such as those associated with integrating new property management systems or retraining staff, can lock H World into existing supplier relationships, granting suppliers greater power. The uniqueness of certain supplier products, like proprietary software or exclusive amenities, further limits H World's alternatives. For instance, the 2024 hospitality tech landscape highlighted unique AI solutions that are difficult to substitute.

H World's substantial purchasing volume can reduce the bargaining power of smaller, dependent suppliers, but this leverage is diminished with larger, more diversified providers. The threat of forward integration by suppliers, particularly in technology or real estate, also presents a strategic risk that necessitates careful supplier relationship management.

| Factor | Impact on H World | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration increases supplier leverage. | Volatility in construction materials impacted H World's development pipeline. |

| Switching Costs | High costs limit H World's ability to change suppliers. | Significant costs for system integration and retraining. |

| Uniqueness of Offerings | Differentiated products reduce H World's alternatives. | Emergence of unique AI hospitality software in 2024. |

| H World's Purchasing Volume | Stronger leverage with smaller suppliers, weaker with larger ones. | Reliance of niche suppliers on H World's orders. |

| Forward Integration Threat | Potential for suppliers to become competitors. | Strategic risk for technology and real estate suppliers. |

What is included in the product

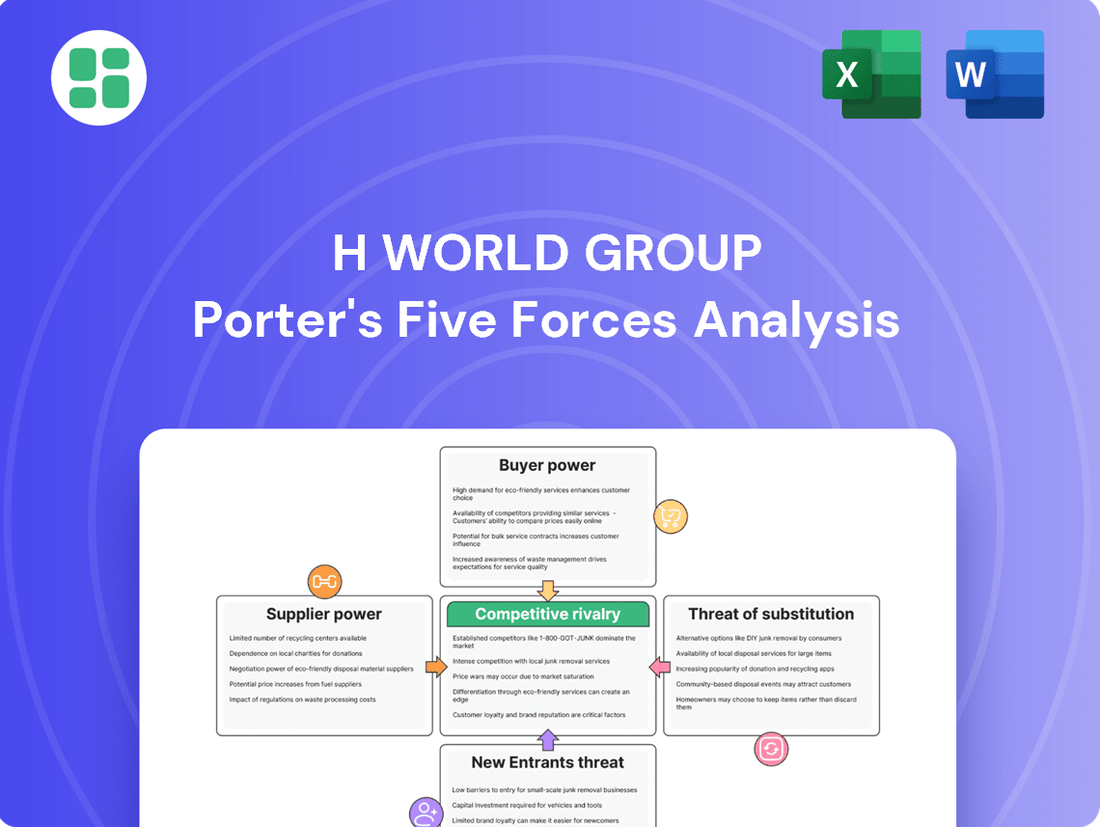

This analysis of H World Group's competitive landscape examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, providing strategic insights into its market position.

H World Group's Porter's Five Forces Analysis provides a clear, one-sheet summary of all competitive forces, perfect for quick strategic decision-making and identifying key pressure points.

Customers Bargaining Power

Customer price sensitivity is a significant force for H World Group, especially in its economy and midscale hotel segments. In 2024, with a highly competitive lodging market, travelers in these categories readily compare prices online, making them acutely aware of even small rate increases. This means H World must carefully balance pricing to avoid losing guests to rivals, impacting its revenue potential.

The bargaining power of customers is significantly influenced by the availability of substitutes. For H World Group, this means customers can easily find alternative accommodations, impacting their leverage.

The hotel industry is highly competitive, with numerous hotel chains and independent establishments. In 2024, the global hotel market continued to see strong competition, with new entrants and established players vying for market share. This abundance of choice directly empowers customers to negotiate for better prices or switch to providers offering more attractive terms.

Beyond traditional hotels, alternative lodging options like Airbnb have also become a substantial substitute. In 2023, the short-term rental market continued its growth trajectory, offering travelers diverse and often more budget-friendly choices, further amplifying customer bargaining power against established hotel brands like H World.

Customers today have unprecedented access to information, largely thanks to online travel agencies (OTAs), review platforms, and comparison websites. This transparency allows them to easily compare prices, amenities, and service quality across different hotel brands, significantly boosting their bargaining power against H World Group.

With readily available information, customers can make well-informed decisions, putting pressure on H World Group to maintain competitive pricing and deliver high-quality experiences. For instance, a traveler can easily see that in 2024, average hotel room rates in major Chinese cities saw fluctuations, making price comparison a critical factor for consumers.

H World Group actively works to counter this by strengthening its loyalty program, H Rewards. The goal is to encourage direct bookings, which bypasses OTAs and allows H World to build stronger customer relationships and potentially reduce the commission costs associated with third-party platforms, thereby mitigating some of the customer's bargaining leverage.

Volume of Purchases

The volume of purchases significantly influences customer bargaining power within the hotel industry. For H World Group, large corporate accounts or group bookings represent substantial revenue streams, granting these customers greater leverage to negotiate discounted rates and favorable terms. Individual leisure travelers, conversely, typically possess less bargaining power due to their smaller booking volumes.

H World Group's strategy of catering to diverse market segments, from budget-conscious travelers to premium clients, means it must manage varying levels of customer purchasing volume. This segmentation directly impacts the bargaining power dynamics. For instance, a large corporation booking hundreds of room nights annually can demand concessions that a single traveler cannot.

In 2024, the hotel sector continued to see strong demand from corporate travel, particularly for large-scale events and conferences. This trend amplifies the bargaining power of major corporate clients. H World Group's ability to secure and retain these high-volume accounts is crucial for maintaining competitive pricing and occupancy rates. The group's extensive network of hotels across various price points allows it to serve a wide range of corporate needs, from business trips to employee accommodation programs.

- Corporate Accounts: Large corporations booking significant volumes of rooms wield considerable bargaining power, often securing preferential rates.

- Group Bookings: Conference organizers and tour operators making bulk reservations also gain leverage for negotiations.

- Individual Travelers: Leisure travelers booking individual rooms generally have lower bargaining power.

- Segment Diversity: H World Group's varied customer base means bargaining power differs across its different hotel brands and service levels.

Customer Loyalty and Switching Costs

H World Group benefits from strong customer loyalty, largely cultivated through its H Rewards program. This loyalty acts as a significant dampener on customer bargaining power. When customers are invested in loyalty programs, they perceive higher switching costs, making them less inclined to switch to competitors, even for minor price concessions.

The effectiveness of H World's loyalty strategy is evident in its membership growth. By 2024, H Rewards membership had reached 267 million, and this upward trend continued, with membership climbing to 277 million by the first quarter of 2025. This increasing engagement signifies a growing base of loyal customers who are less sensitive to price changes and more committed to the brand.

- Customer Loyalty: H World's H Rewards program fosters strong customer loyalty.

- Switching Costs: High loyalty creates switching costs, reducing customer power.

- Membership Growth: H Rewards membership reached 267 million in 2024 and 277 million by Q1 2025.

- Reduced Bargaining Power: Loyal customers are less likely to switch for minor price differences.

The bargaining power of customers for H World Group is significantly shaped by price sensitivity and the availability of numerous substitutes in the highly competitive hotel market. In 2024, travelers, especially in the economy and midscale segments, actively compare prices, making H World Group's pricing strategy critical for retaining guests.

The ease with which customers can switch to alternative lodging, including traditional hotels and short-term rentals like Airbnb, further empowers them. This access to diverse options, coupled with readily available online information on prices and quality, allows consumers to exert considerable pressure on H World Group to offer competitive rates and superior experiences.

| Factor | Impact on H World Group | 2024/2025 Data Point |

|---|---|---|

| Price Sensitivity | High, especially for economy/midscale | Customers readily compare prices online. |

| Availability of Substitutes | High | Includes numerous hotel chains and alternative lodging like Airbnb. |

| Information Transparency | High | Online travel agencies and review sites empower informed decisions. |

| Customer Loyalty (H Rewards) | Mitigates power | 277 million members by Q1 2025, up from 267 million in 2024. |

What You See Is What You Get

H World Group Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This comprehensive Porter's Five Forces analysis of H World Group delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. Understanding these forces is crucial for strategic decision-making and identifying opportunities for competitive advantage.

Rivalry Among Competitors

The competitive landscape for H World Group in the Chinese hotel market is exceptionally fierce, characterized by a vast number of domestic and international competitors. This intense rivalry is fueled by the presence of major domestic players such as Jinjiang and BTG, alongside a growing influx of international brands and a multitude of smaller, independent establishments.

By the close of 2024, H World Group had significantly expanded its footprint, operating over 11,000 hotels. This scale positions them as a dominant force, yet they must continually navigate the aggressive strategies and market penetration efforts of their numerous rivals.

The growth rate of the hotel industry, both in China and globally, plays a crucial role in shaping competitive rivalry. When the market expands rapidly, there's more room for new entrants and existing players to grow without directly clashing over market share. However, a slowing growth rate often forces companies to compete more aggressively for the same pool of customers, leading to intensified rivalry.

China's hotel market is expected to see continued expansion, with projections indicating it could reach US$ 170.40 billion by 2033. This growth is generally positive, but any unexpected deceleration in this trajectory could significantly increase the pressure on companies like H World Group, forcing them to fight harder for market dominance.

H World Group's ability to differentiate its broad range of brands, from budget-friendly to premium, significantly impacts competitive rivalry. By offering unique guest experiences and tailored offerings across its segments, the company can lessen the pressure of direct price competition. For instance, H World's focus on enhancing its portfolio and brand positioning, evident in its continuous expansion and renovation efforts, aims to create distinct value propositions in a crowded market.

Exit Barriers

High exit barriers, like substantial investments in owned or leased hotel properties and long-term franchise agreements, can trap unprofitable competitors within the market. This situation often leads to persistent oversupply and heightened price wars, even when some companies are clearly struggling. For instance, in 2024, the global hotel industry continued to grapple with the lingering effects of earlier overbuilding in some regions, which exacerbated competitive pressures.

H World Group's strategic shift towards an asset-light model is a key factor in potentially mitigating these exit barriers. By reducing its direct ownership of physical assets, the company can theoretically reduce the sunk costs associated with exiting certain markets or divesting underperforming segments. This approach is becoming increasingly prevalent as companies seek greater flexibility in dynamic market conditions.

- Exit Barriers: Significant fixed assets (properties) and long-term contracts (franchises) can keep unprofitable competitors in the market, leading to oversupply and price competition.

- Industry Impact: In 2024, the hotel sector still saw the effects of past overbuilding in certain areas, intensifying competitive rivalries.

- H World's Strategy: The company's move toward an asset-light model aims to reduce its exposure to these high exit barriers, offering greater operational flexibility.

Strategic Commitments and Aggressiveness of Rivals

The competitive landscape for H World Group is characterized by aggressive strategic commitments from rivals. Competitors are actively engaged in rapid network expansion, often accompanied by aggressive pricing strategies and significant investments in technology and service enhancements to capture market share.

These actions directly fuel the intensity of rivalry within the hotel industry. For instance, H World Group itself has ambitious expansion plans, aiming to open approximately 2,300 new hotels in 2025, a move that necessitates a sharp focus on outmaneuvering competitors who are also pursuing growth.

- Intensified Competition: Rivals are not just expanding but also investing heavily in digital transformation and customer experience improvements, forcing H World Group to match these efforts to maintain its competitive edge.

- Price Sensitivity: Aggressive pricing tactics by competitors can lead to price wars, impacting the profitability of all players, including H World Group.

- Strategic Investments: Competitors are making substantial capital expenditures on new properties and renovations, signaling a long-term commitment to market dominance that H World Group must counter.

Competitive rivalry for H World Group is intense, driven by a crowded market with numerous domestic and international players. In 2024, H World operated over 11,000 hotels, a scale that necessitates constant strategic maneuvering against rivals who are also expanding and investing in service enhancements.

The industry's growth trajectory, projected to reach US$170.40 billion by 2033, generally benefits companies, but any slowdown could intensify competition for market share. H World's strategy to differentiate its diverse brand portfolio is crucial in mitigating direct price wars, while its move towards an asset-light model aims to reduce exposure to high exit barriers that can trap less competitive firms in the market.

| Competitor Action | Impact on H World Group | 2024/2025 Context |

| Aggressive Network Expansion | Increased market saturation, pressure on occupancy rates | H World planned ~2,300 new hotels in 2025; rivals also pursuing growth. |

| Investment in Technology & Service | Need for continuous innovation to match competitor offerings | Competitors investing in digital transformation and customer experience. |

| Pricing Strategies | Risk of price wars, impacting profit margins | Aggressive pricing by rivals can erode profitability across the sector. |

SSubstitutes Threaten

The threat of substitutes for H World Group's hotel services is considerable, primarily from the growing popularity of alternative accommodation options. These include platforms like Airbnb, which saw a 30% increase in bookings in 2024 compared to the previous year, offering unique stays and often lower prices. Serviced apartments also present a strong alternative, particularly for longer stays, providing more home-like amenities.

The threat of substitutes for H World Group's offerings, primarily in the hotel and hospitality sector, is significantly shaped by the cost and perceived quality of alternatives. If substitute options, such as Airbnb or budget hotel chains, provide comparable comfort and amenities at a lower price point, they become a more attractive choice for consumers. For instance, in 2024, the continued growth of the short-term rental market means travelers have more options that can undercut traditional hotel pricing, especially for longer stays or group bookings.

Furthermore, the perceived quality and unique experiences offered by substitutes can also elevate their threat. A well-managed boutique hotel or a unique homestay experience might offer a more memorable stay than a standard hotel room, even at a similar price. H World Group needs to consistently evaluate its brand value proposition, ensuring its hotels deliver superior service and amenities that justify their cost compared to these evolving alternatives in the market.

Customer willingness to switch from traditional hotels to alternatives like serviced apartments or guesthouses is influenced by travel purpose and duration. For example, business travelers on extended stays may find serviced apartments more appealing due to their amenities and home-like feel, whereas leisure travelers seeking budget options might gravitate towards guesthouses.

In 2024, the rise of the sharing economy and alternative accommodations continues to present a significant threat. Platforms offering unique stays or lower price points can attract a segment of H World Group's customer base, particularly younger demographics and budget-conscious travelers. The perceived value of these substitutes, often tied to cost savings and unique experiences, directly impacts customer loyalty to traditional hotel brands.

Technological Advancements Facilitating Substitutes

Technological advancements have significantly lowered the barrier for substitute offerings in the hospitality sector. Digital platforms and online travel agencies (OTAs) now make it incredibly simple for alternative accommodation providers, such as short-term rental platforms like Airbnb, to reach a global customer base. This ease of access and reduced search costs for consumers directly amplifies the threat of substitutes for traditional hotel chains like H World Group.

The aggregation of diverse lodging options on these online platforms empowers travelers. They can effortlessly compare prices, amenities, and locations of hotels against vacation rentals, homestays, and other non-traditional lodging. For instance, by mid-2024, the global short-term rental market was projected to reach over $100 billion, showcasing the significant scale of these alternatives.

This increased visibility and ease of comparison mean that H World Group faces a more potent threat from substitutes than ever before. Travelers can readily identify and book alternatives that might offer perceived better value or unique experiences. The continued innovation in travel technology ensures this threat will remain a dynamic factor for H World Group to navigate.

- Digitalization of Travel: Online platforms have democratized accommodation options, making it easier for new players to enter the market and connect with travelers.

- Consumer Choice Amplification: Aggregated booking sites allow for direct comparison between hotels and substitutes, driving price competition and influencing booking decisions.

- Growth of Alternative Accommodation: The short-term rental market, a key substitute, continues its robust growth, with global revenues expected to surpass $100 billion by mid-2024, indicating a substantial and growing alternative for travelers.

- Reduced Switching Costs: Technological ease of booking and information access minimizes the effort for consumers to switch from traditional hotels to alternative lodging.

Economic Conditions Impacting Travel Choices

During economic downturns, the threat of substitutes intensifies for hotel groups like H World. Consumers facing tighter budgets often explore more economical alternatives, such as budget accommodations, vacation rentals, or even staying with friends and family. For instance, in 2024, reports indicated a noticeable shift towards cost-saving travel arrangements as inflation persisted, impacting discretionary spending on lodging.

Conversely, periods of economic prosperity can bolster demand for H World's offerings, as consumers are more willing to spend on premium or full-service hotel experiences. However, even in good economic times, the availability of diverse lodging options means that the threat of substitutes remains a constant consideration. The travel industry's recovery post-pandemic has seen a surge in various accommodation types, each vying for market share.

- Economic Downturns: Increased preference for budget lodging and alternative accommodations.

- Economic Prosperity: Higher demand for full-service hotels, but substitutes remain competitive.

- 2024 Trends: Inflationary pressures influenced consumer choices towards cost-effective travel solutions.

- Market Dynamics: A wide array of lodging options continuously challenges traditional hotel models.

The threat of substitutes for H World Group is substantial, driven by the increasing accessibility and appeal of alternative accommodations. In 2024, platforms like Airbnb continued to grow, with bookings up 30% year-over-year, offering travelers unique experiences and often lower price points. Serviced apartments also pose a significant threat, especially for extended stays, providing a more home-like environment.

| Substitute Type | Key Appeal | 2024 Market Trend/Data |

|---|---|---|

| Short-Term Rentals (e.g., Airbnb) | Unique experiences, local immersion, potential cost savings | Bookings increased 30% year-over-year. Global market projected to exceed $100 billion by mid-2024. |

| Serviced Apartments | Home-like amenities, space, suitability for longer stays | Growing preference among business travelers on extended assignments. |

| Budget Hotels/Guesthouses | Lower price points, basic amenities | Increased demand during economic downturns and periods of inflation. |

Entrants Threaten

The hotel industry, including players like H World Group, demands considerable capital to establish a presence. Building new hotels, acquiring existing ones, or even setting up franchise operations requires substantial upfront investment in land, construction, and essential amenities. For example, in 2024, the average cost to build a mid-scale hotel in the US could range from $15 million to $30 million, depending on location and size.

These high capital requirements act as a significant barrier, deterring potential new entrants who may lack the necessary financial backing. While H World Group has strategically adopted an asset-light model, emphasizing manachised and franchised hotels to mitigate its own capital risk, the fundamental need for large sums of money to enter and compete effectively remains a powerful deterrent for new competitors in the broader hospitality sector.

H World Group, like many established hotel chains, benefits significantly from strong brand loyalty and deep-seated customer relationships. Their H Rewards program, boasting over 277 million members as of recent data, represents a powerful retention tool, making it challenging for newcomers to sway existing clientele.

New entrants must invest heavily in marketing and customer acquisition to even begin to chip away at this established trust. Building a comparable distribution network and brand recognition takes considerable time and capital, acting as a substantial barrier to entry.

Newcomers face significant hurdles in securing access to crucial distribution channels like online travel agencies (OTAs) and global distribution systems (GDS). Established companies, including H World Group, often possess strong, long-standing relationships and preferential agreements that are difficult for new entrants to replicate.

These existing relationships translate into better visibility and terms, making it challenging for new players to achieve the same market penetration. For instance, H World Group benefits from a substantial portion of its bookings coming directly from its member base, which stood at over 65% of total reservations in 2024, indicating a well-established and loyal customer network that new entrants would struggle to tap into initially.

Economies of Scale and Experience Curve

Large hotel conglomerates like H World Group leverage significant economies of scale. This advantage is evident in their purchasing power for supplies, centralized marketing efforts, and investment in advanced technology, all contributing to lower per-unit operating costs. Newcomers often find it challenging to match these cost efficiencies, creating an immediate competitive hurdle.

H World Group's aggressive expansion strategy further solidifies its scale advantage. The company opened an impressive 2,442 new hotels in 2024 alone, a testament to its ability to rapidly grow its network. This rapid expansion means new entrants face an already established and cost-optimized competitor, making market entry considerably more difficult.

- Economies of Scale: H World benefits from bulk purchasing and operational efficiencies.

- Experience Curve: Accumulated operational knowledge leads to cost reductions over time.

- Marketing Reach: Larger marketing budgets and established brand recognition attract customers more effectively.

- Technology Investment: Greater resources allow for investment in cutting-edge reservation and management systems.

Government Policy and Regulations

Government policy and regulations present a substantial threat to new entrants in the hospitality sector, especially within China's dynamic market. Significant hurdles such as stringent licensing requirements, complex zoning laws, and evolving environmental regulations can act as powerful deterrents. For instance, obtaining the necessary permits and ensuring compliance with diverse local mandates can incur substantial costs and time, making it challenging for newcomers to establish a foothold.

The hospitality industry, including companies like H World Group, must navigate a landscape shaped by government oversight. In 2024, China continued to emphasize stricter enforcement of consumer protection laws and safety standards, adding layers of compliance for any new hotel or travel service provider. These regulatory complexities can significantly increase the capital expenditure and operational risk for potential competitors, thereby protecting established players.

- Regulatory Hurdles: Obtaining necessary business licenses and operational permits can be a lengthy and costly process.

- Licensing Requirements: Specific licenses are often required for different service offerings, such as food and beverage or accommodation.

- Zoning Laws: Local zoning regulations dictate where hospitality establishments can be built and operated, limiting available locations.

- Environmental Regulations: Increasingly stringent environmental standards, particularly concerning waste management and energy efficiency, add to compliance costs.

The threat of new entrants for H World Group is moderate, primarily due to the substantial capital required to enter the hotel market. Building or acquiring properties, coupled with establishing brand presence and distribution networks, demands significant financial resources. For example, in 2024, the average cost to construct a mid-scale hotel in the US was estimated between $15 million and $30 million, a considerable barrier for aspiring competitors.

H World Group also benefits from strong brand loyalty and an extensive rewards program, which makes it difficult for new players to attract customers. Their H Rewards program, with over 277 million members, fosters customer retention. New entrants would need to invest heavily in marketing and customer acquisition to compete with this established trust and loyalty, which is a significant deterrent.

Access to distribution channels is another key barrier. Established companies like H World Group have strong relationships with online travel agencies and global distribution systems, often securing preferential terms. In 2024, over 65% of H World Group's reservations came directly from its member base, highlighting the advantage of its established network over newcomers.

Furthermore, H World Group's economies of scale, driven by its vast network and efficient operations, contribute to lower per-unit costs. The company's aggressive expansion, adding 2,442 new hotels in 2024, amplifies this advantage. New entrants face an already cost-optimized and widespread competitor, making market entry considerably more challenging.

Porter's Five Forces Analysis Data Sources

Our H World Group Porter's Five Forces analysis is built upon a robust foundation of data, including the company's annual reports and SEC filings, alongside industry-specific market research from reputable firms like Statista and IBISWorld.